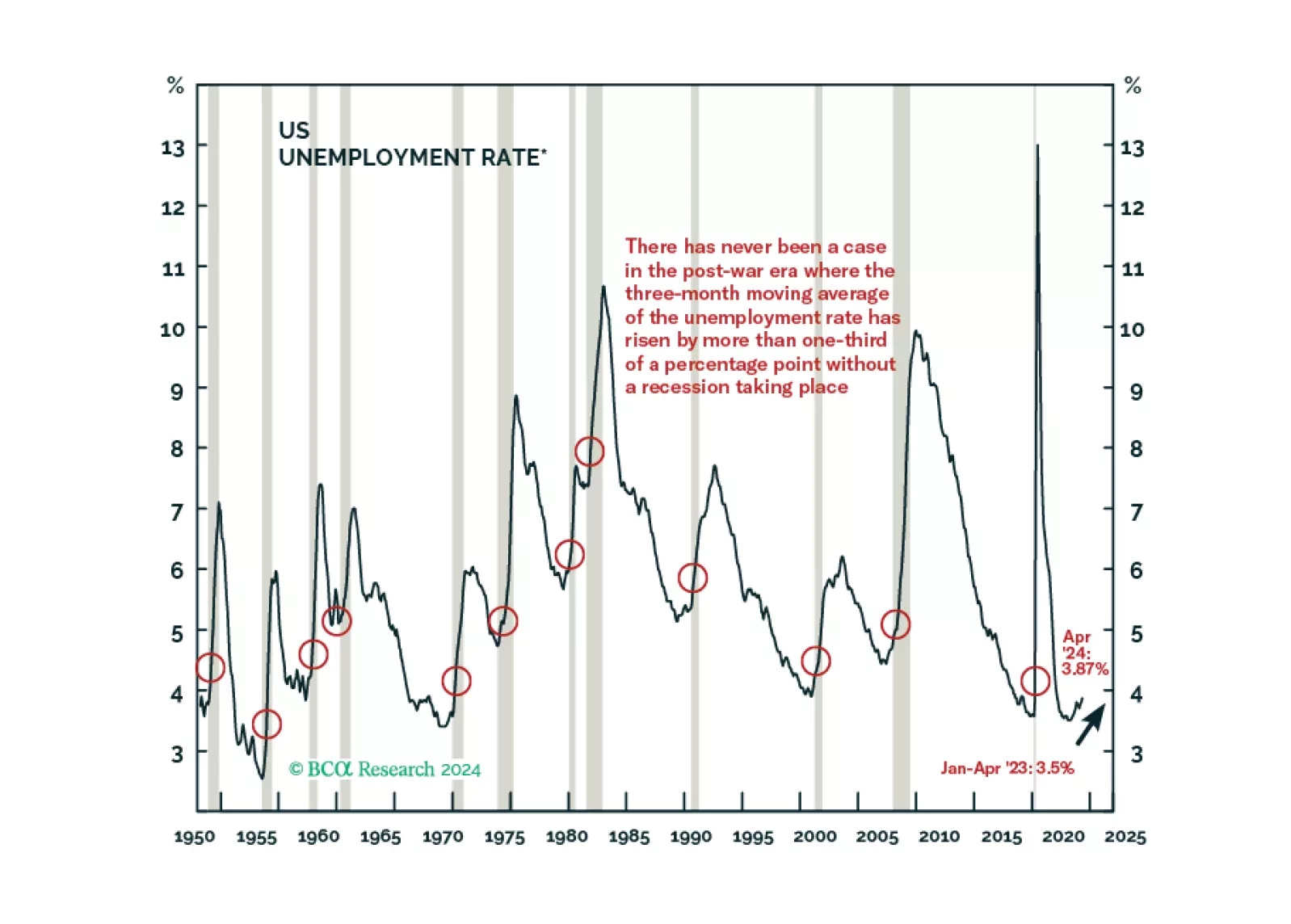

An adverse shock is not a recession prerequisite. The empirical record shows that the US economy regularly evolves its way into a contraction with little fanfare. If current cooling trends continue, we project a recession will…

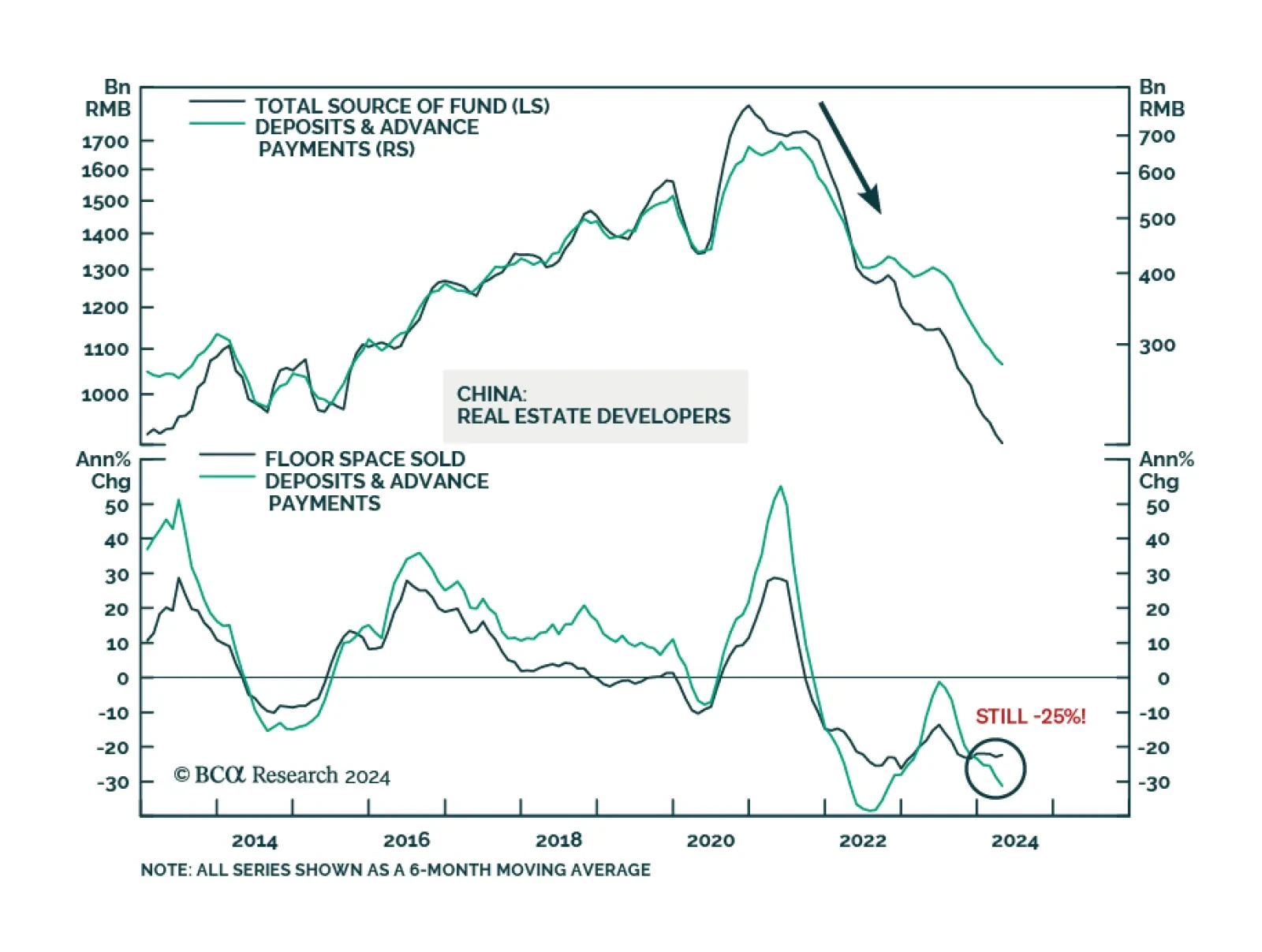

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

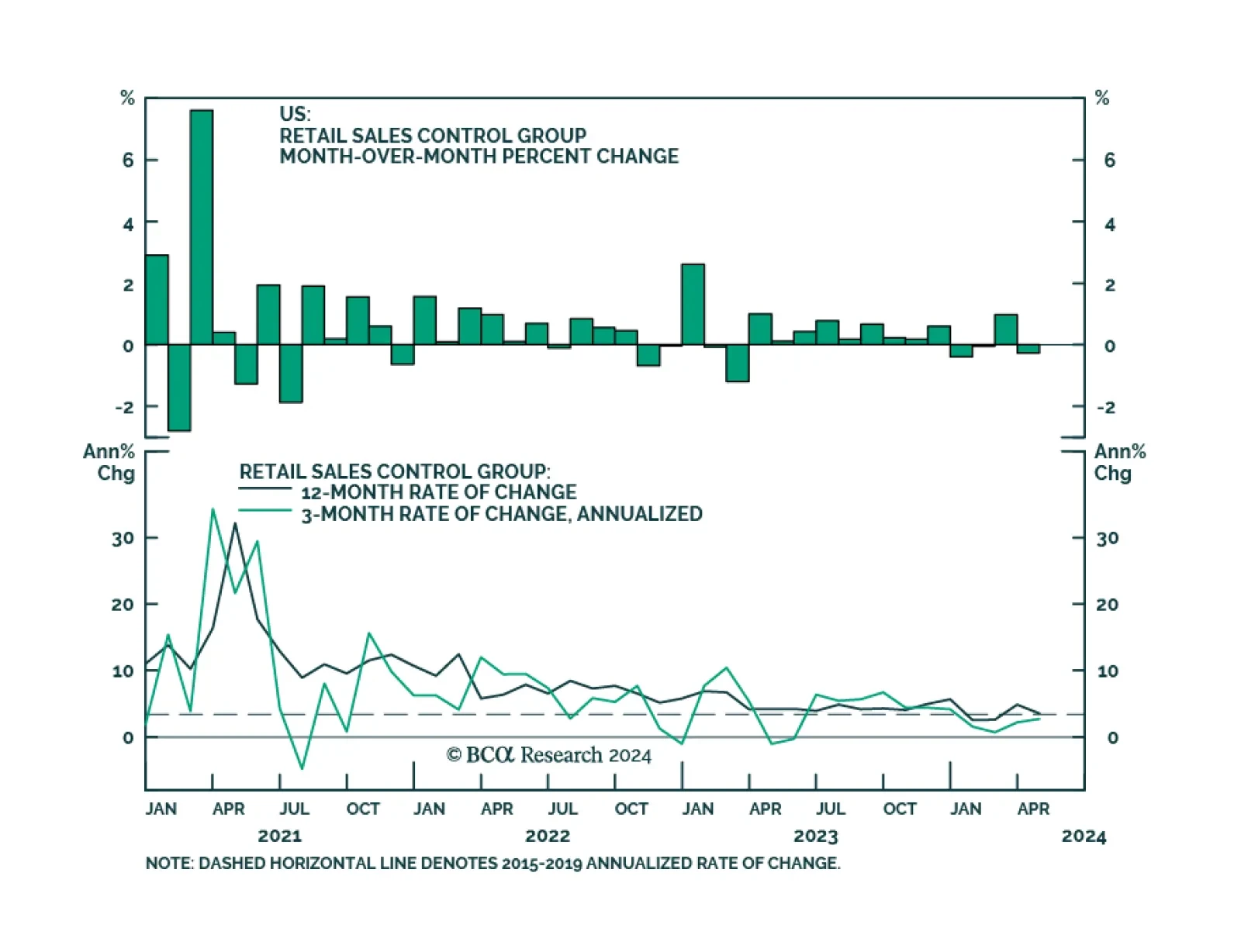

US retail sales remained unchanged in April, a downside surprise from expectations of 0.4% m/m growth. Notably, the retail sales control group (an input to GDP) declined by 0.3% m/m despite expectations of mild growth and all of…

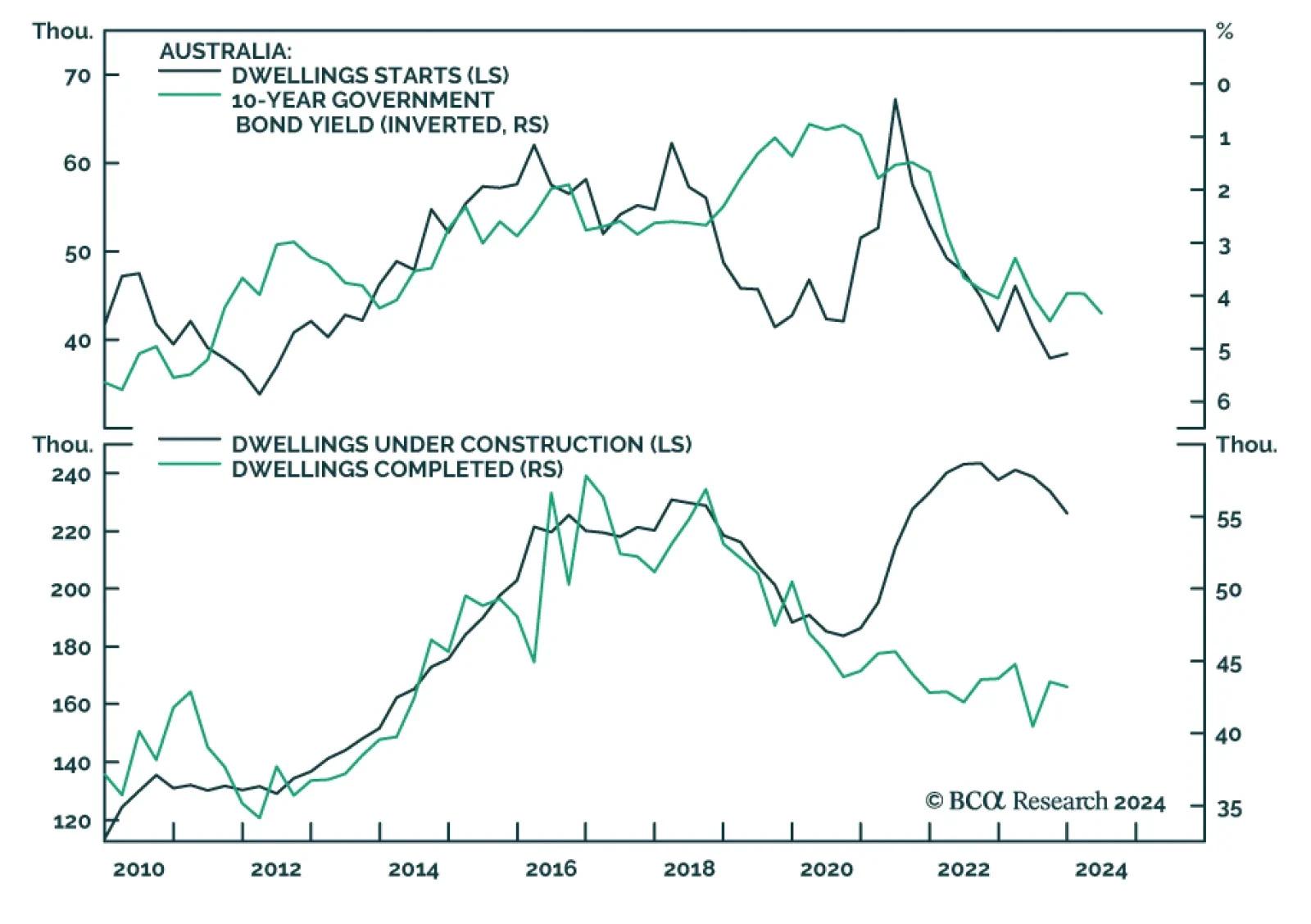

Despite historically high interest rates and the fact that variable-rate mortgage issuances dominate the mortgage market landscape, Australian home prices continue to climb at a close to double-digit annual rate. The Core Logic…

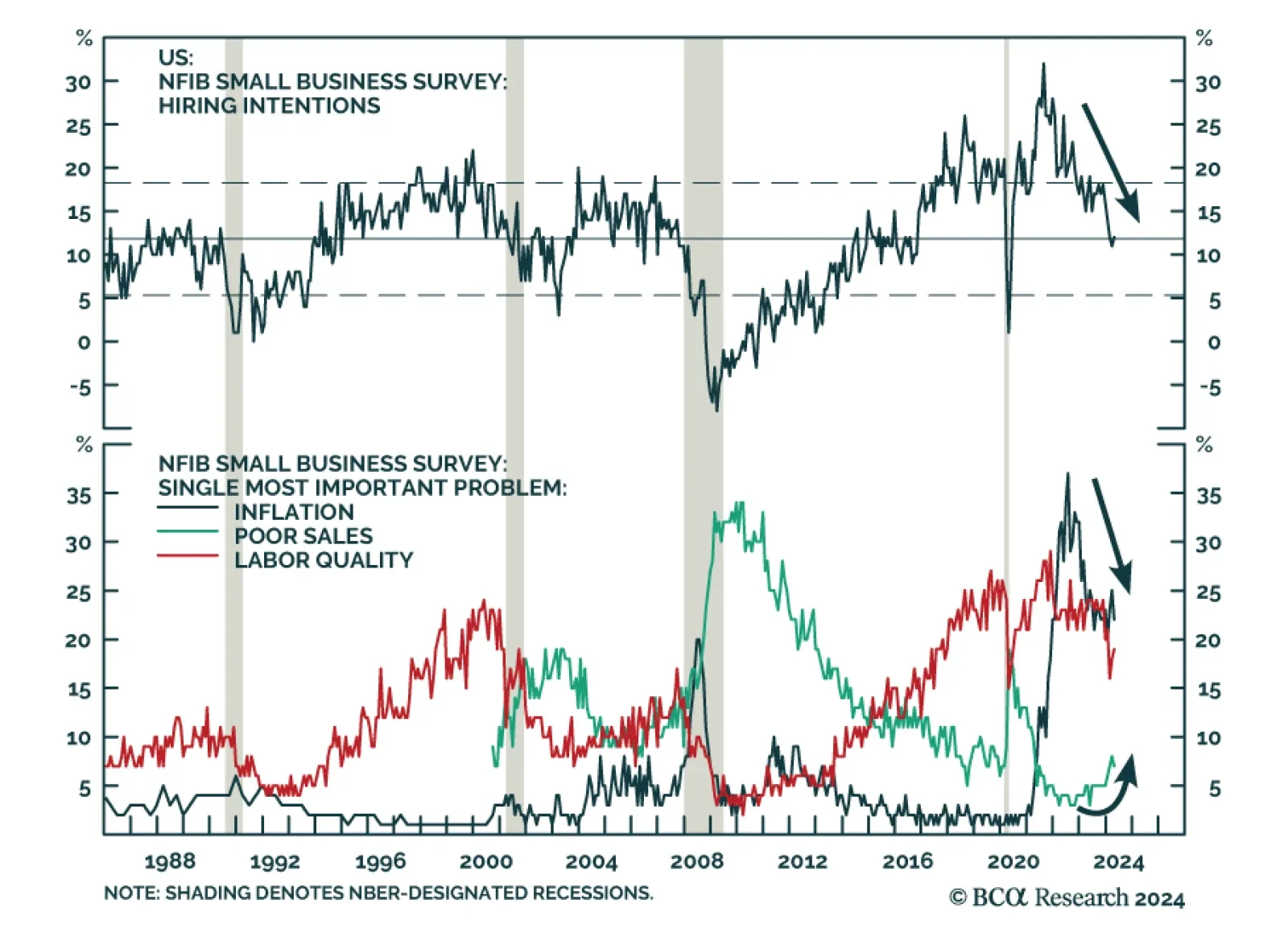

On the surface, the Tuesday release of the NFIB Small Business Survey indicated resilience among small businesses. The headline index appreciated to 89.7 from 88.5, upending expectations of a moderation to 88.2. However,…

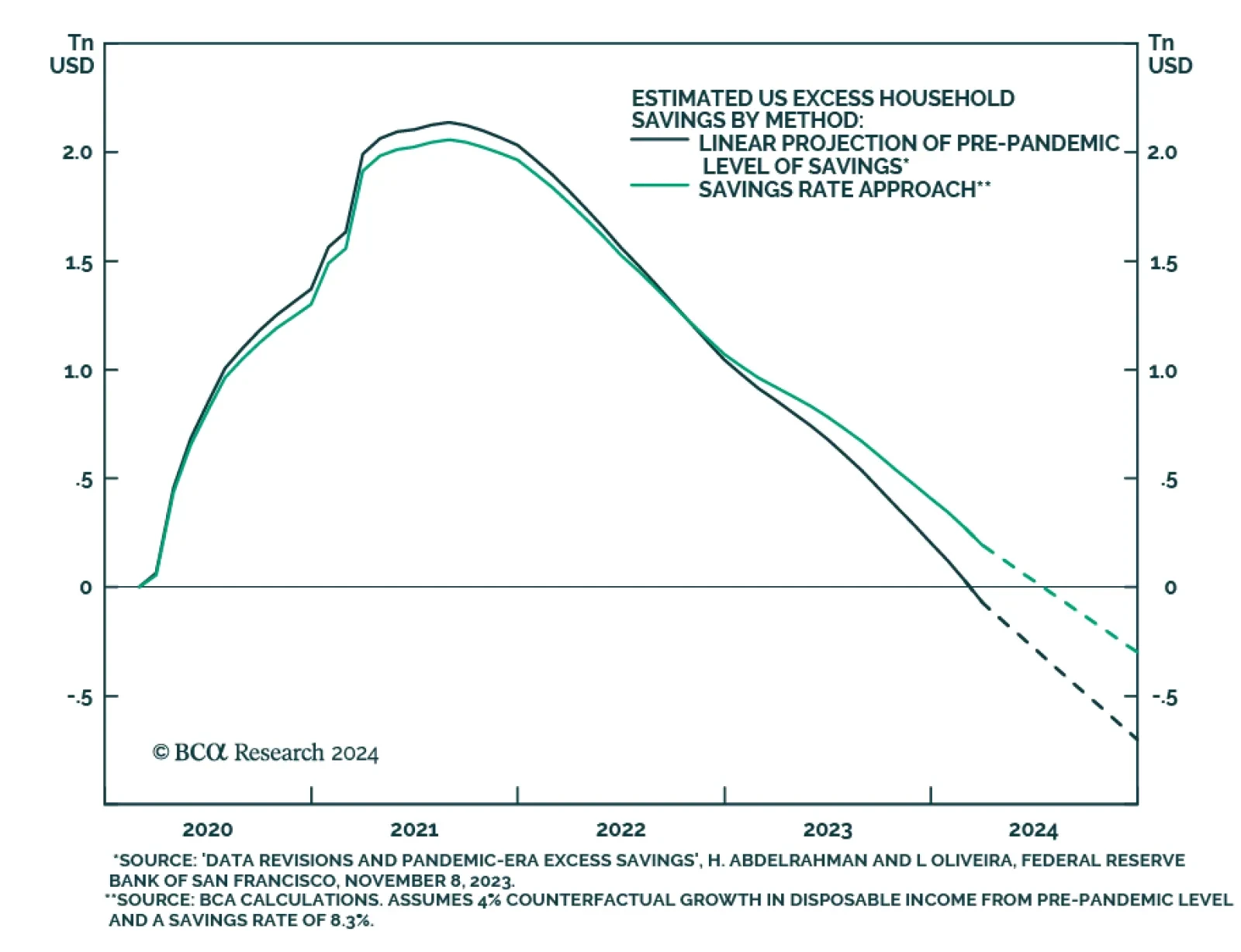

Emergency pandemic policies elongated the lag between Fed rate hikes and an observable slowdown in the economy. Notably, fiscal transfers and constrained consumption options endowed households with more than $2 trillion of…

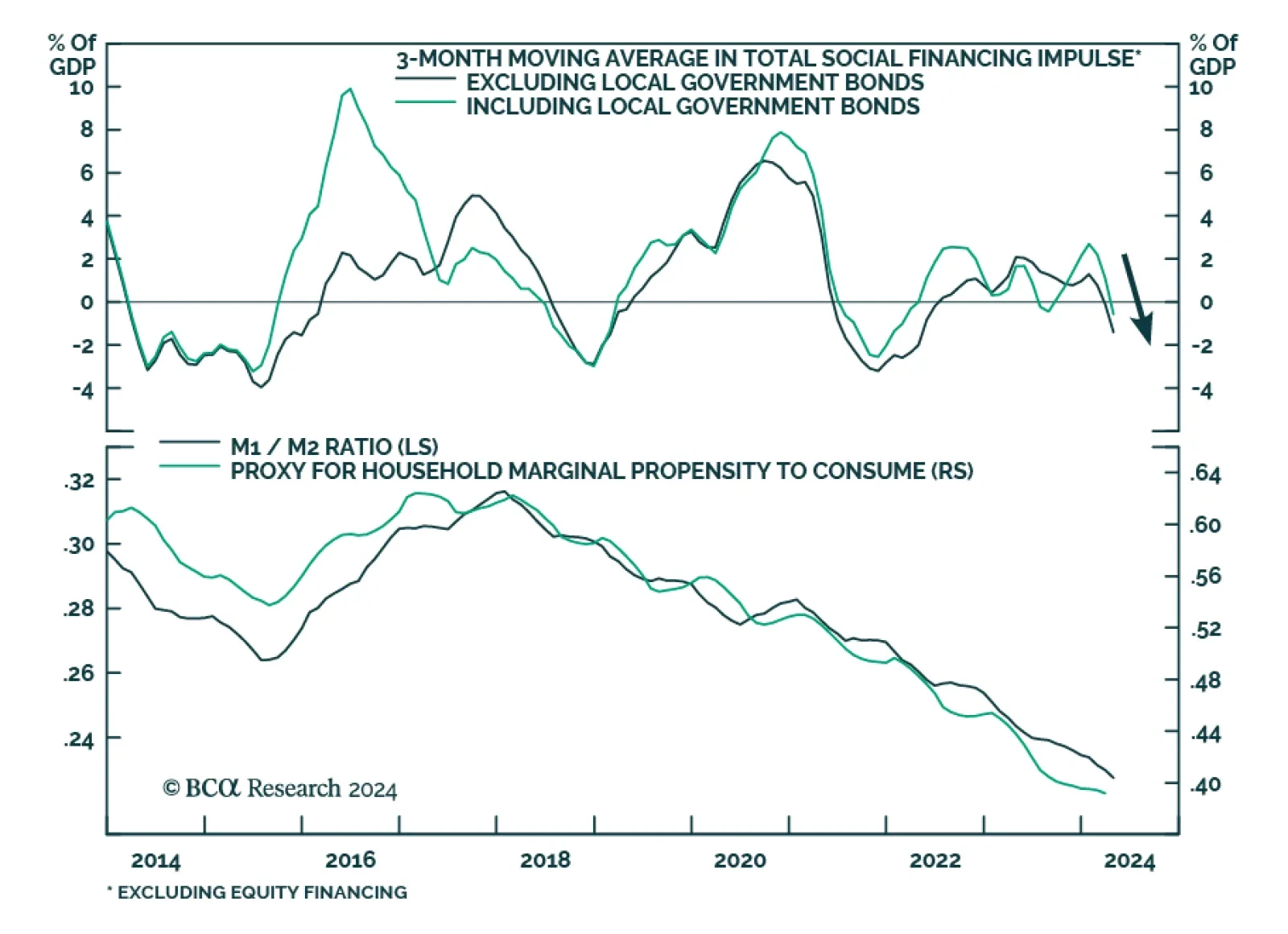

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…

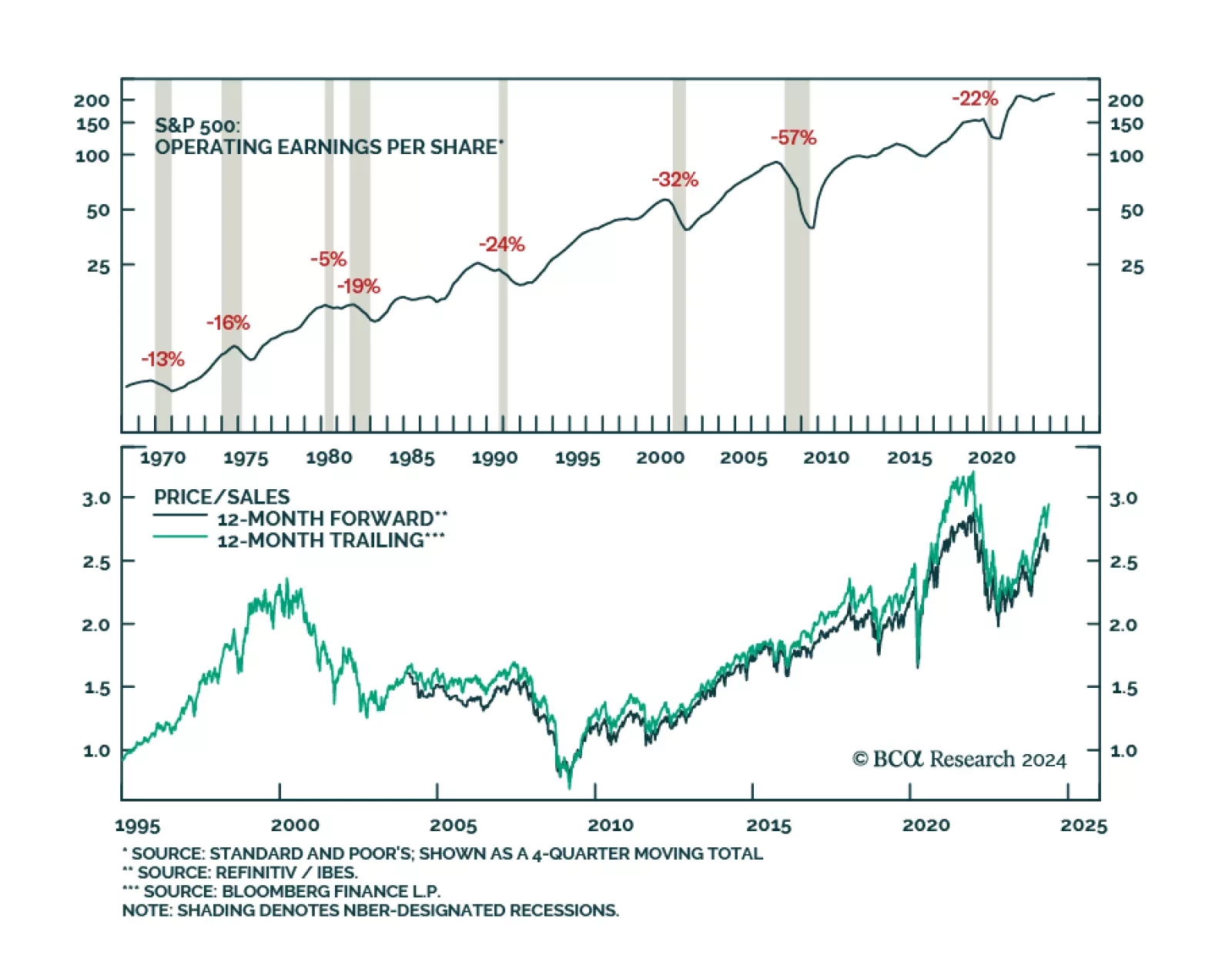

We marked the first X on our Equity Downgrade Checklist and the latest JOLTS, Employment Situation and SLOOS releases brought us closer to ticking some others. We remain tactically neutral on equities but expect that we will…

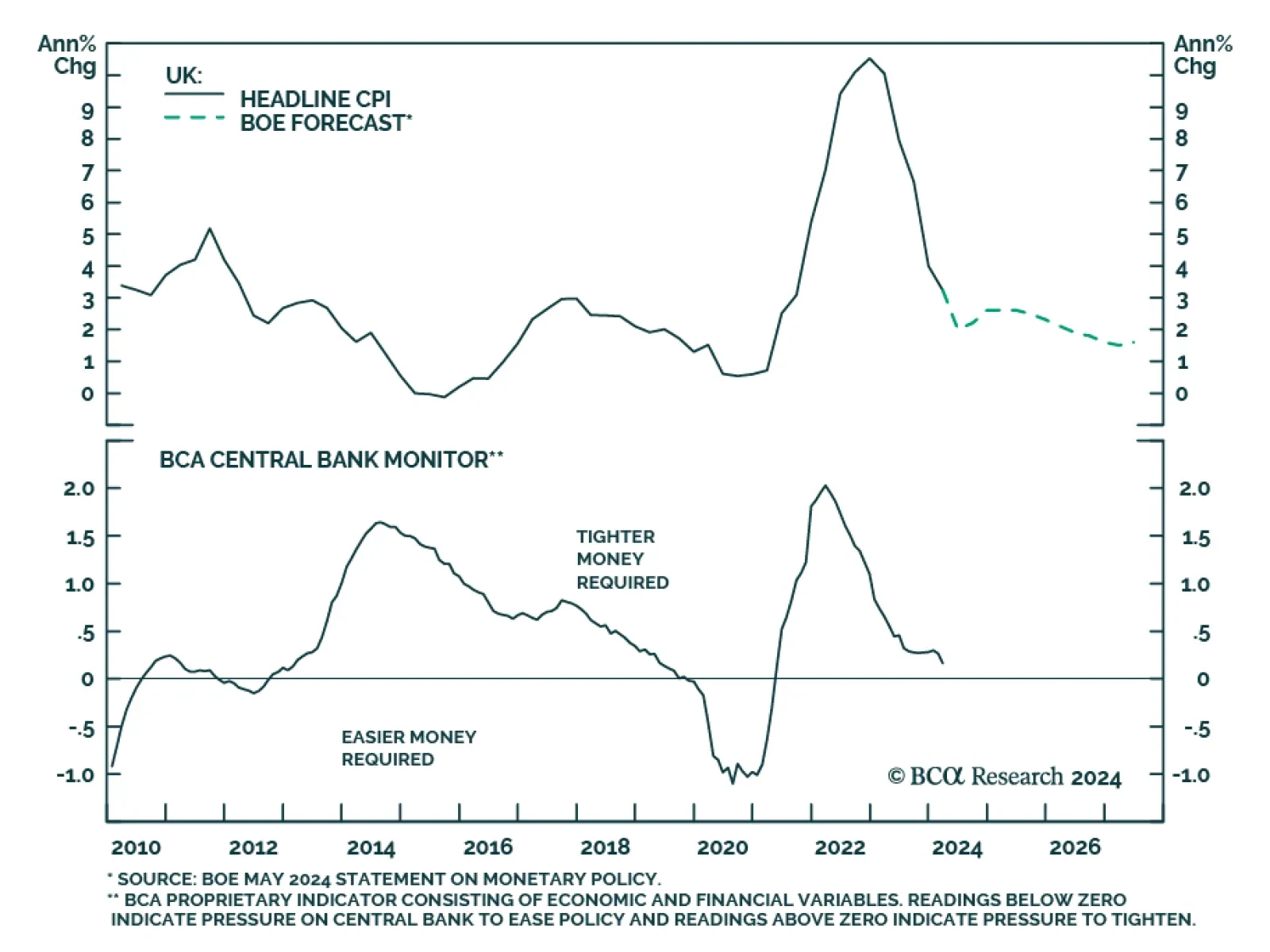

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…