Data received since we began reassessing our bearish stance supported our notion that the economy is not as strong as the investor consensus perceives. But the softness will likely have to intensify in July and August to preserve our…

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

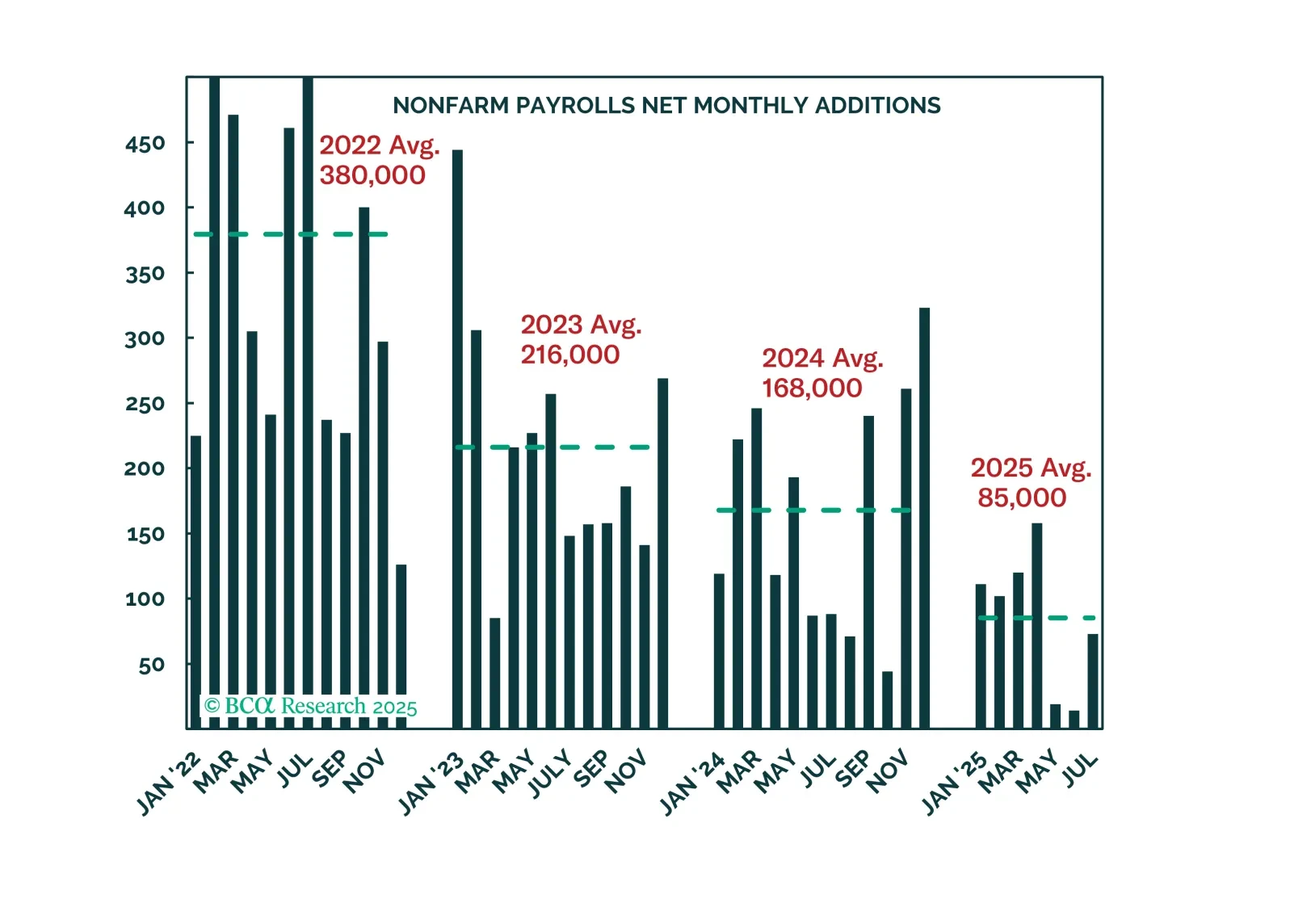

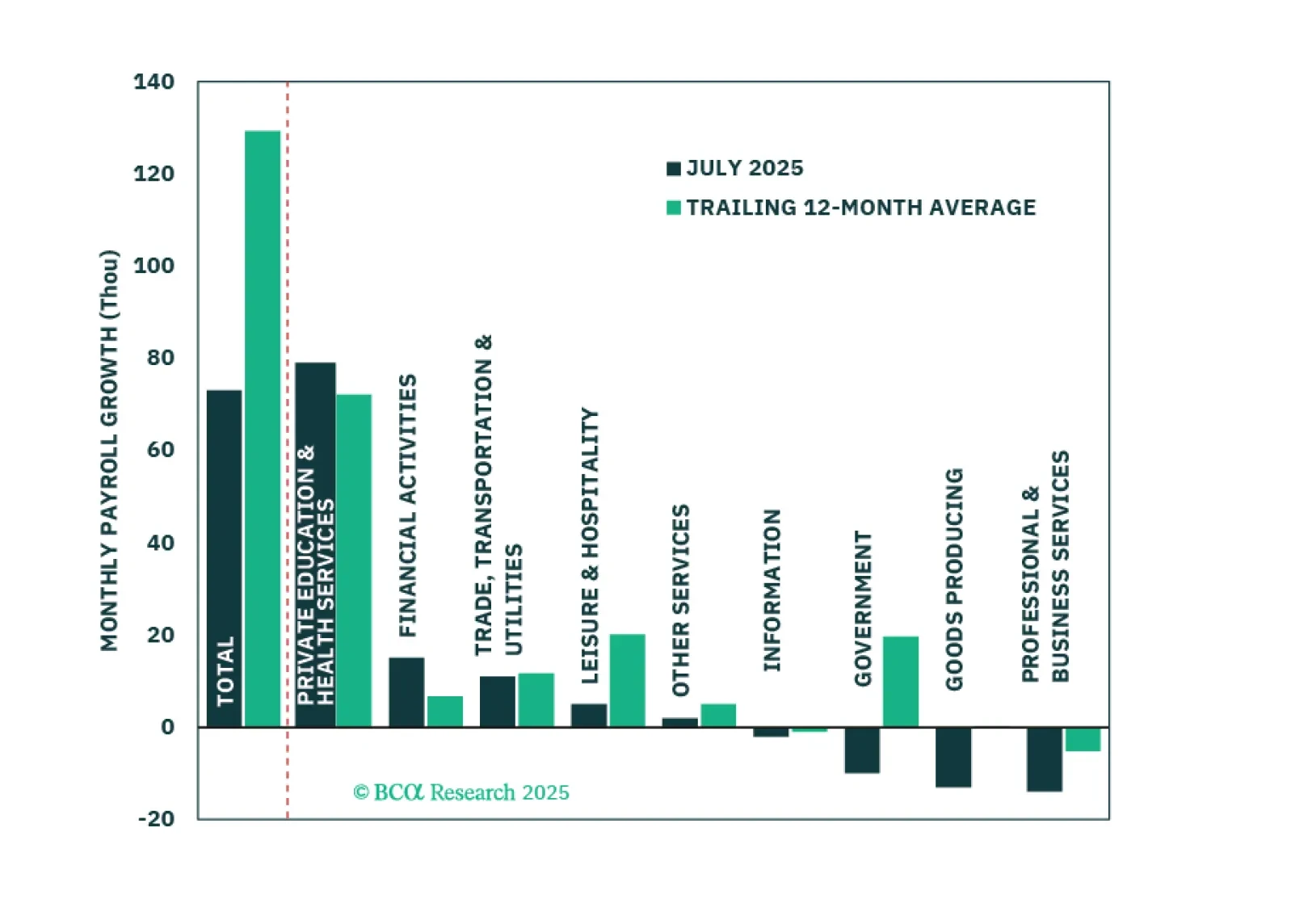

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

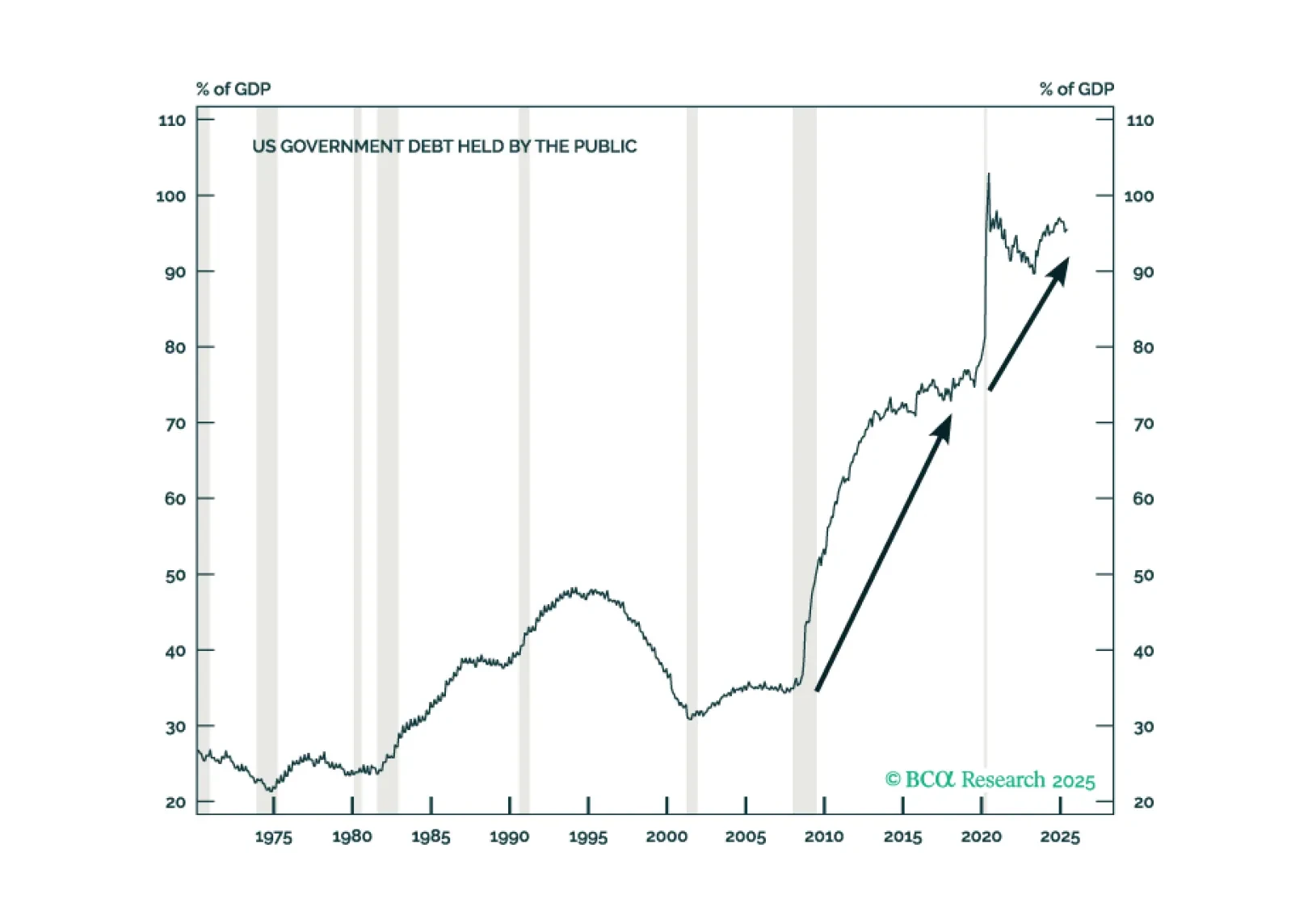

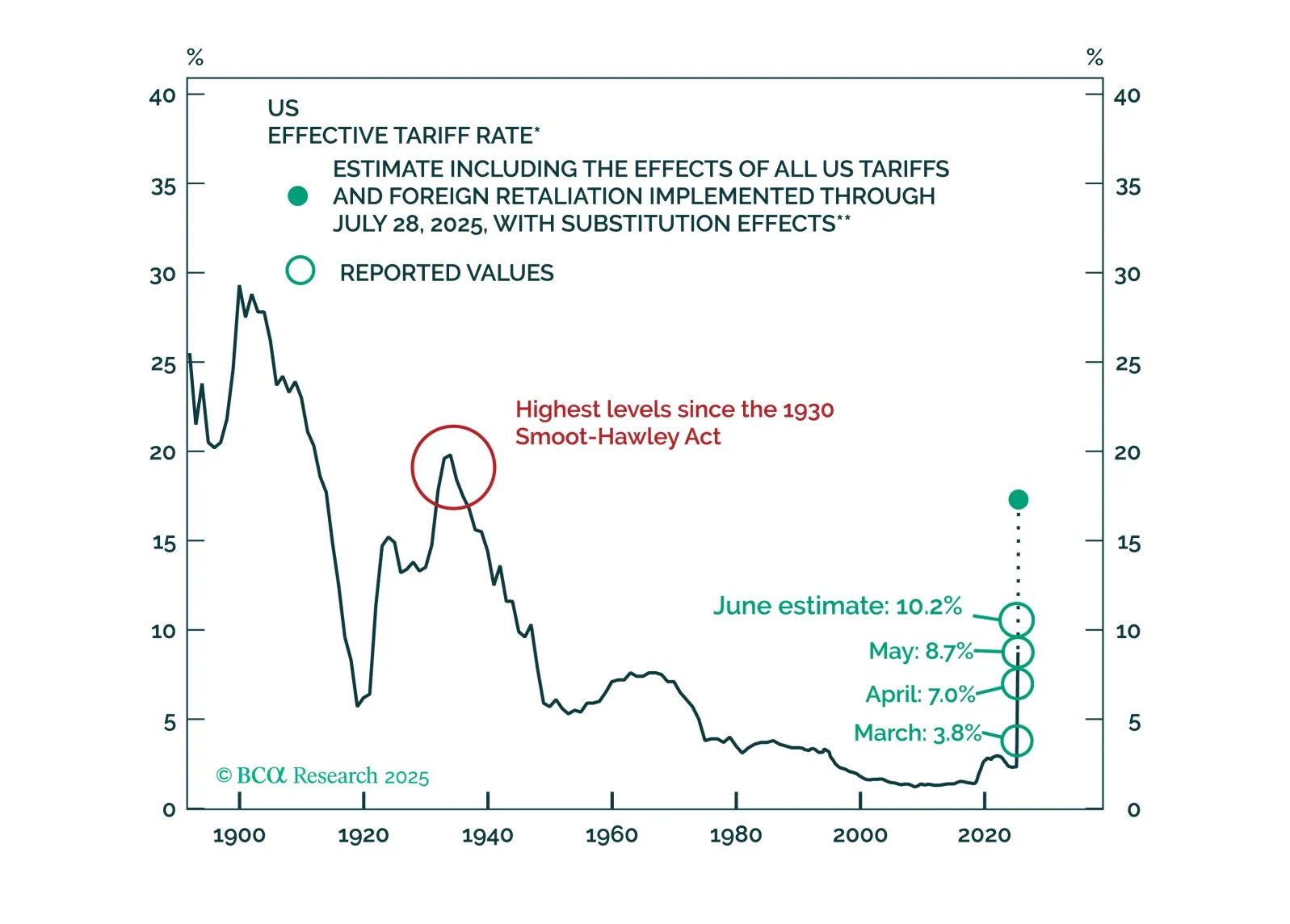

In Section I, Doug weighs the recent reduction in trade uncertainty against the clear signs of labor market and consumer weakness. In Section II, Jonathan reviews the US fiscal outlook in the wake of the passage of the OBBBA.

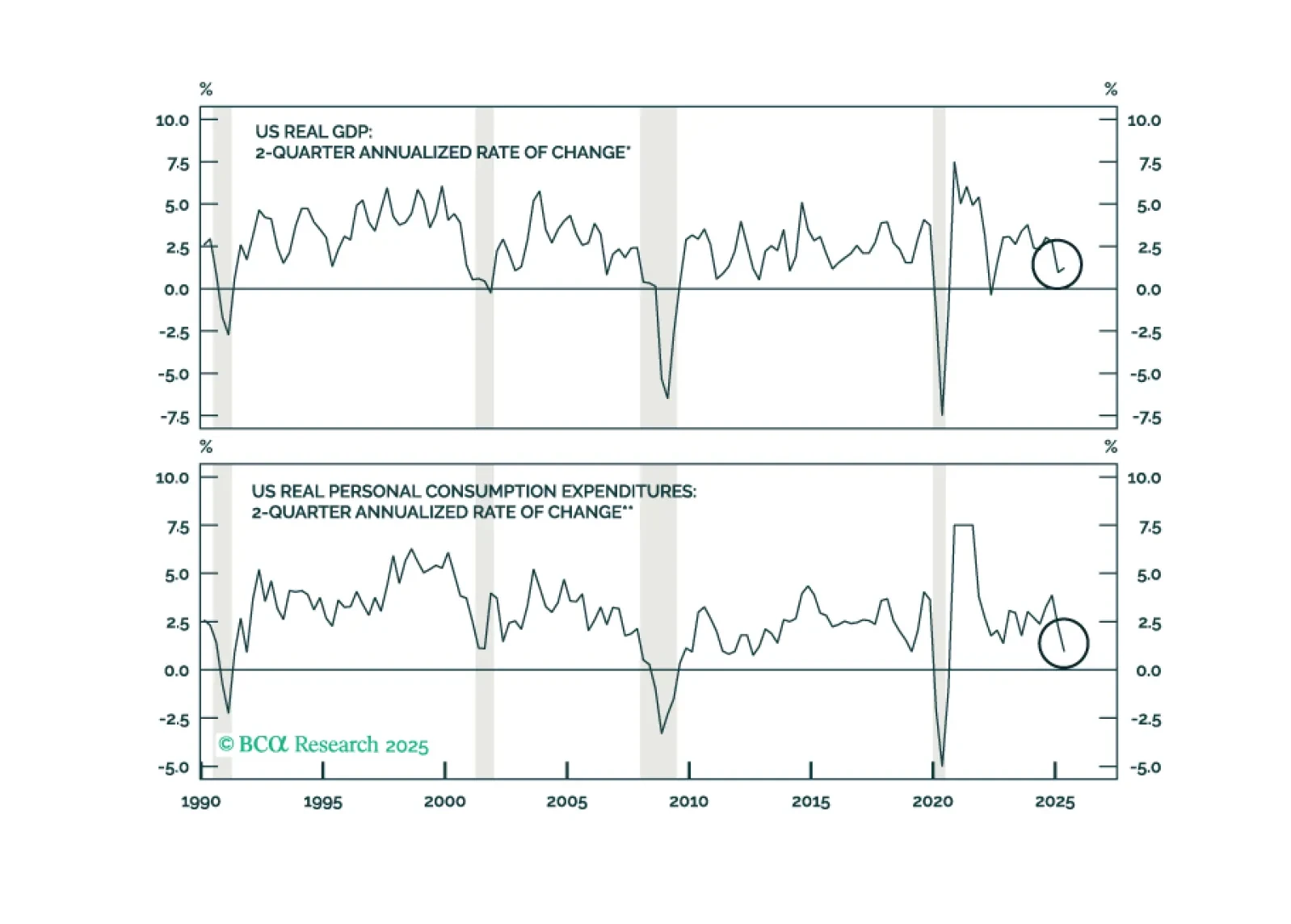

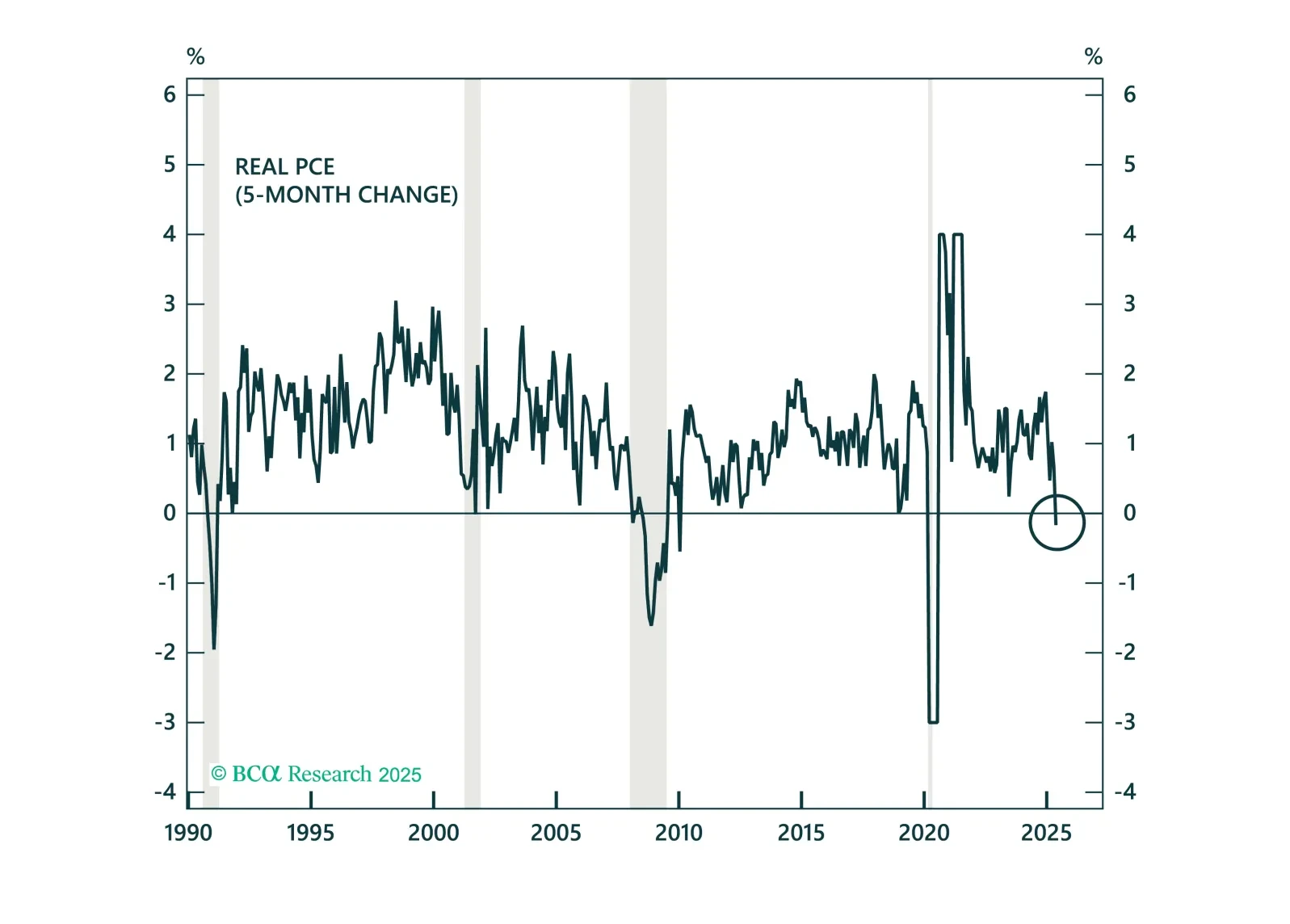

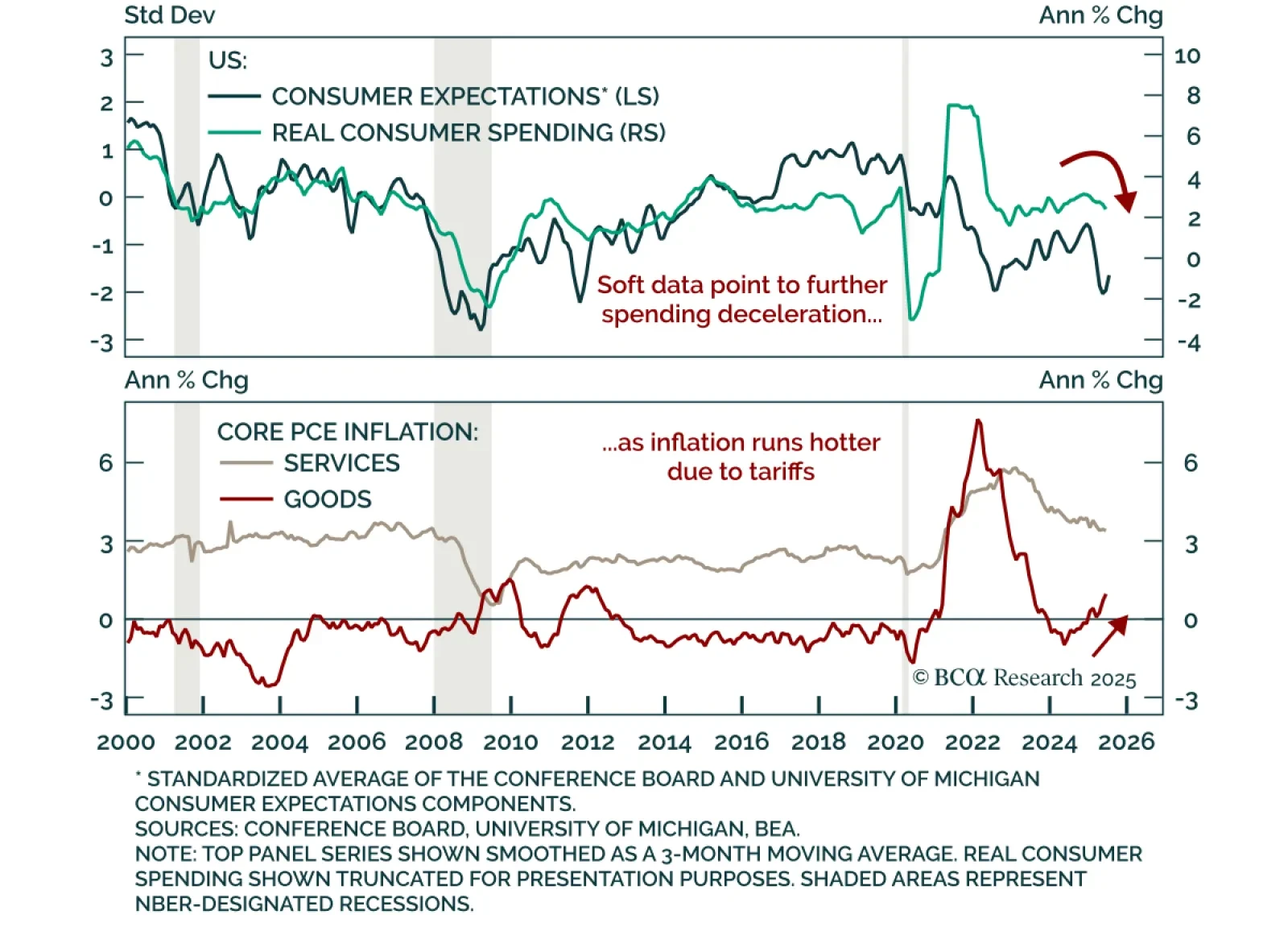

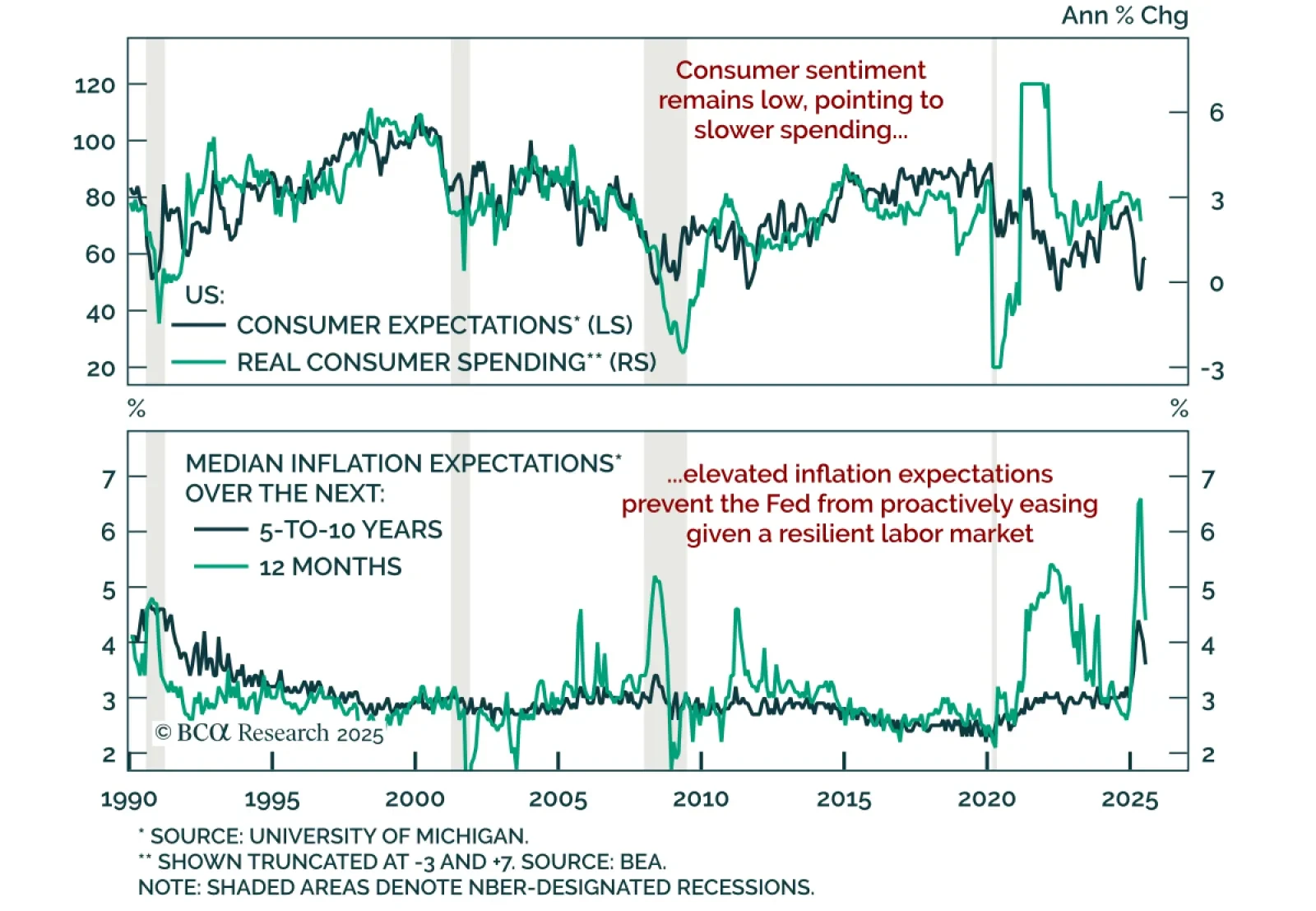

June US income and spending shows softening demand and rising goods inflation pressure, reinforcing our long-duration stance. Real personal spending only rose 0.1% m/m, in line with expectations. Personal income increased 0.3% m…

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

Although we think the economy is weaker than investors realize, it has remained resilient and we will not fight the tape forever. If clear signs of a recession do not emerge over the next six weeks, we will drop our defensive…

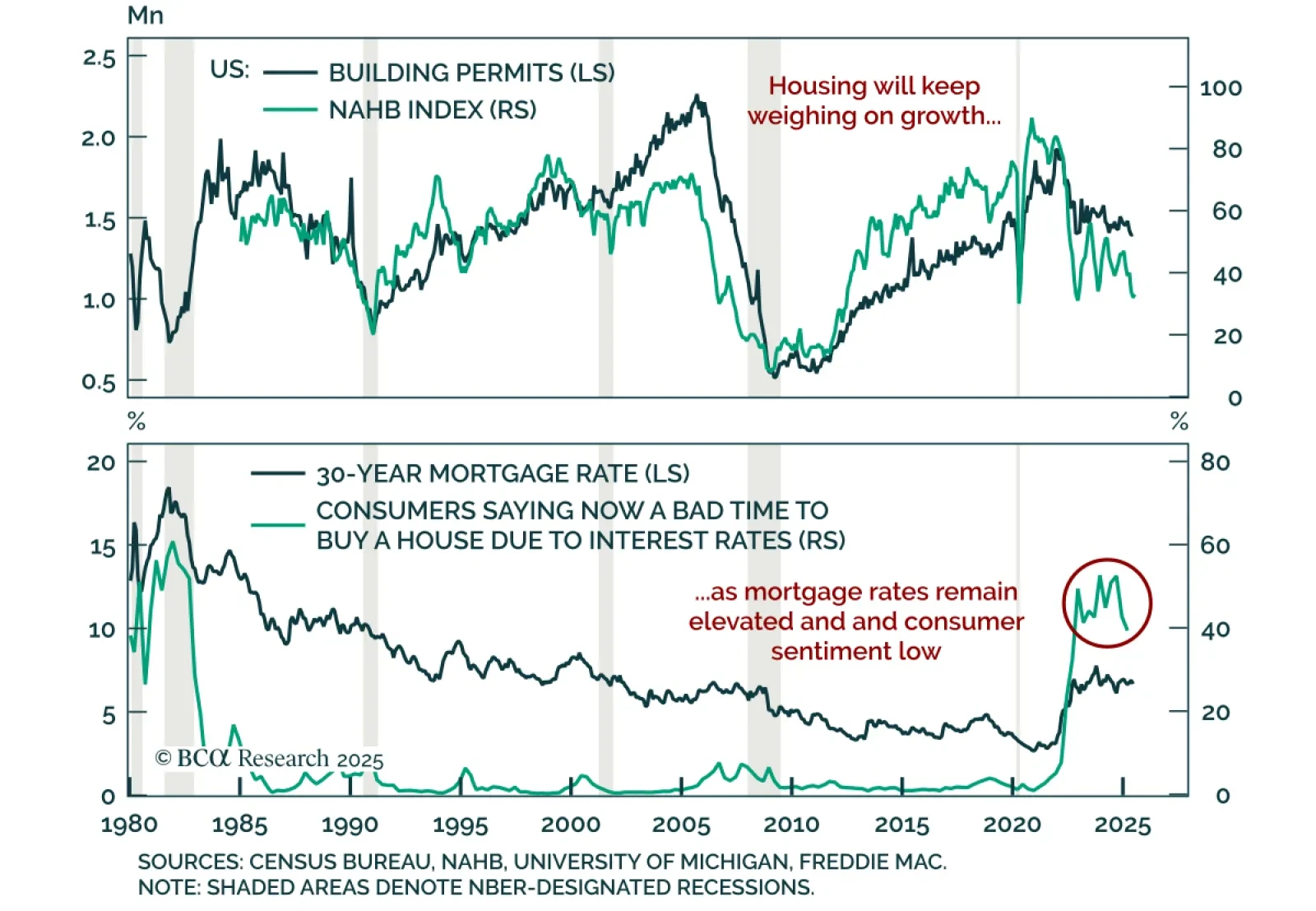

June US housing data surprised to the upside, but the broader sector is still weak, reinforcing our modest underweight on equities. Housing starts rose an annualized 4.6% m/m, and building permits ticked up 0.2% after a 2.0%…

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…