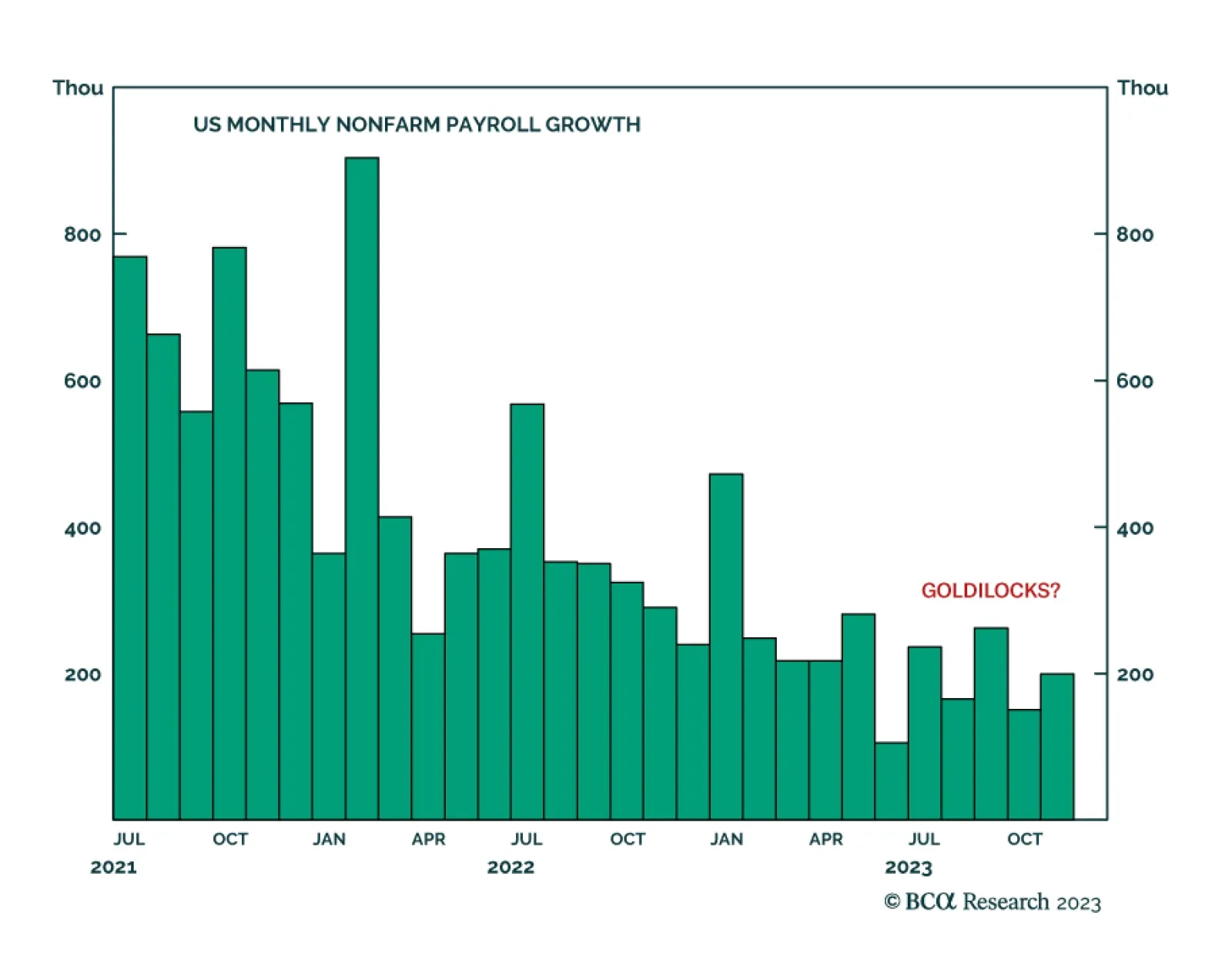

The US employment report delivered a positive surprise on Friday. Nonfarm payroll growth accelerated from 150 thousand to 199 thousand in November, beating expectations of 185 thousand. Importantly, the favorable result was…

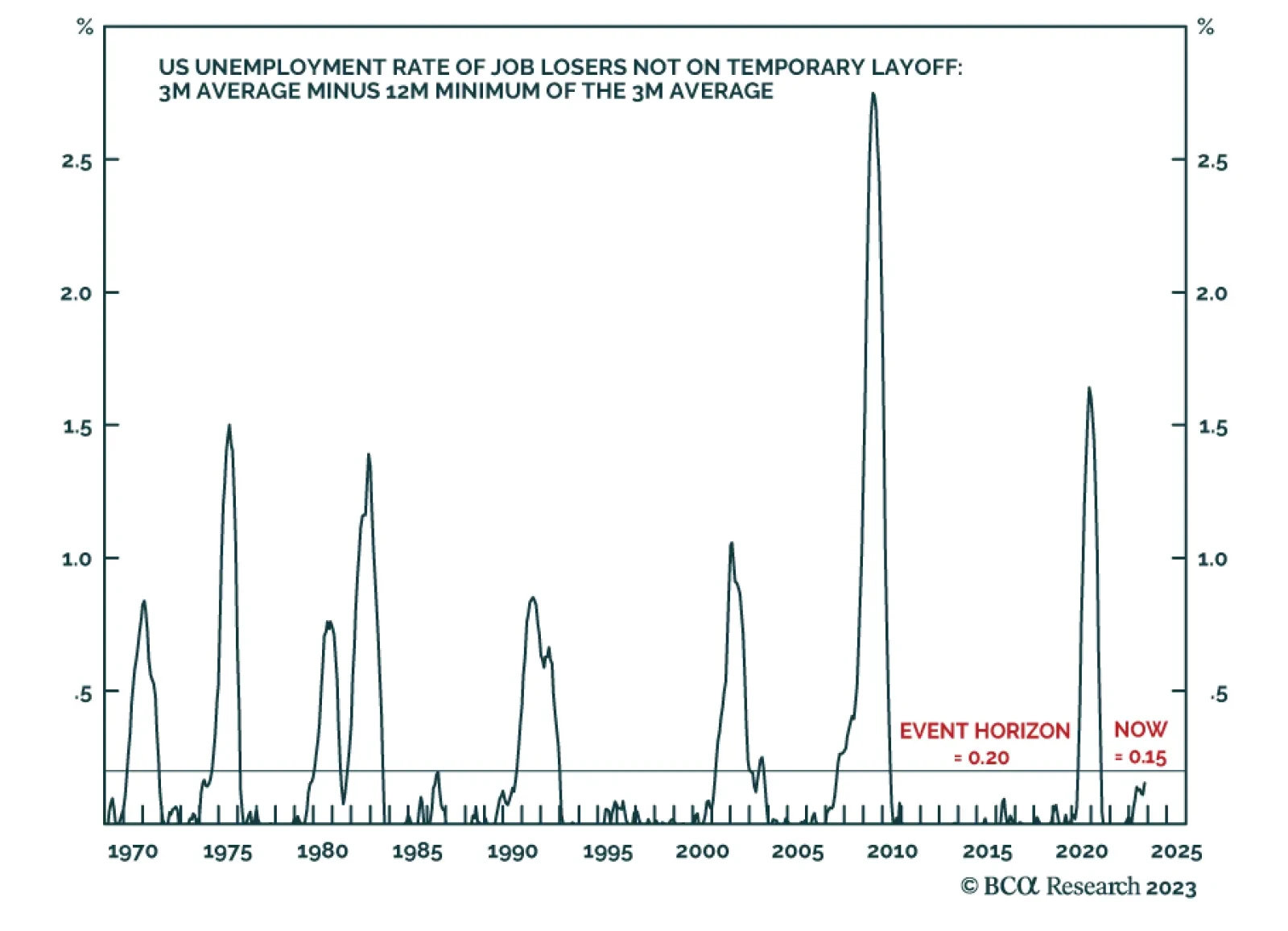

The ‘Joshi rule’ real-time recession indicator signals the start of a US recession when the three-month moving average of the unemployment rate of ‘job losers not on temporary layoff’ rises by 0.20 percent…

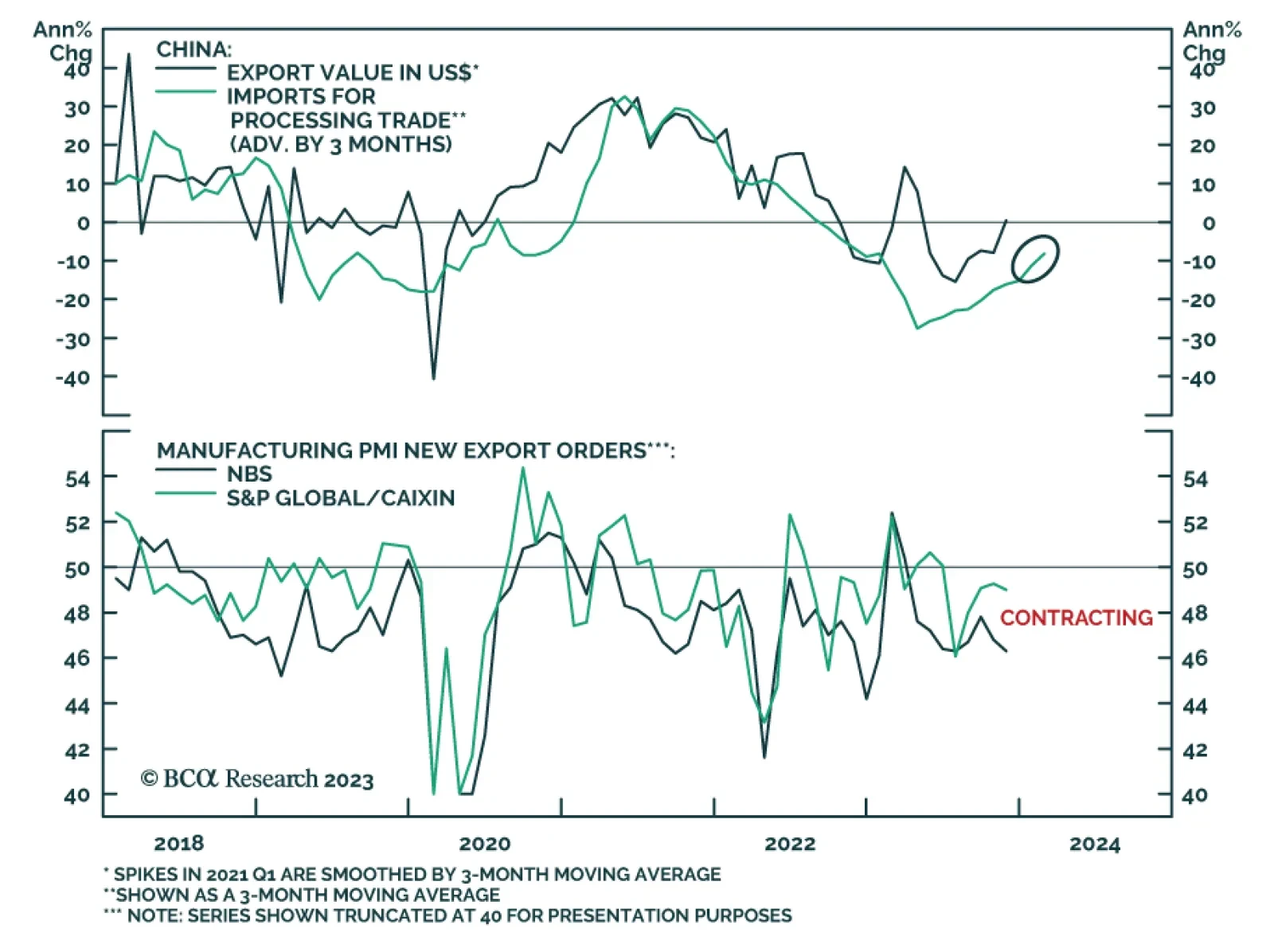

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…

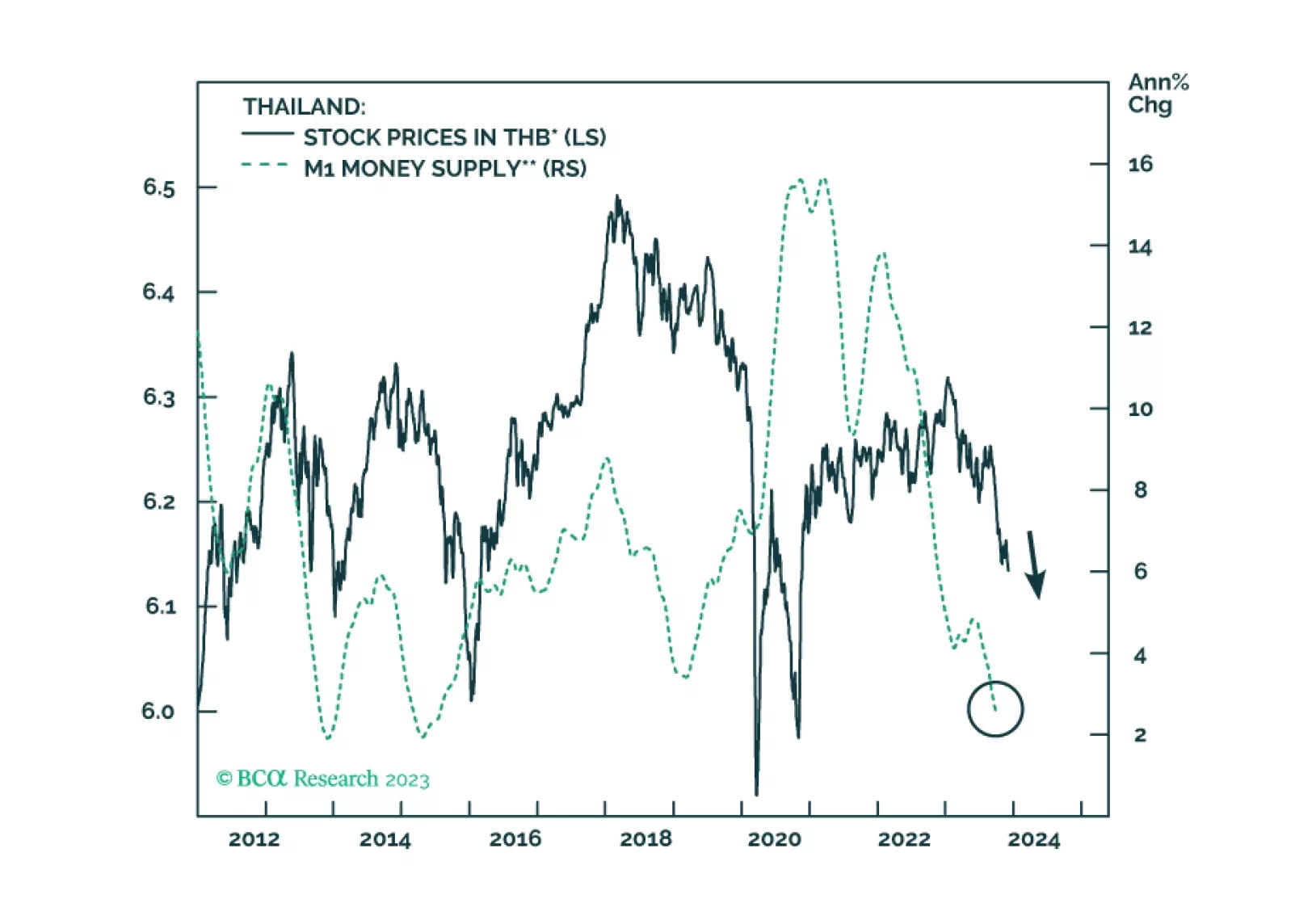

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

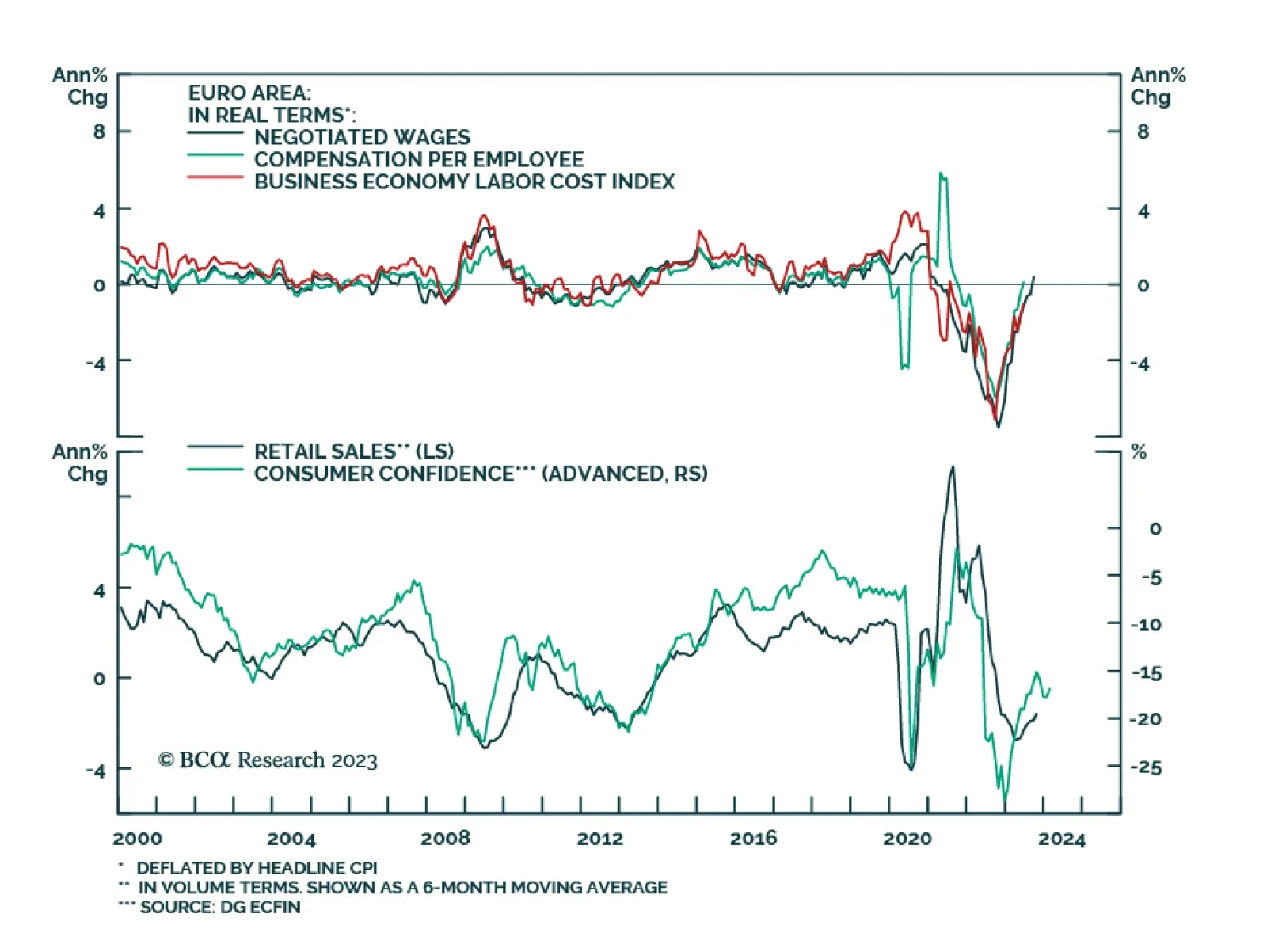

Retail sales volumes grew on a sequential basis for the first time in three months in October, rising by 0.1% m/m following an upwardly revised 0.1% m/m decline. On an annual basis, the pace of decline slowed from -2.9% y/y to -1…

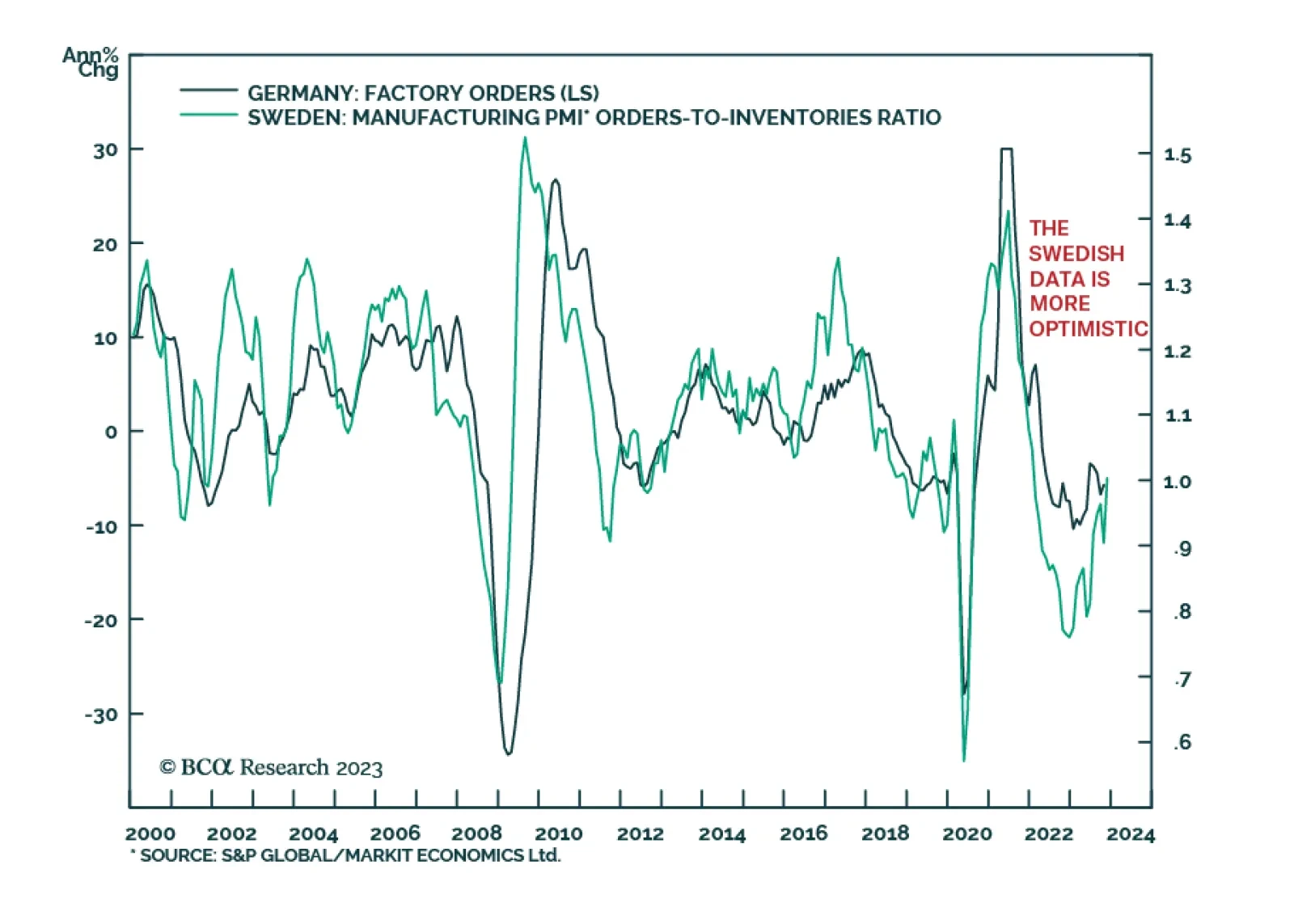

German factory orders sent a disappointing signal on Wednesday. New orders at German factories unexpectedly declined by 3.7% m/m in October, disappointing expectations of a 0.2% m/m rise following two consecutive months of…

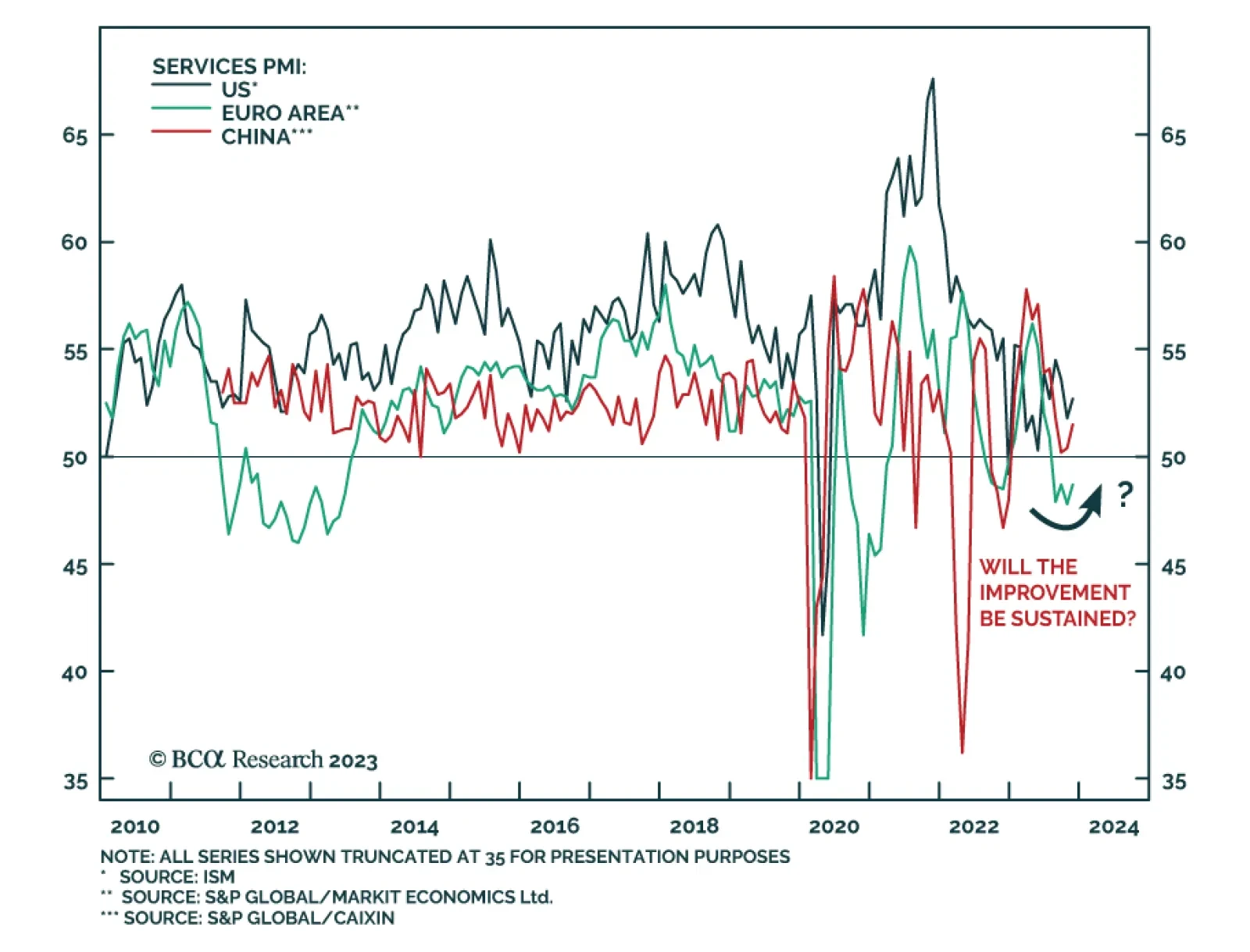

The November services PMIs sent a slightly positive signal on Tuesday. The global measure ticked up from 50.4 to 50.6, pointing to a marginal pickup in the pace of expansion. Importantly, this slight improvement was broad-based…

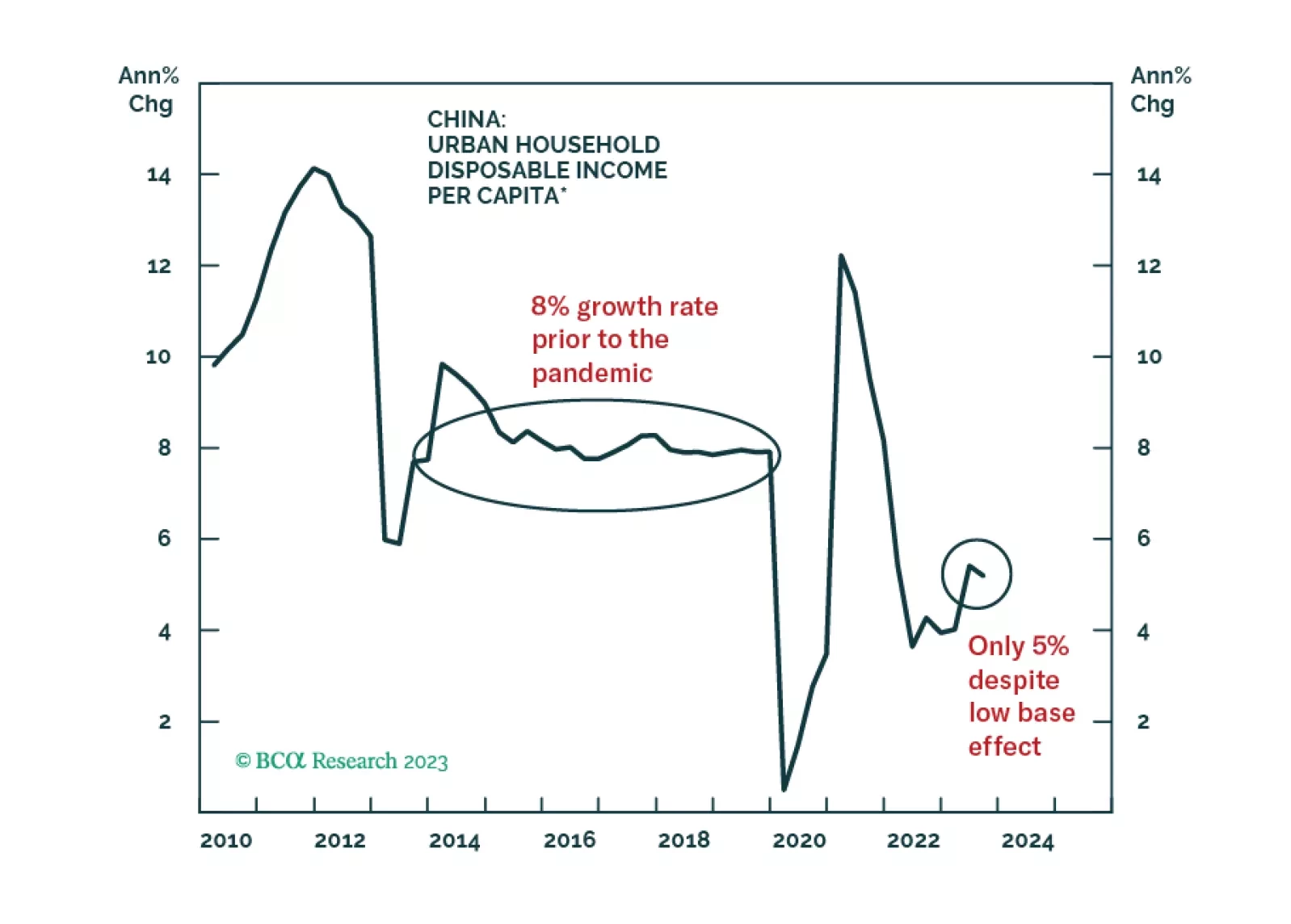

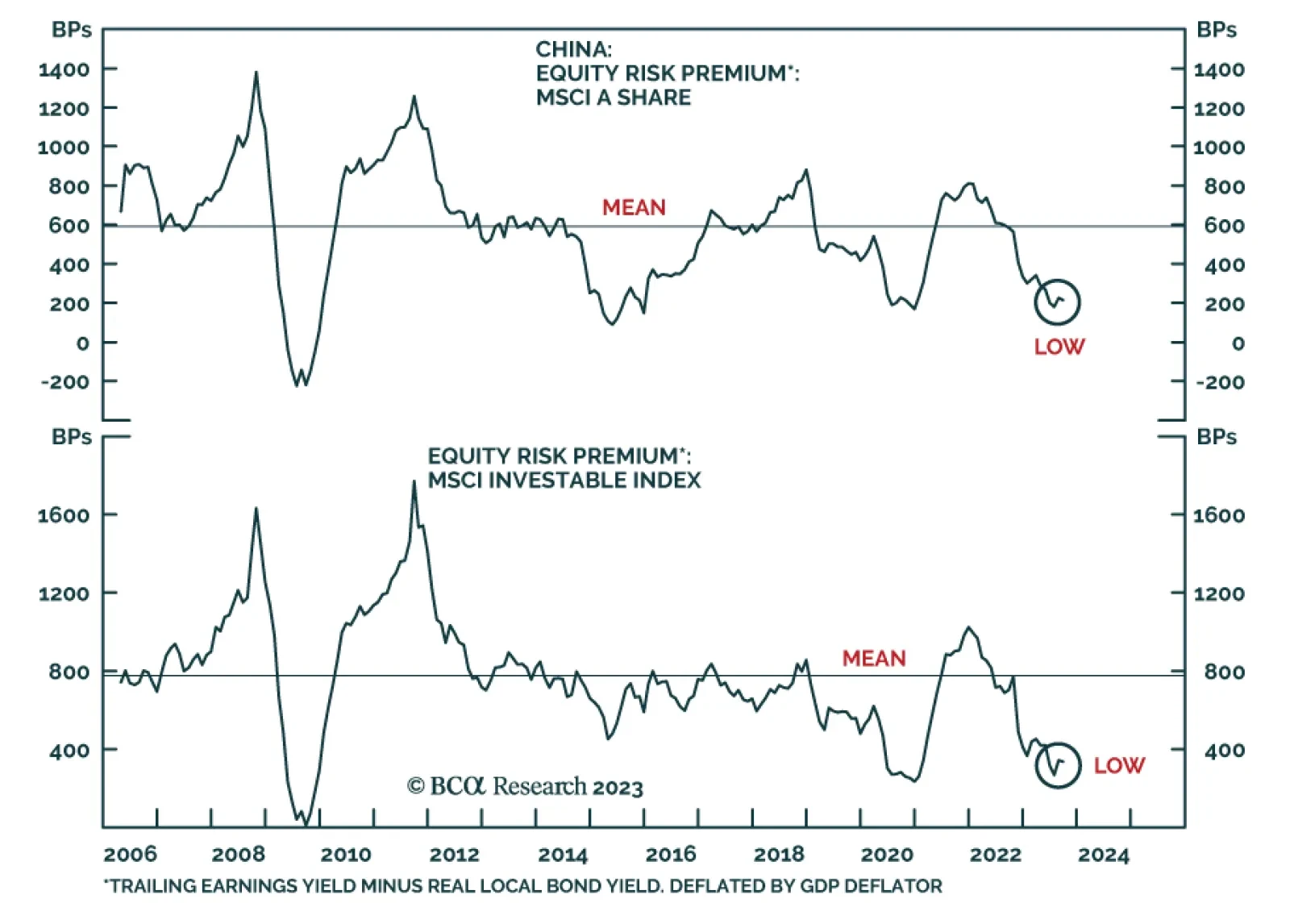

China’s CSI 300 equity index closed at its lowest level since early 2019 on Tuesday following news that Moody’s downgraded its outlook for China’s credit rating from stable to negative. The report cited the…