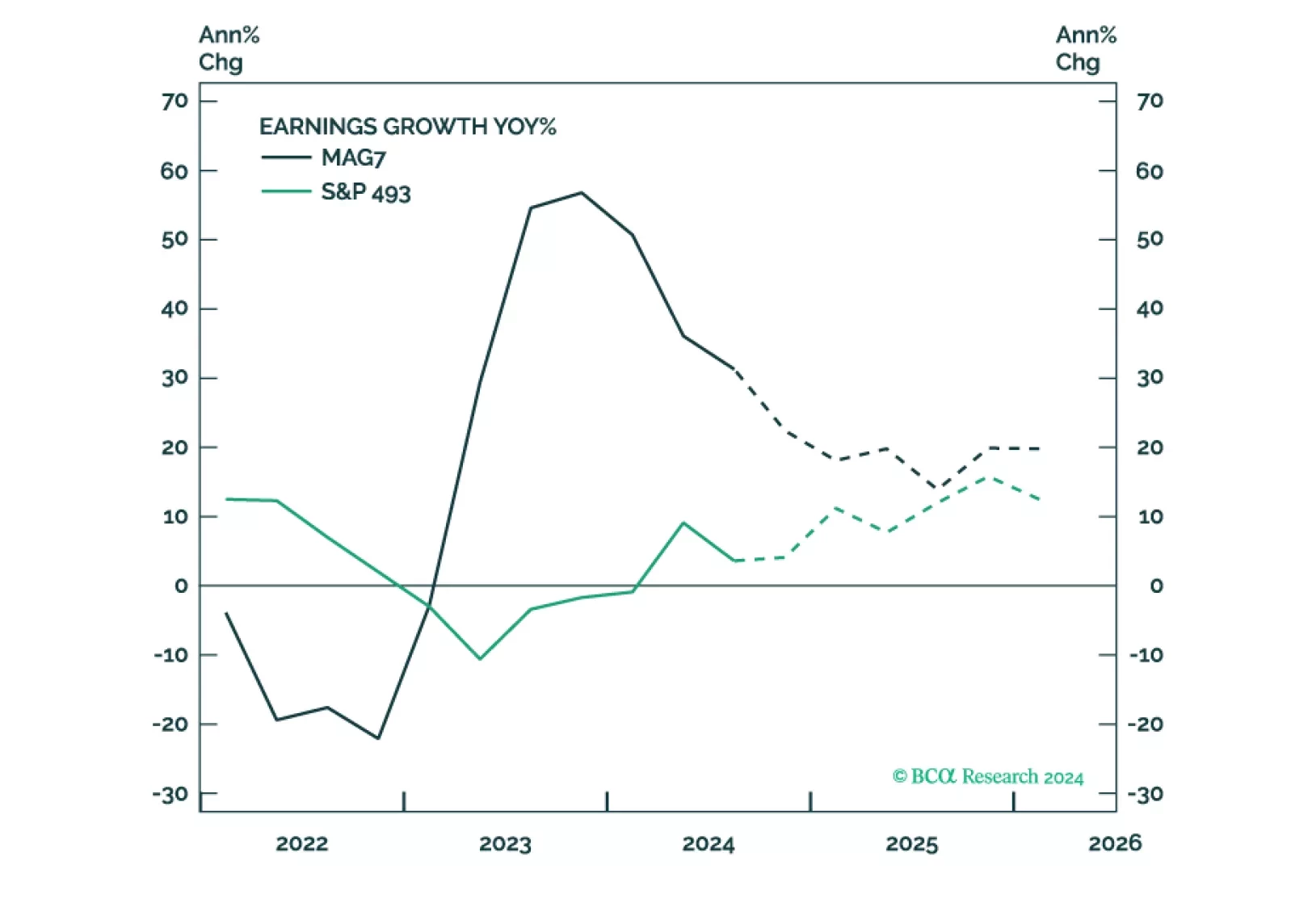

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

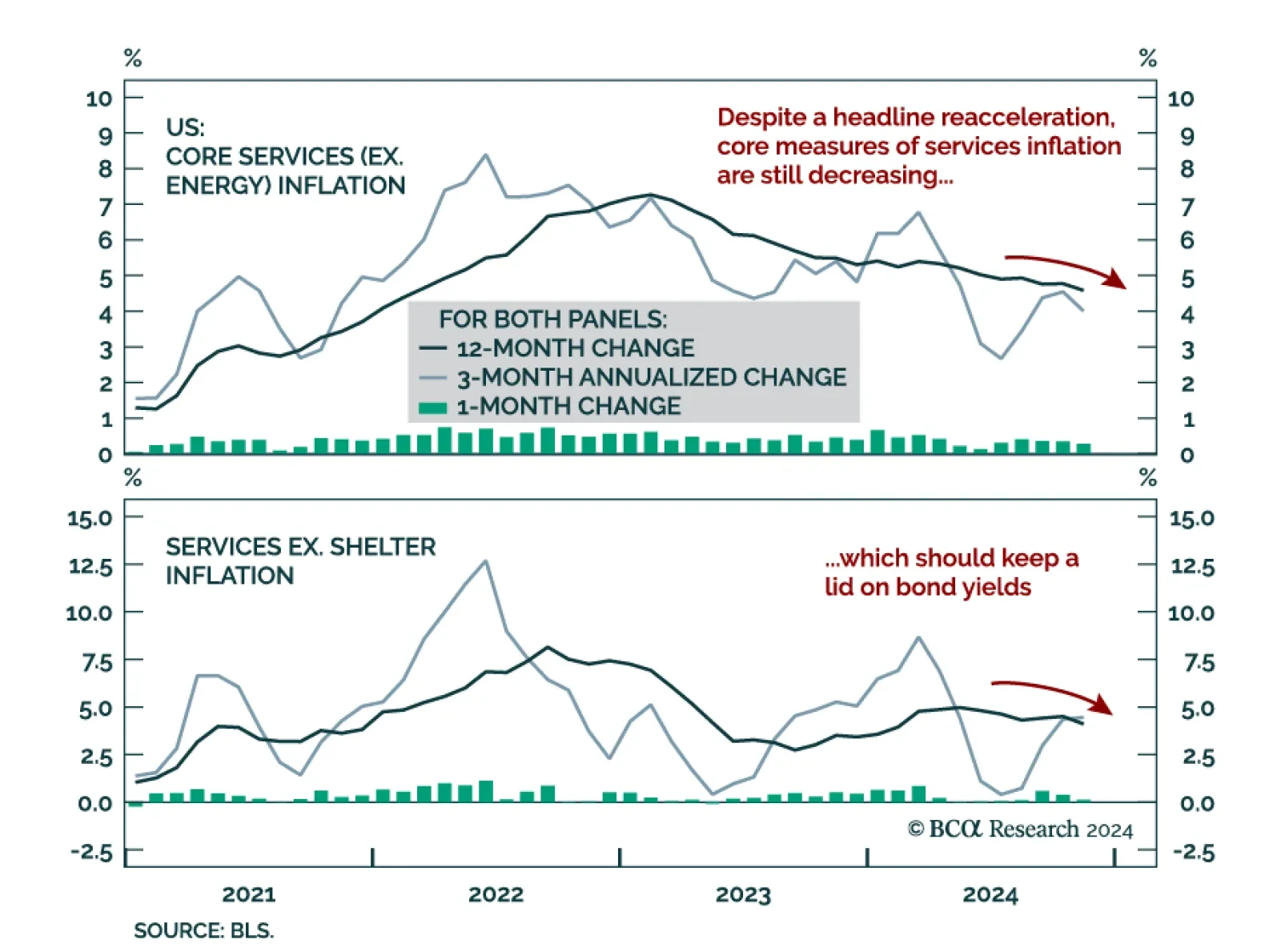

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

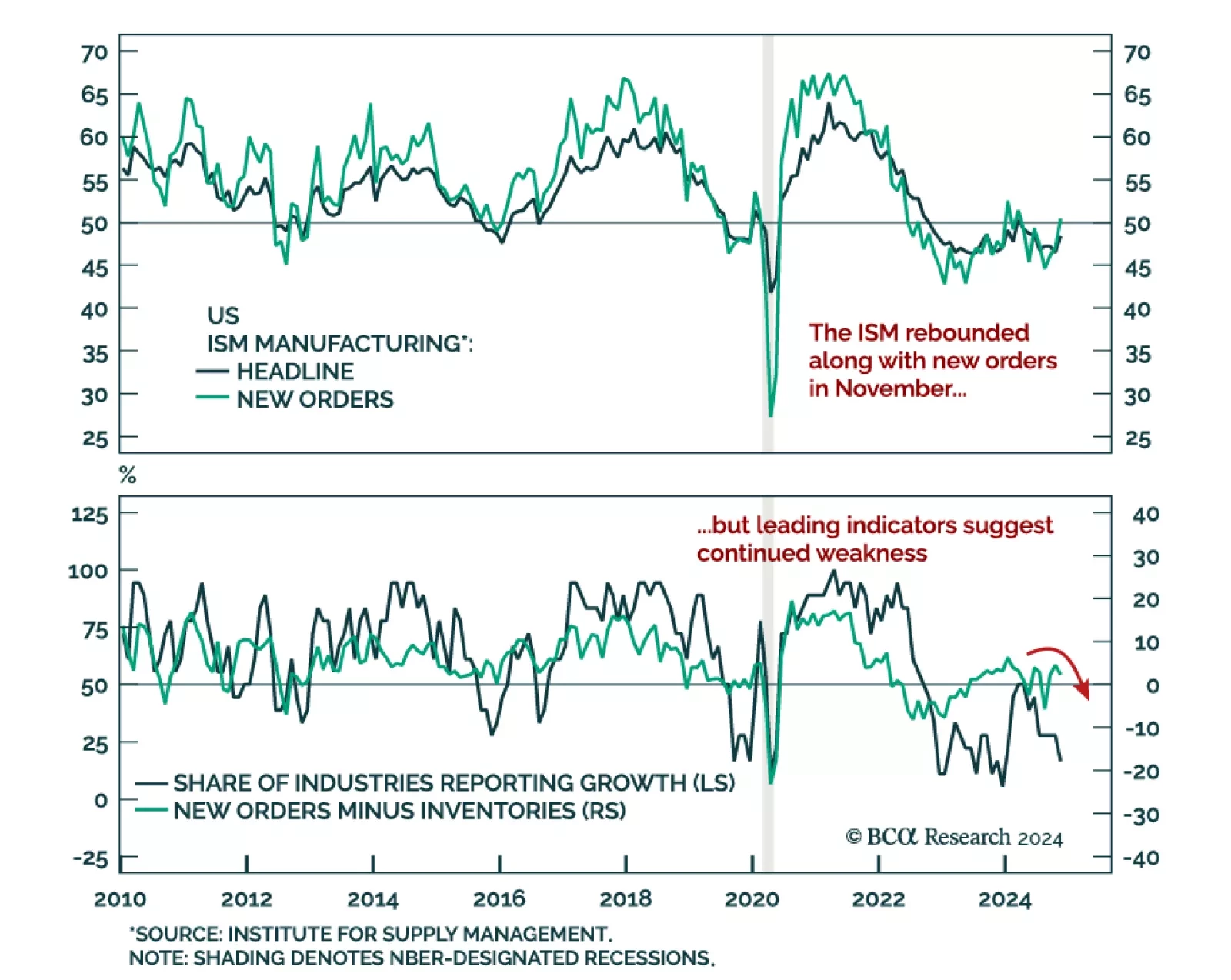

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

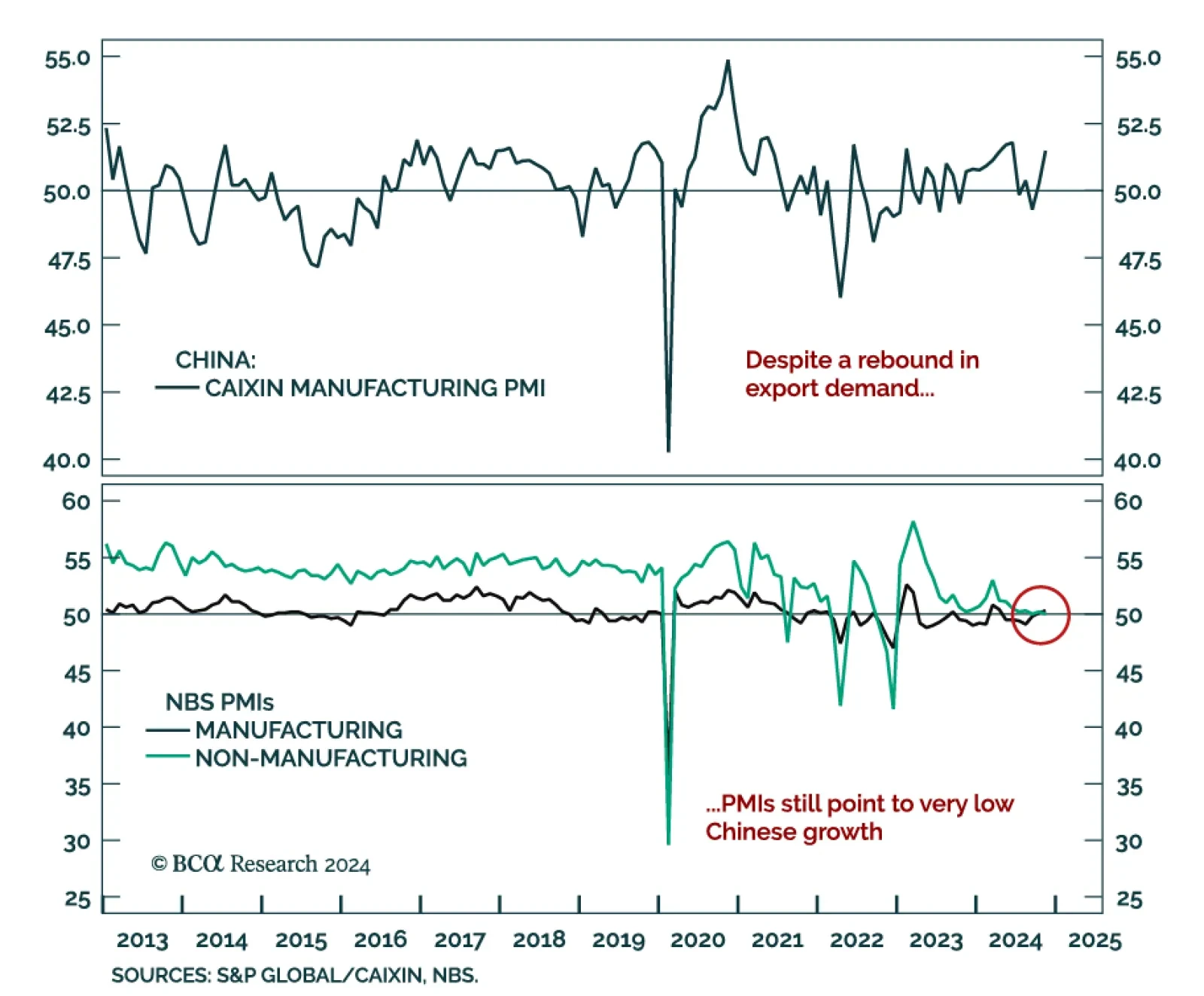

China’s November PMIs were mixed, and reflected very low growth. The official composite PMI was unchanged at 50.8, driven by a small uptick in manufacturing to 50.3 and a small downtick of services to 50. The Caixin…

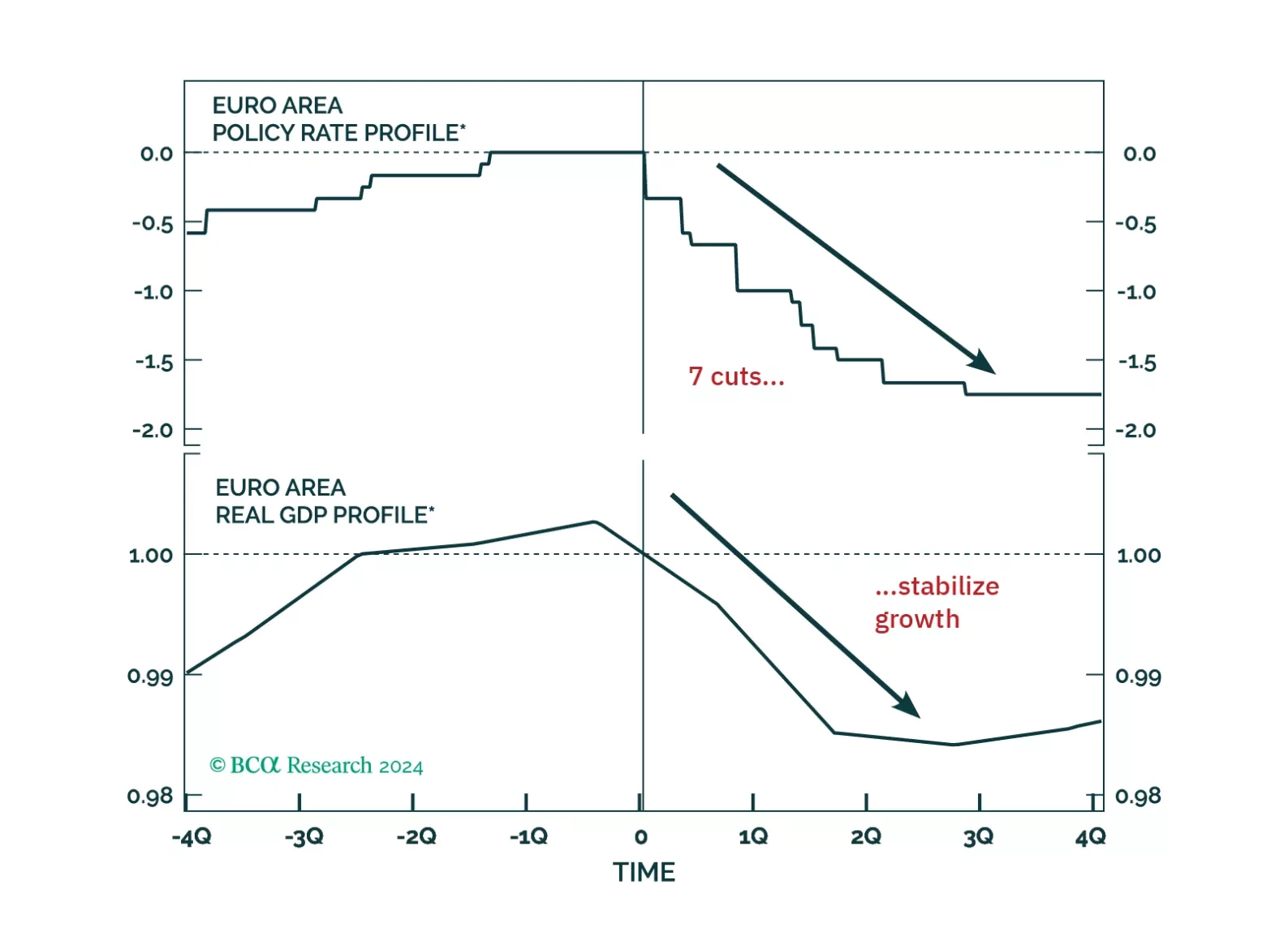

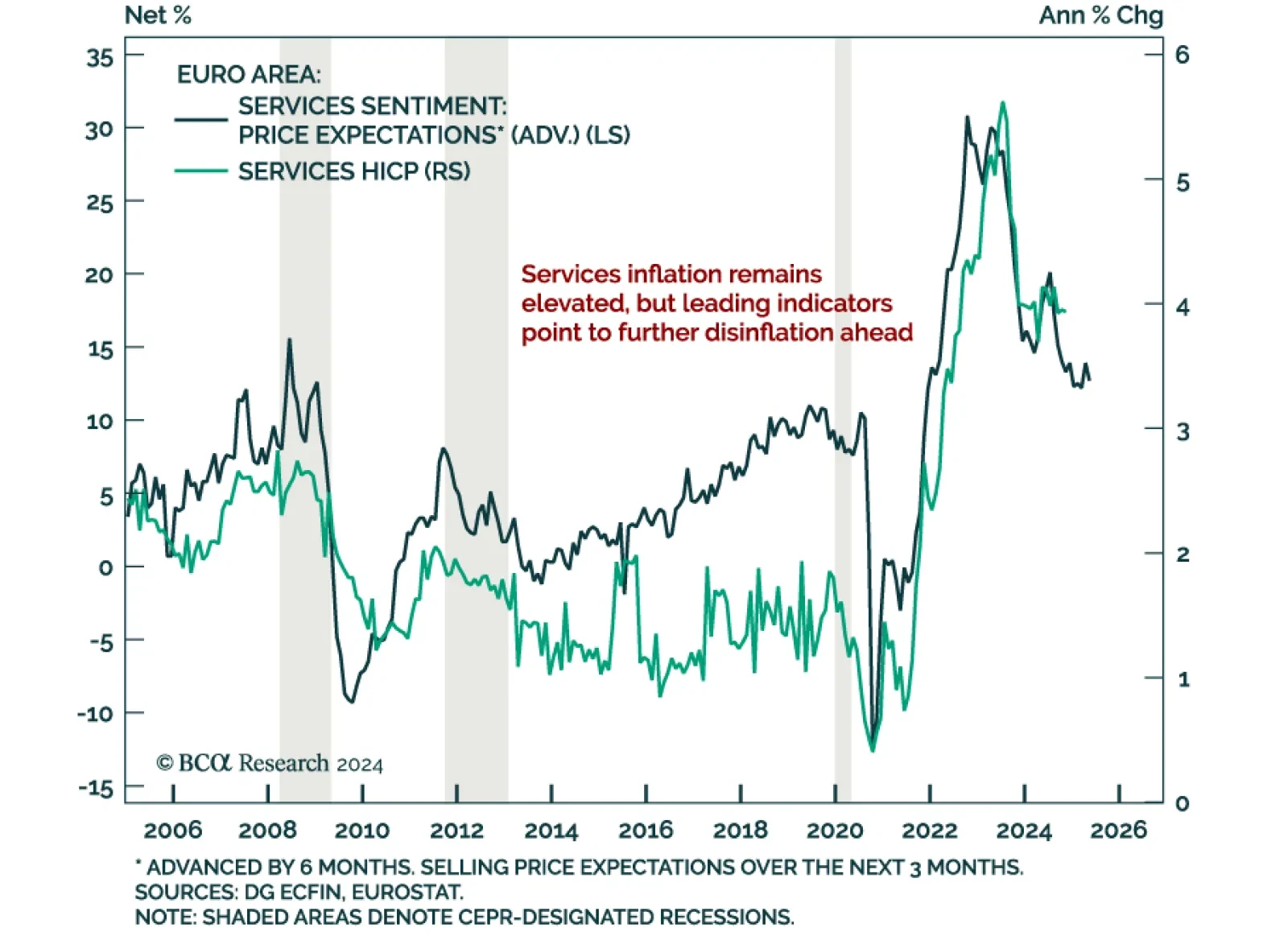

The November flash Eurozone inflation estimate met expectations, with headline HICP accelerating to 2.3% y/y from 2.0% in October, above the ECB’s target. Core inflation remained constant at 2.7%. At 3.9%, services…

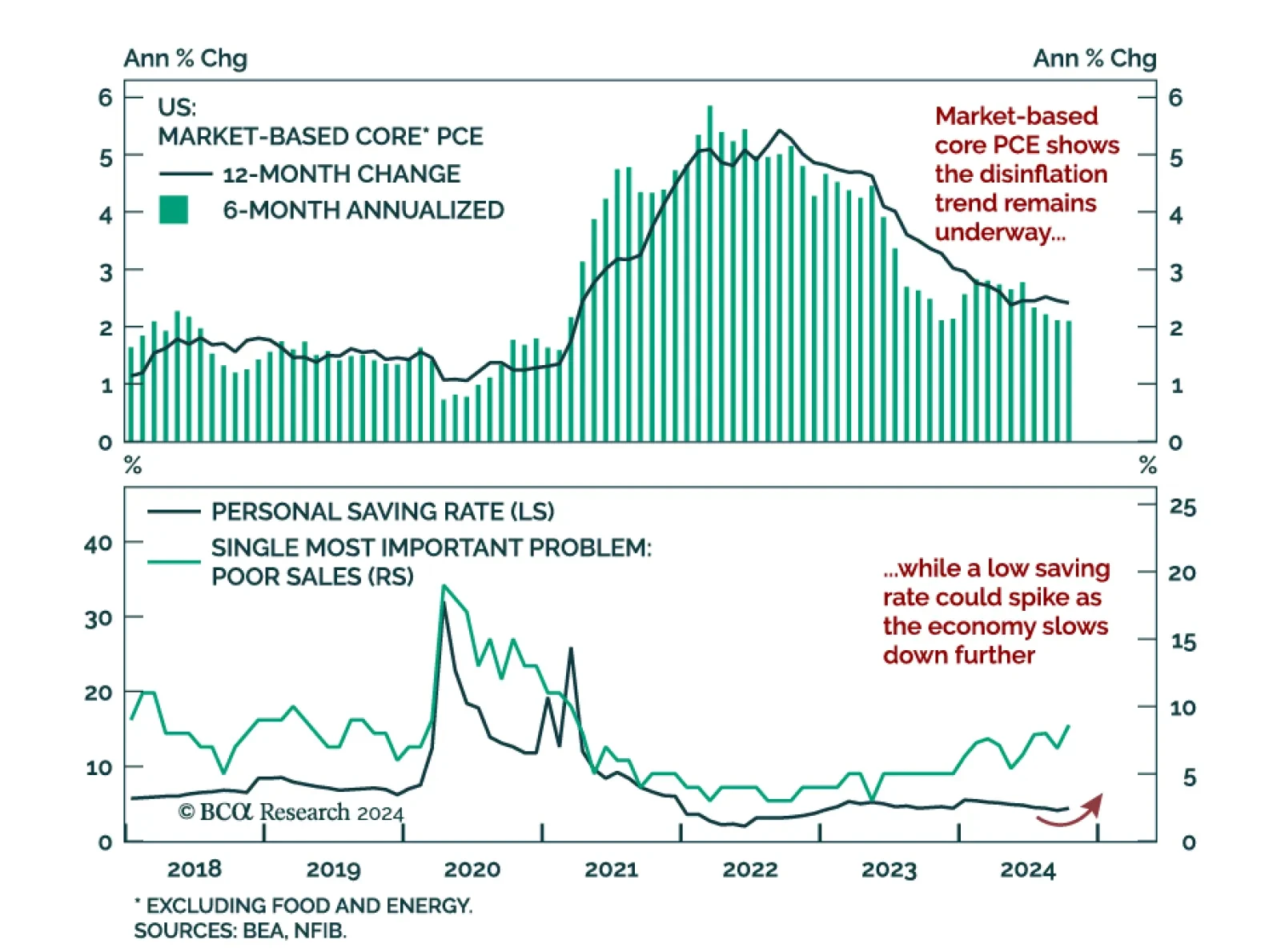

The Fed’s preferred measure of inflation, core PCE, met expectations of 0.3% m/m in October, and accelerated to 2.8% y/y from 2.7% in September. Inflation rose on the back of hot inputs from the PPI report, which is not…

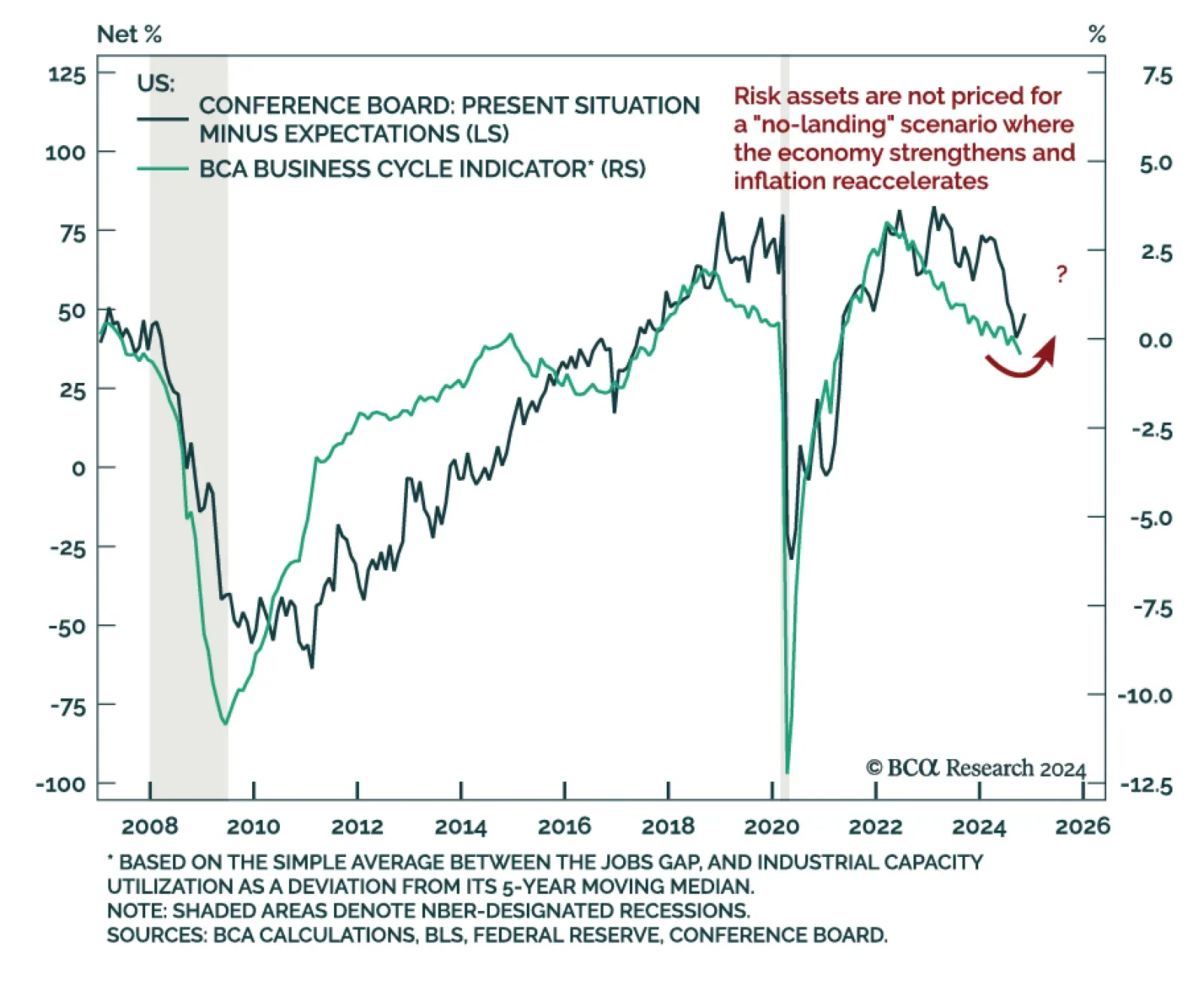

Consumer confidence came in as expected in November, with The Conference Board’s index rising to 111.7 from 108.7 in October, a level not seen since August 2023. Both the assessment of consumers’ present and future…