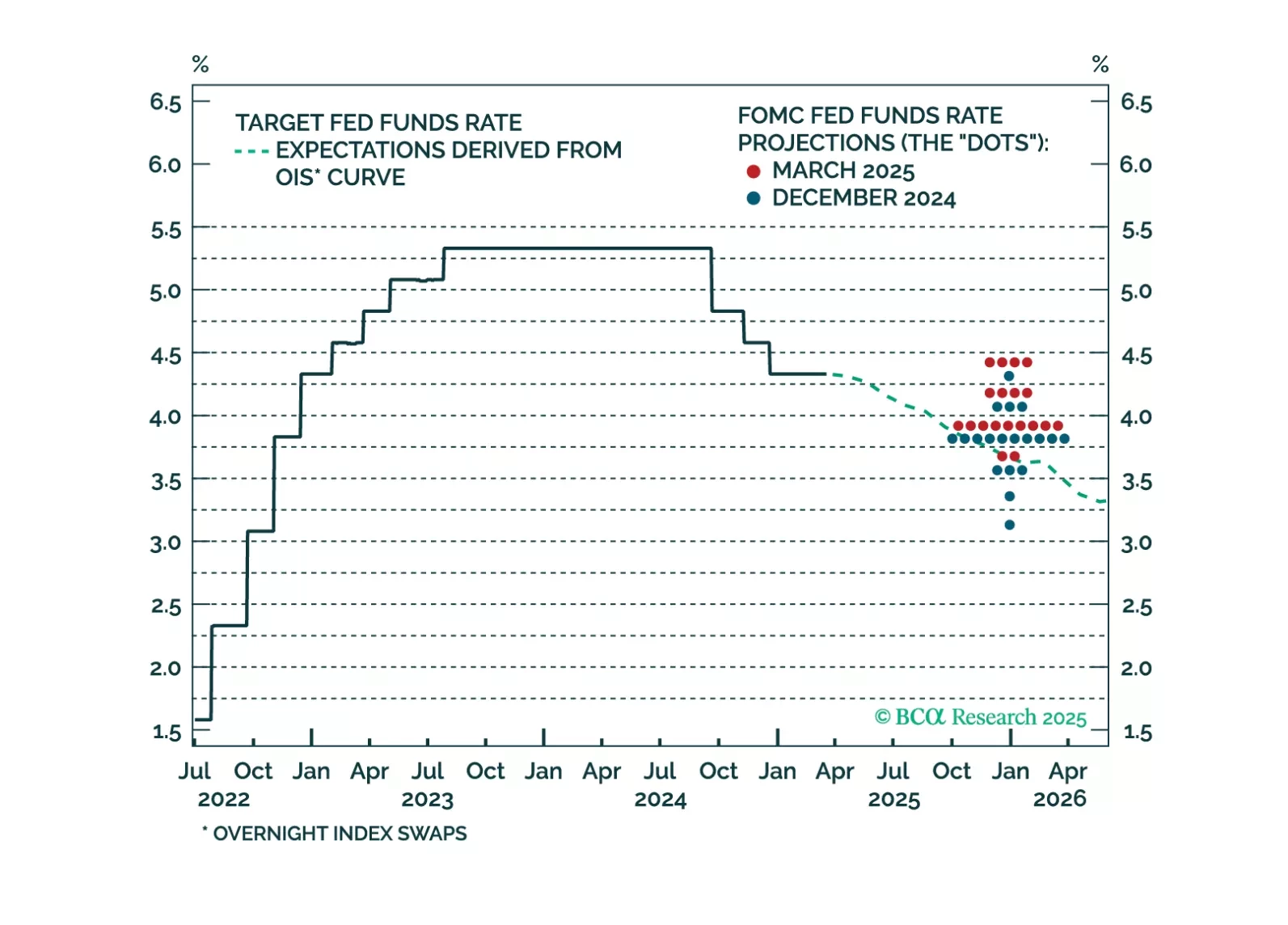

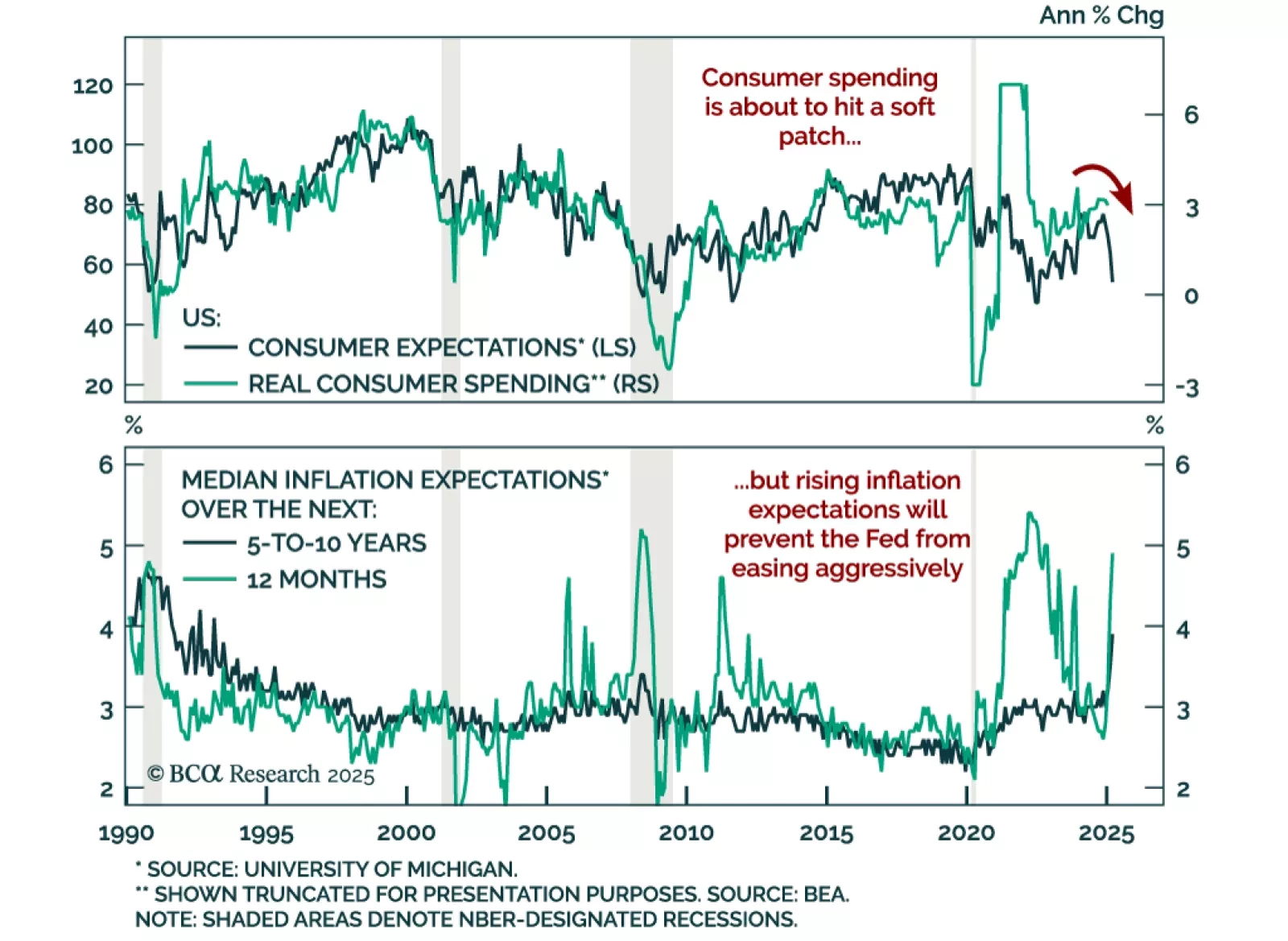

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

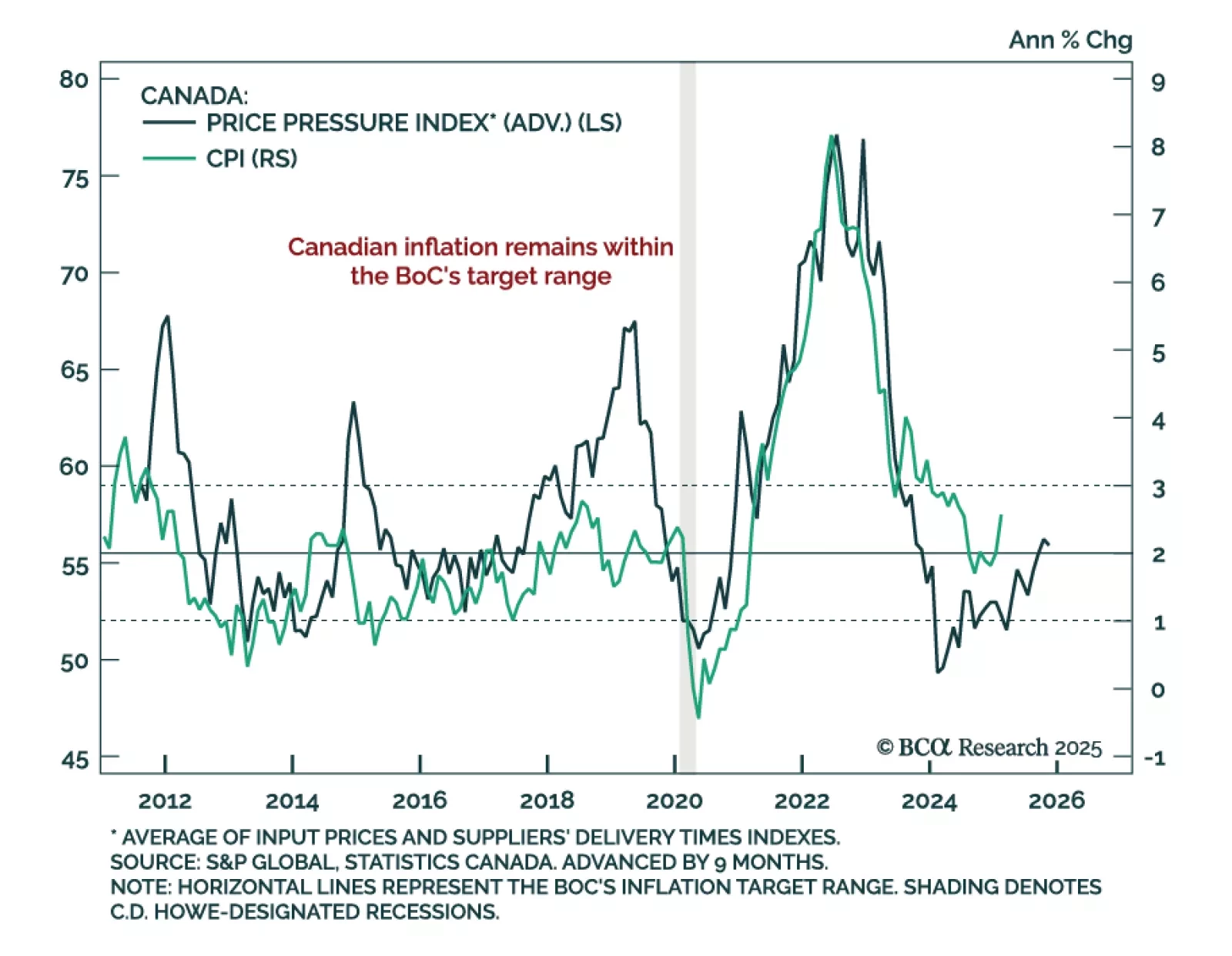

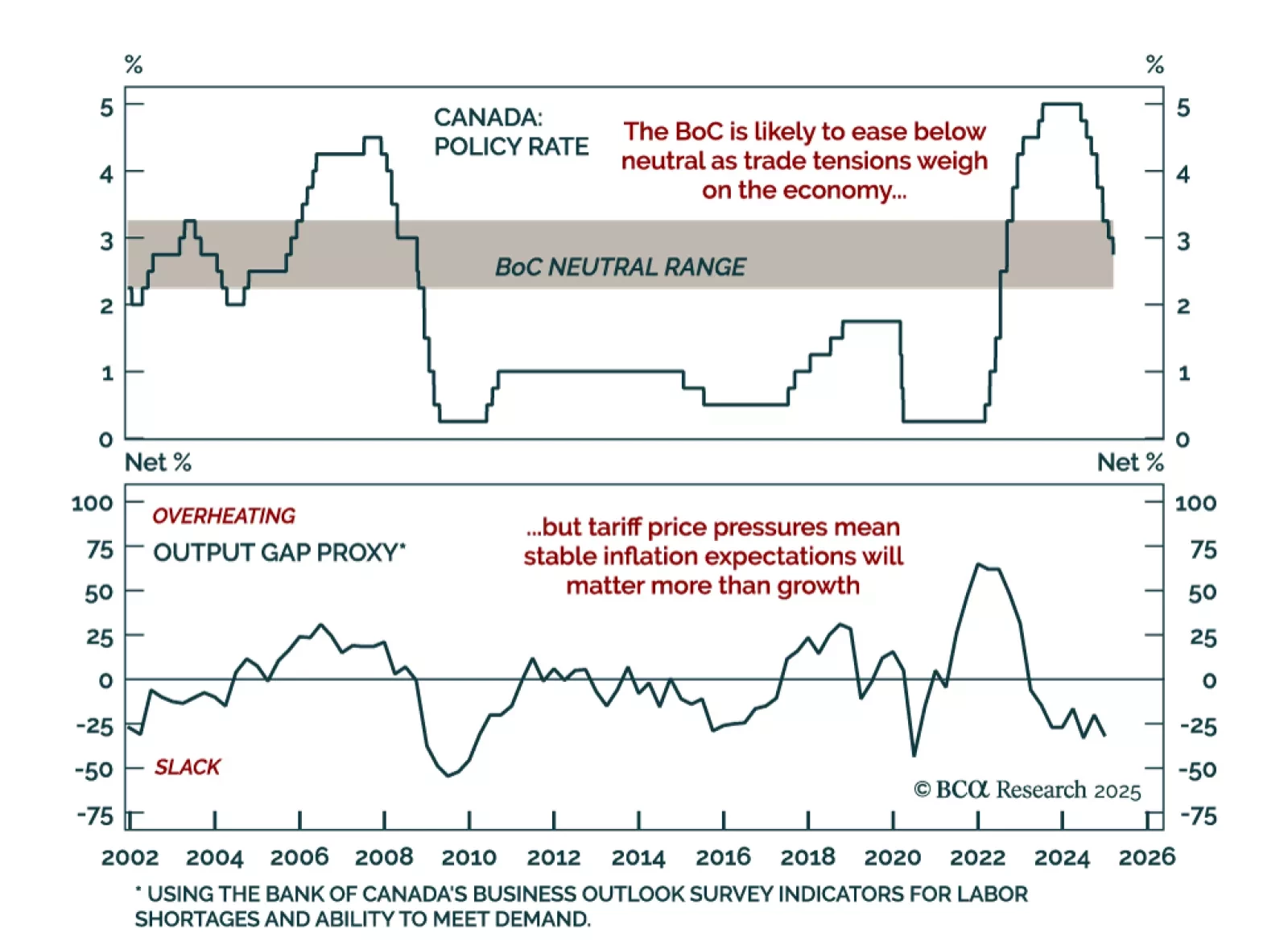

February Canadian headline inflation was stronger than expected, rising to 2.6% y/y from 1.9% in January. The Bank of Canada’s core measures were also slightly hotter than expected, both rising to 2.9% from 2.7% a month prior, near…

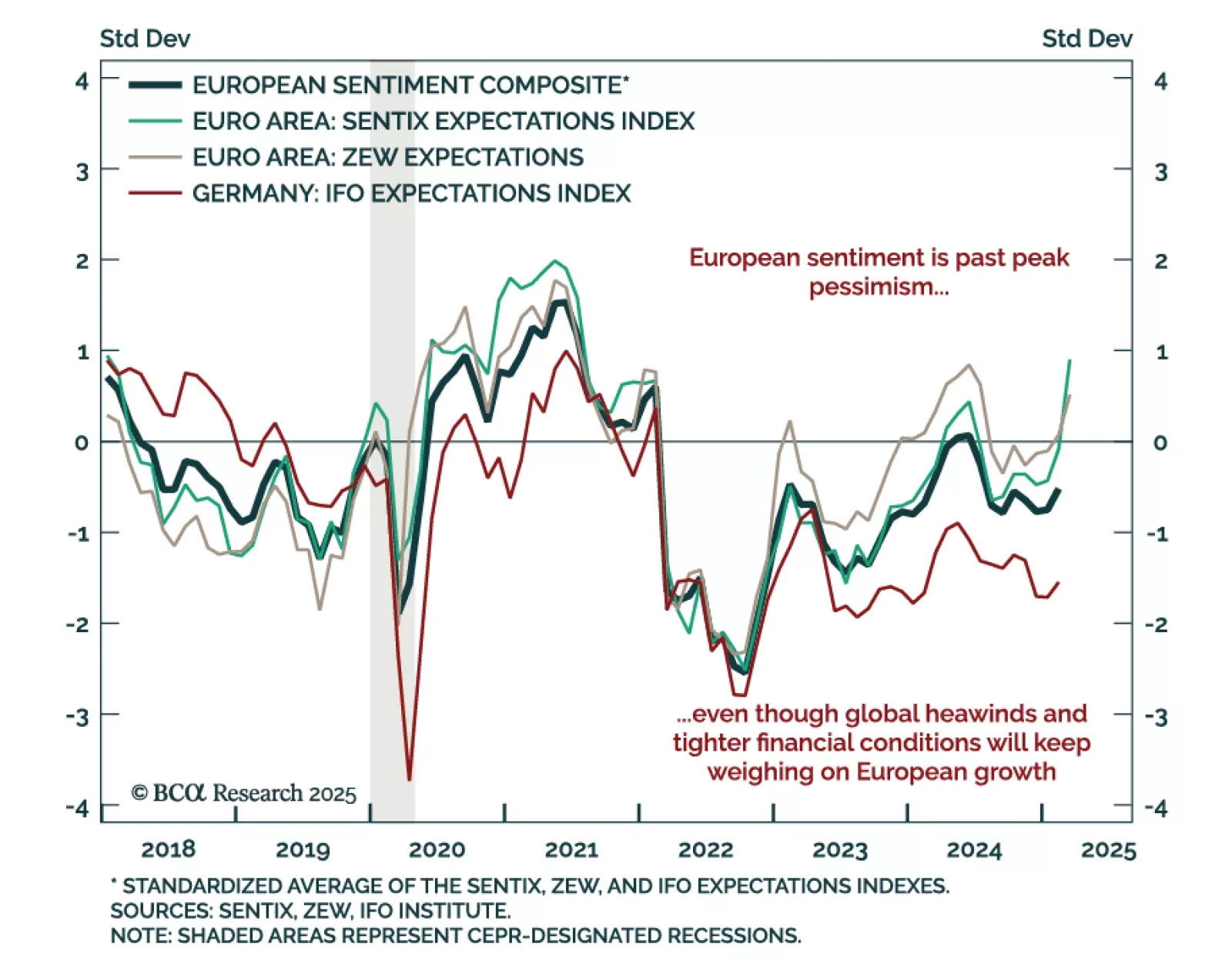

The March ZEW index for Germany and the eurozone beat estimates, with the expectations component rising to 51.6 from 26.0 in February. The current situation assessment only marginally improved yet remains deeply negative at -87.6.…

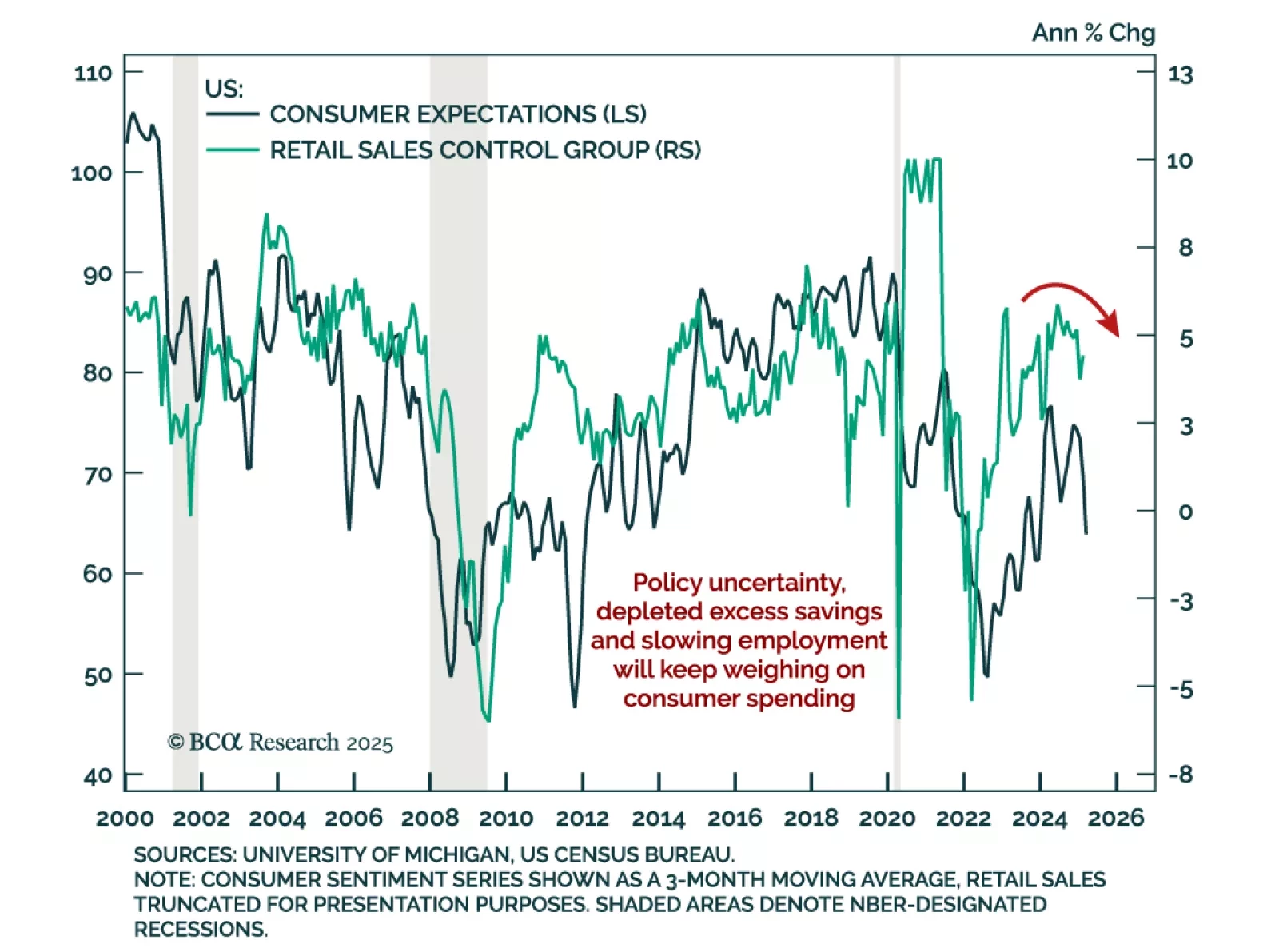

February US retail sales were mixed, with the headline number missing expectations at only 0.2% m/m. January’s reading was revised down to -1.2%. Core measures (excluding gas & autos) were roughly in line with estimates, but the…

The preliminary March University of Michigan Consumer Sentiment Index missed estimates, falling to 57.9 from 64.7. The decrease came from both the assessment of current conditions and expectations, with the latter falling almost 10…

The Bank of Canada cut by 25 bps to 2.75% as expected. This seventh consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range. The BoC is in a tough place. The trade war…

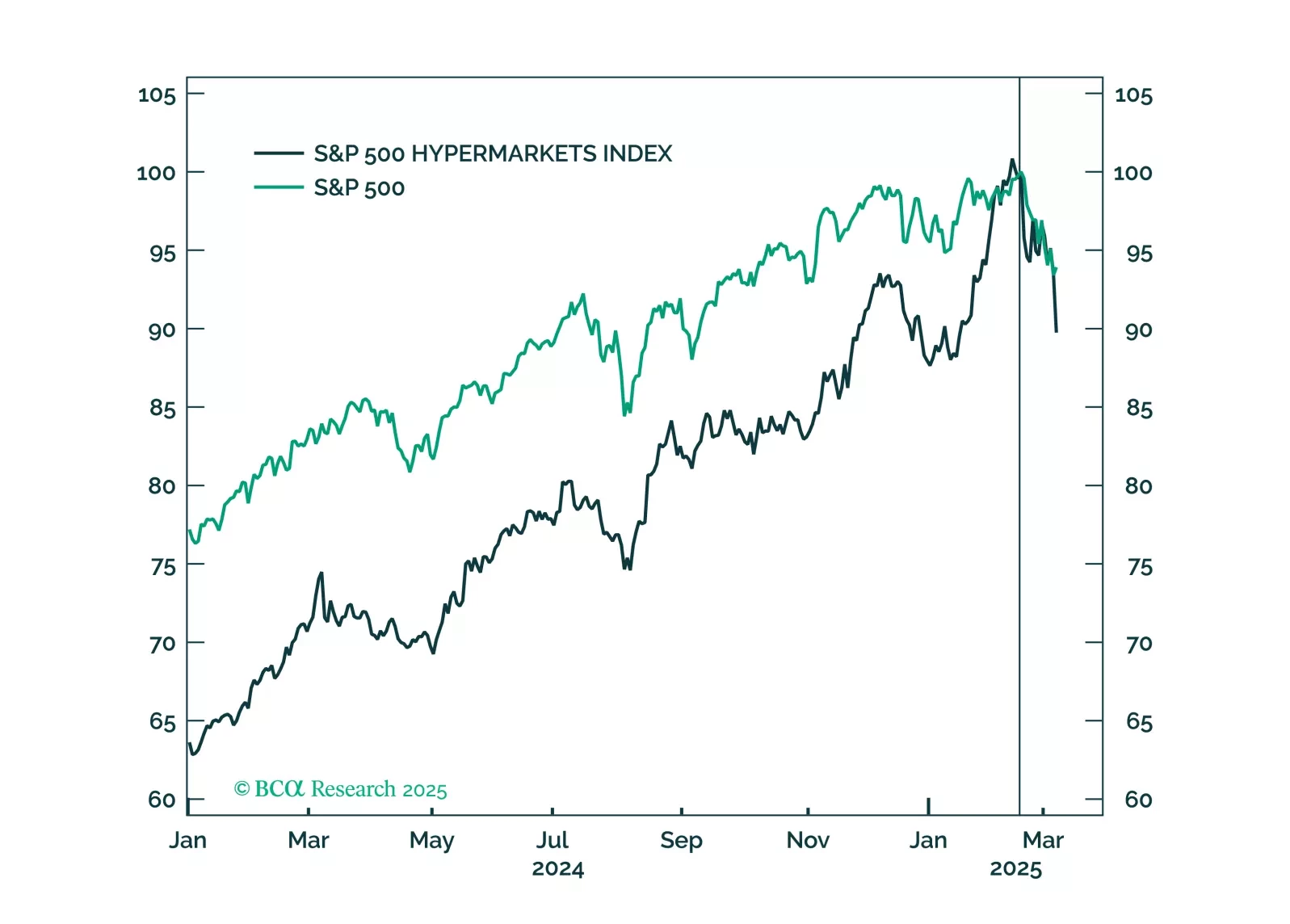

The Q4 earnings results were spectacular but are now in the rear-view mirror. Now, investors are laser-focused on tariff threats, earnings headwinds brought about by a stronger dollar, and an unhappy consumer. Our analysis of…

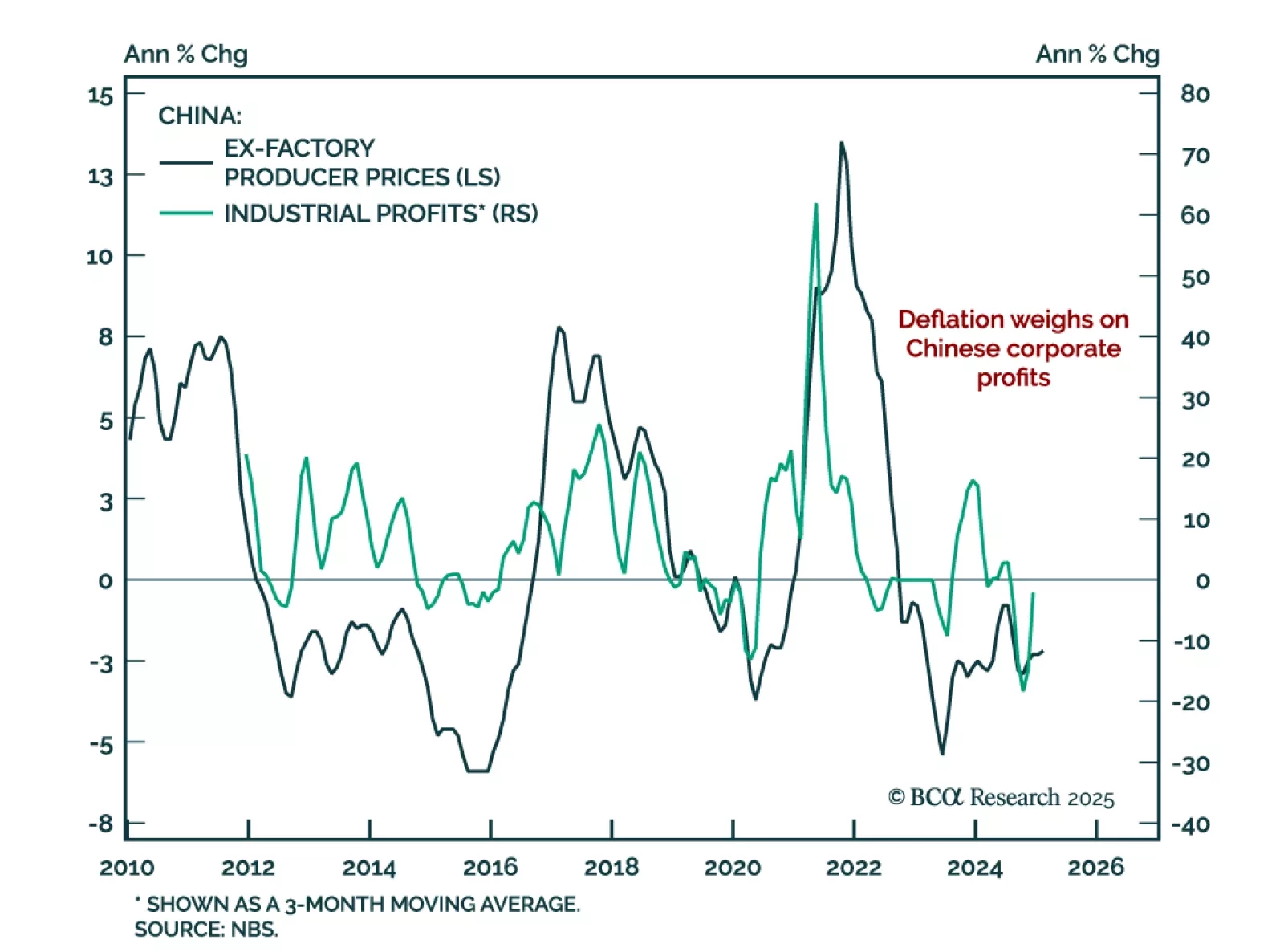

China’s February consumer prices fell 0.7% y/y after expanding on an annual basis in January. Producer price deflation stood at -2.2% y/y, roughly unchanged from a month prior. China’s first quarter data is heavily influenced by…

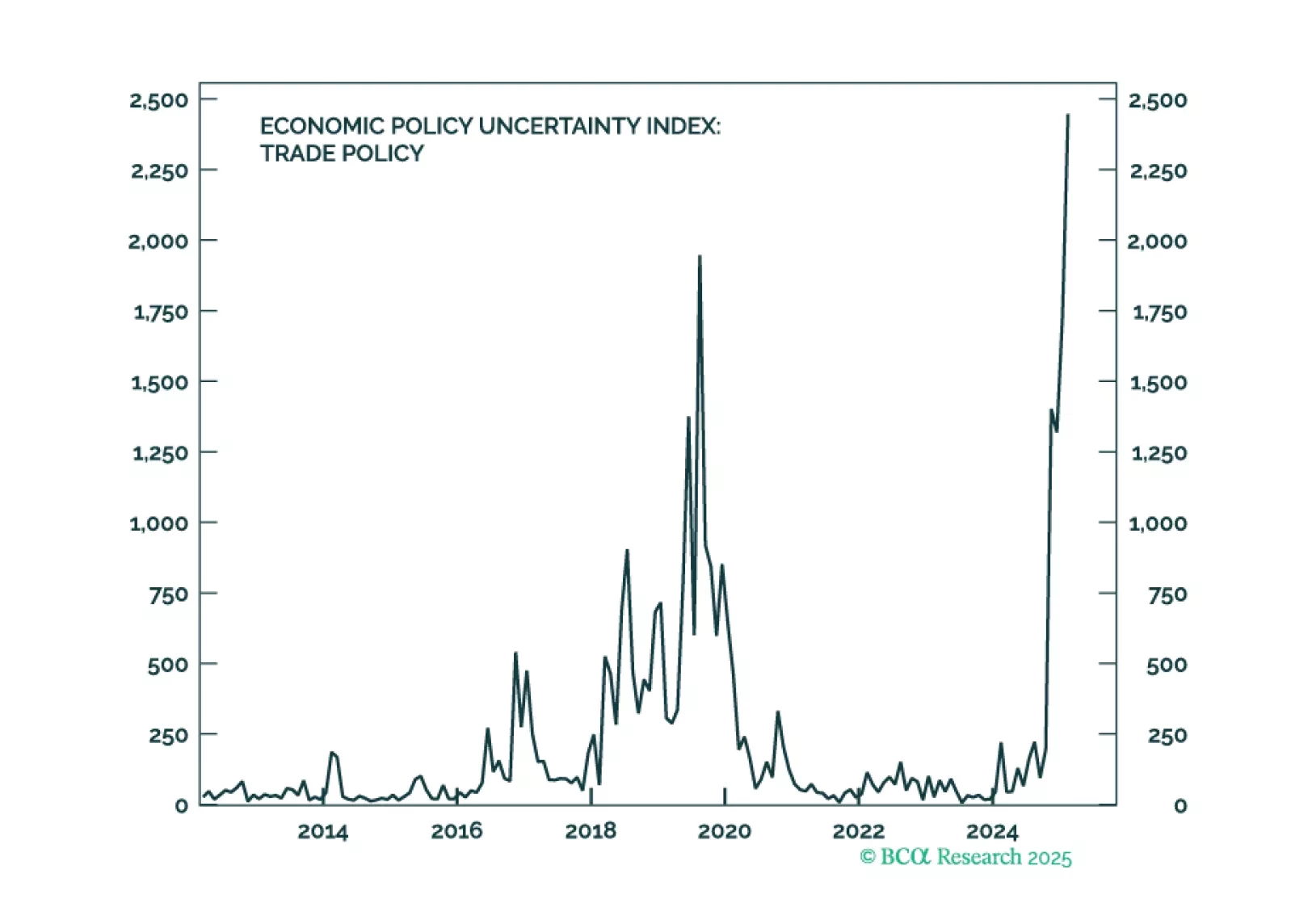

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

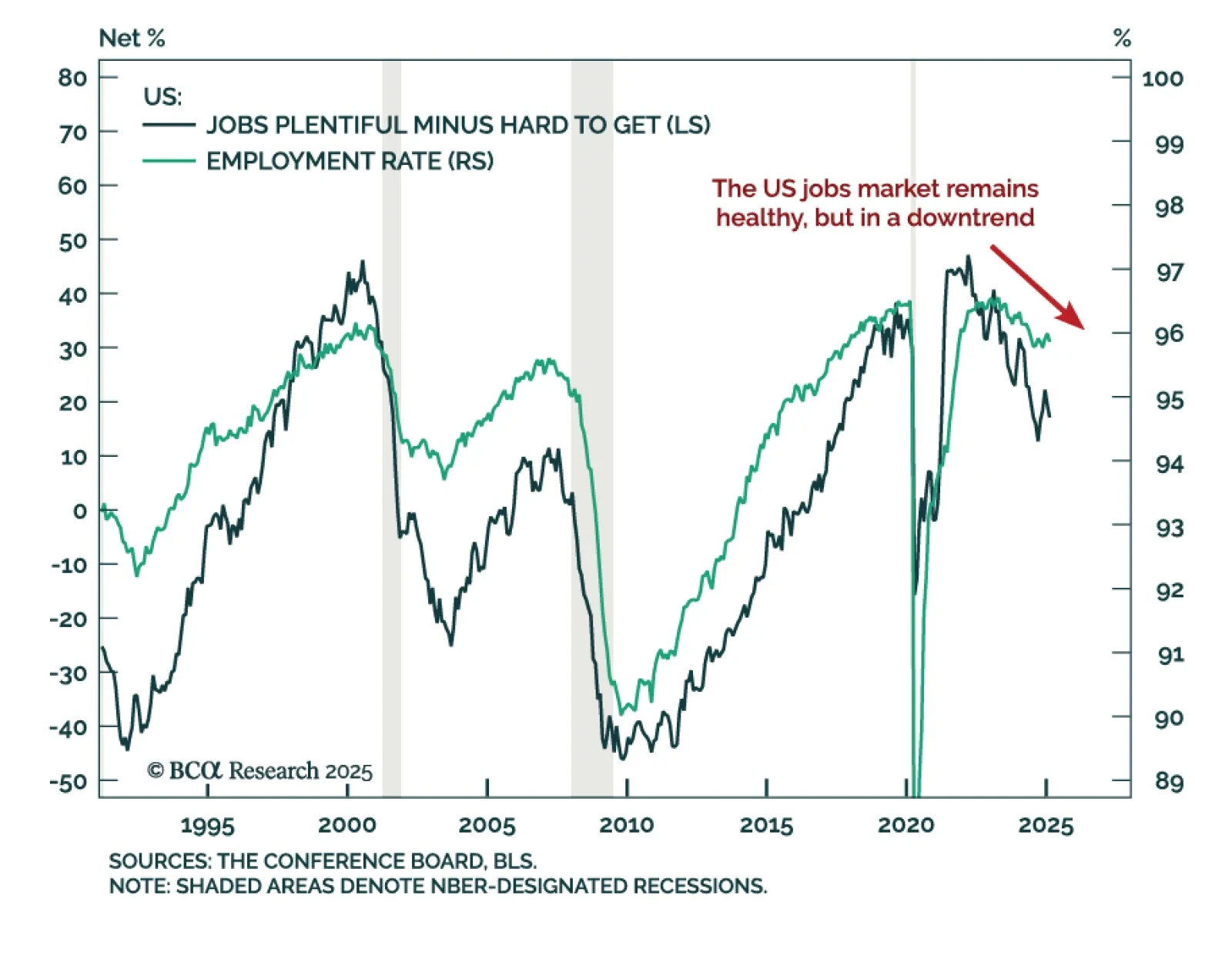

The February US jobs report was slightly weaker than expected, reflecting a slowing but still healthy labor market. At 151k, payrolls missed estimates. January’s number was revised down from 143k to 125k, bringing the 3-month moving…