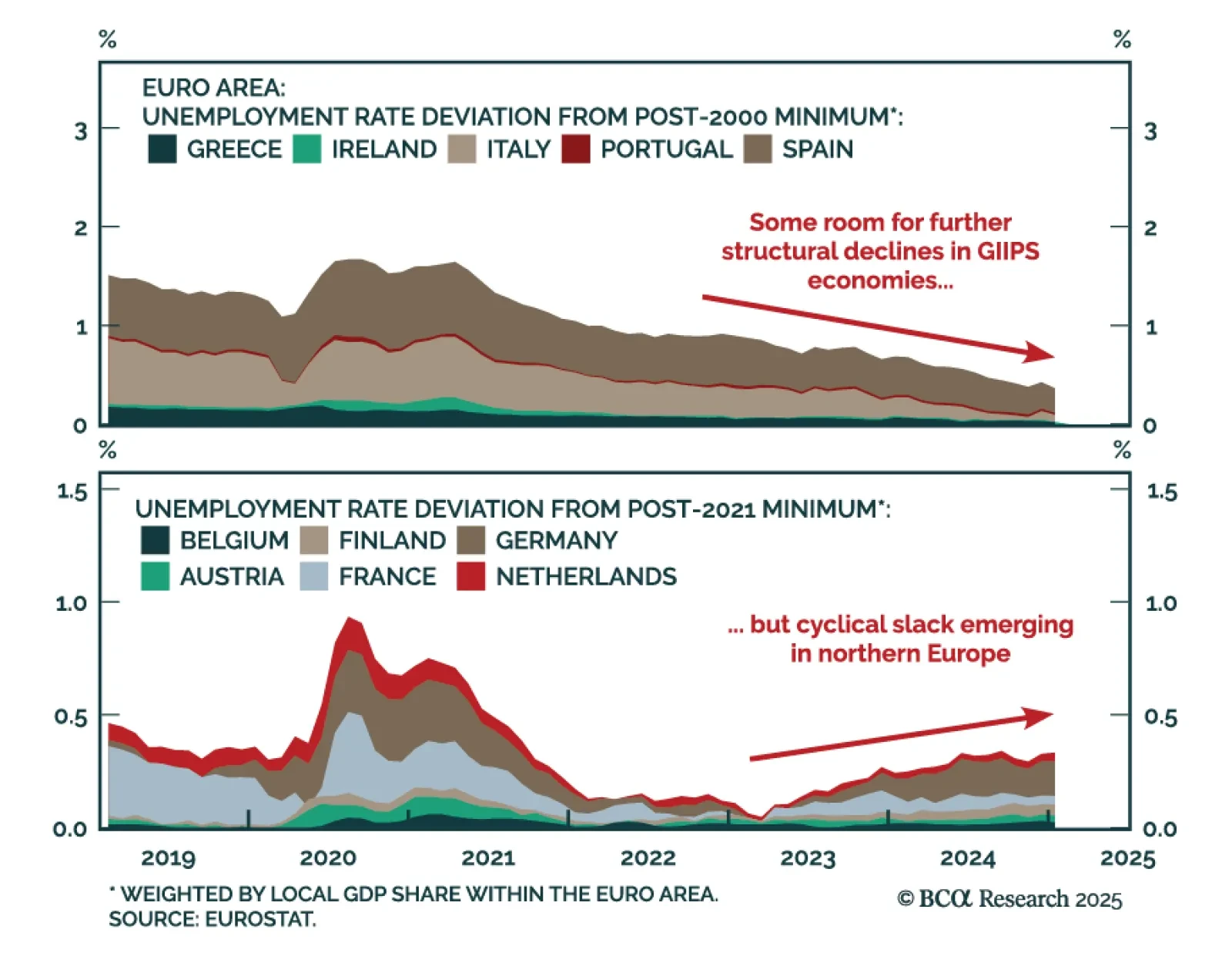

Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income strategy team. Robert digs into Eurozone employment dynamics. January data showed that unemployment remains at record lows, but regional…

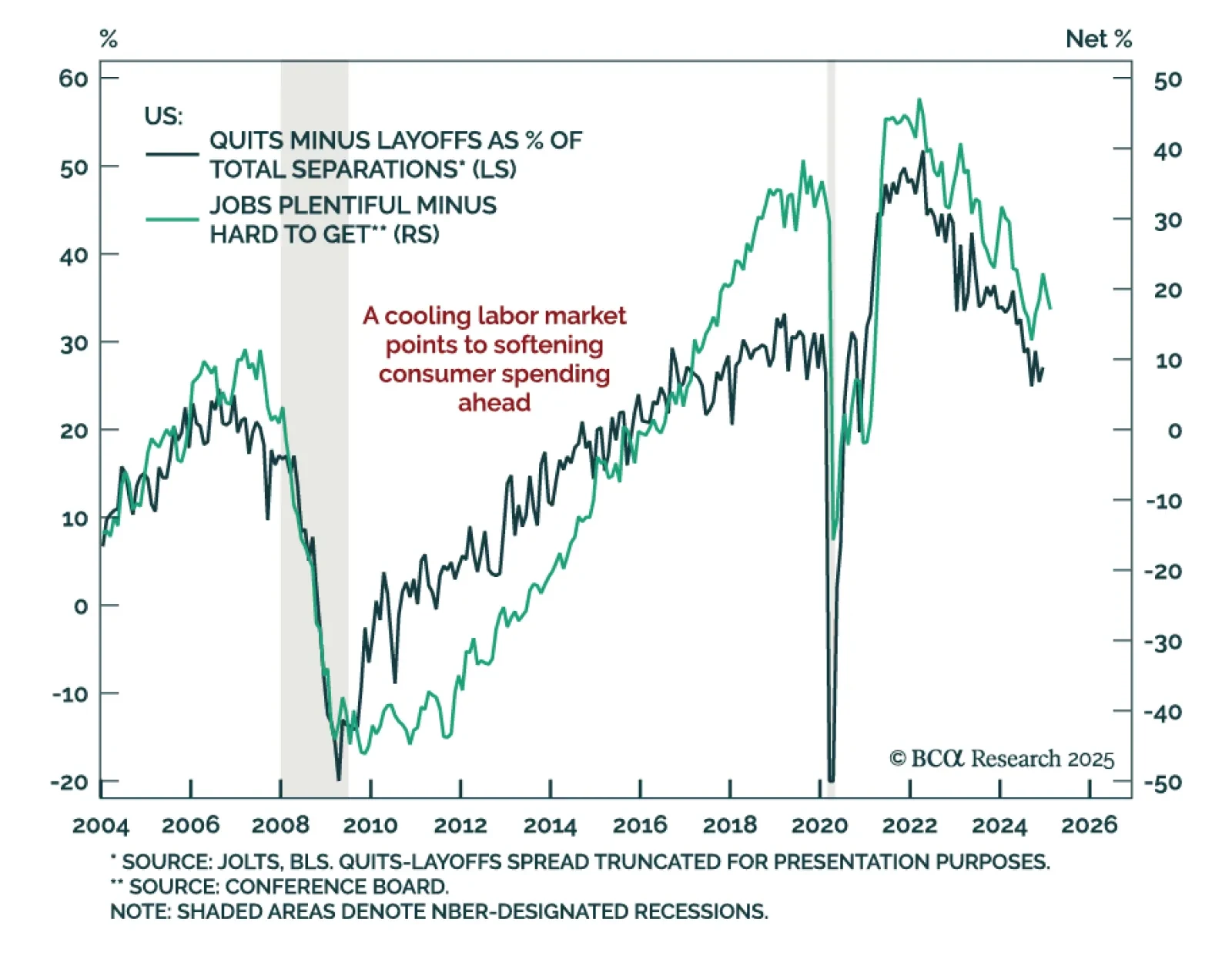

This morning’s employment report showed solid job growth, but recent consumer spending indicators are more concerning. The risk of recession starting within the next few months has increased. We suggest some important indicators for…

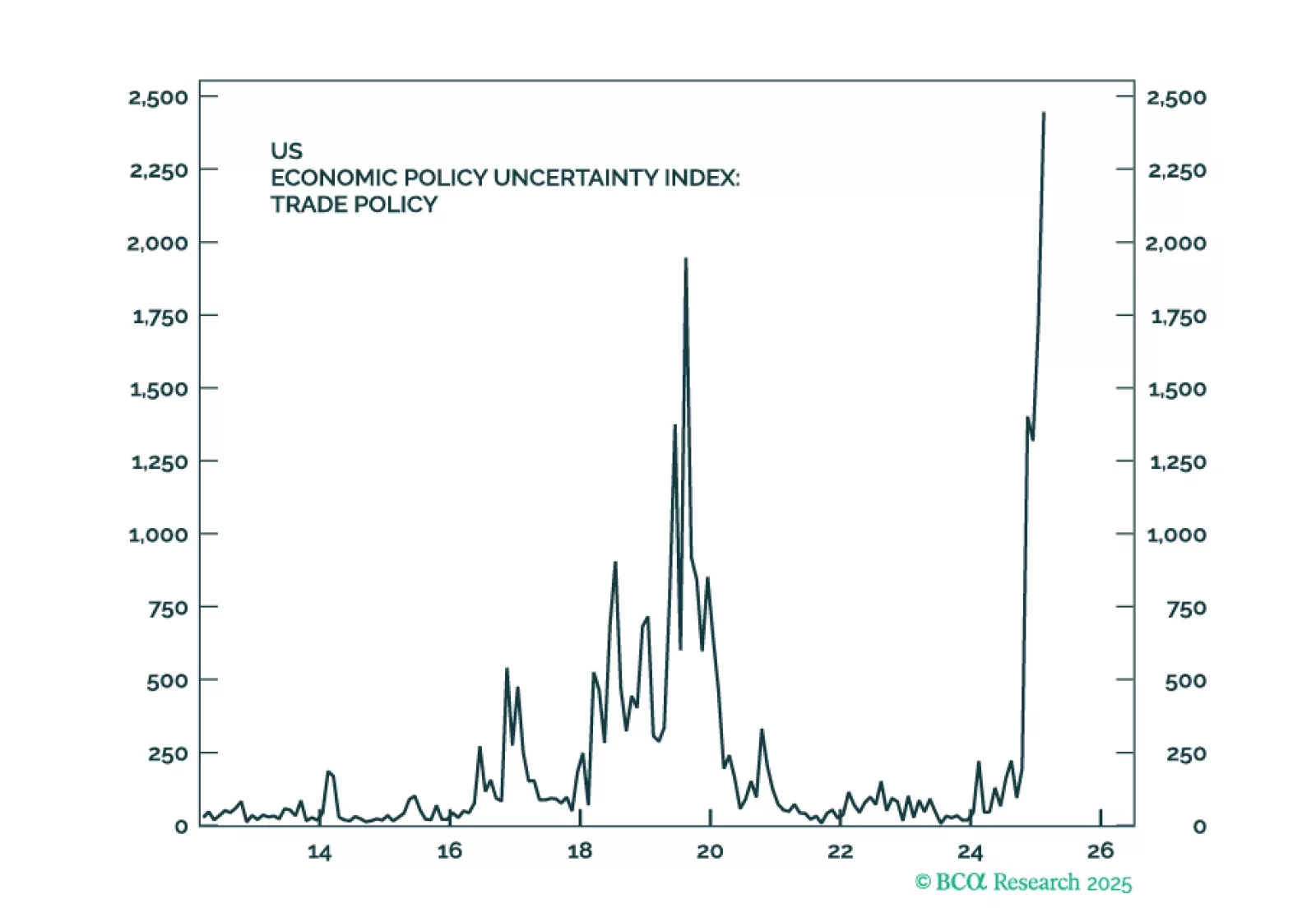

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

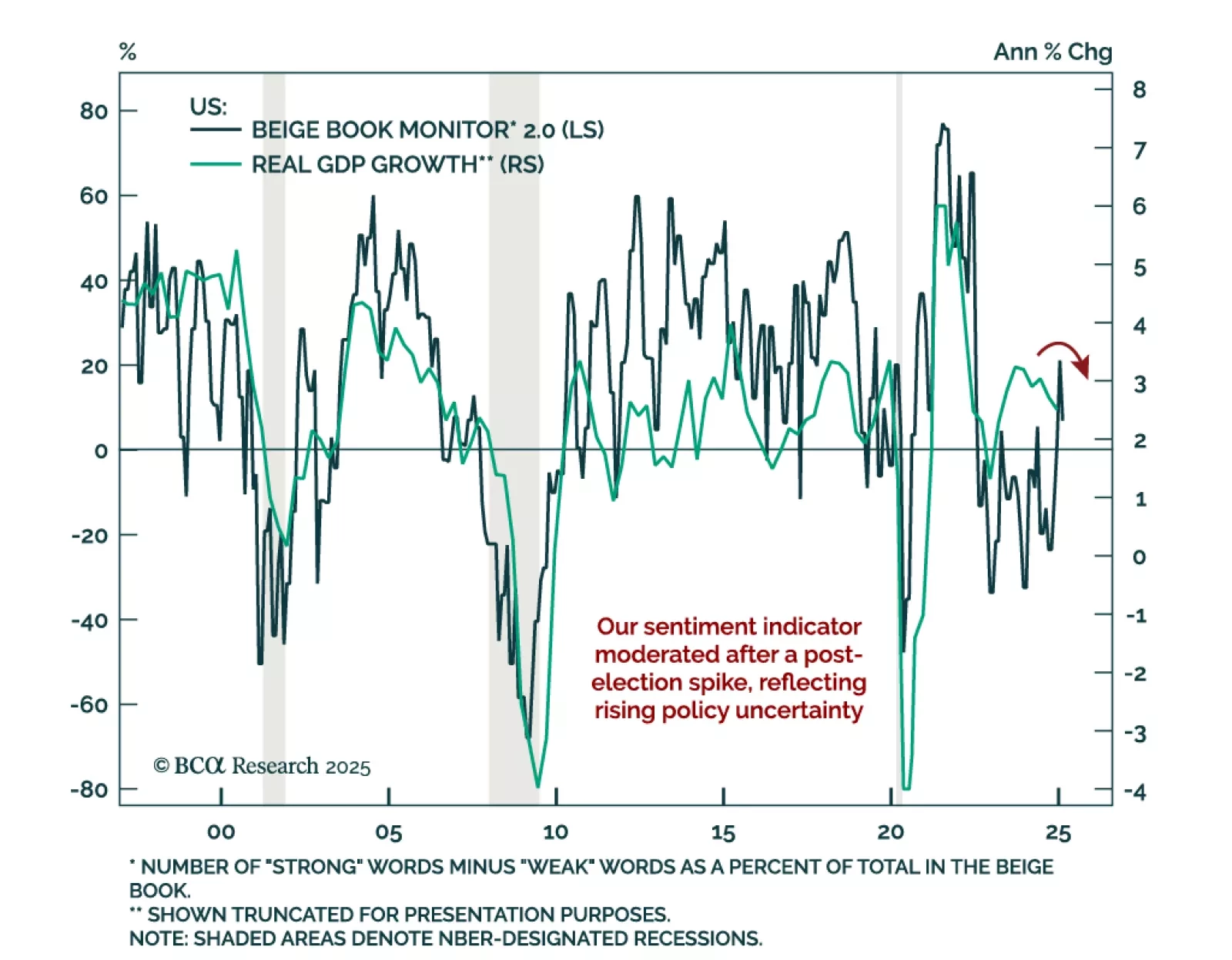

The Federal Reserve’s Beige Book shows a slowing economy, a moderating labor market, and rising price pressures. The latest Beige Book is in line with other sentiment indicators showing slower growth and decreased confidence…

This week we are sending you a sector chart pack. In the front section of the chart pack, we review February’s performance, take stock of the recent macroeconomic developments, and examine whether market rotation will continue. We…

Our Chart Of The Week comes from Juan Correa, from our Global Asset Allocation (GAA) strategy service. Juan highlights weakening US growth observed in the data lately. We have seen a few growth slowdown episodes since 2022…

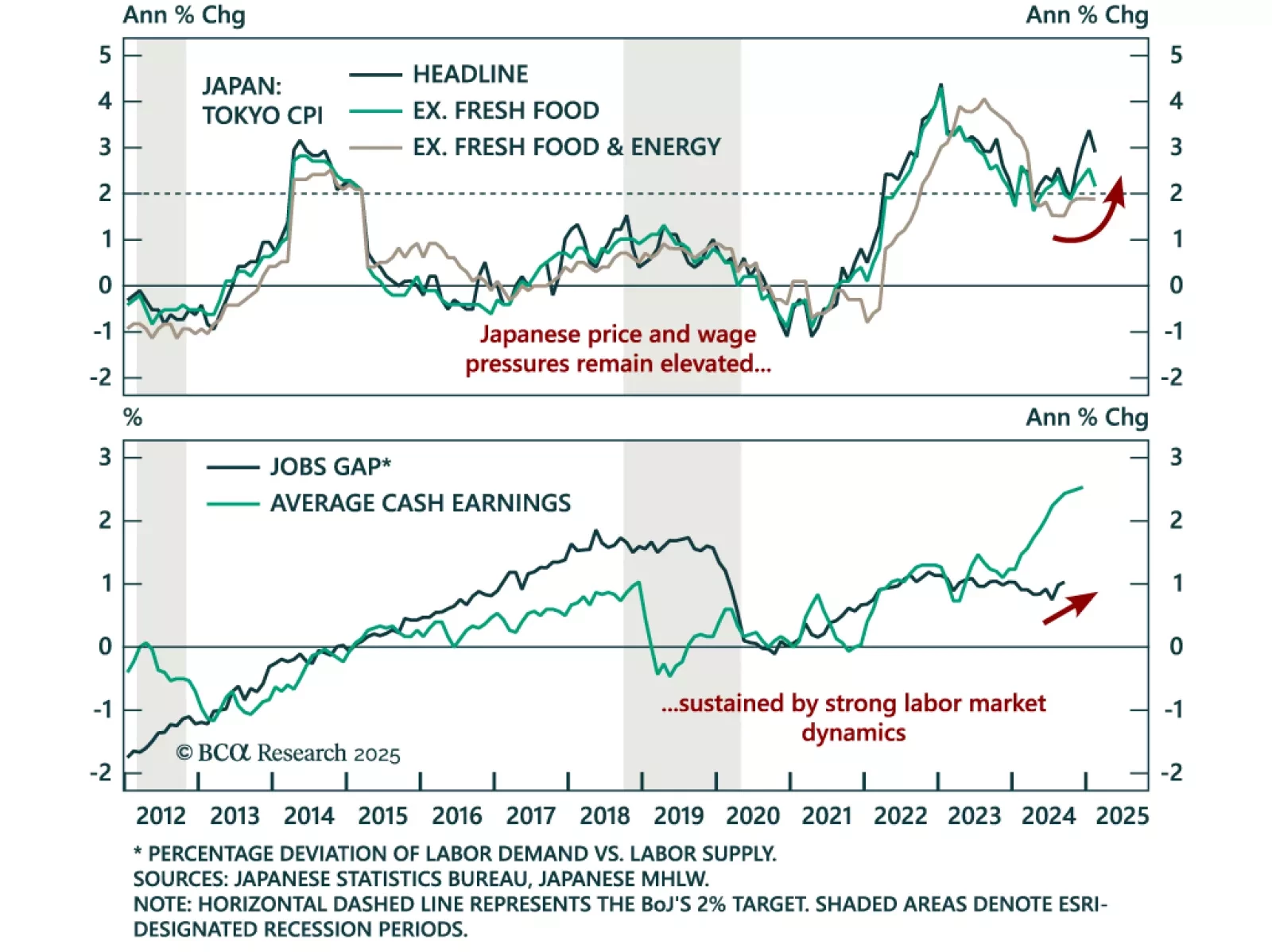

The February Tokyo CPI print came in slightly cooler than expected. Headline inflation moderated to 2.9% y/y from 3.4%, while “core core” was steady at 1.9%. The Tokyo CPI gives an advance reading on national price pressures,…

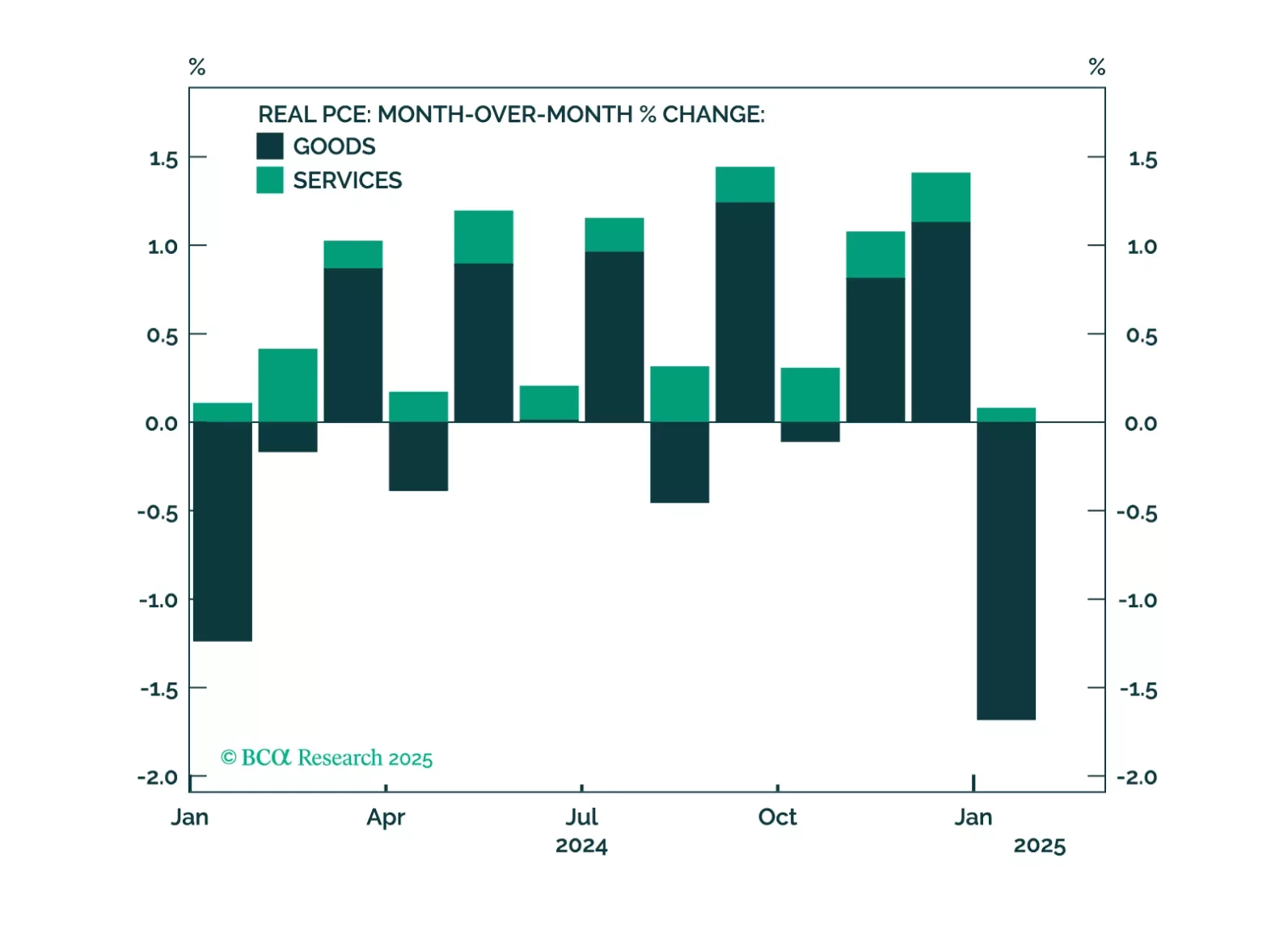

January PCE inflation was in line with expectations, with headline and core inflation rising 0.3% m/m, leaving the respective annual growth rates at 2.5% and 2.6%, near the Fed’s projection for 2025. Consumer spending missed…

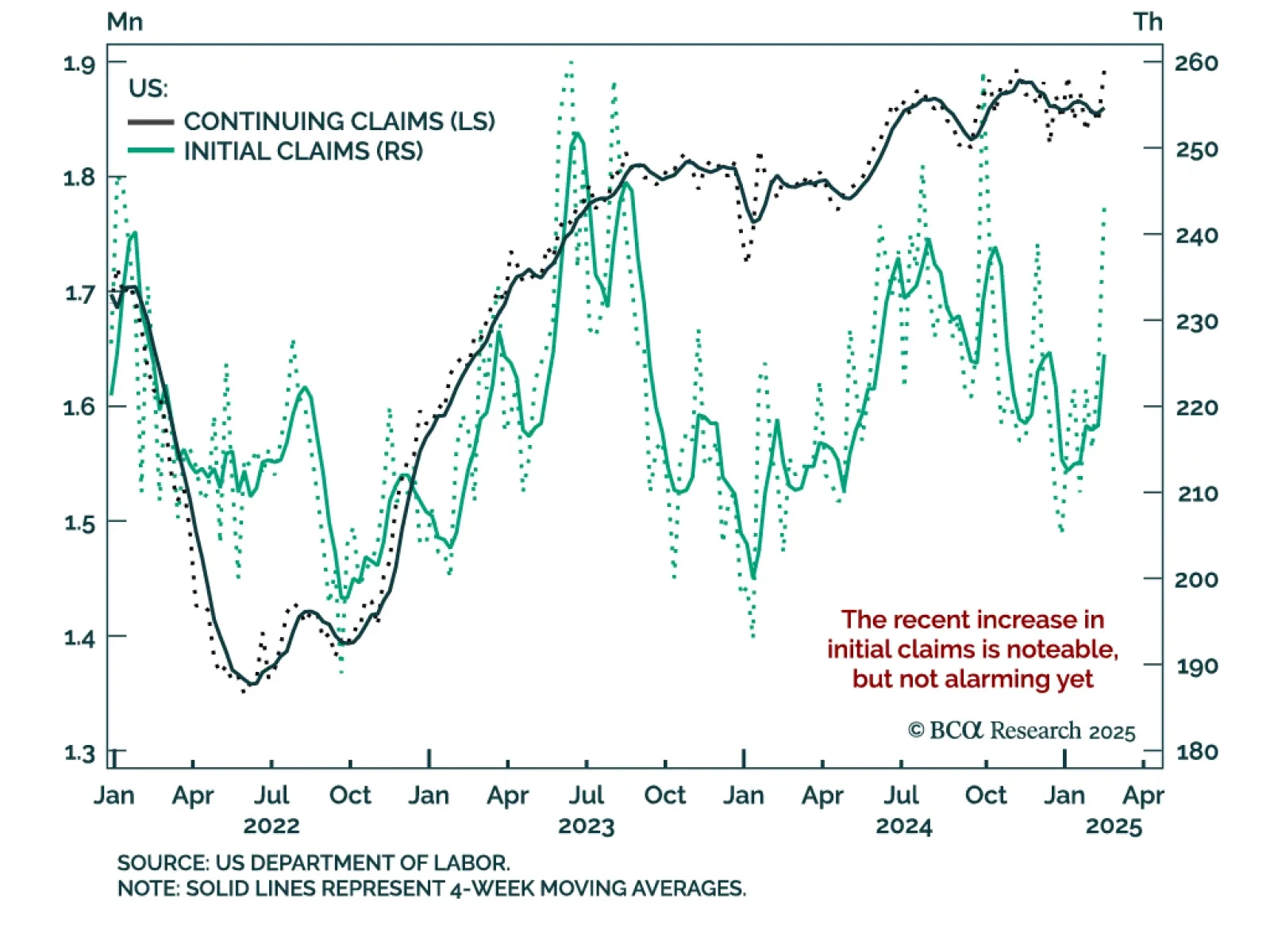

Weekly initial claims ticked up to 242k, near 2024 highs. The data is under the spotlight as the Trump administration implements a reduction of the federal workforce through the DOGE. Initial claims are not alarming yet; they…

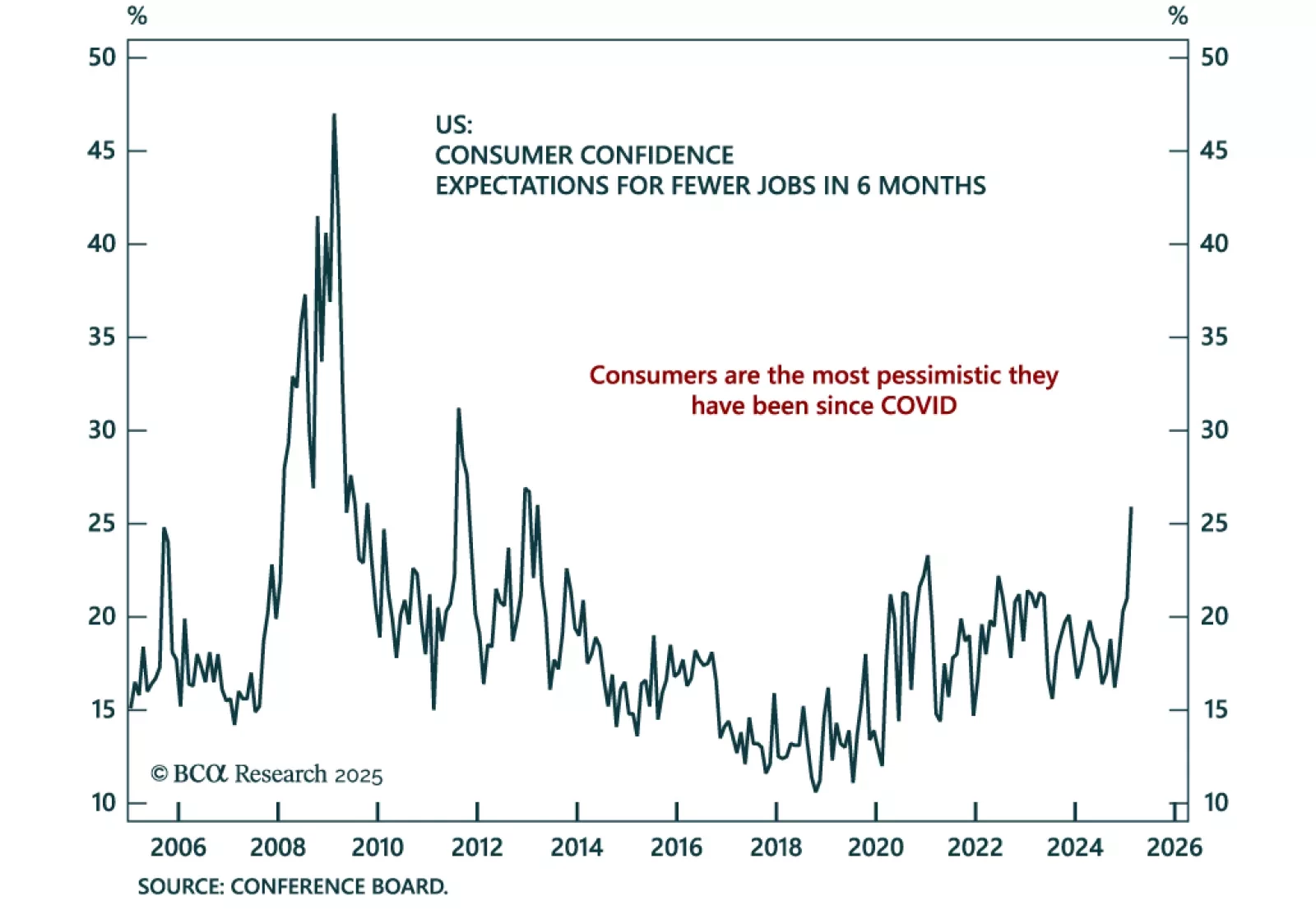

The February Conference Board Consumer Confidence index missed estimates for the third month in a row, falling to 98.3 from 105.3. Consumers’ assessment of both their current situation and their expectations worsened, with the latter…