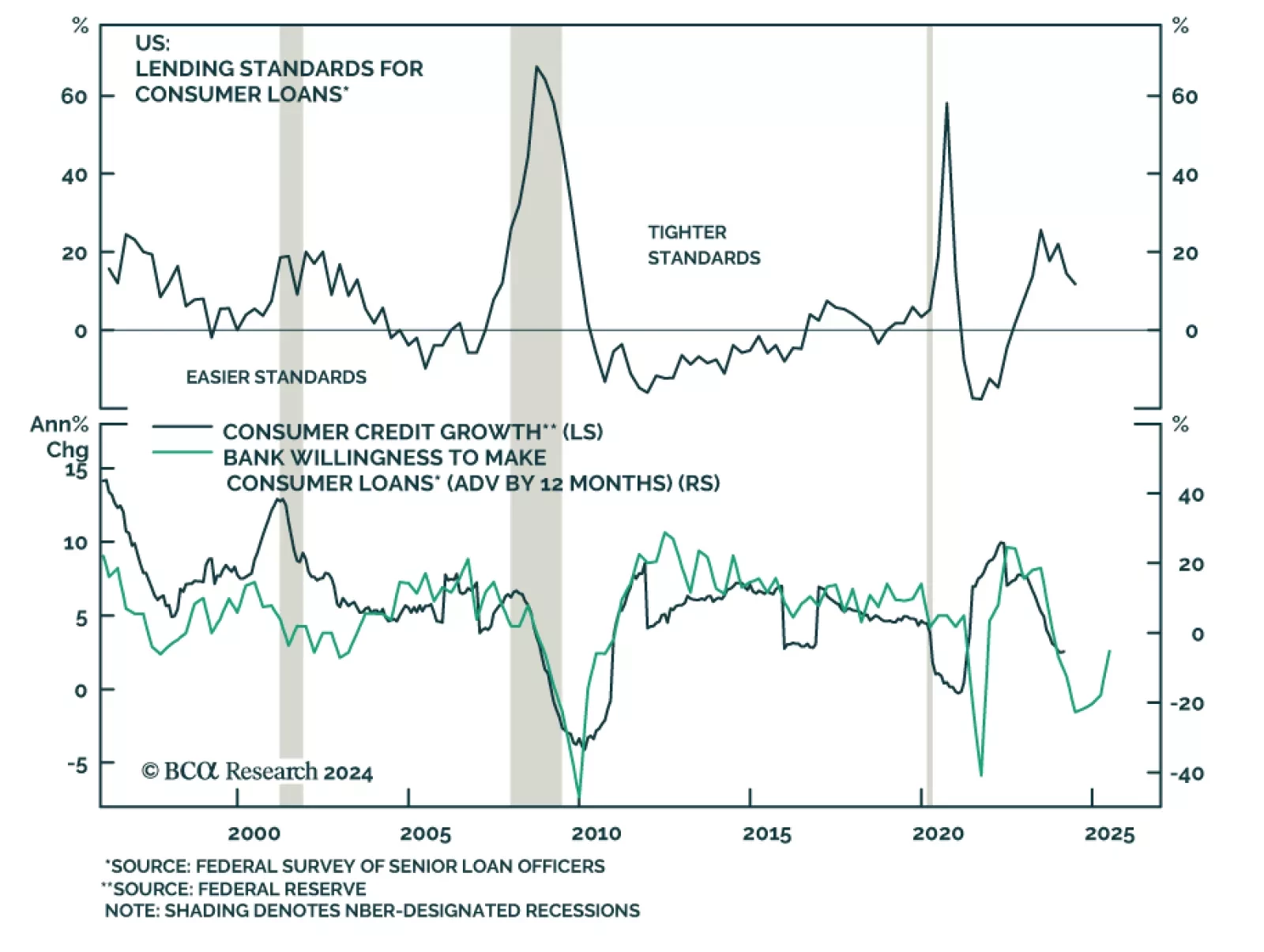

Lending standards continued to tighten for most loan categories in Q1 2024. US banks reported tightening lending standards for C&I and CRE. For real-estate-backed loans to households, lending standards tightened further…

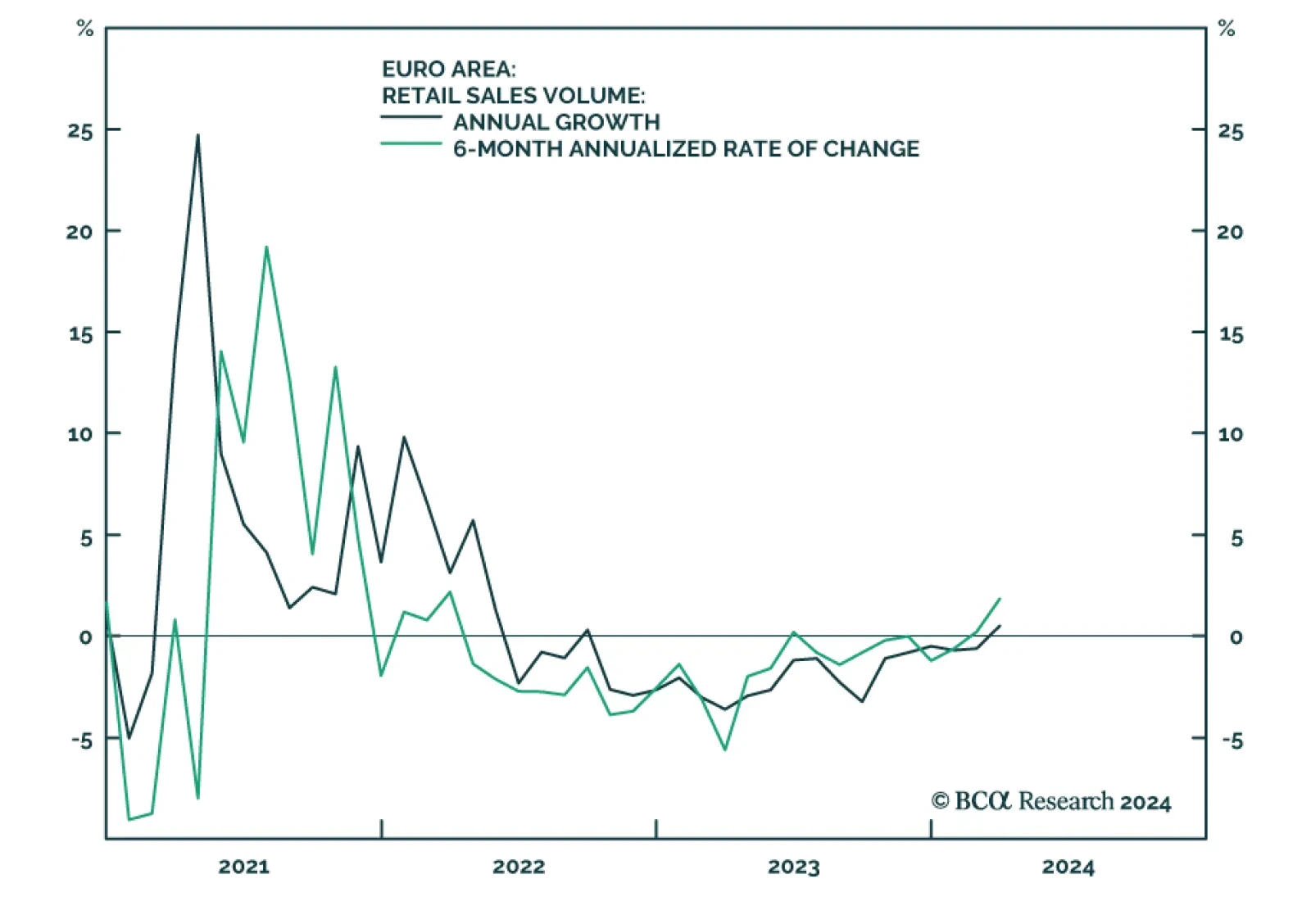

European retail sales were stronger-than-expected in March. They grew by 0.7% y/y from an upwardly revised 0.5% contraction in February, upending expectations that they would continue to decline. Improved sales in food…

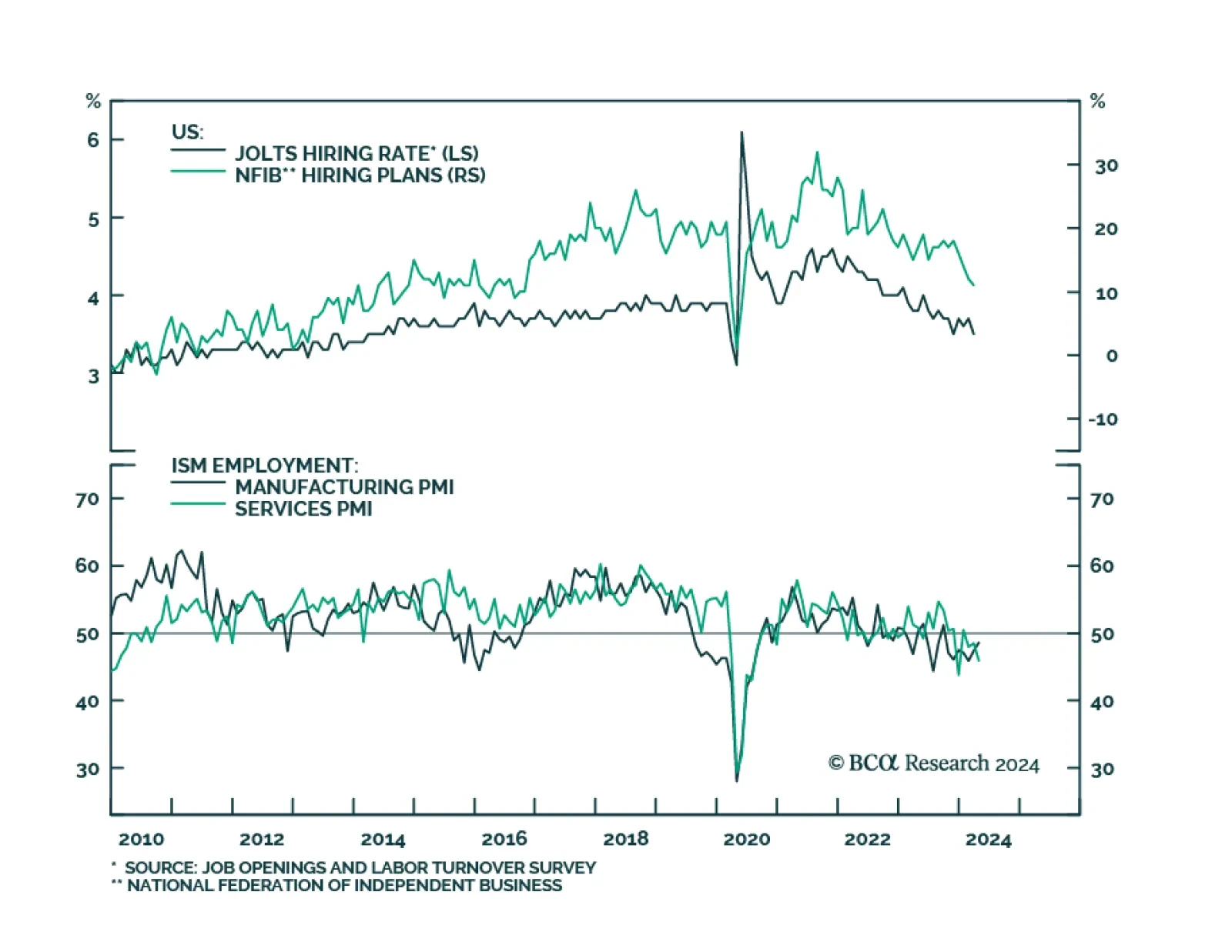

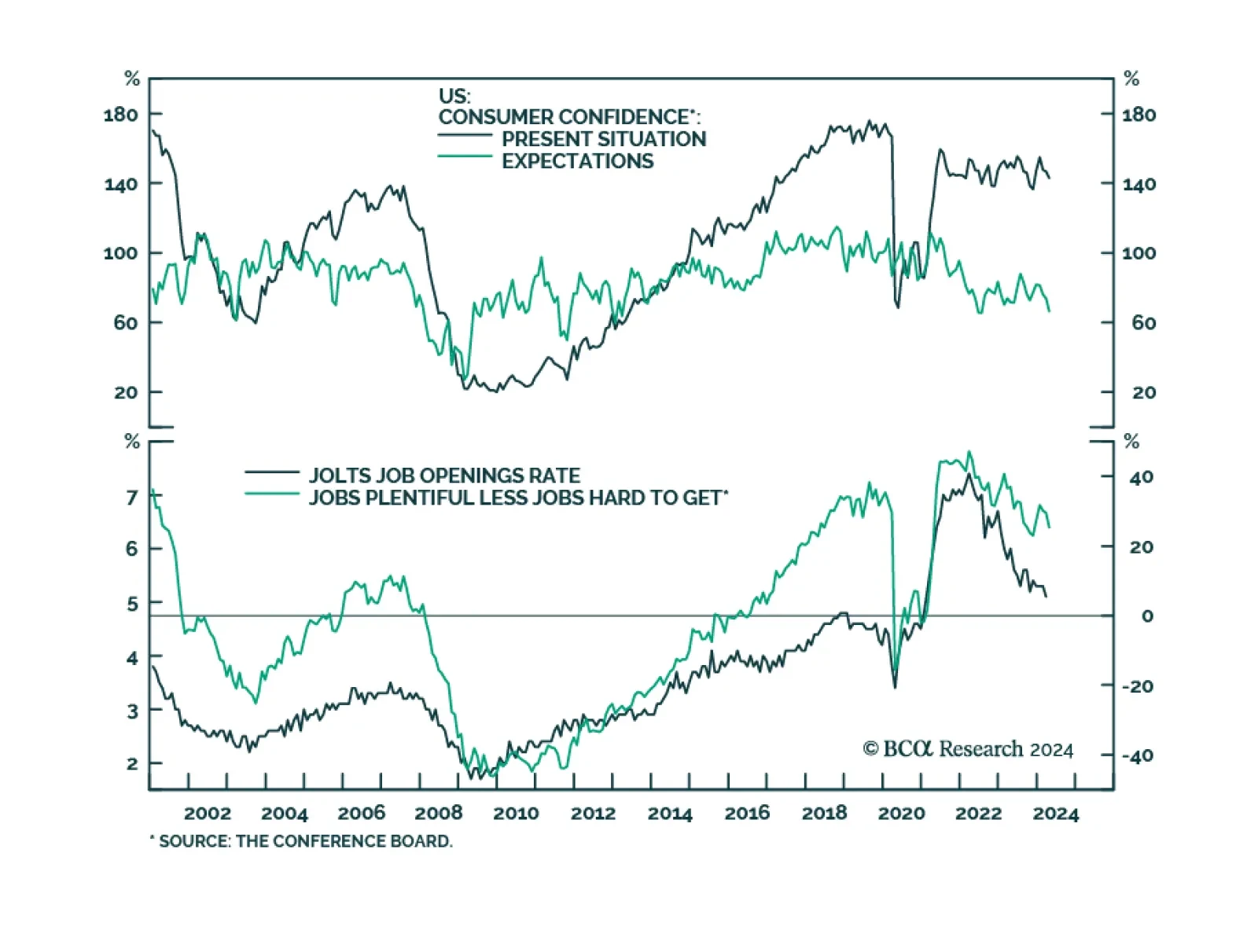

According to BCA Research’s US Bond Strategy service, while US economic data clearly show that labor demand has slowed from its peak two years ago, it isn’t yet clear whether this slowing represents a re-normalization…

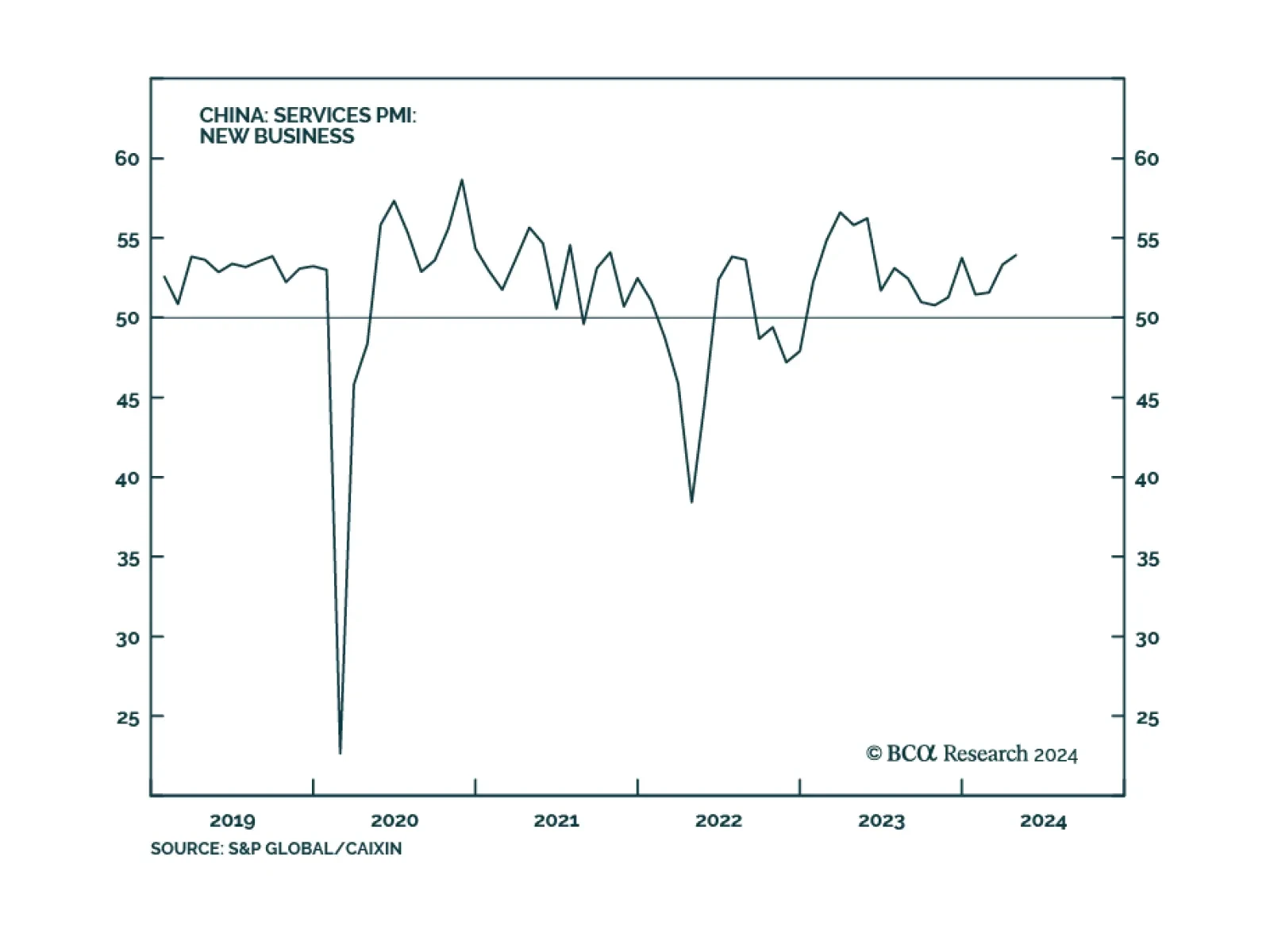

The Caixin services and composite PMIs were broadly unchanged in April. The services PMI decreased from 52.7 to 52.5, in line with expectations, while the composite PMI increased from 52.7 to 52.8. Details underscored positive…

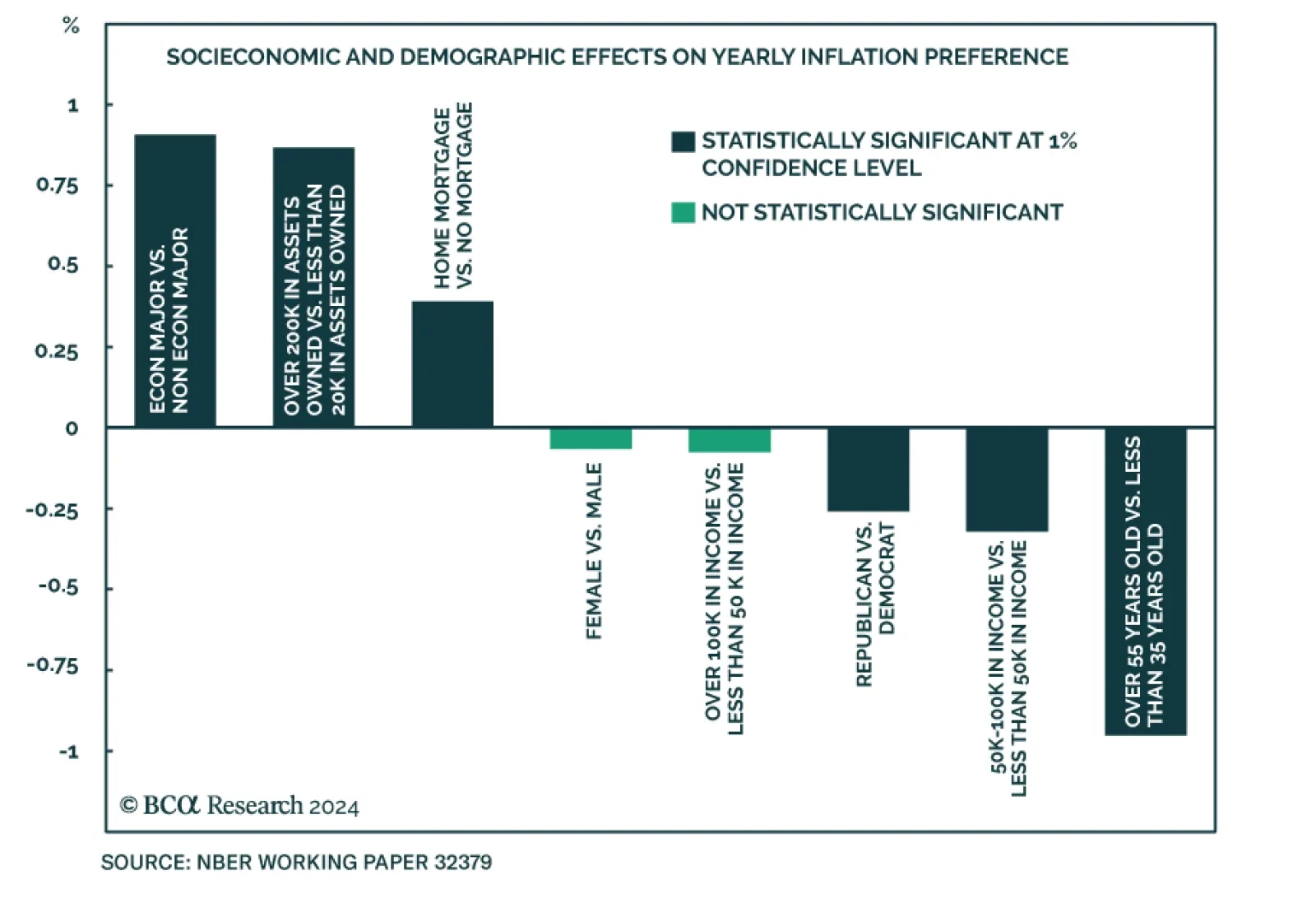

The Federal Reserve has a target inflation of 2%. But what level of inflation does the American public actually prefer? A recent NBER paper titled “Inflation Preferences” by Afrouzi, Dietrich, Myrseth, Priftis, and…

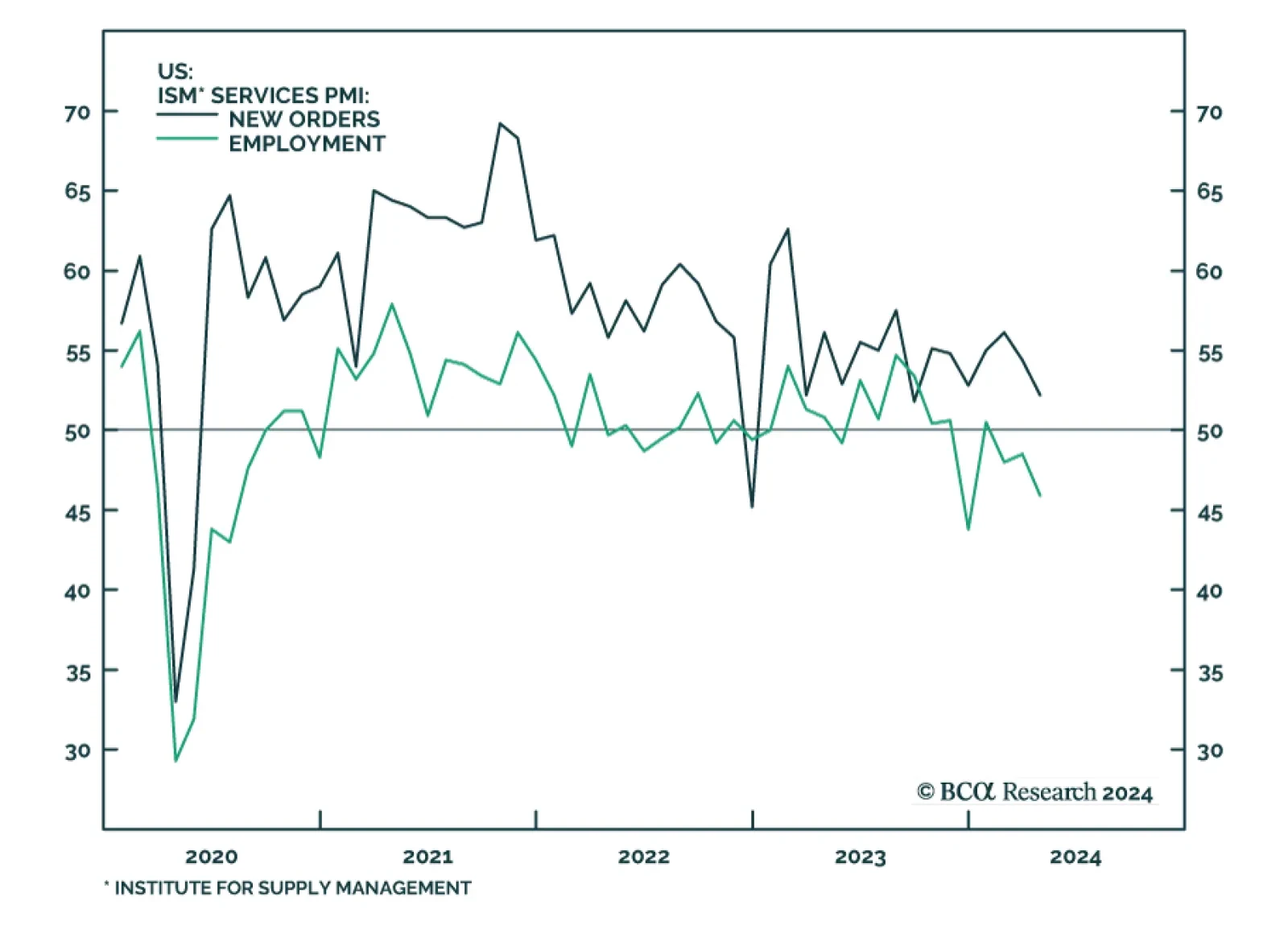

The ISM Services PMI largely disappointed in April. The headline index fell to 49.4 from 51.4, below expectations of a faster pace of growth. April’s contraction ends a streak of 15 consecutive months of services-sector…

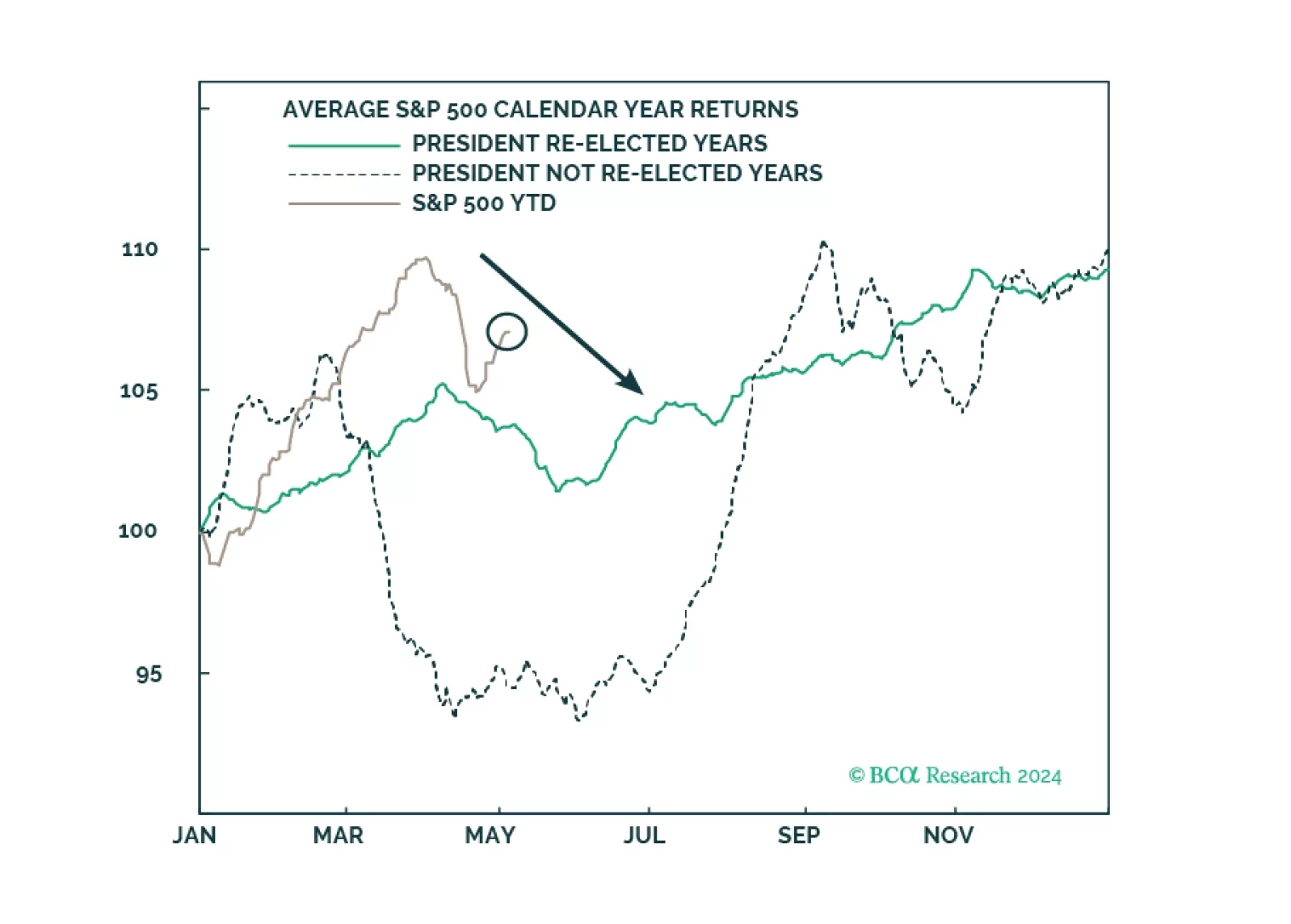

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

The Conference Board’s gauge of consumer confidence largely disappointed in April. 3.9- and 7.6-point decreases in the Present Situation and Expectations subcomponents, respectively, drove the overall index to a 22-month…

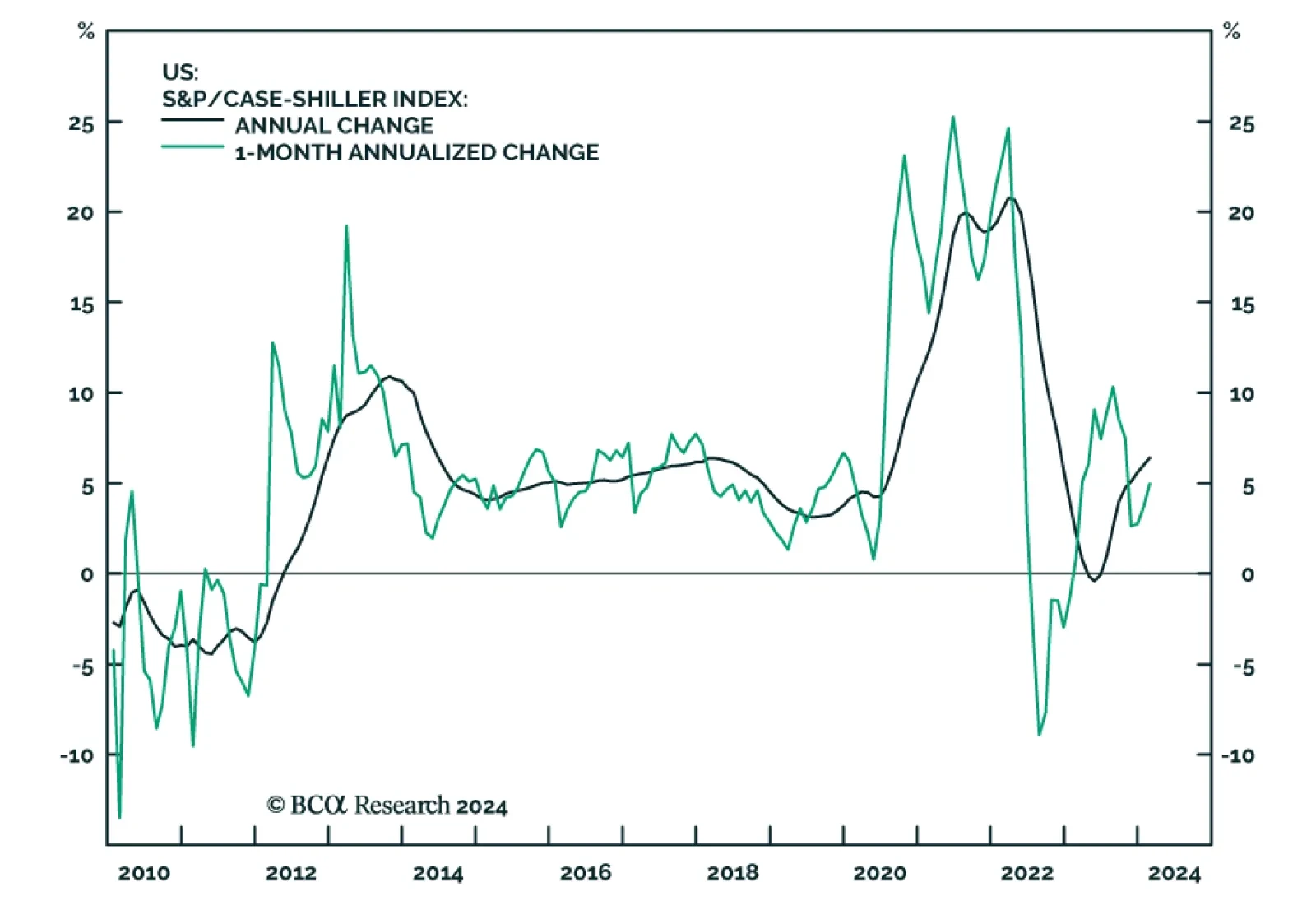

The house price index from the Federal Housing Finance Agency grew by 1.2% in February, improving from a decline of 0.1% previously, and above expectations of 0.1%. Meanwhile the S&P/Case-Shiller Home Price Index rose by 7.3…

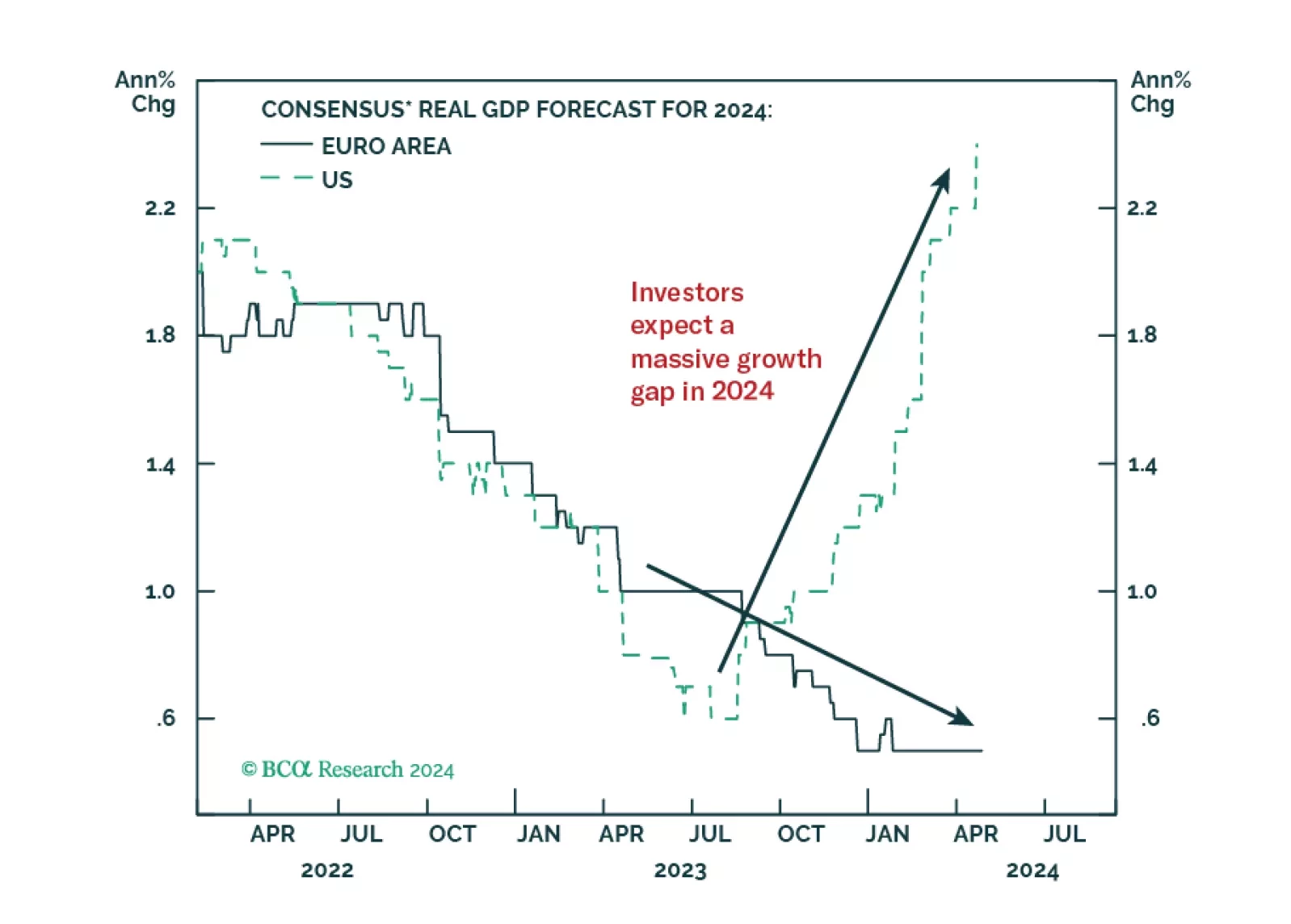

Investors anticipate a record growth gap between the US and the Eurozone in 2024. Does this skewed expectation create market opportunities?