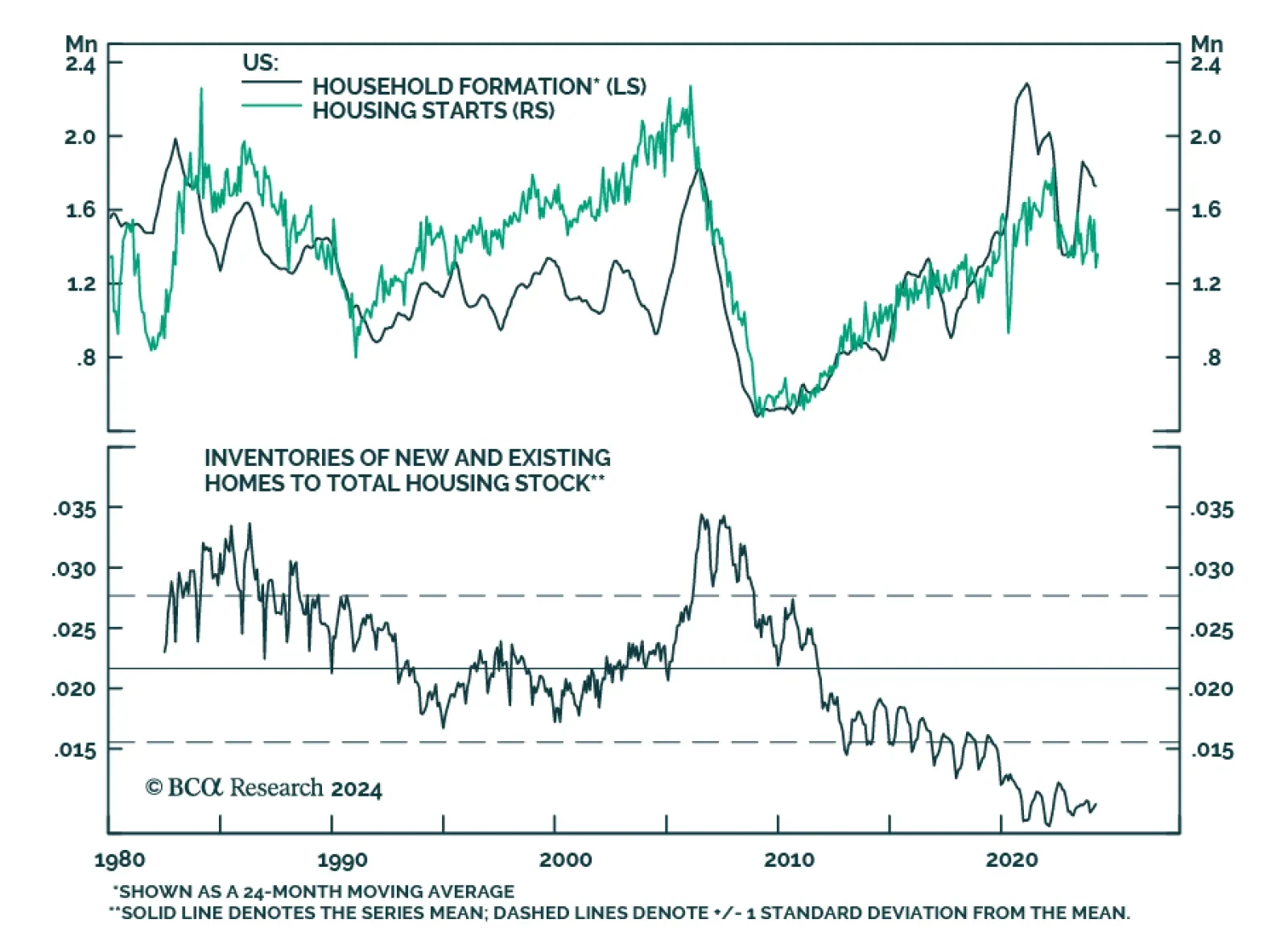

Recent US housing market data has been uninspiring. The FHFA house price index decelerated in March from 1.2% m/m to 0.1% m/m, disappointing expectations of 0.5% m/m, and the S&P CoreLogic 20-City index growth rate…

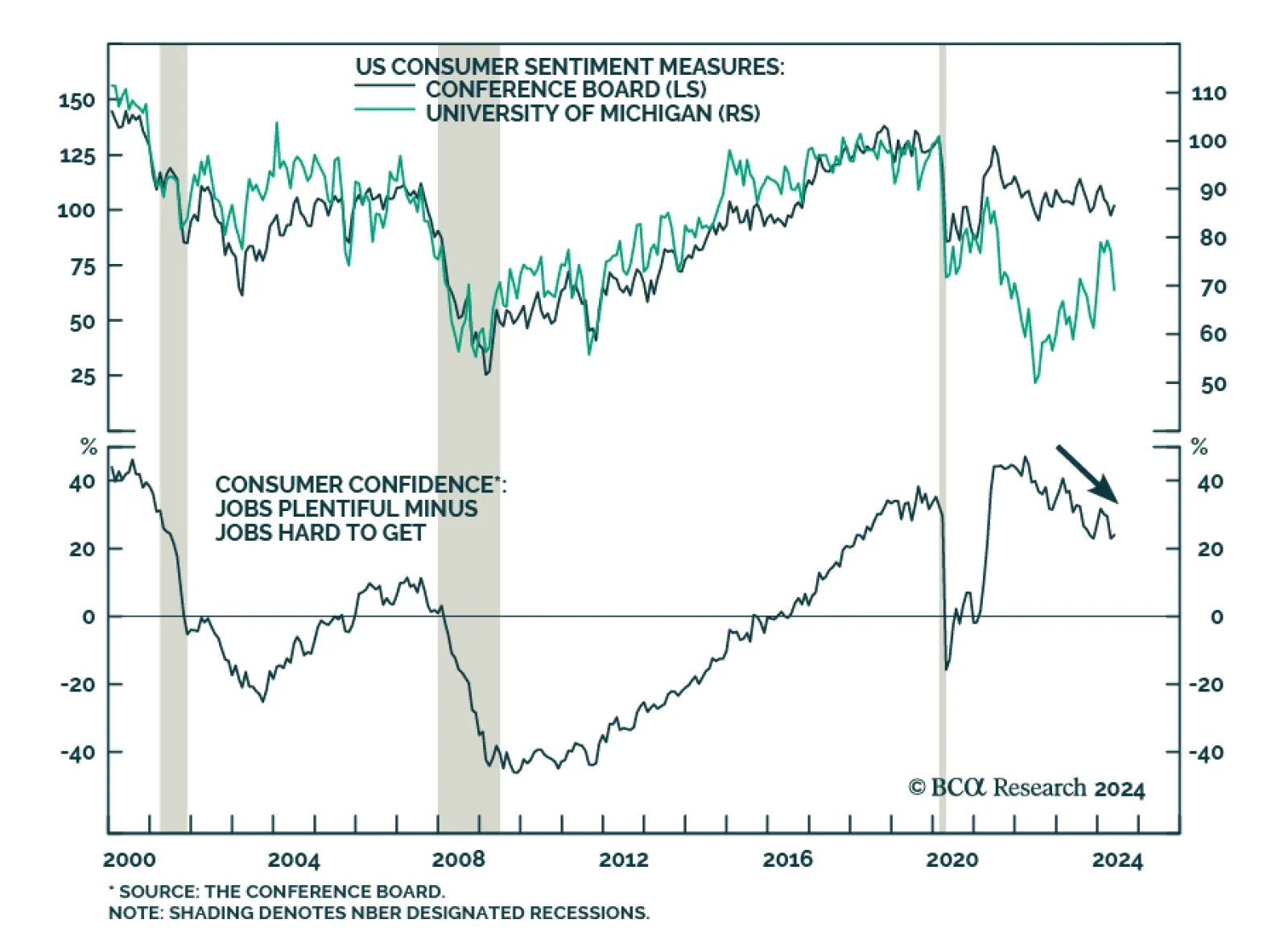

The Conference Board’s measure of consumer confidence surprised to the upside on Tuesday. The headline index improved to 102 from 97.5, upending expectations of a continued moderation to 96. The rebound follows 3…

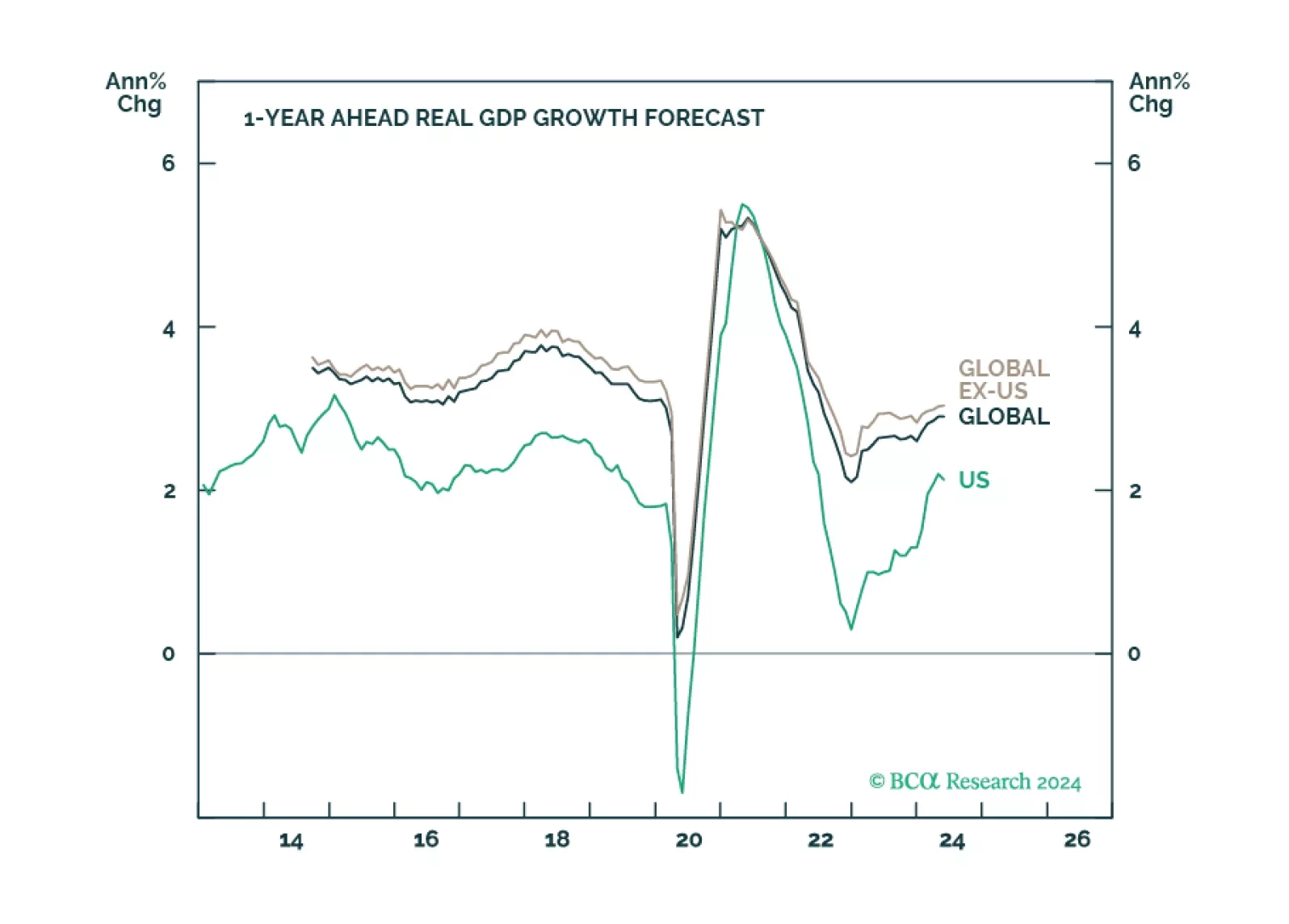

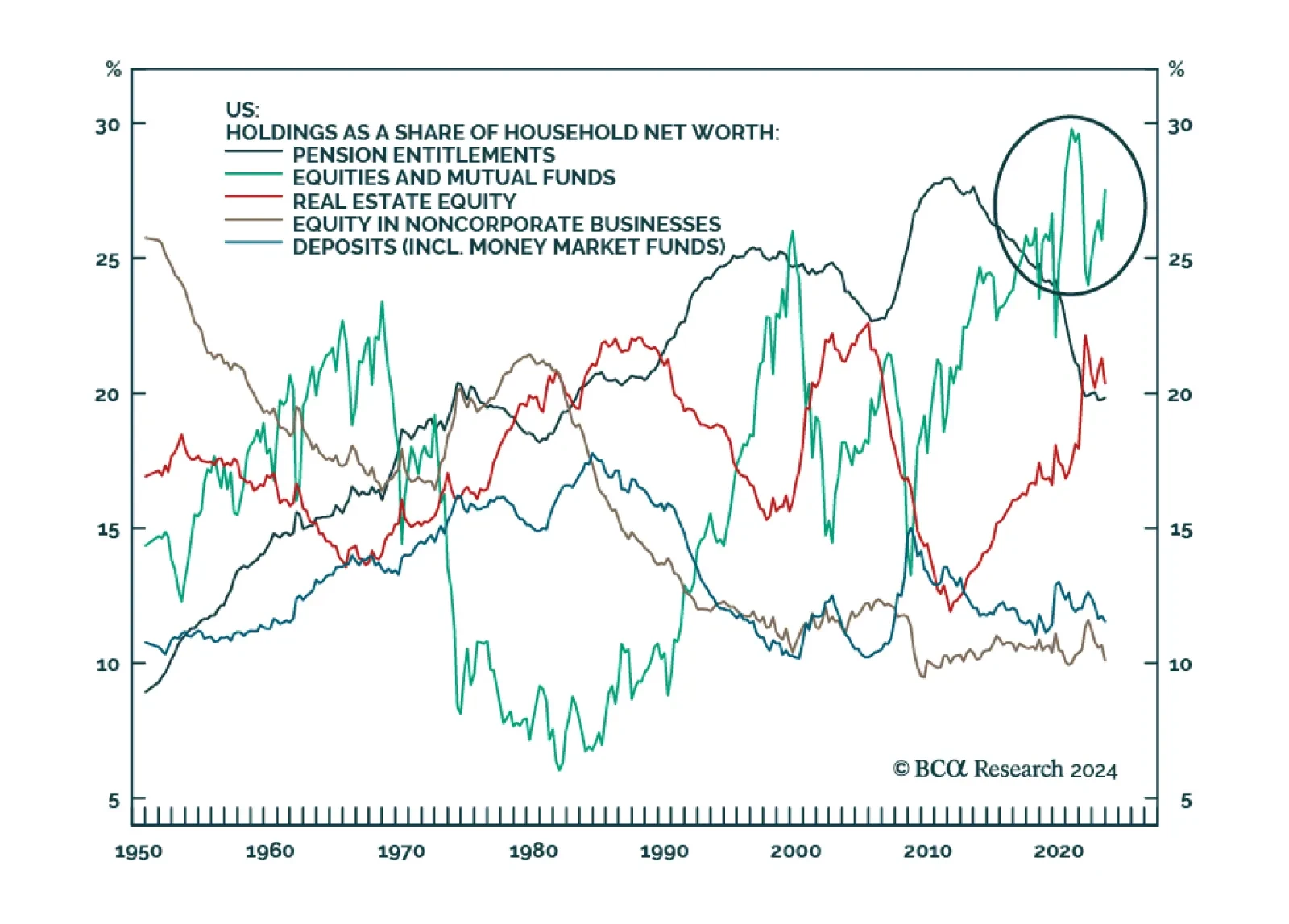

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

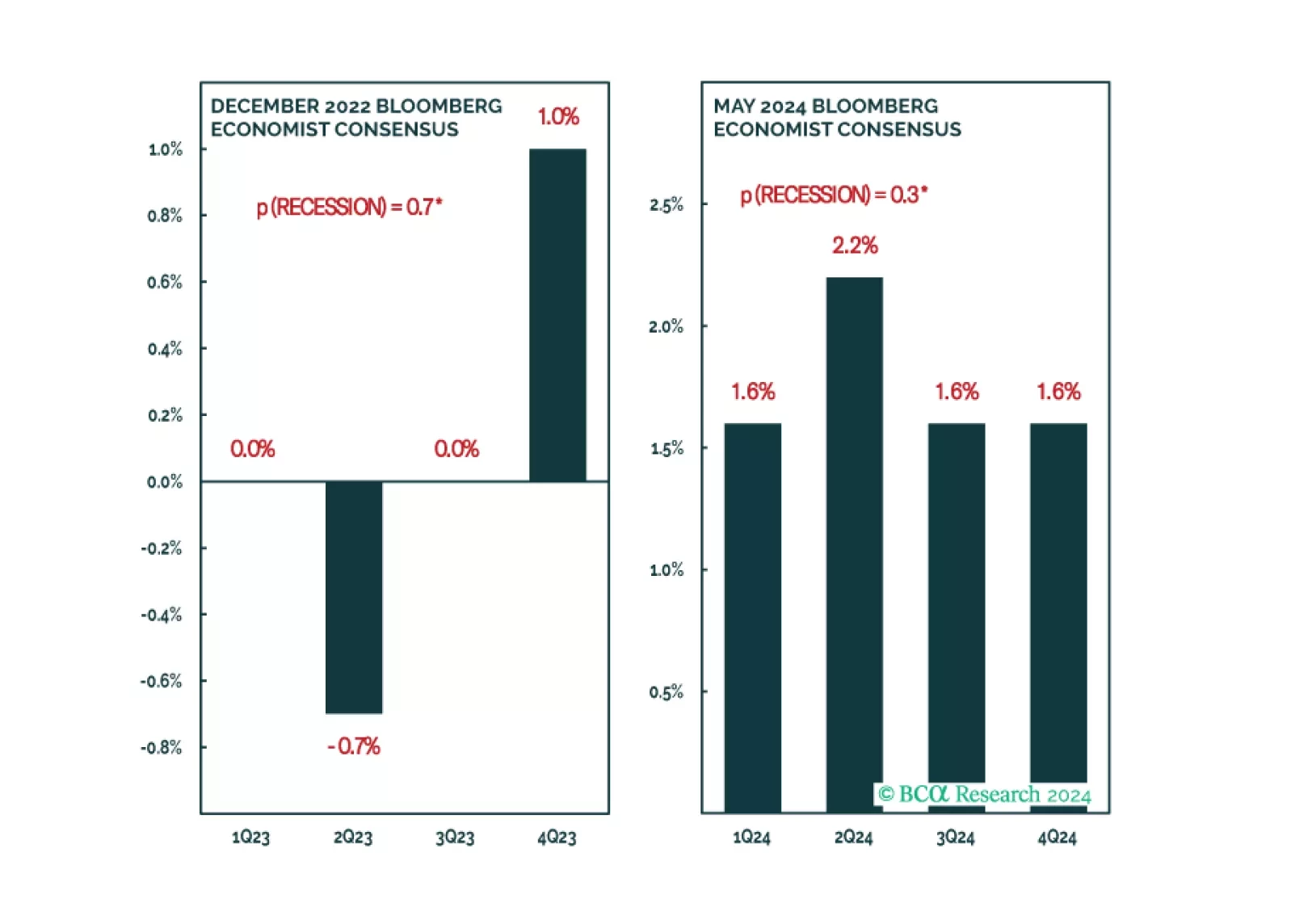

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…

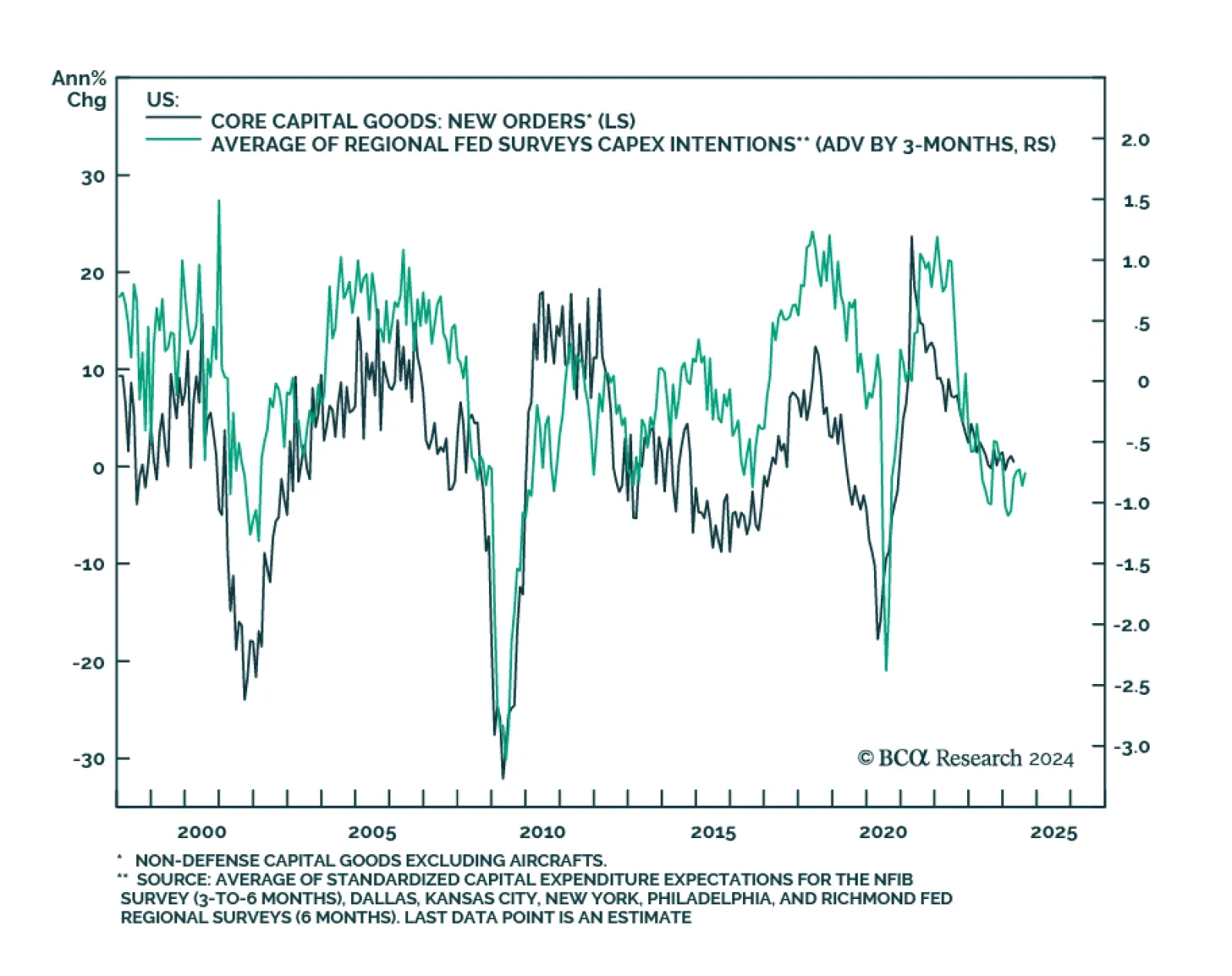

US durable goods orders surprised to the upside in April, growing 0.7% m/m against expectations they would decline. The March growth rate was nevertheless revised significantly lower, from 2.6% m/m to 0.8% m/m. Core capital…

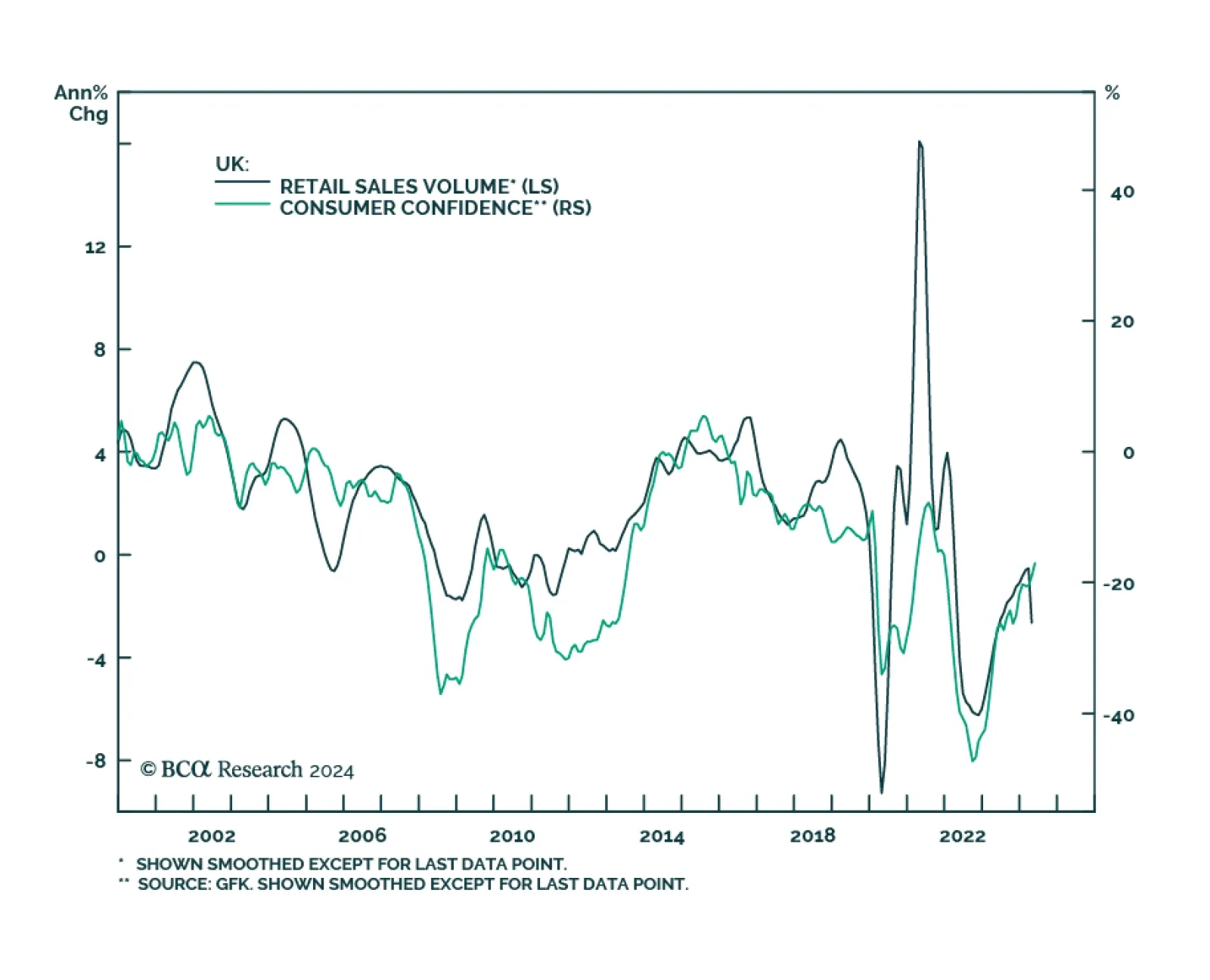

UK retail sales plunged 2.3% m/m in April from a downwardly revised 0.2% m/m contraction in March, significantly undershooting expectations of a 0.5% m/m decline. Household goods as well as clothing and footwear stores led the…

We do not subscribe to the Goldilocks scenario in which price pressures continue to ease while economic growth remains robust. We expect that softening labor demand will eventually hinder consumption as wage and payrolls growth…

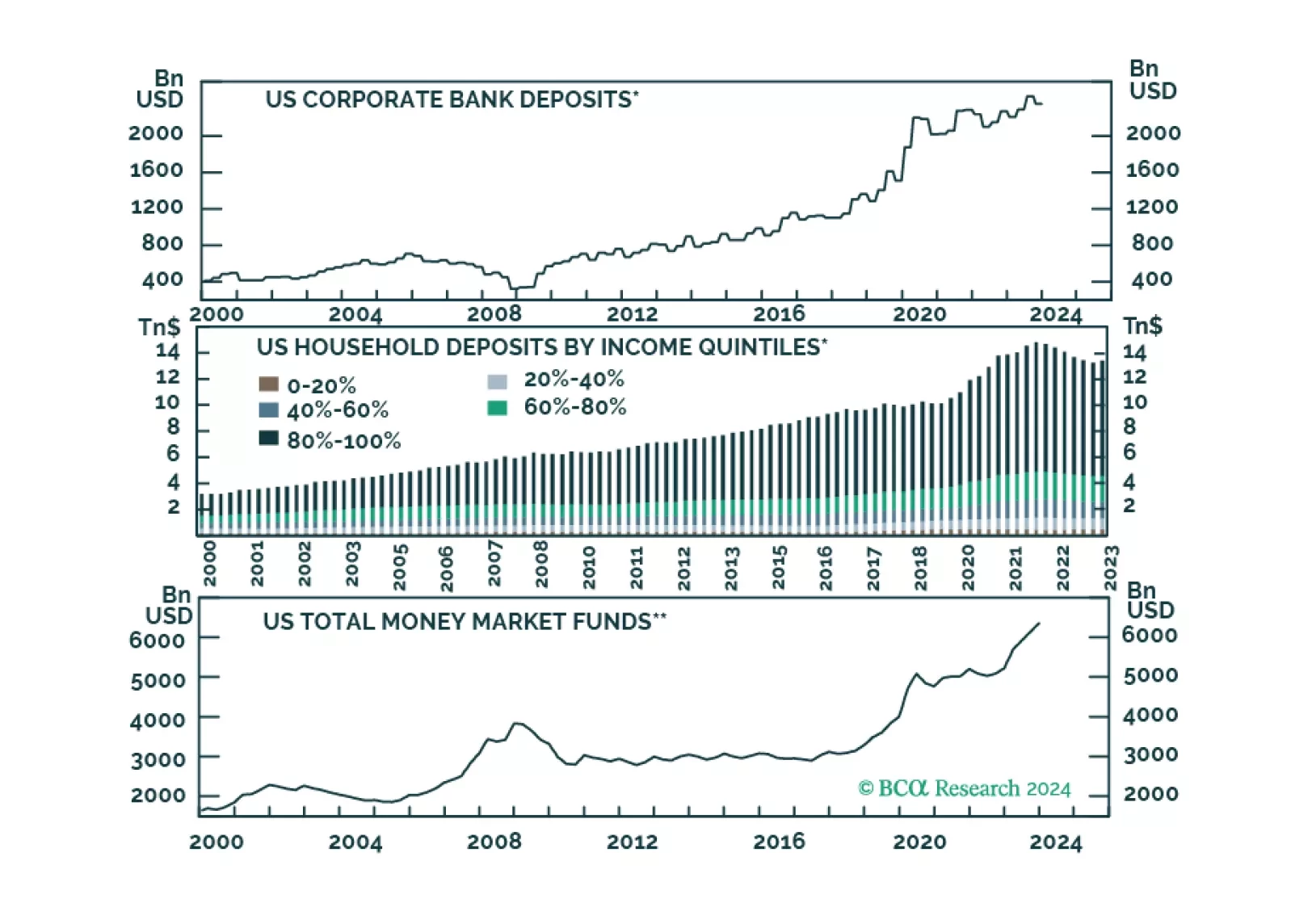

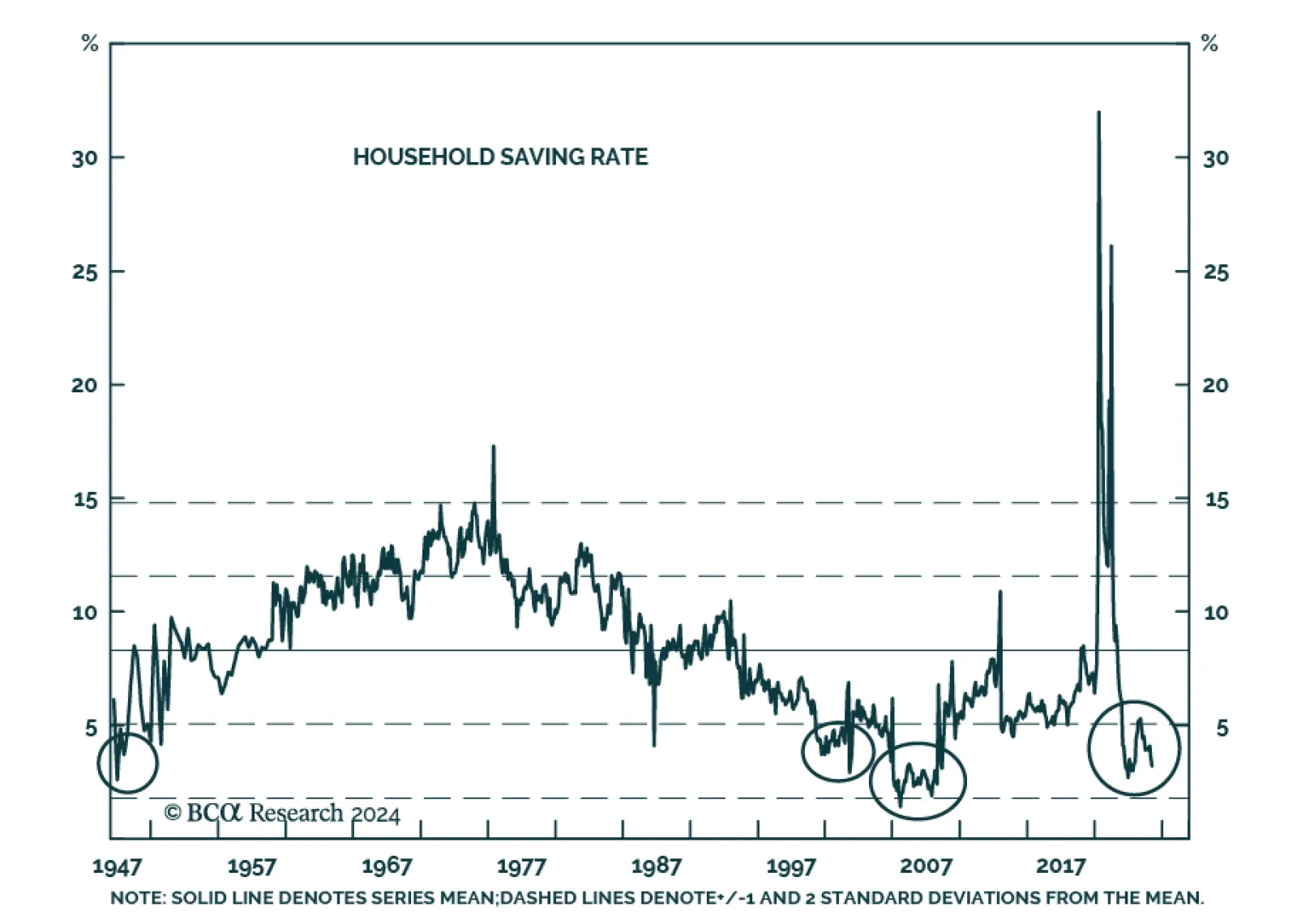

Our US Investment strategists have used the savings rate as a proxy for households’ willingness to spend. Its persistent decline suggests that consumers have been spending their pandemic-era excess savings and our…

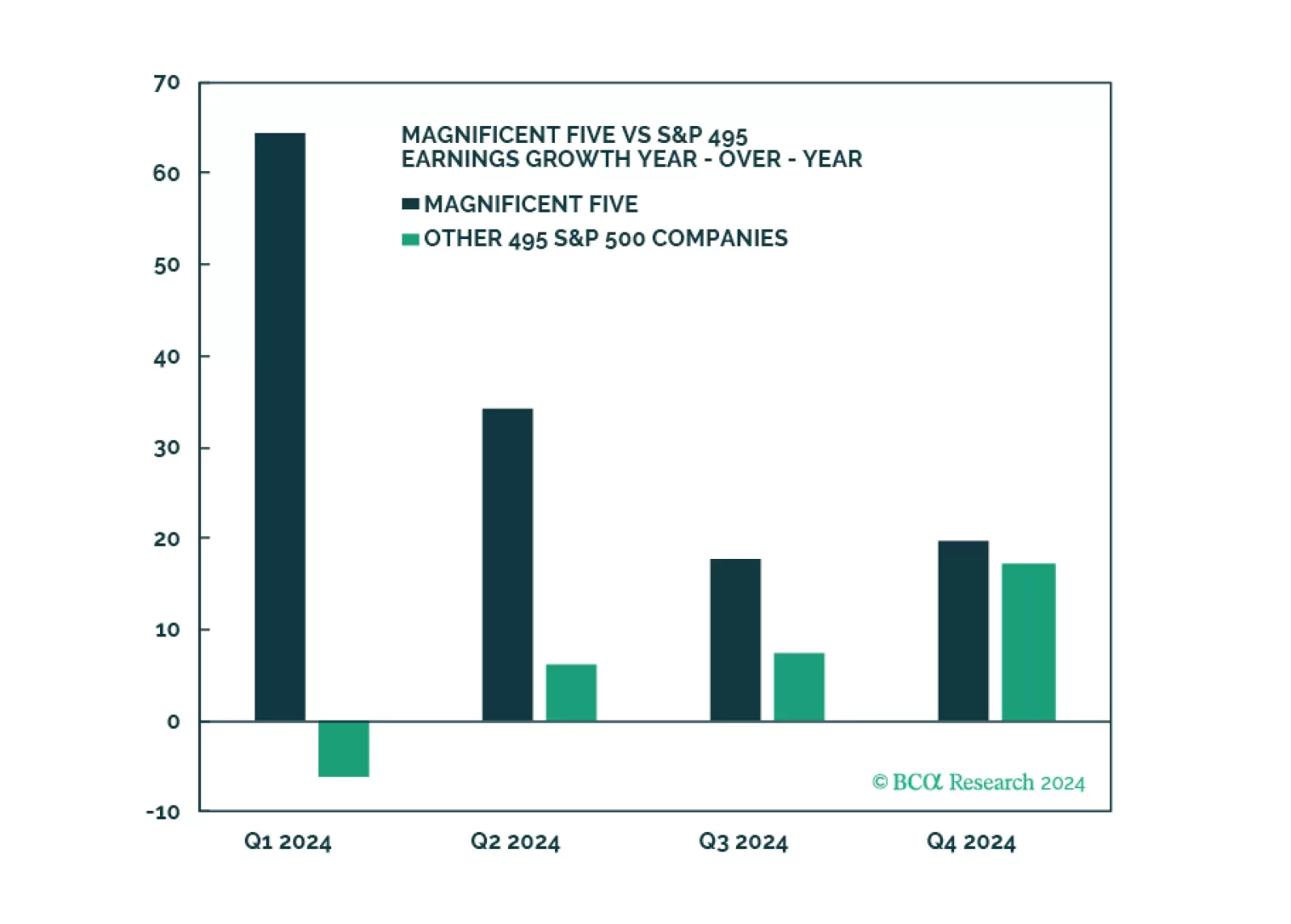

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…