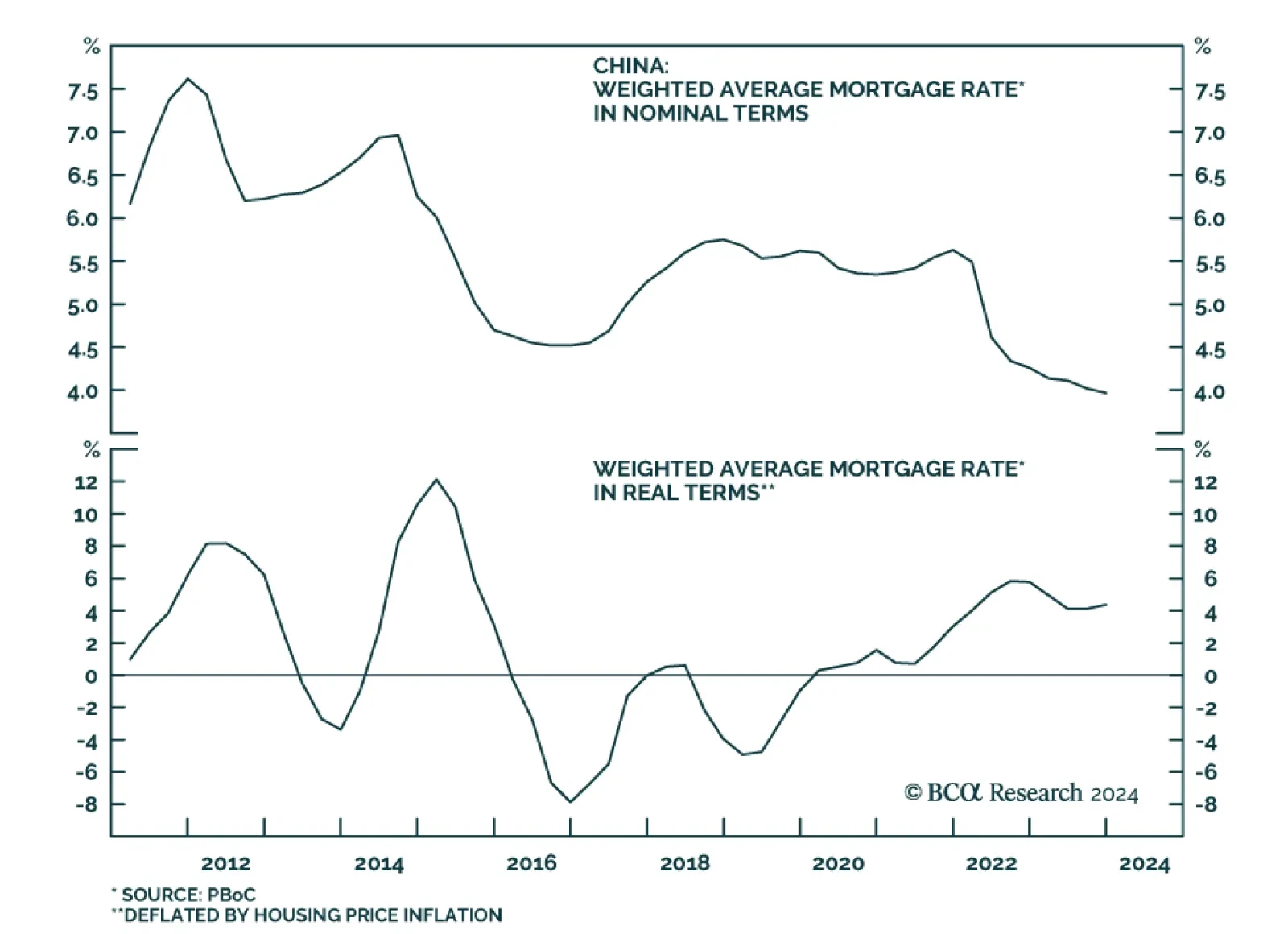

Chinese policymakers surprised on Tuesday with greater-than-anticipated easing for the troubled property market. Although the 1-year loan prime rate (LPR) – the benchmark for most household and corporate loans – was…

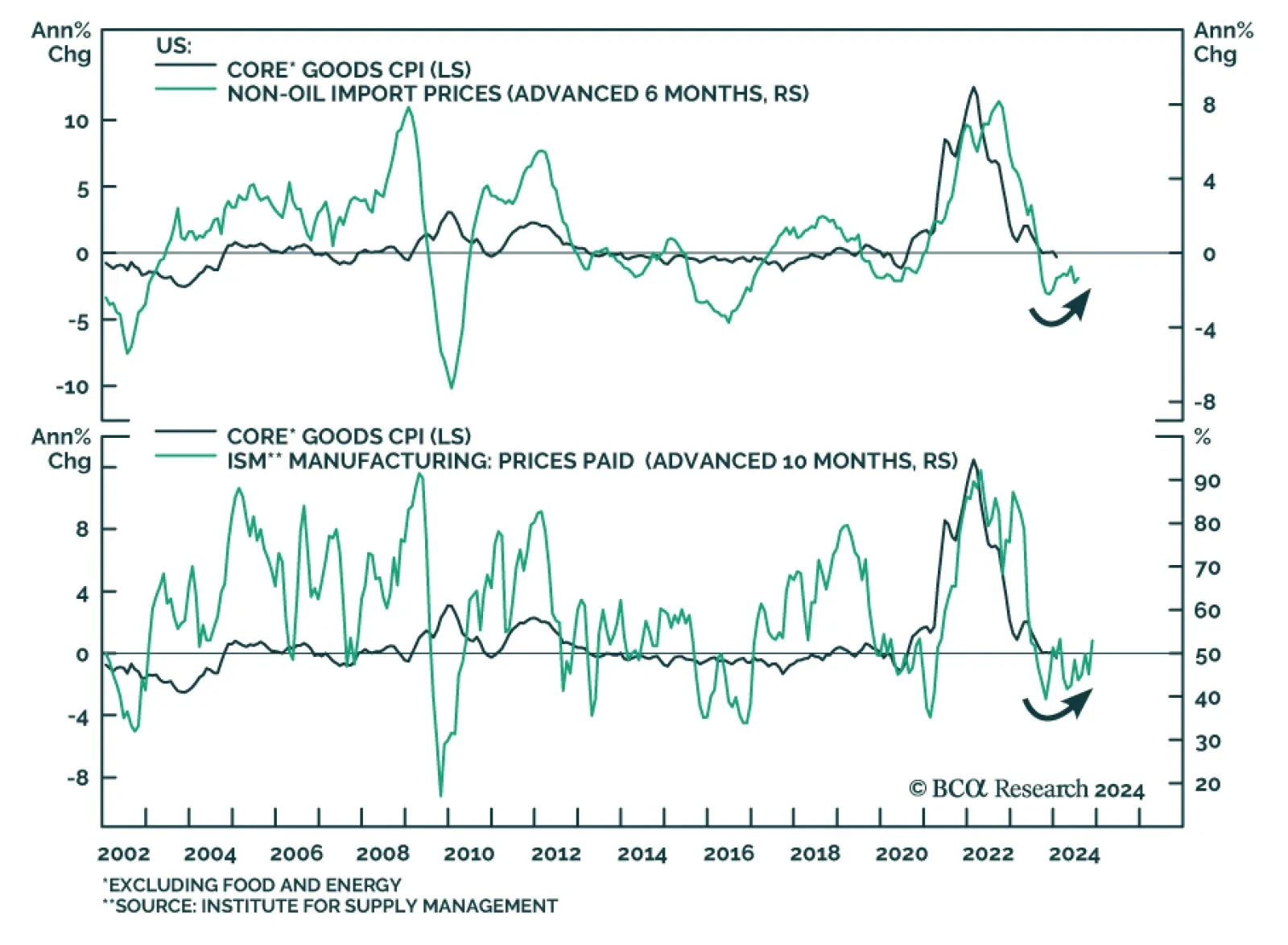

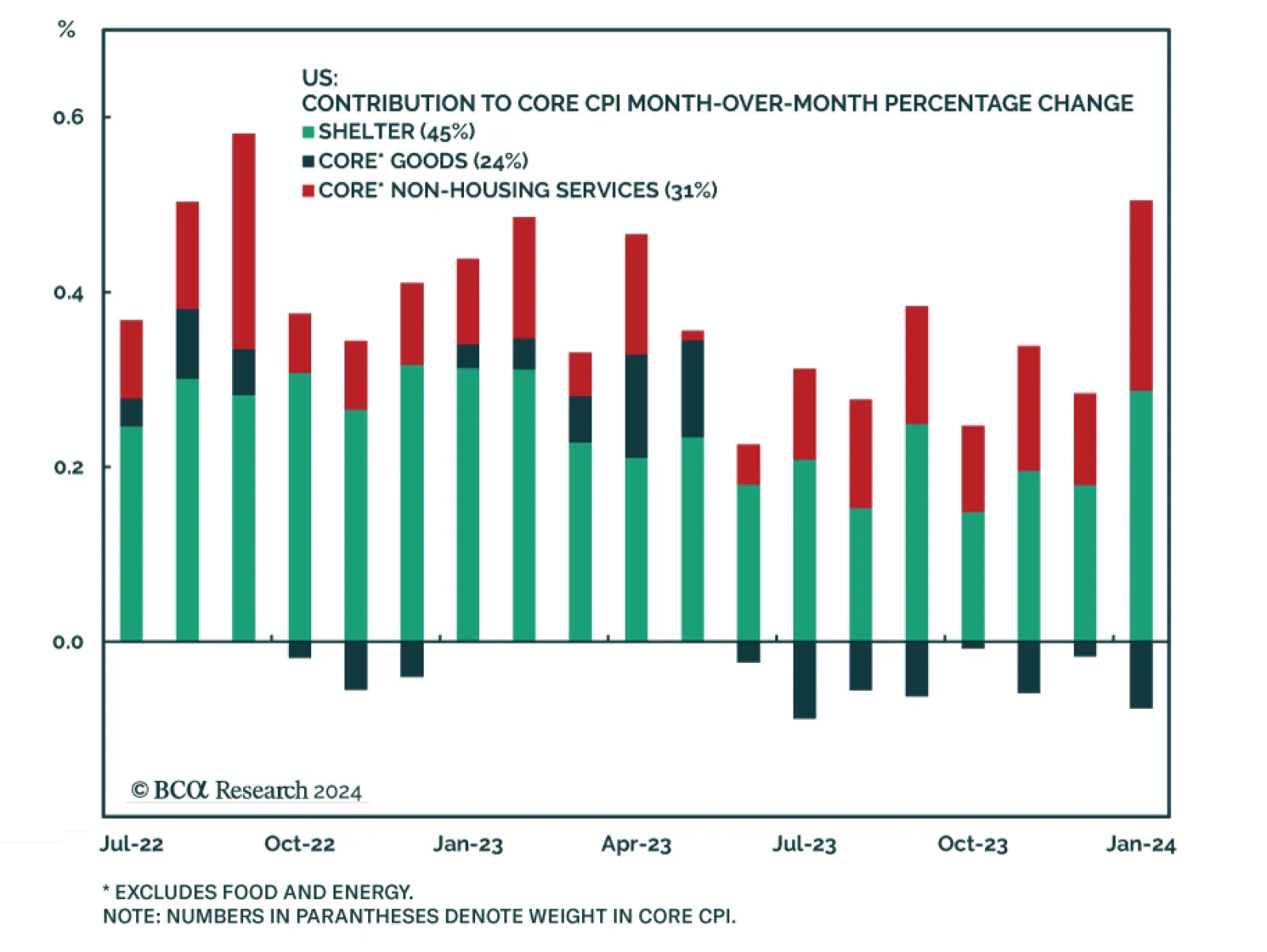

Much of the focus of investors concerned about lingering price pressures has been on services prices. There is good reason for that. Even though core CPI inflation remains relatively elevated at 3.9% y/y in January, core goods…

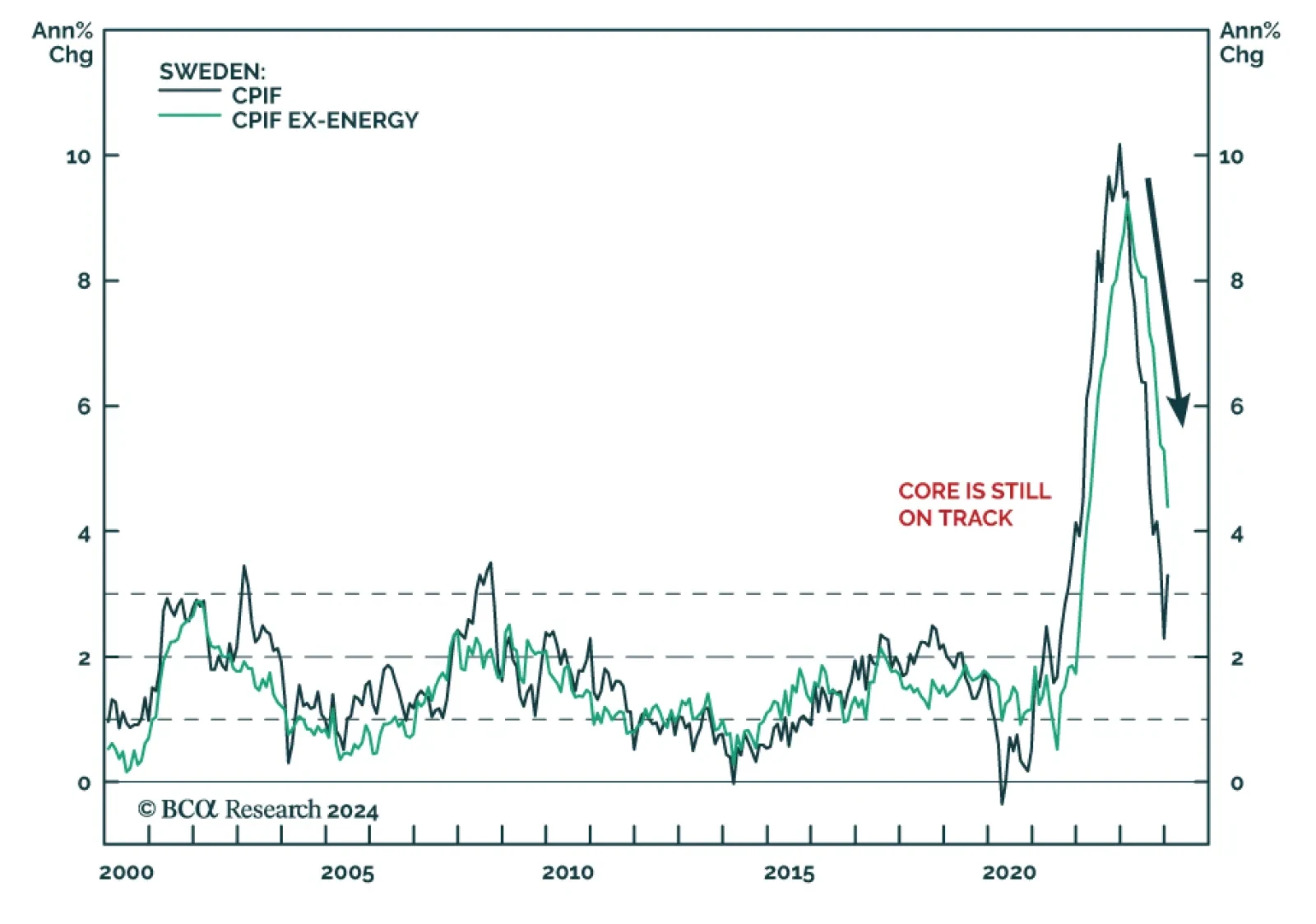

The stronger-than-anticipated acceleration in Sweden’s headline CPI inflation is unlikely to derail the Riksbank’s plan to pivot to policy easing this year. In particular, base effects from lower energy prices a year…

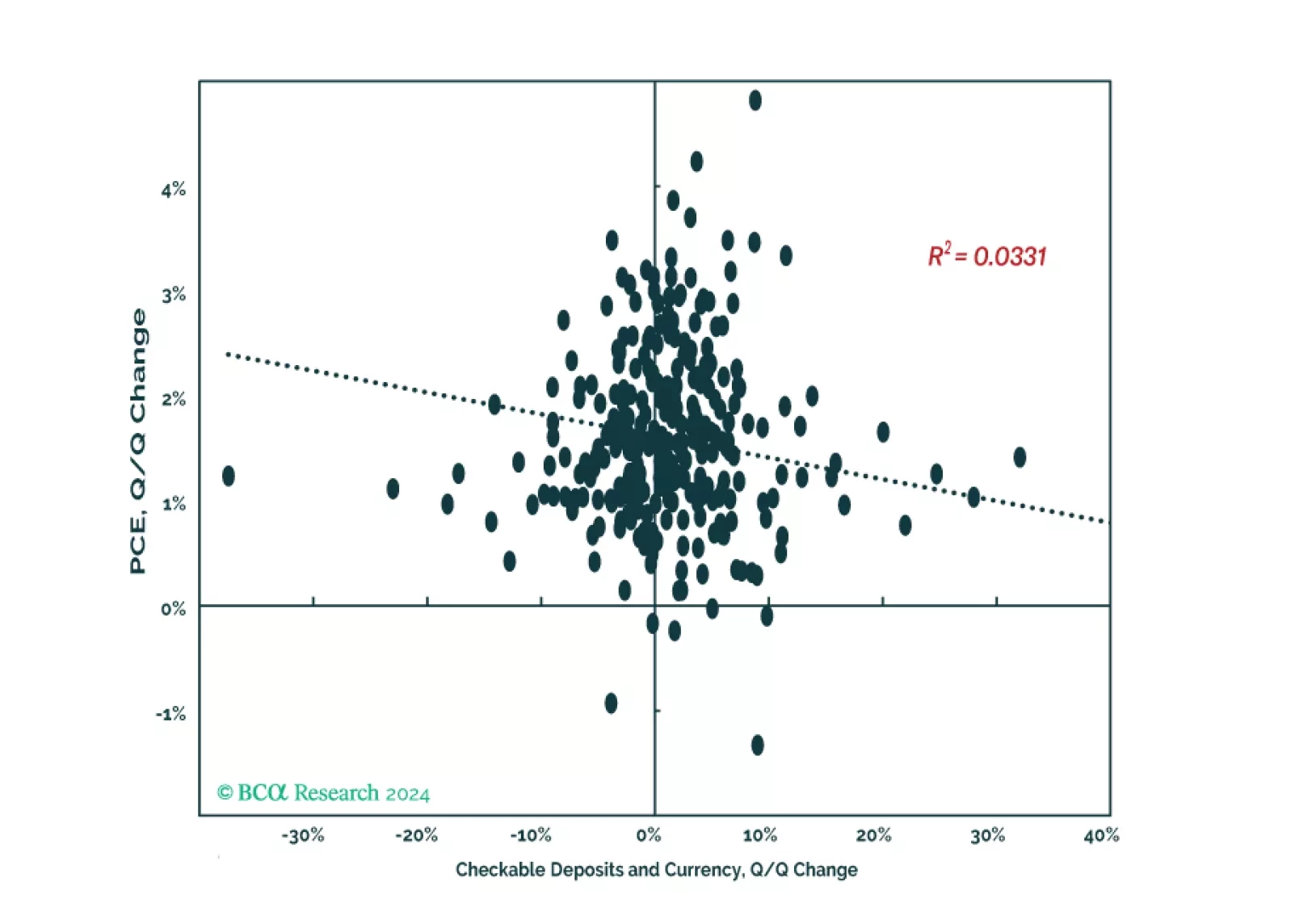

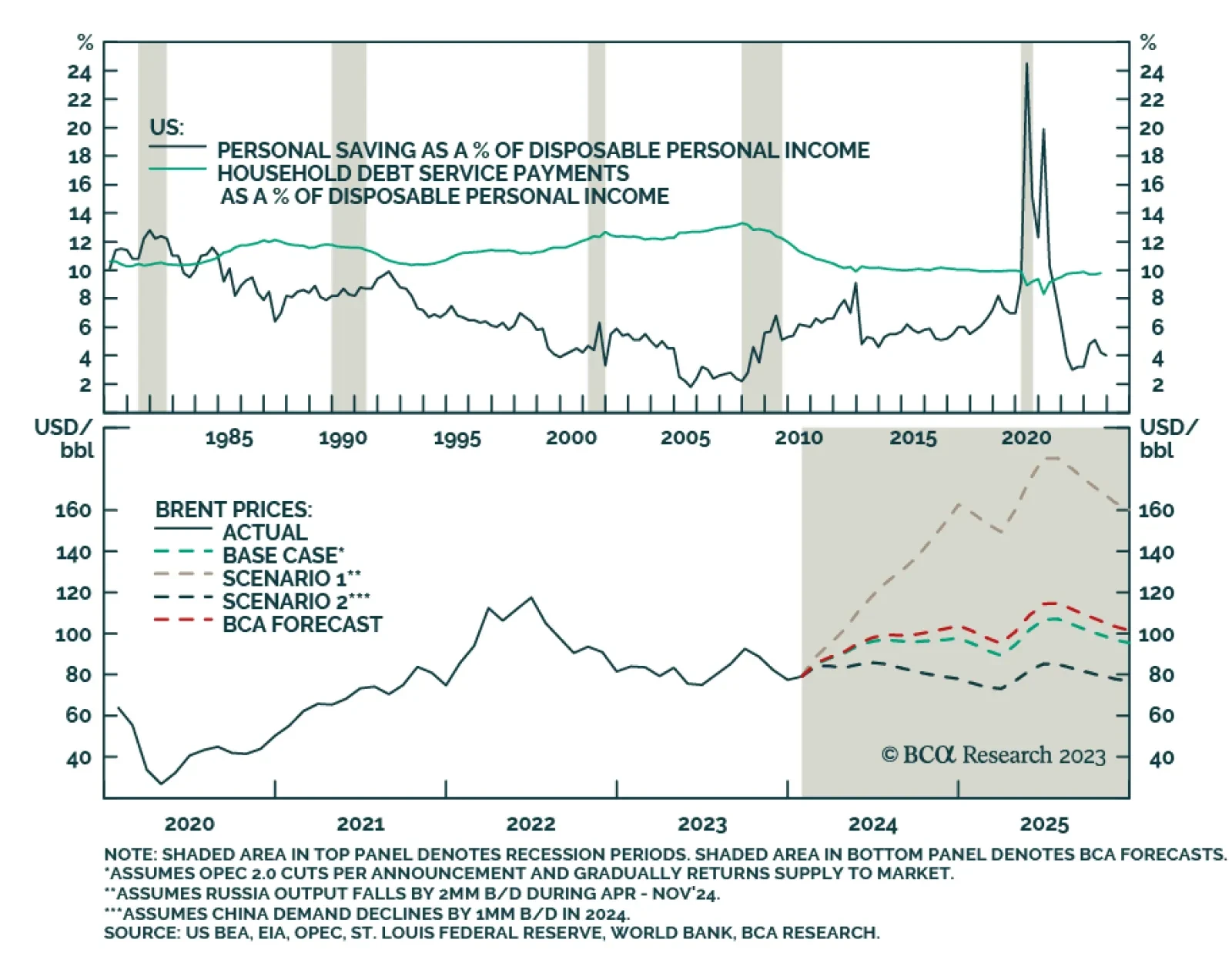

Households have ramped up their cash holdings since the end of 2019, but the absence of an empirical link between cash and consumption leads us to believe that we’ve modestly overestimated the risk of consumer-driven overheating.

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

Our Commodity & Energy colleagues see oil markets balanced in the short run, which keeps their Brent price forecasts at $95/bbl and $105/bbl for 2024 and 2025. That said, they note the odds are increasing demand…

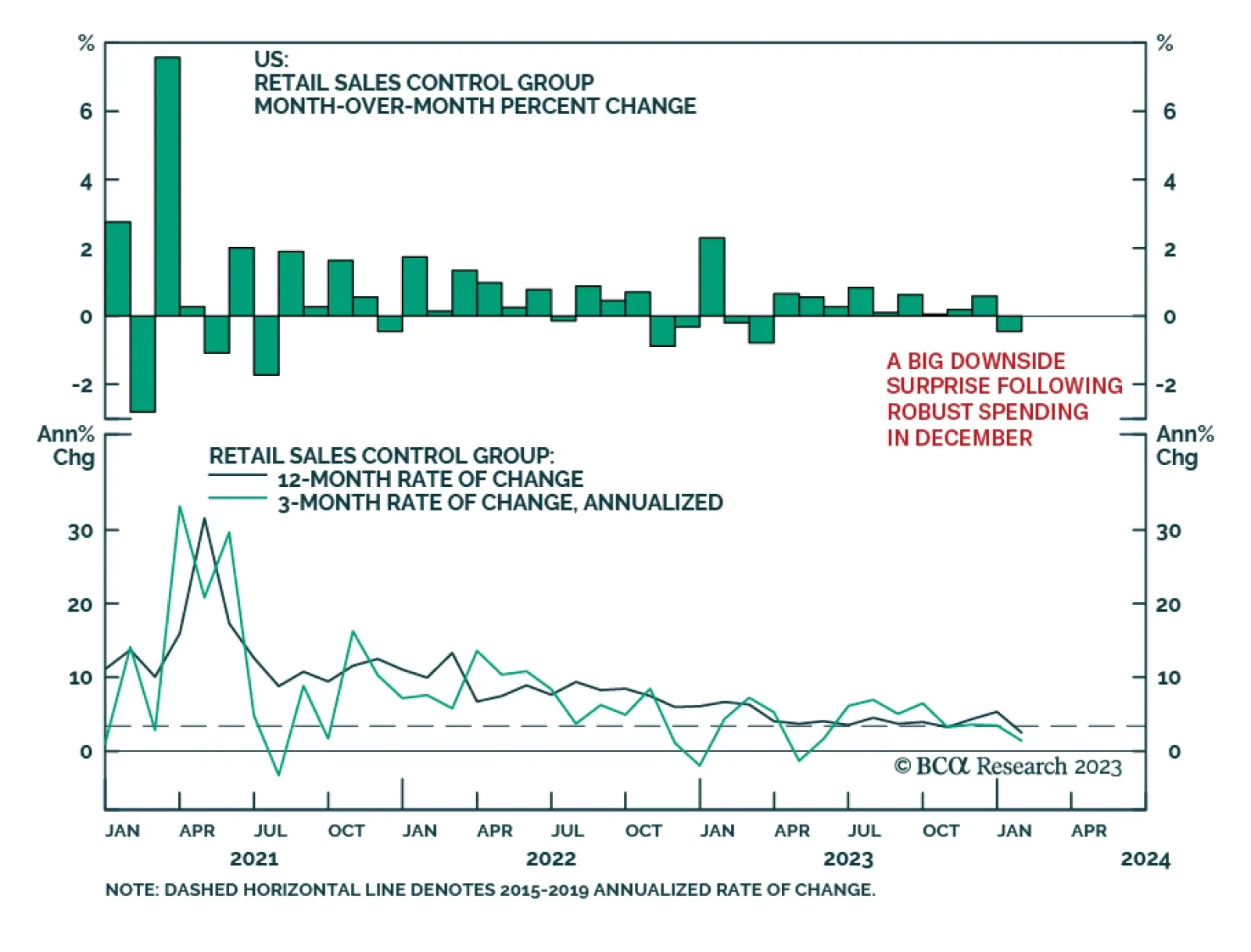

The US retail sales report for January delivered a disappointing message about consumer spending. The 0.8% m/m drop in overall retail sales was worse than expectations of a 0.2% m/m decline and marked the most severe monthly…

The US CPI report for January showed inflation did not cool as much as anticipated. Headline inflation accelerated from 0.23% to 0.31% on a month-over-month basis, higher than anticipations of 0.2% m/m. It fell from 3.4% to 3.1%…

Over the past few months we have been highlighting that there are some budding signs of a recovery in global manufacturing activity. Most notably, the new orders-to-inventories ratio of Sweden’s manufacturing PMI has been…