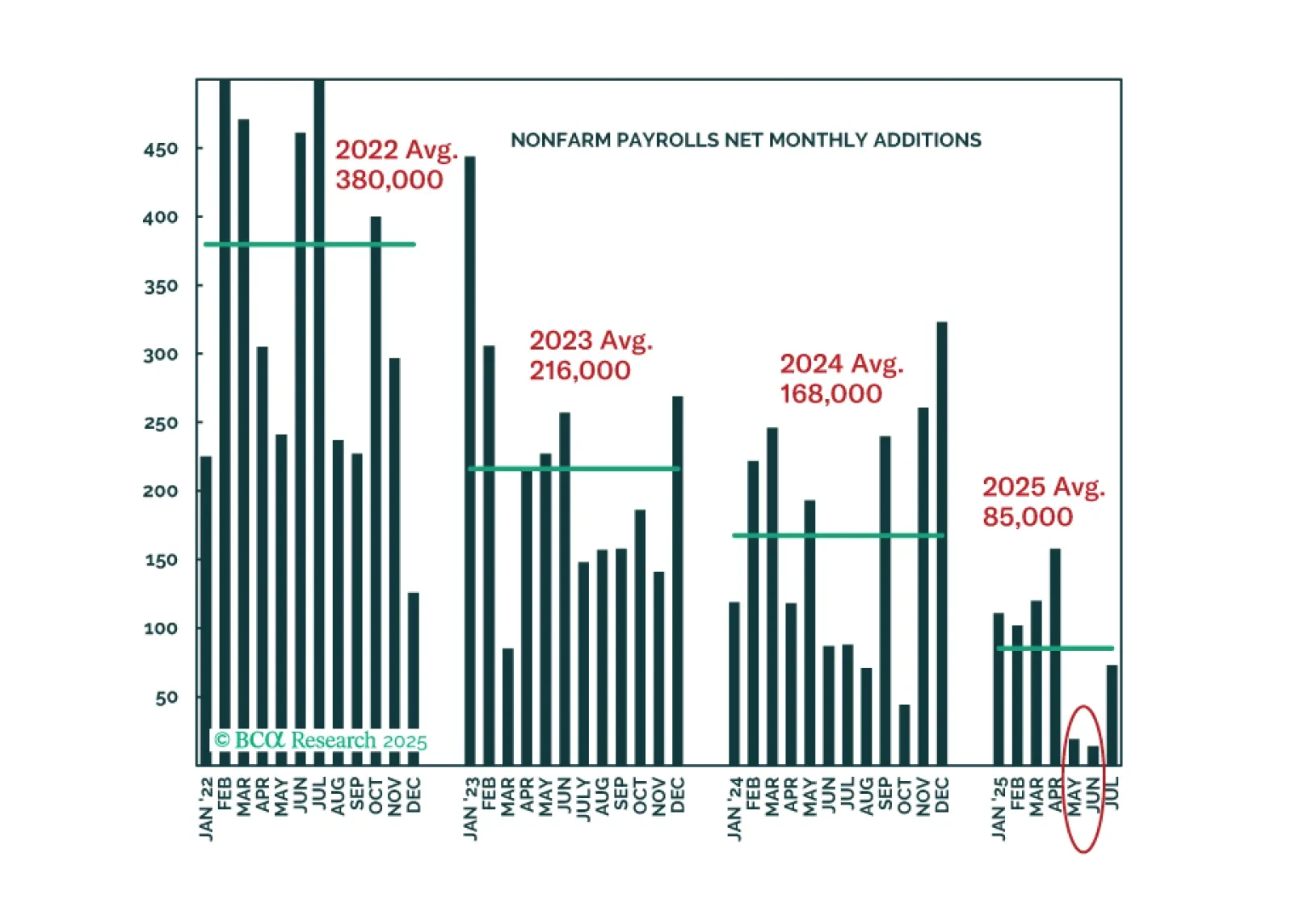

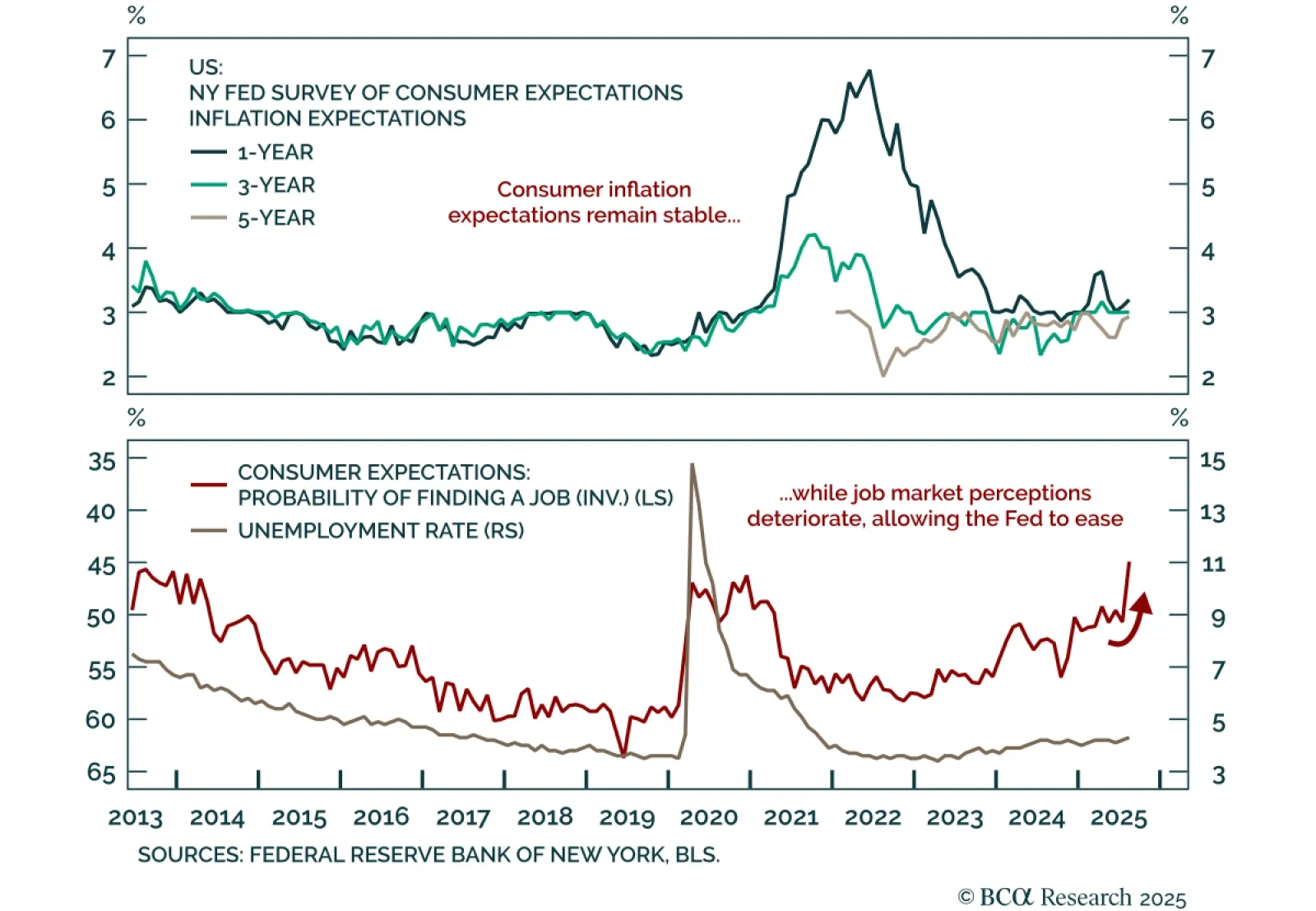

Stable long-term inflation expectations and weak labor perceptions support a defensive stance. The NY Fed Survey of Consumer Expectations showed 1-year inflation expectations ticking up to 3.2% in August, while the 3-year (3.0…

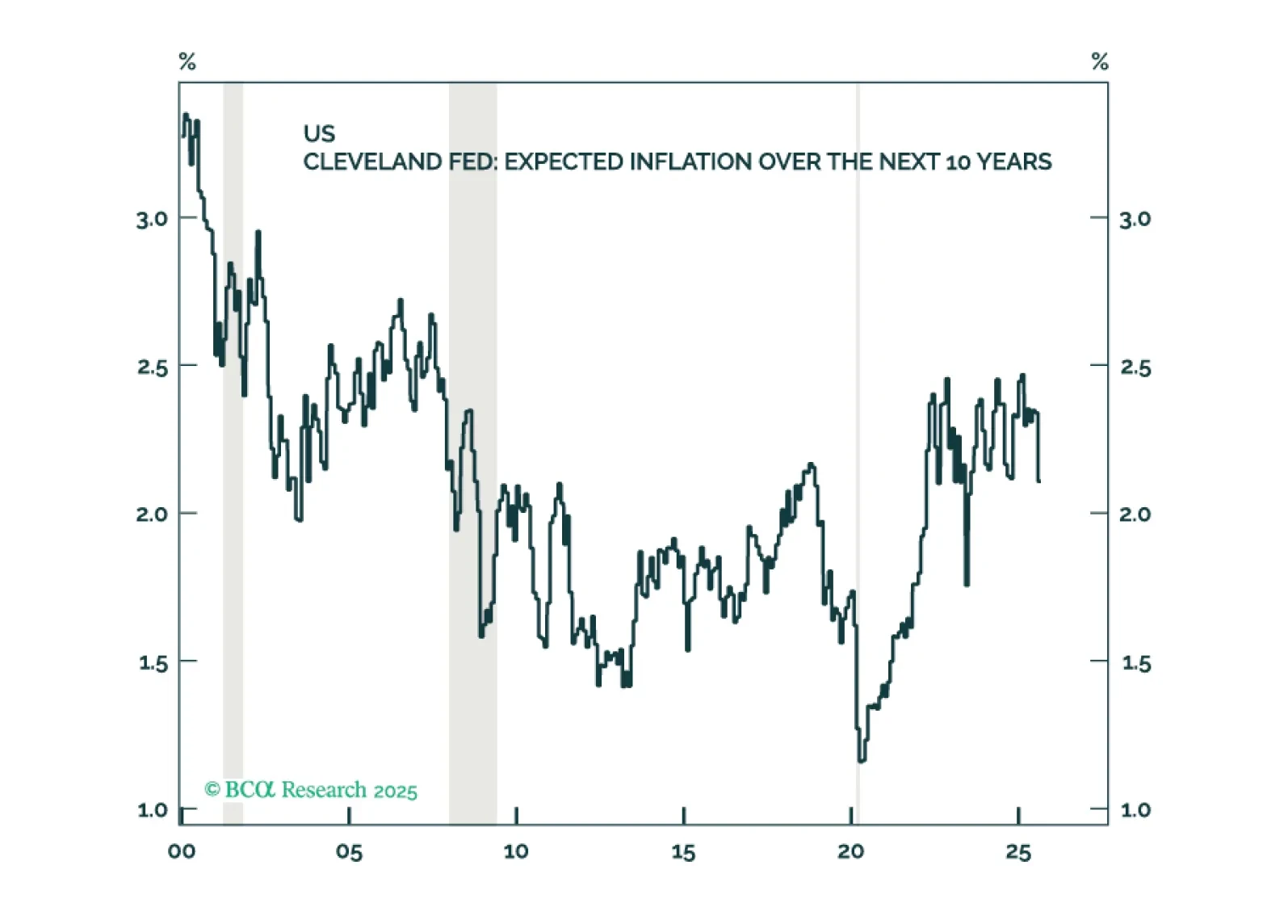

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

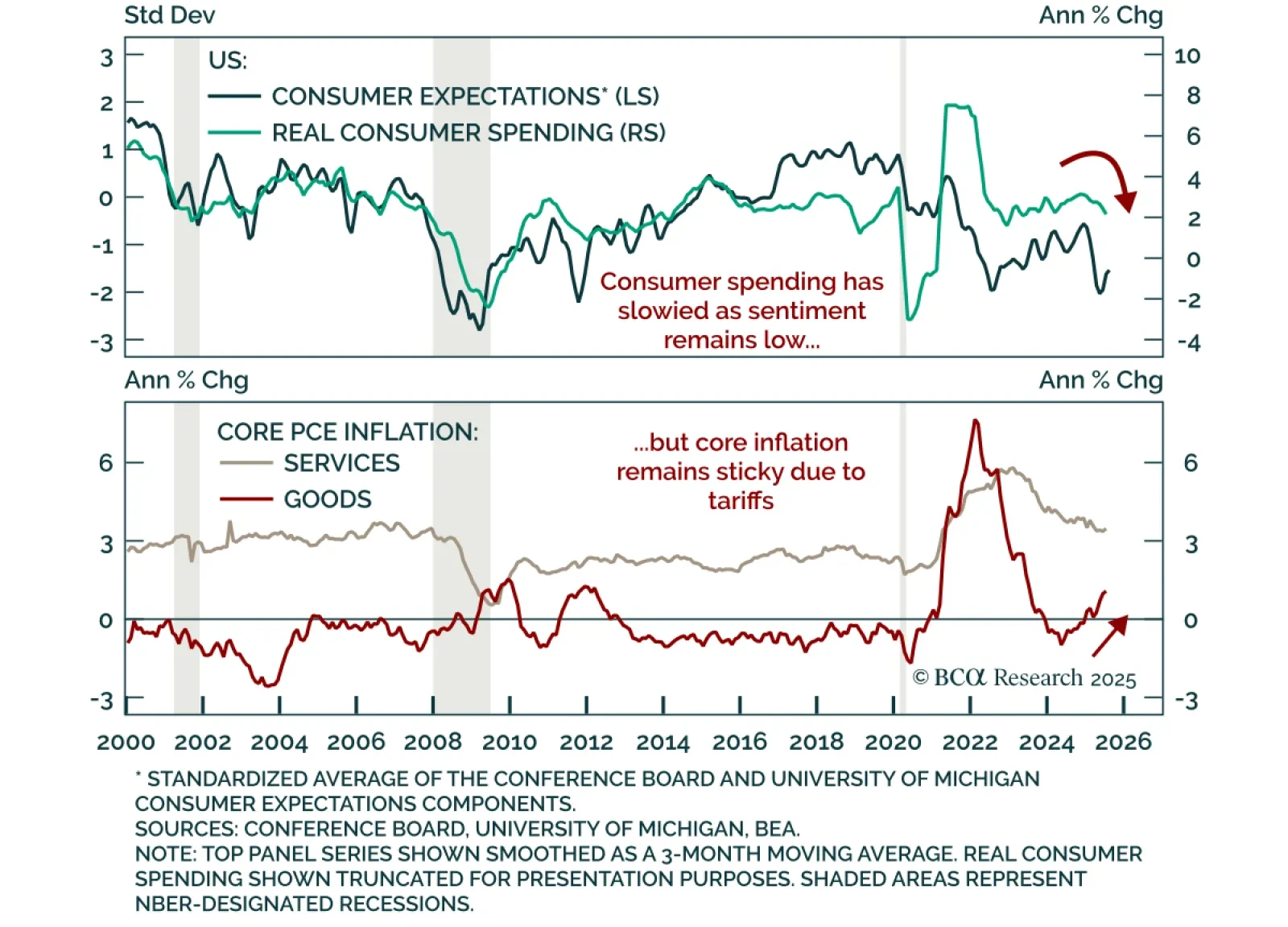

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

In Section I, Doug notes that a negative stance toward stocks will require a meaningful and imminent deterioration in the US macro data given the ongoing impact of AI optimism on the global equity market. In Section II, Chester…

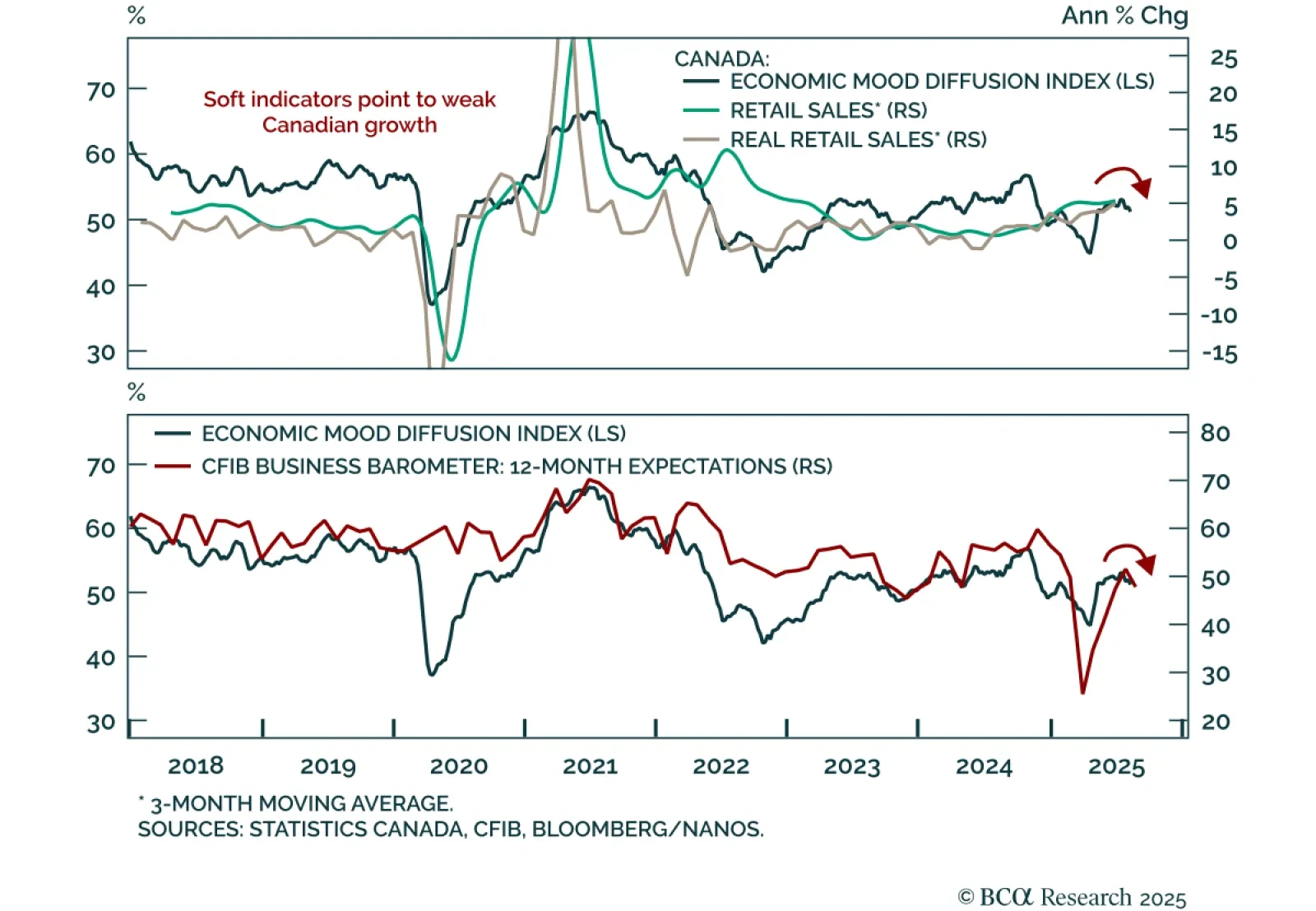

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

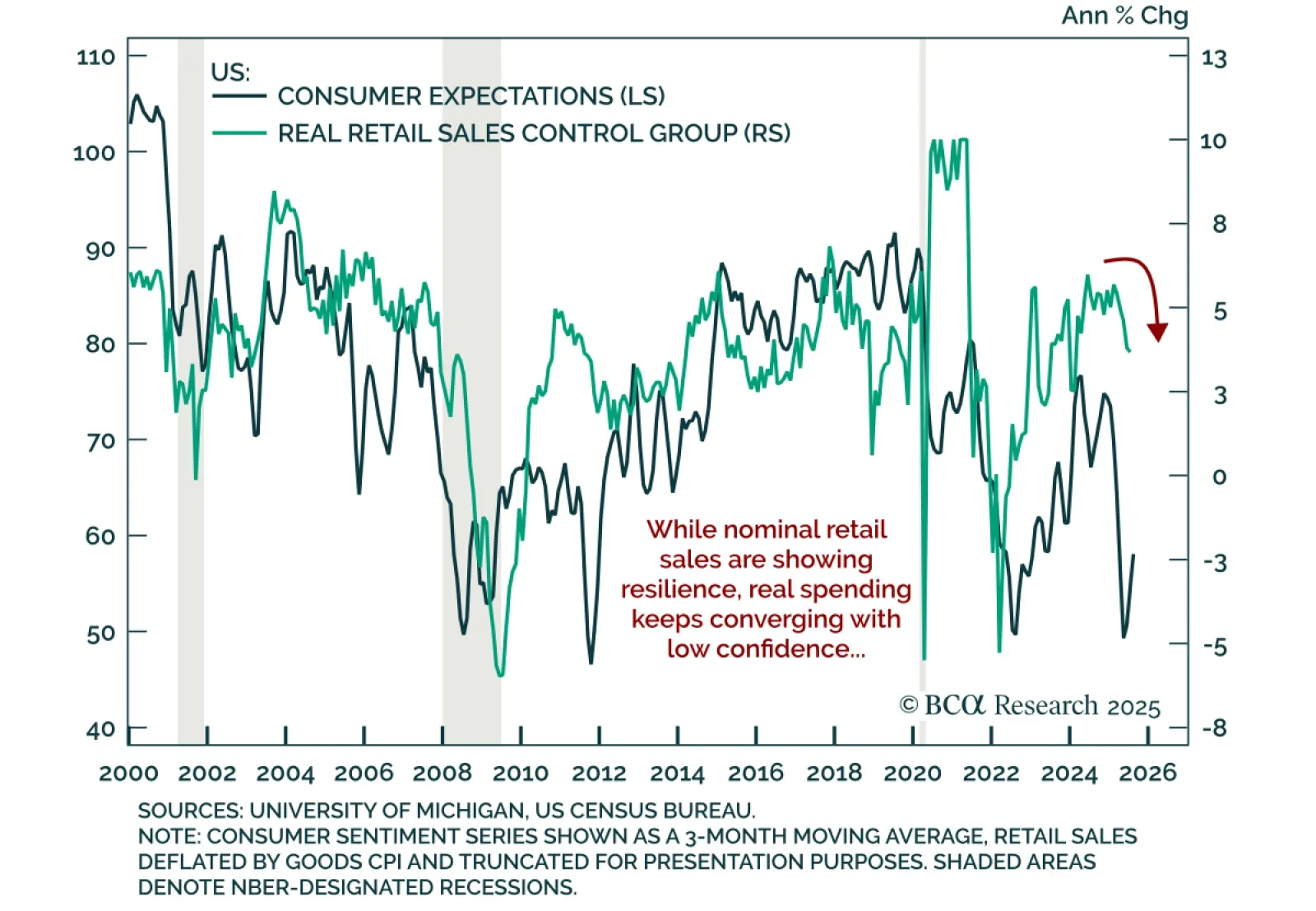

Retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales rose 0.5% m/m in July, below estimates and decelerating from 0.9% in June. The control group beat estimates…

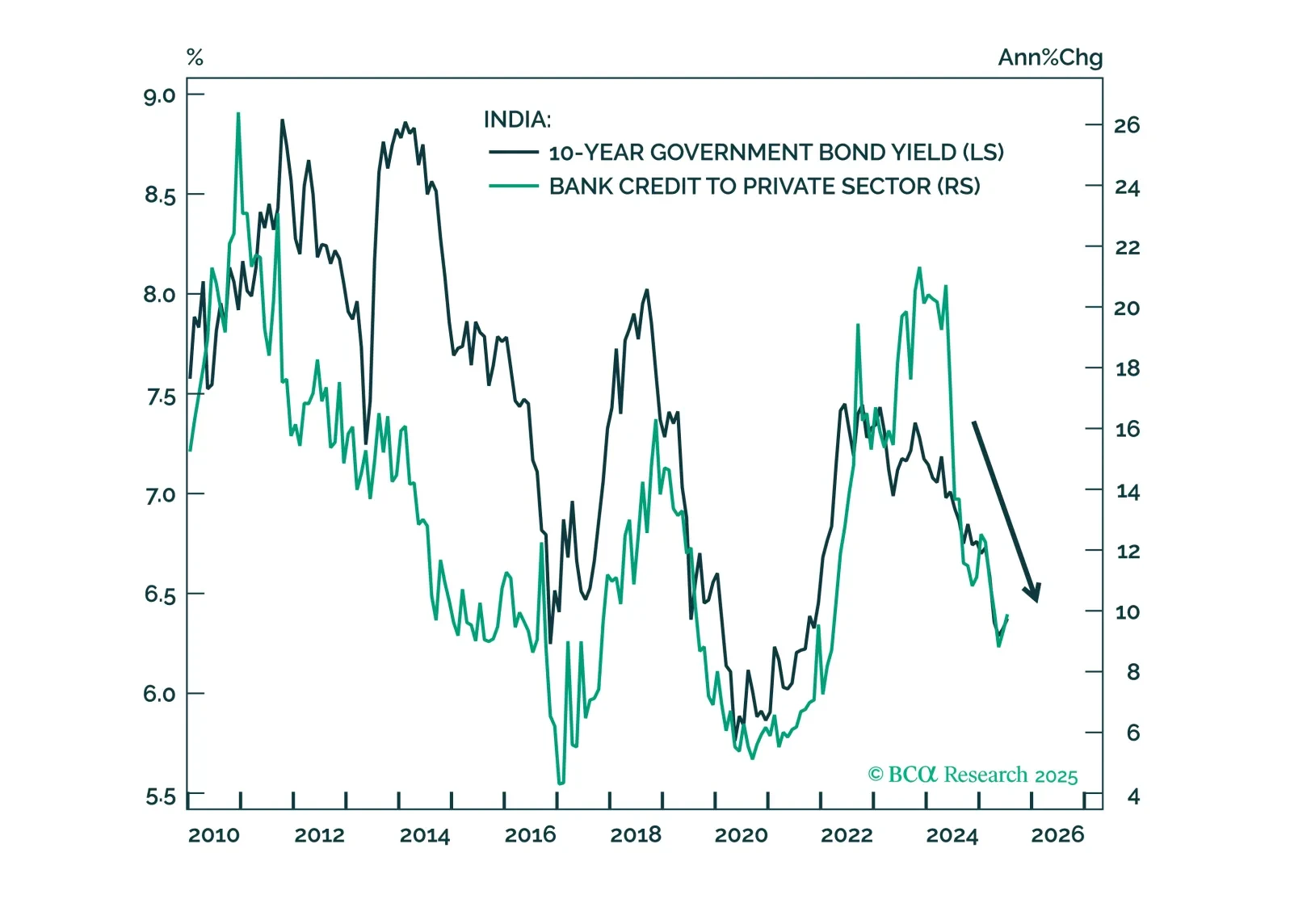

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

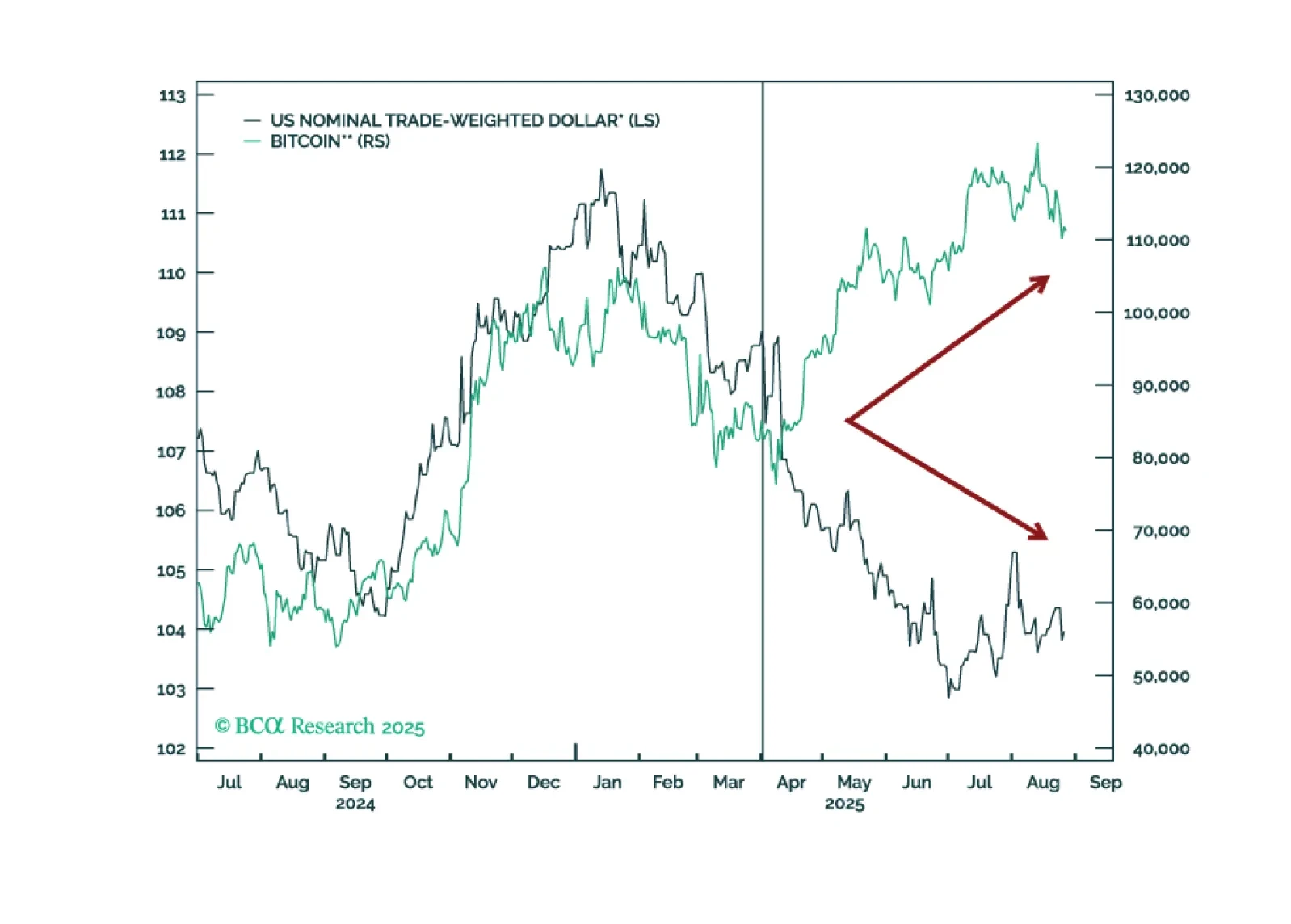

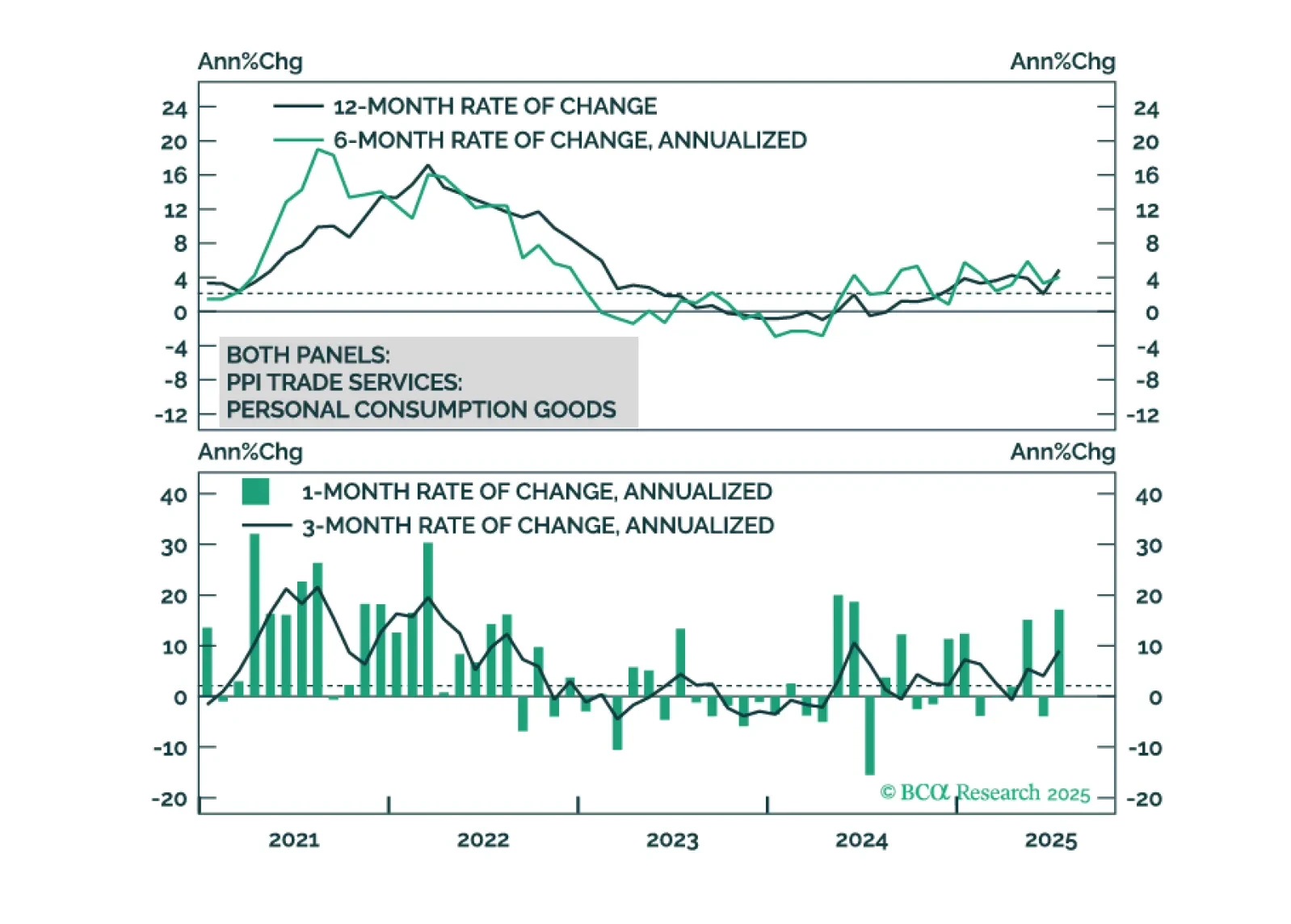

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.

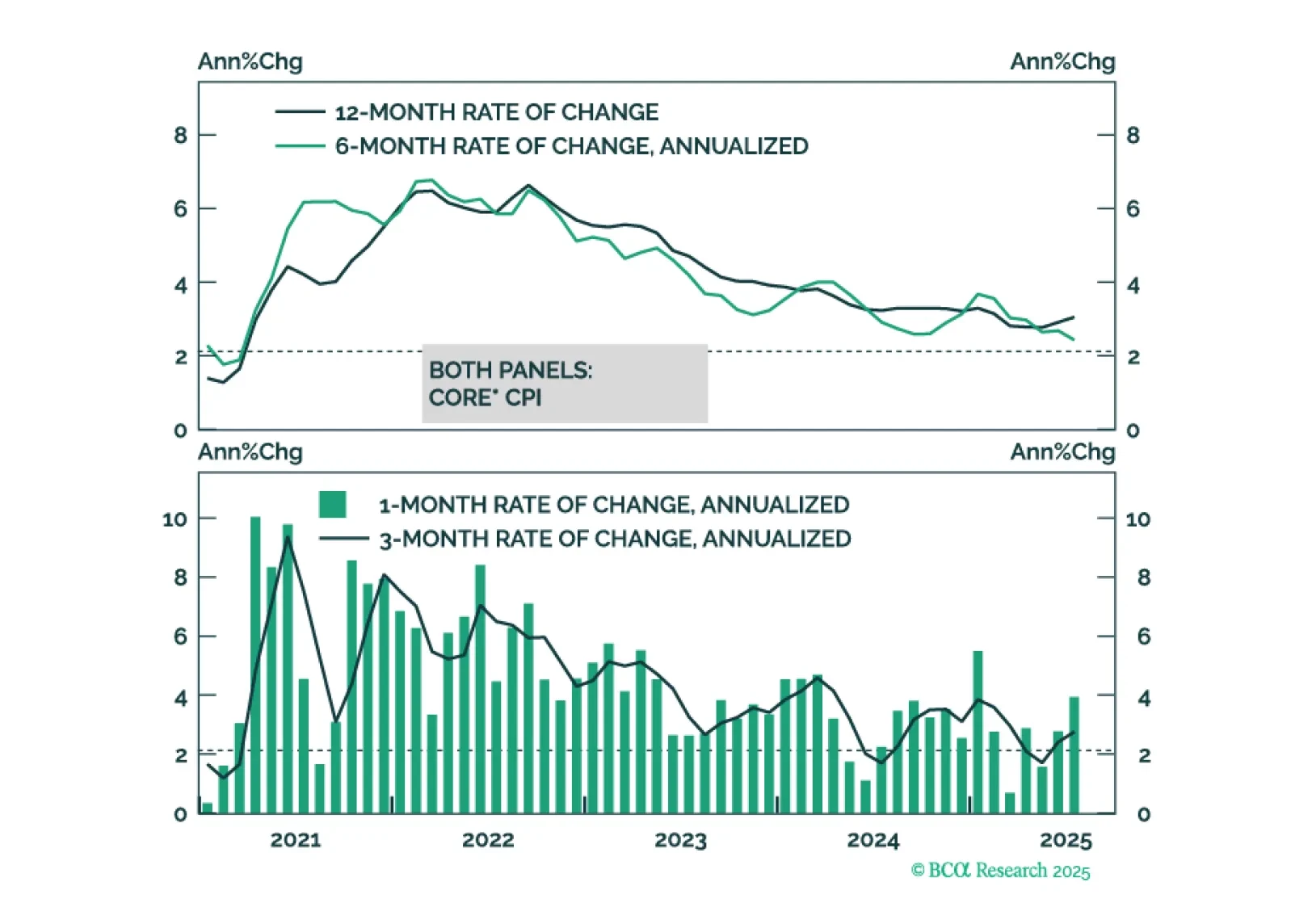

This morning’s CPI report marginally tips the scales in favor of a September rate cut.