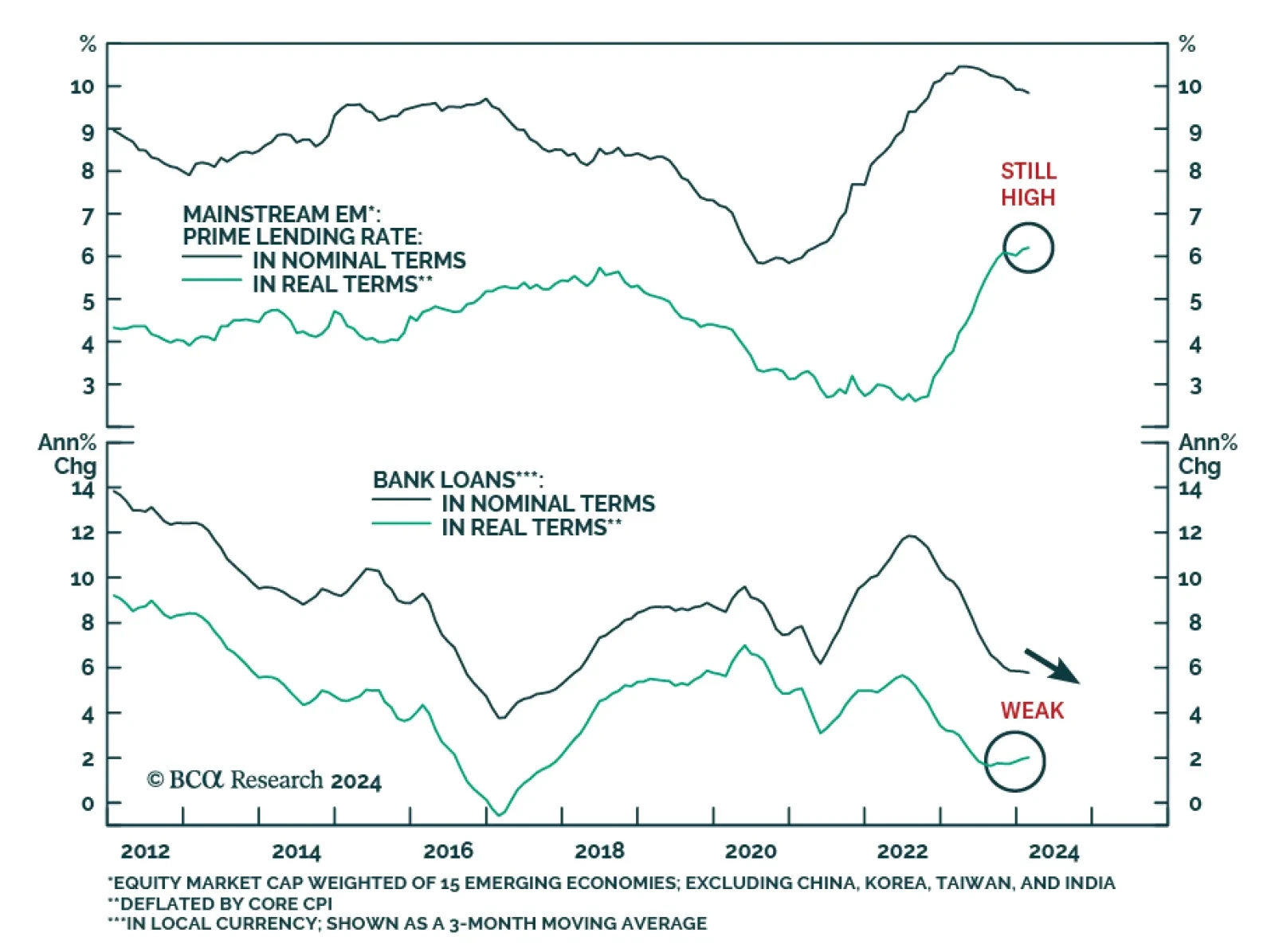

According to BCA Research’s Emerging Markets Strategy service, although certain Chinese industries and individual EM economies are growing briskly, overall EM growth will remain tepid, with risks skewed to the downside.…

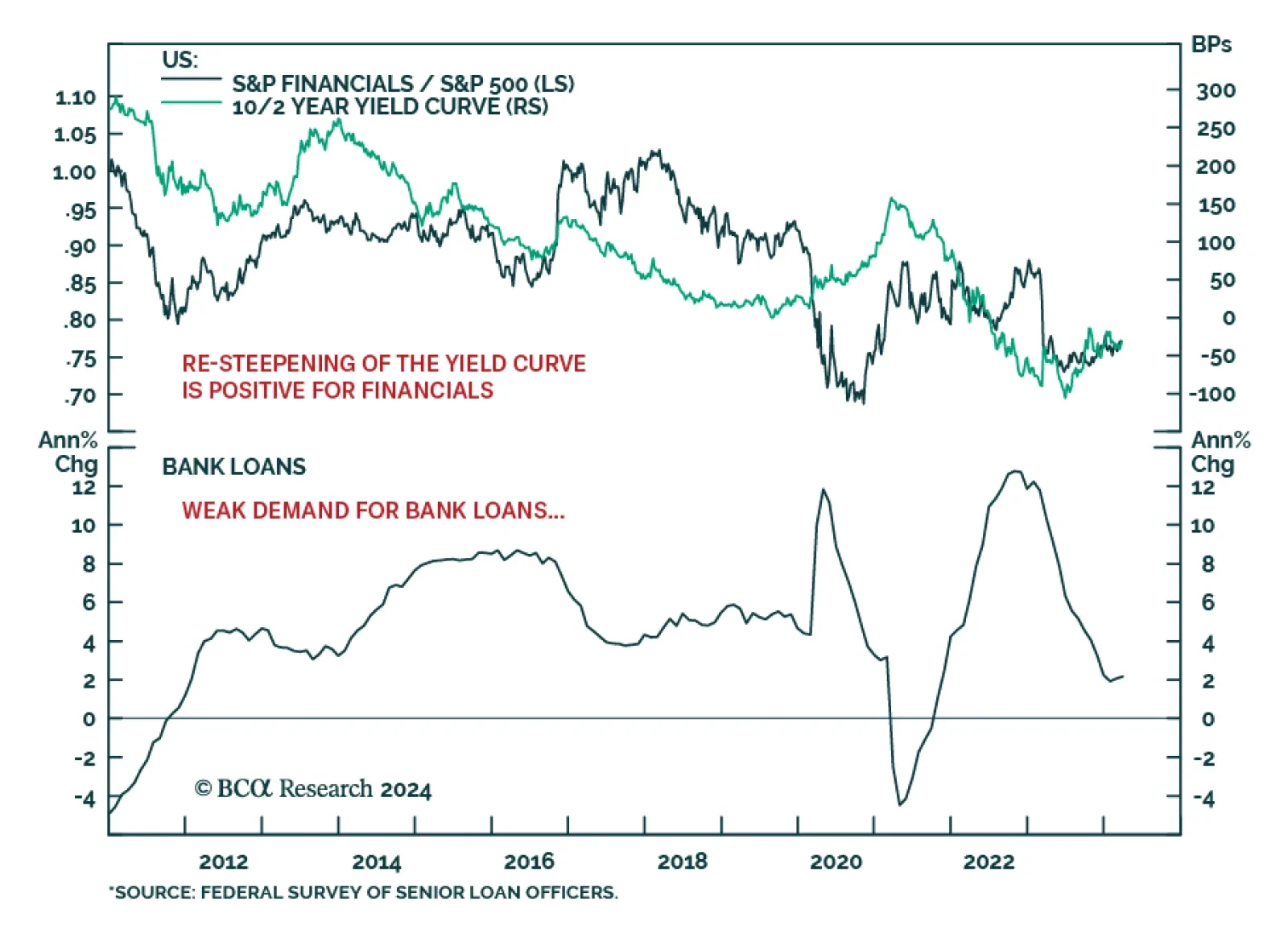

The steepening of the yield-curve powered the outperformance of the S&P 500 Financials relative to the overall market since the spring of 2023 banking crisis. This sector returned 30.1% over this period, against 27.3% for the…

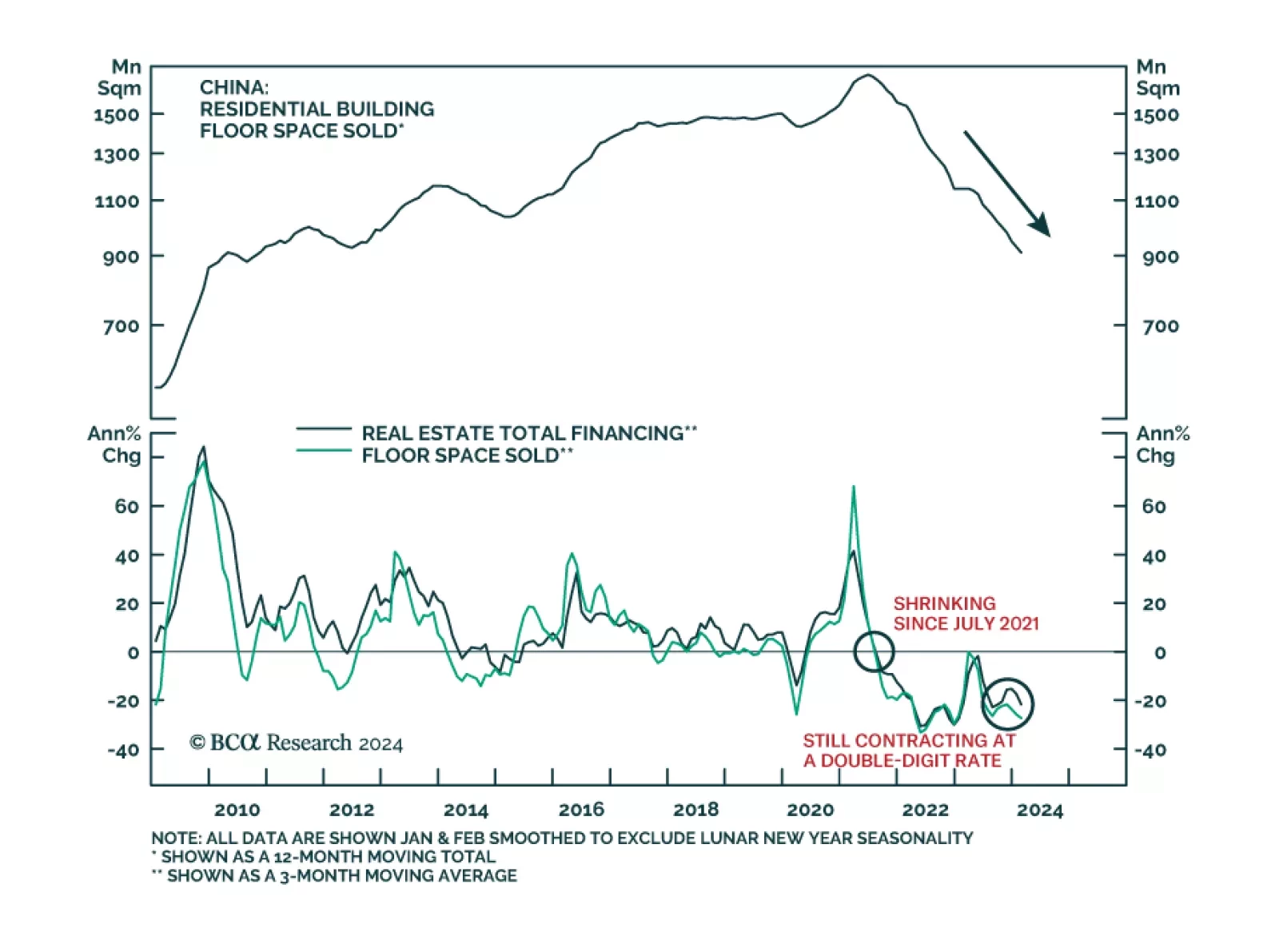

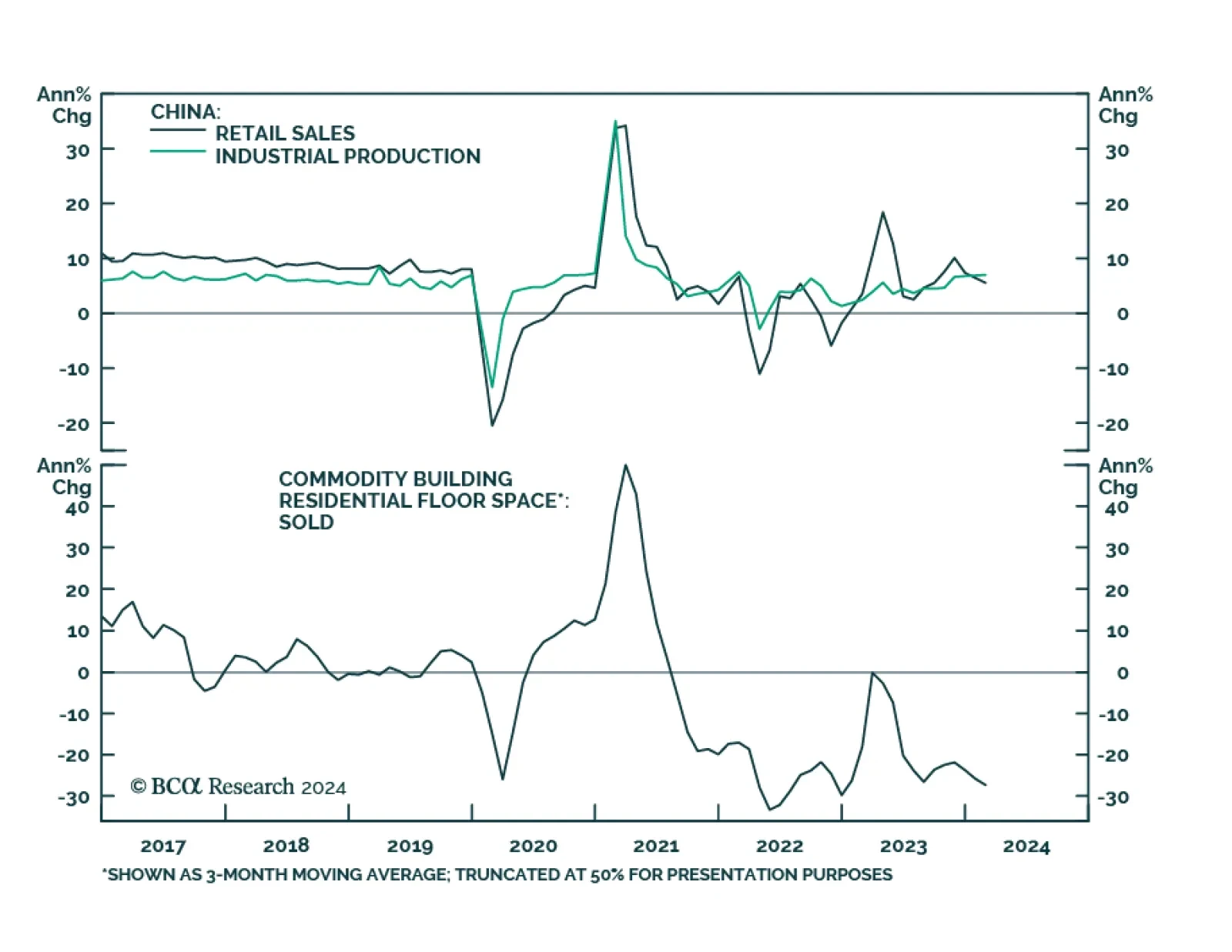

According to BCA Research’s China Investment Strategy service, the adjustment in China’s real estate sector is not over. Odds are that the property market will contract for the fourth year in a row. The property…

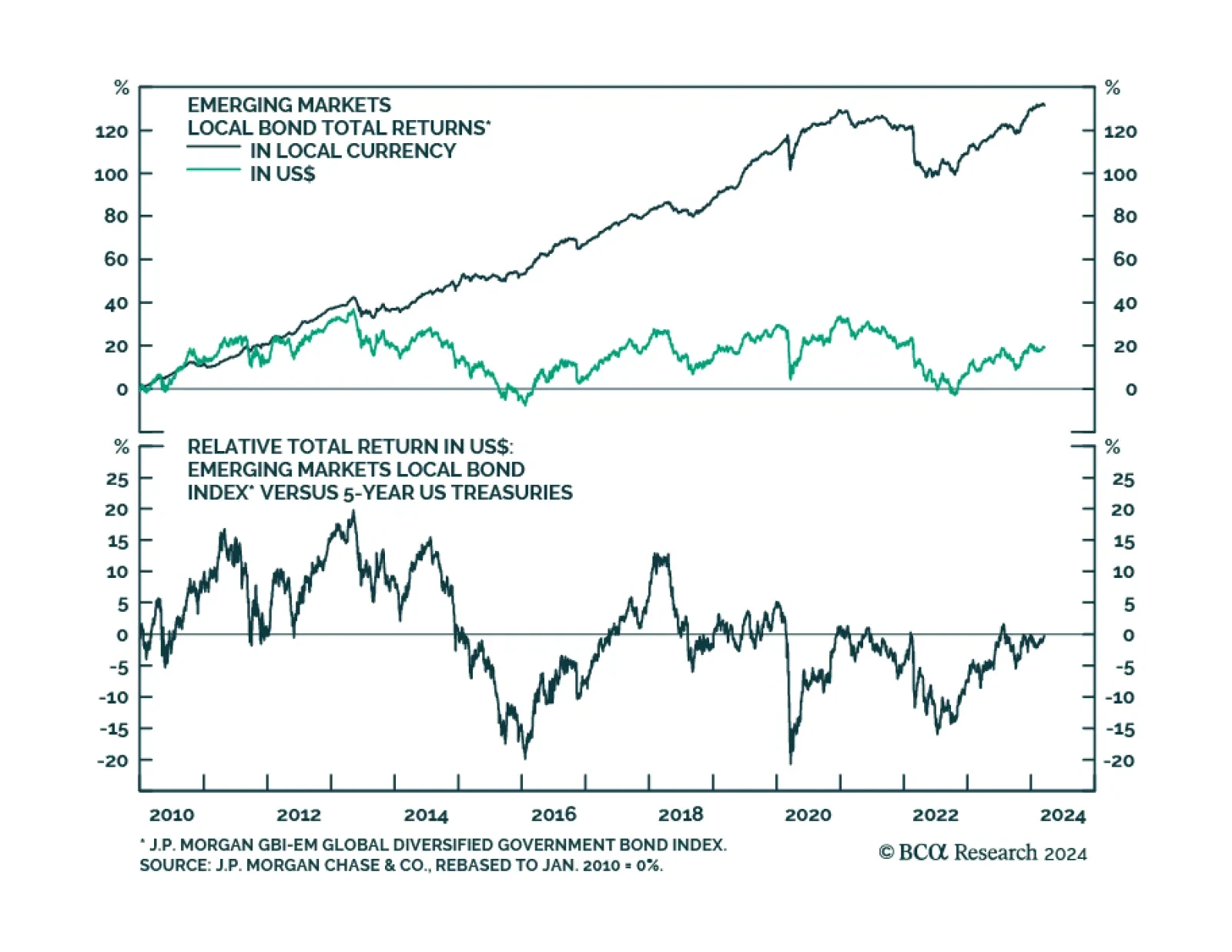

According to BCA Research’s Global Asset Allocation service, the impact of the global savings glut is among the four structural trends that will drive EM debt going forward. As an asset traditionally further out on the…

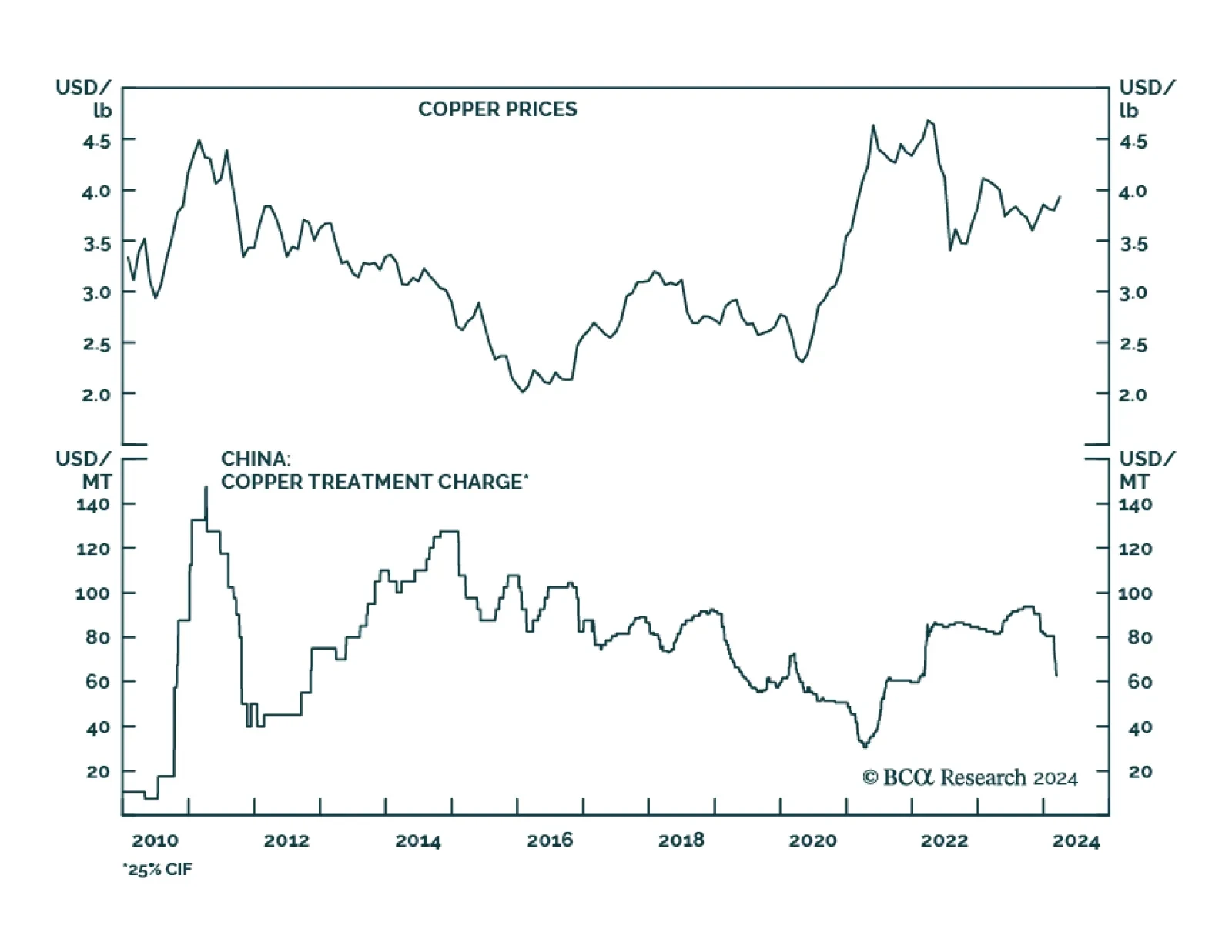

In a recent Insight we highlighted that the selloff in the price of iron ore – which is down 25.4% year-to-date – is sending a pessimistic signal on China’s economy, suggesting that the current rally in Chinese…

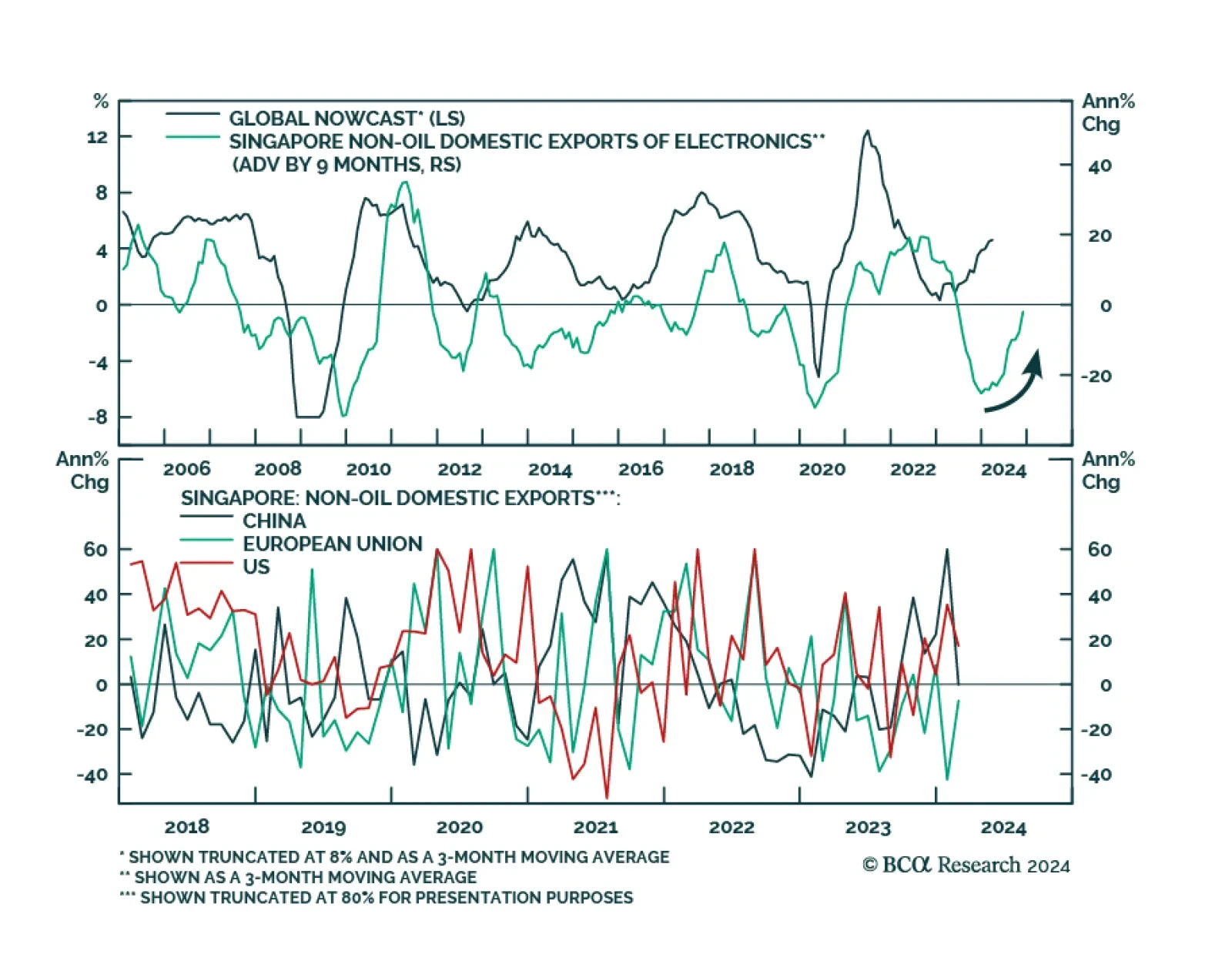

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…

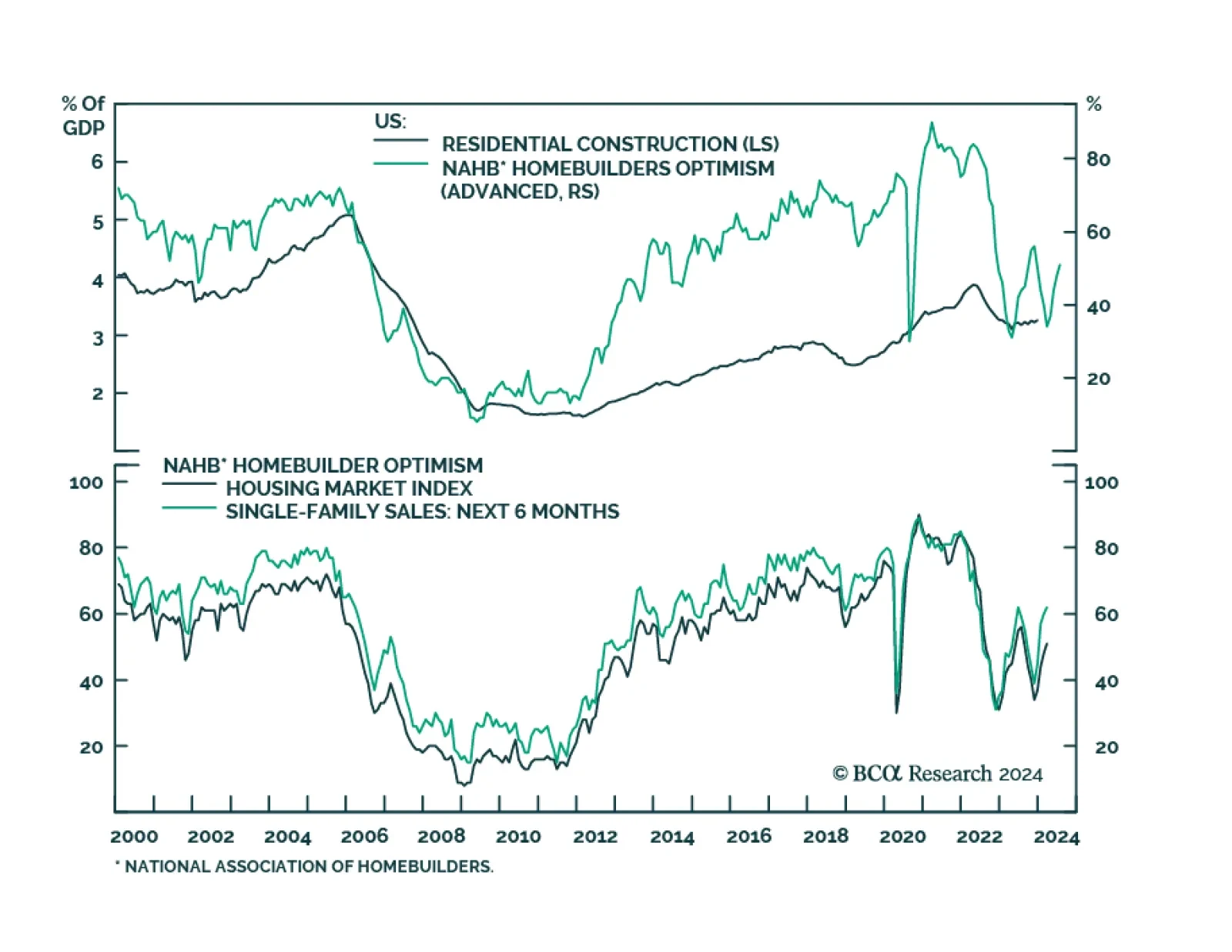

Indicators continue to point to resilient US housing market dynamics. The NAHB Housing Market Index increased for the fourth consecutive month to an 8-month high of 51 in March, beating expectations it would remain unchanged at…

Chinese economic data for the first two months of the year were mixed. On the one hand, industrial production and fixed asset investment growth came in above consensus estimates, accelerating to 7.0% y/y (vs. expectations of 5.2…

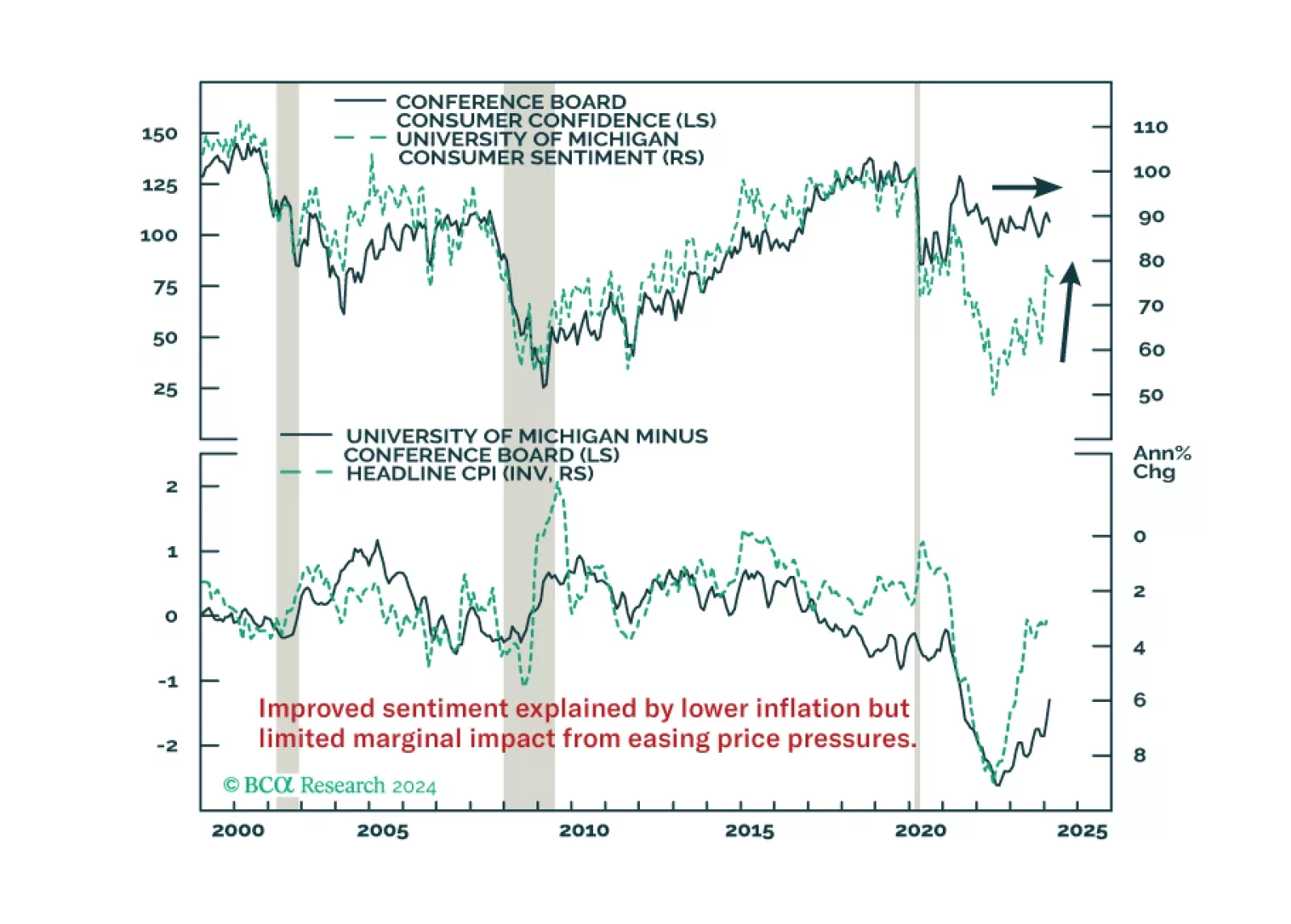

Improved consumer morale will not compensate for the fading tailwinds to consumption. Neither will the wealth effects from higher stocks and home prices.

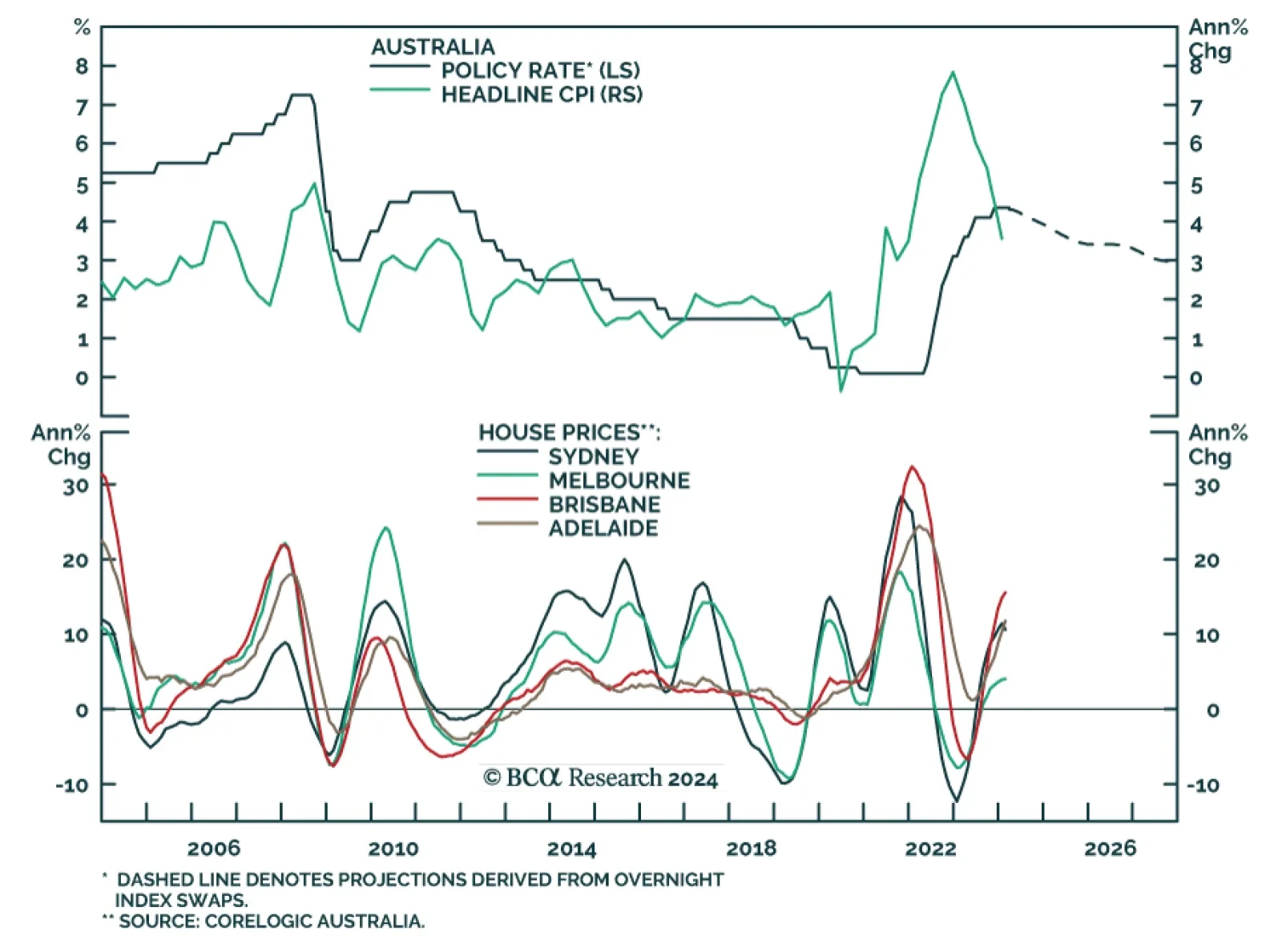

According to BCA Research’s Foreign Exchange Strategy service, Australia’s macroeconomic environment validates a long AUD position, especially at the crosses. The market expects that the RBA will cut interest rates…