A nascent theme in the latest data is the broad improvement in European sentiment. The February Sentix and ZEW surveys both improved, and flash estimates for European consumer confidence beat estimates, ticking up to -13.6%.…

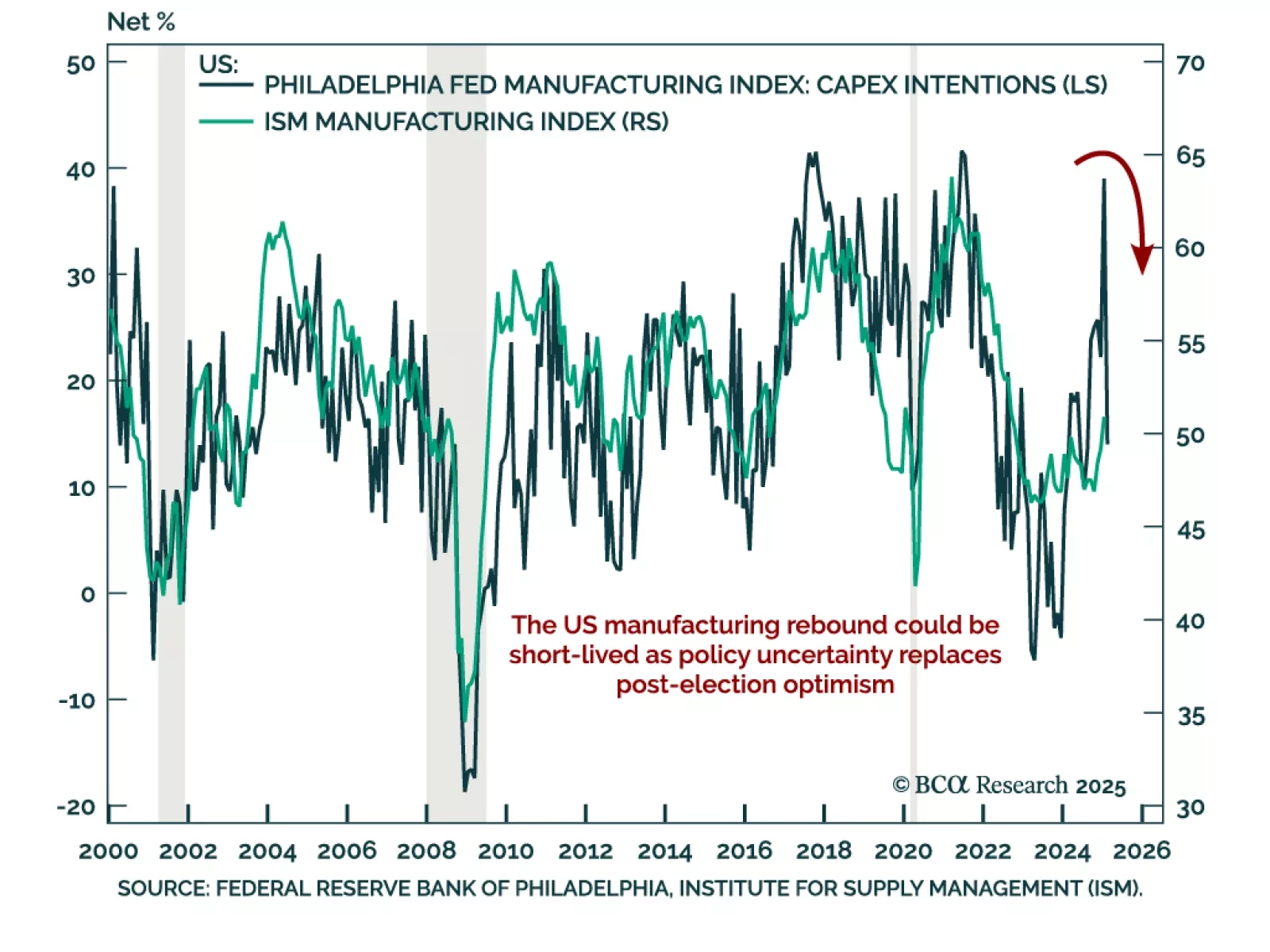

The February Philadelphia Fed Manufacturing index beat expectations, but retreated to 18.1 from last month’s lofty 44.3 reading. All activity subcomponents pulled back, except for delivery times. The Philly Fed index is volatile…

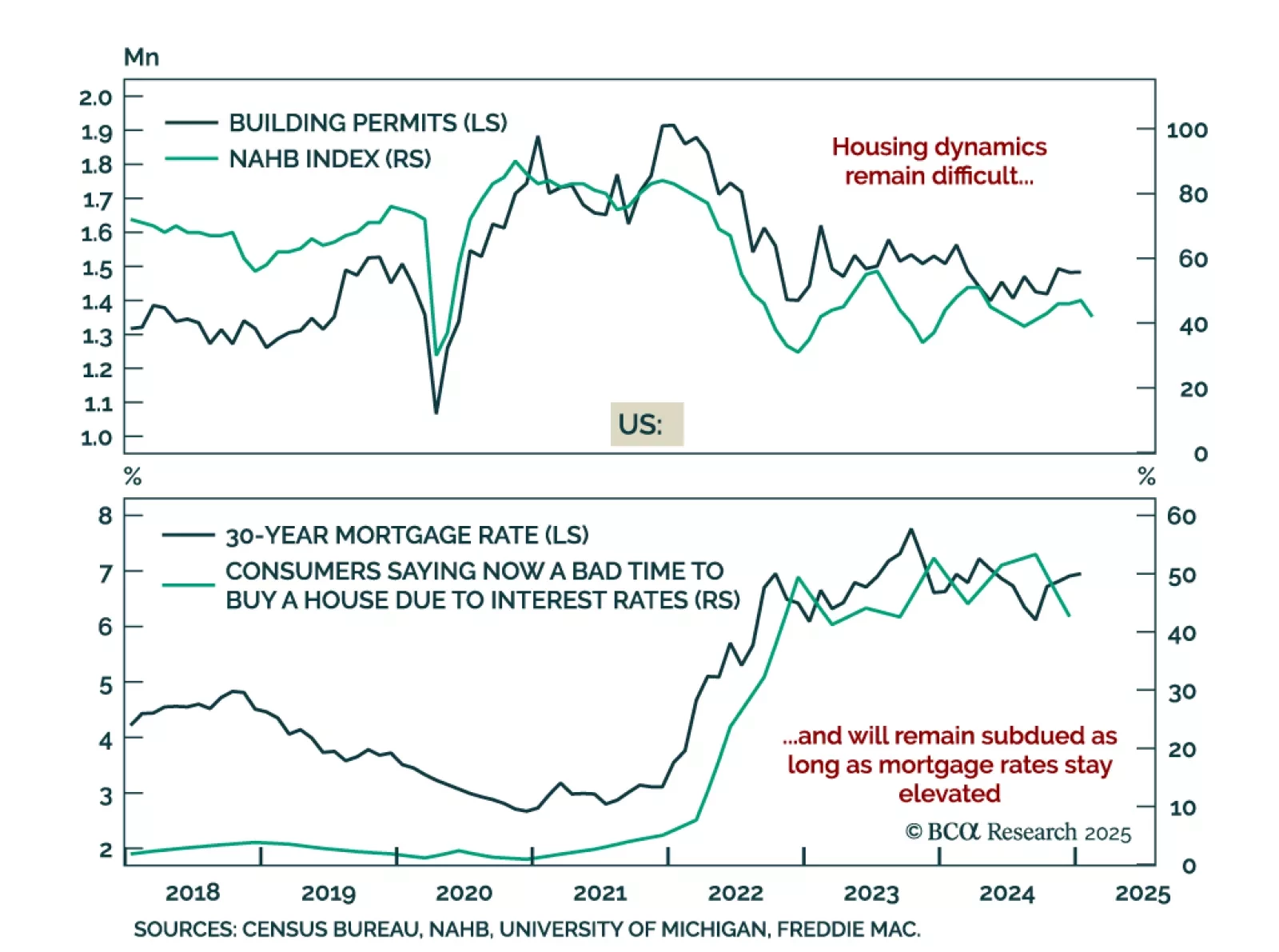

US January housing data disappointed, with housing starts falling 9.8% m/m after expanding 16.1% in December. The February NAHB Housing Market Index also weakened, falling to 42 from 47 in February. Building permits were the one…

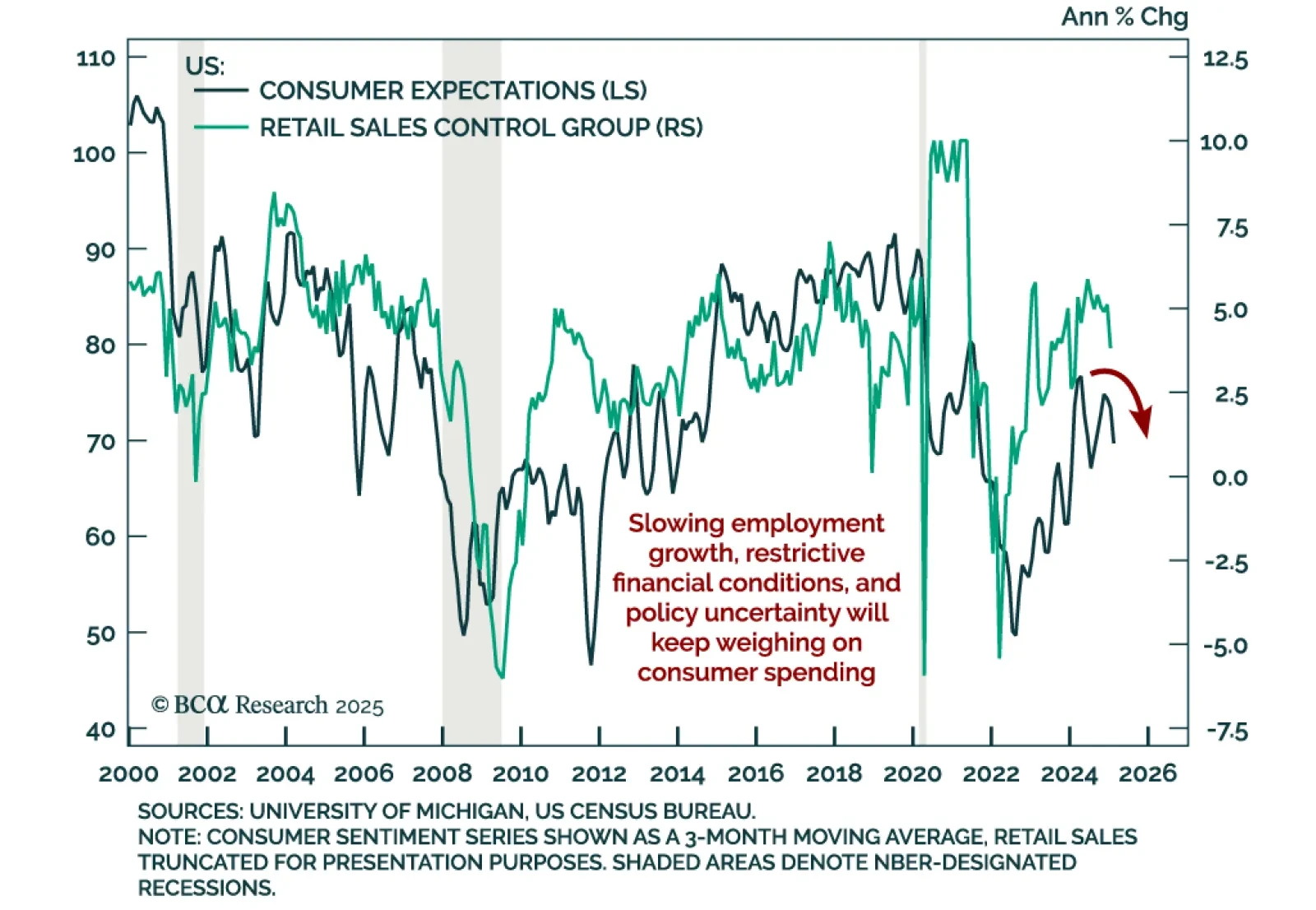

January US retail sales missed estimates, with the headline number contracting by 0.9% m/m. The decline was broad-based, with spending excluding autos and gas down 0.5%, and the control group also down 0.8%. The retail sales…

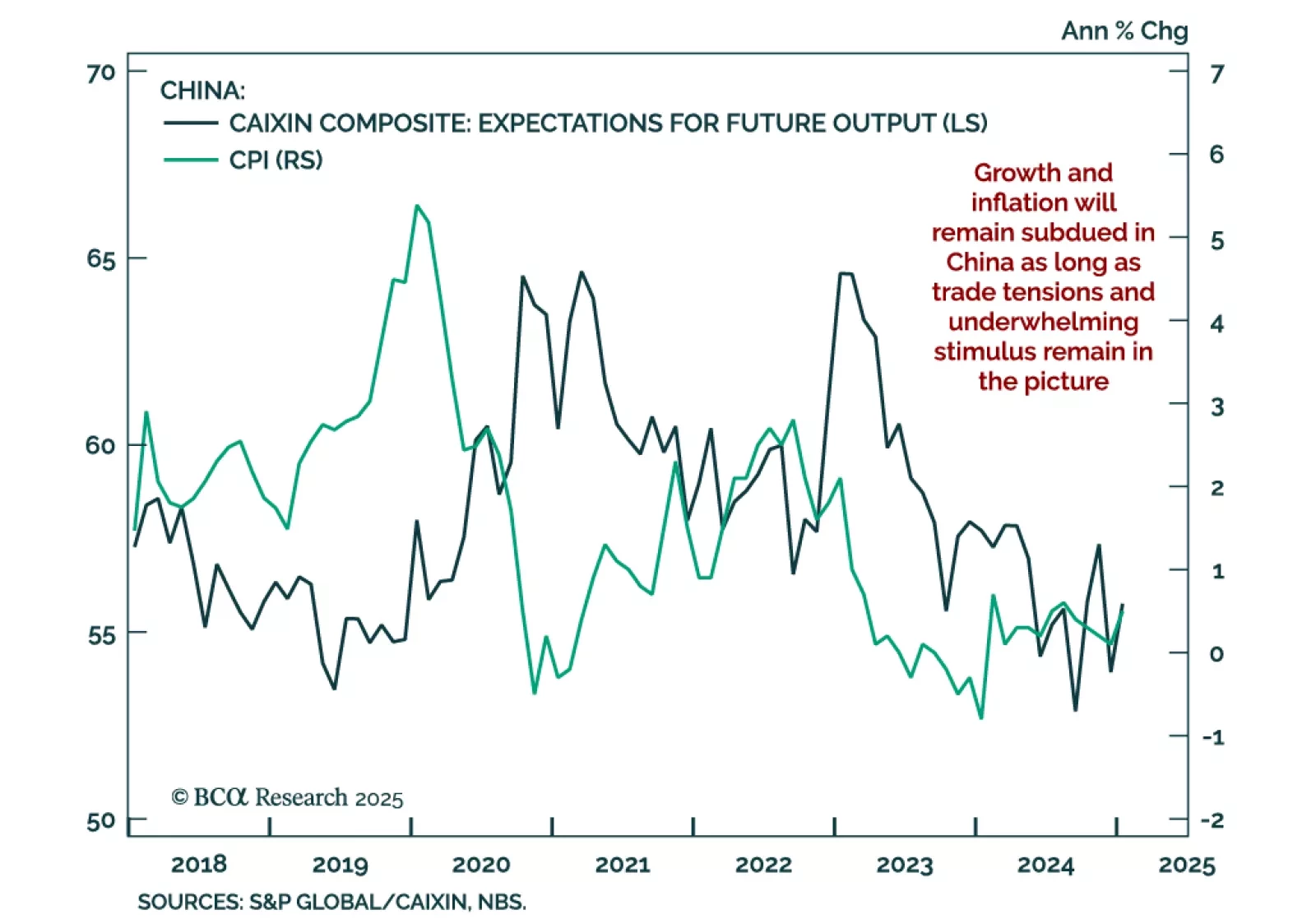

China’s January consumer prices rebounded to 0.5% y/y, and producer price deflation was unchanged at -2.3%. China’s first quarter data tends to be distorted by the Chinese New Year, as its variable dates shift consumption peaks…

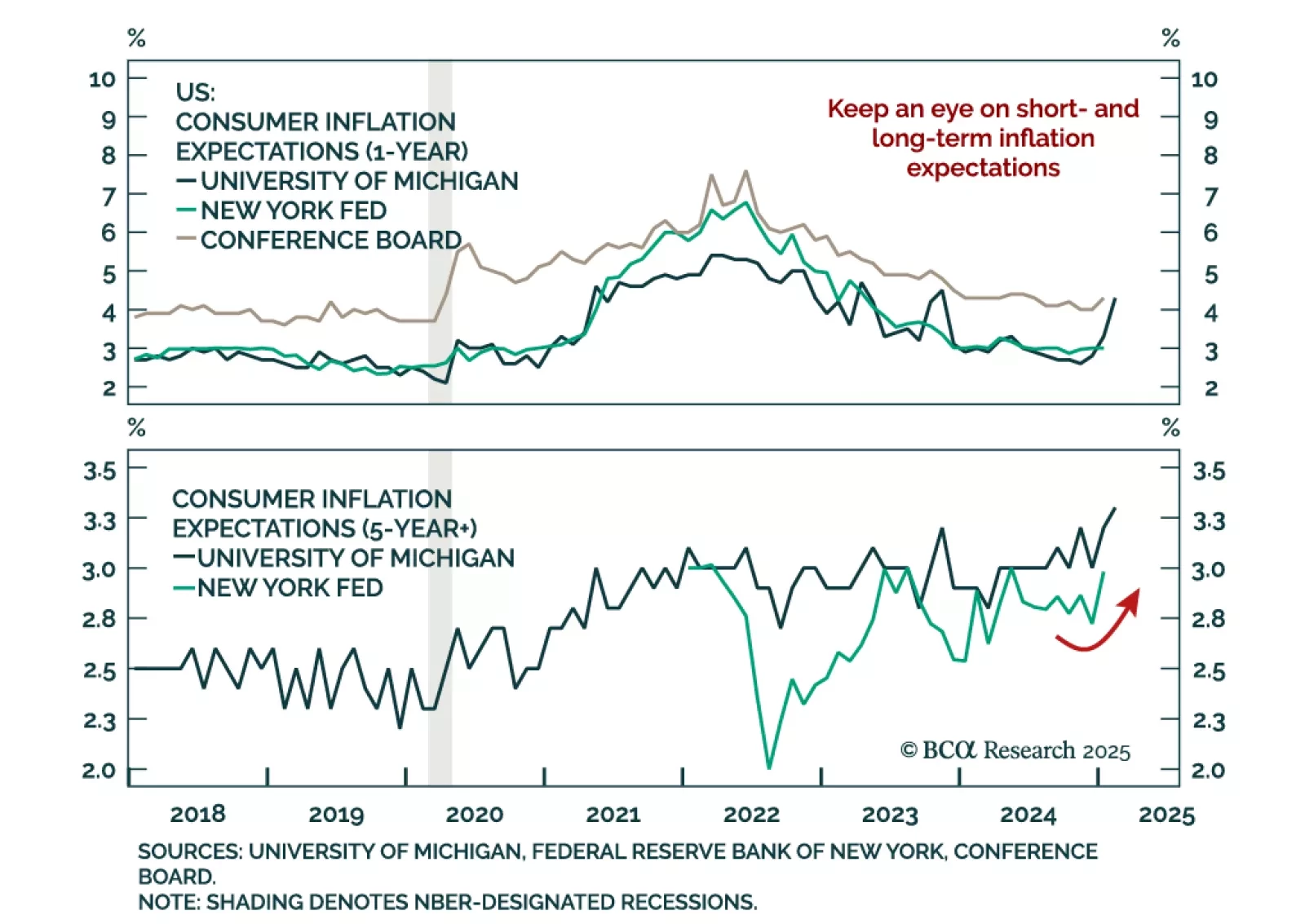

The New York Fed’s Survey of Consumer Expectations’ 1-year and 3-year inflation expectations were unchanged in January. Five-year ahead expectations however increased, as did expectations for staples inflation, while spending…

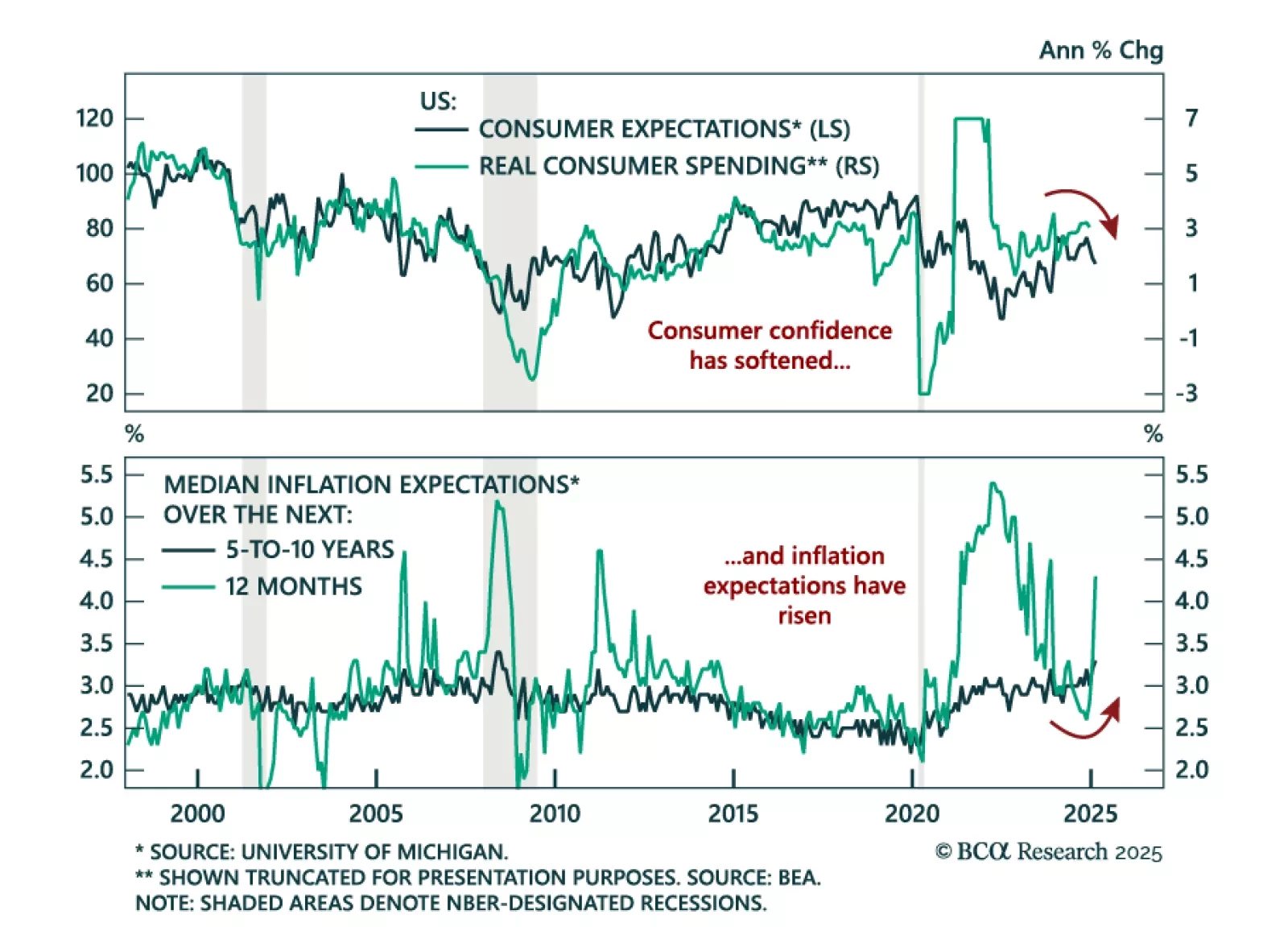

The preliminary February University of Michigan Consumer Sentiment Index missed estimates, falling to 67.8 from 71.1 in January. The decrease came from both expectations and the assessment of current conditions. Measures of 1-year…

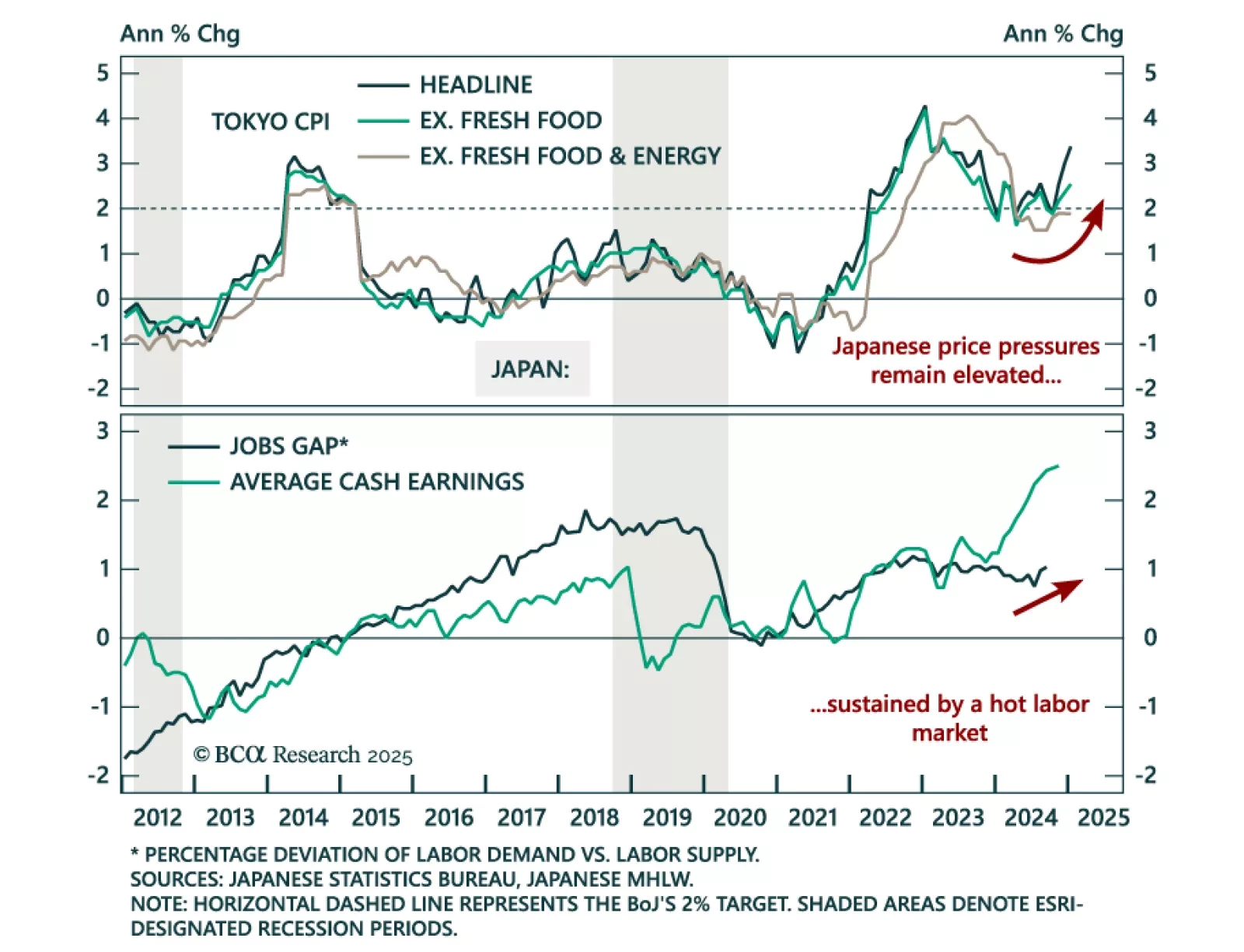

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

December PCE inflation was in line with expectations, with headline inflation at 0.3% m/m (2.6% y/y) and core at 0.2% m/m (2.8% y/y). The Q4 employment cost index also came in line with expectations at 0.9% q/q. Inflation is…

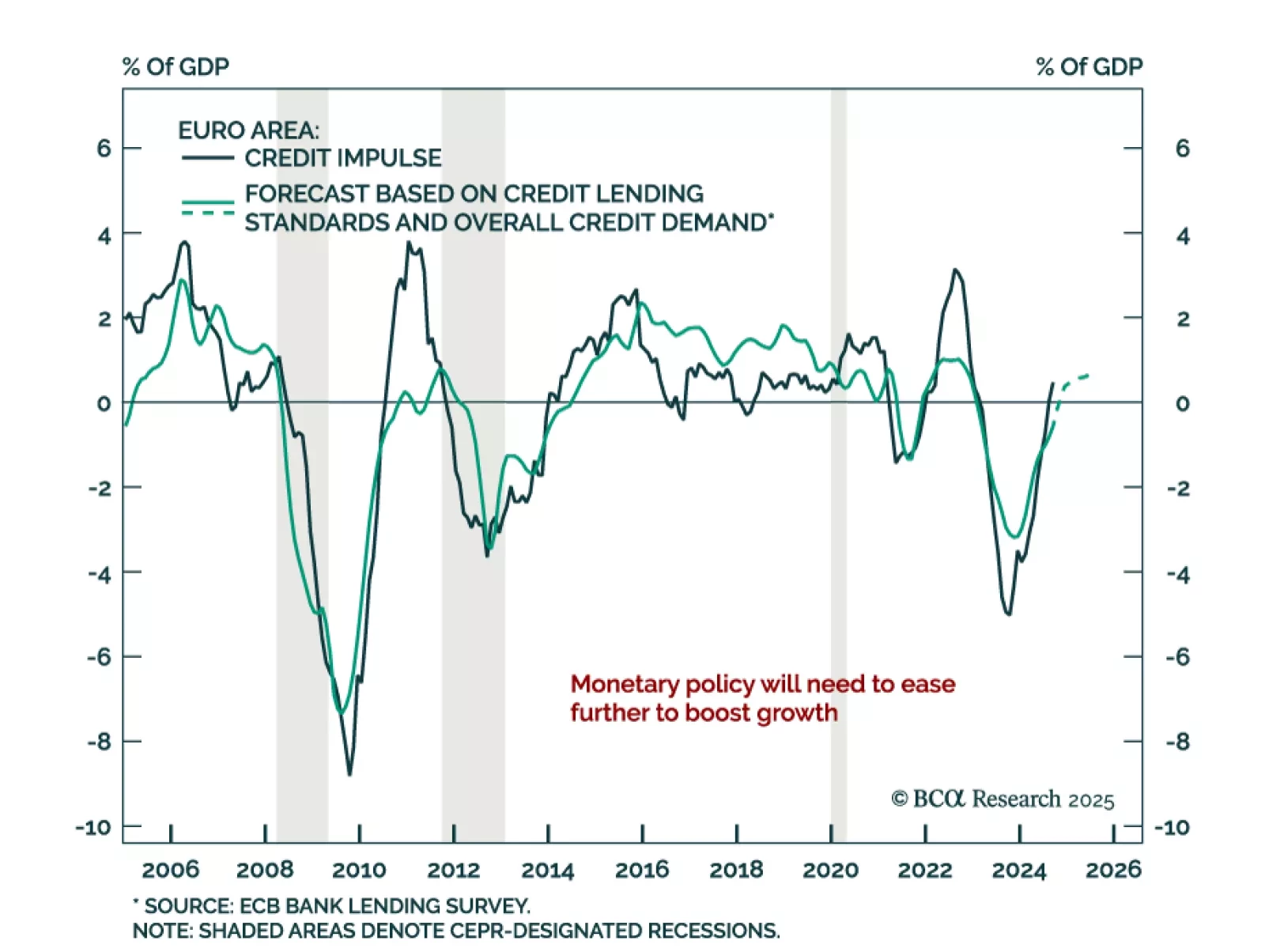

The January 2025 ECB bank lending survey saw a net tightening of credit standards in Q4 2024. Credit standards were tightened for business and consumer lending, and were roughly unchanged for home mortgage loans. Banks expect further…