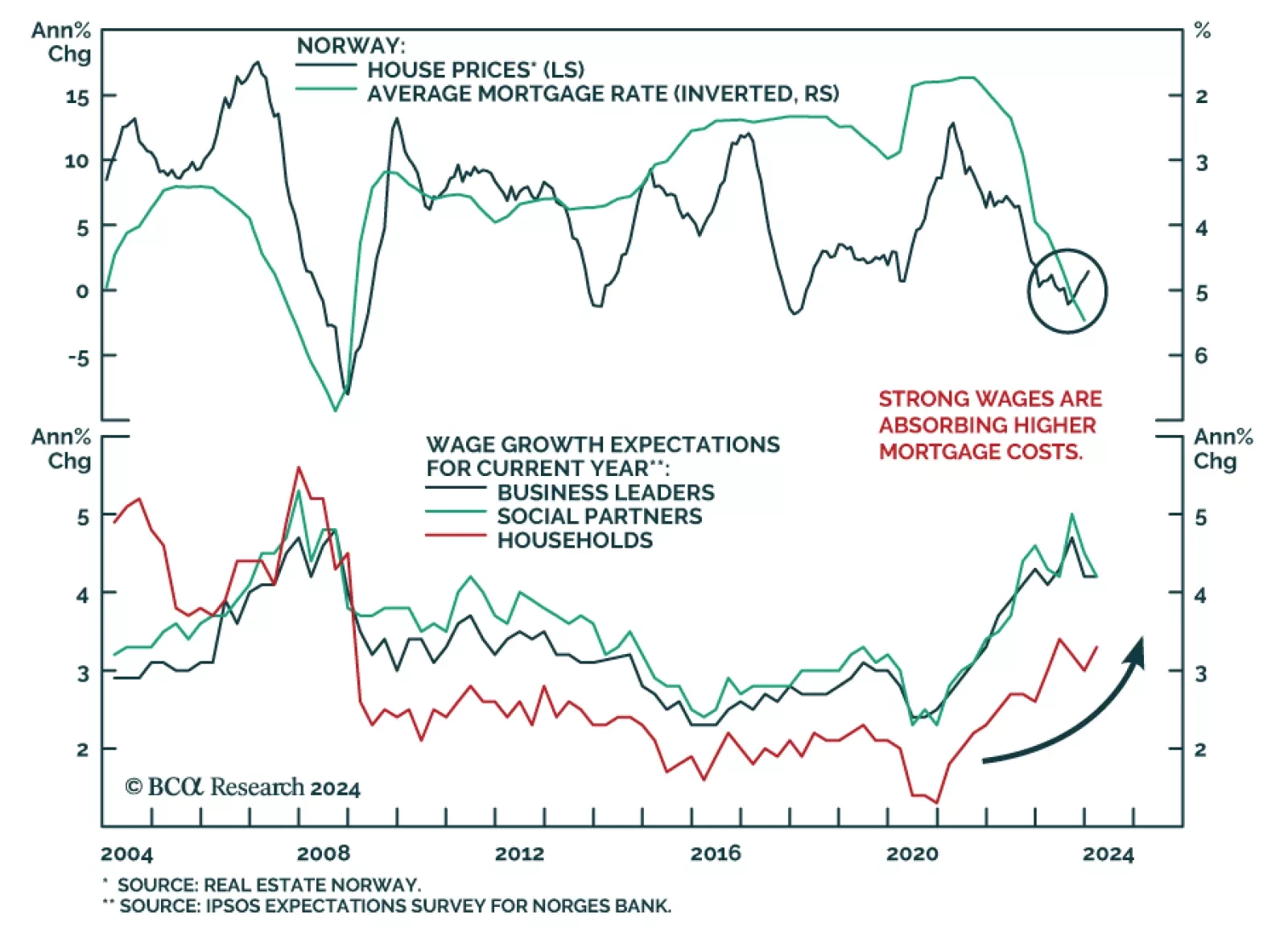

Data out of Norway is becoming increasingly positive, and there is a strong investment case to be made for the country, with bullish implications for both equities and the currency: Retail sales remain robust and are…

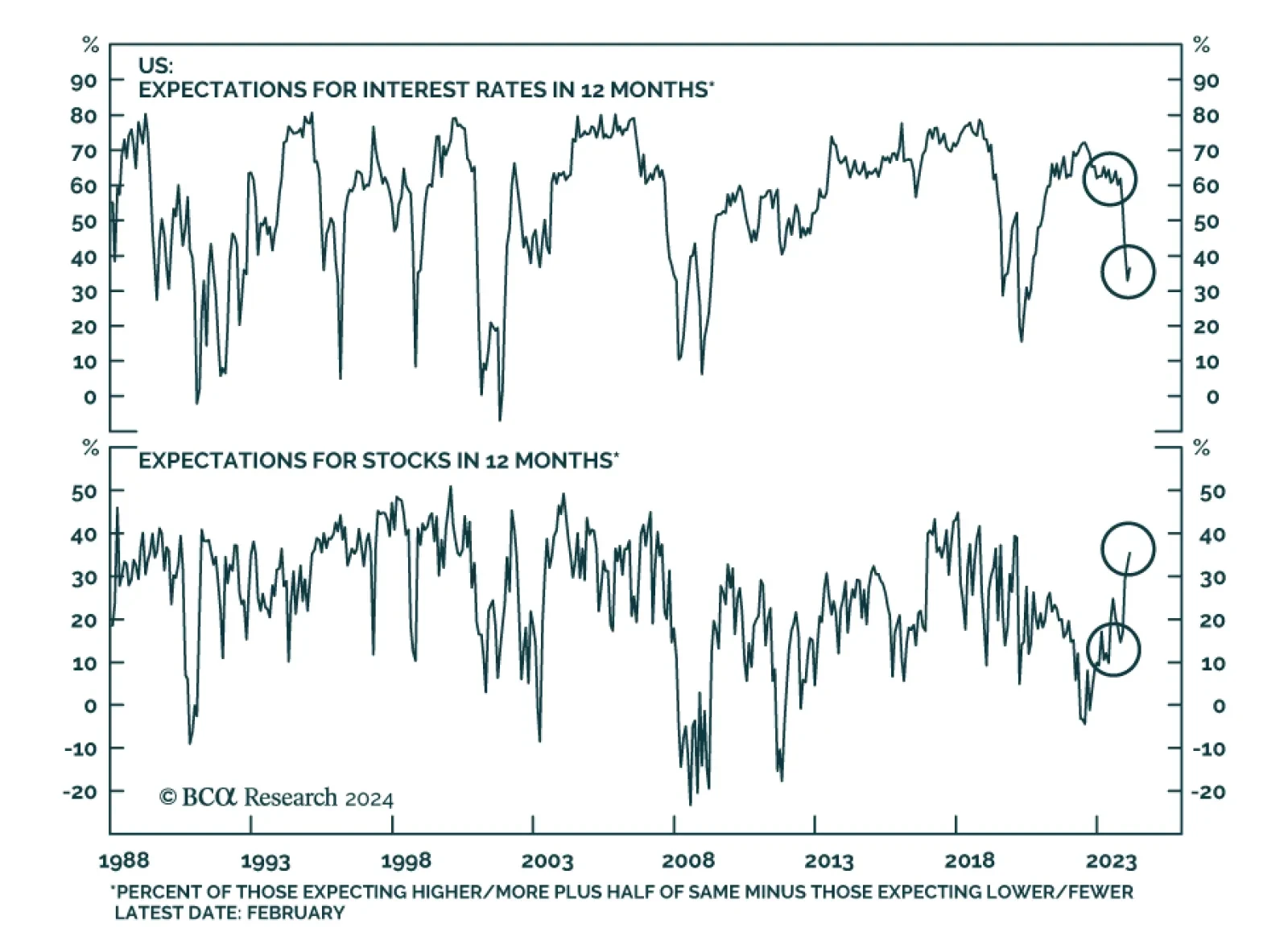

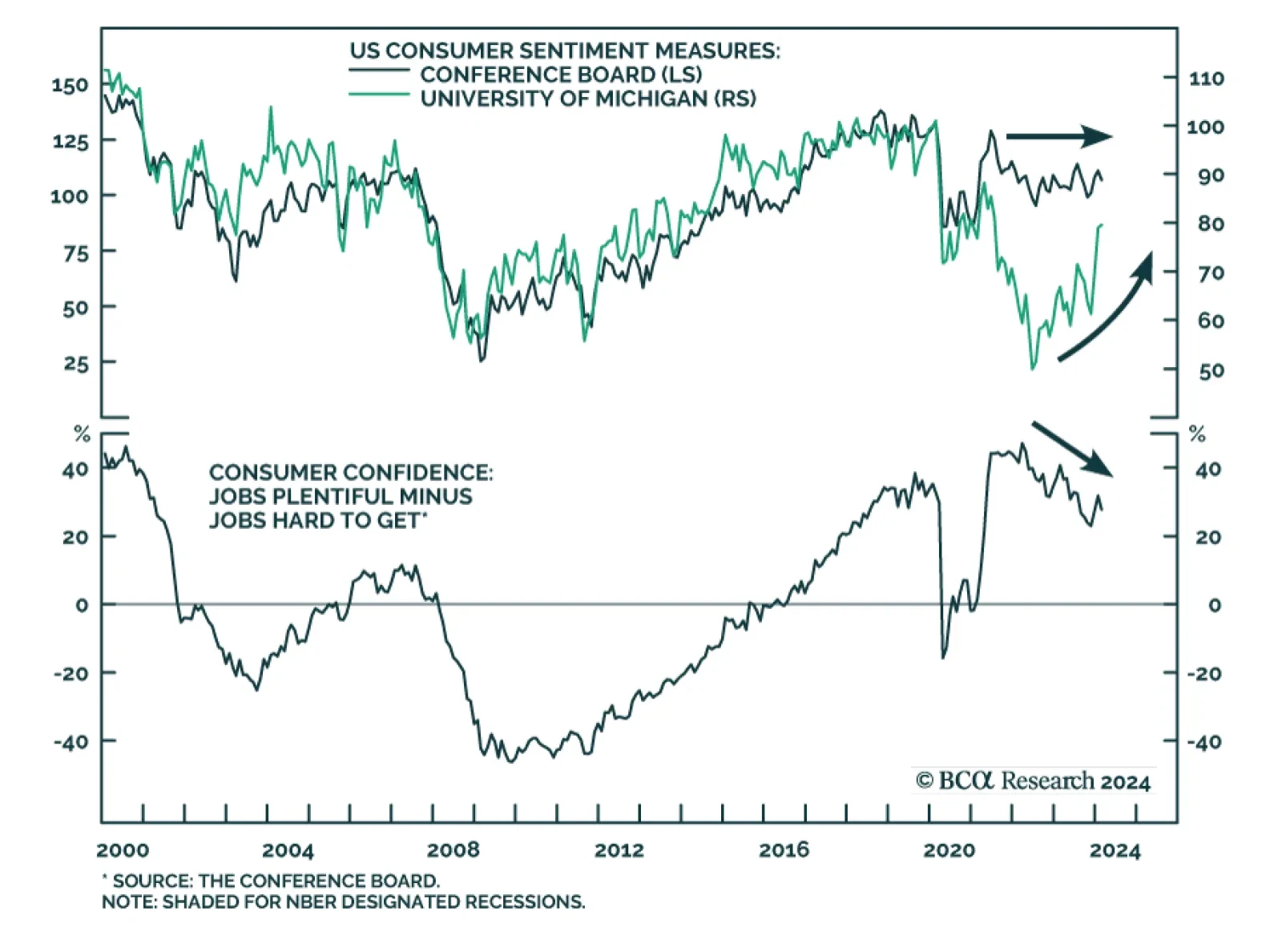

Economic sentiment has improved since the December FOMC meeting, with positive momentum extending into February. The chart above neatly summarizes the impact that the Fed’s projected easing has had on sentiment, both on…

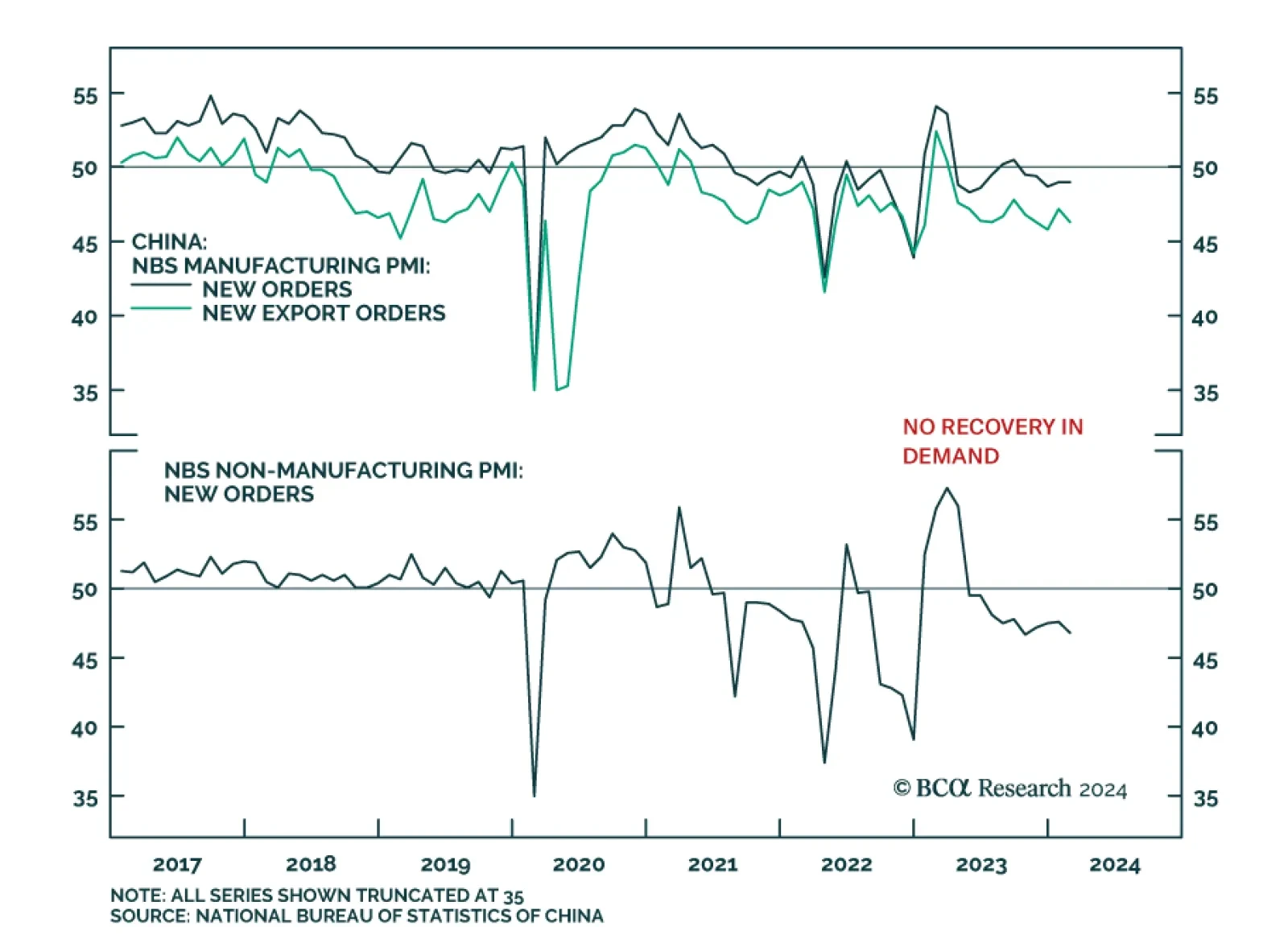

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

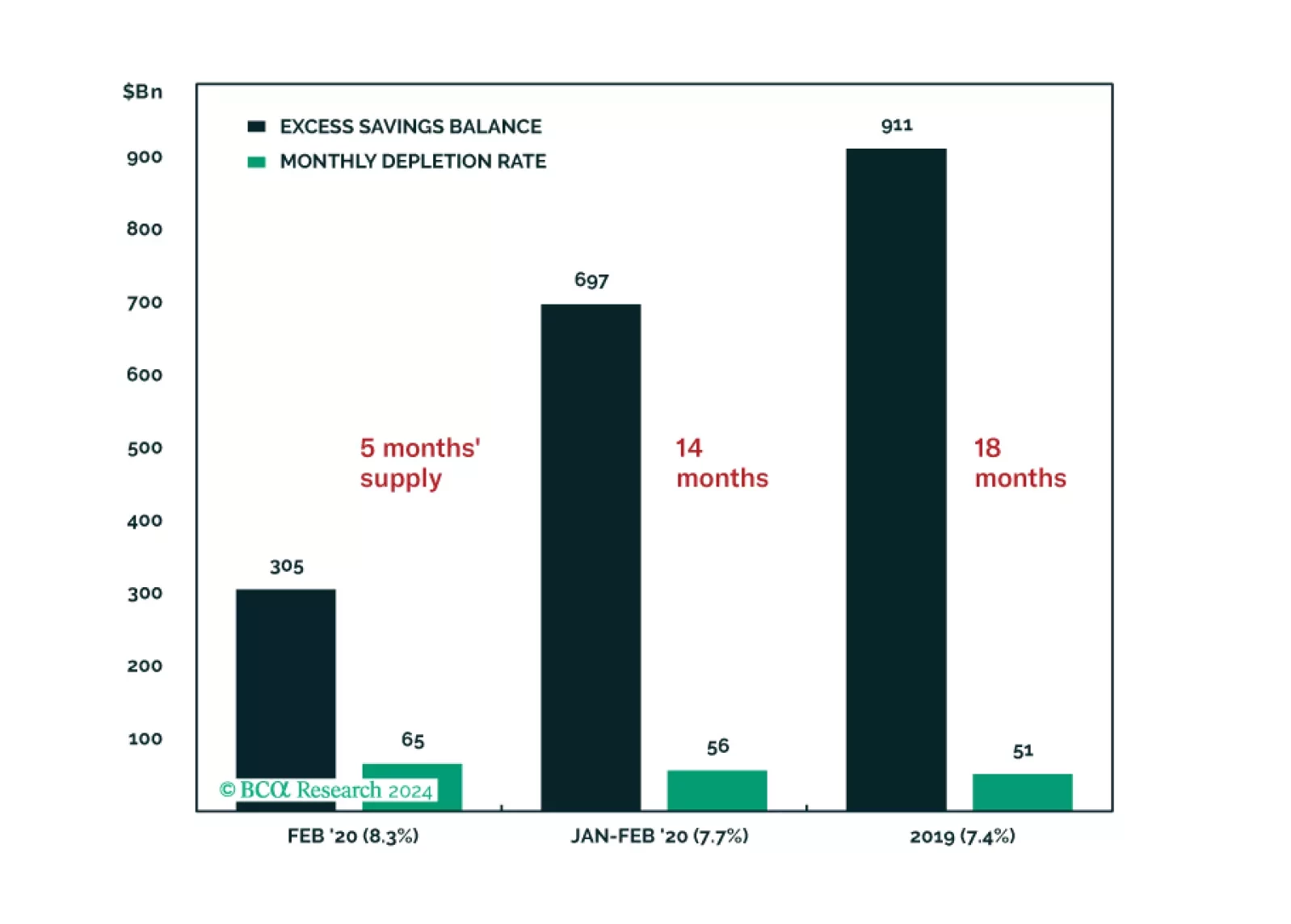

We feel as good about spurning the soft-landing narrative today as we did about spurning the recession narrative a year ago, but we are not giving into complacency. This week’s report looks at two key ways that we may be getting it…

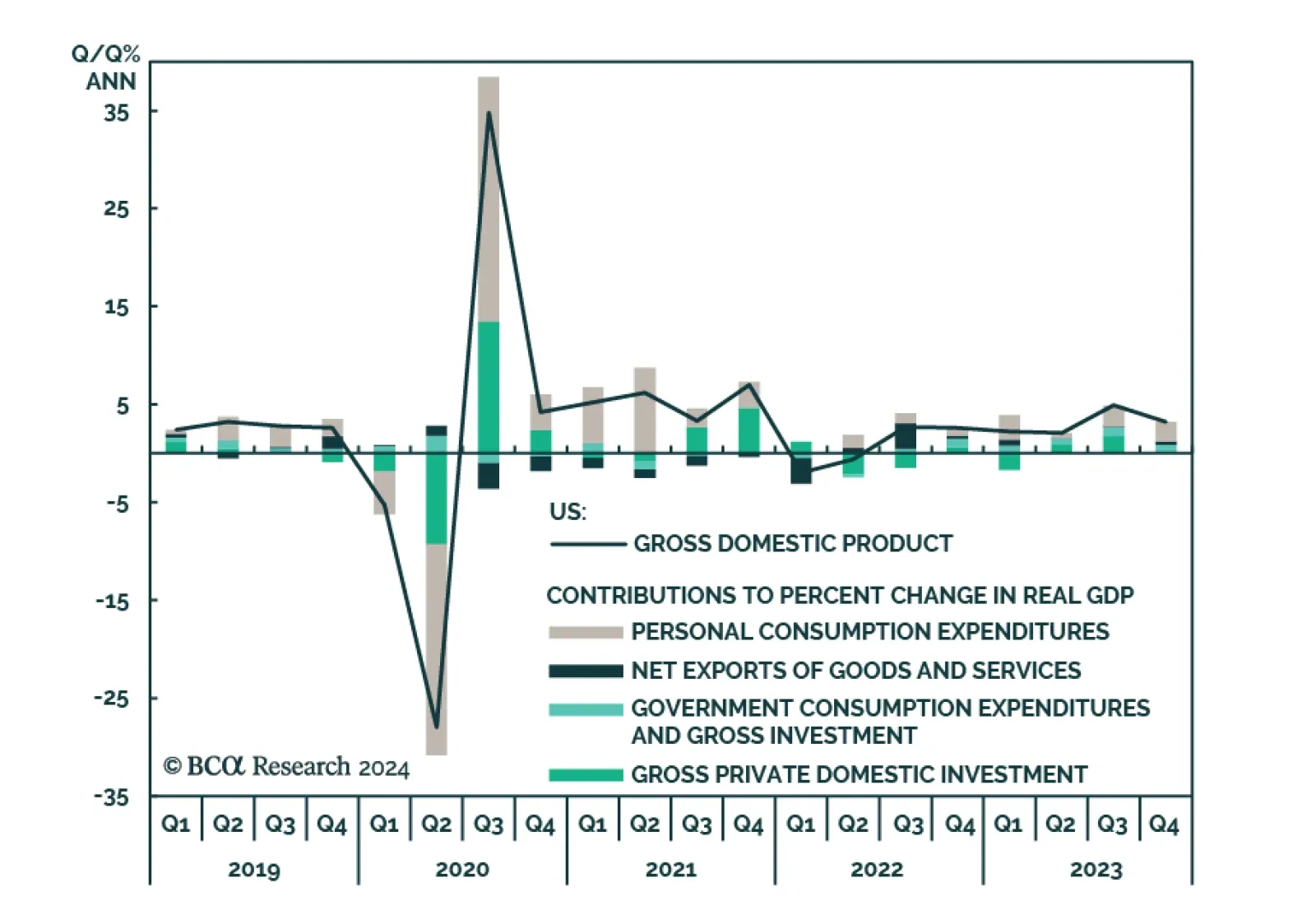

US GDP growth for Q4 was revised lower from 3.3% to 3.2% annualized, driven by a downward revision to private inventory investments (now detracting 0.27 points from a previous 0.07 contribution to GDP). However, consumer spending…

The US Conference Board’s February Consumer Confidence release surprised to the downside. The index decreased to 106.7 from a downwardly revised 110.9, disappointing expectations it would improve to 115.0. Consumers’…

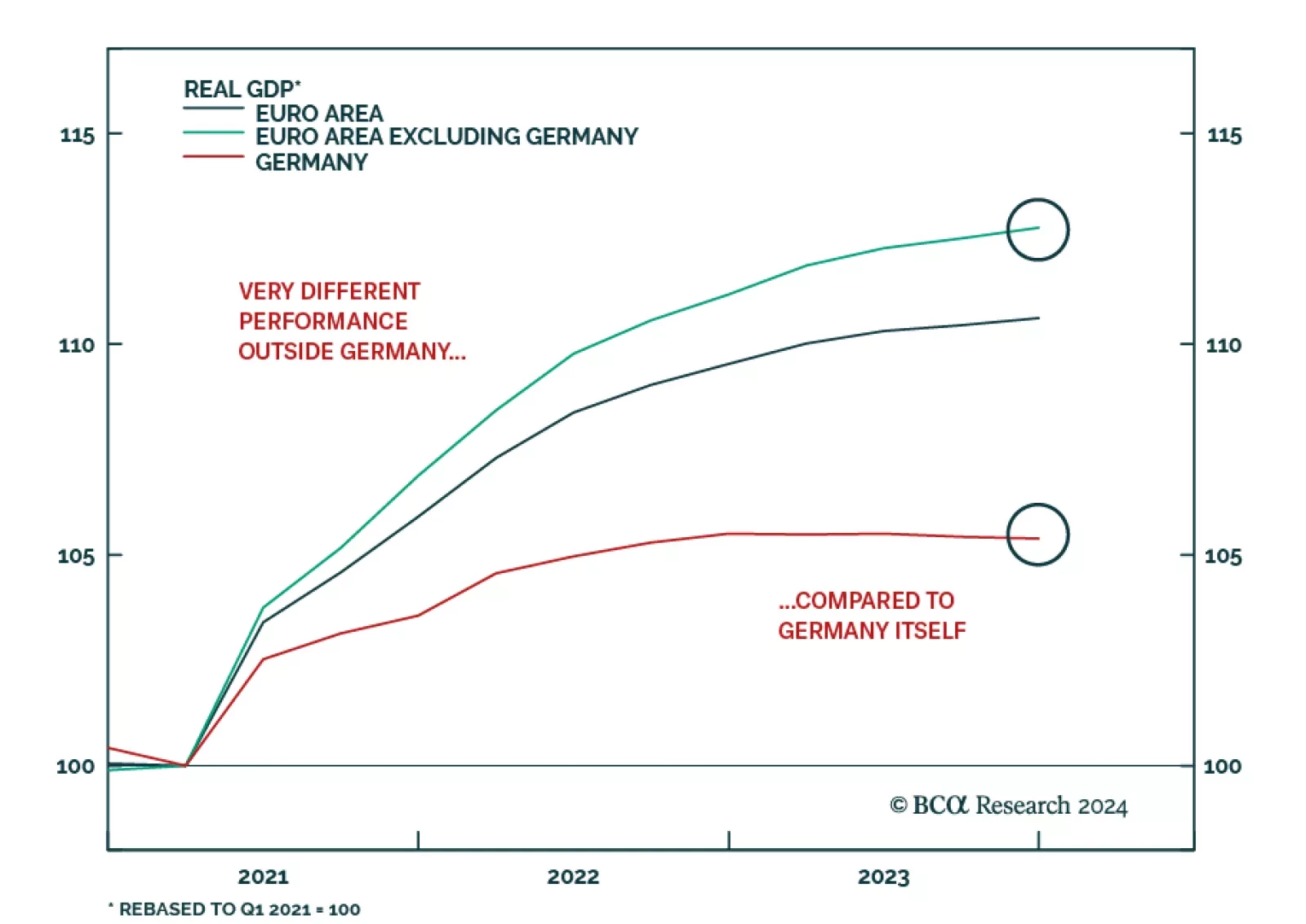

According to BCA Research’s European Investment Strategy service, Germany will likely drag the overall Euro Area into contraction, even if, individually, other countries manage to avoid a recession. This slightly better…

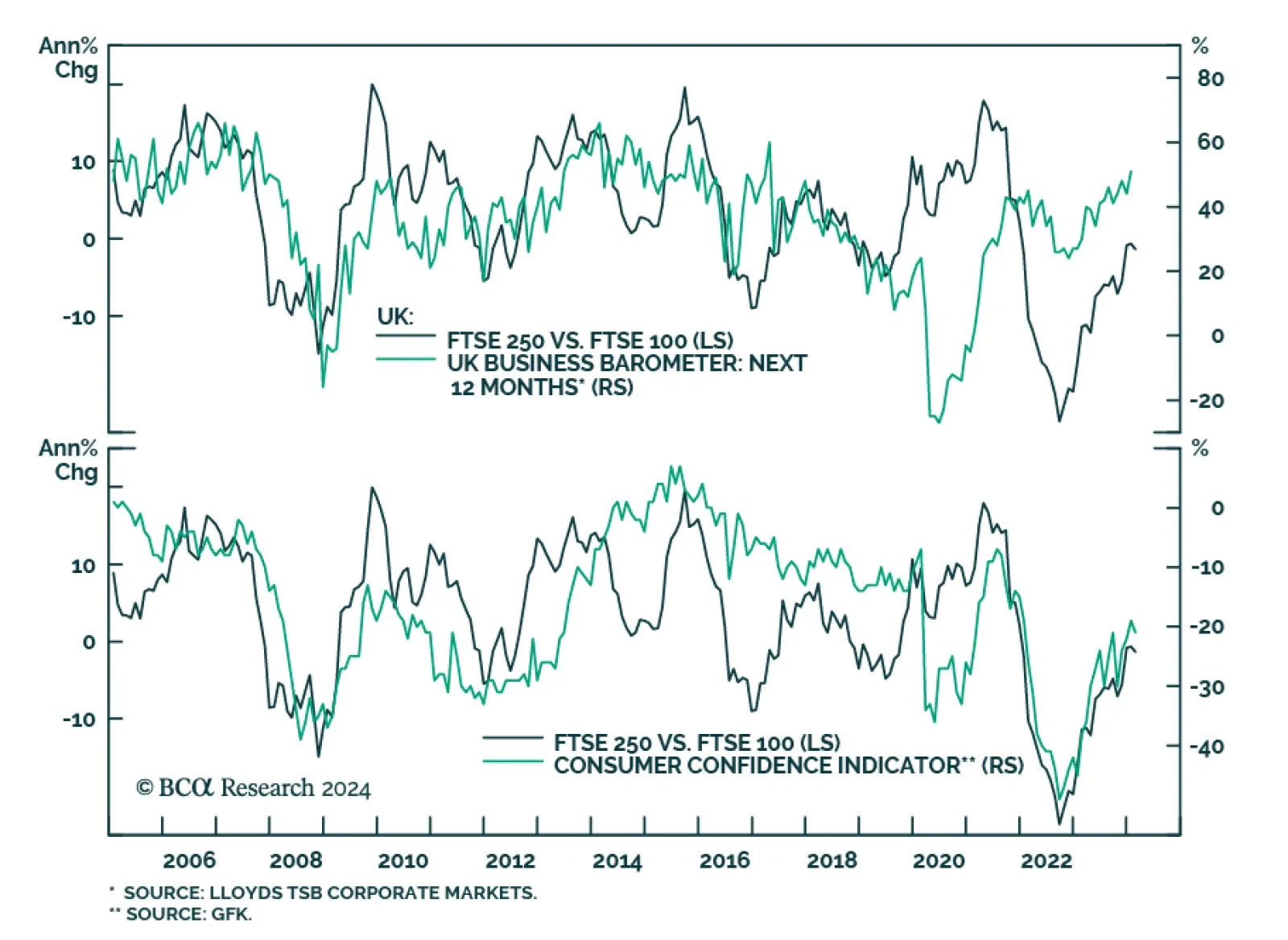

The FTSE 250 has been outperforming the FTSE 100 since late October 2023, with the former gaining 13.7% versus 3.9% in the case of the latter over this period. To the extent that UK small cap stocks are more exposed to…

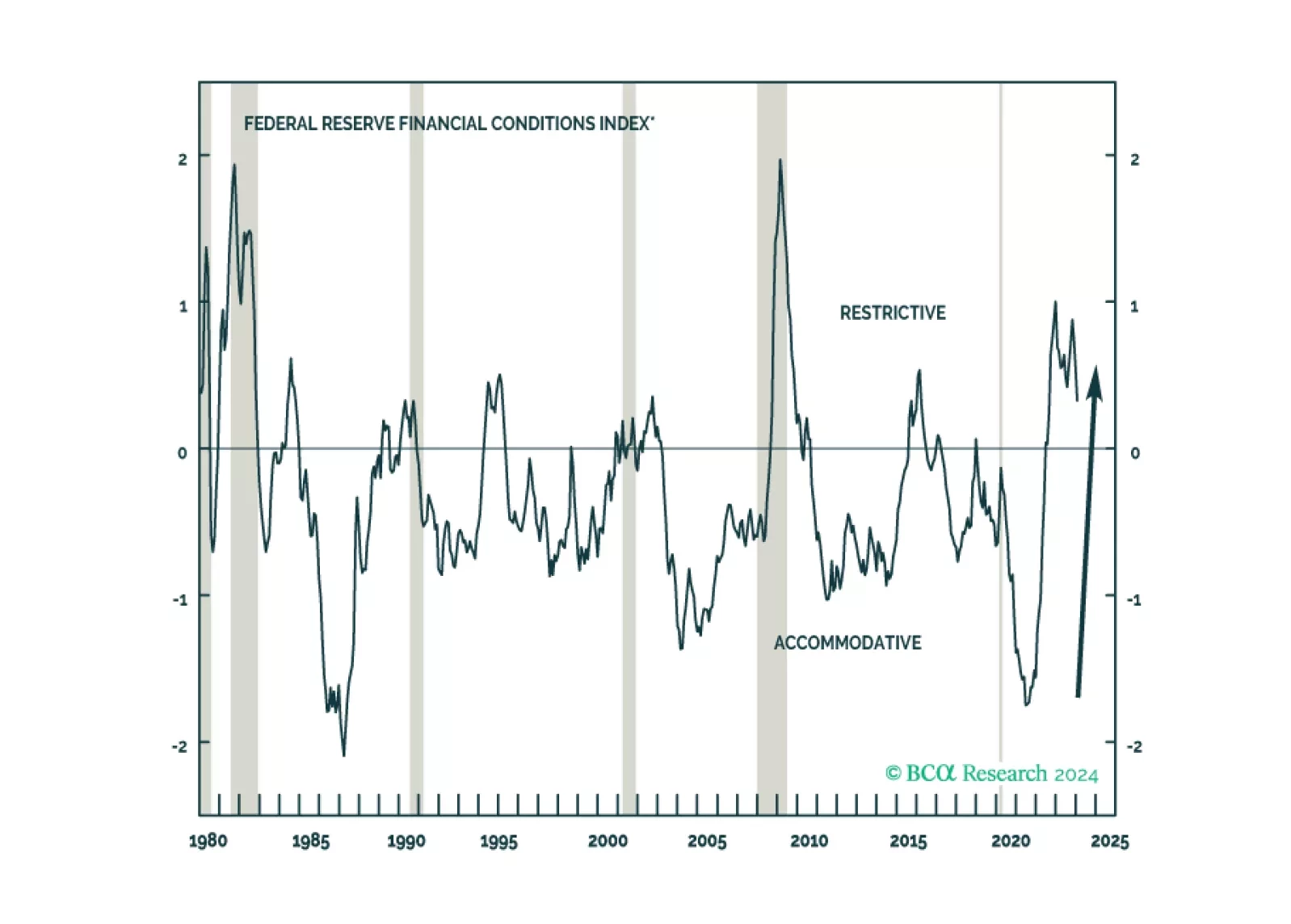

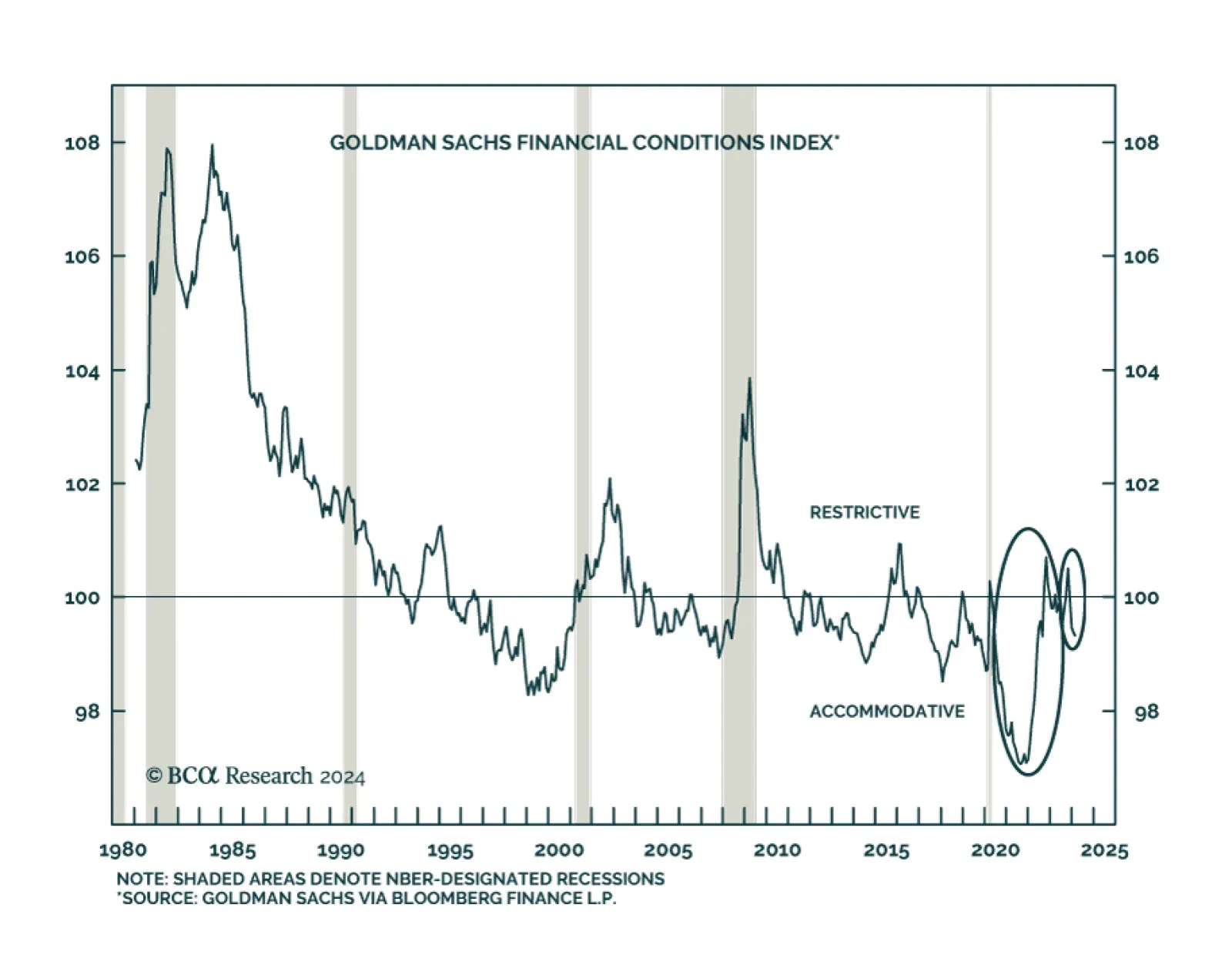

According to BCA Research’s US Investment Strategy service, investors should take care not to read too much into the recent easing in financial conditions. According to Goldman Sachs’ Financial Conditions Index (…

Clients have been pushing back on our recession call on the grounds that it is incompatible with the economy’s second-half acceleration and the more recent easing in financial conditions. We examine both of those points in the course…