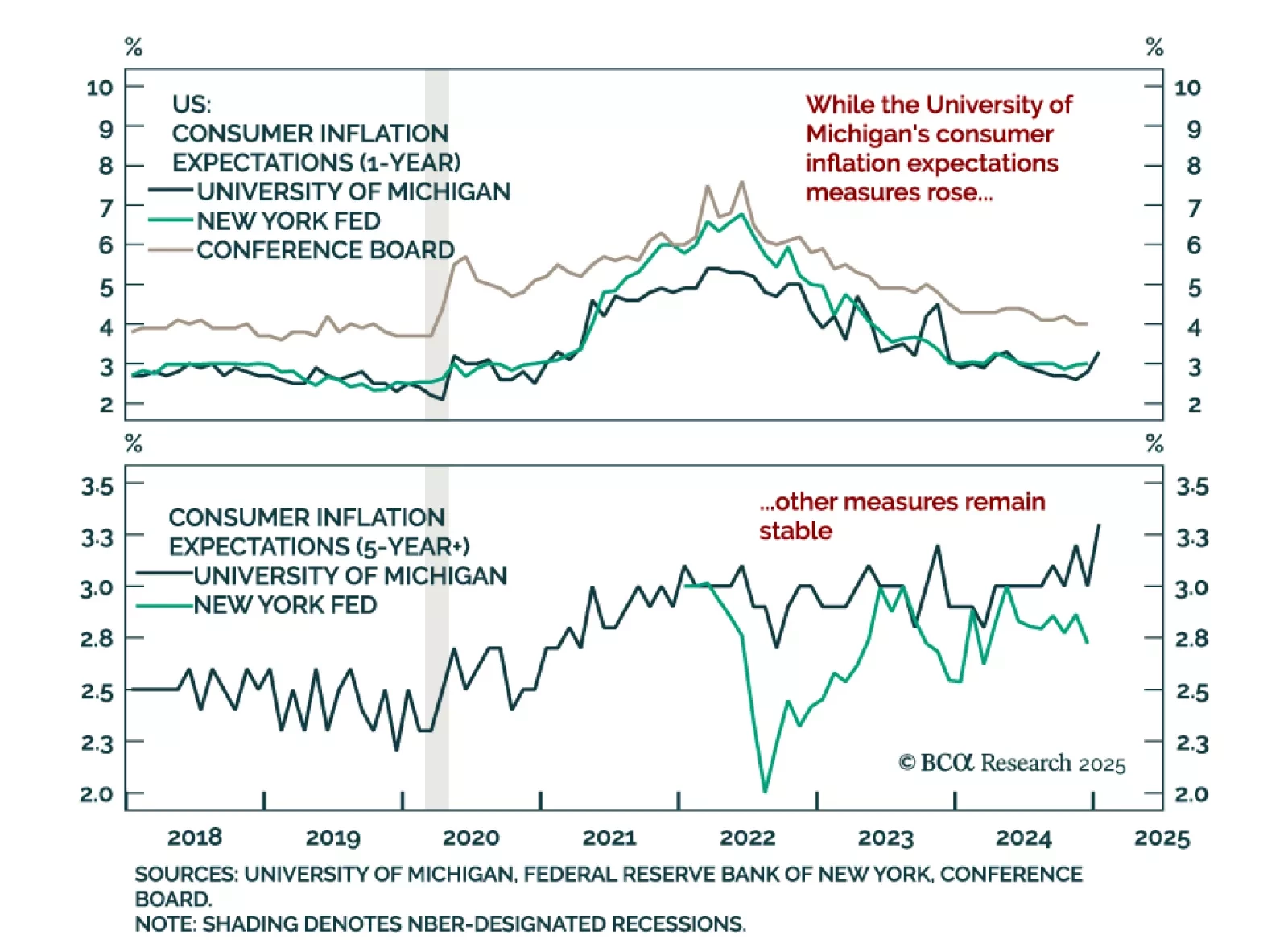

The preliminary January University of Michigan Consumer Sentiment Index missed estimates on Friday, driven by a cooling of consumer expectations. Worryingly, both the 1-year and 5-to-10 year inflation expectations ticked up to 3.3%…

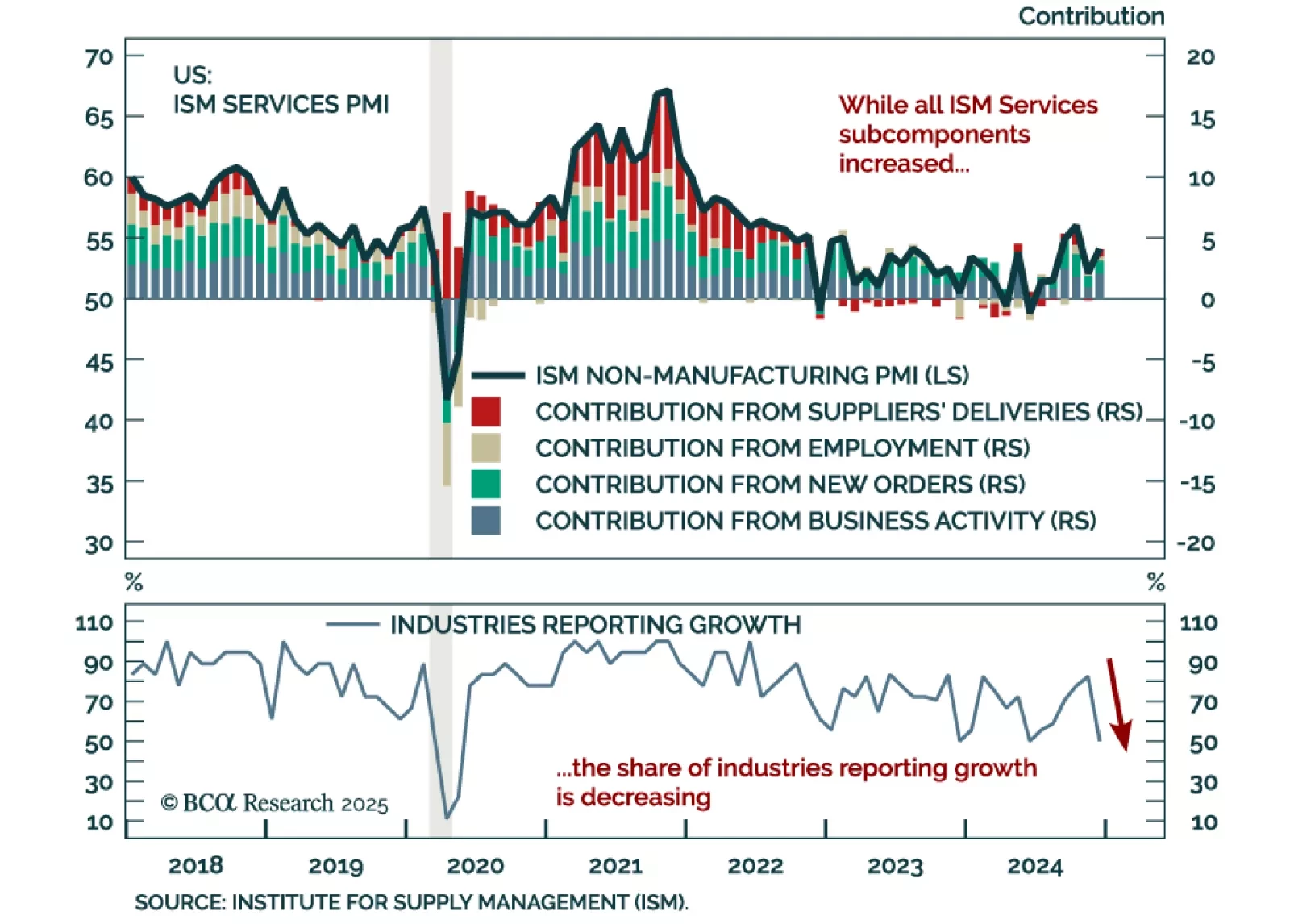

The December ISM Services PMI beat estimates, increasing to 54.1 from 52.1 in November. All subcomponents increased except for employment, which nonetheless remains in expansion. The prices paid component was especially strong,…

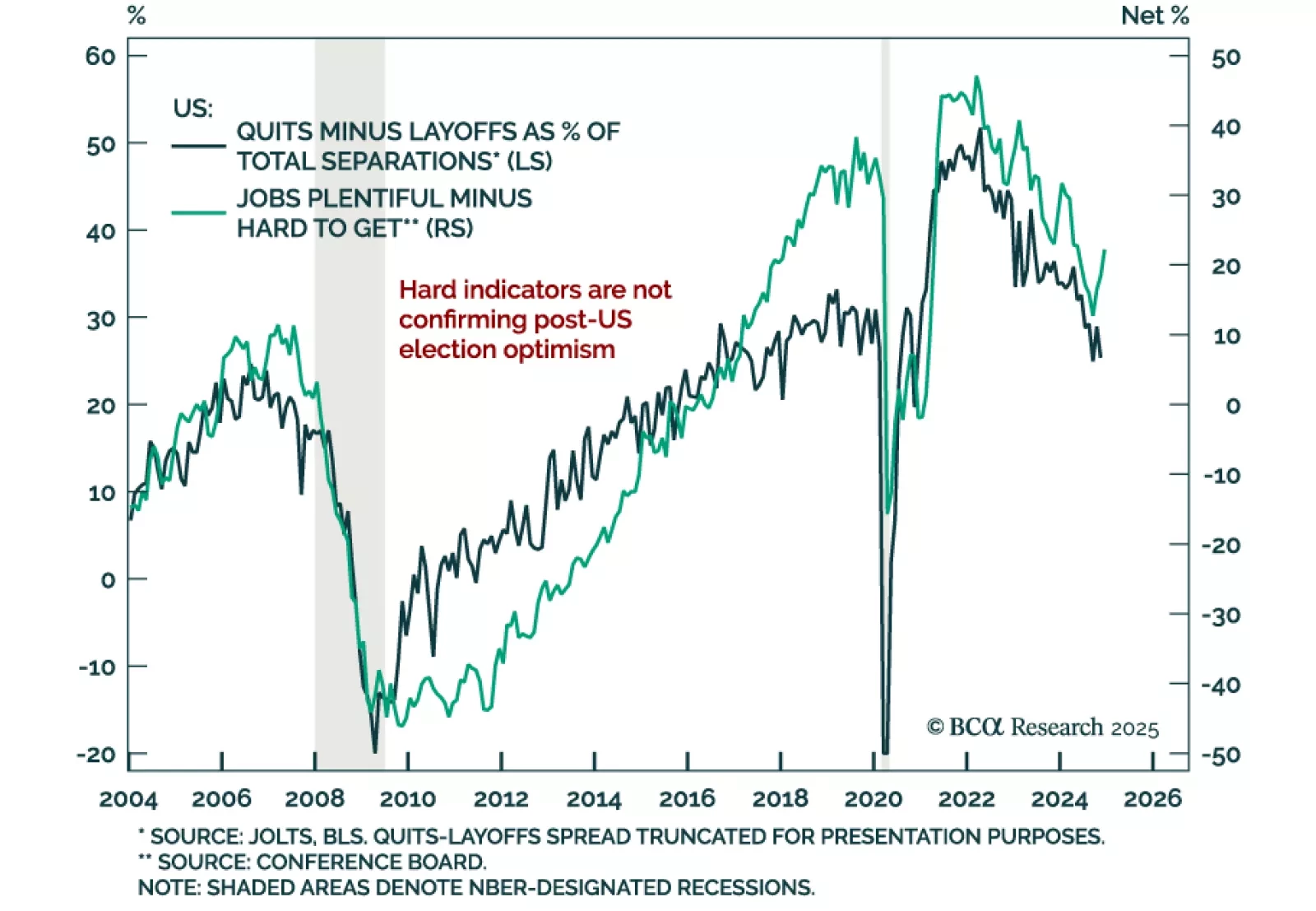

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

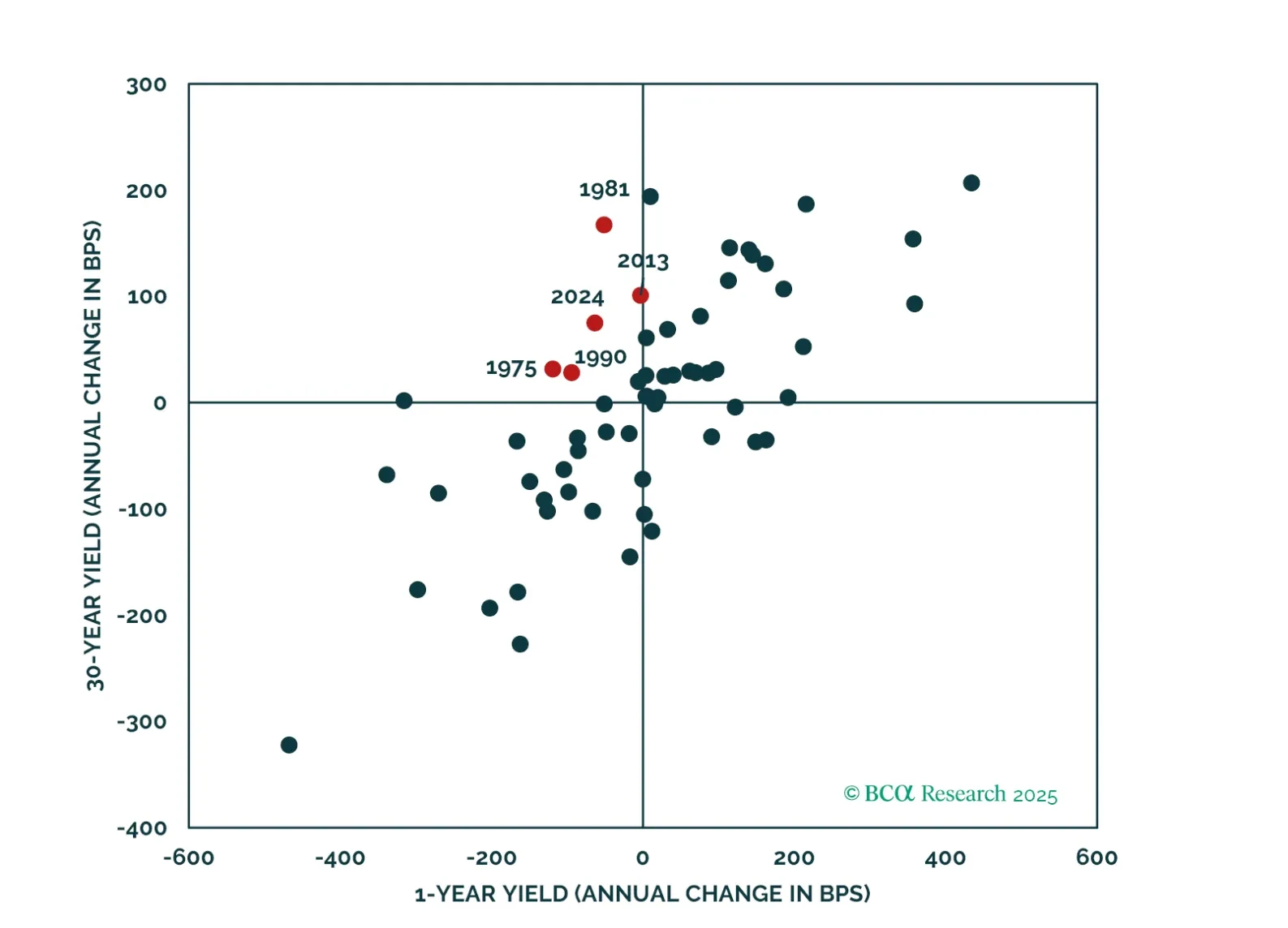

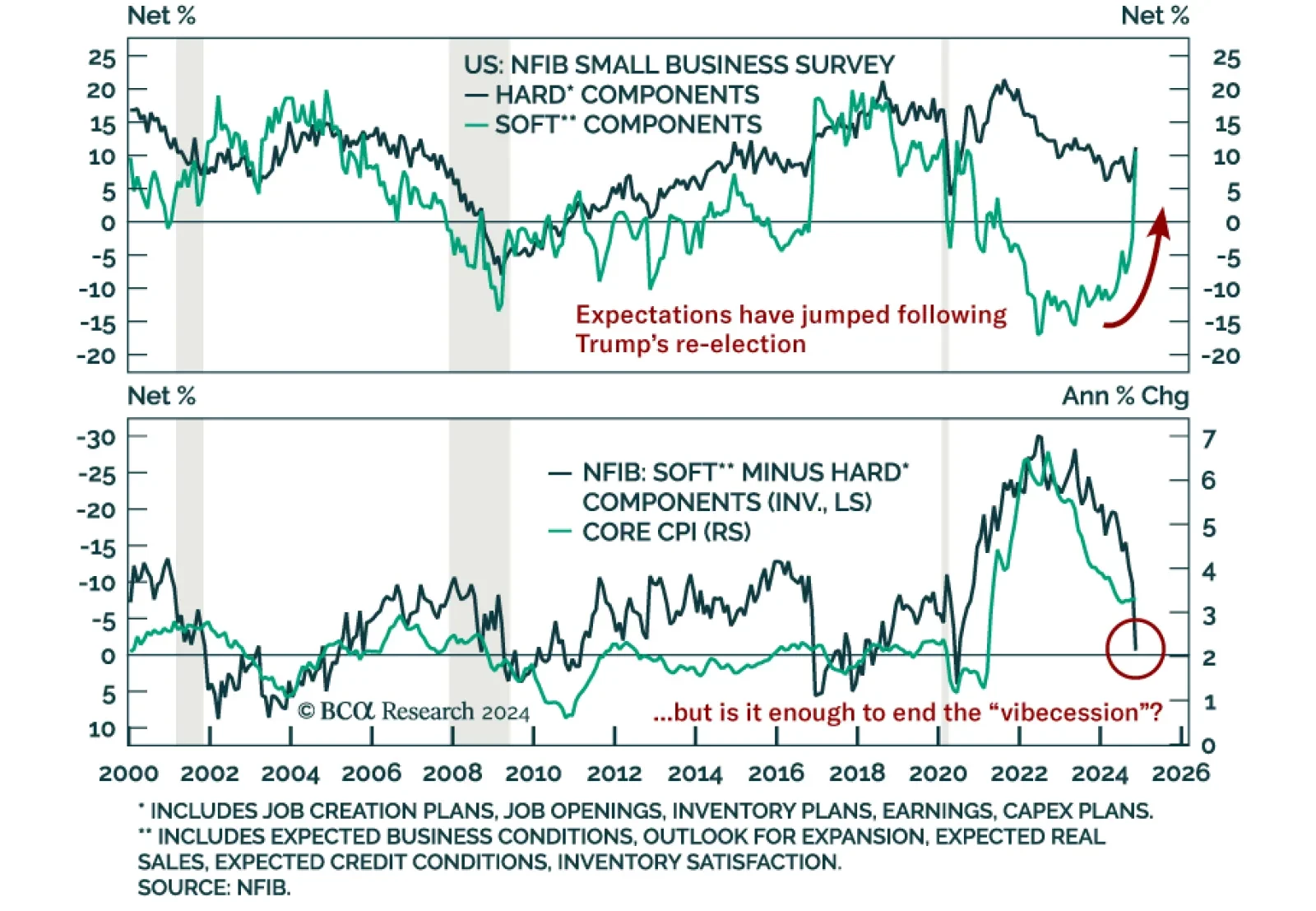

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

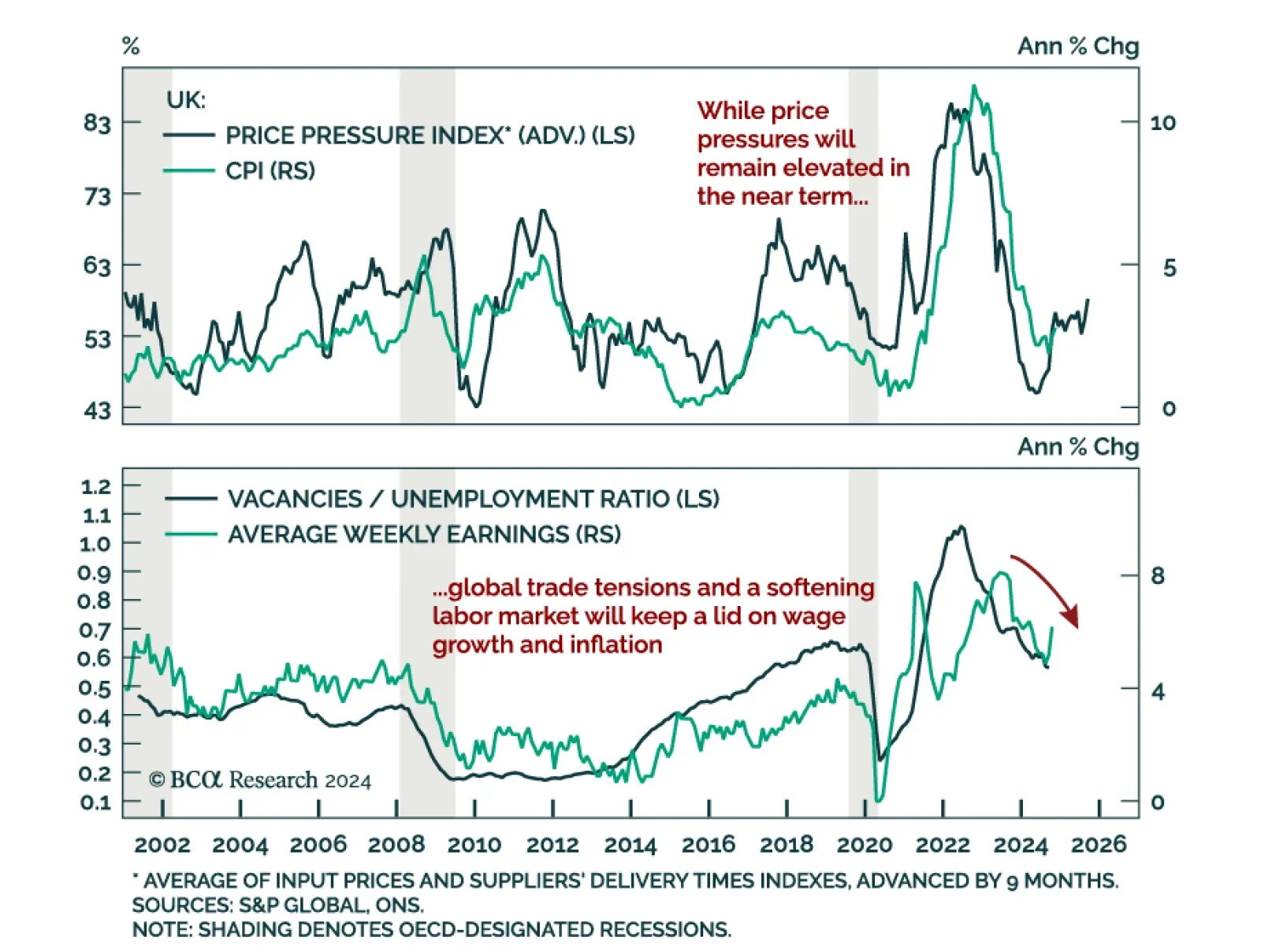

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

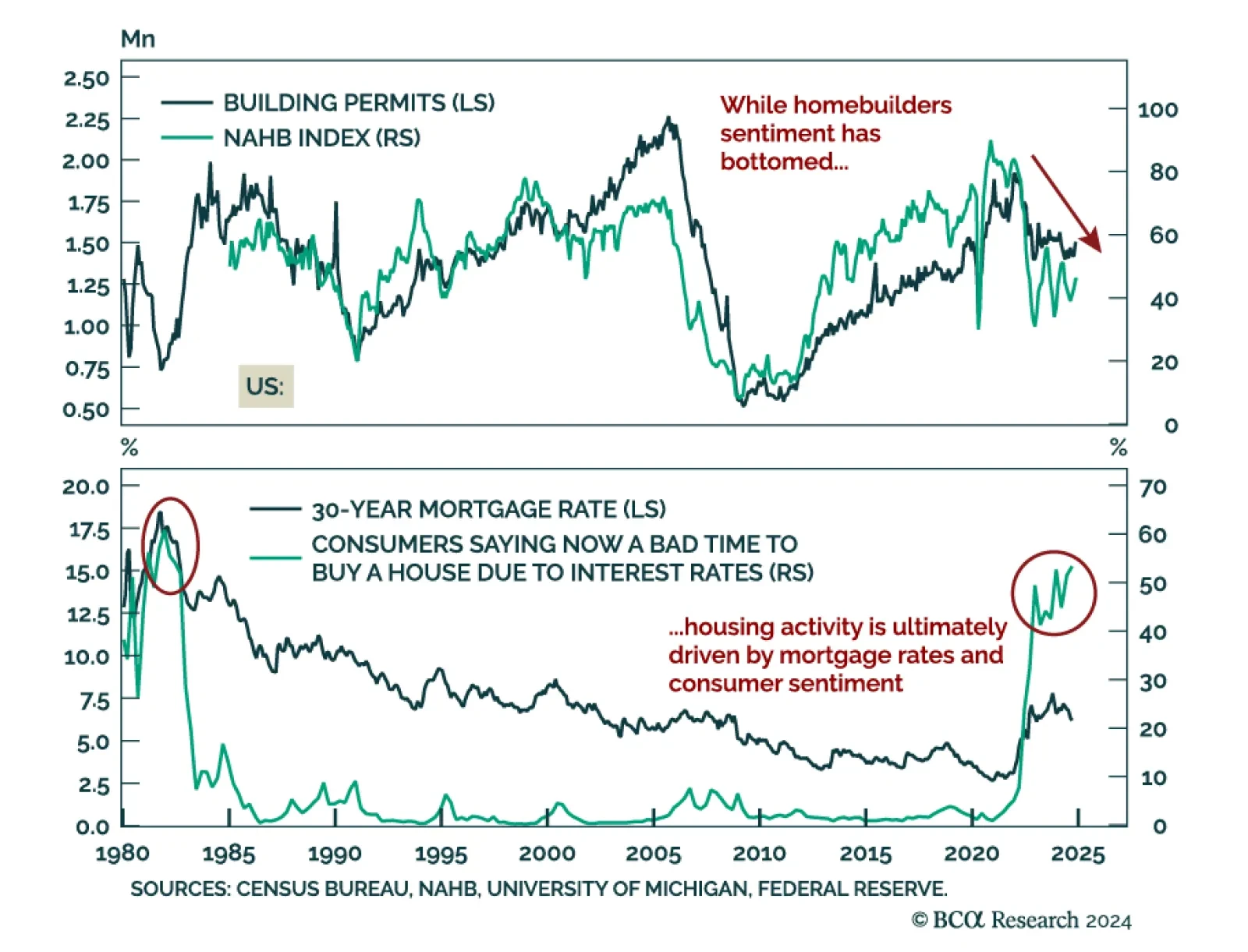

US November housing data was mixed, but still reflected a weak picture. Housing starts were down 1.8% m/m, below expectations of a 2.6% increase. However, building permits were stronger than expected, increasing 6.1%. Units under…

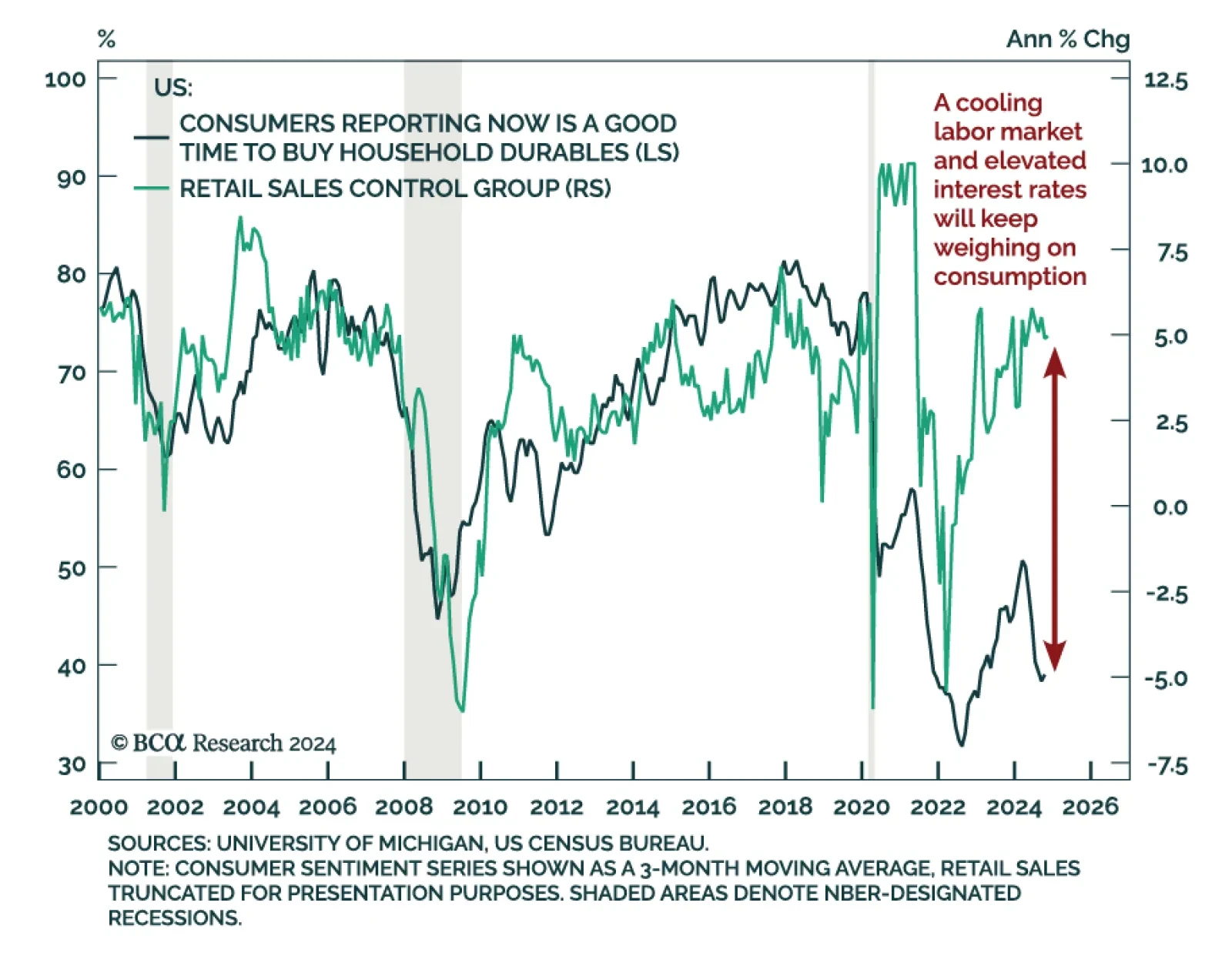

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

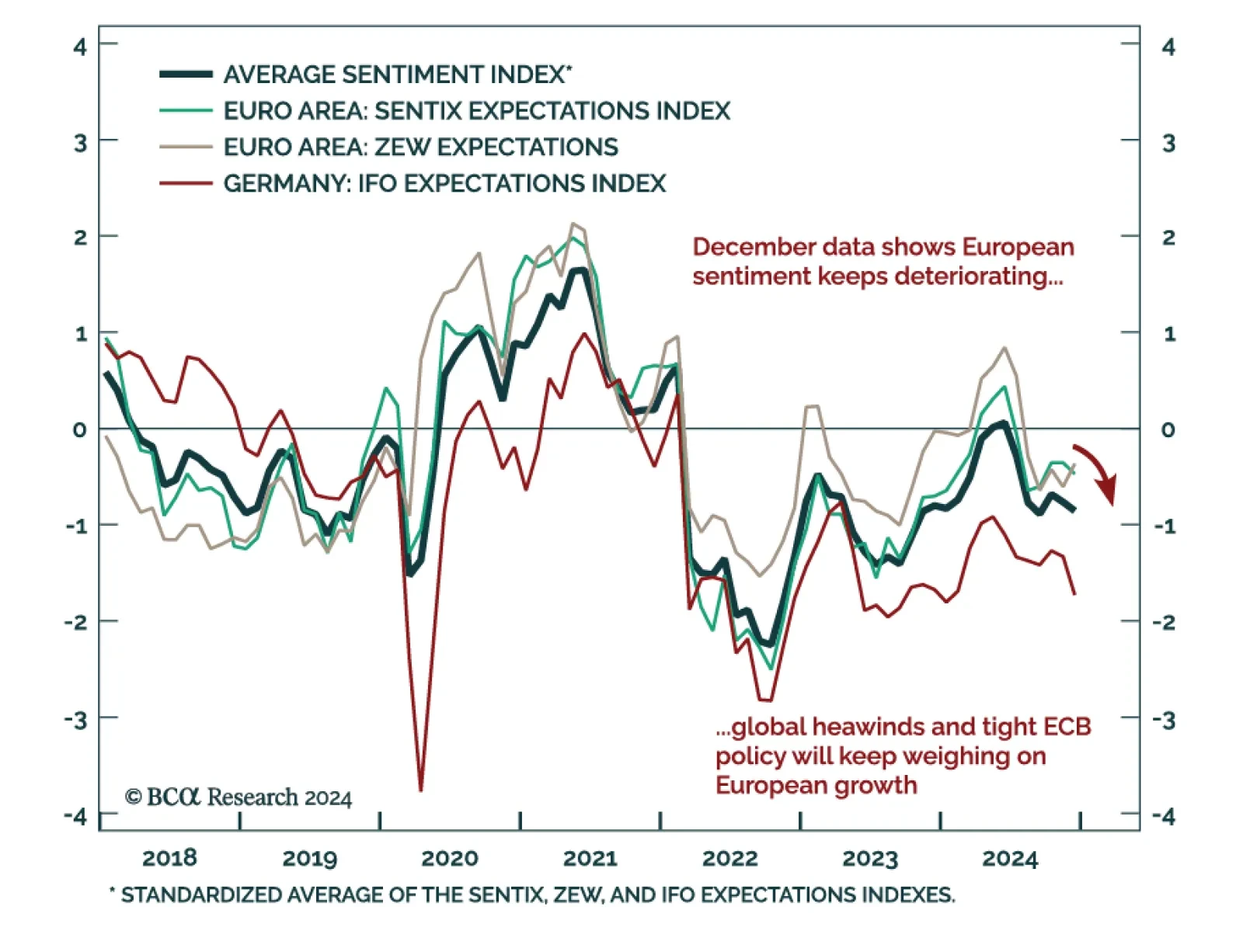

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

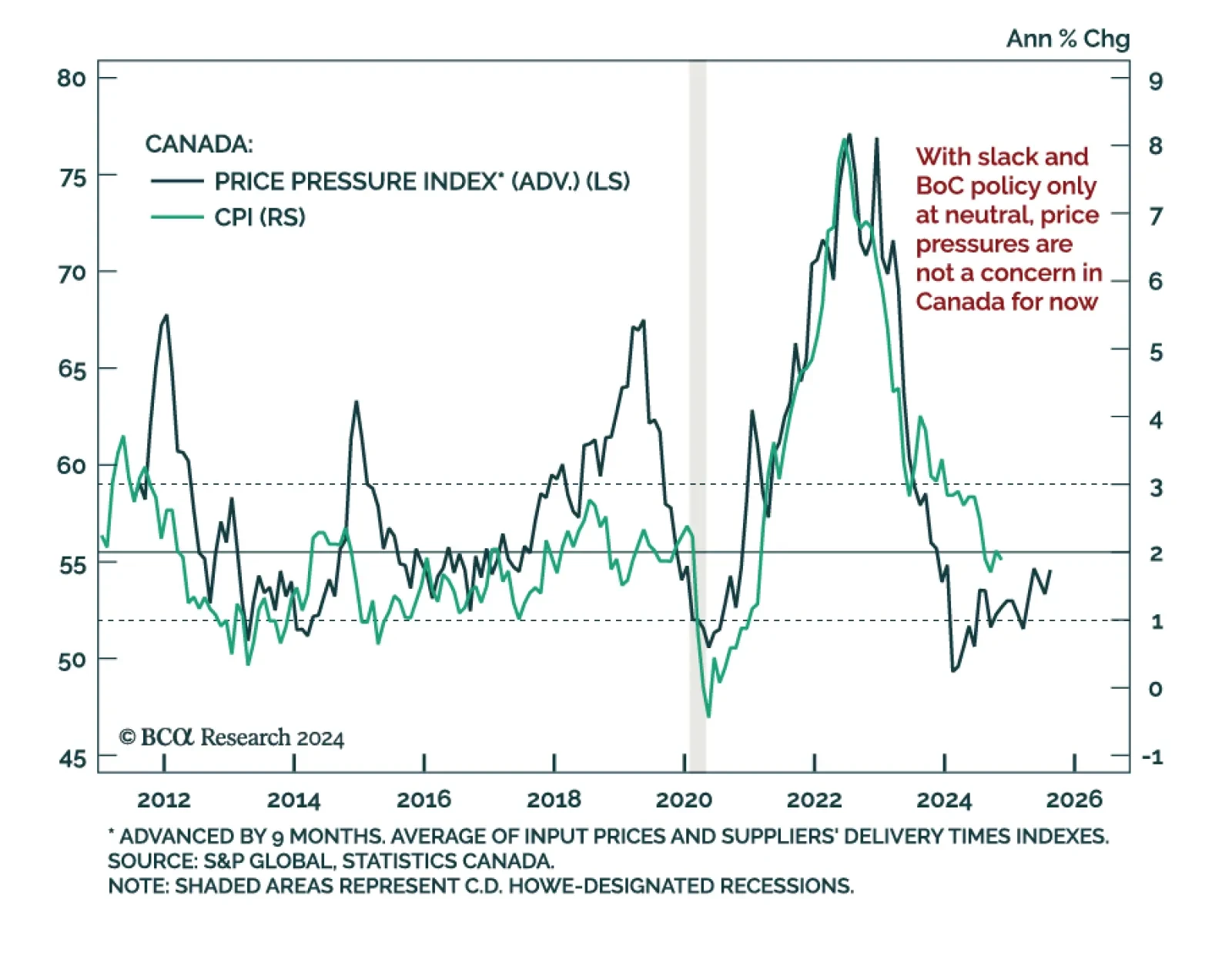

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…

The post-COVID US recovery was different from previous cycles. Despite an ebullient economy, US consumers and firms have just not been feeling it, as reflected by the depressed signals from so-called soft, survey-based indicators…