A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

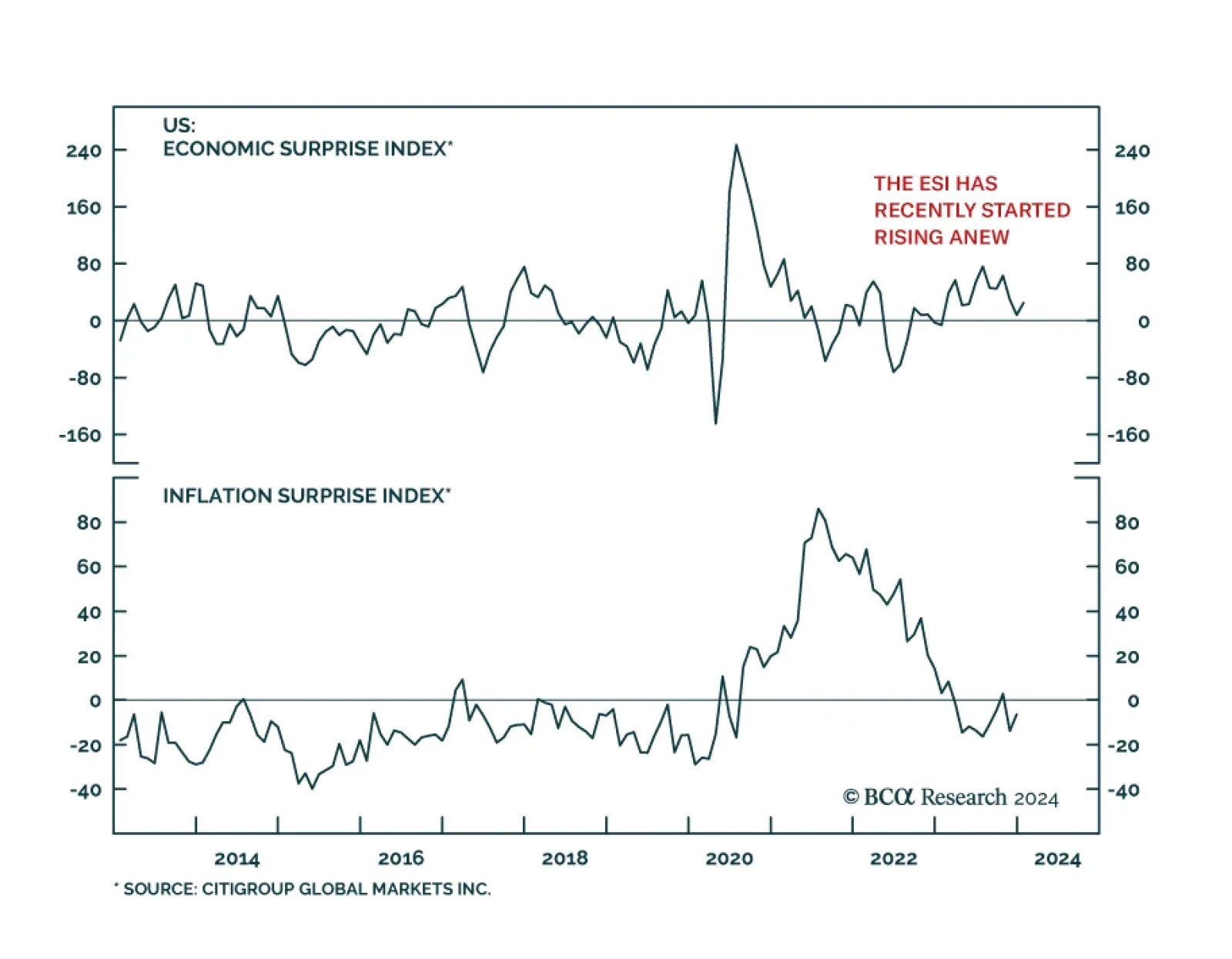

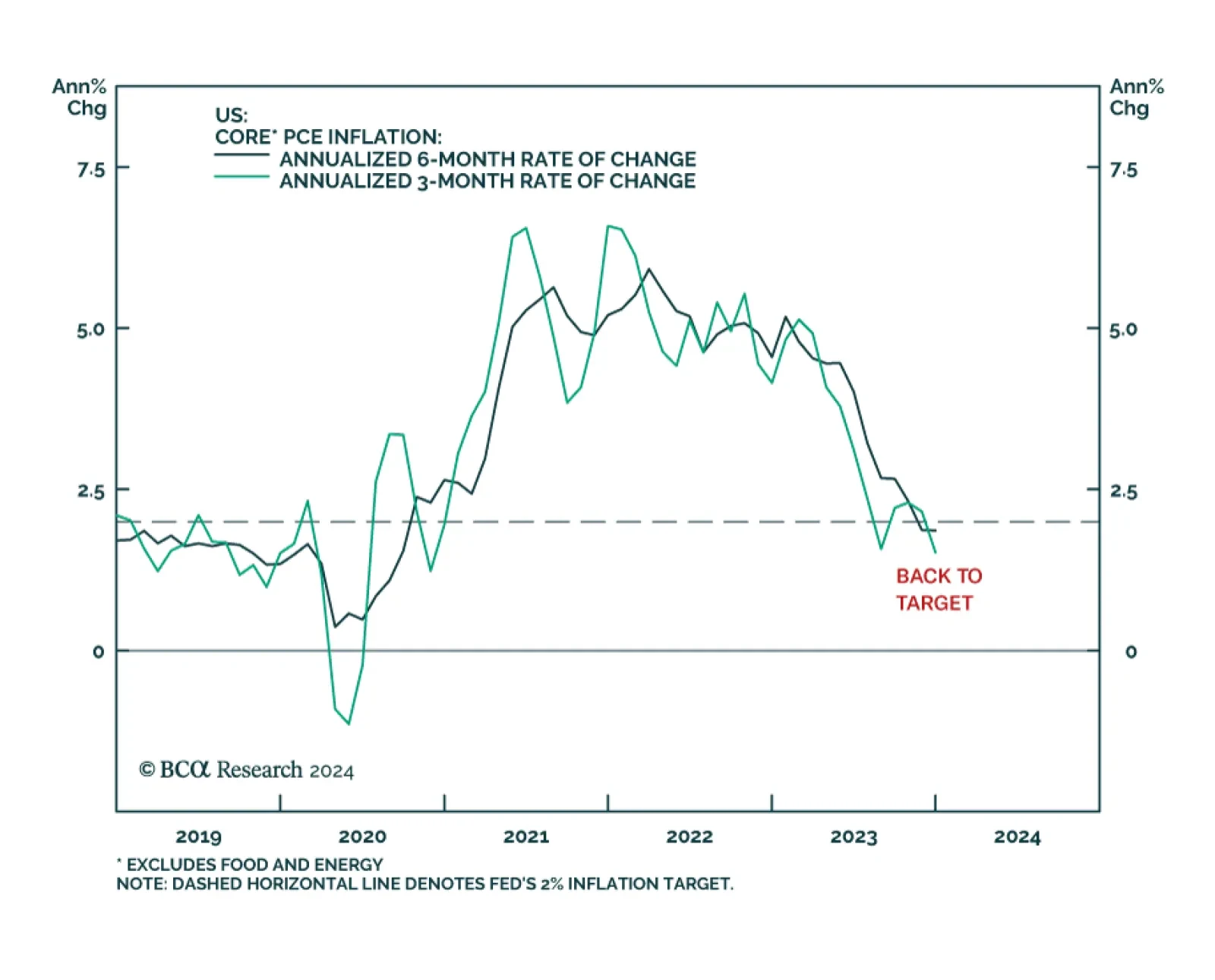

With the latest PCE release confirming that the disinflation process is intact (see The Numbers), a key question facing investors is around the timing of the Fed’s pivot to rate cuts. Indeed, the US inflation surprise index…

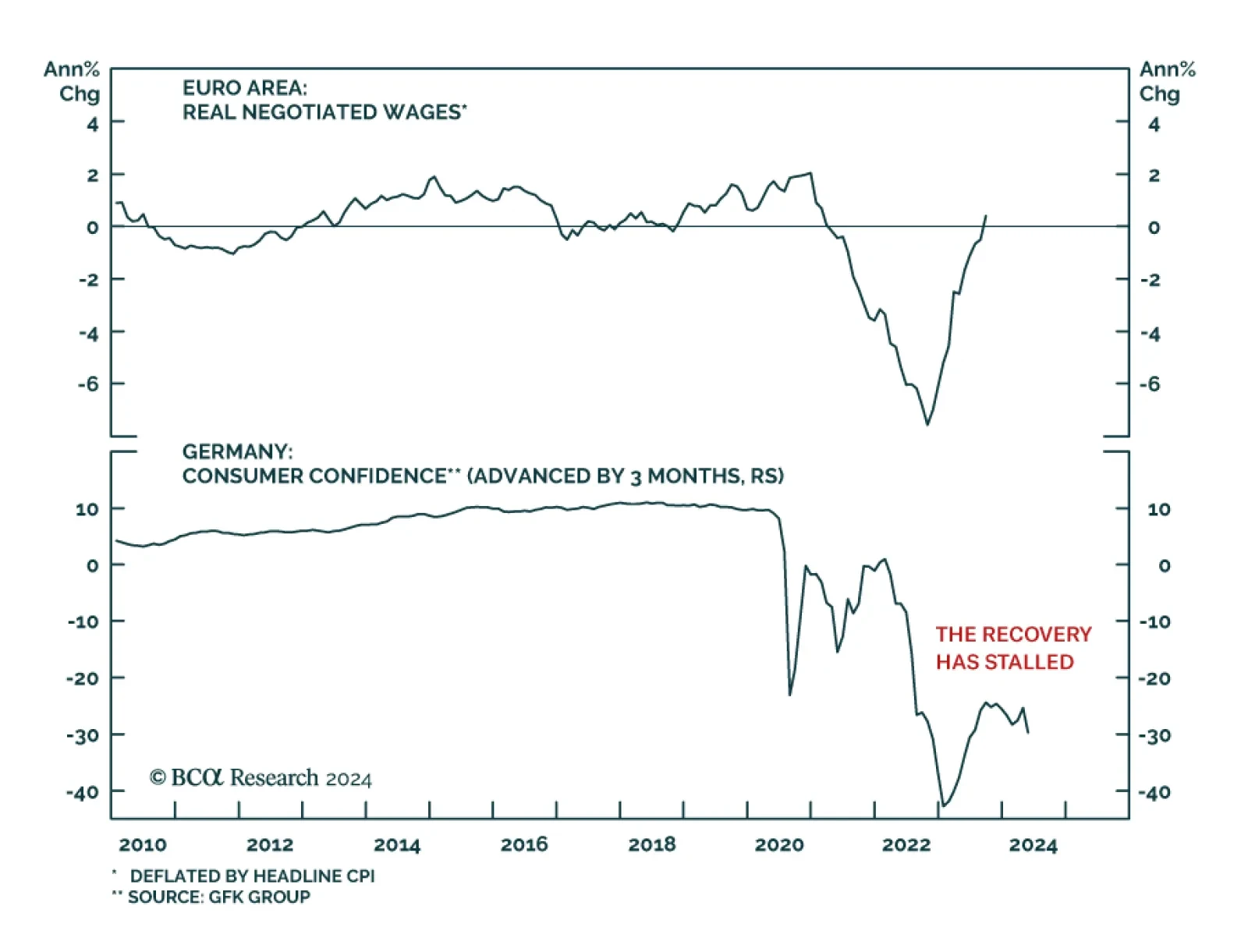

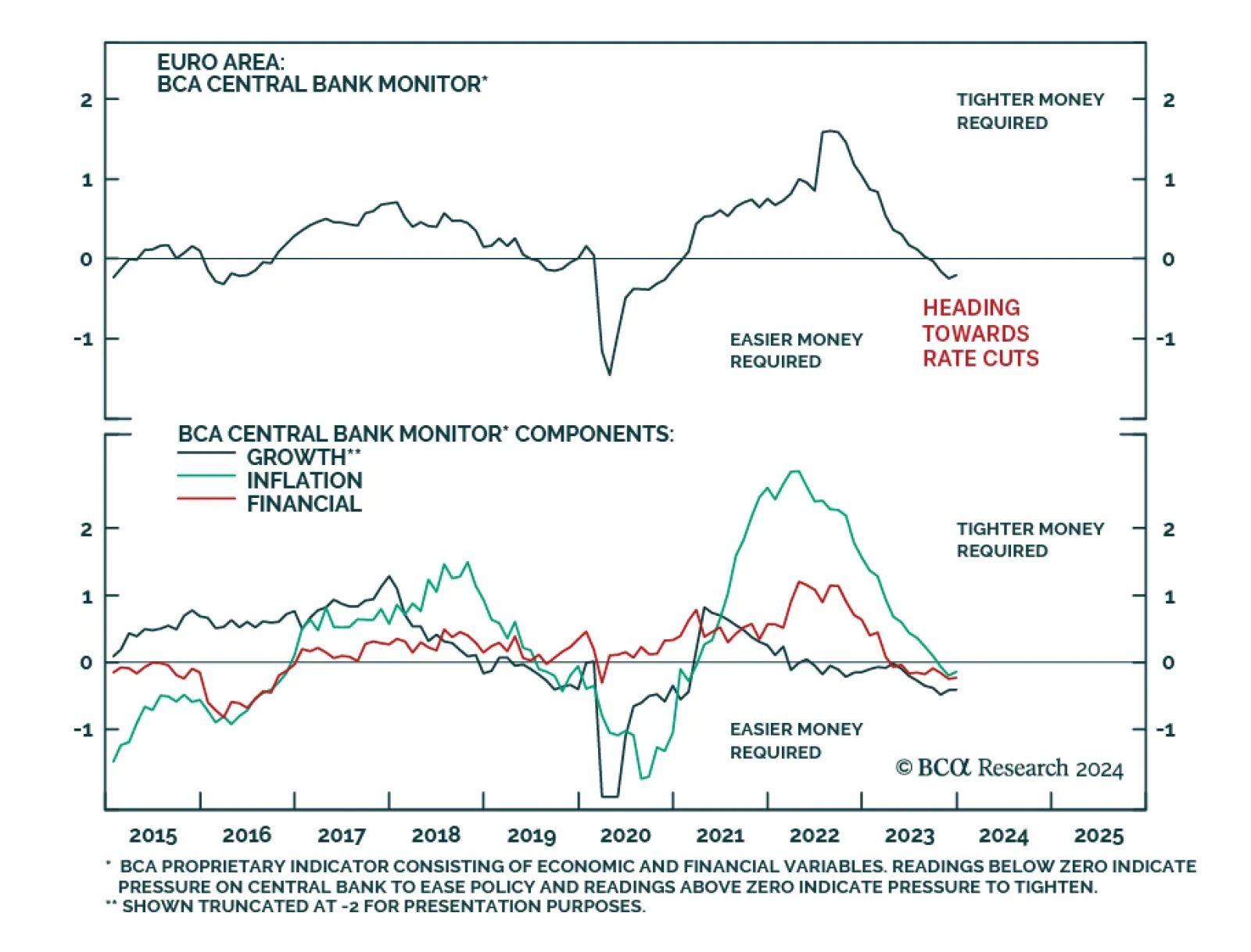

Over the past few months, falling inflation has provided a boost to real wages in the Euro Area which returned to growth in 2023Q3 after 9 consecutive quarters of decline. This dynamic in turn improved the purchasing power of…

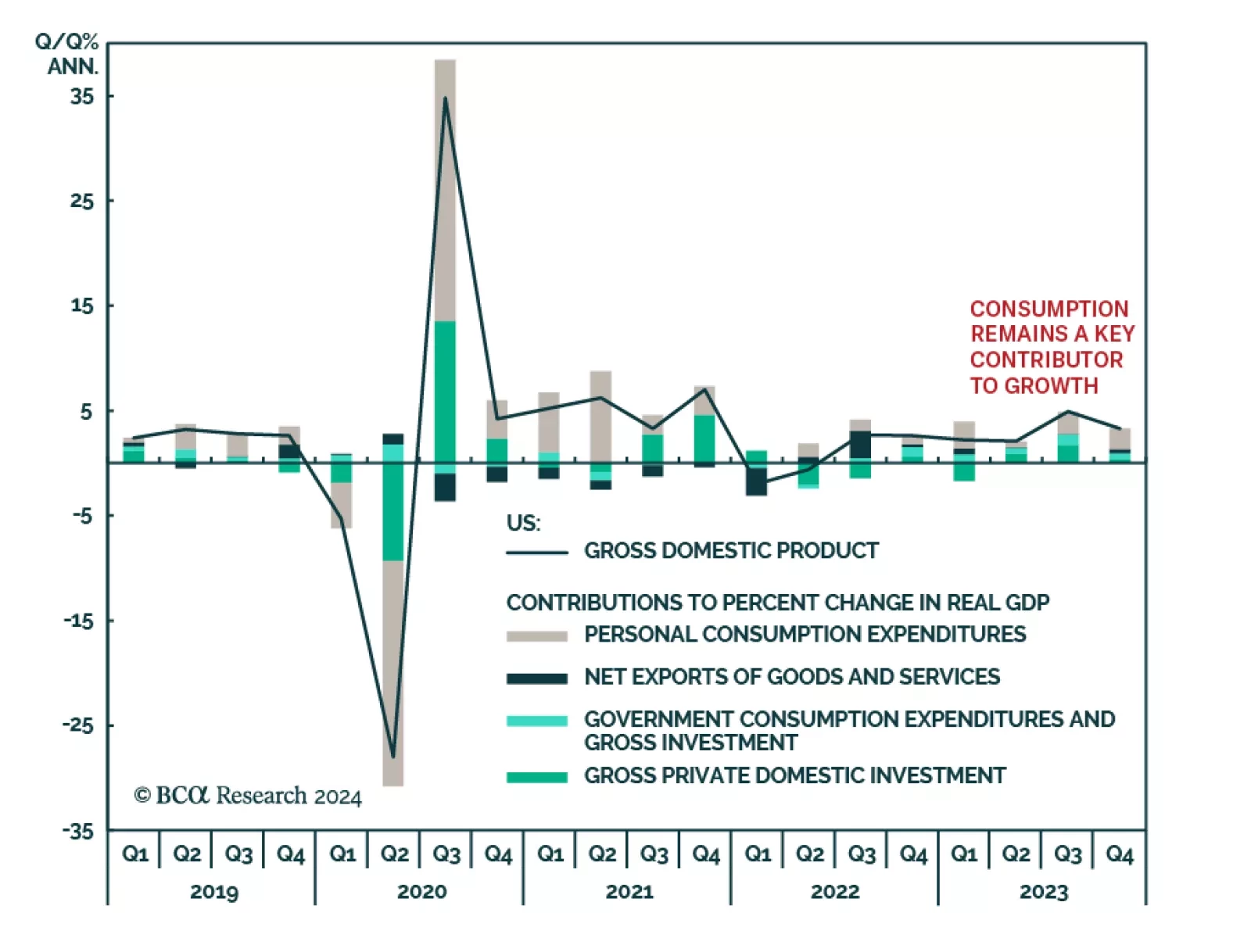

Friday’s US Personal Income and Outlays report for December delivered a positive update on the US economy. On the growth side, the data confirm the signal from the Q4 GDP release that consumer spending continues to power…

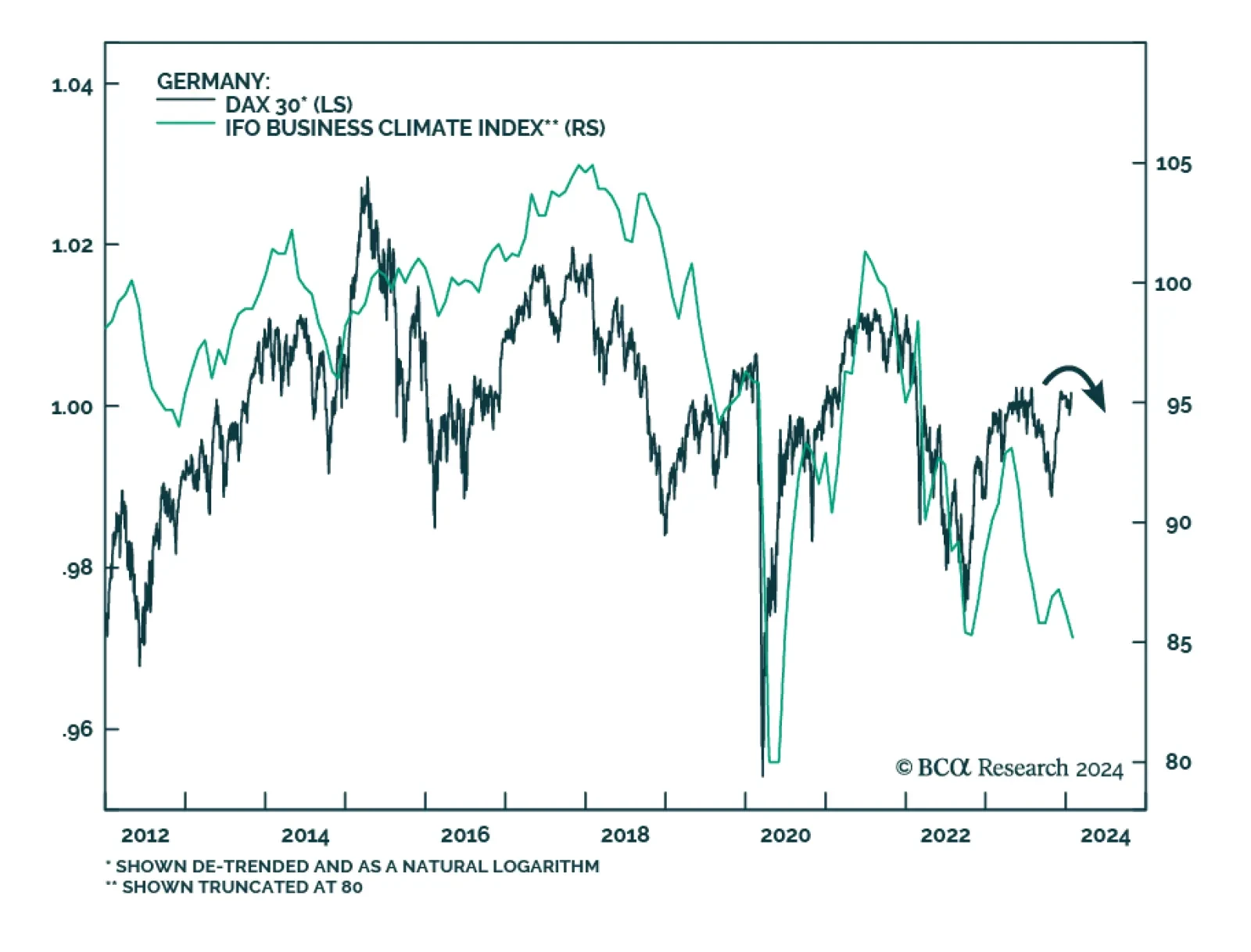

Germany’s IFO survey is sending a warning. The Business Climate Index unexpectedly fell for the second month in a row in January. Importantly, increased pessimism about the current situation and the outlook are driving this…

Government bond yields rallied and yield curves steepened across the Eurozone on Thursday following a less hawkish than anticipated tone from the ECB. As expected, the central bank kept policy rates unchanged and reiterated that…

The Q4 2023 US GDP print delivered a positive message on economic conditions. Although real GDP growth decelerated from 4.9% to 3.3%, it came in well above consensus expectations of 2.0% and the Atlanta Fed’s GDPNow…

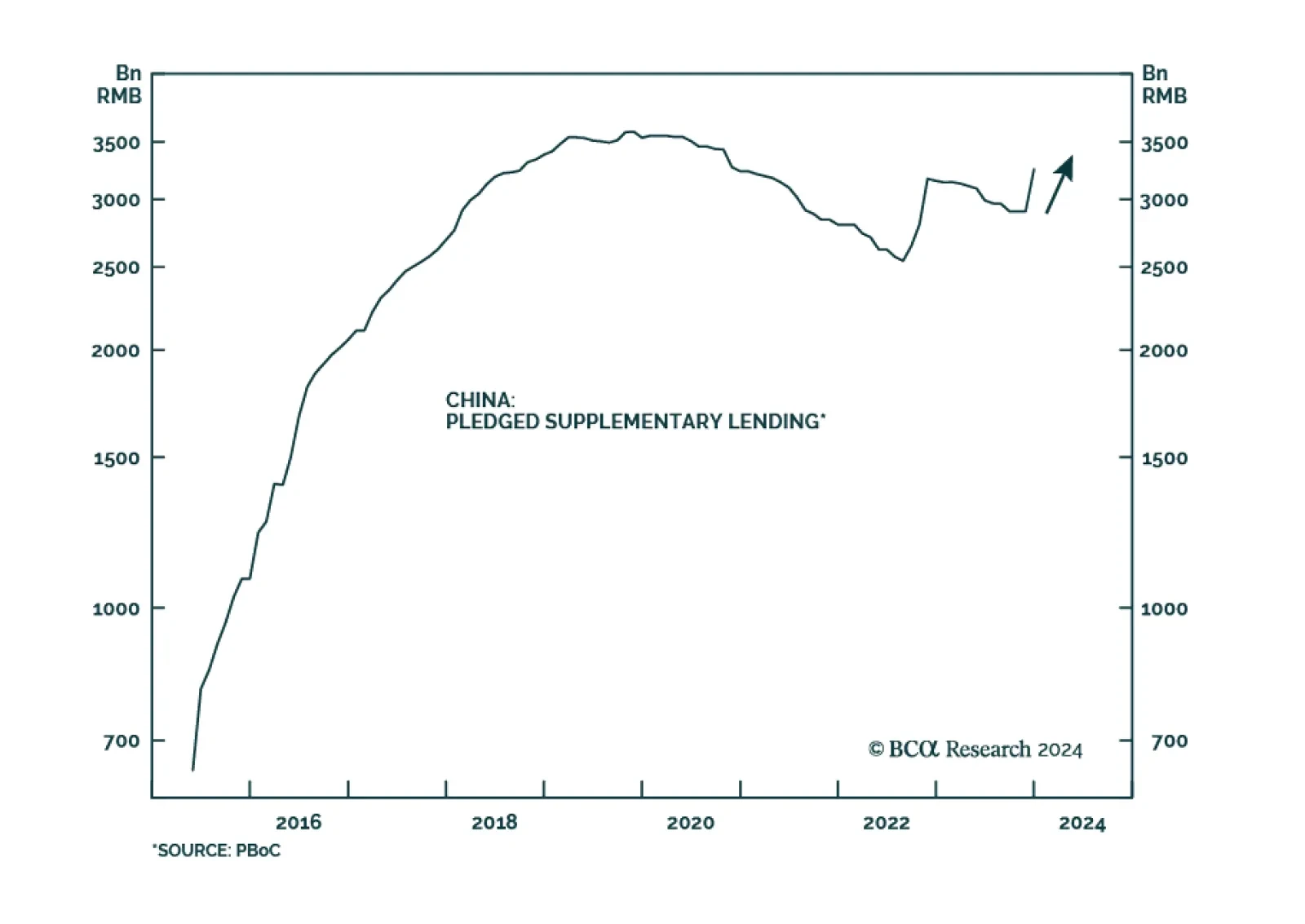

According to BCA Research’s China Investment Strategy service, the current Pledged Supplementary Lending (PSL) program will provide much less support to the housing market and construction activity than the 2015-2018…

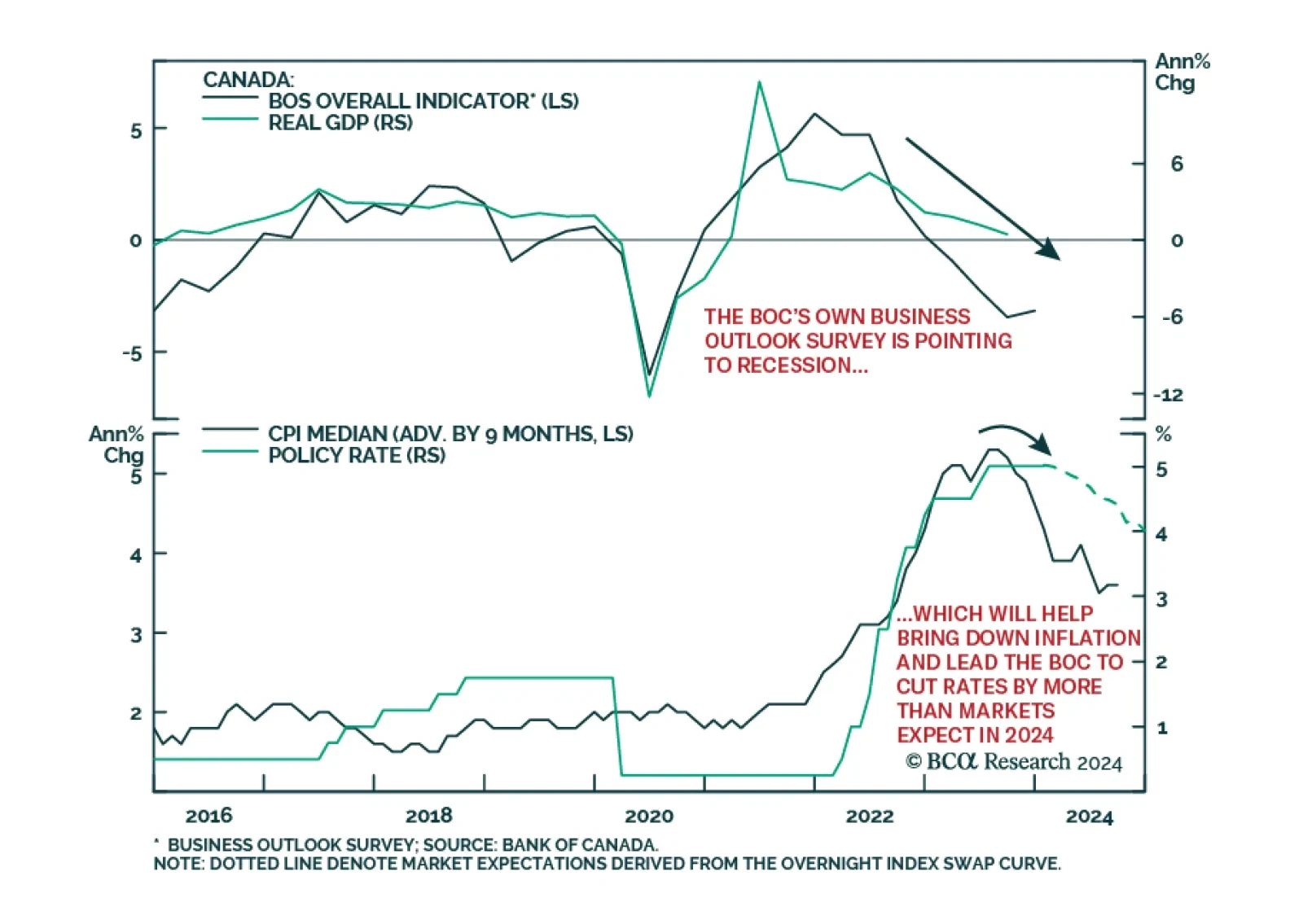

The Bank of Canada (BoC) kept rates steady at yesterday’s monetary policy meeting, leaving its policy rate at 5%. The central bank presented updated economic projections in a new Monetary Policy Report (MPR), which were…

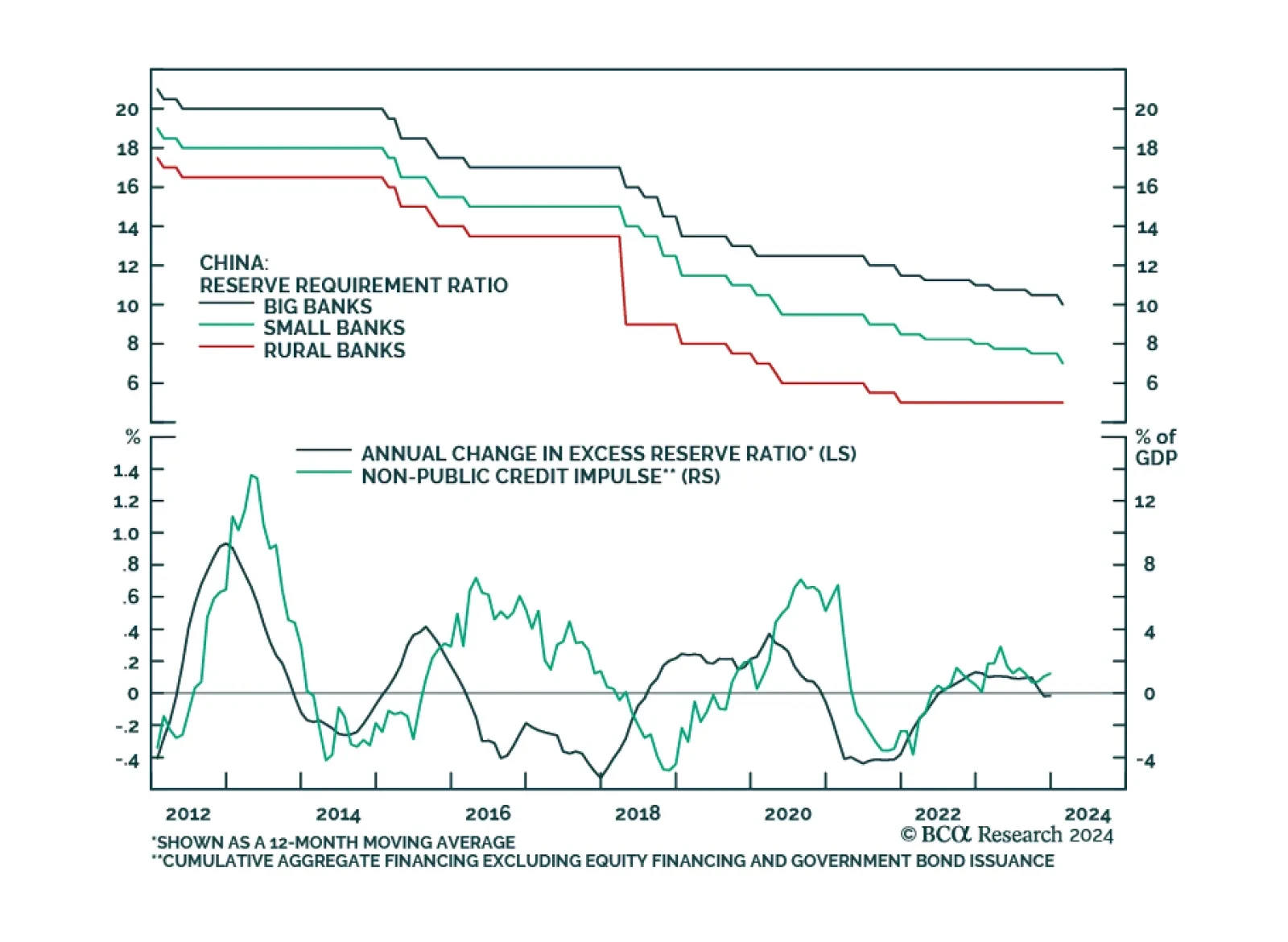

Chinese policymakers have ramped up their efforts to support the economy and financial markets over the past few days. On Wednesday, the People’s Bank of China (PBoC) announced that on February 5 it will cut the reserve…