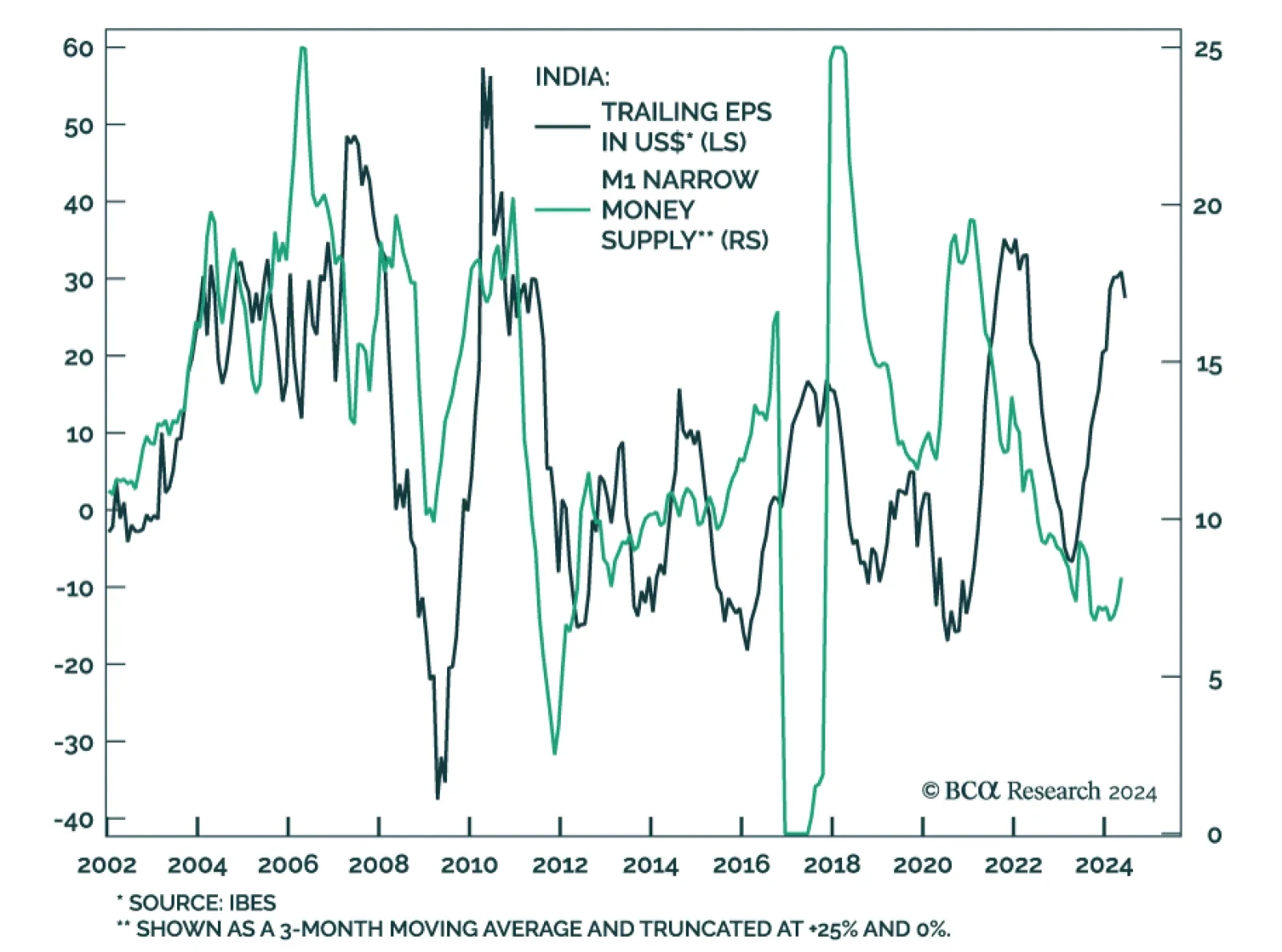

Our colleagues from the Emerging Markets Strategy team argue that investors should brace for a significant correction in Indian stocks in the coming months. They posit that the pillar of Indian corporations' sustained profit…

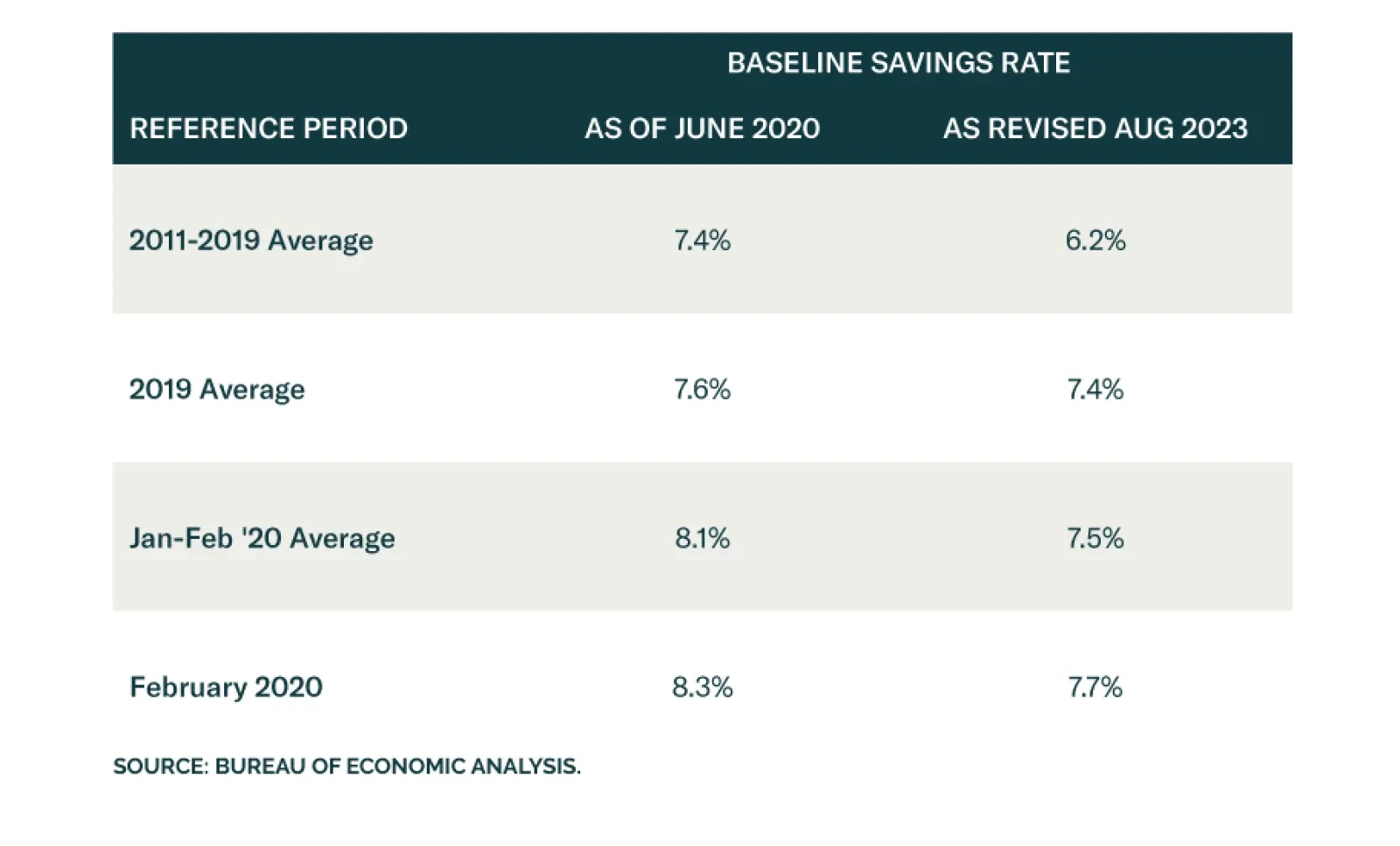

Our US Investment strategists define excess savings as the difference between what households saved beginning in March 2020 and what they might have saved had the pandemic not occurred. To estimate the latter, they assumed that…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

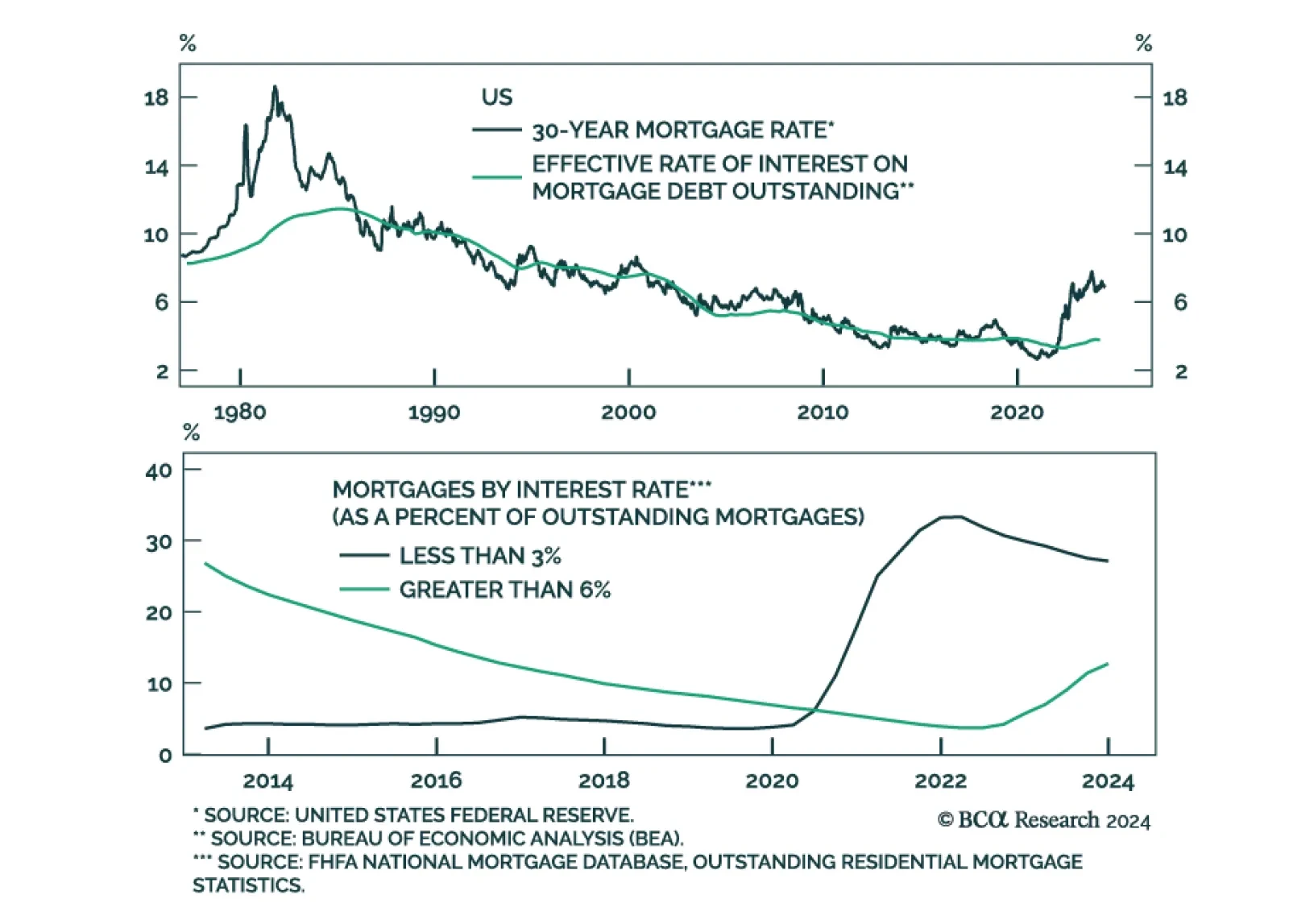

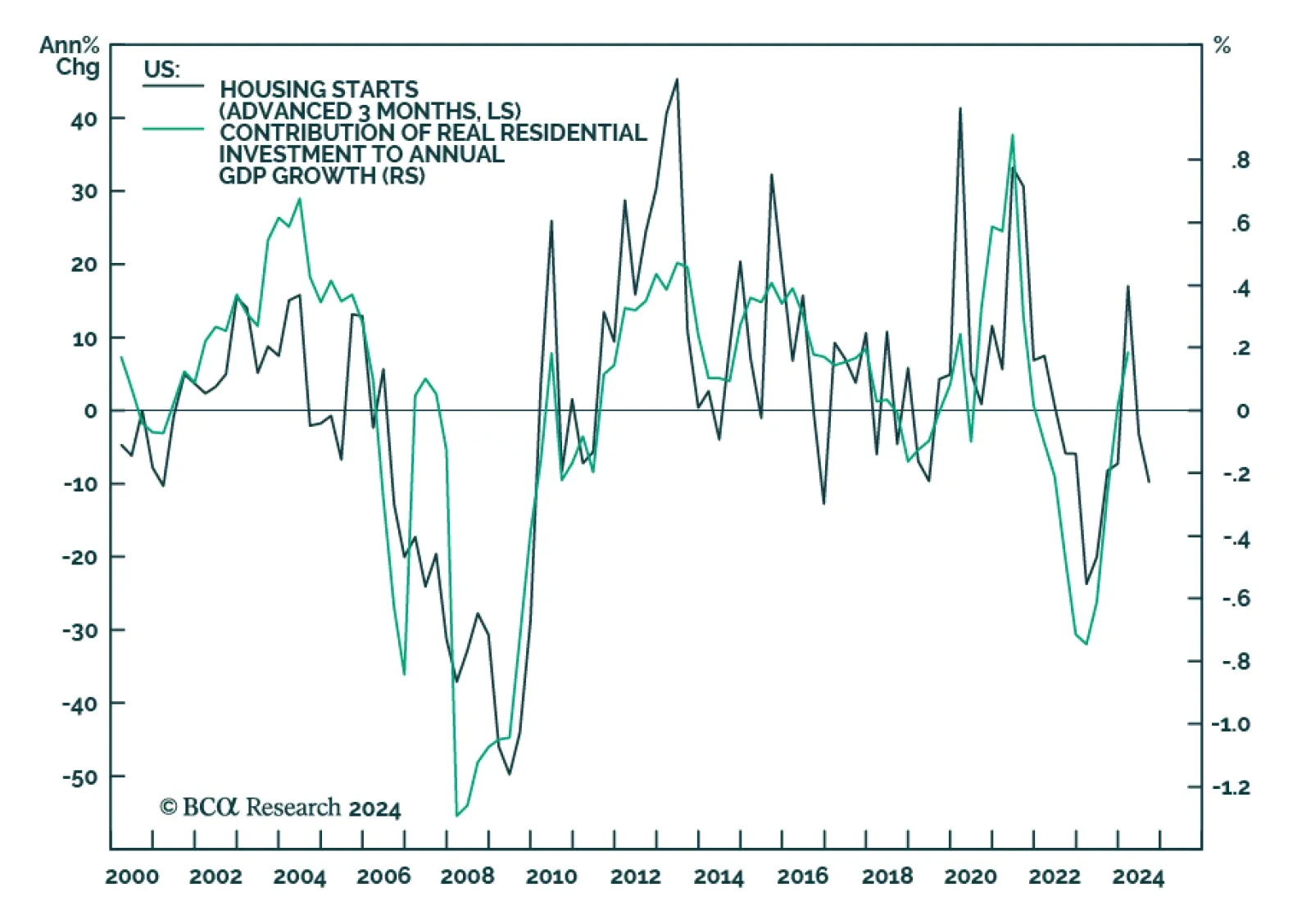

The US conventional 30-year mortgage rate climbed back above 7% in late June and drove a 2.6% weekly contraction in mortgage applications. The fixed-rate home affordability index sank to a nearly four-decade low. Housing is…

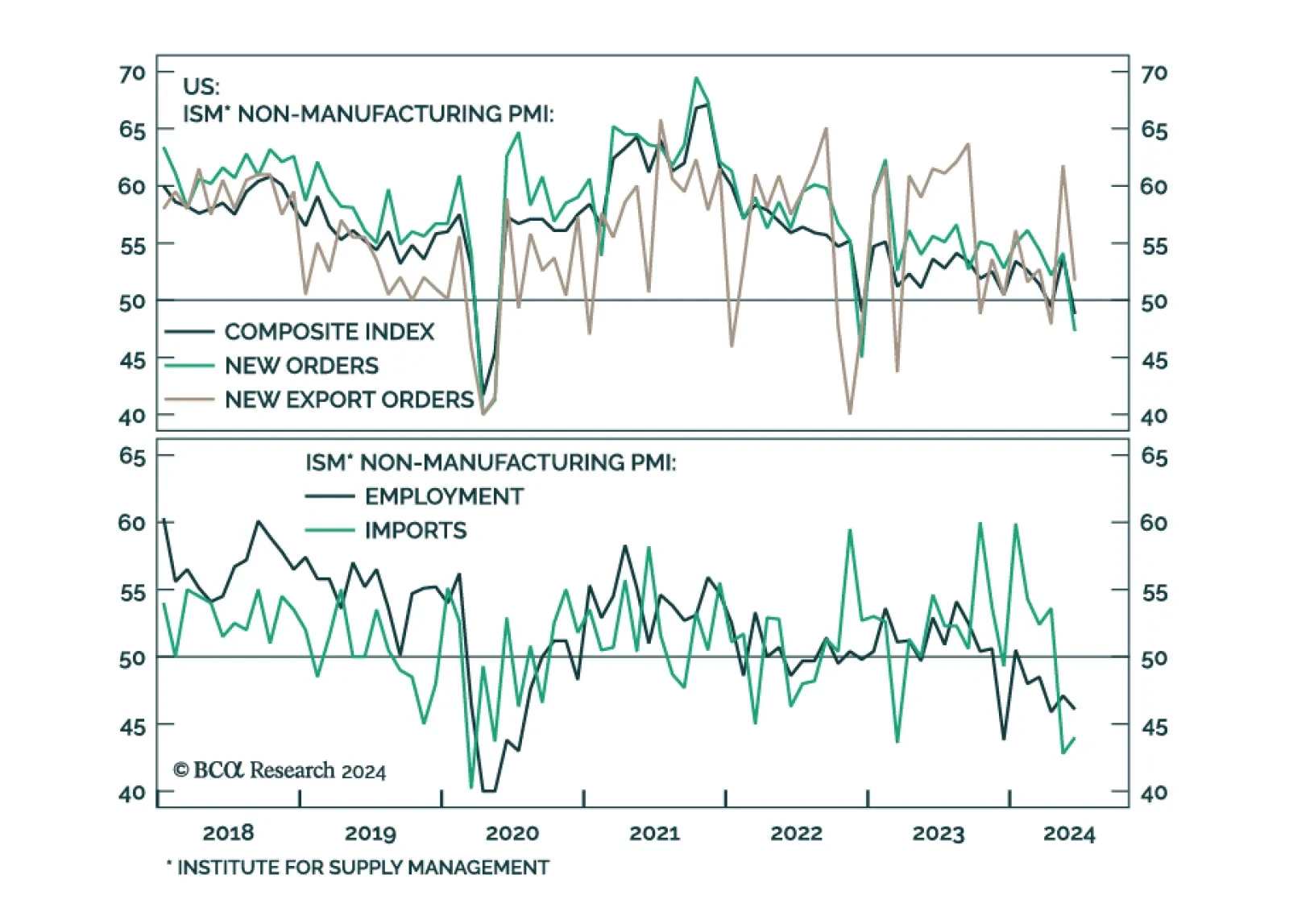

The ISM Services PMI largely disappointed in June. The headline index plunged from 53.8 to 48.8, its fastest pace of contraction since May 2020, far below expectations of 52.7. This series can be noisy and the June update…

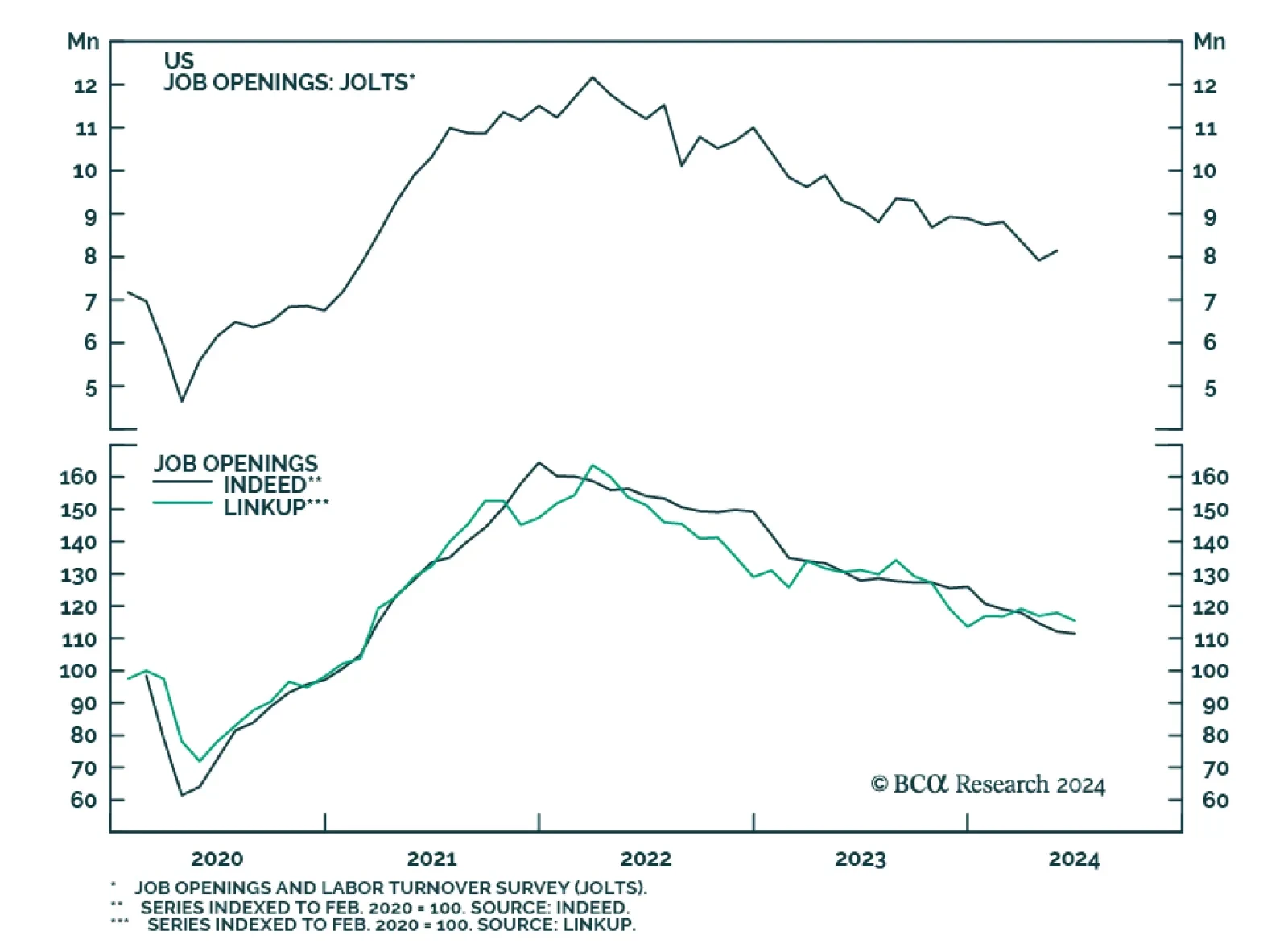

The number of job openings in the US surprised to the upside in May, growing from a downwardly revised 7.9 million to 8.1 million. Not only did the growth in job openings beat expectations of a decline, but the May number even…

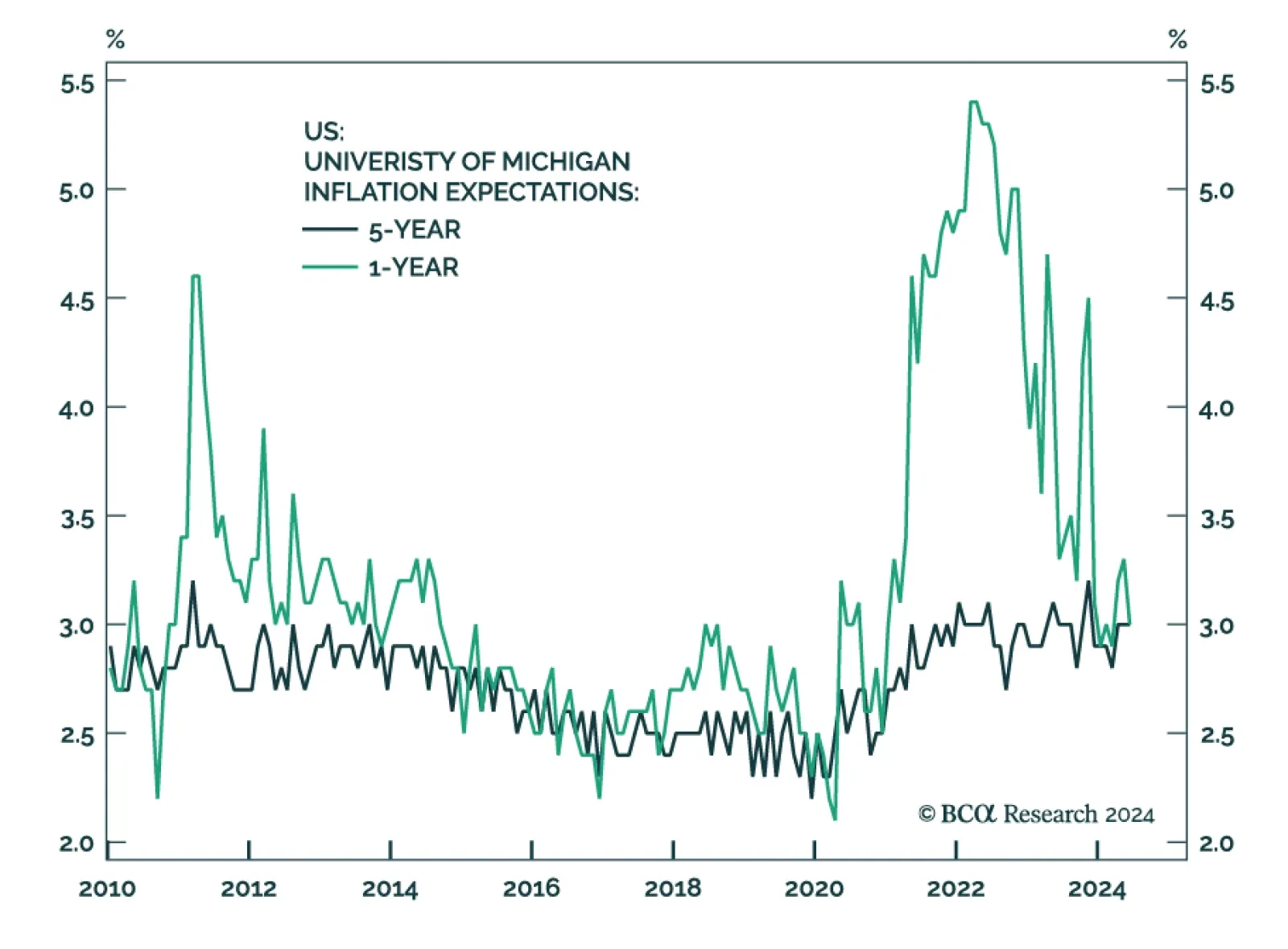

The University of Michigan survey of consumers was released on Friday. The sentiment measure increased from 65.6 to 68.2, beating consensus estimates of 66. Current conditions as well as expectations also increased, going from 62…

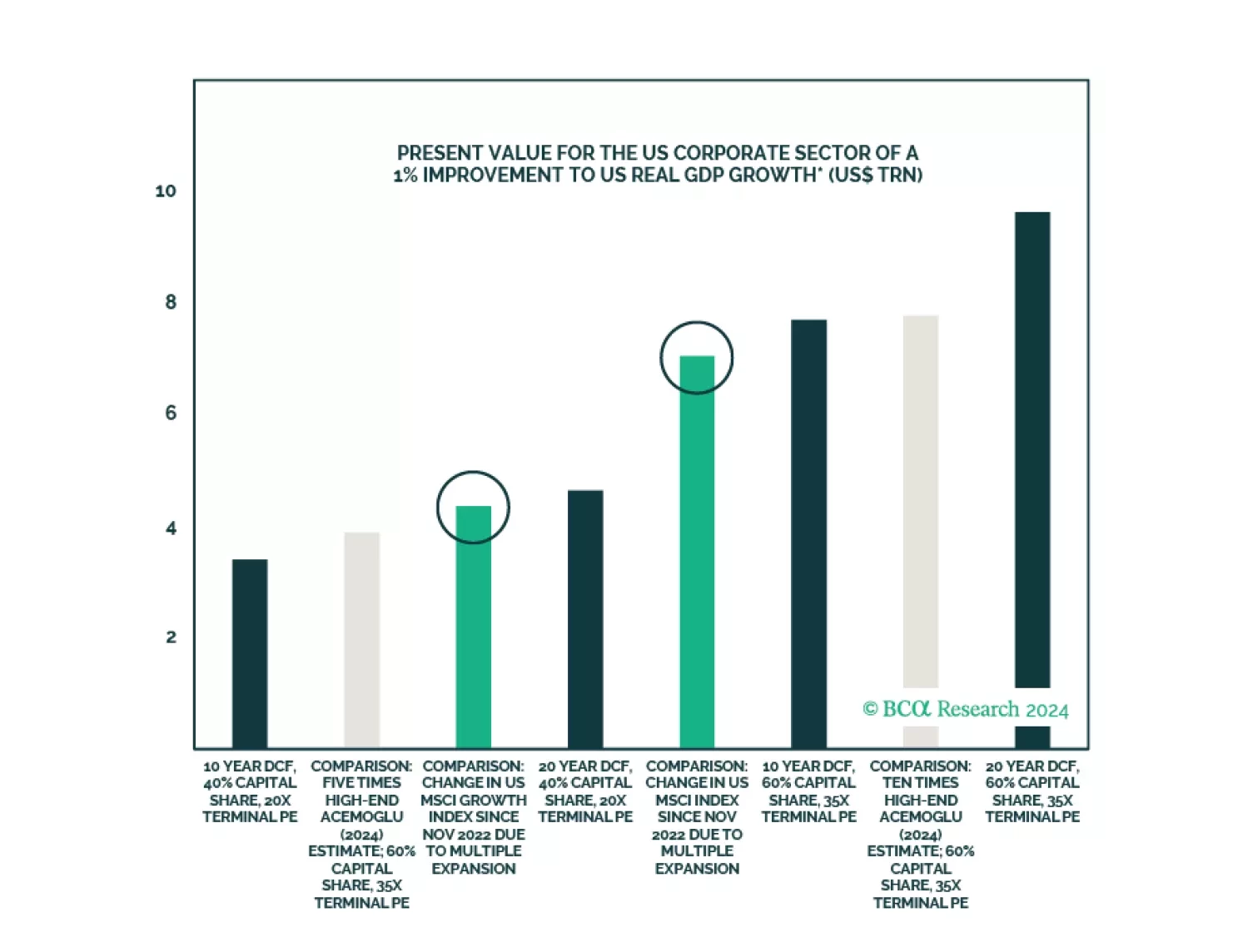

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

Right after the pandemic, many US homeowners locked in mortgages at extremely low rates. When interest rates rose, these homeowners refused to sell, as moving to a new home would result in an interest rate reset. In turn this…