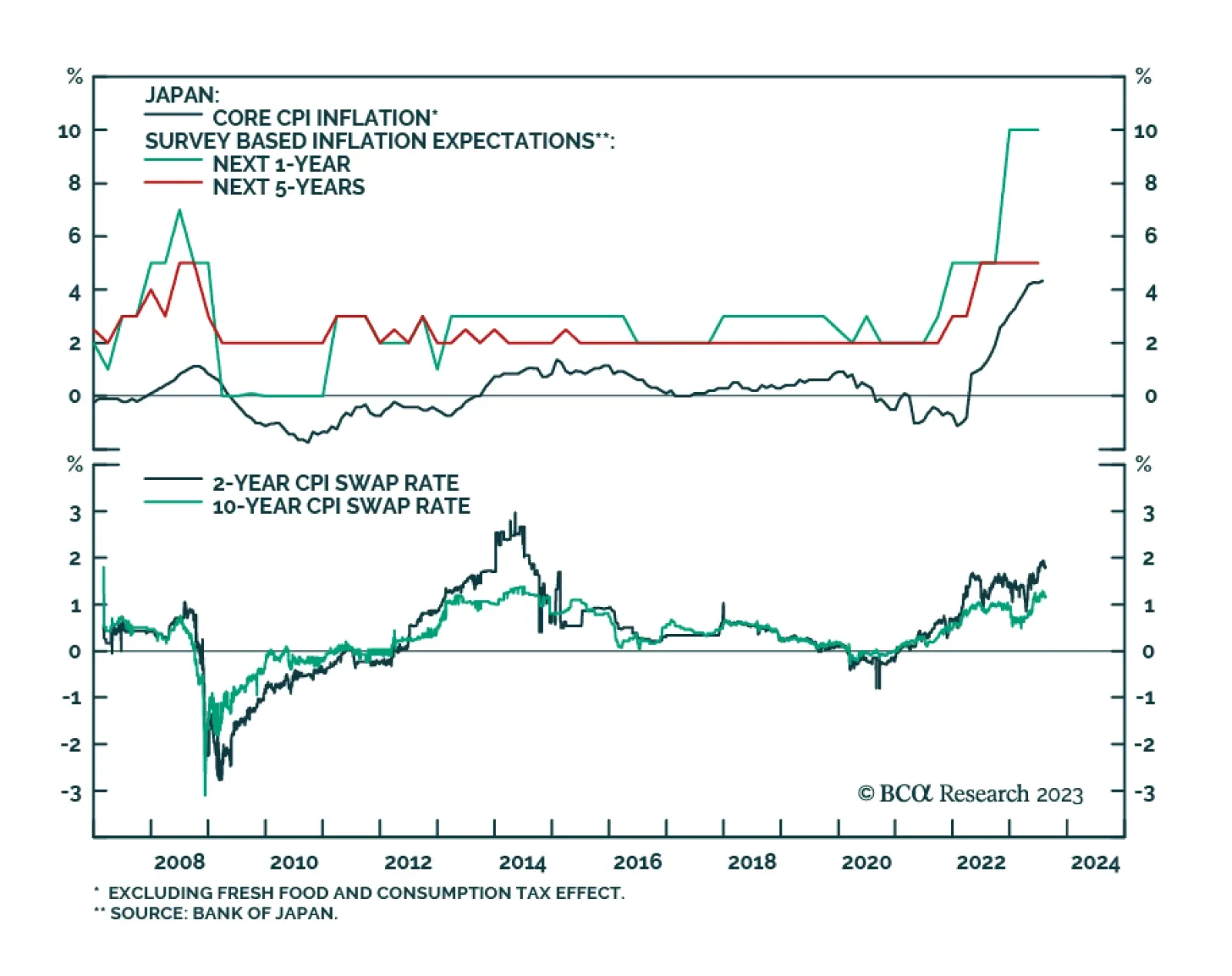

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most indications of Japanese inflation are pointing to upside surprises. This will boost interest-rate differentials in…

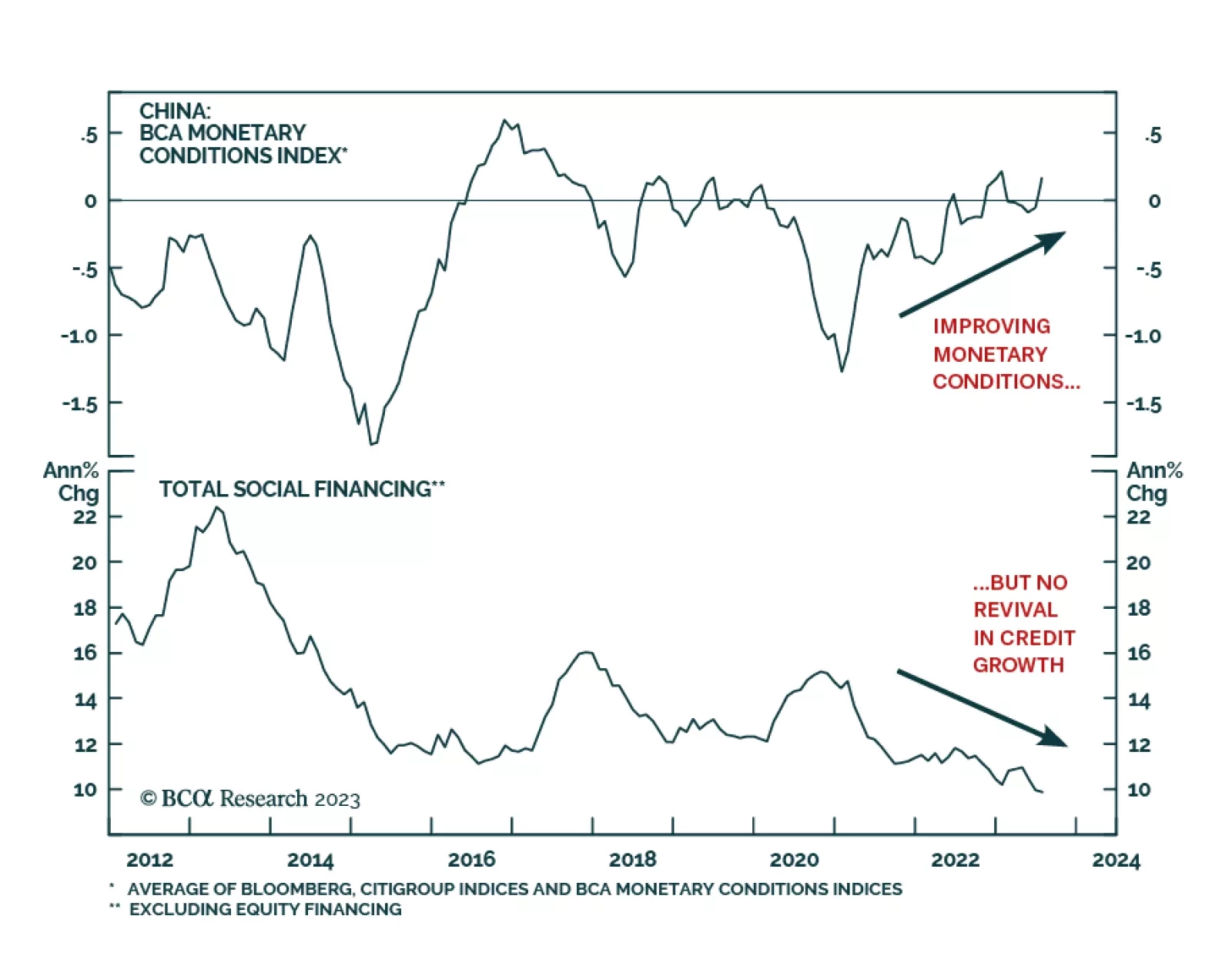

Despite the underwhelming economic recovery, Chinese authorities remain reluctant to open wide stimulus taps as much as they have in past economic downturns. This is corroborated by the PBoC’s marginal interest rate cut…

In this special report, we discuss whether the economic conditions necessary for a stronger yen (and higher JGB yields) will materialize over the next 12-to-18 months.

BCA Research's US Investment Strategy service’s yearlong recommendation to overweight equities was founded on its high-conviction view that investors were underestimating American consumers’ resources and resolve…

Inspired by a client’s questions, we examine the rationale behind the implementation of the trailing stop governing our near-term asset allocation recommendations.

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

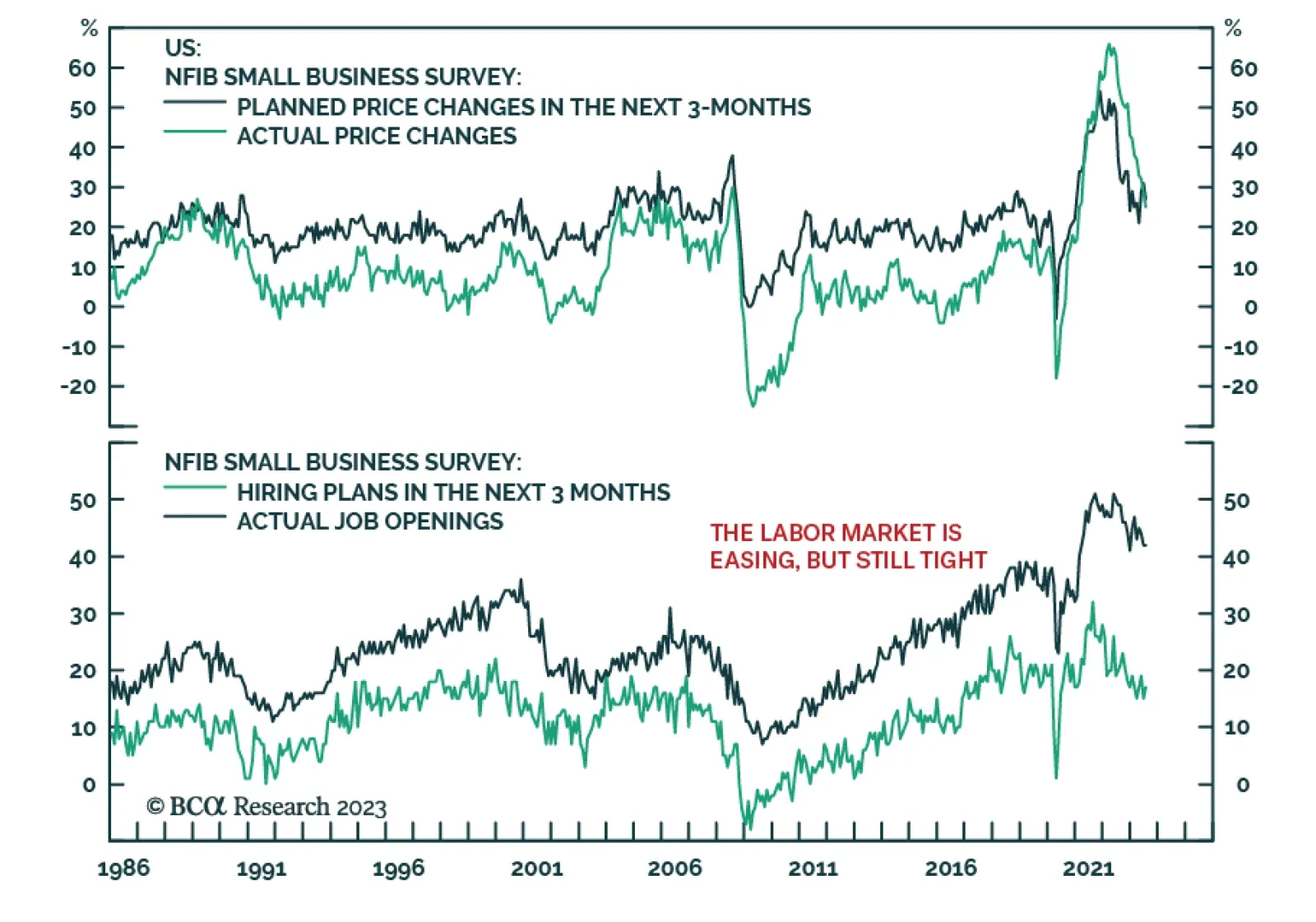

The US NFIB’s Small Business Optimism Index increased by 0.9 points to an eight-month high of 91.9, beating expectations of a more muted 0.3-point increase. Although the level remains depressed below the 49-year average of…

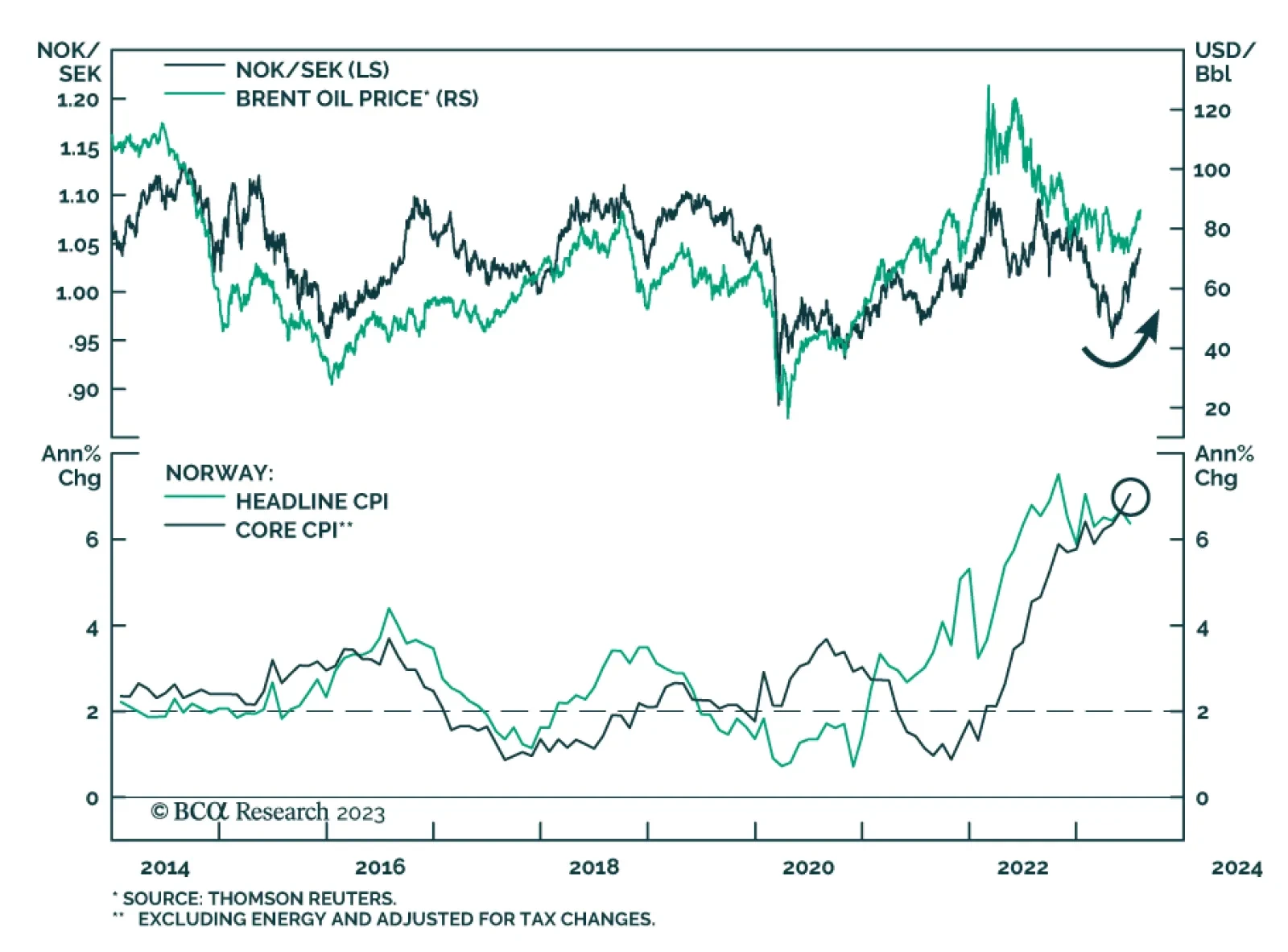

The Norwegian krone’s fortunes have recently reversed. It has been the best performing G10 currency since the end of May. This comes after a period of pronounced weakness during which it was the only G10 currency to…

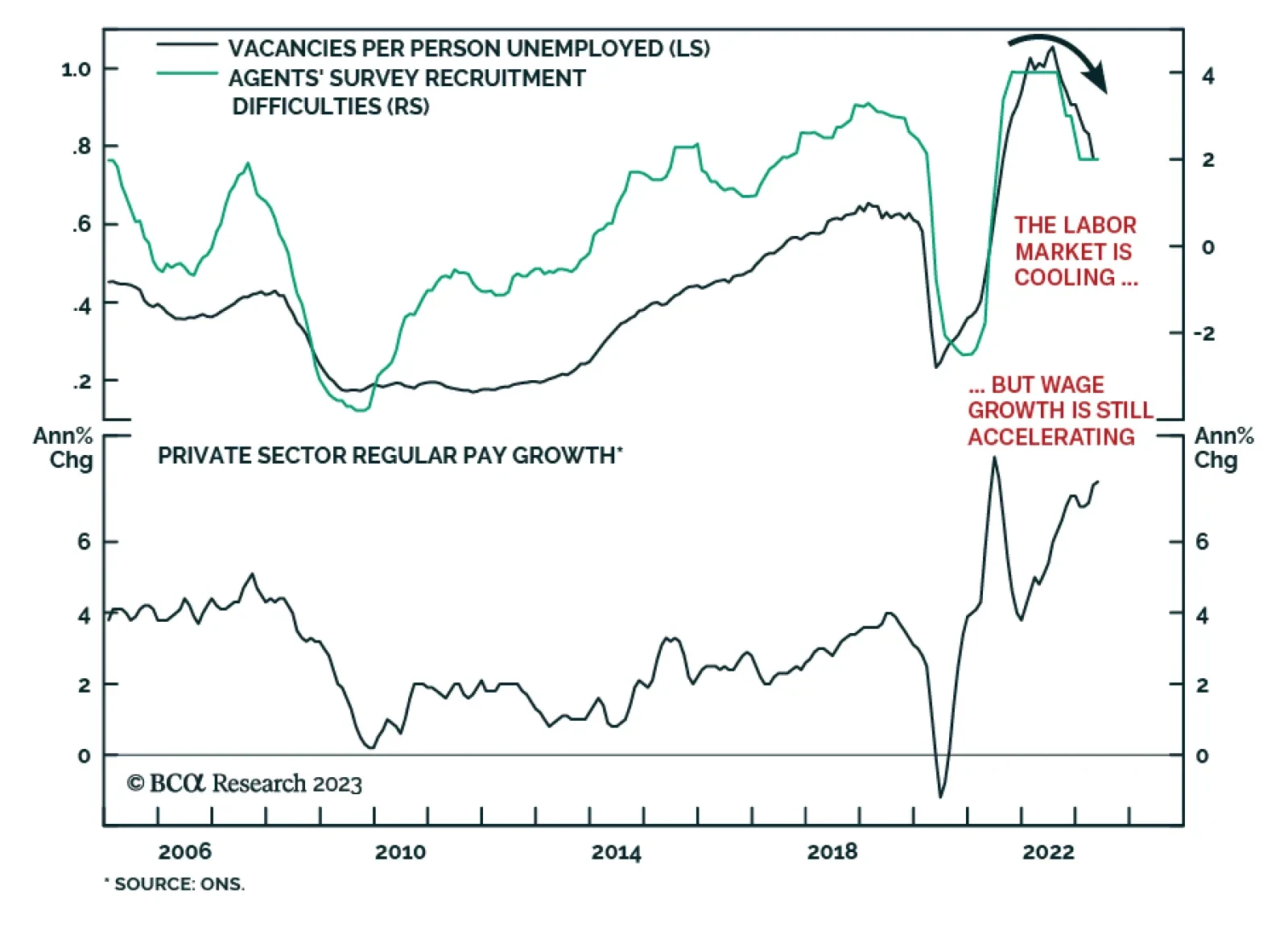

As expected, the Bank of England delivered another 25 basis point rate increase at its Thursday meeting, lifting the policy rate to 5.25%. Going forward, Bailey – not unlike his counterparts at the Fed and ECB –…