The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

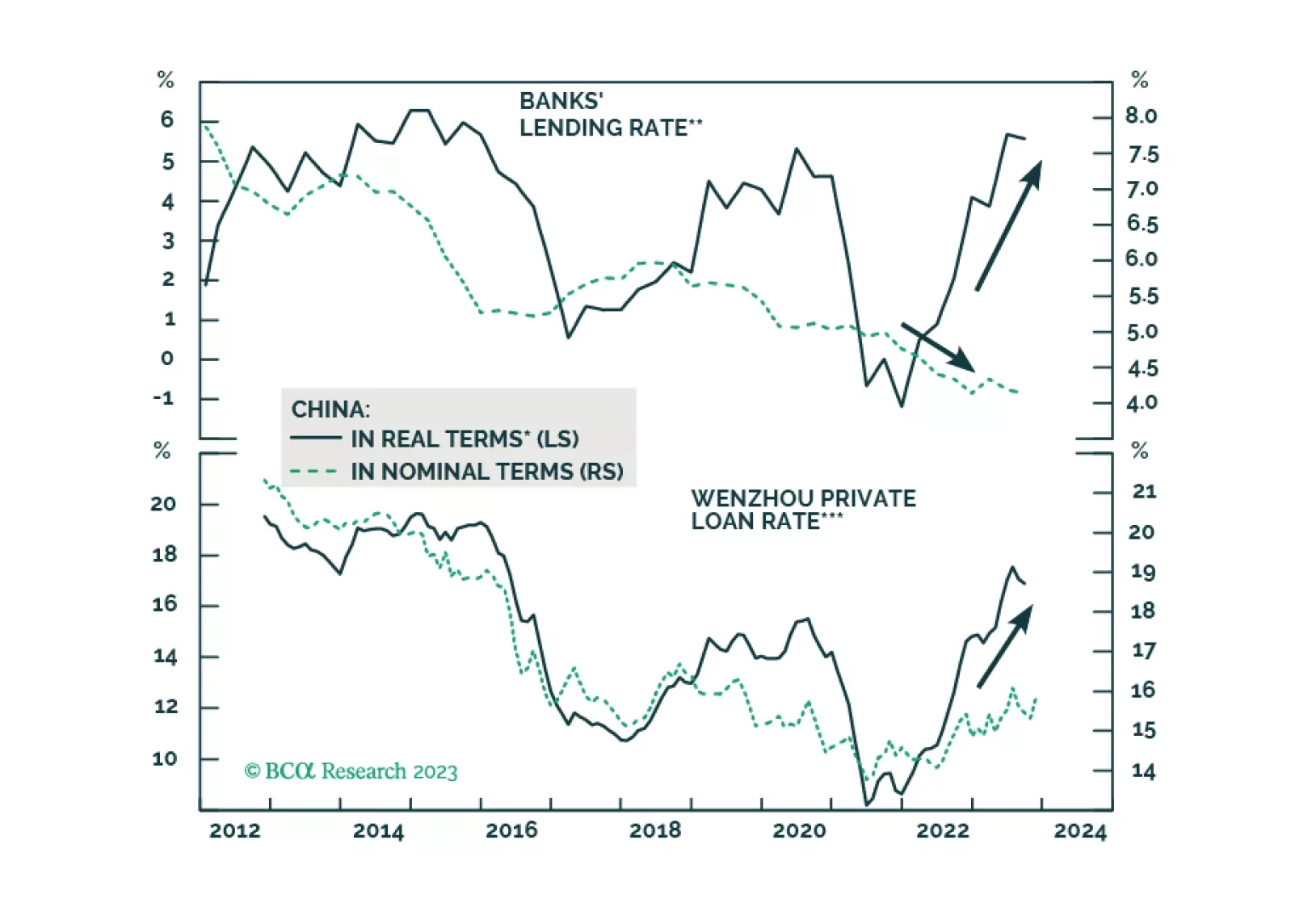

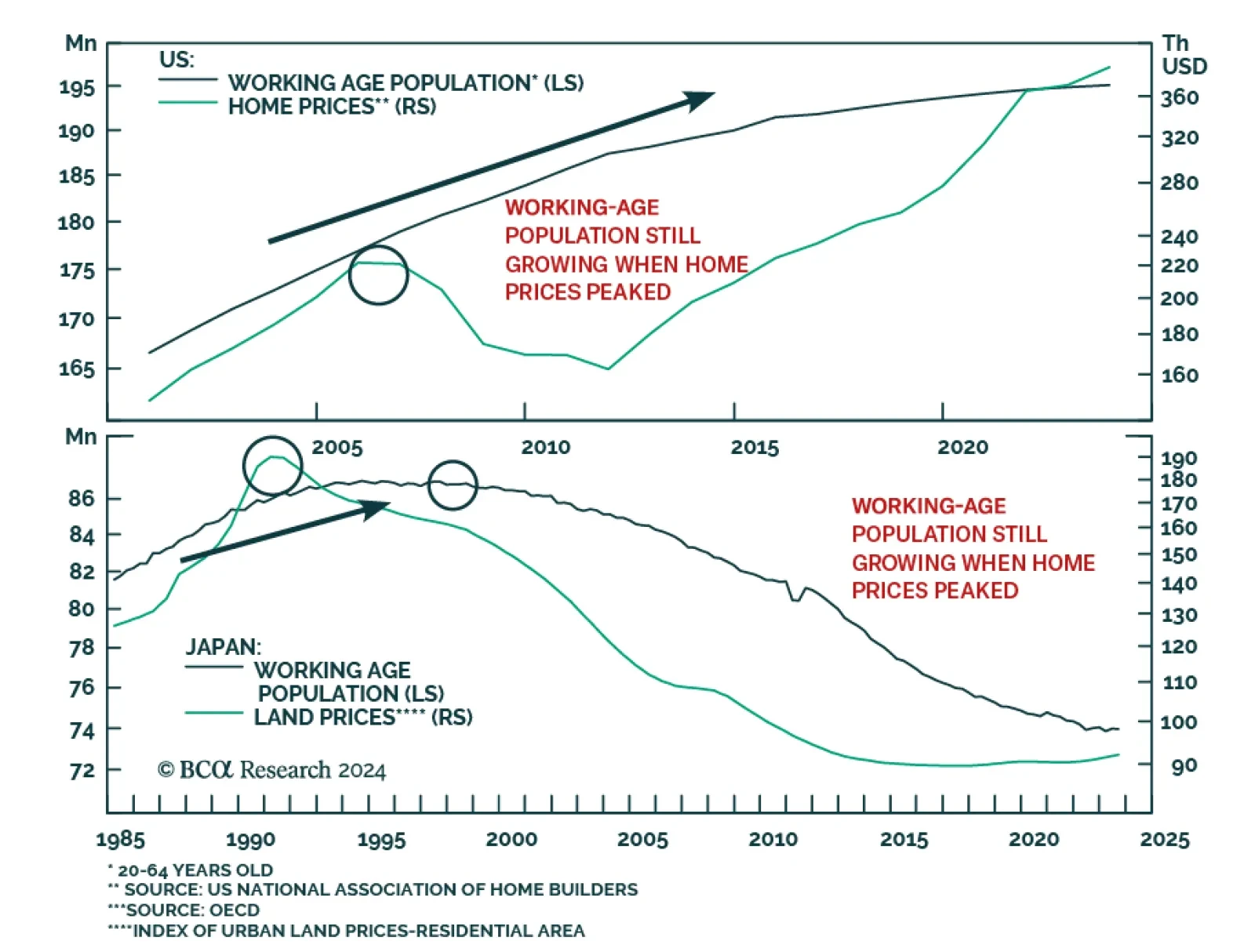

According to BCA Research’s China Investment Strategy service, the structural landscape of China's property market today is, in many aspects, more challenging than the real estate markets in Japan and the US at the peak…

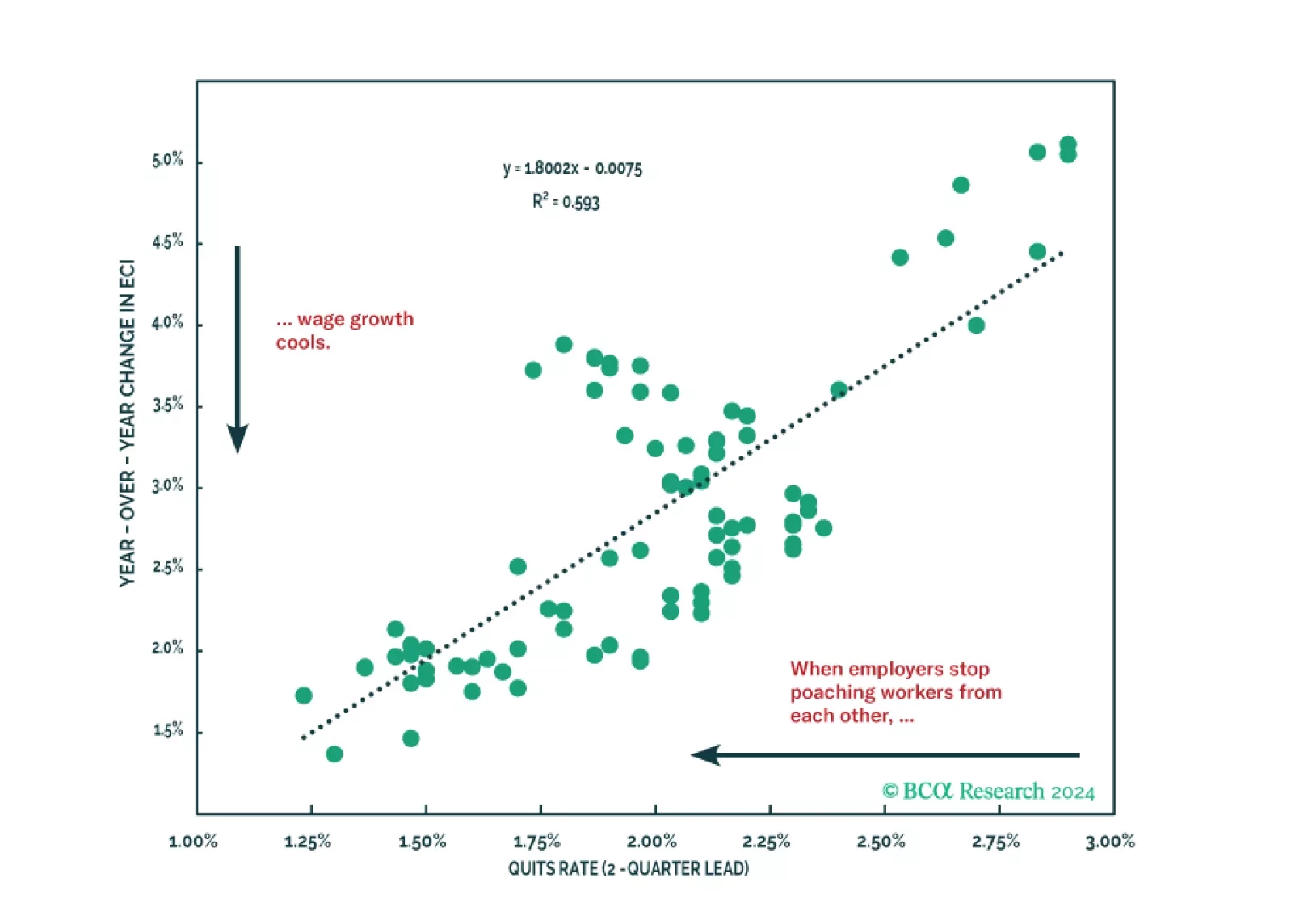

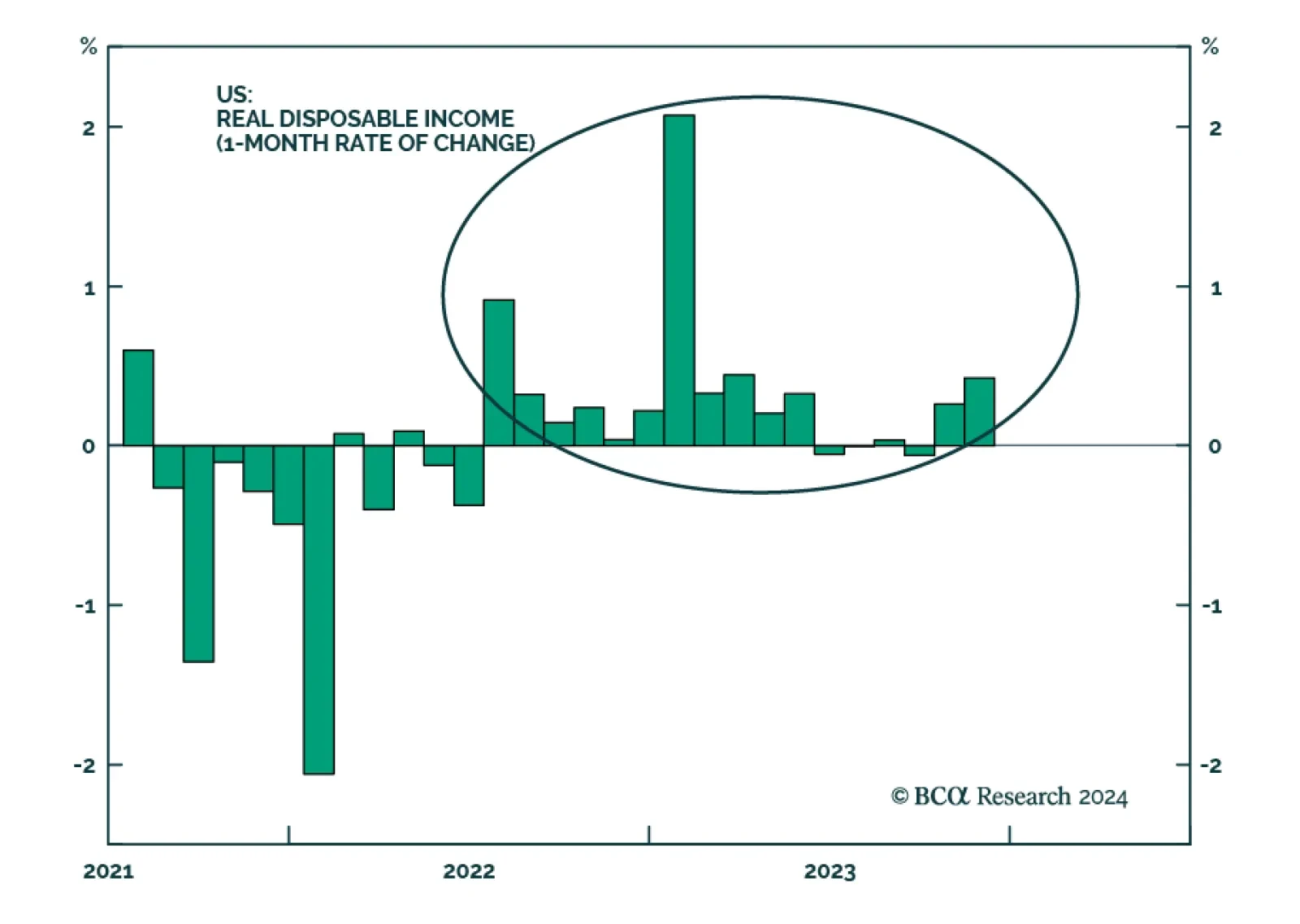

Growth in US disposable income has outpaced inflation nearly every month since mid-2022. Consumption is principally driven by income, but in the US it has gotten a meaningful assist the last two years from the drawdown of excess…

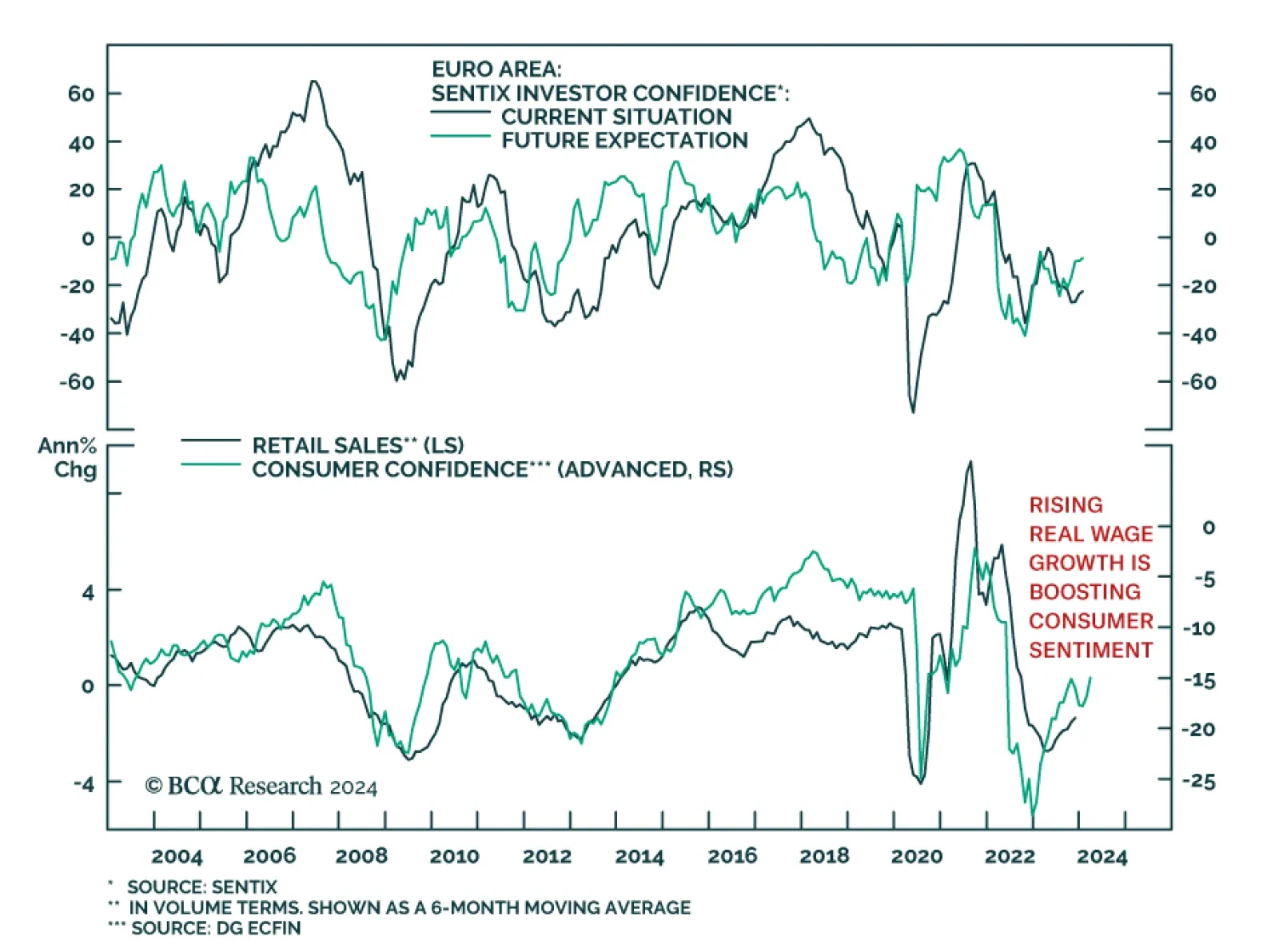

Optimism among investors and economic agents continues to improve in the Eurozone. The Sentix Economic Index for the Eurozone rose from -16.8 to -15.8 in January – in line with consensus expectations and marking the third…

Despite the blah opening to the year, we do not think stocks have reached an inflection point. We expect that incoming data will continue to flatter the soft-landing narrative for another couple of months, helping the S&P 500 to…

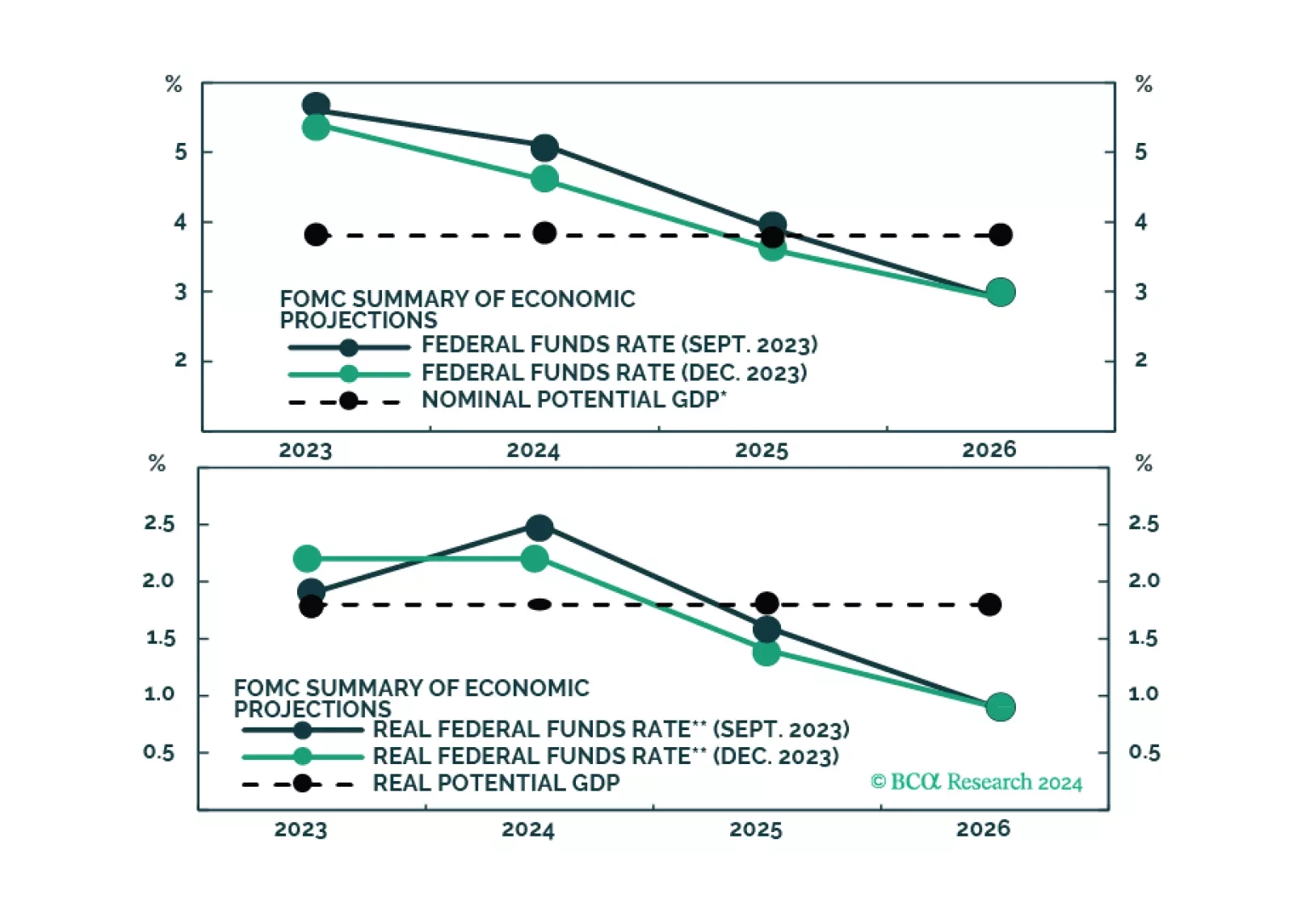

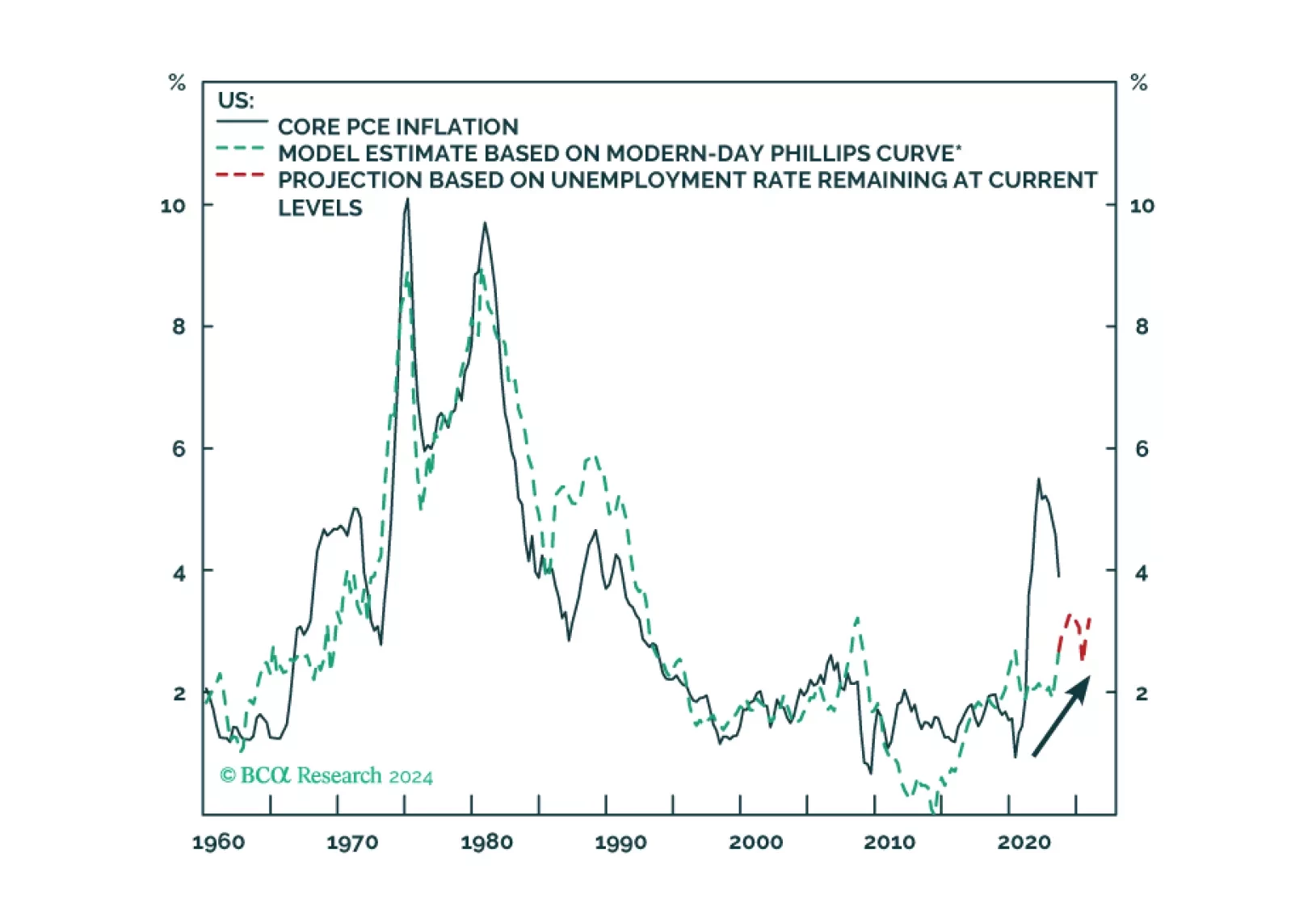

The market is excited by the idea that the Fed will cut rates early this year, even without a recession. But is that likely, with inflation still set to be around 2.8% mid-year?

In Section I, we discuss the implications and potential risks of the Fed’s recent pivot. The near-term implications of the Fed's dovish pivot are likely to continue to be bullish for risky asset prices, and a new high in global stock…

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

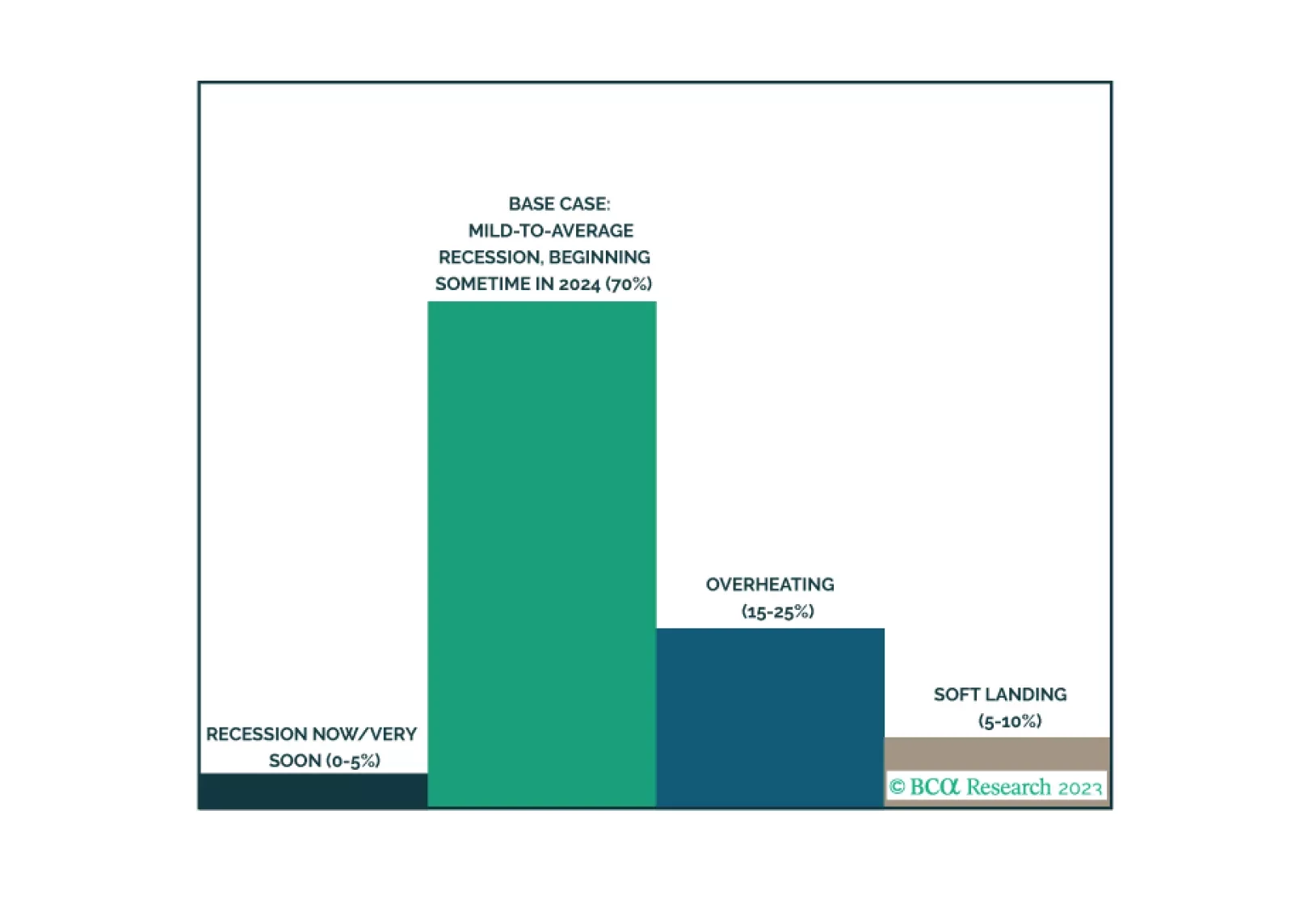

Our last publication of 2023 is an illustrated guide to our view that the economy will enter a recession around midyear. We expect equities will underperform Treasuries and cash over much of 2024, but we are waiting to turn…

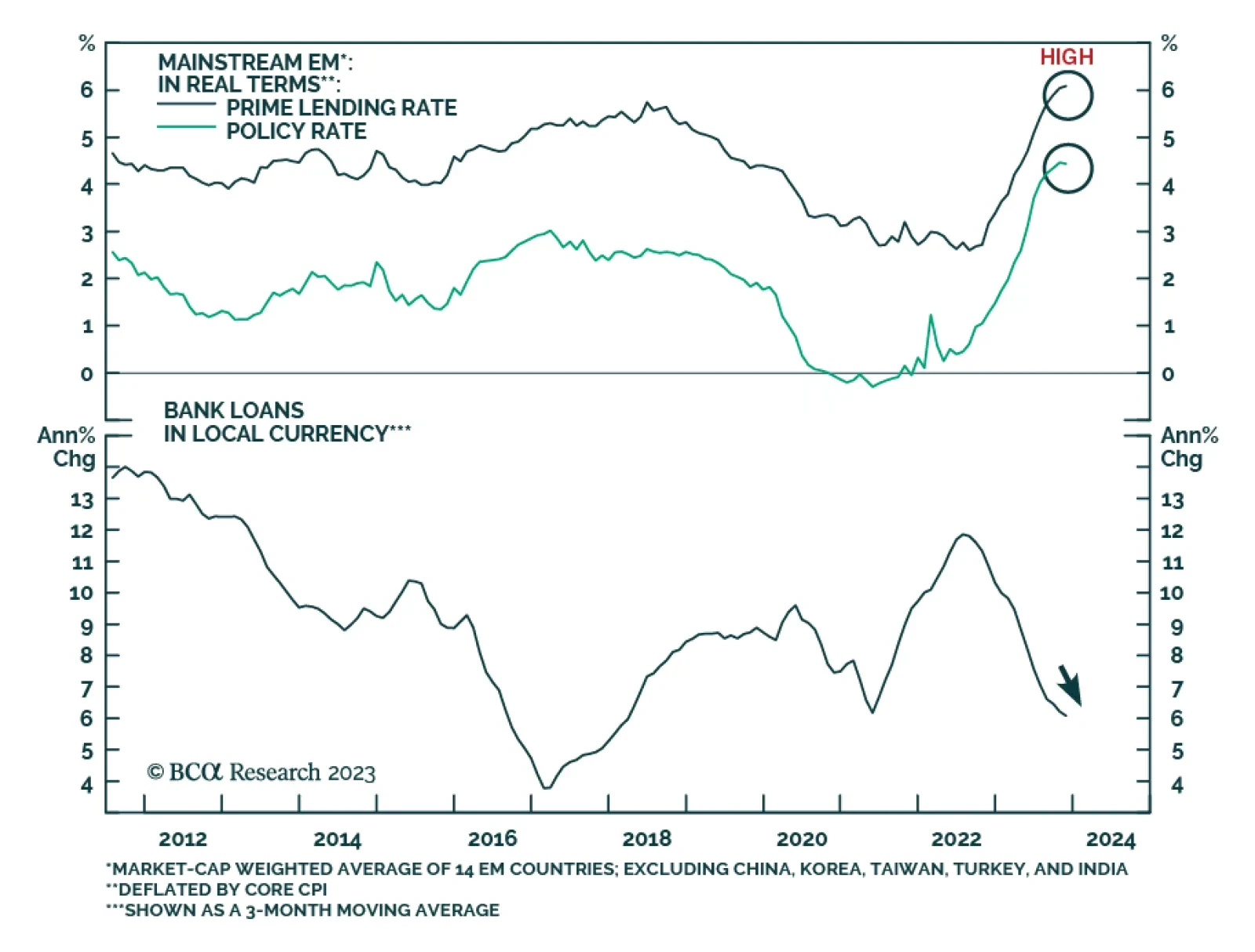

According to BCA Research’s Emerging Markets Strategy service, domestic demand and corporate profits will disappoint across mainstream Emerging Market economies (excluding China, India, Korea, and Taiwan) in H1 2024.…