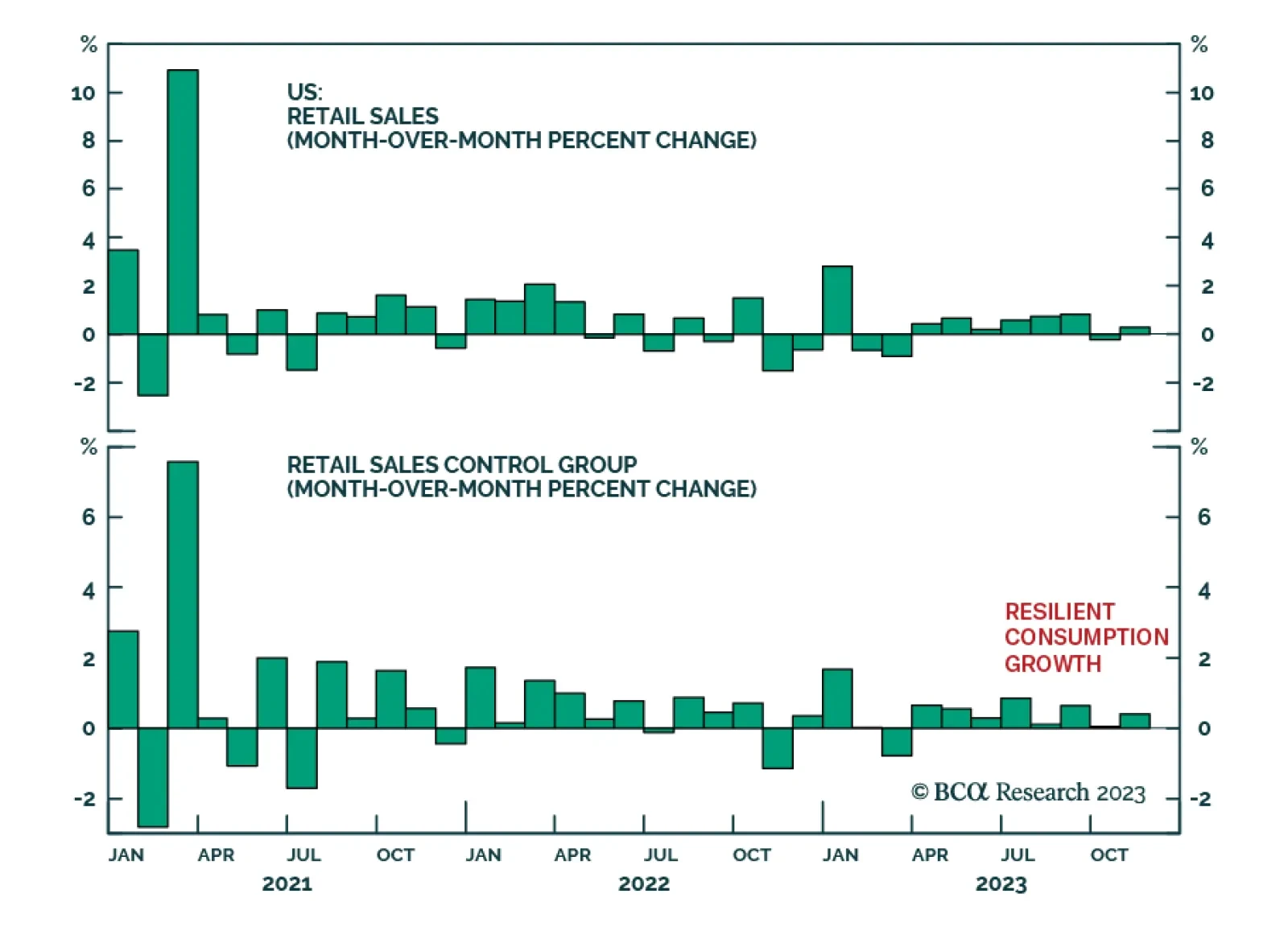

The November US retail sales release for November delivered a positive signal about consumer spending. Overall retail sales unexpectedly increased by 0.3% m/m, surprising expectations of a 0.1% m/m decline. The details of the…

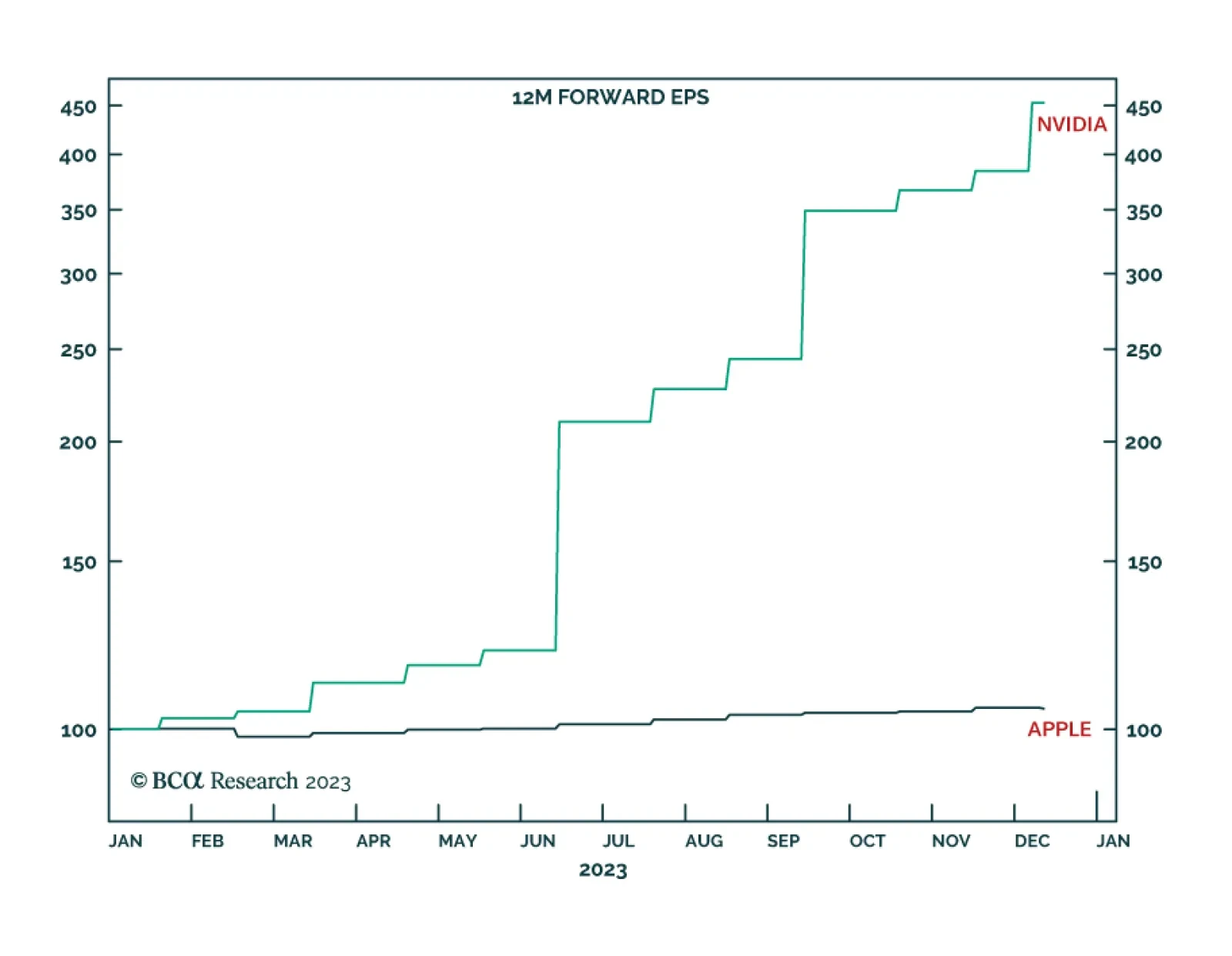

According to BCA Research’s Counterpoint service, the AI gold rush will struggle to find any gold. In a gold rush, very few people get rich finding gold. But the guys selling the picks and shovels make a fortune! In the…

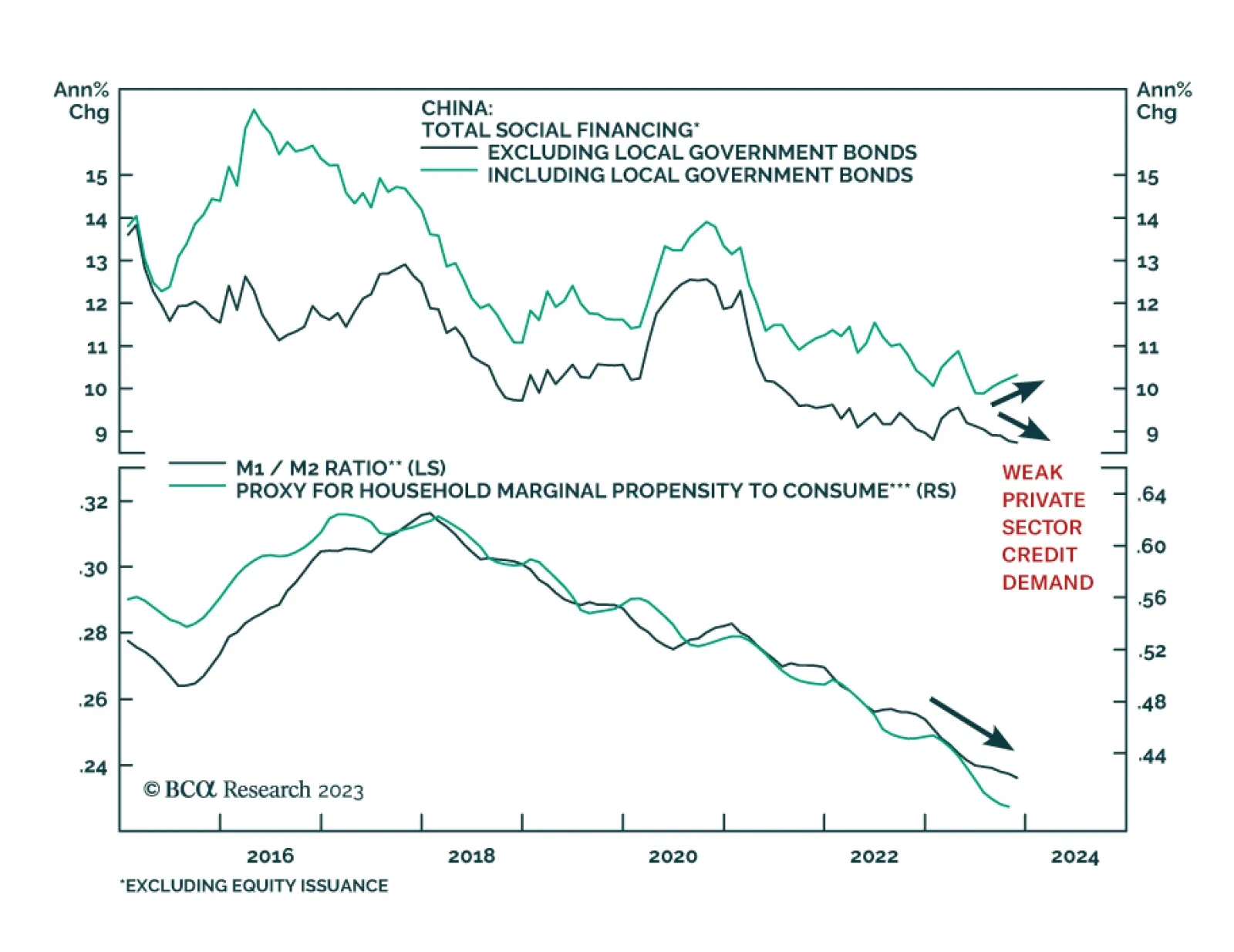

China’s credit expanded by less than expected in November. The CNY 2.45 trillion increase in aggregate financing fell short of anticipations of CNY 2.595 trillion following a CNY 1.845 trillion rise in October. Similarly,…

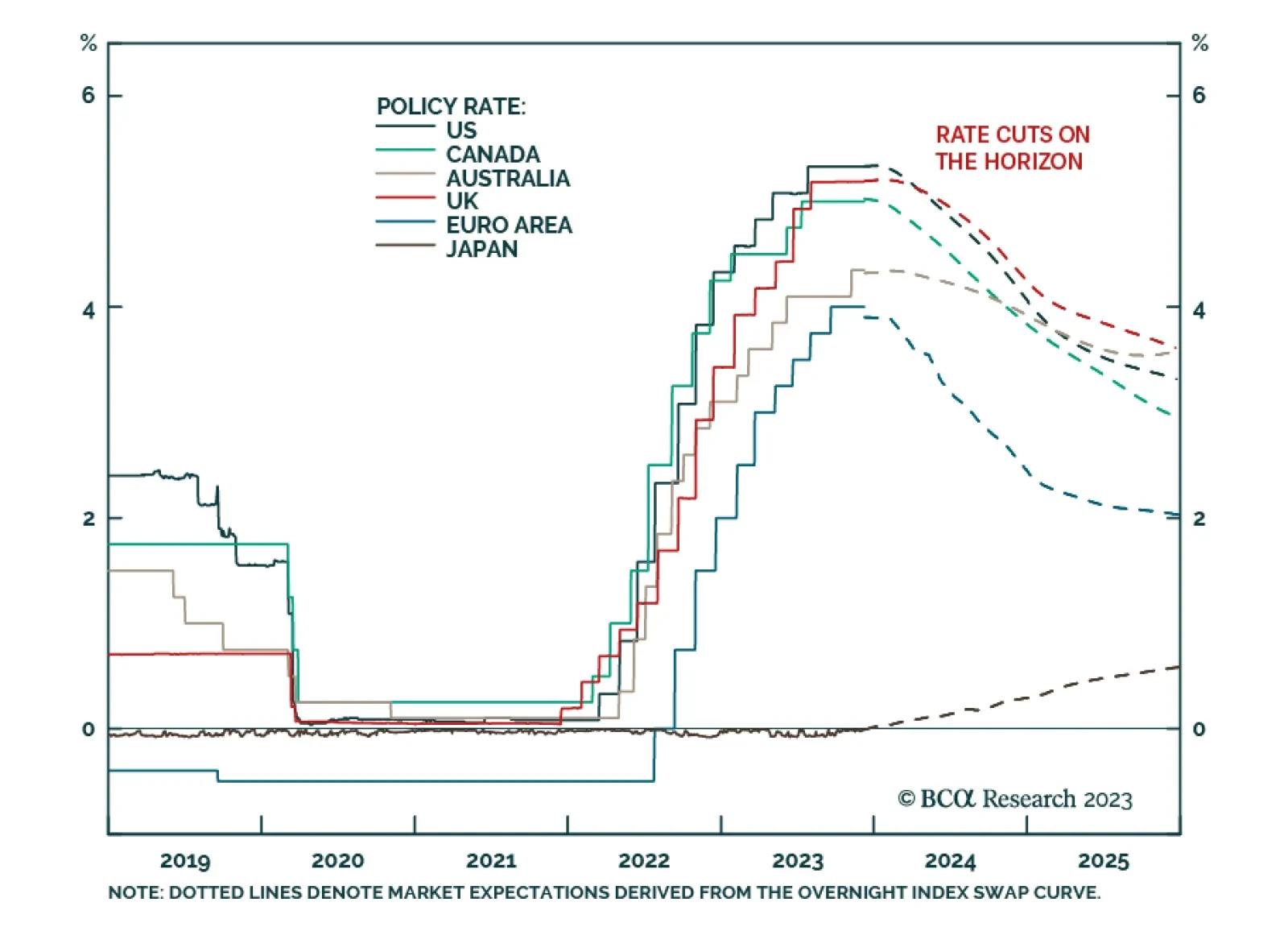

Multiple major DM central banks are scheduled to decide on monetary policy this week. The US Fed will meet on Wednesday, followed by the ECB, BoE, and Norges Bank on Thursday. It comes after the BoC and RBA both opted to keep…

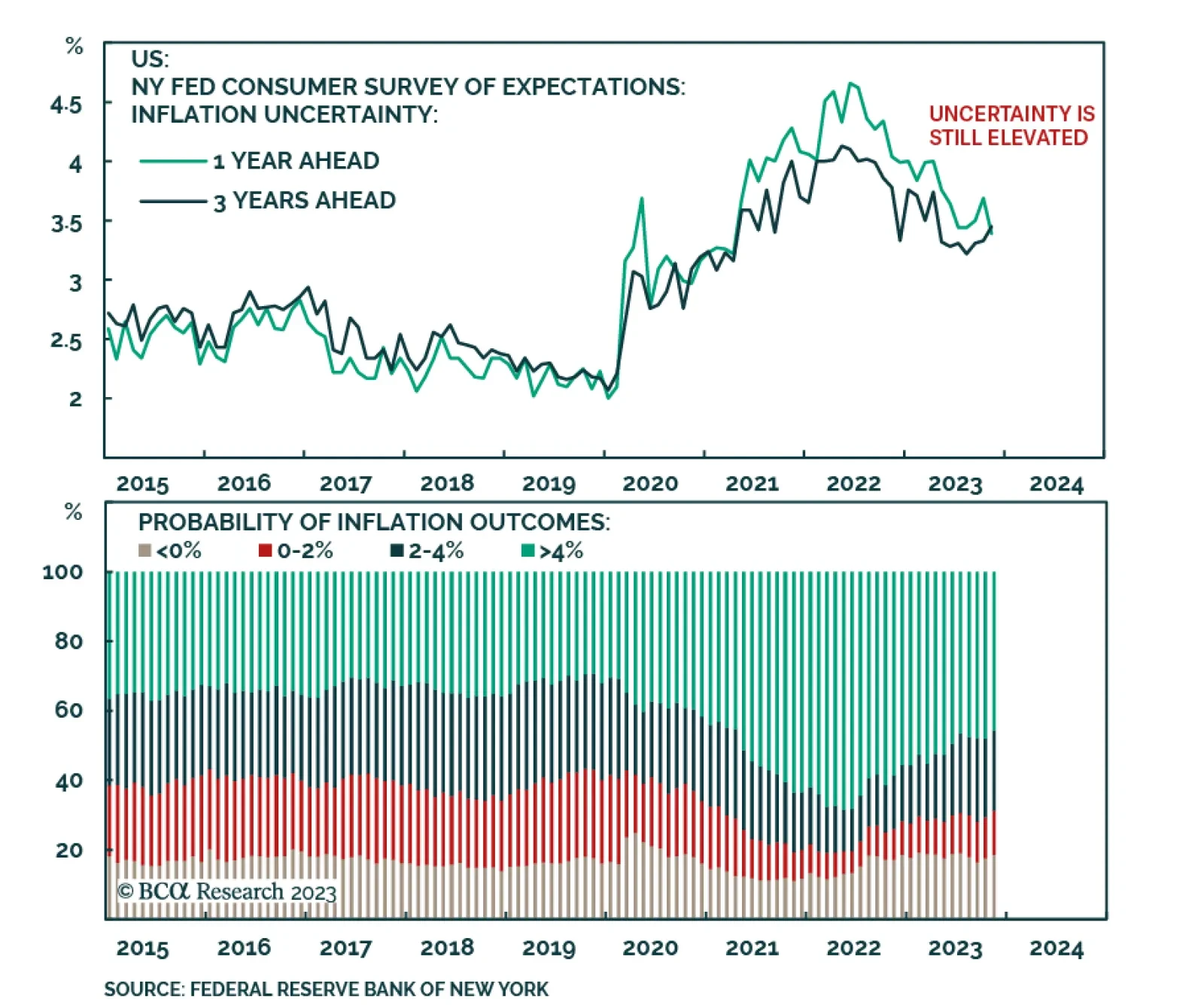

Results of the New York Fed’s November Survey of Consumer Expectations corroborate the signal from the University of Michigan’s preliminary results that inflation expectations are receding. The 0.2 percentage point…

China’s CPI and PPI releases delivered a negative signal about the domestic economy. The rate of contraction in the CPI index accelerated to -0.5% y/y in November, the sharpest rate of decline in 3 years and disappointing…

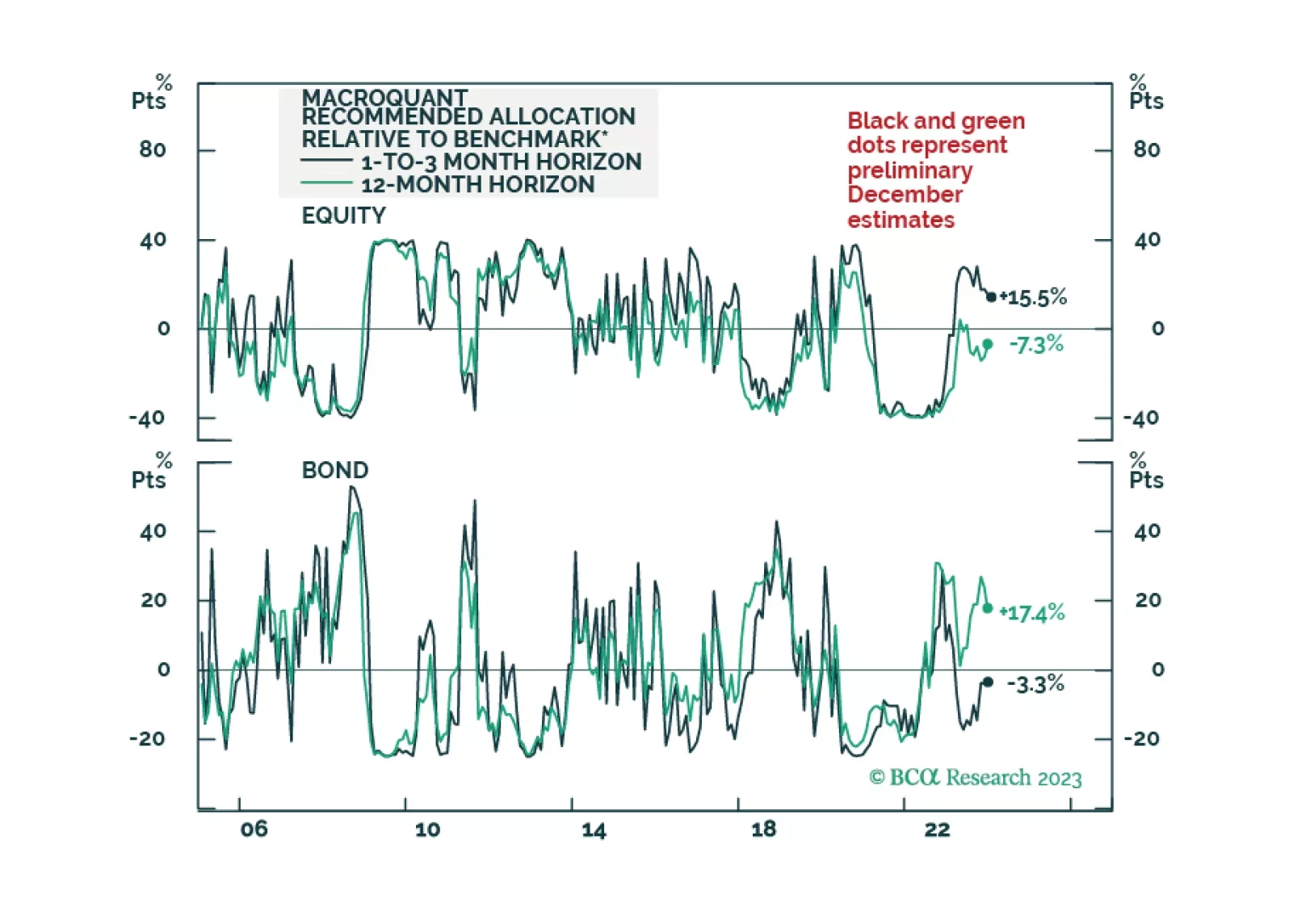

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

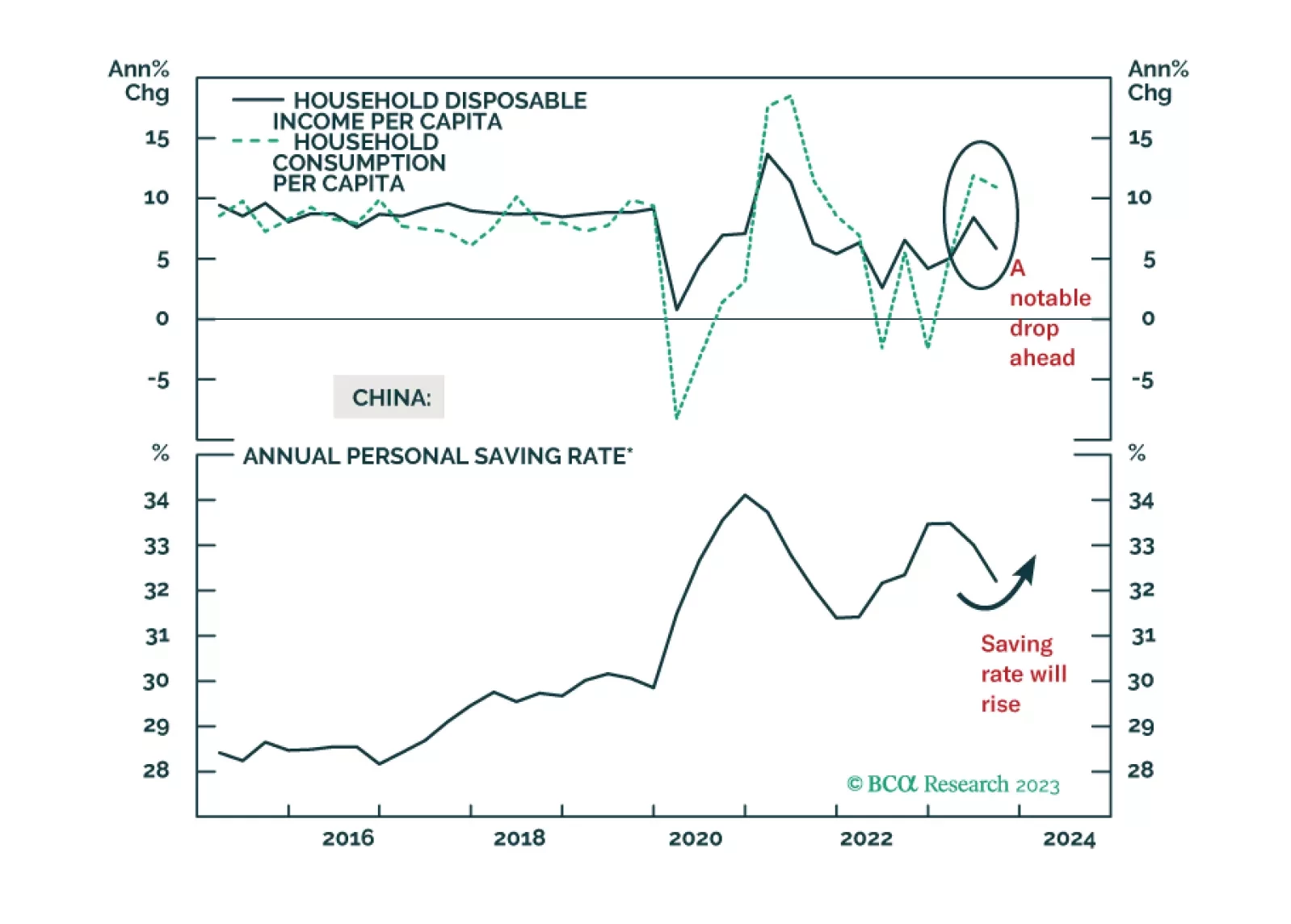

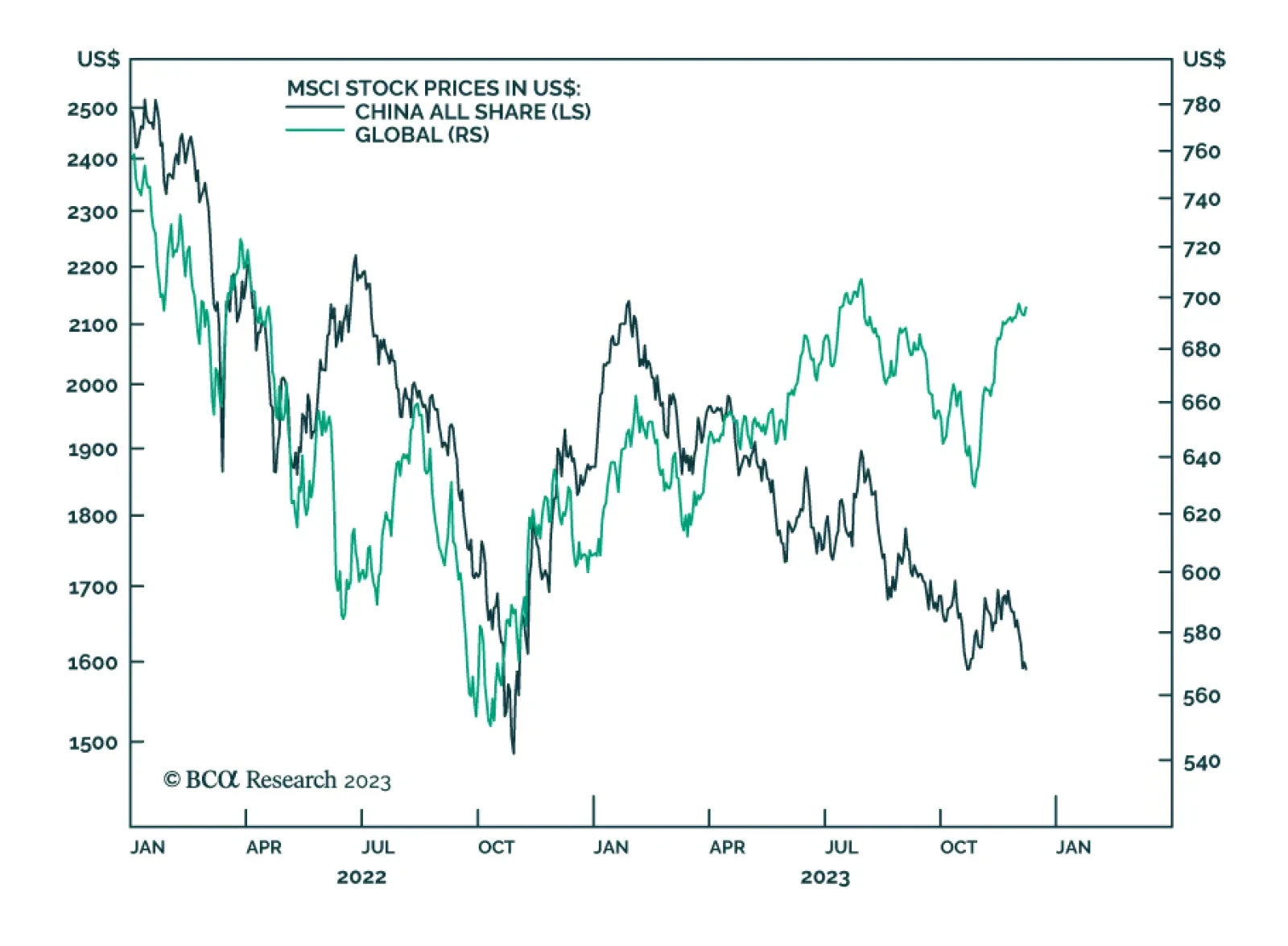

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…

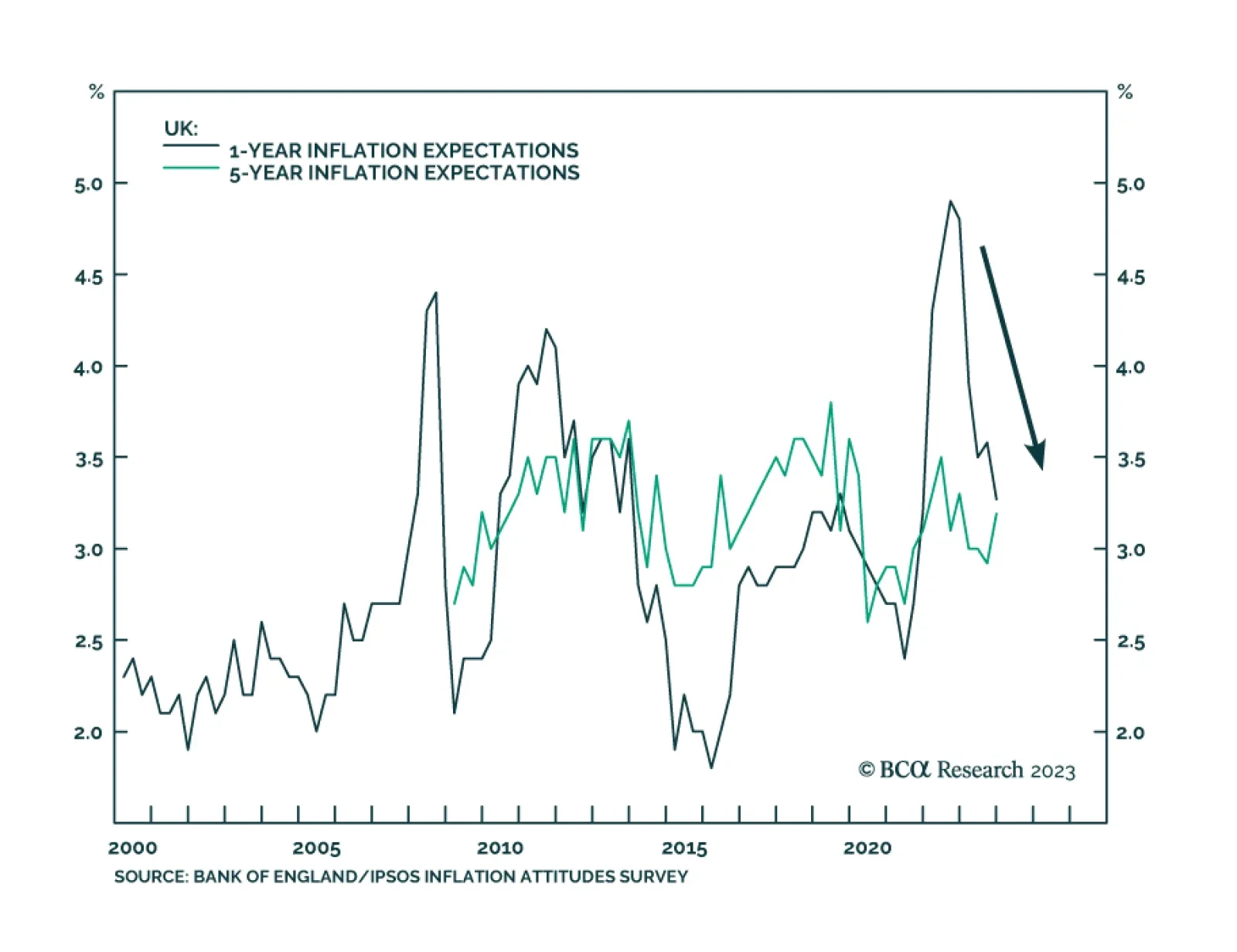

The latest Bank of England/Ipsos quarterly Inflation Attitudes Survey shows the public revised down its near-term inflation outlook. Respondents now believe inflation will fall to 3.3% in the year ahead – down from 3.6% in…