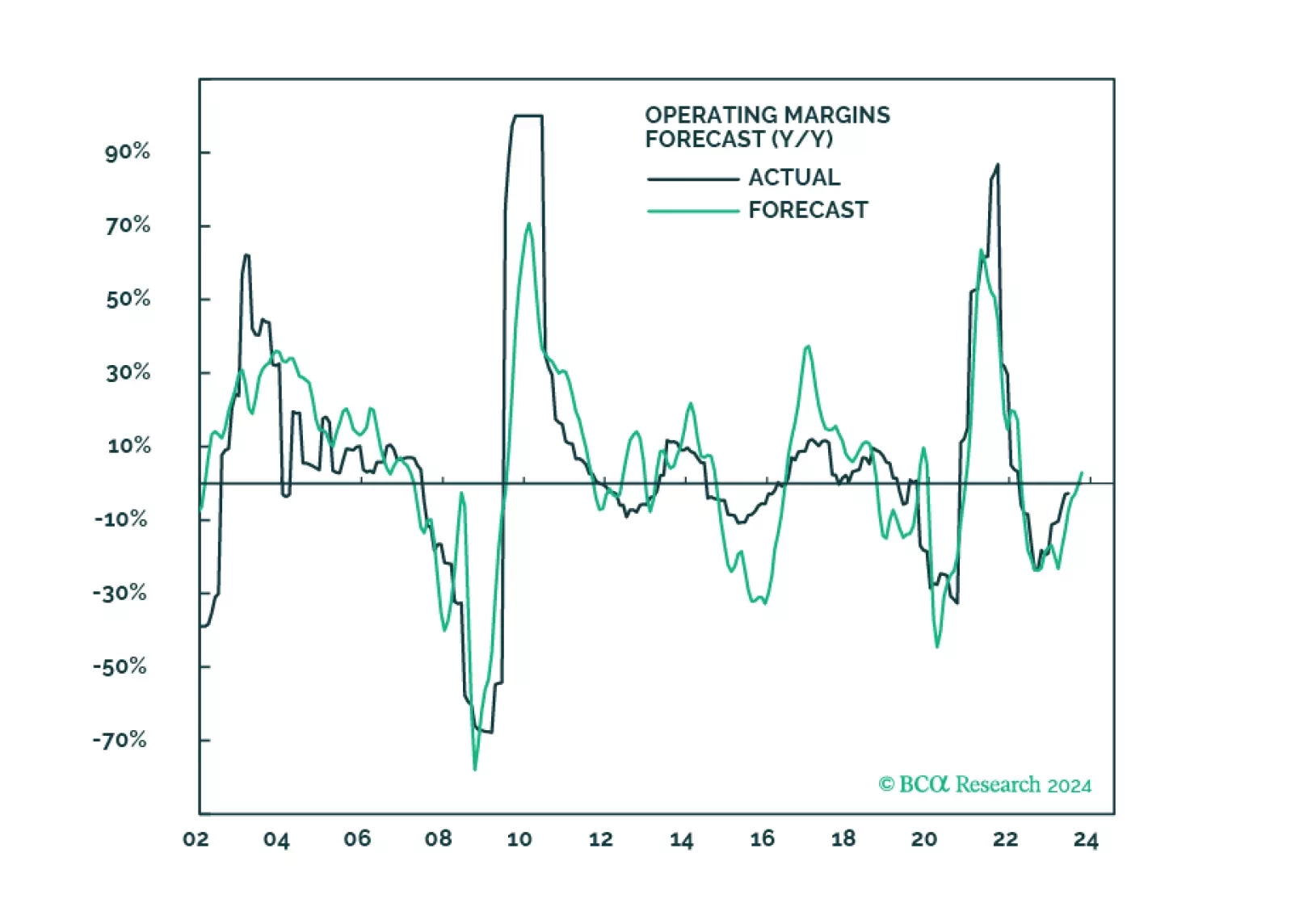

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

The AI craze was the dominant force driving difference in equity sector returns in 2023. Broadly-defined technology sectors were the top three outperformers last year with IT, Communication Services, and Consumer Discretionary…

The S&P 500 closed at a fresh year-to-date high on Friday, breaking slightly above its late-July top. The brisk rally since late-October erased all the losses of the prior three months. However, the sector performance has…

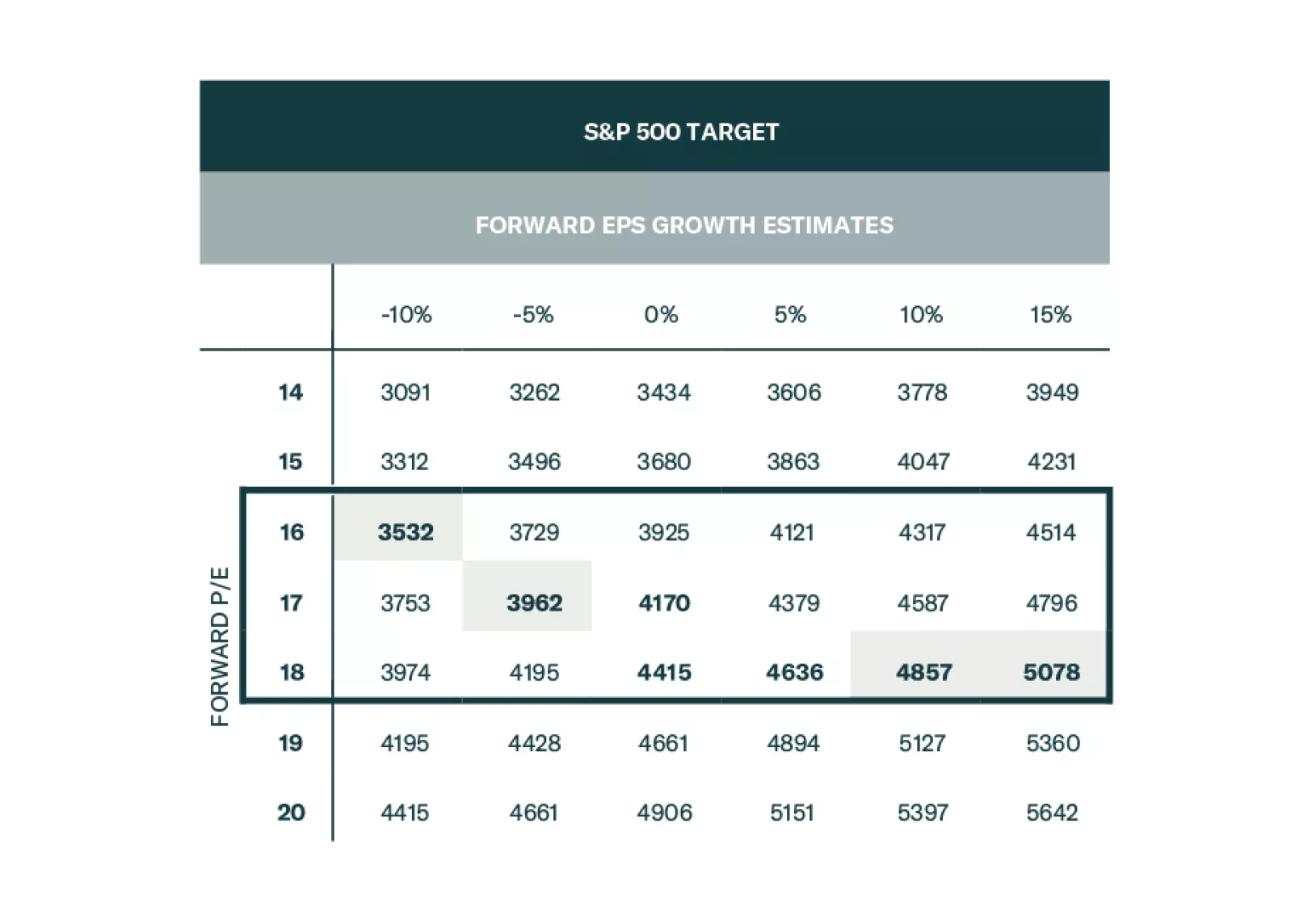

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

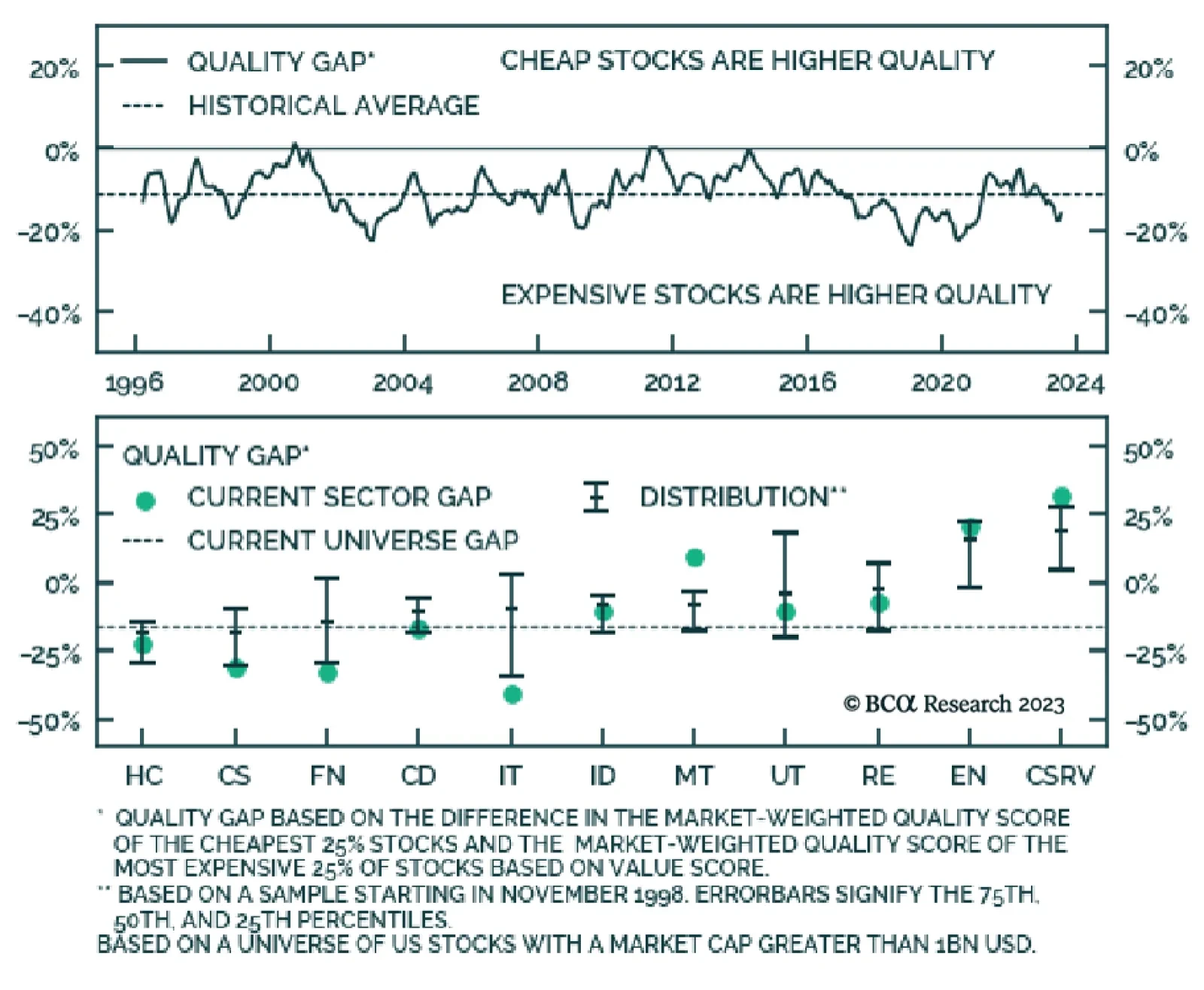

The Equity Analyzer Platform uses a 30-factor model called the BCA Score to help our clients build robust portfolios. Multi-factor models are constructed to avoid the common pitfalls of focusing on one factor dimension, such as…

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…