The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

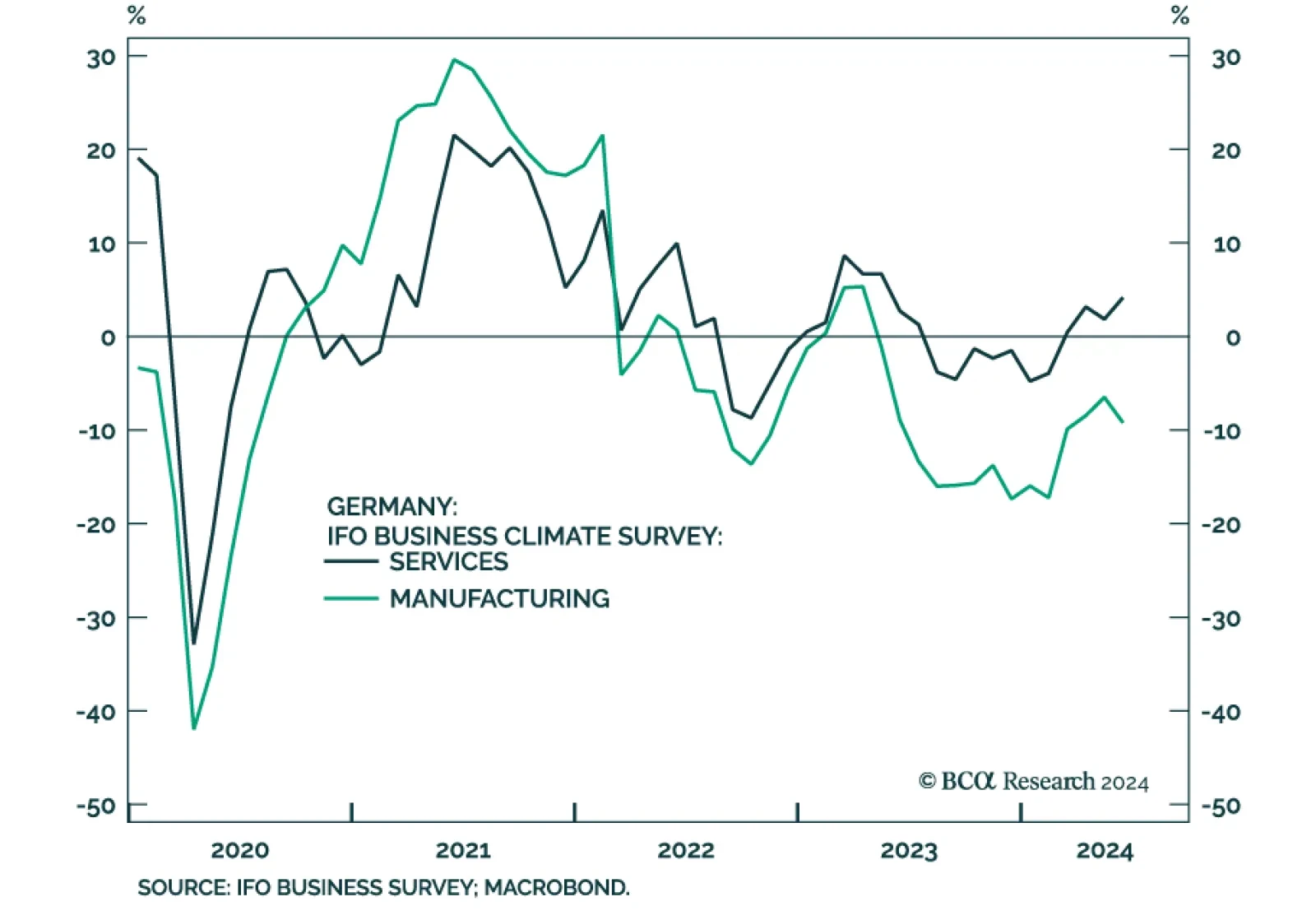

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

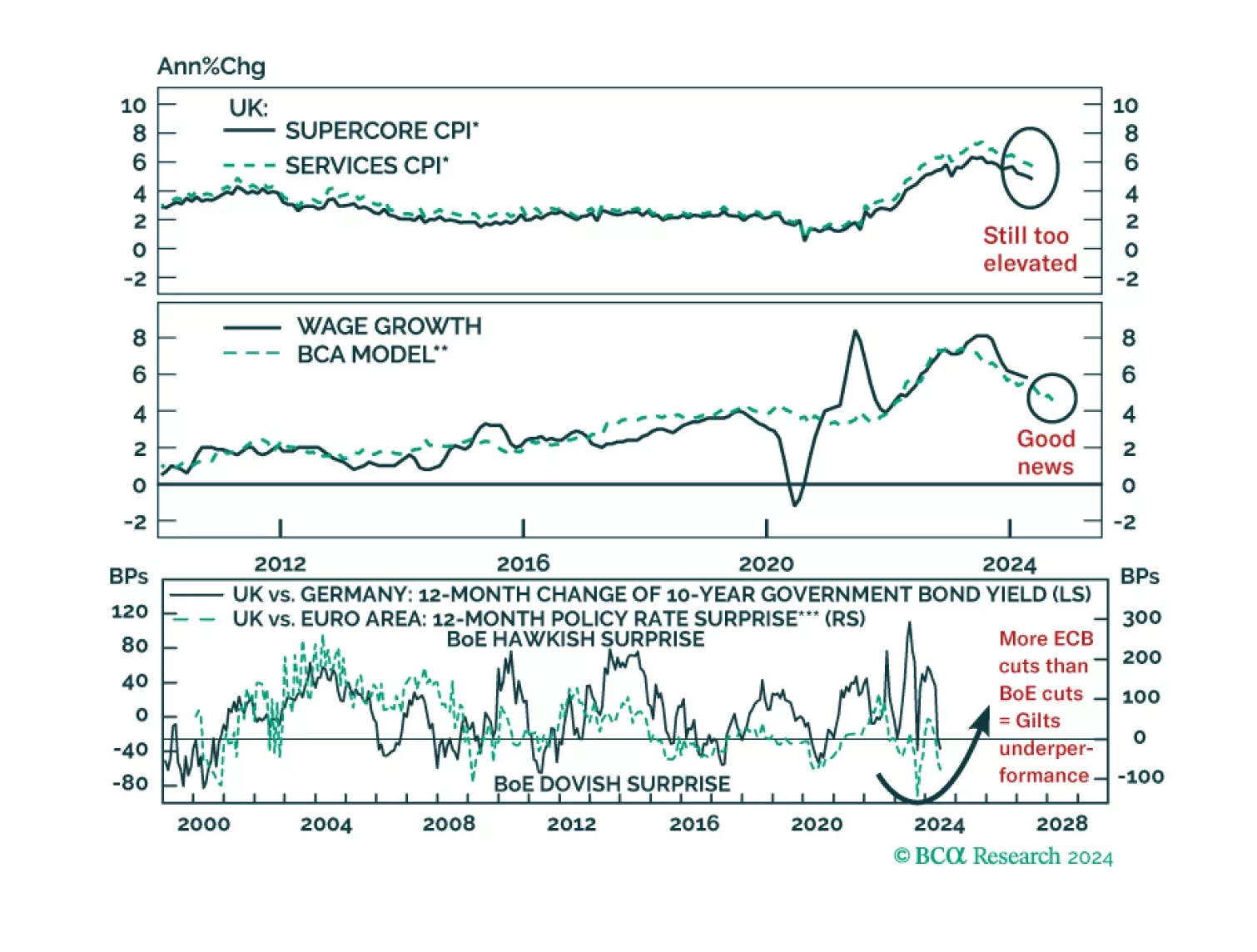

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

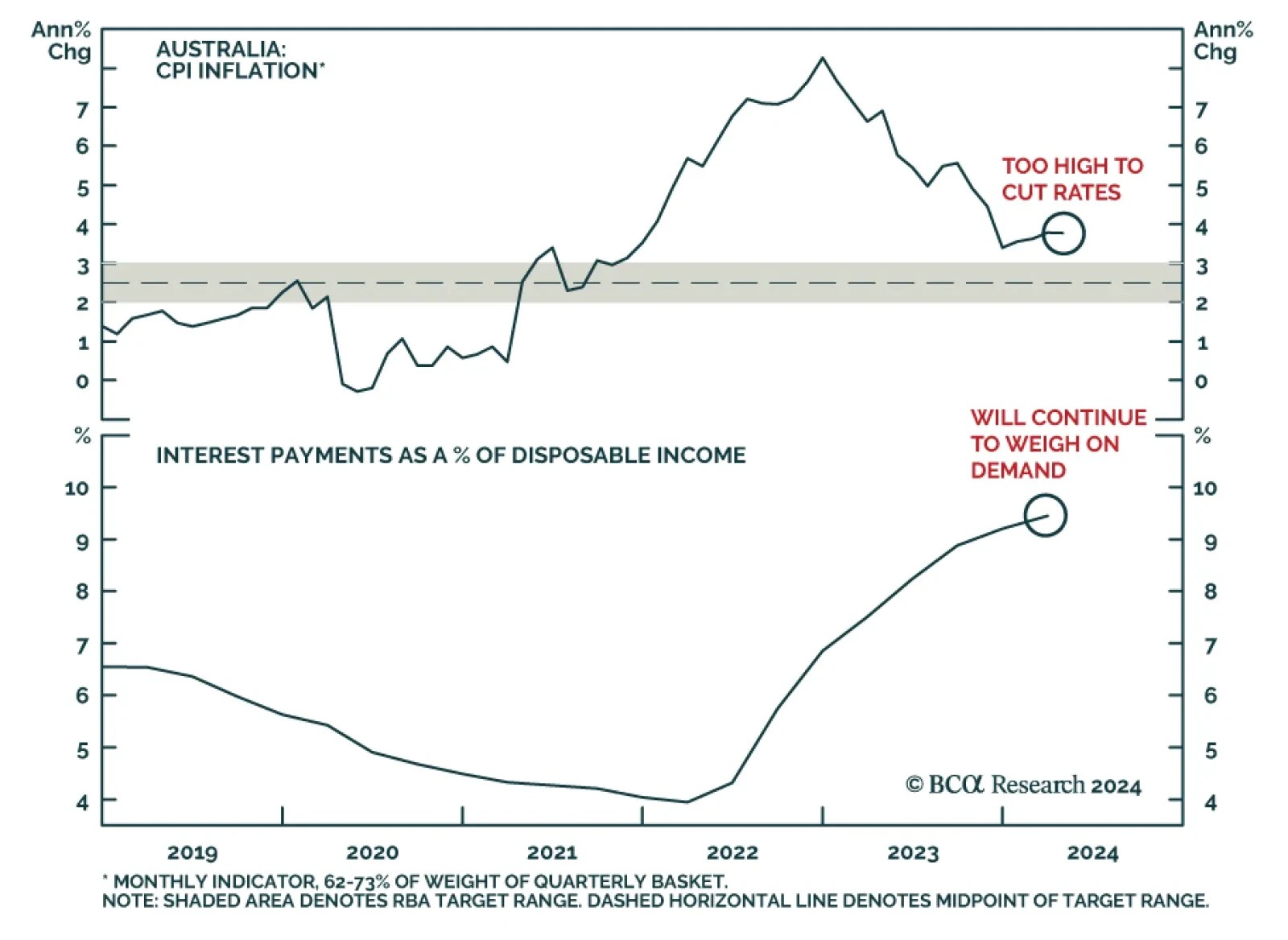

The Reserve Bank of Australia kept its cash rate at 4.35% at its policy meeting on Tuesday, in line with market expectations. Australia’s monthly measure of headline inflation came in at 3.6% in April, still considerably…

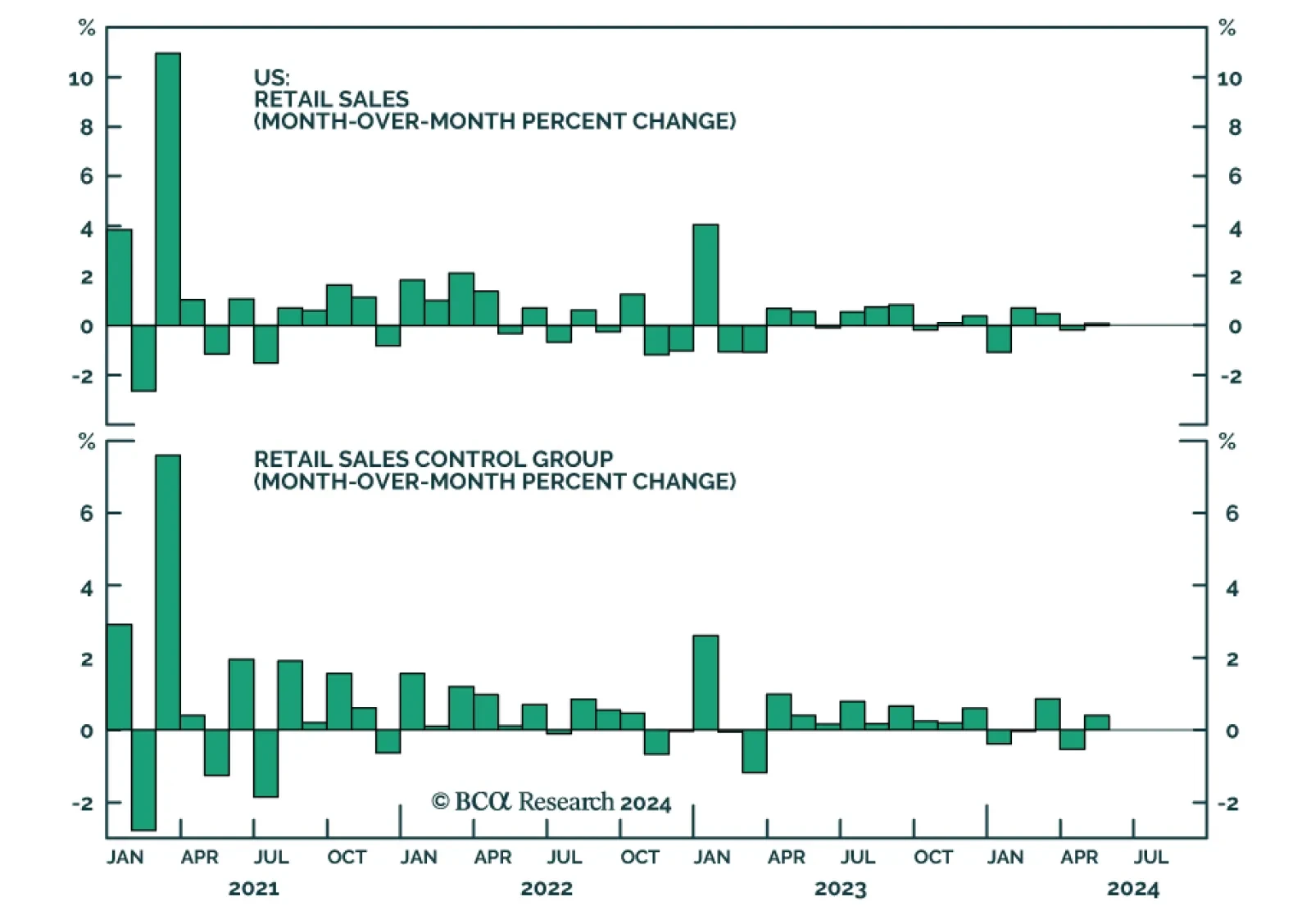

US retail sales were mostly unchanged, growing by a mere 0.1% m/m in May, short of the expected 0.3% monthly increase. A 2.2% m/m decline in gasoline stations’ sales weighed on the overall result, though retail sales…

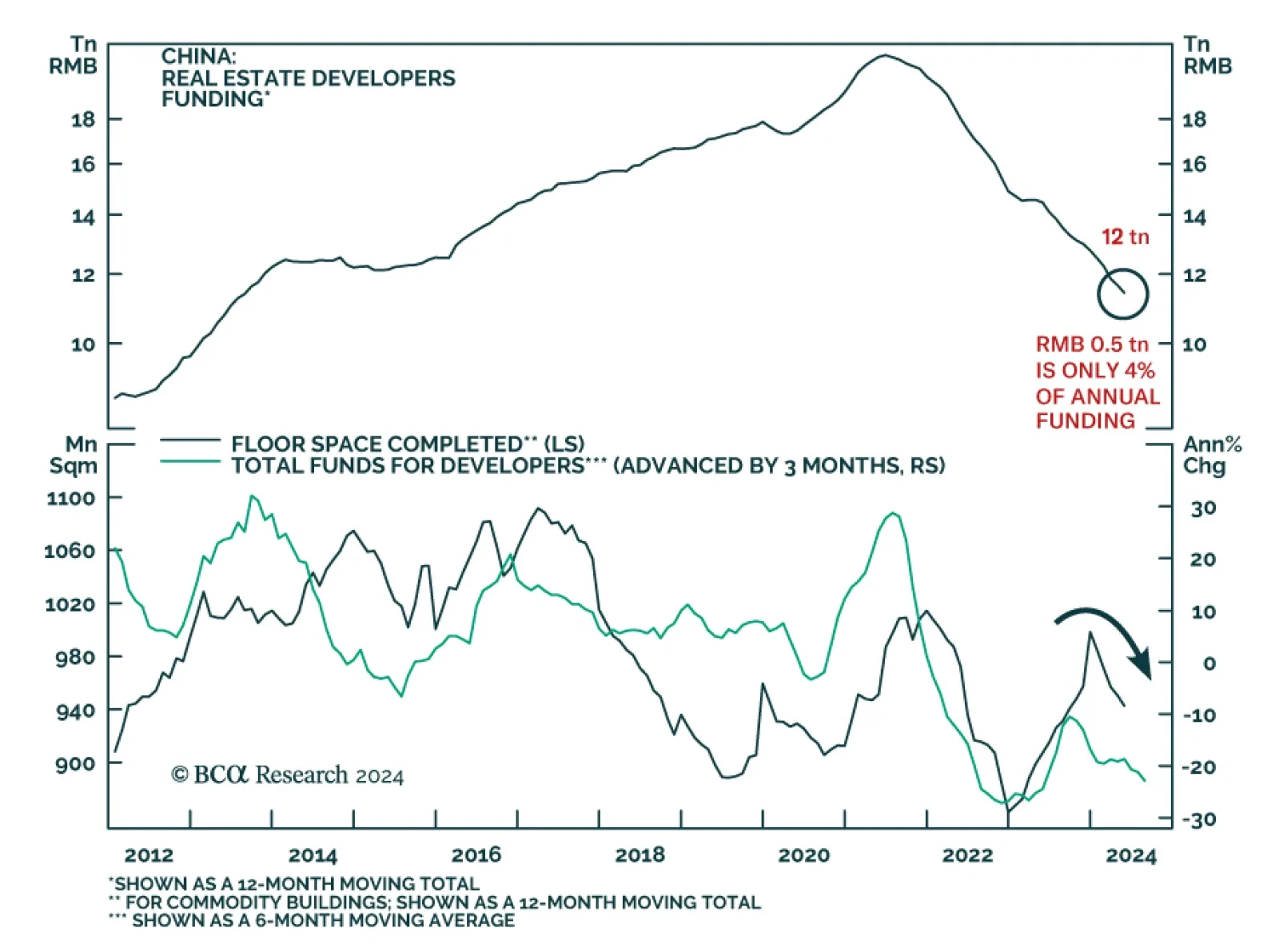

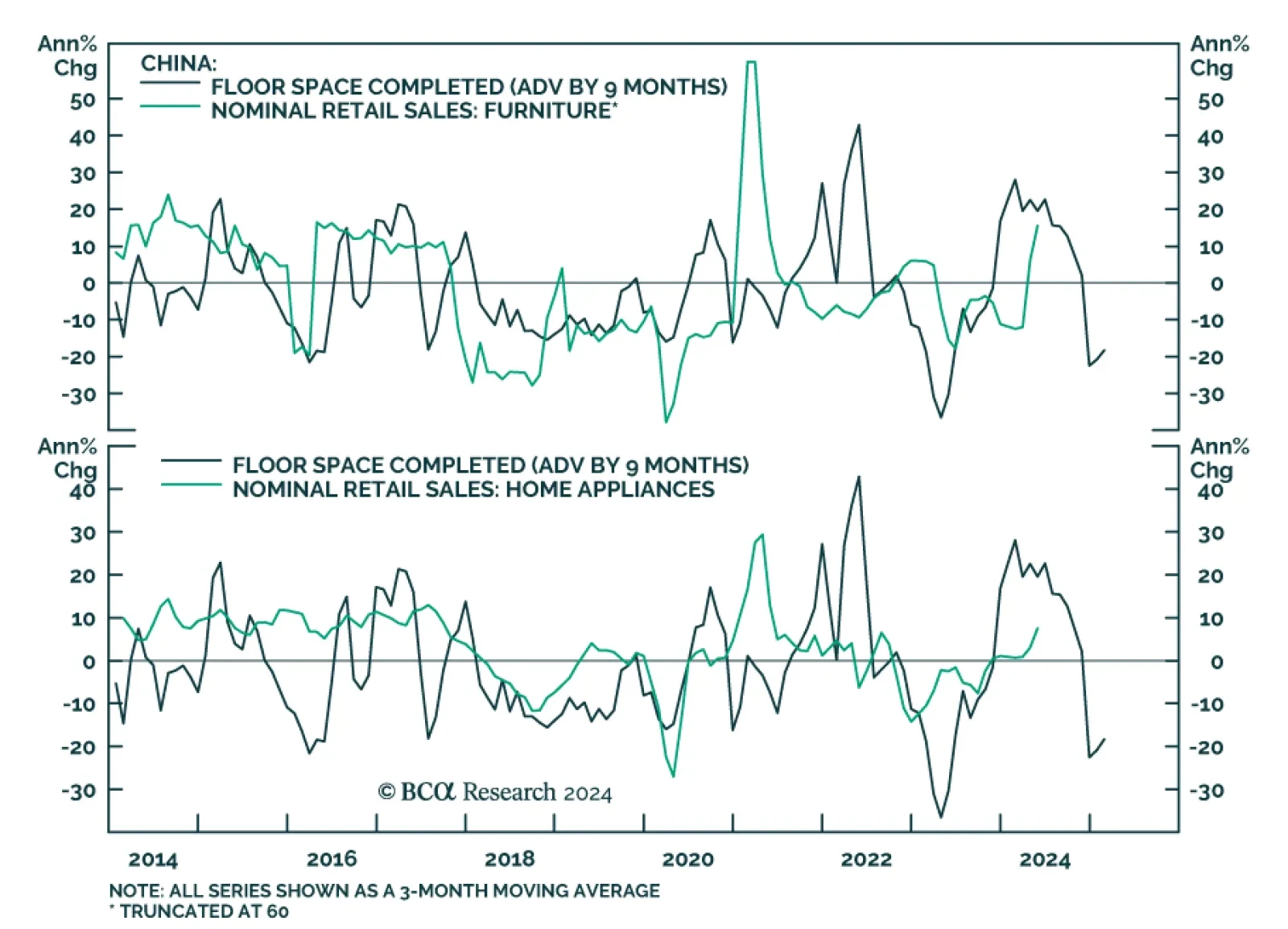

Declines in Chinese new and used home prices accelerated in May to 0.71% m/m and 1.00% m/m respectively, and the contraction in residential investment deepened to 10.1% YTD y/y. These figures come on the heels of relaxed purchase…

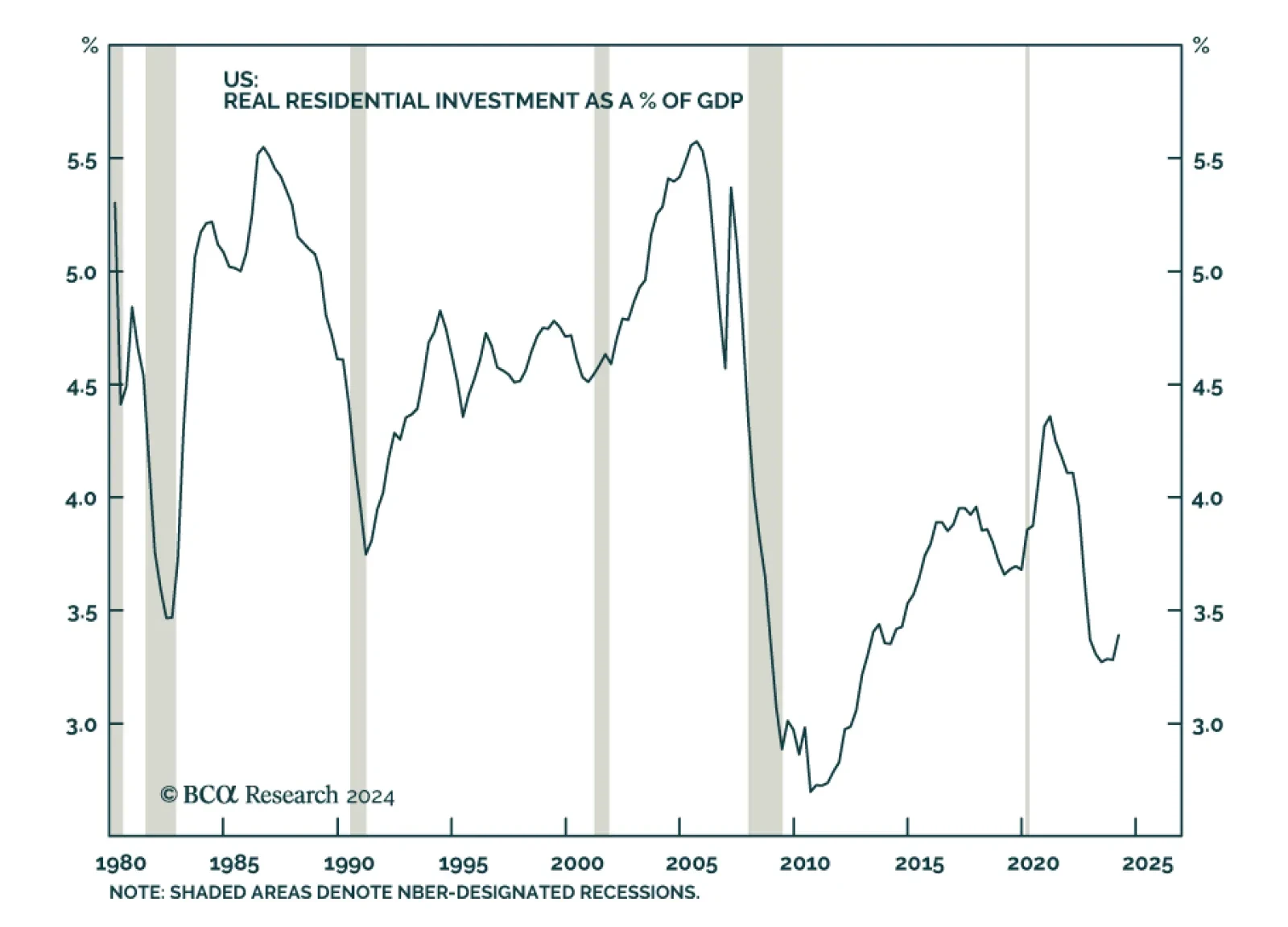

Housing is the most interest-rate-sensitive sector of the economy. Yet, the very aggressive monetary tightening cycle has only had a muted effect on home prices. While recent housing market data have been mixed, prices have not…

Chinese retail sales grew 3.7% y/y in May, from 2.3% in April, upending expectations of a more muted 3.0% increase. The government appliance trade-in program has likely boosted these figures. Sales of home-related goods such…

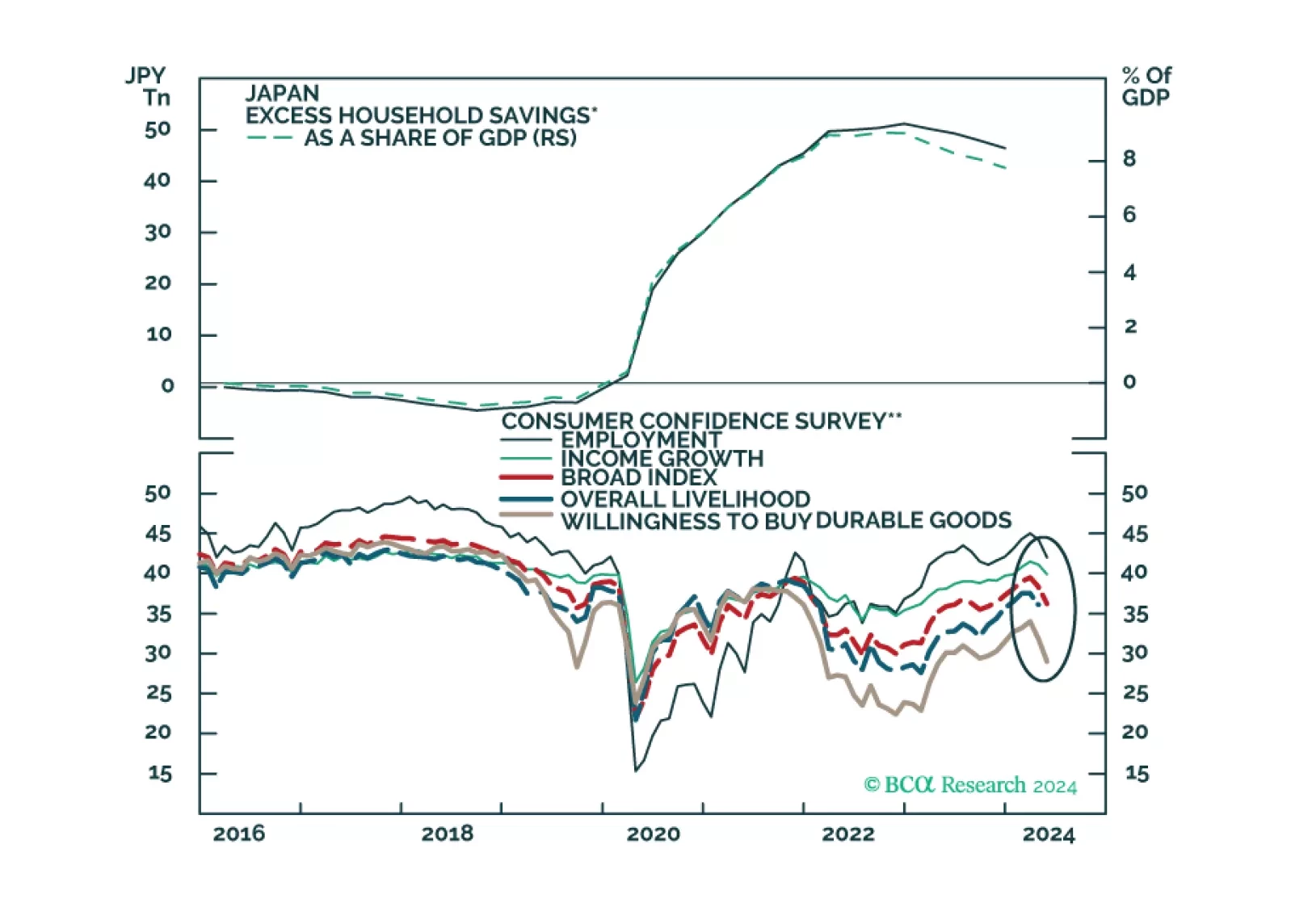

In this insight, we update our thinking on the recent BoJ move in terms of positioning for the yen and JGB yields.