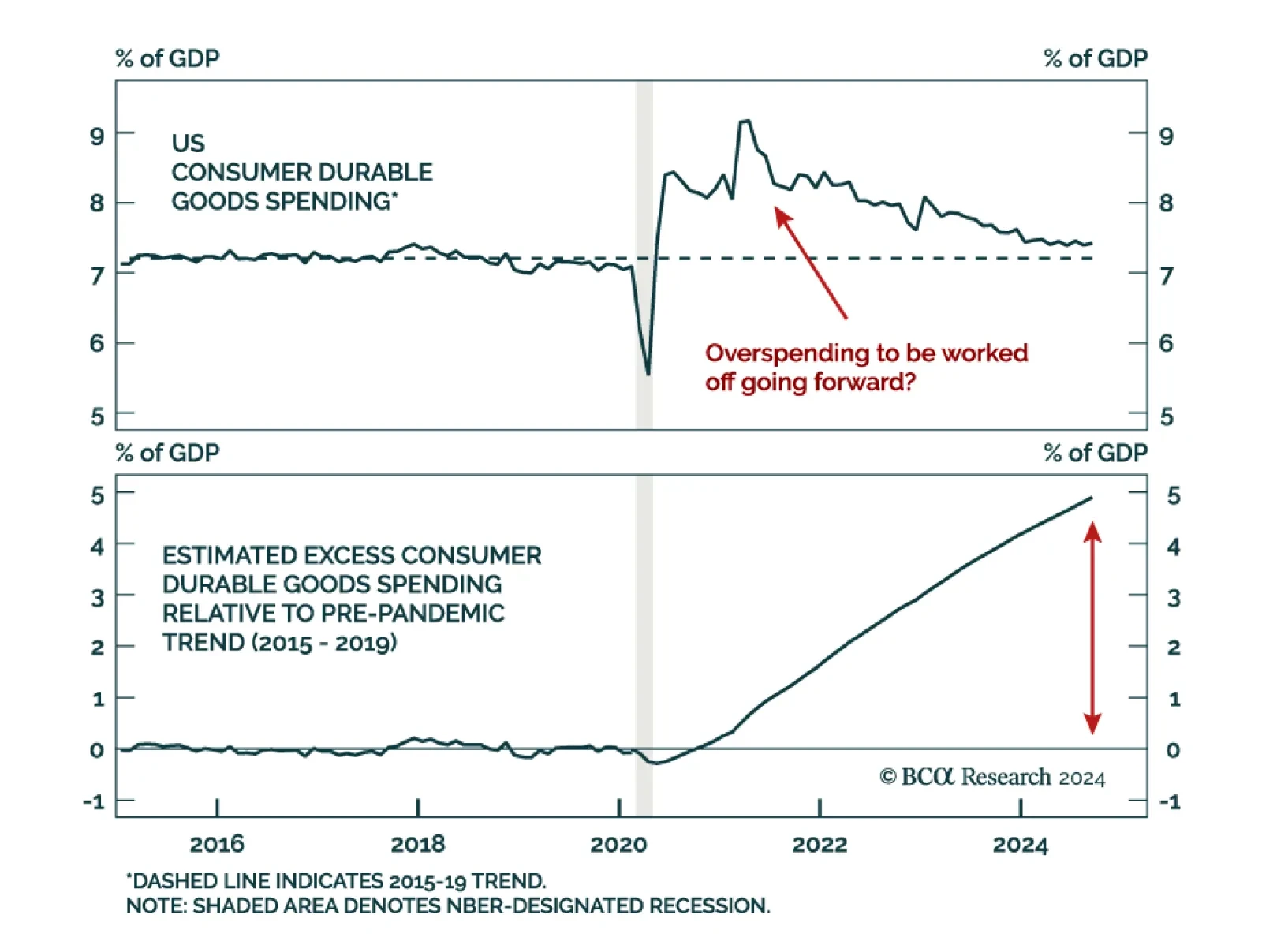

Our US Investment Strategy team analyzed recent US consumer trends through the lens of major retailers’ earnings calls, which highlighted increasingly prudent spending. Consumer caution is apparent in these earnings…

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…

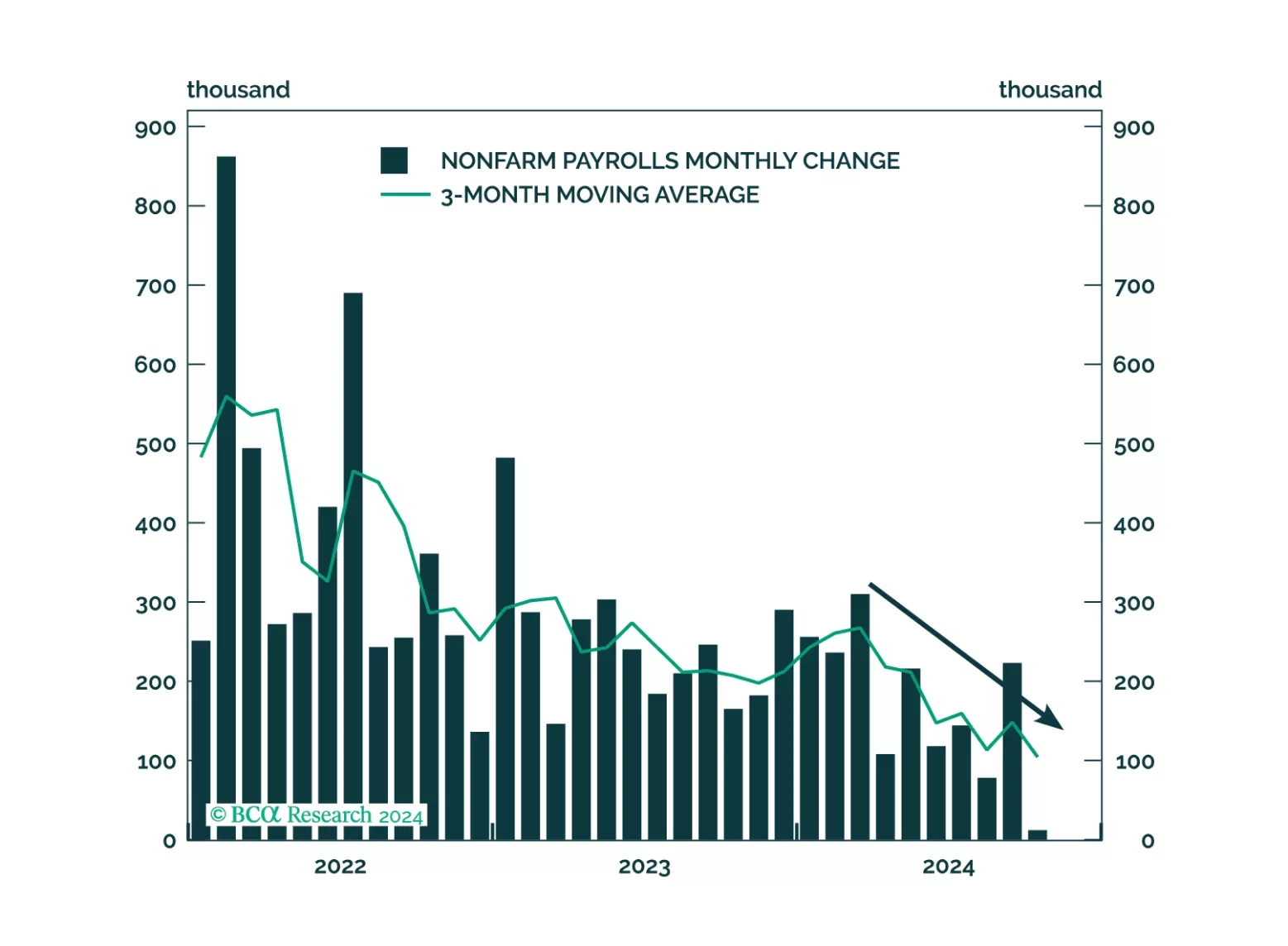

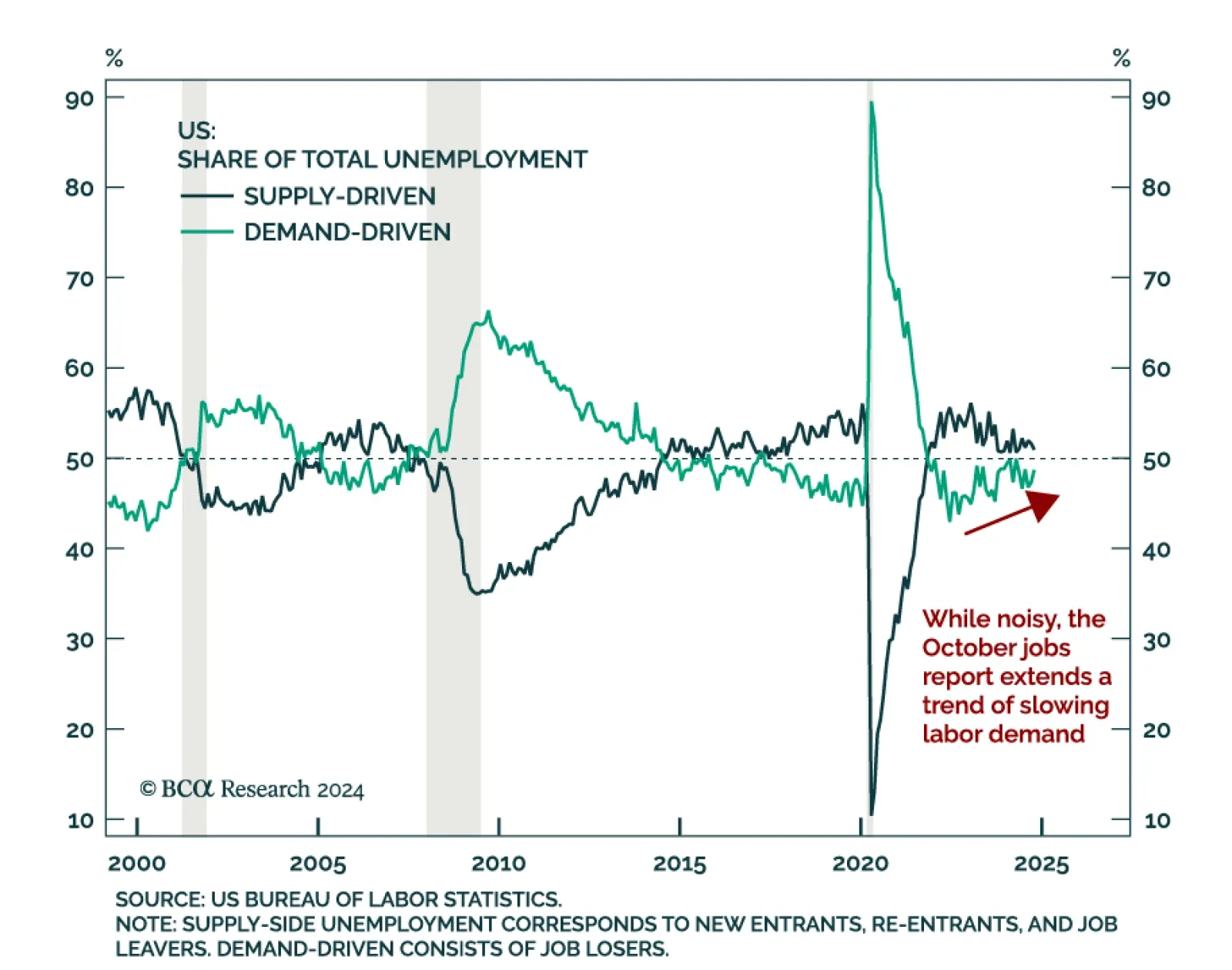

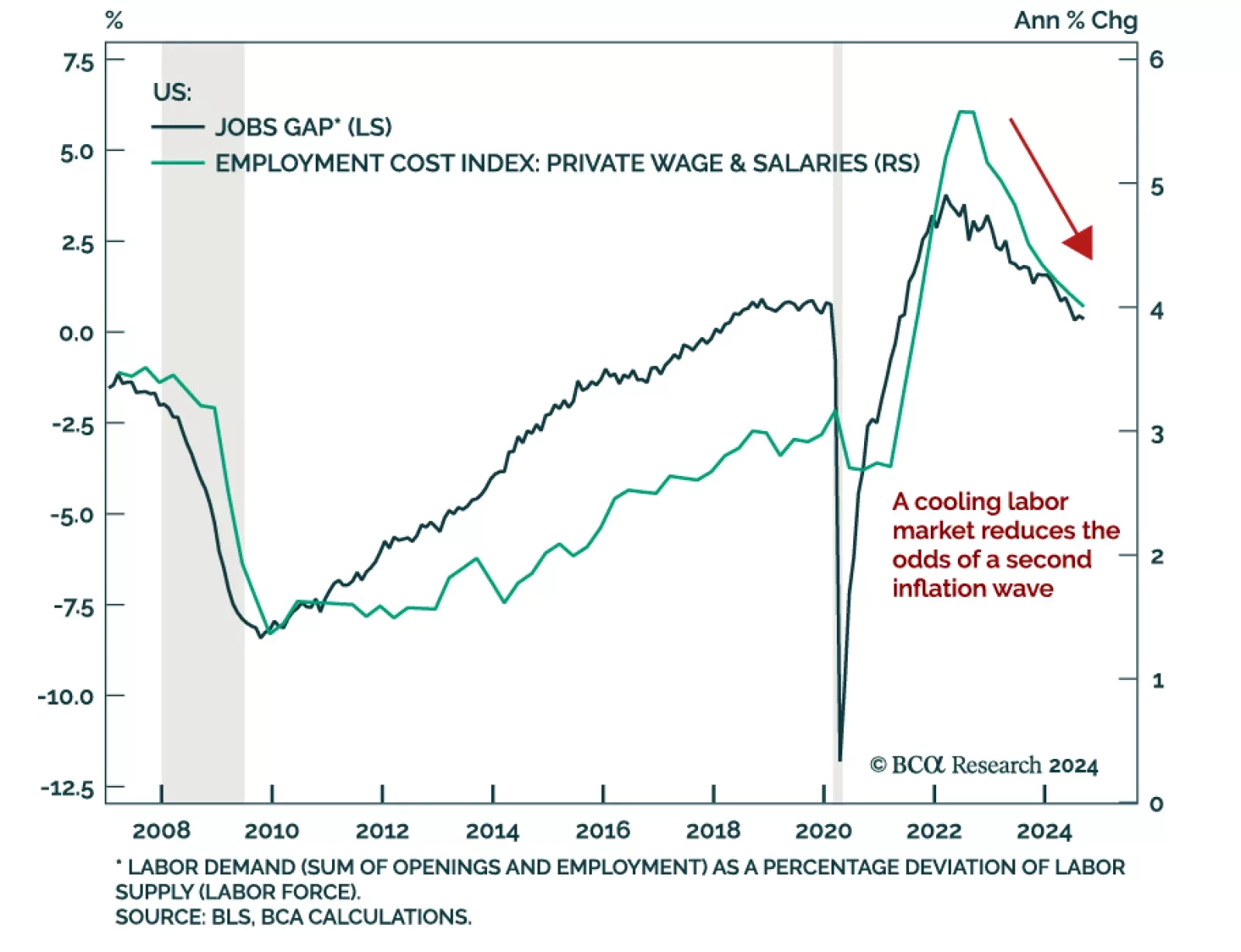

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…

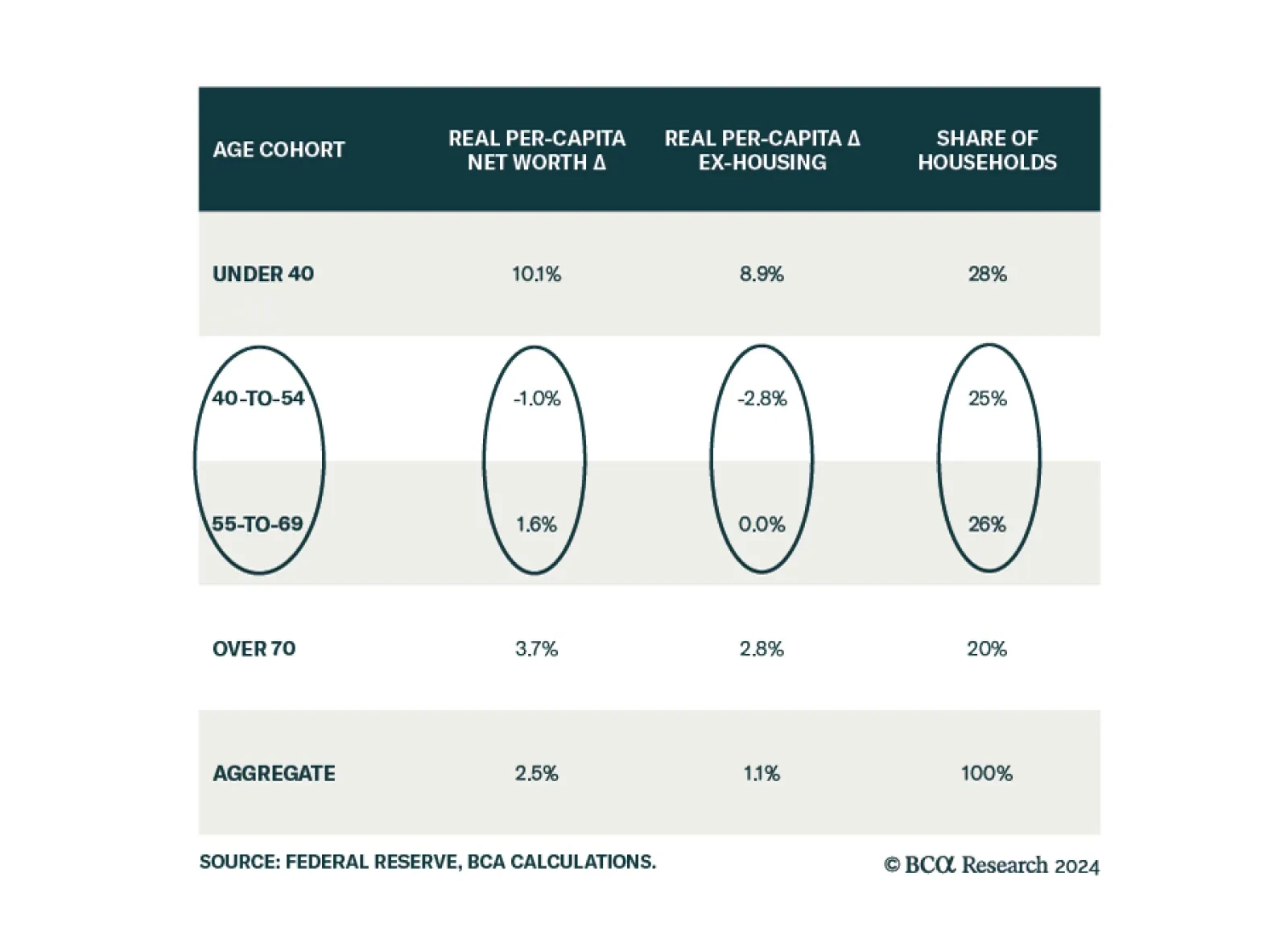

As US consumers remain one of the few engines of global growth, our US Investment Strategy colleagues took a deep dive on consumer trends, augmented with comments from US banks’ earnings calls. Middle-aged consumers have…

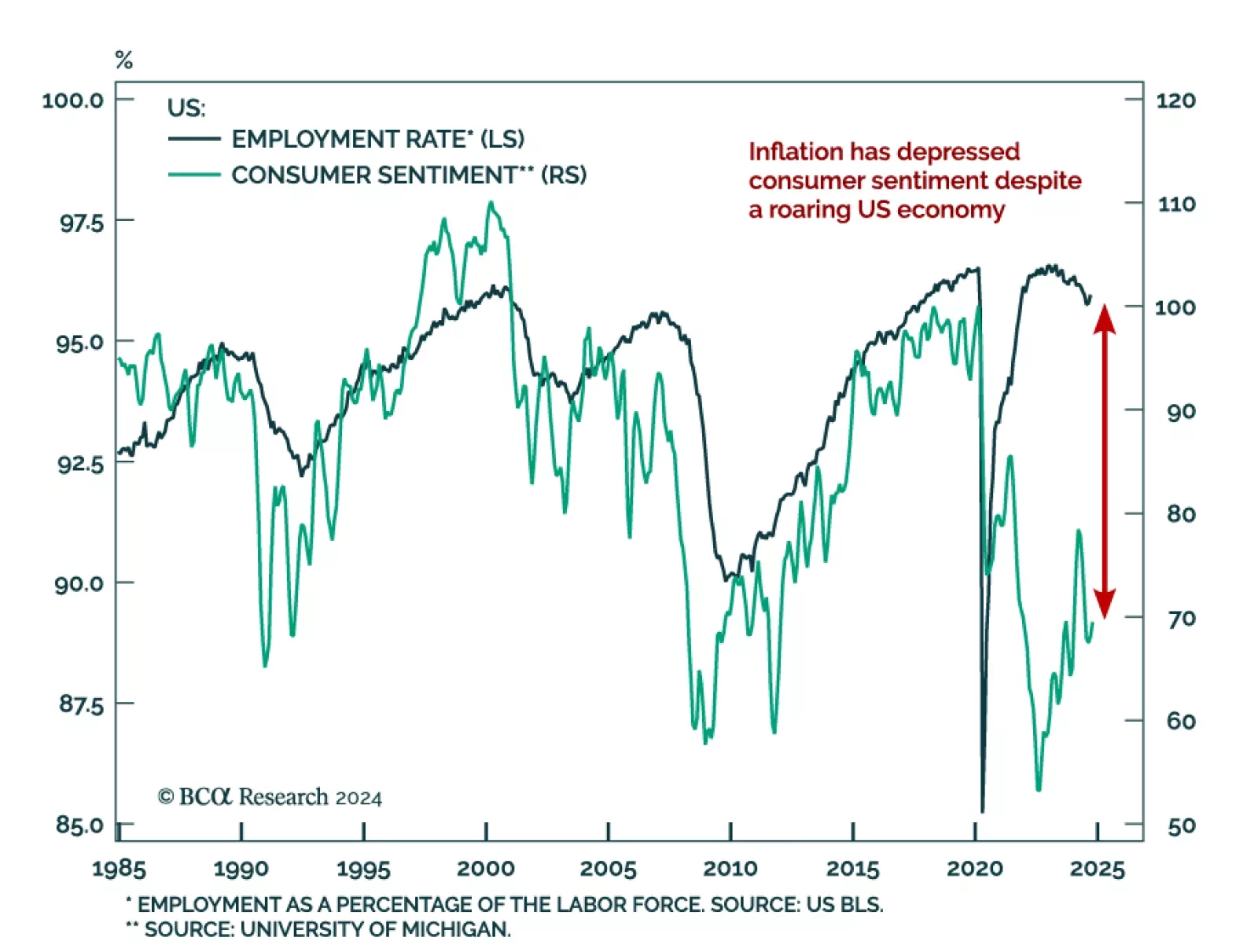

The main driver of global consumer sentiment in the past few years has been high inflation. Nowhere has this been the case more than in the US, where measures of animal spirits were depressed despite a roaring economy. Today,…

Middle-aged households have lagged youngish and older households since the pandemic and the 40-to-54 cohort is worse off than it was at the end of 2019. The fragmenting of the seemingly monolithic US consumer widens the path to a…

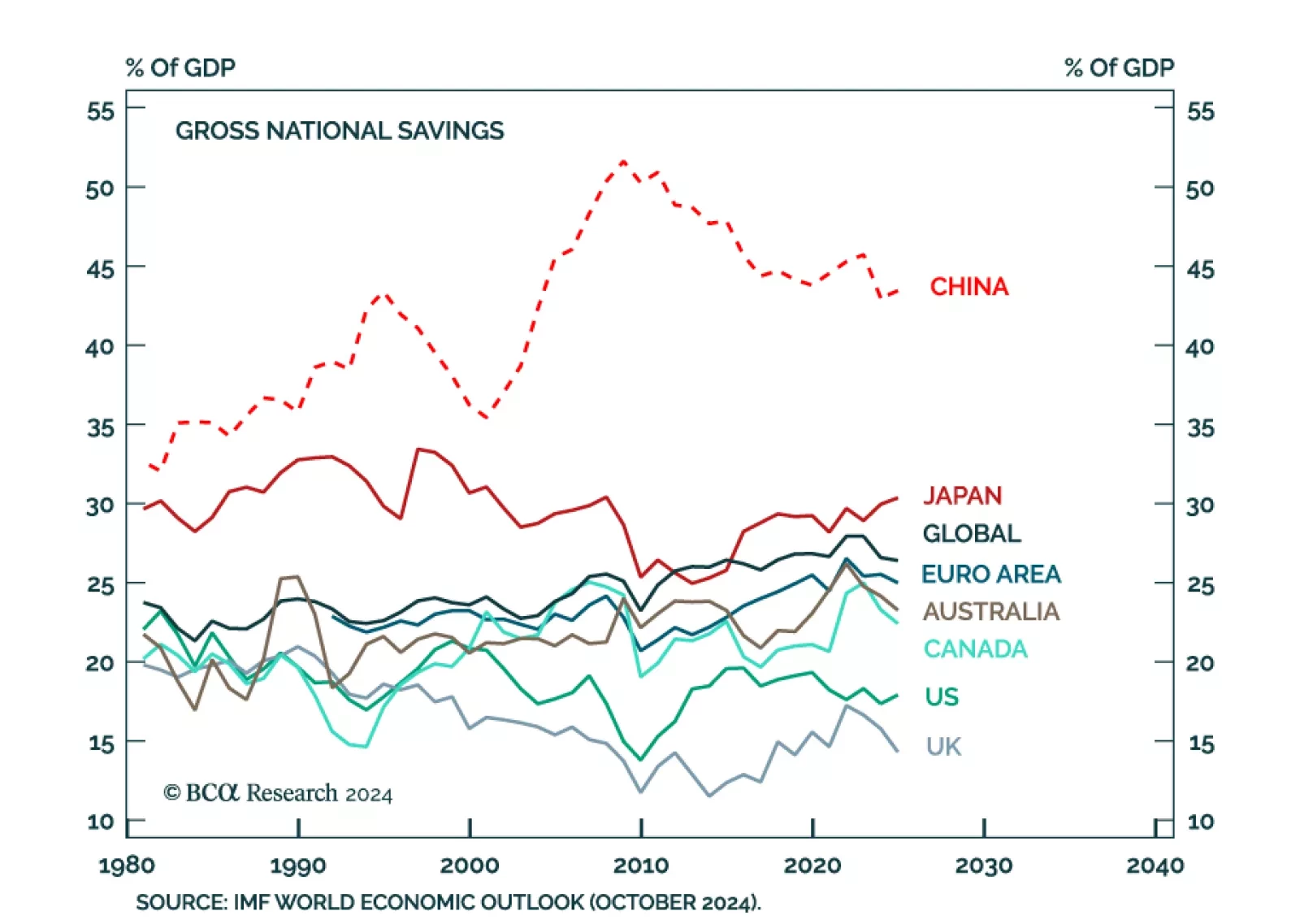

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…