The uptick in the Conference Board's Consumer Confidence Index to 102.0 pushed it above consensus estimates of 101.0 in November. Although this is a marginally positive signal, the prior month was revised down from 102.6 to…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

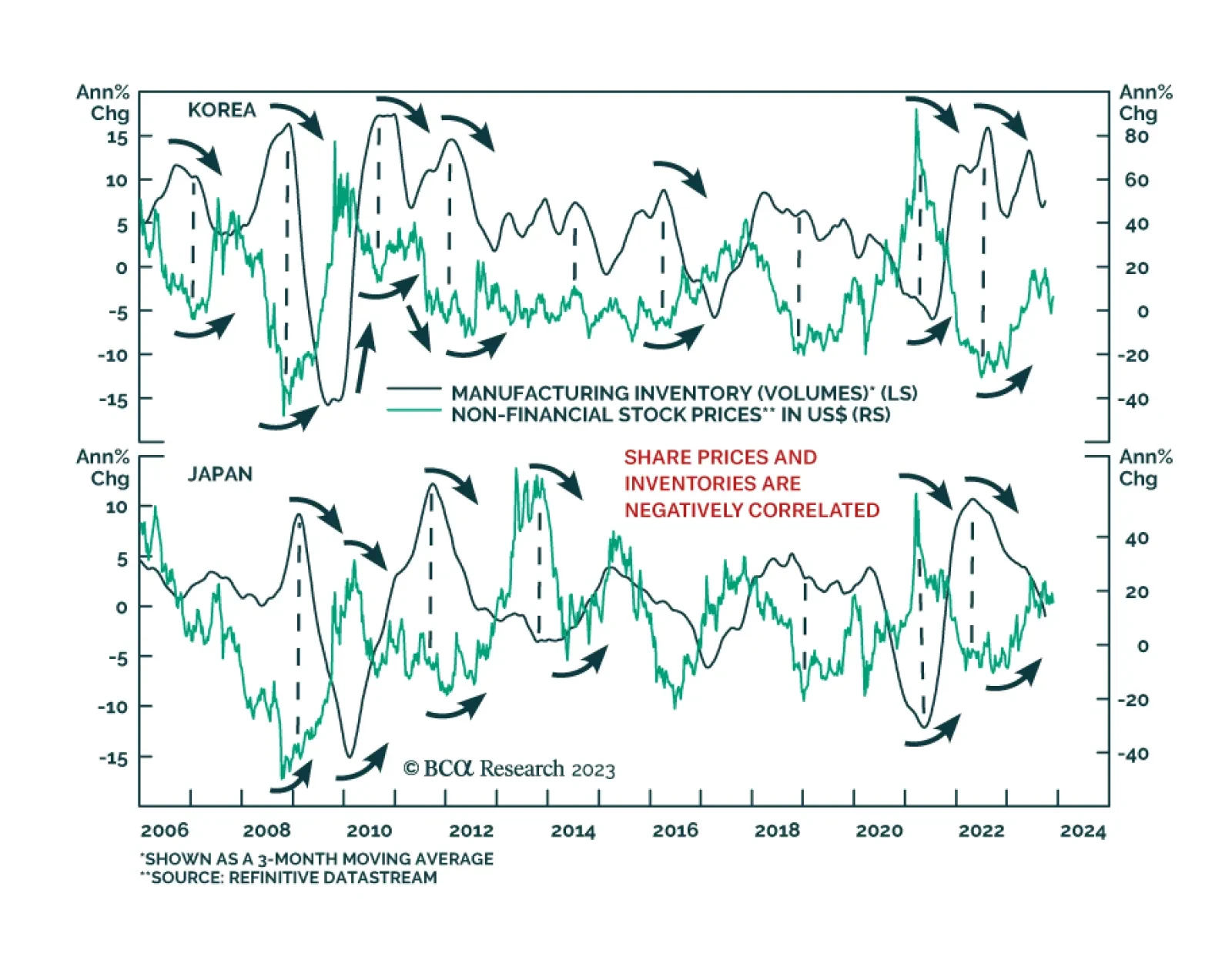

According to BCA Research's Emerging Markets Strategy service, investors should focus on fluctuations in final demand rather than inventories. A common narrative endorsed by many market participants is that inventory…

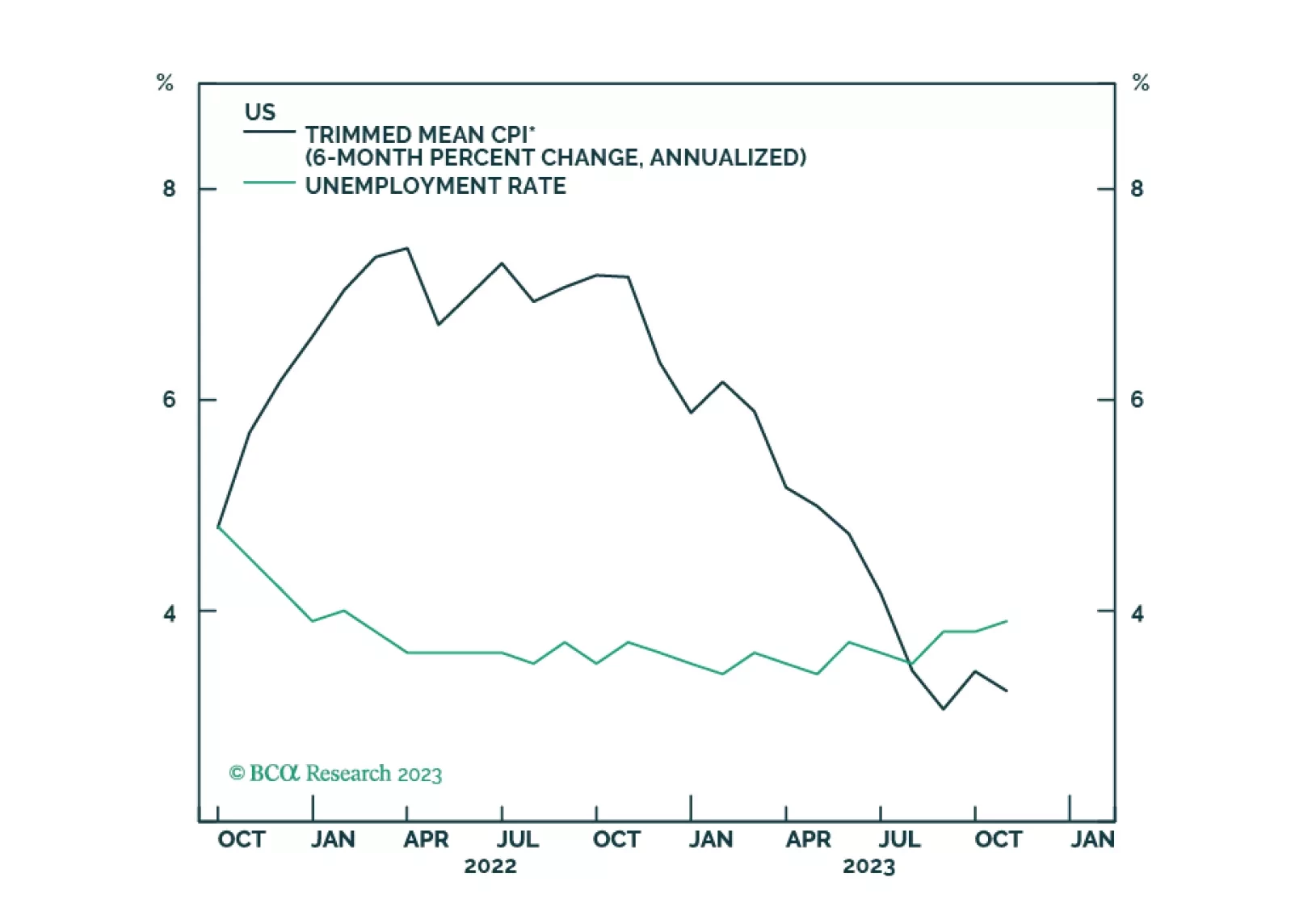

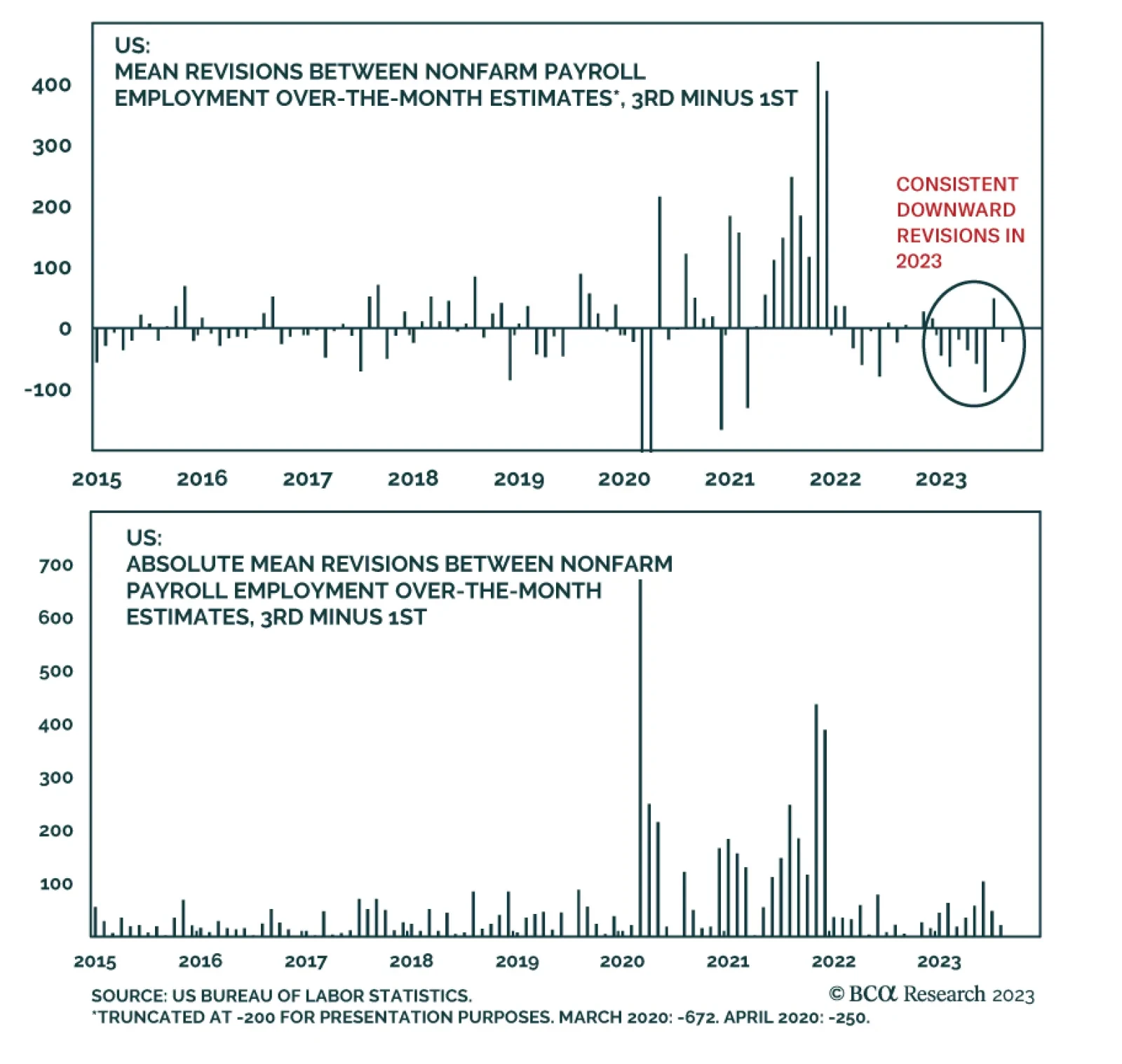

The US nonfarm payroll report is an important monthly data release that investors scrutinize for updates on the state of the US labor market and economy more broadly. In the current context, the updates help gauge whether the US…

Our kinked Phillips curve framework predicted the immaculate disinflation of 2023. That same framework is now warning that the global economy is heading towards a recession in the second half of 2024.

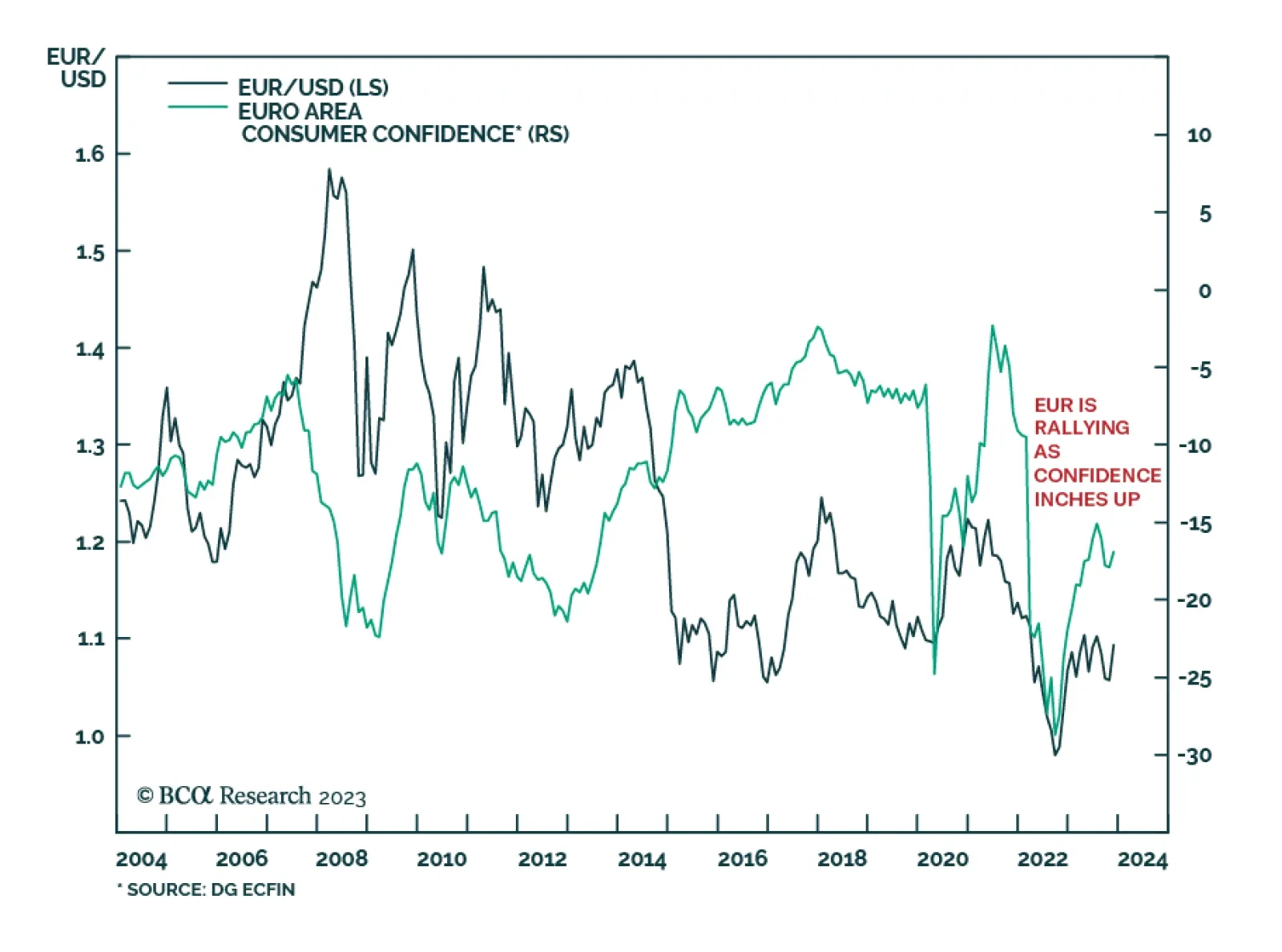

Confidence is on the mend in the Euro Area. The rebounding ZEW growth expectations index reveals that investors are becoming more optimistic. The German IFO's business climate index inched higher in October for the first time…

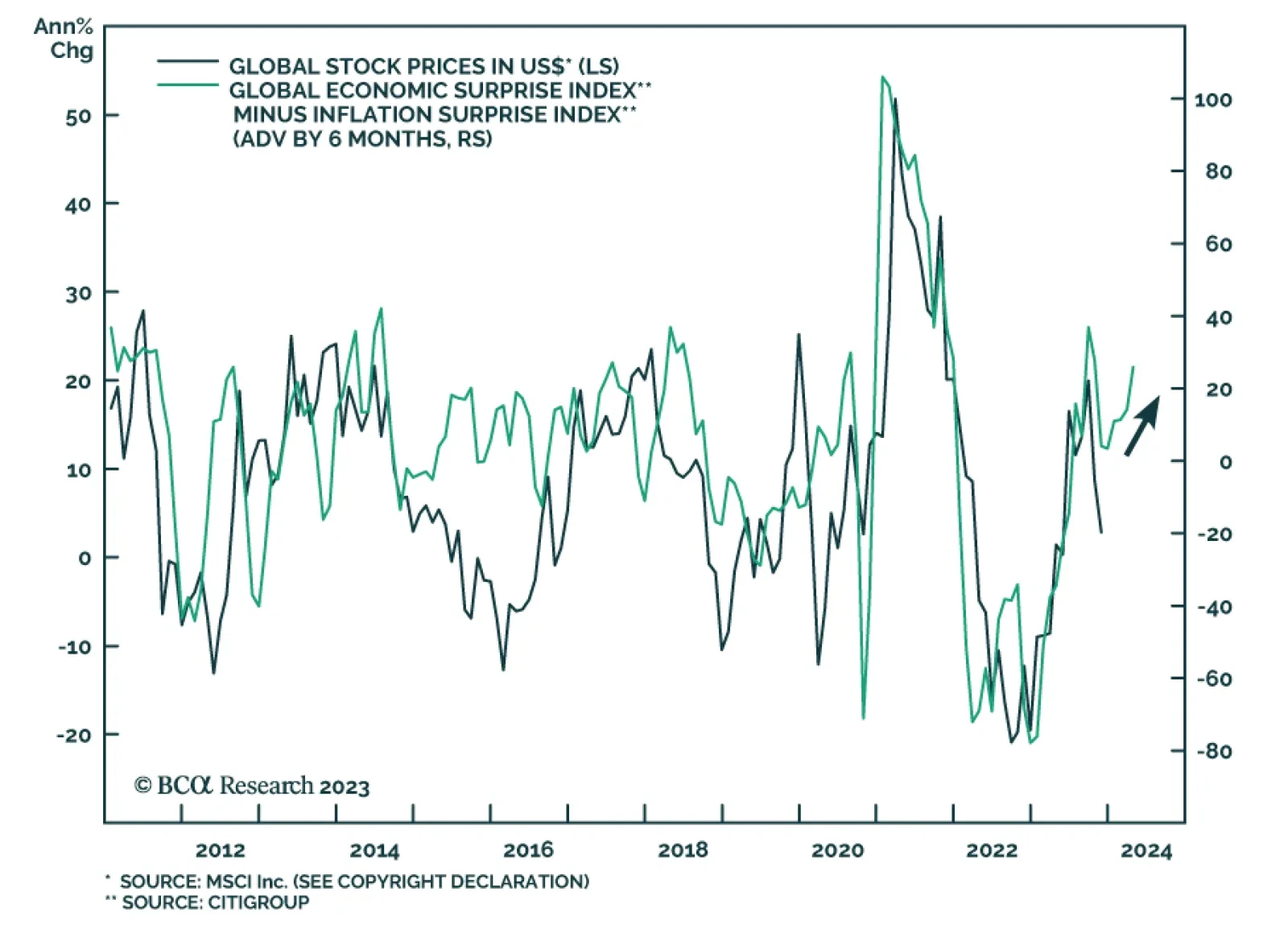

After dipping into negative territory between June and early August, the Global Economic Surprise Index has since rebounded, signalling an improvement in economic momentum. Initially, this rebound was isolated to the US. However…

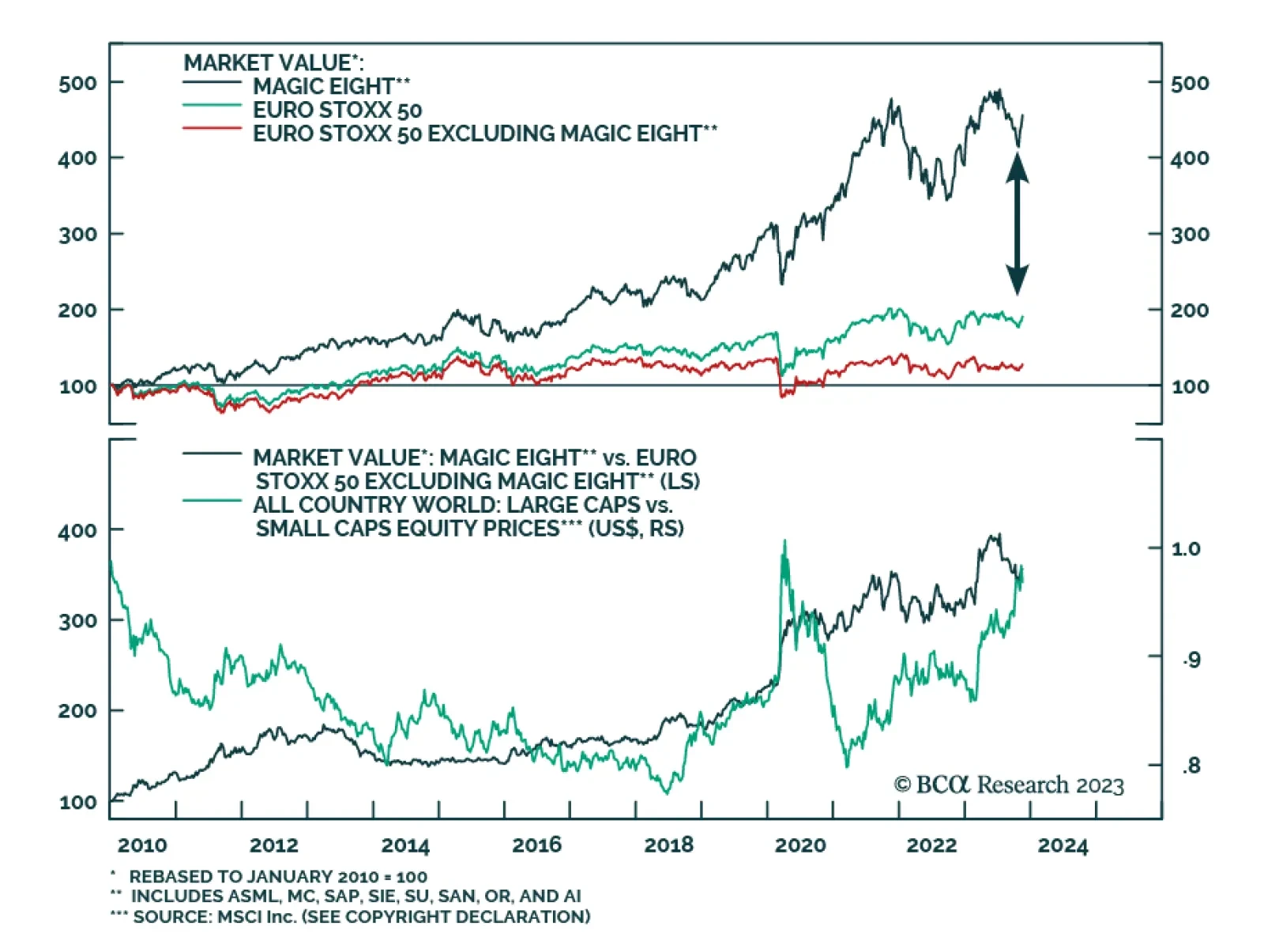

According to BCA Research’s European Investment Strategy service, the Magic Eight are the European counterpart to the US’ Magnificent Seven. The dominance of the so-called Magnificent Seven in the US S&P 500 is…

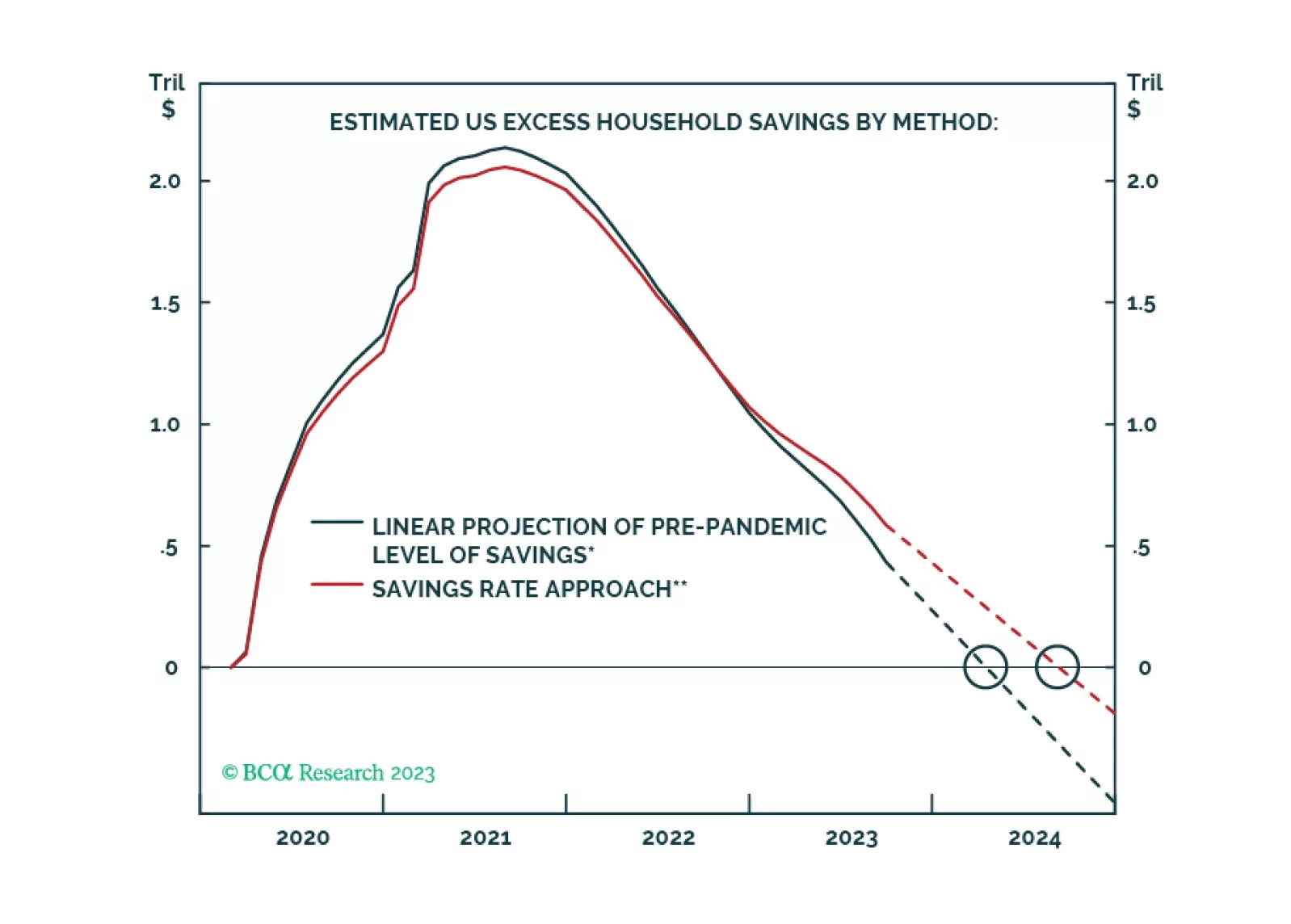

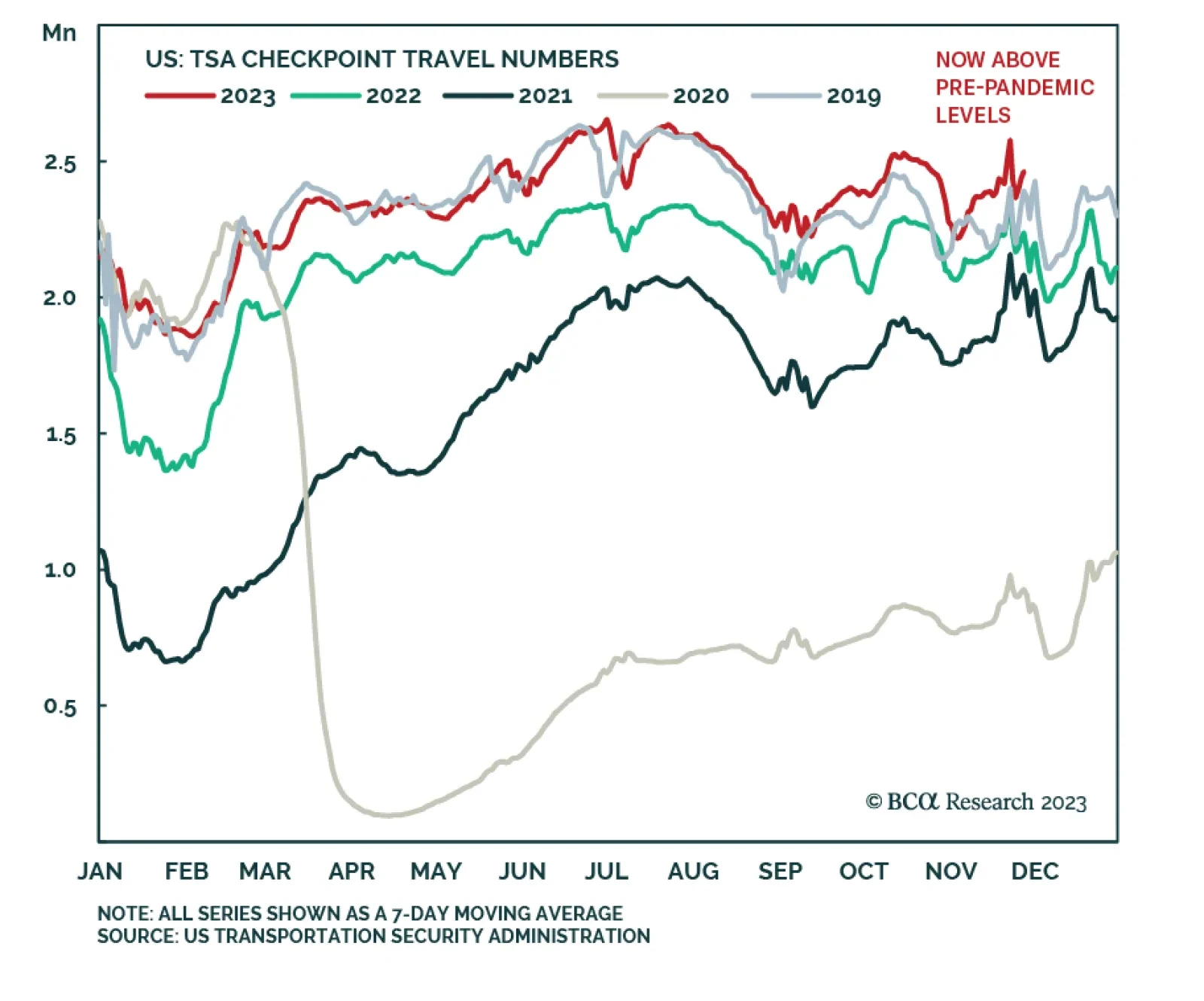

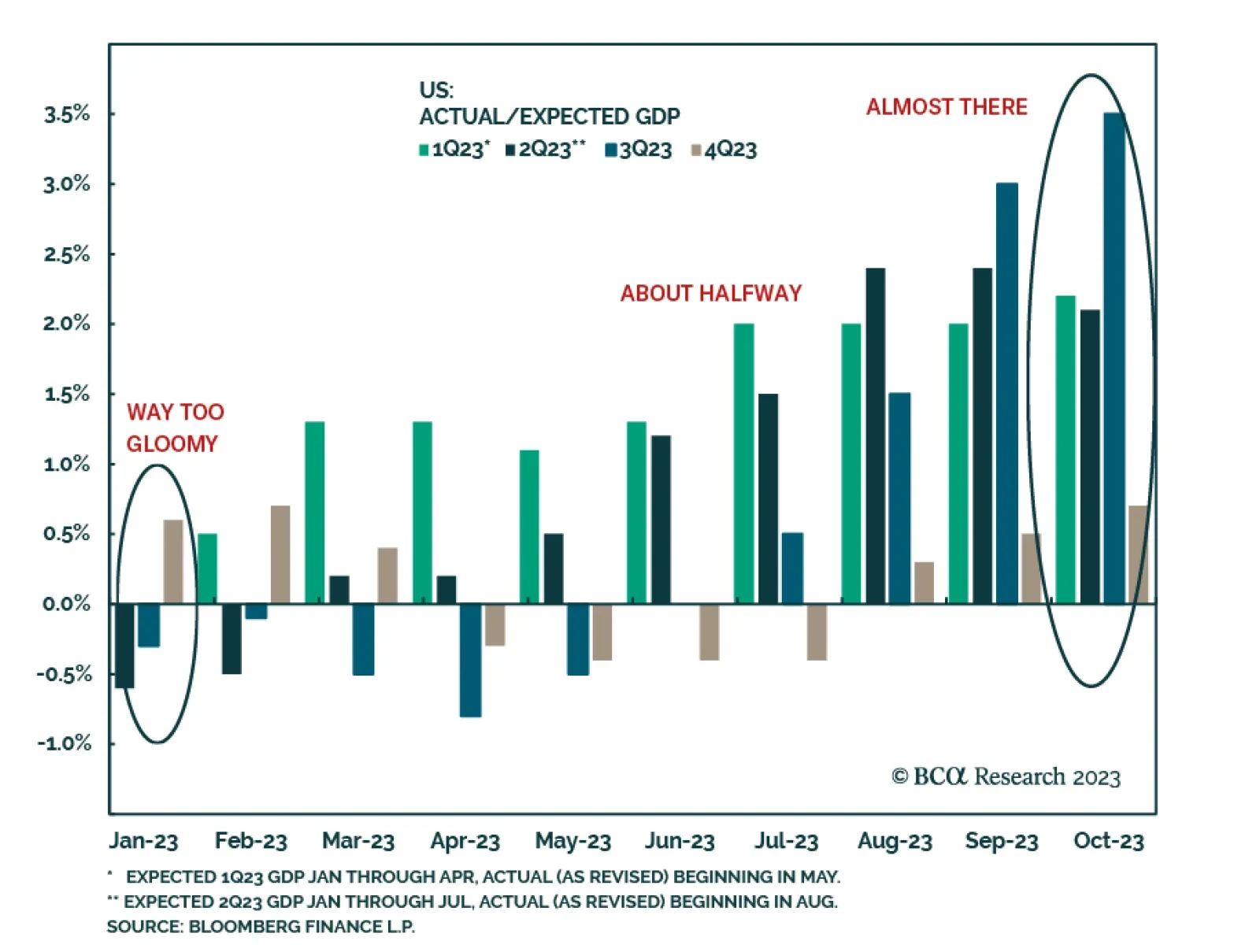

The soft-landing narrative is gaining momentum, pushing equities higher and potentially offering investors a better entry point to position against it. Financial markets appear to have been surprised by the comforting…