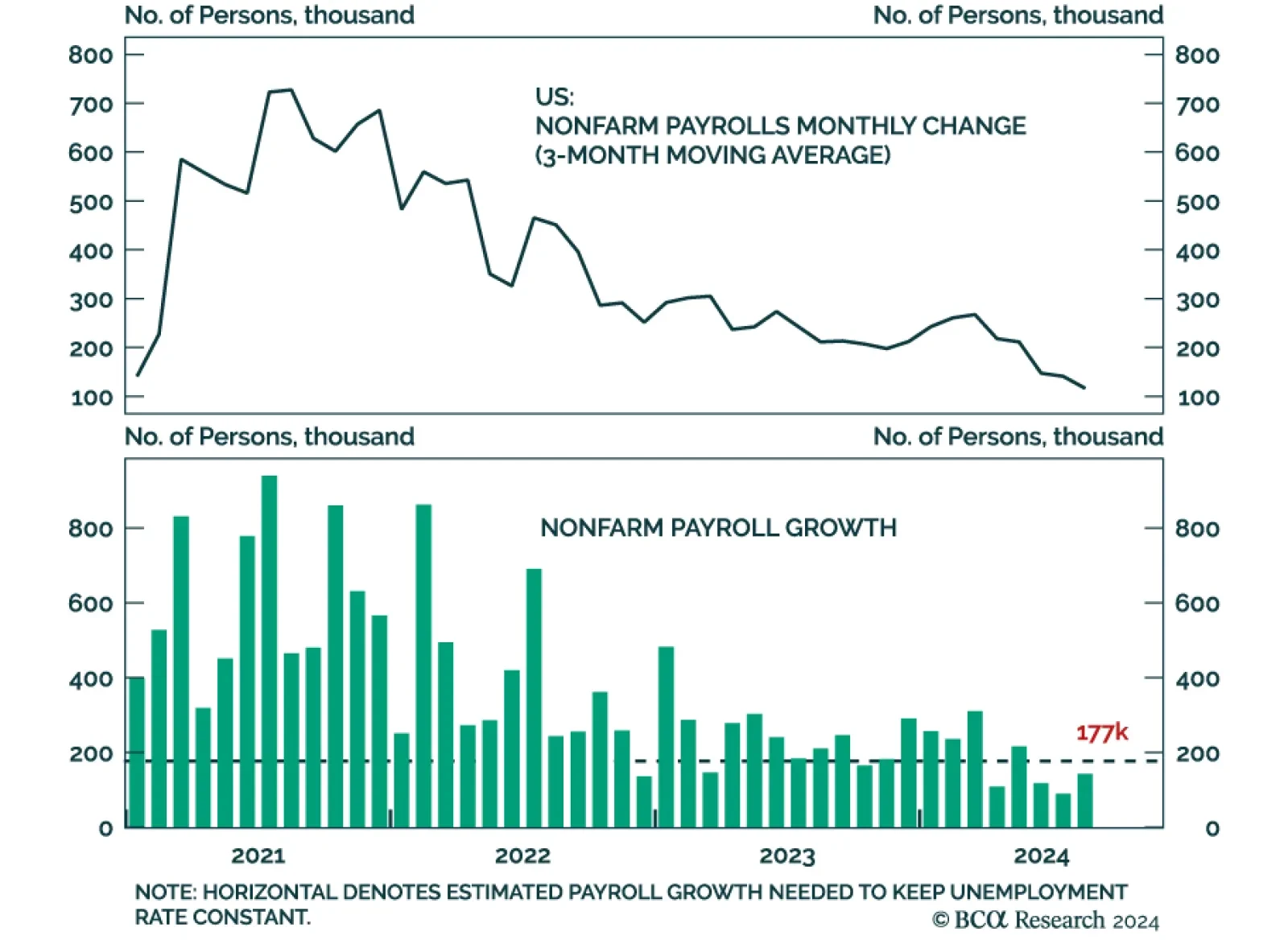

August nonfarm payrolls expanded by 142 thousand workers, from a downwardly revised 89 thousand and below expectations of 165 thousand. Payroll growth fell to a four-year-low of 116 thousand on a 3-month moving average basis.…

The Fed’s Beige Book compiles qualitative input sourced from business and other organizational contacts in each of its 12 Districts. It precedes FOMC meetings by a couple of weeks and is meant to help participants trace the…

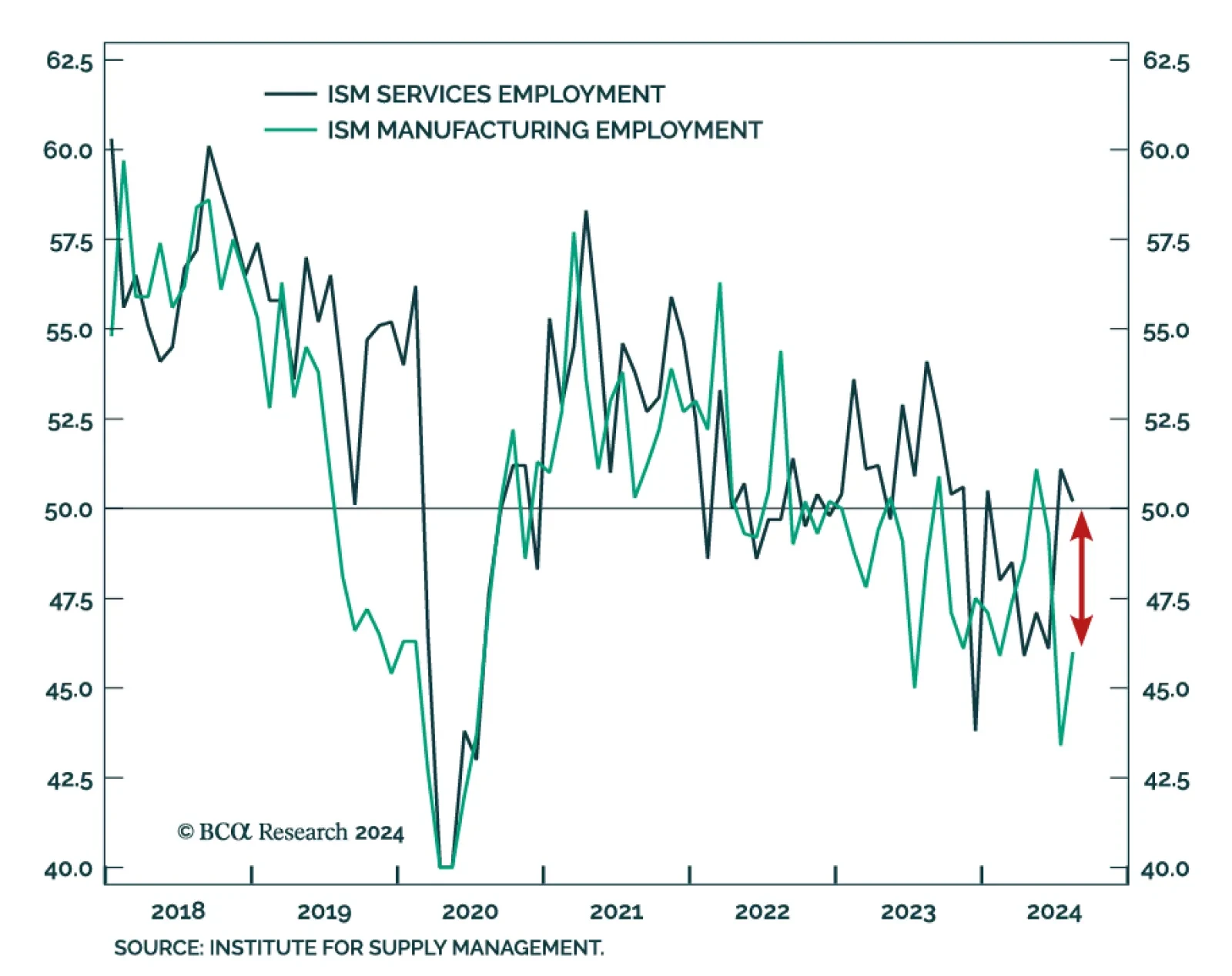

The ISM services PMI remained mostly stable in August, extending a second consecutive month of modest expansion. The headline index ticked 0.1 point higher to 51.5. However, although new orders continued to expand, new export…

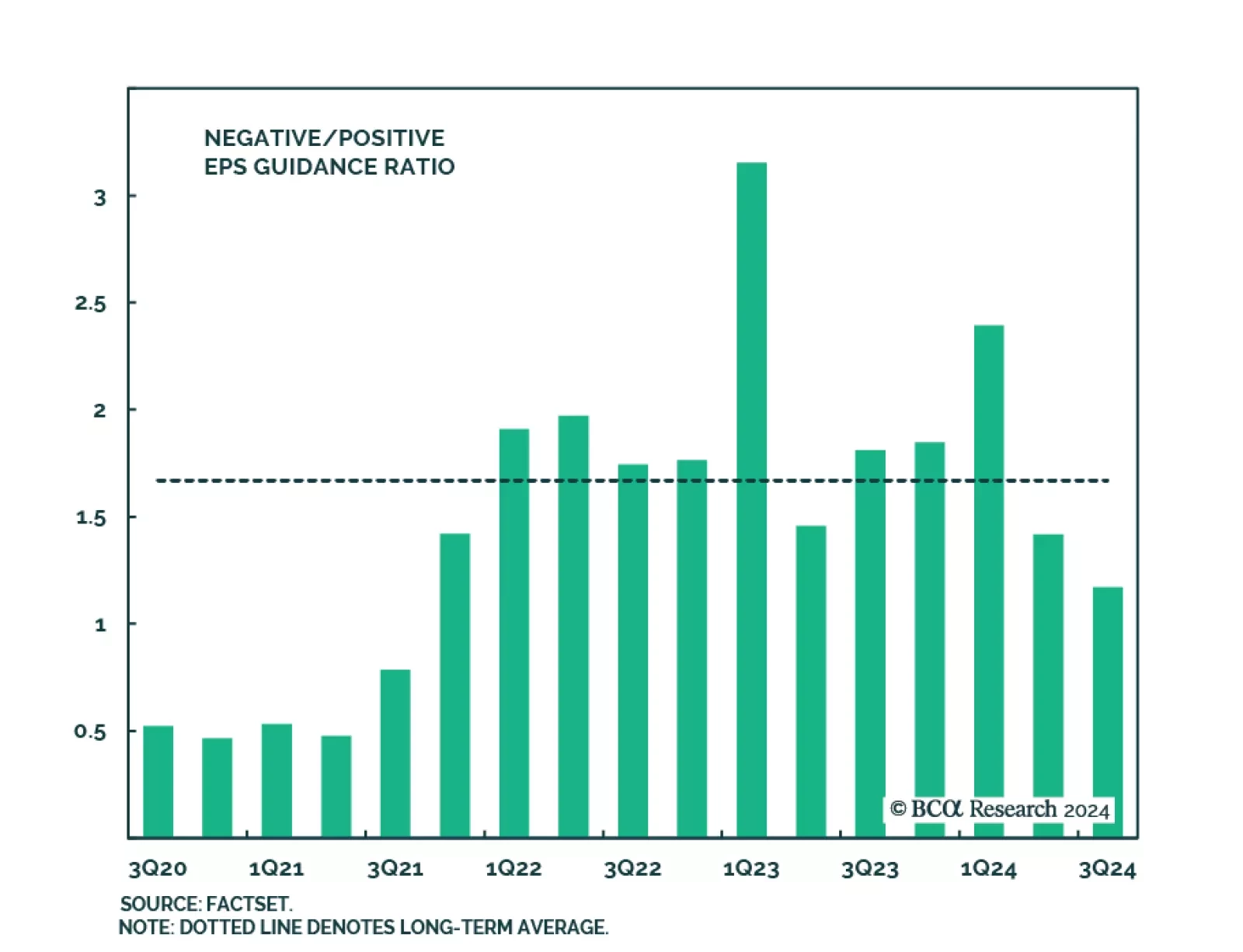

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

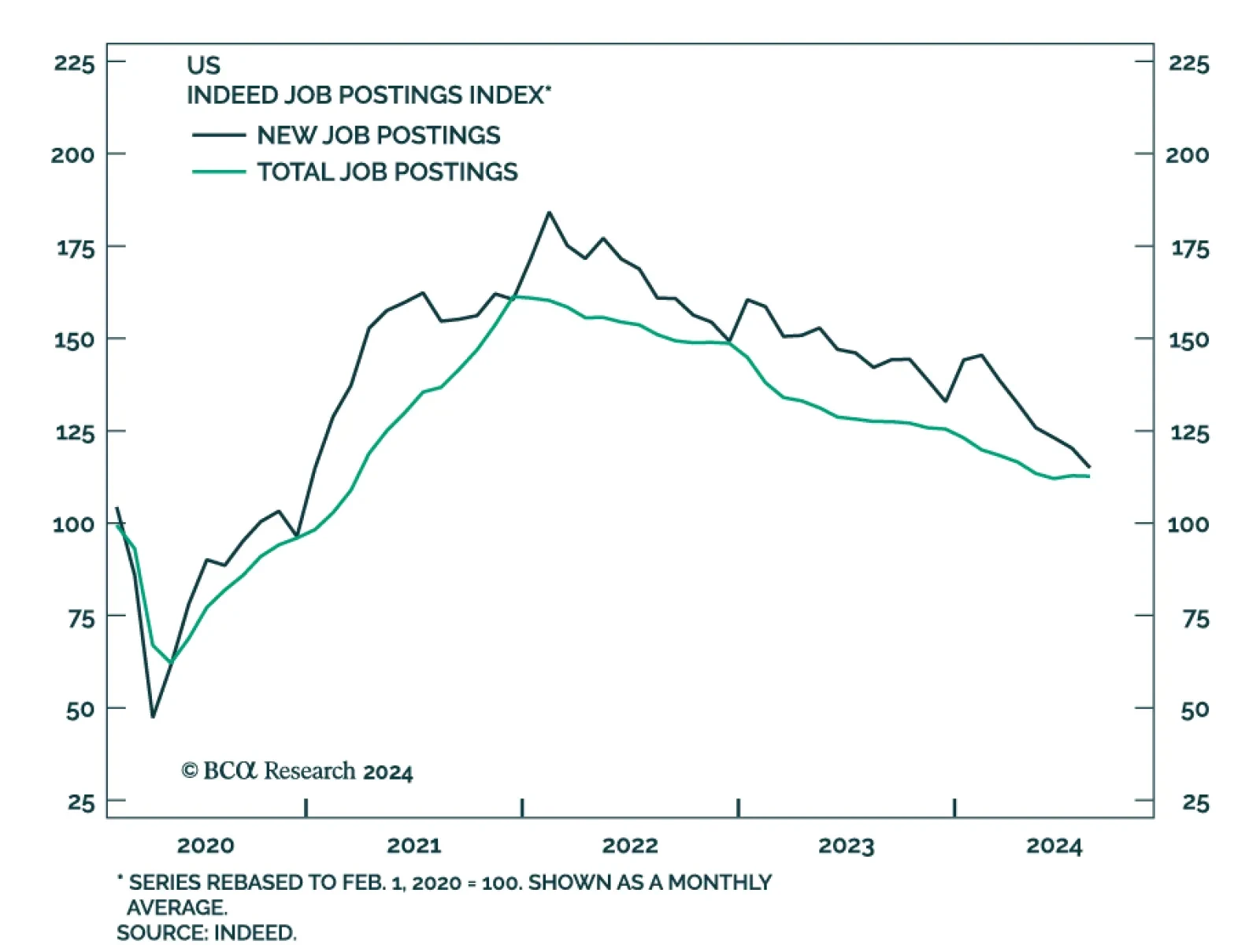

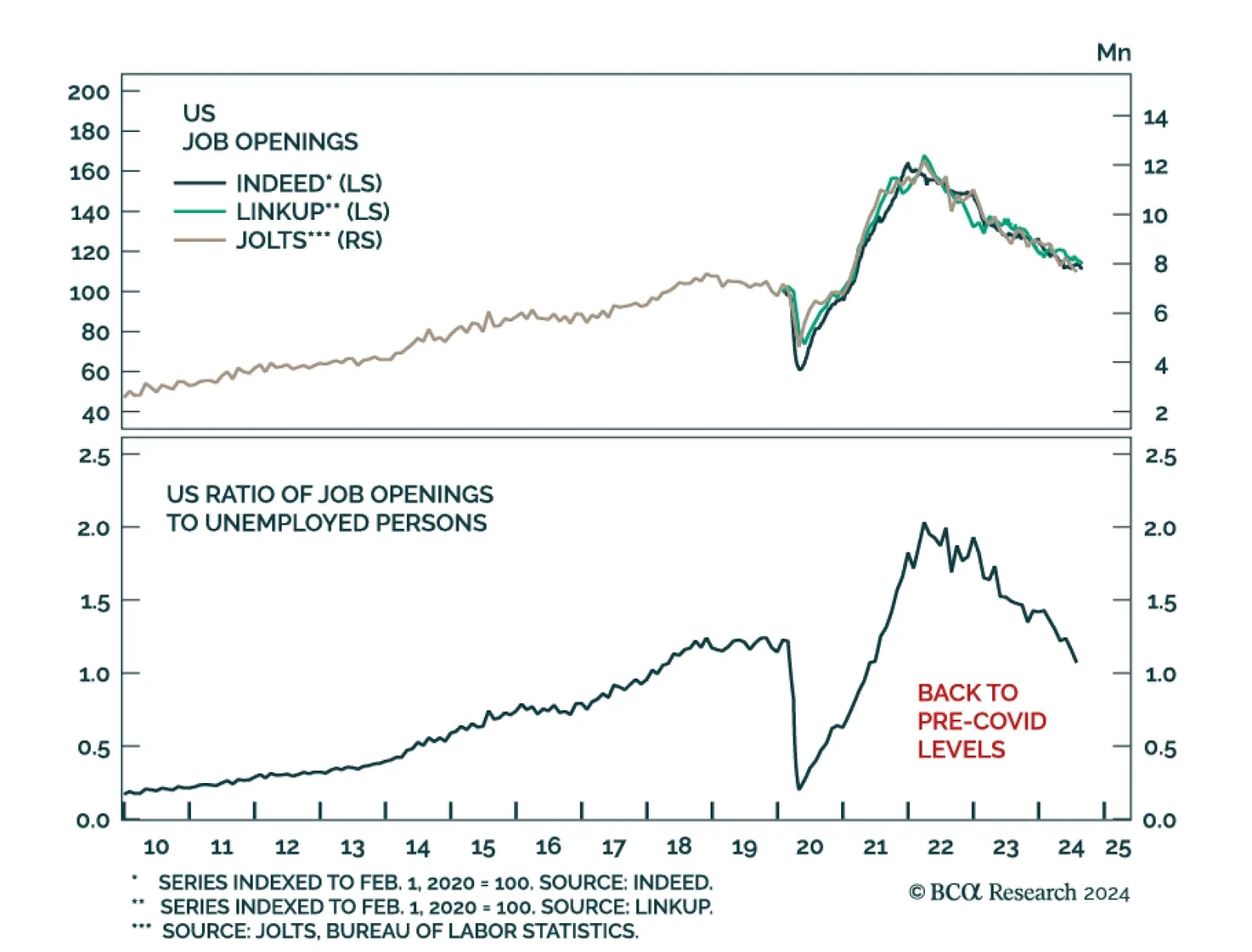

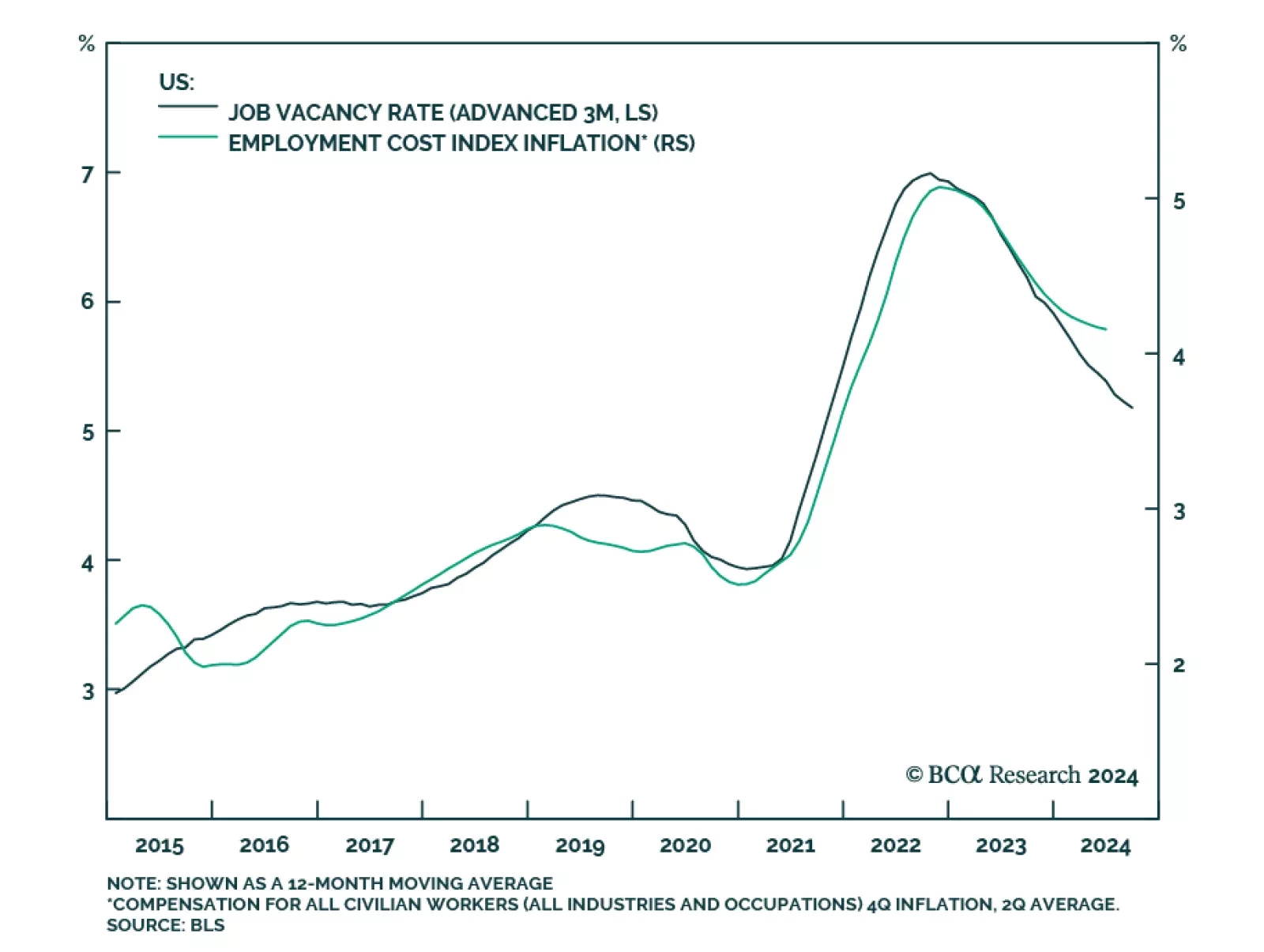

US job openings declined from a downwardly revised 7.91 million to 7.67 million in July, the lowest level since 2021 and well short of expectations of 8.1 million. The downward revision indicates that labor demand actually…

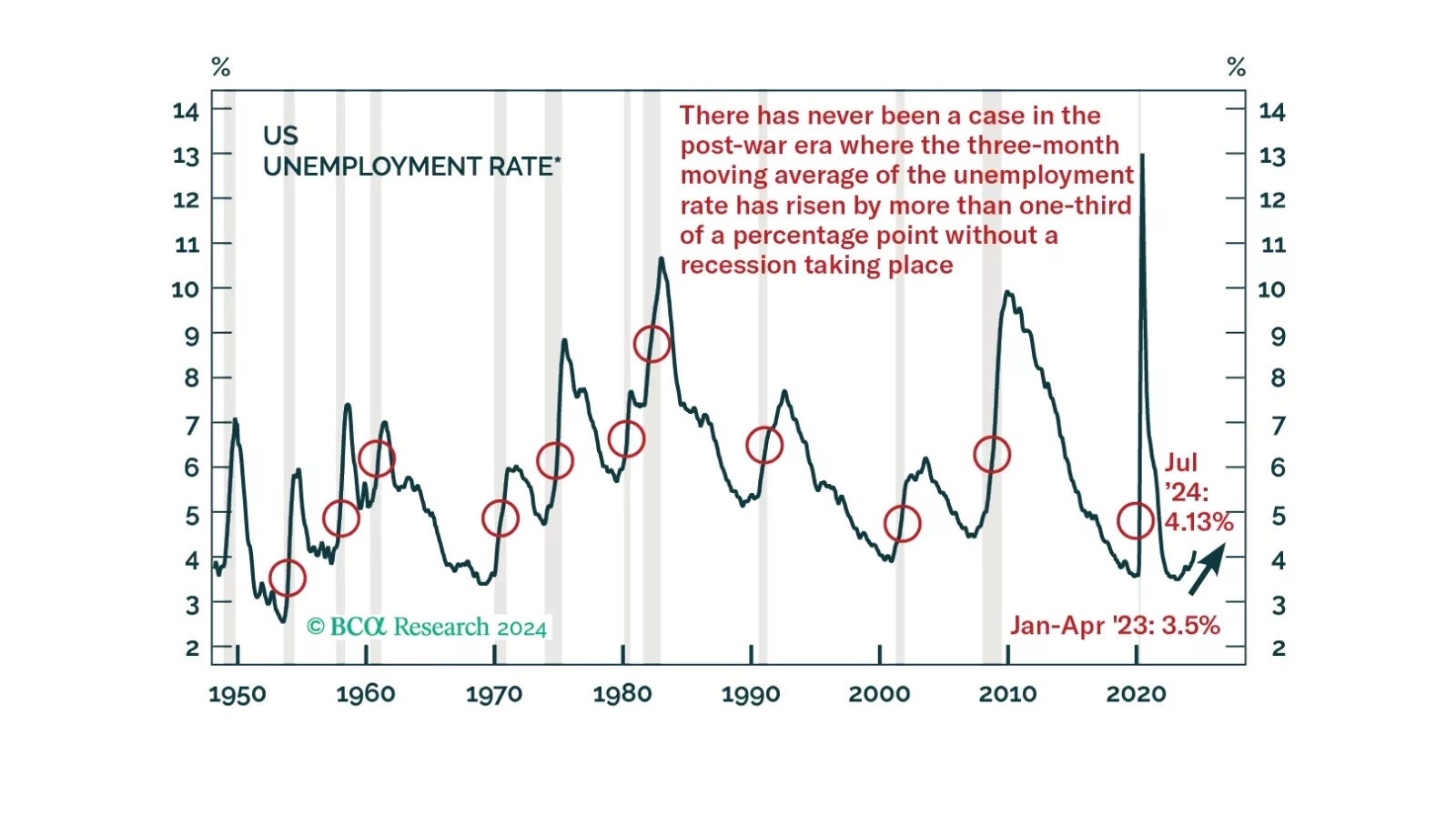

Our annual end-of-summer chartbook report traces the labor market deterioration that led us to downgrade equities at the beginning of August. It also highlights the soft-landing expectations that the credit and equity markets are…

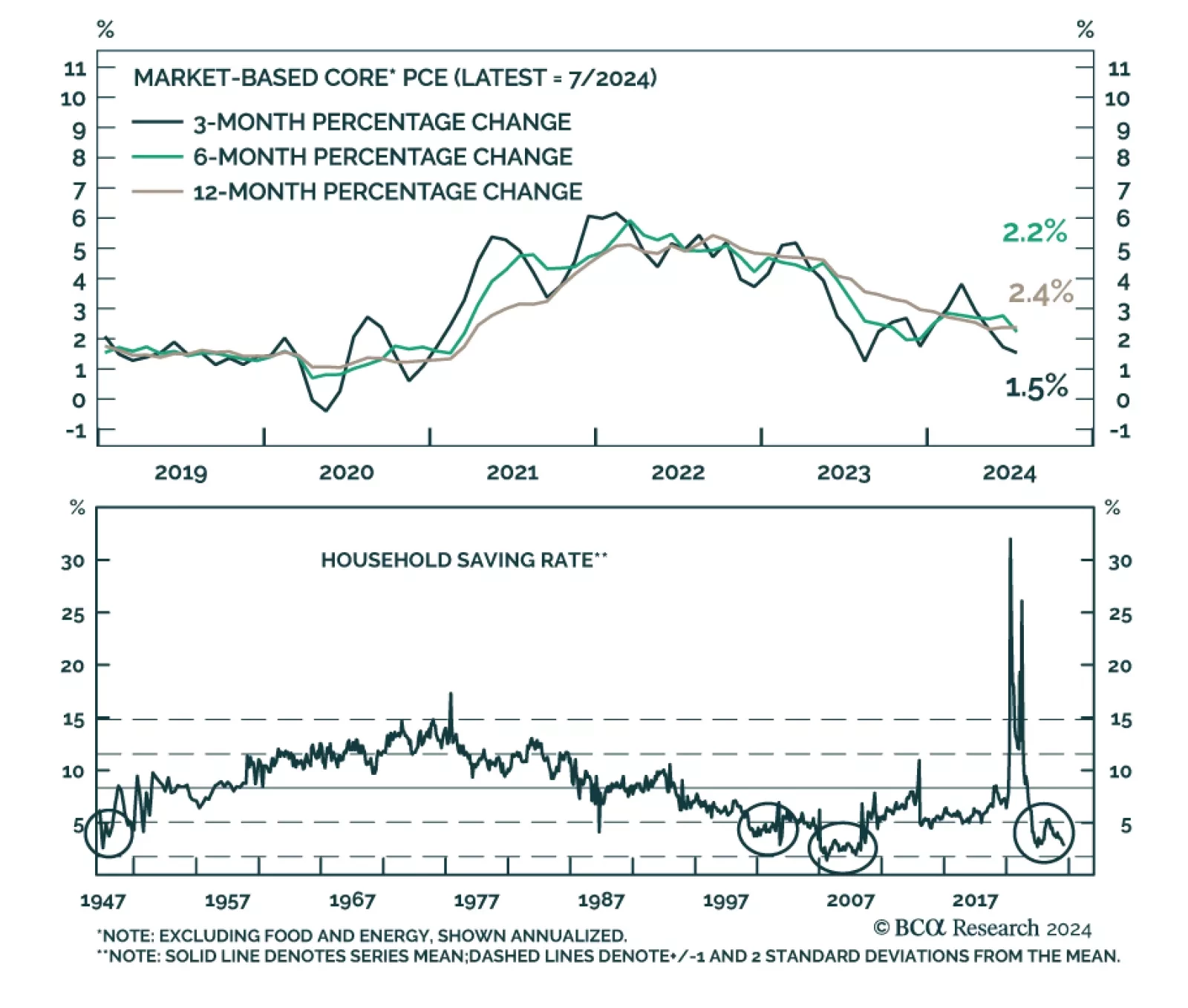

US nominal personal income growth accelerated from 0.2% m/m to 0.3% in July, faster-than-anticipated, whereas personal spending accelerated from 0.3% to 0.5%, in line with expectations. The savings rate edged lower from 3.1% to a…

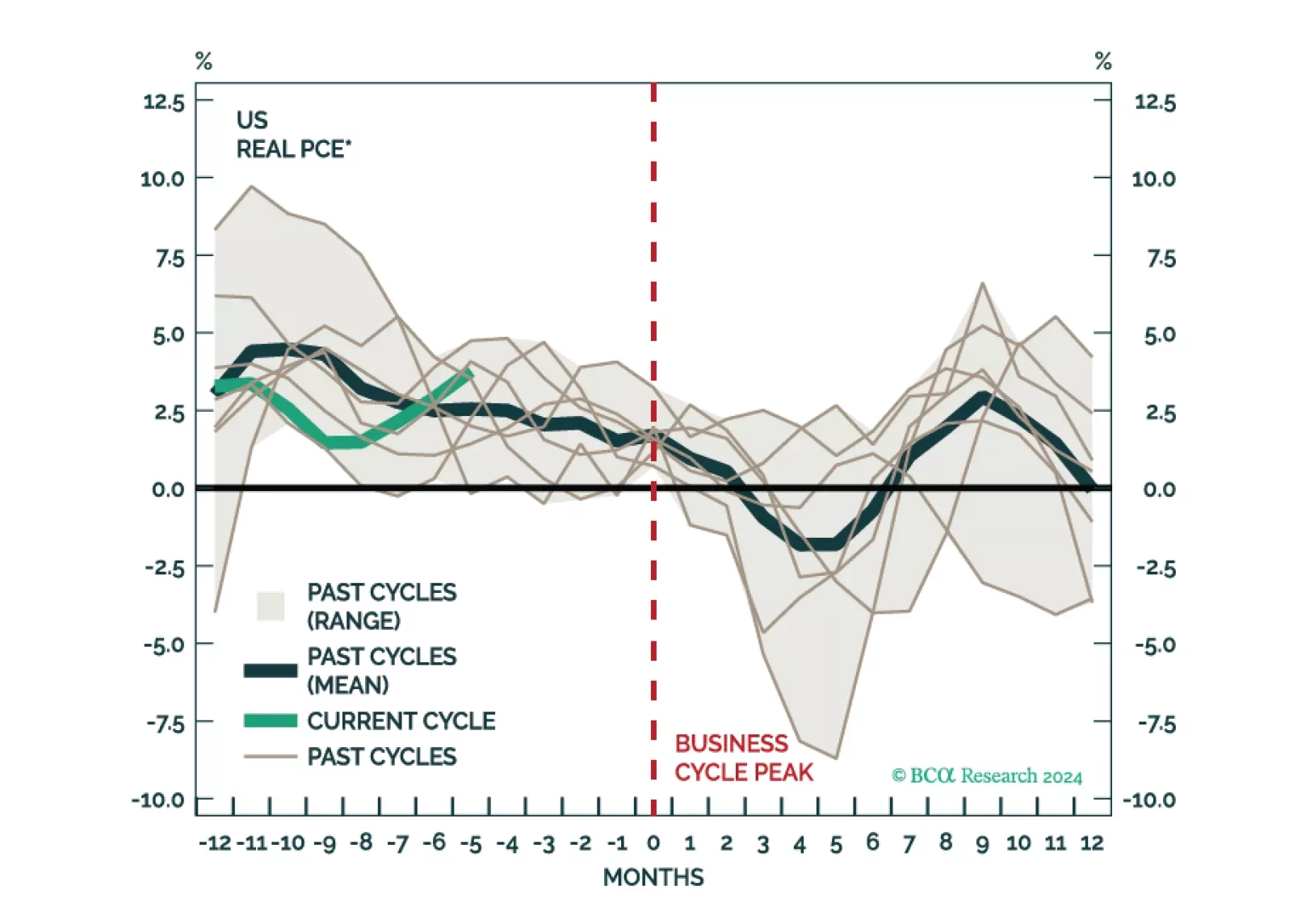

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This…

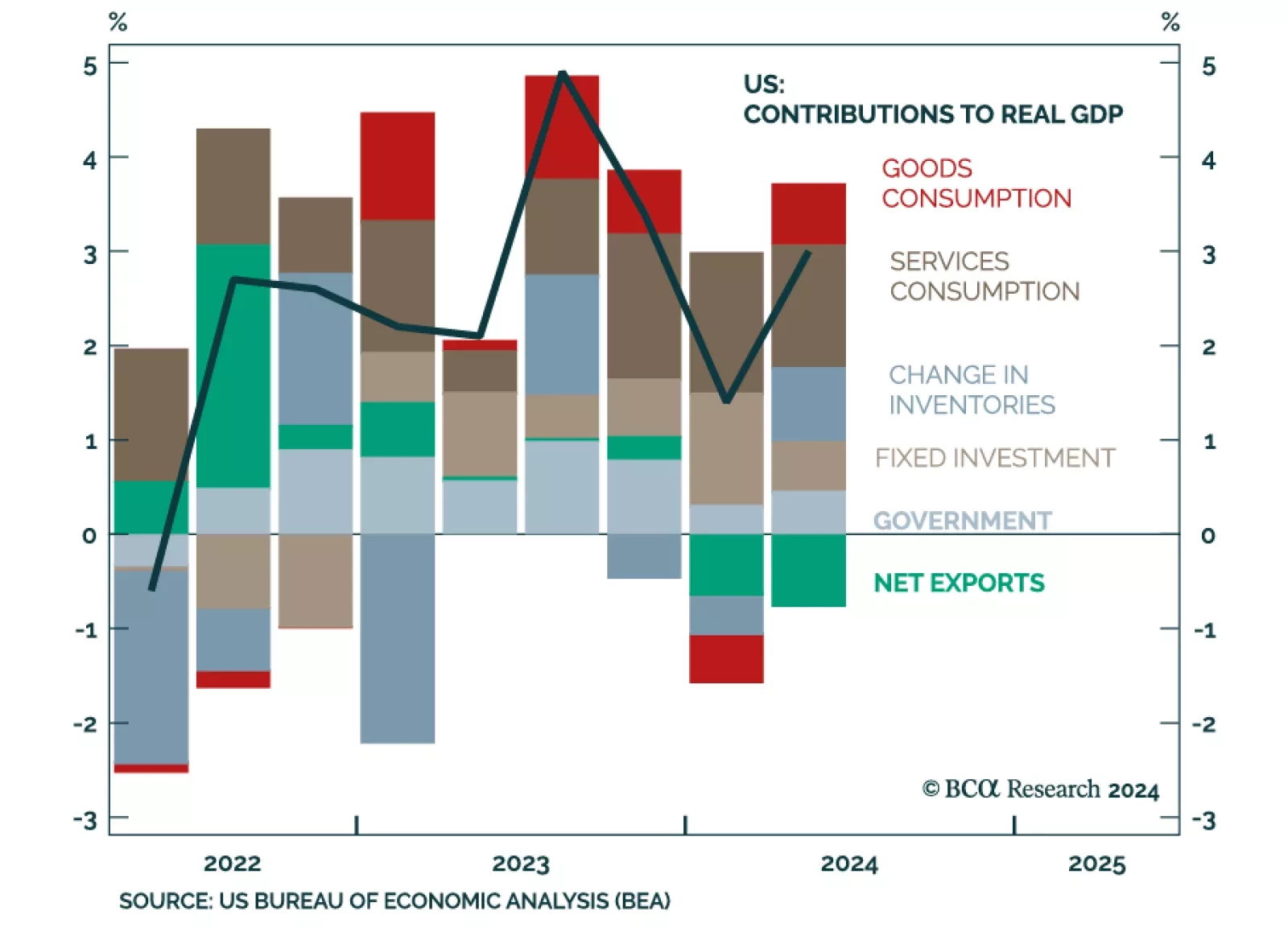

US GDP was unexpectedly revised higher to 3.0% q/q annualized in Q2, from 2.8% previously estimated. A significant upward revision to consumer spending (2.9% from 2.3% against expectations of a downward revision) largely offset…