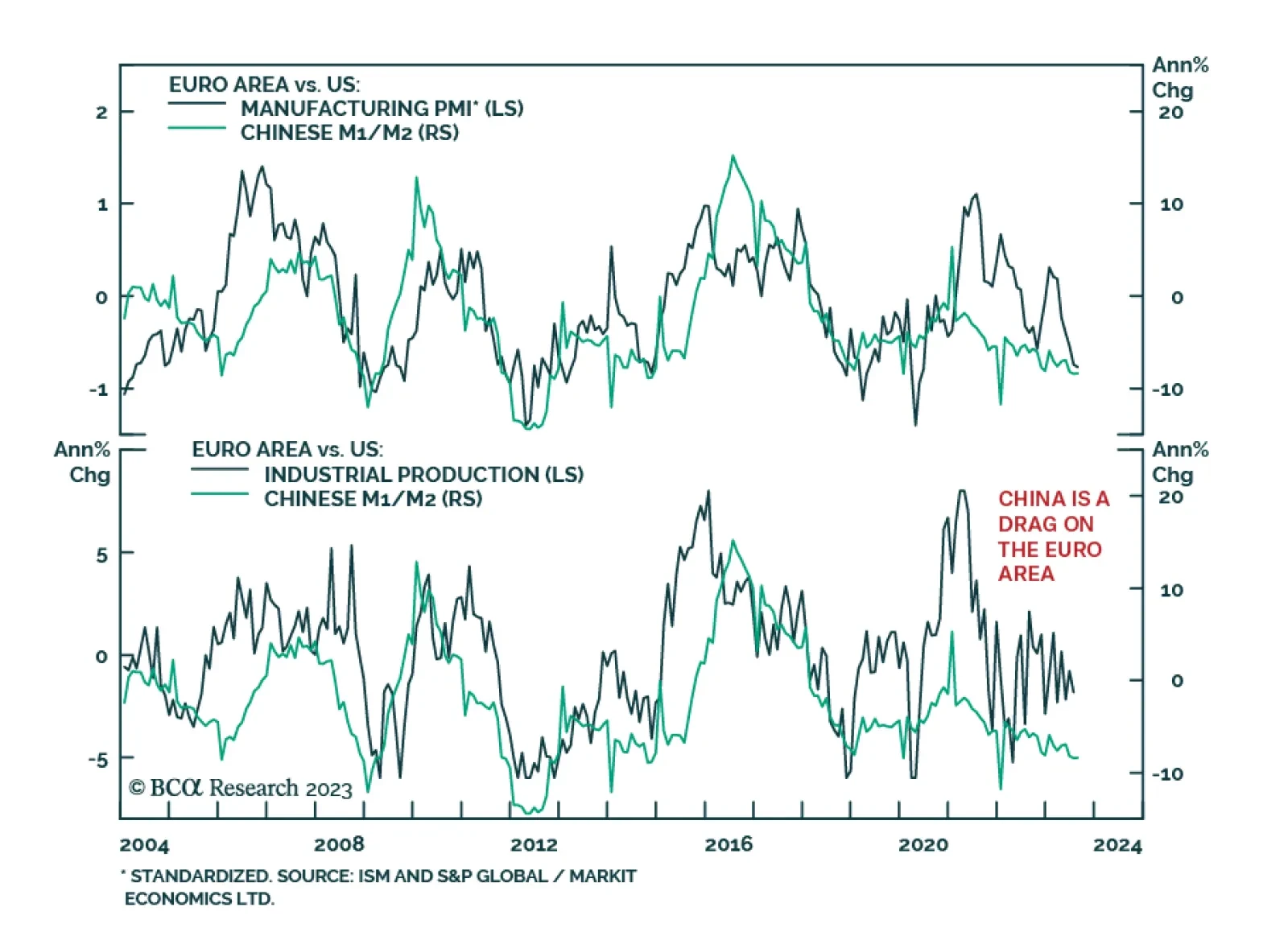

The Euro Area’s industrial production figures for July sent a disappointing signal on Wednesday. The 1.1% m/m decline in output fell below expectations of a smaller 0.9% m/m decrease. On a year-over-year basis, IP…

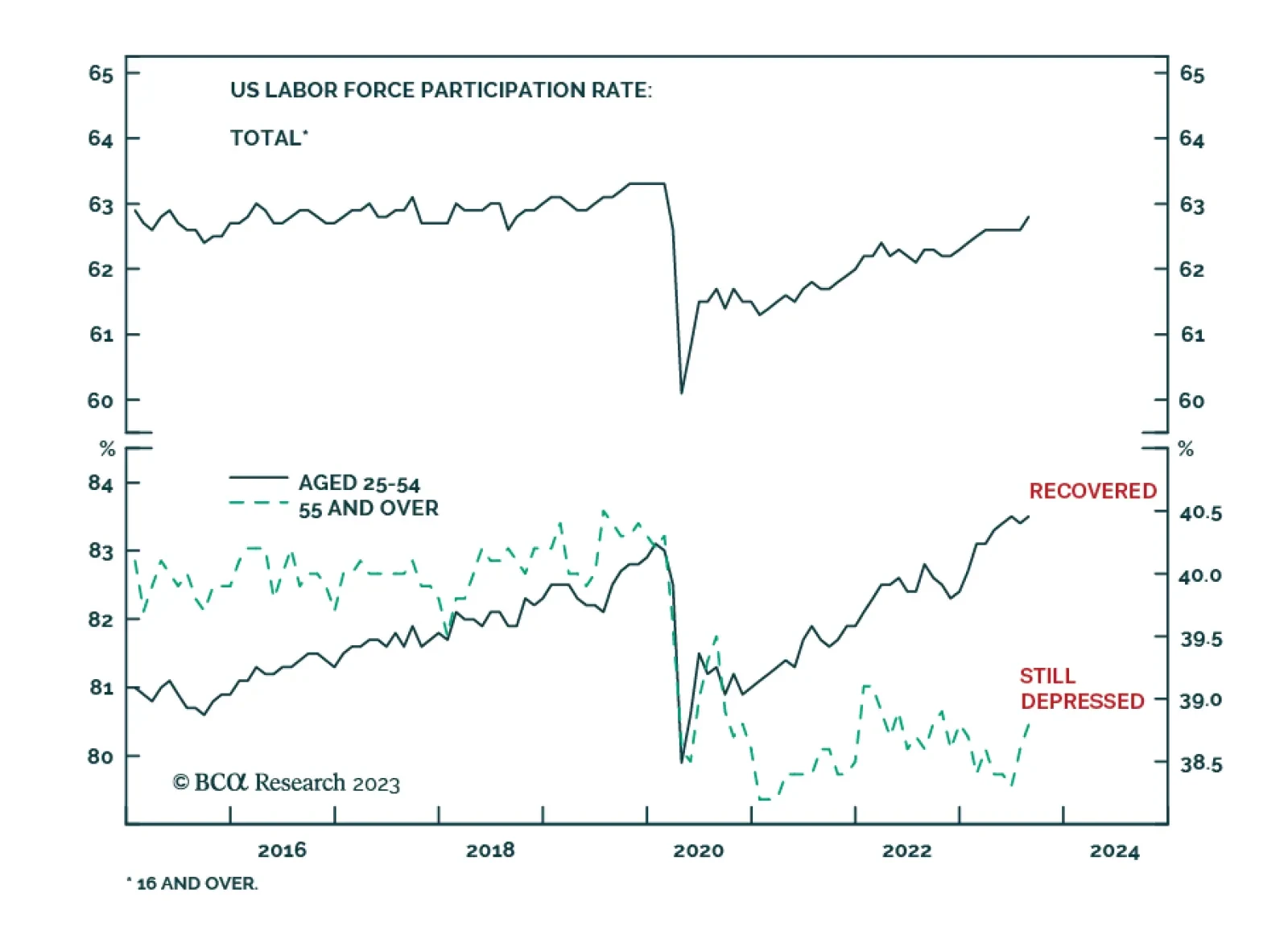

A sharp drop in the US labor force participation rate was among the pandemic disruptions that contributed to tight labor market conditions. The total participation rate collapsed from 63.3% in February 2020 to 60.1% in April 2020…

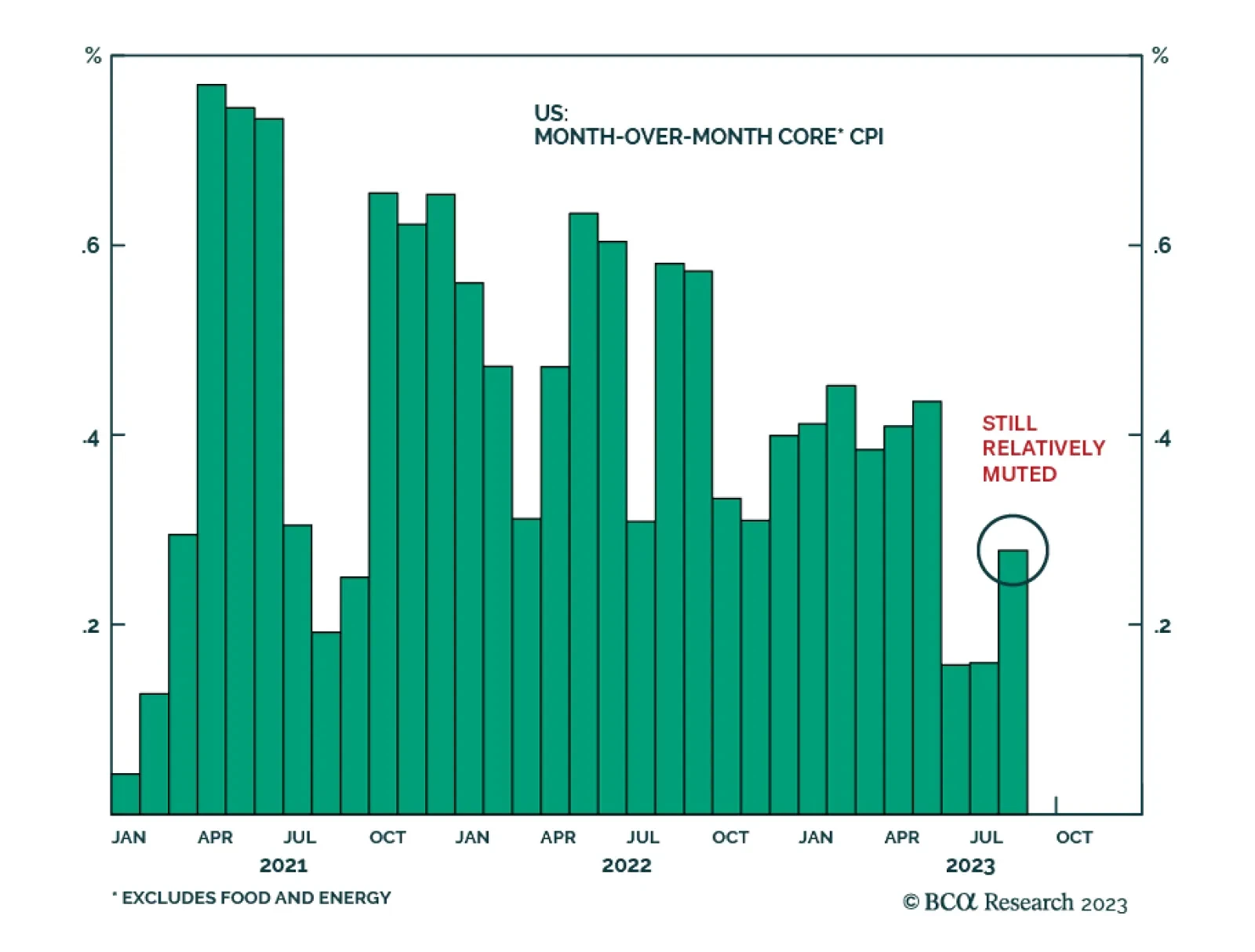

The US CPI release showed monthly inflation accelerated in August. While the increase in headline inflation from 0.2% m/m to 0.6% m/m was in line with consensus estimates, the core index’s 0.3% m/m rise came in slightly…

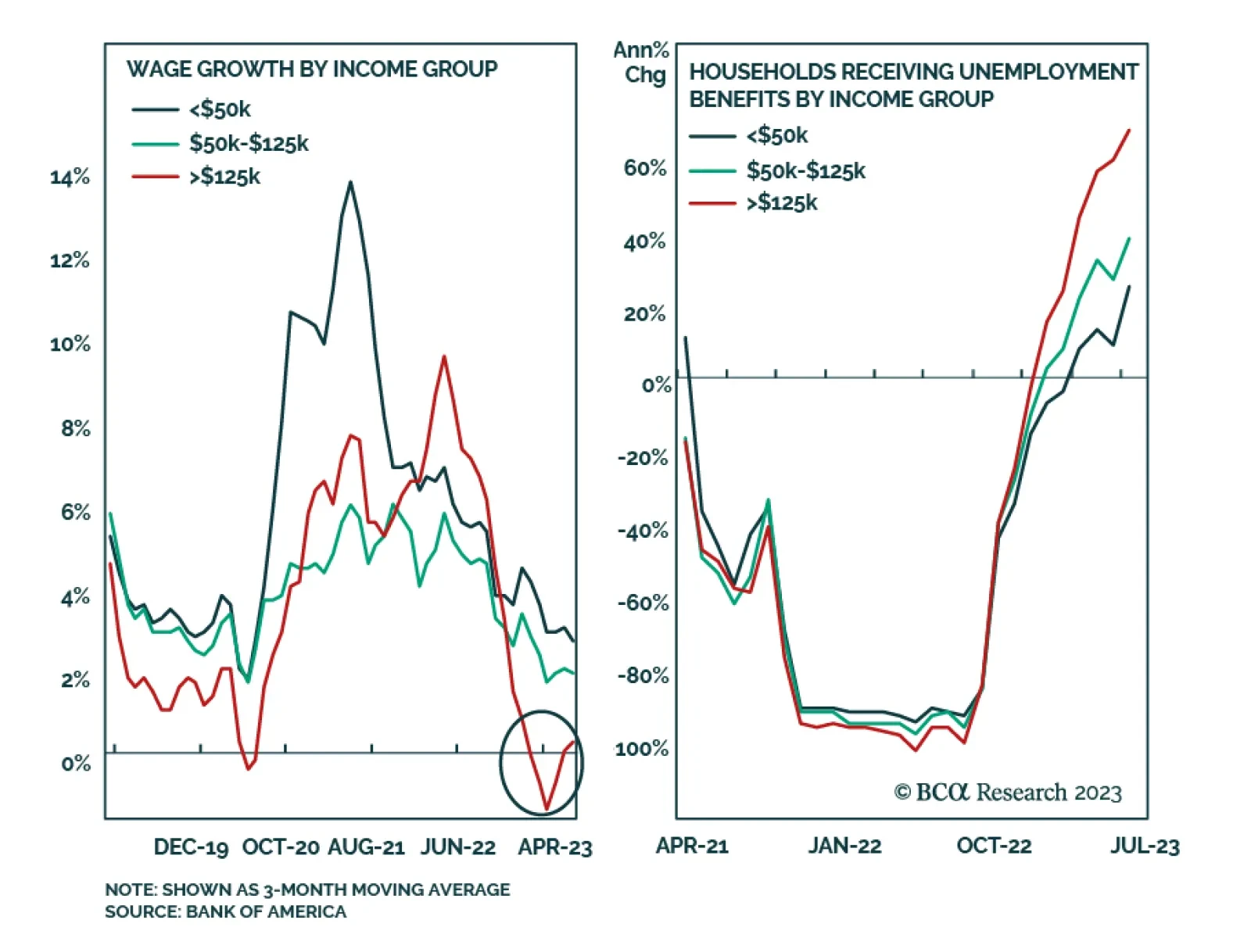

Strong consumer spending so far this year has been powered by robust employment gains coupled with real wage growth turning positive on the back of receding inflationary pressures. However, our US equity strategists…

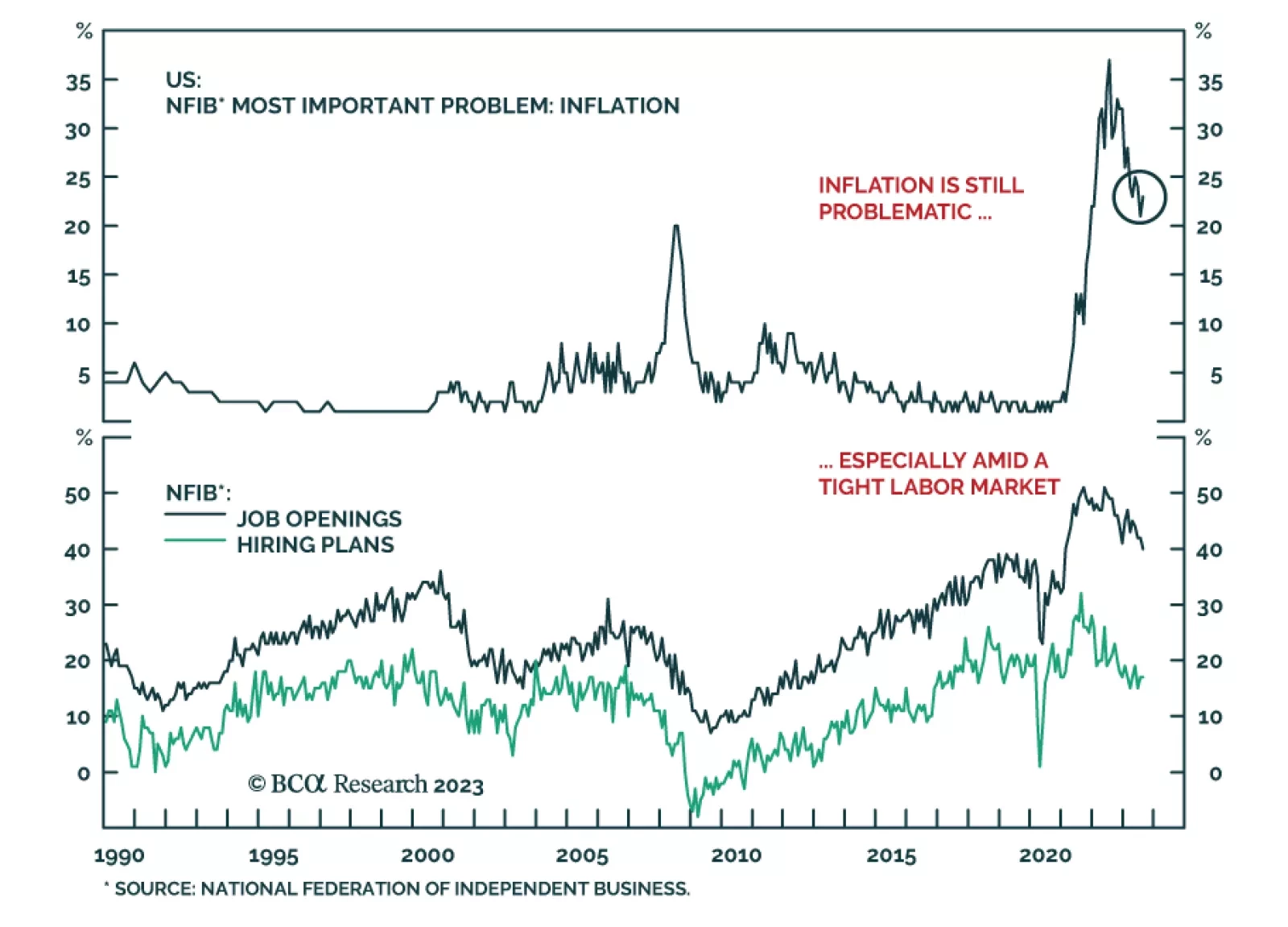

US small business optimism deteriorated for the first time in four months in August. The NFIB index declined by 0.6 point to 91.3, falling slightly below expectations of 91.5. In particular, current conditions deteriorated…

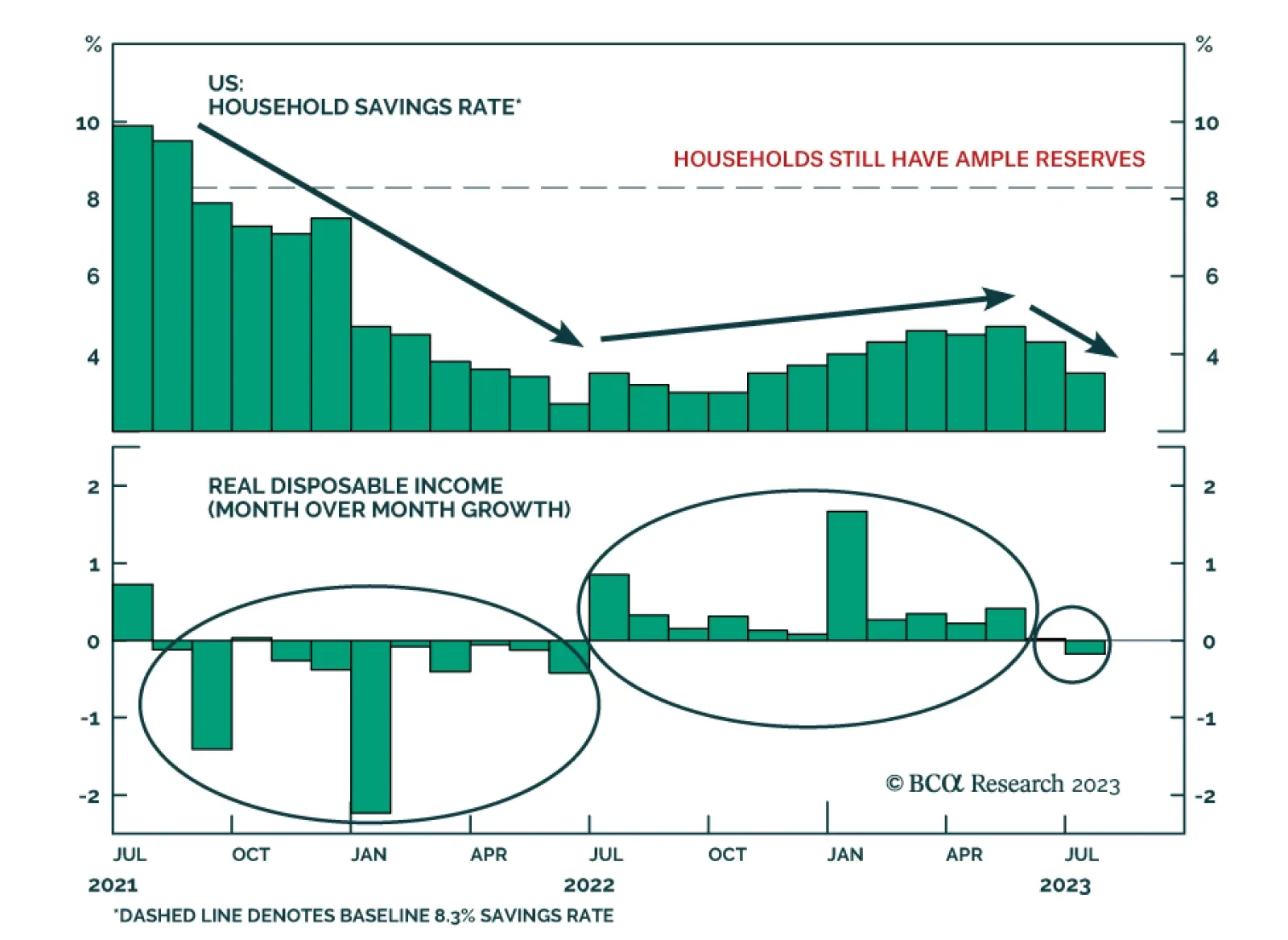

Our colleagues at BCA’s US Investment Strategy service have been excess savings bulls since cash began silting up on household balance sheets as transfer payments flowed from the Capitol to Main Street while High Street…

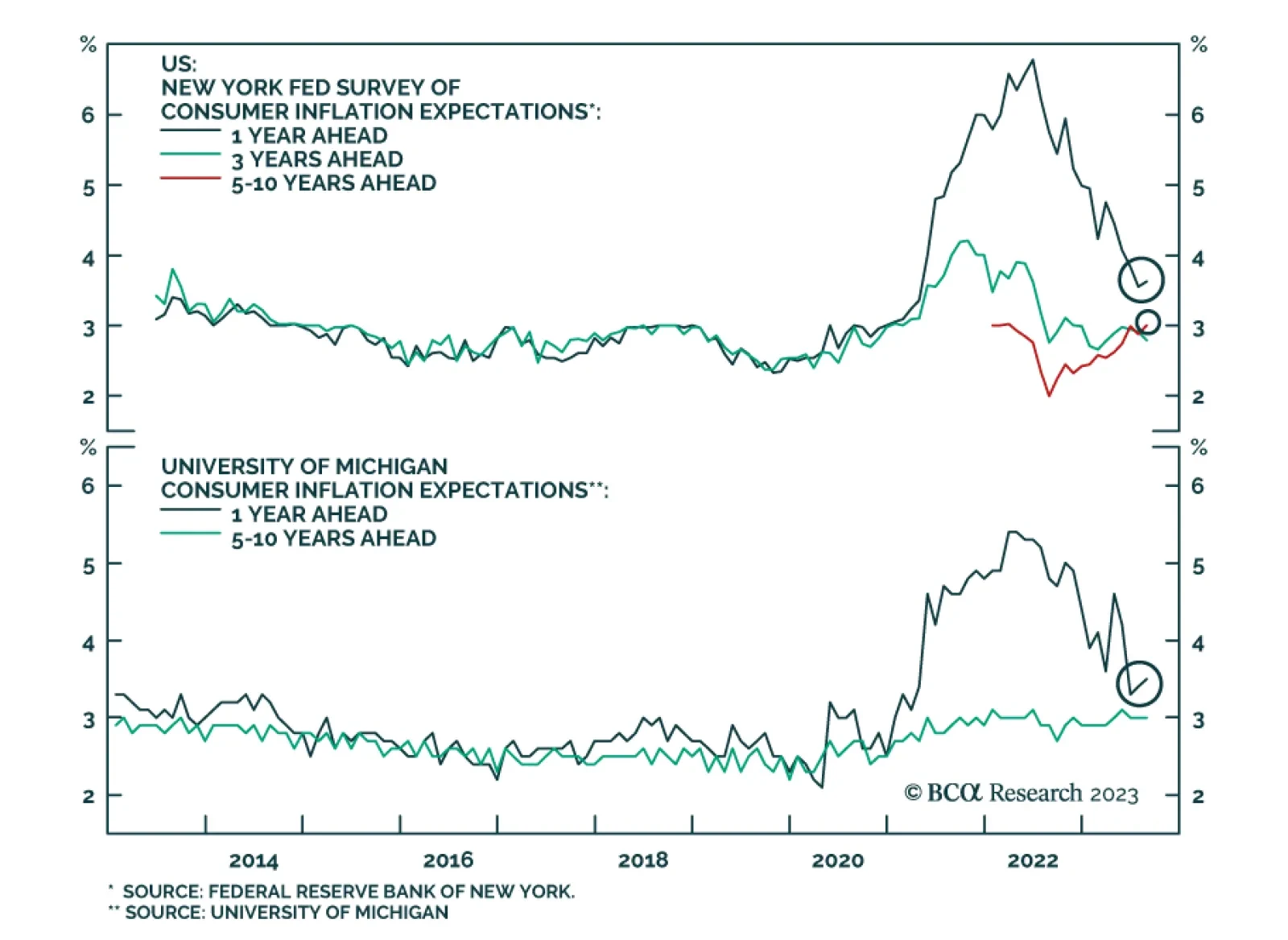

The New York Fed’s latest consumer expectations survey shows household sentiment deteriorated in August. Job loss expectations jumped, with the average perceived likelihood of losing one’s job over the coming year…

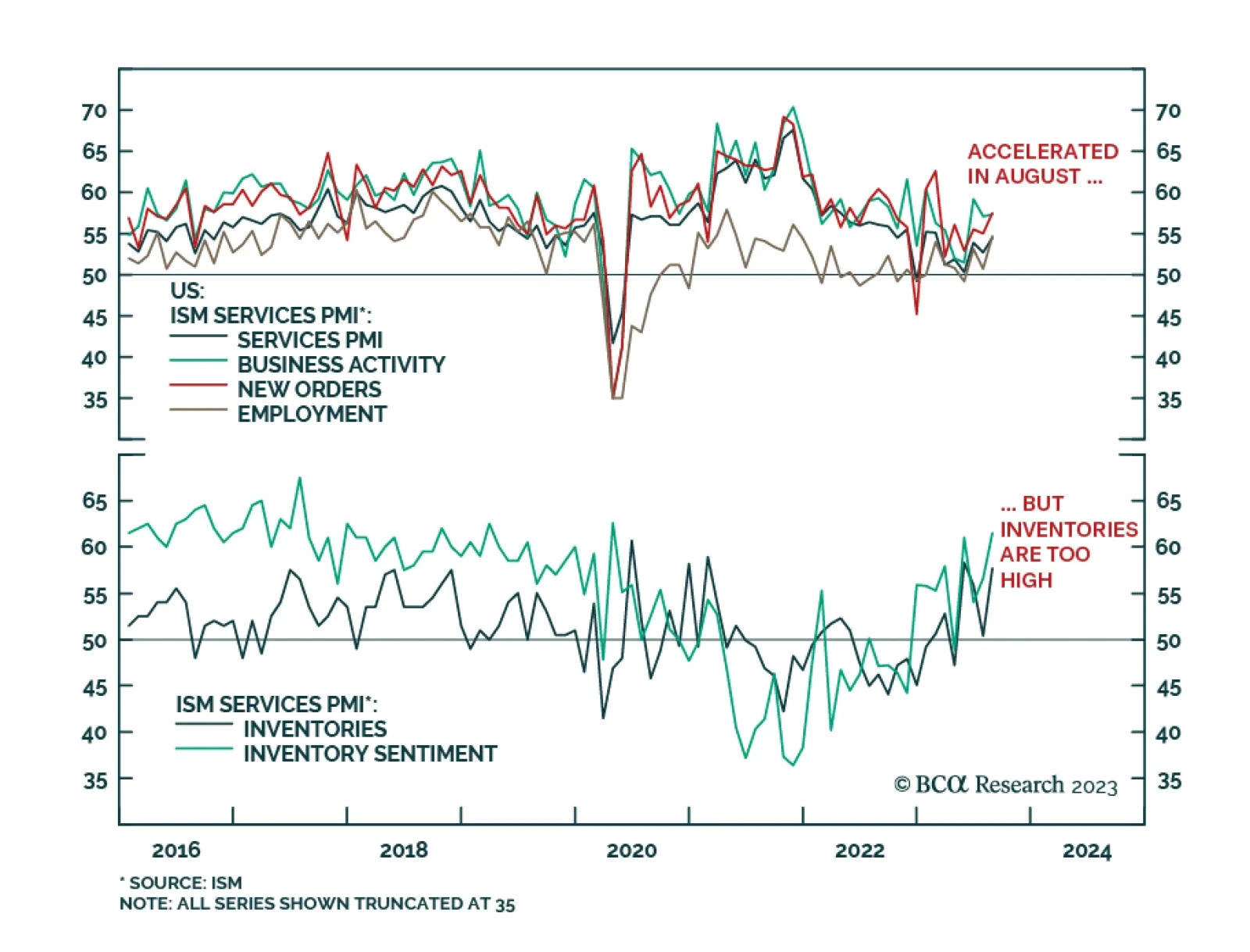

The US ISM delivered a positive signal about service sector activity in August. The headline index unexpectedly jumped by 1.8 points to a six-month high of 54.5, surprising expectations of a 0.2-point decline to 52.5. Importantly…

The resiliency of consumers through 2023 has surprised investors. However, consumer strength will fade into yearend as factors supporting growth in income and spending are waning. i.e., job gains are slowing, wage growth is…

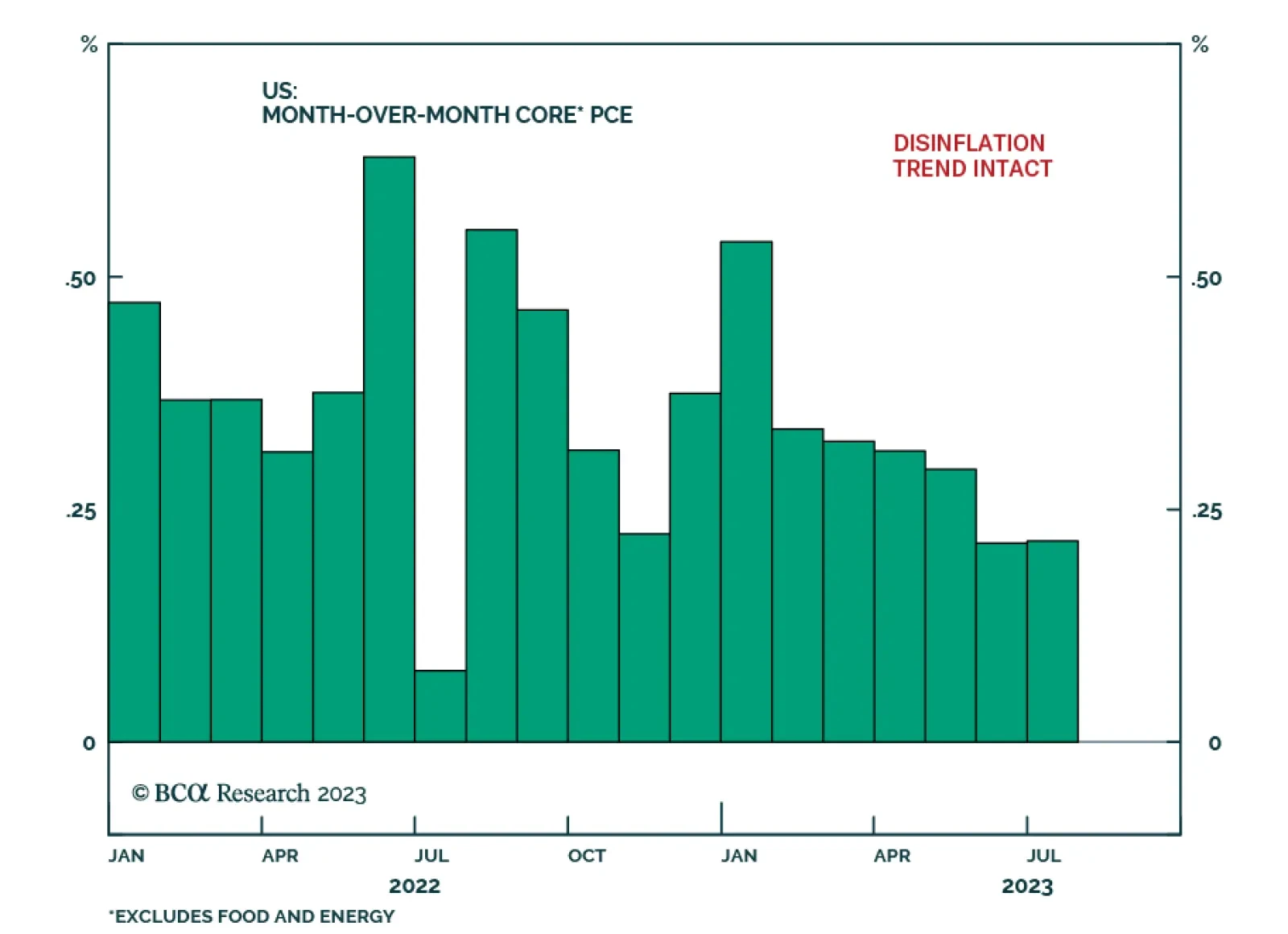

The US Personal Income and Outlays report shows consumption remained resilient in July. Although personal income growth decelerated from 0.3% m/m to 0.2% m/m, spending accelerated from an upwardly revised 0.6% m/m to 0.8% m/m…