In Section I, we note that the recent surge in long-maturity government bond yields is symptomatic of a sharp reduction in market expectations for a soft-landing economic outcome. This underscores that the US and other developed…

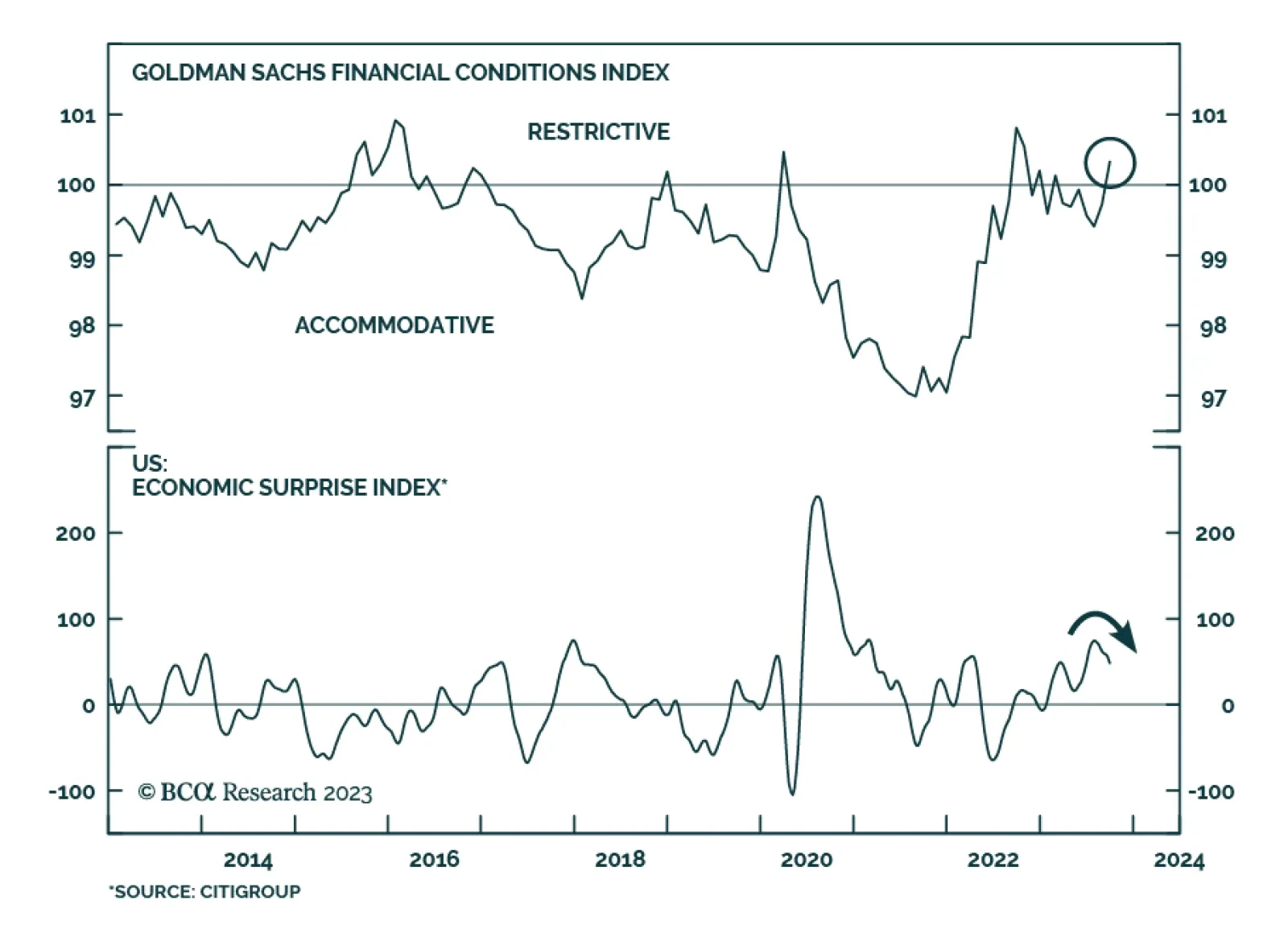

Financial conditions tightened meaningfully in the first three quarters of 2022 as market participants anticipated an aggressive monetary tightening cycle. However, this tightening phase ended in late-2022. Indeed, economic…

BCA Research’s China Investment Strategy service estimates that China’s oil demand growth will decline from 12% year-on-year in the past eight months to a still robust 4%-6% in the next six-to-nine months. China…

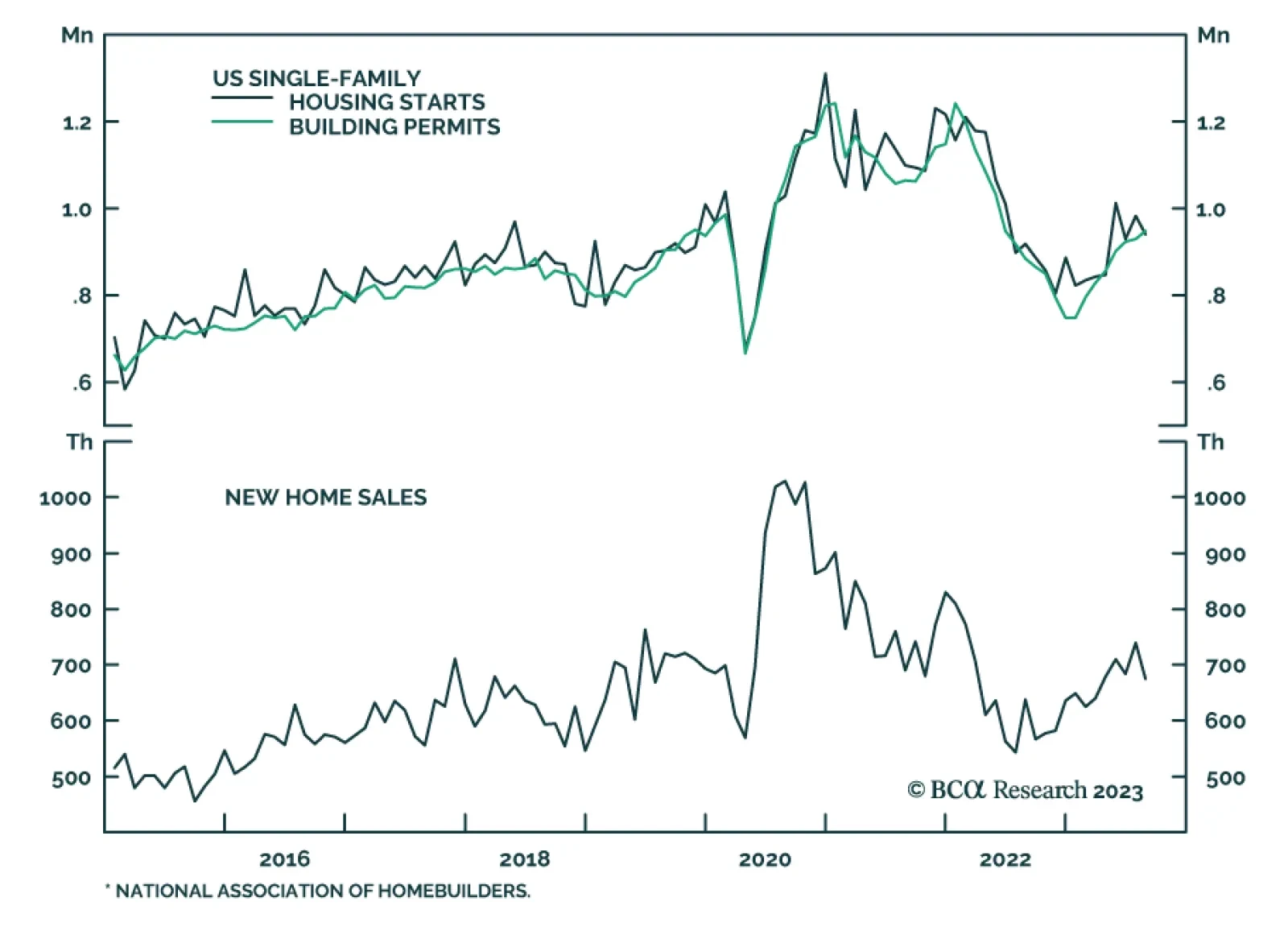

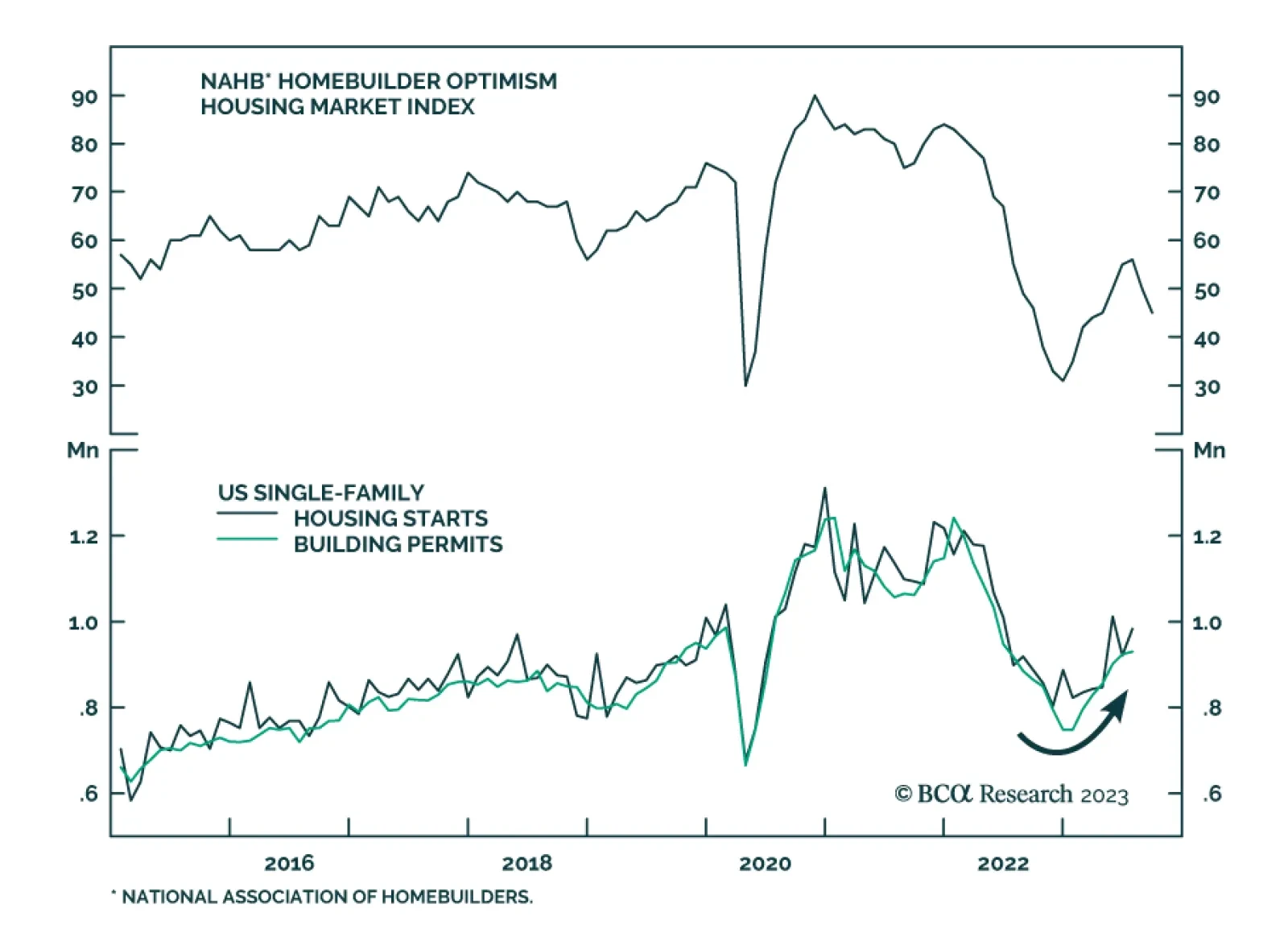

On the surface, US housing market data is sending conflicting signals. On the one hand, both the FHFA as well as the S&P CoreLogic gauges of US house prices surprised to the upside in July and are now expanding on both a…

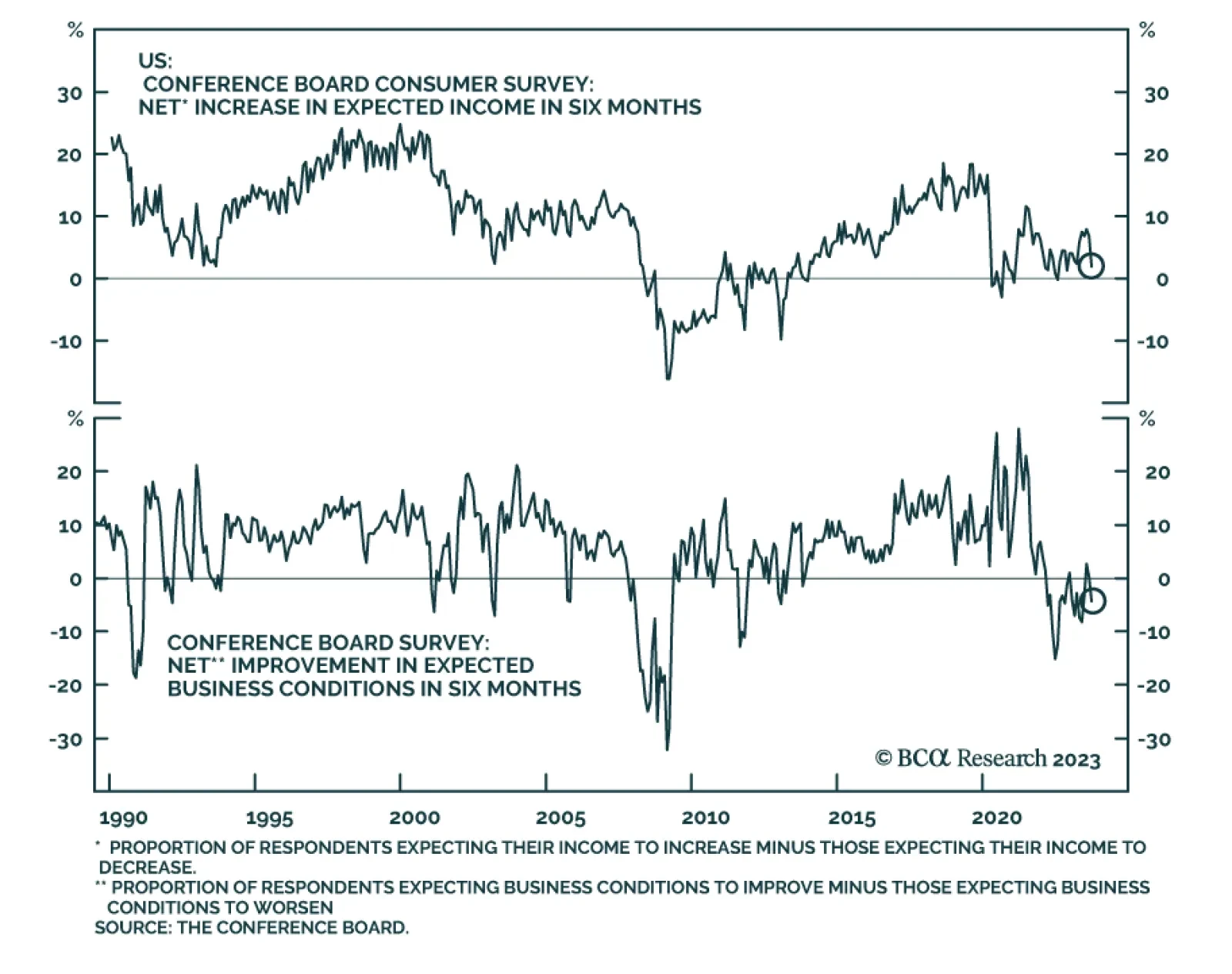

The Conference Board’s Consumer Survey results delivered a negative signal about the US consumption outlook on Tuesday. Although the present situation component inched up marginally in September, a 9.6-point drop in the…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

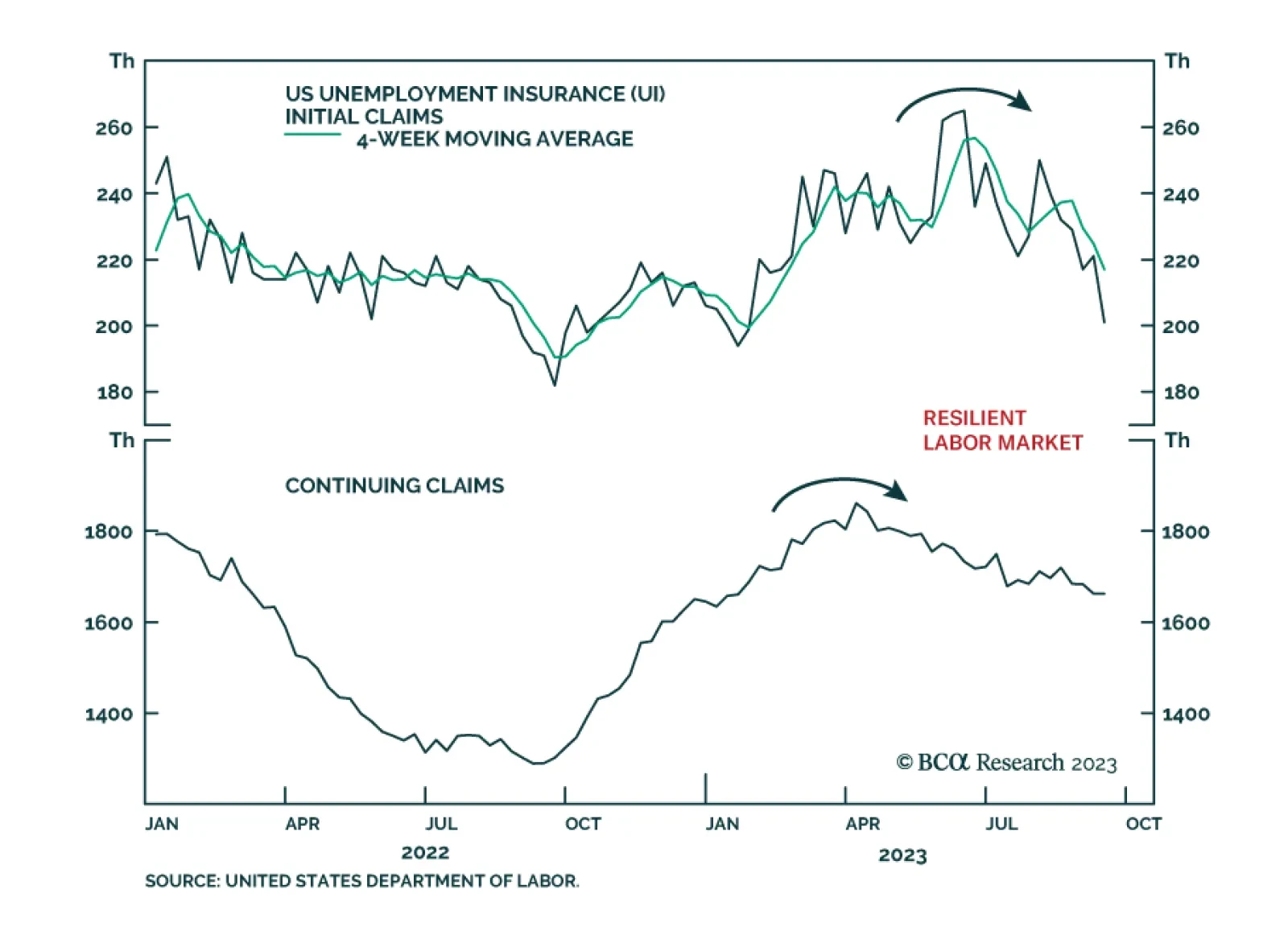

Thursday’s release of US weekly jobless claims and continuing claims delivered a positive surprise about labor market conditions. The decline in initial jobless claims to an eight-month low of 201 thousand came in below…

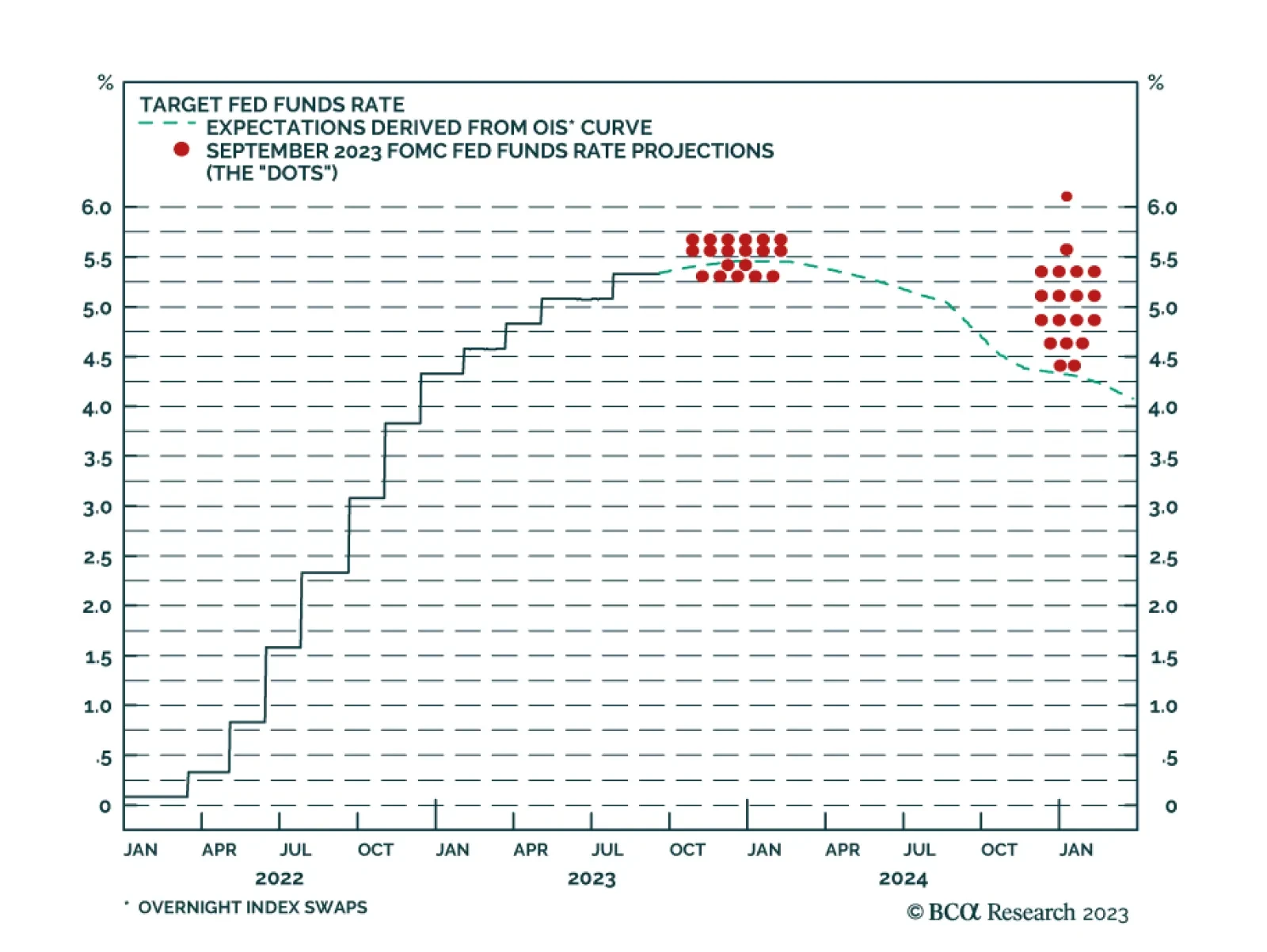

According to BCA Research’s US Bond Strategy service, the 2006/07 roadmap remains a good one for bond investors. The Fed held the funds rate steady this afternoon and made no material changes to its policy statement.…

After a steady rebound in the first half of the year, the US NAHB Housing Market Index’s 5-point decline to 45 in September was a disappointment to consensus estimates of a 1-point decrease. It marks the second consecutive…