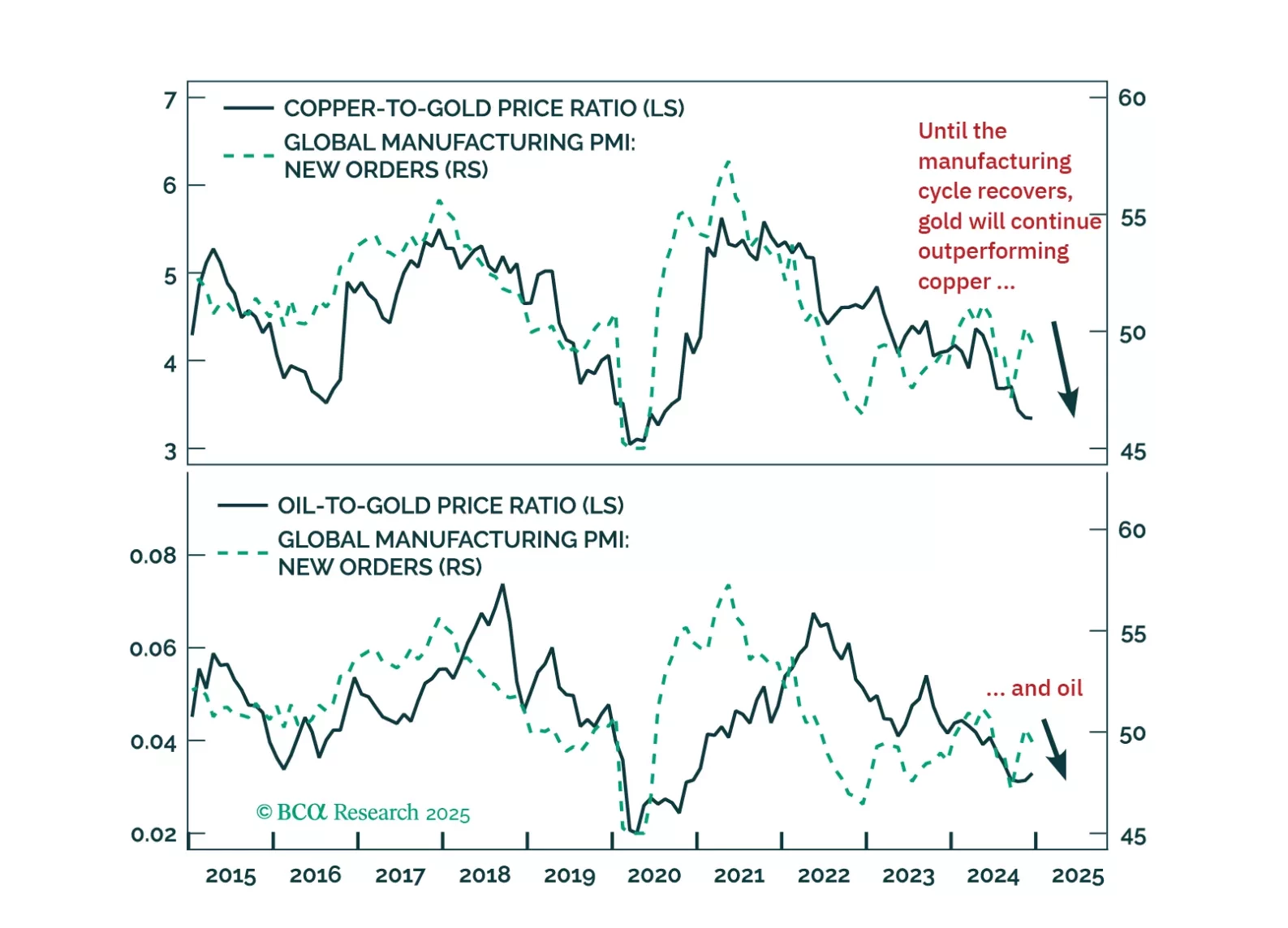

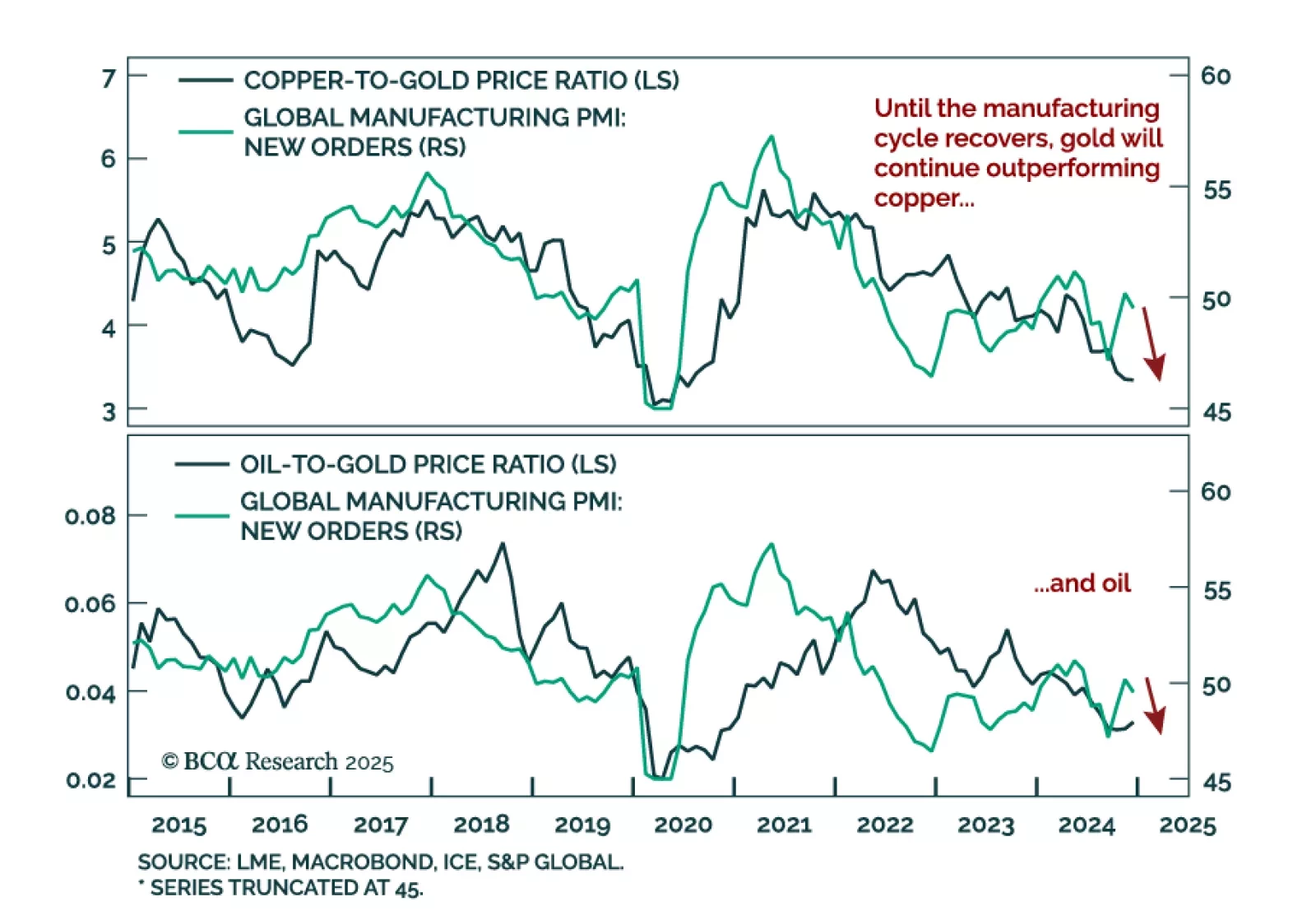

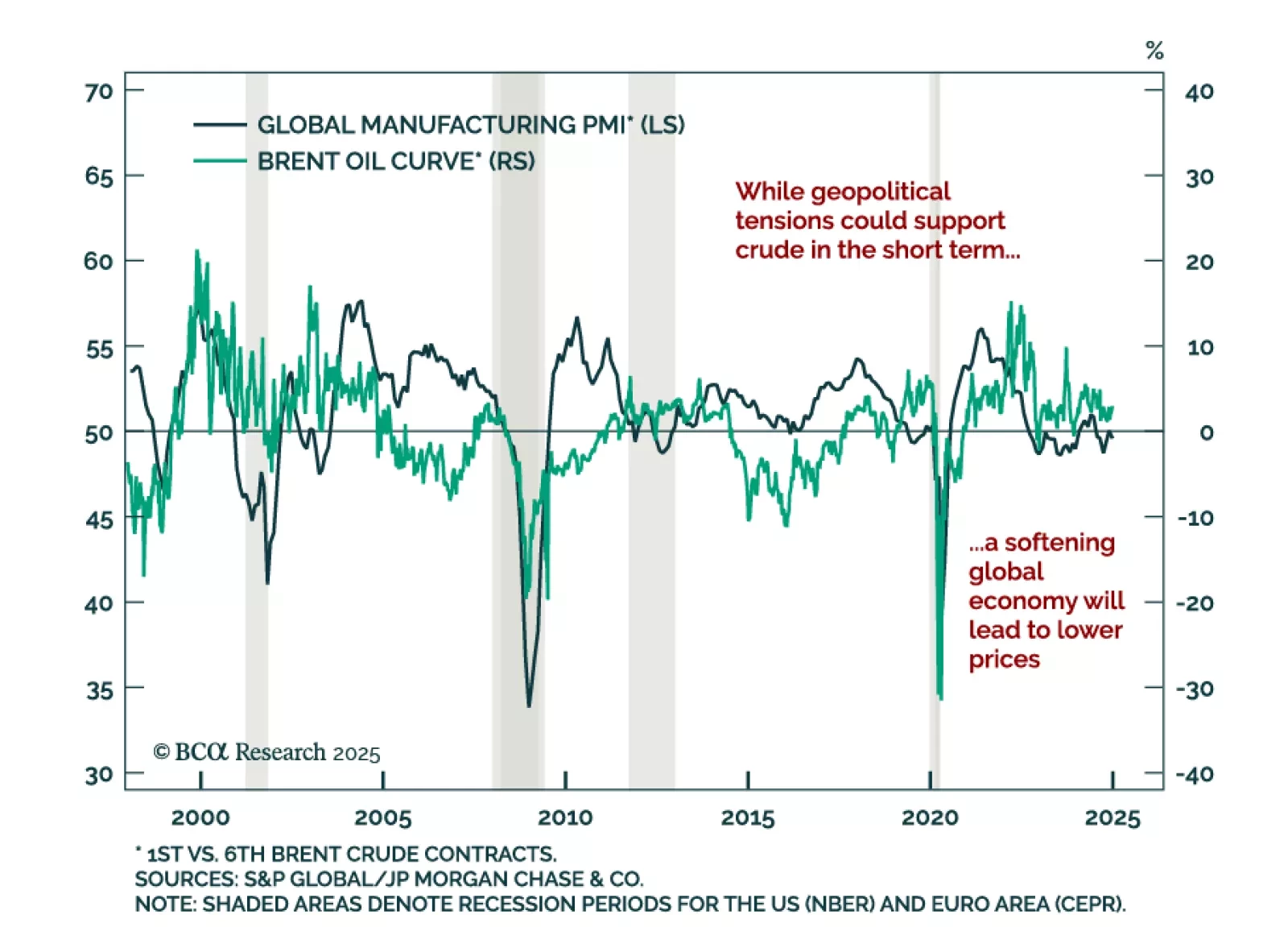

Our Commodities & Energy strategists published a special report outlining three themes they see in the space for 2025. The themes are the following: Sluggish global demand and weak industrial activity will likely weigh…

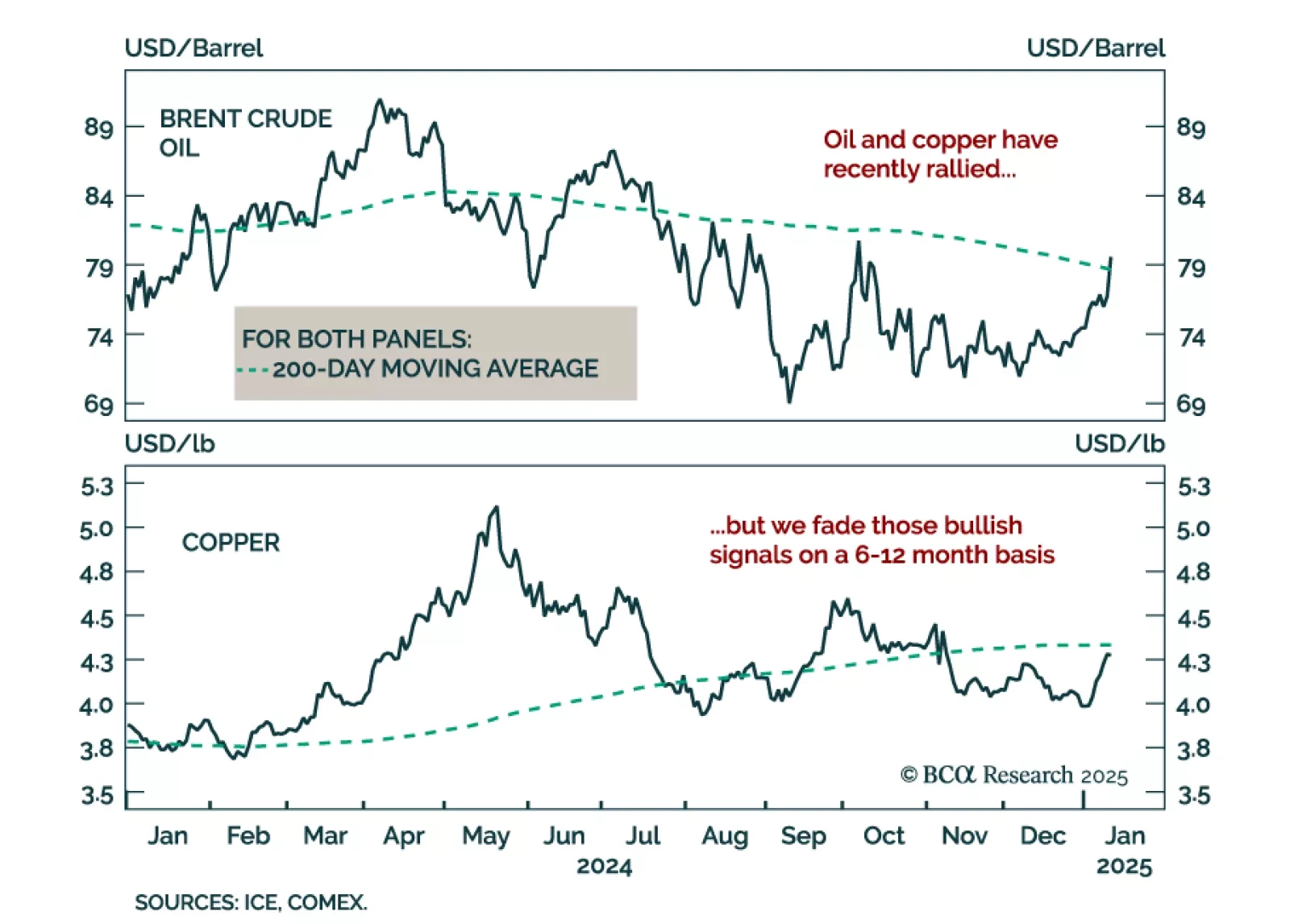

Despite a strong dollar, rising yields, and falling equities, oil and copper prices have recently risen. Oil has broken out above its 200-day moving average, while copper is currently testing its own. Oil’s bullish price…

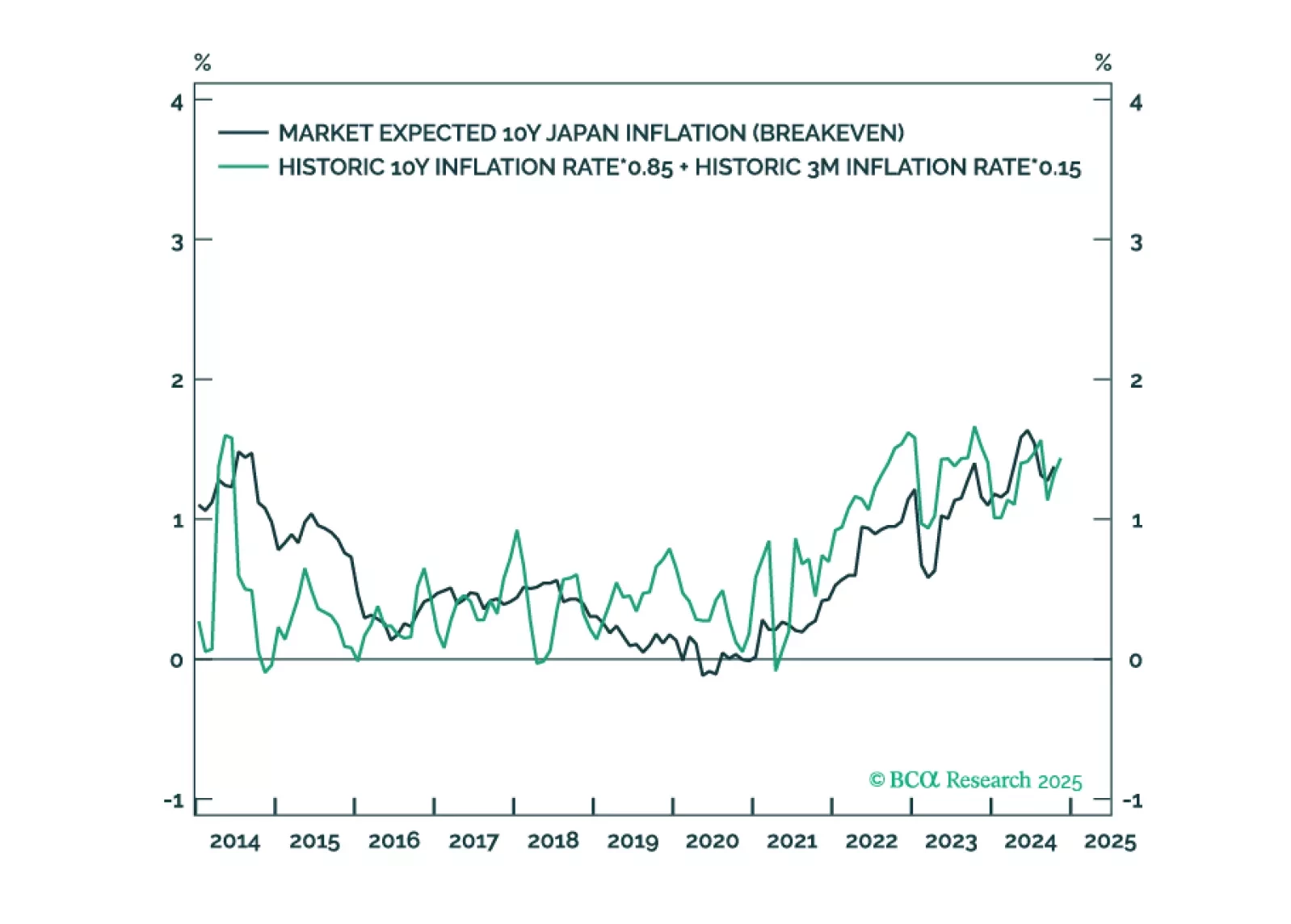

In most developed economies, rising inflation expectations will lift them further above the 2 percent target, limiting the scope for further interest rate cuts. But in Japan, rising inflation expectations will lift them up to the BoJ…

Oil prices have broken out above resistance from a tight trading range since the holidays. We attribute this latest rally to geopolitical tremors more than a vote of confidence from markets on global growth given softening data.…

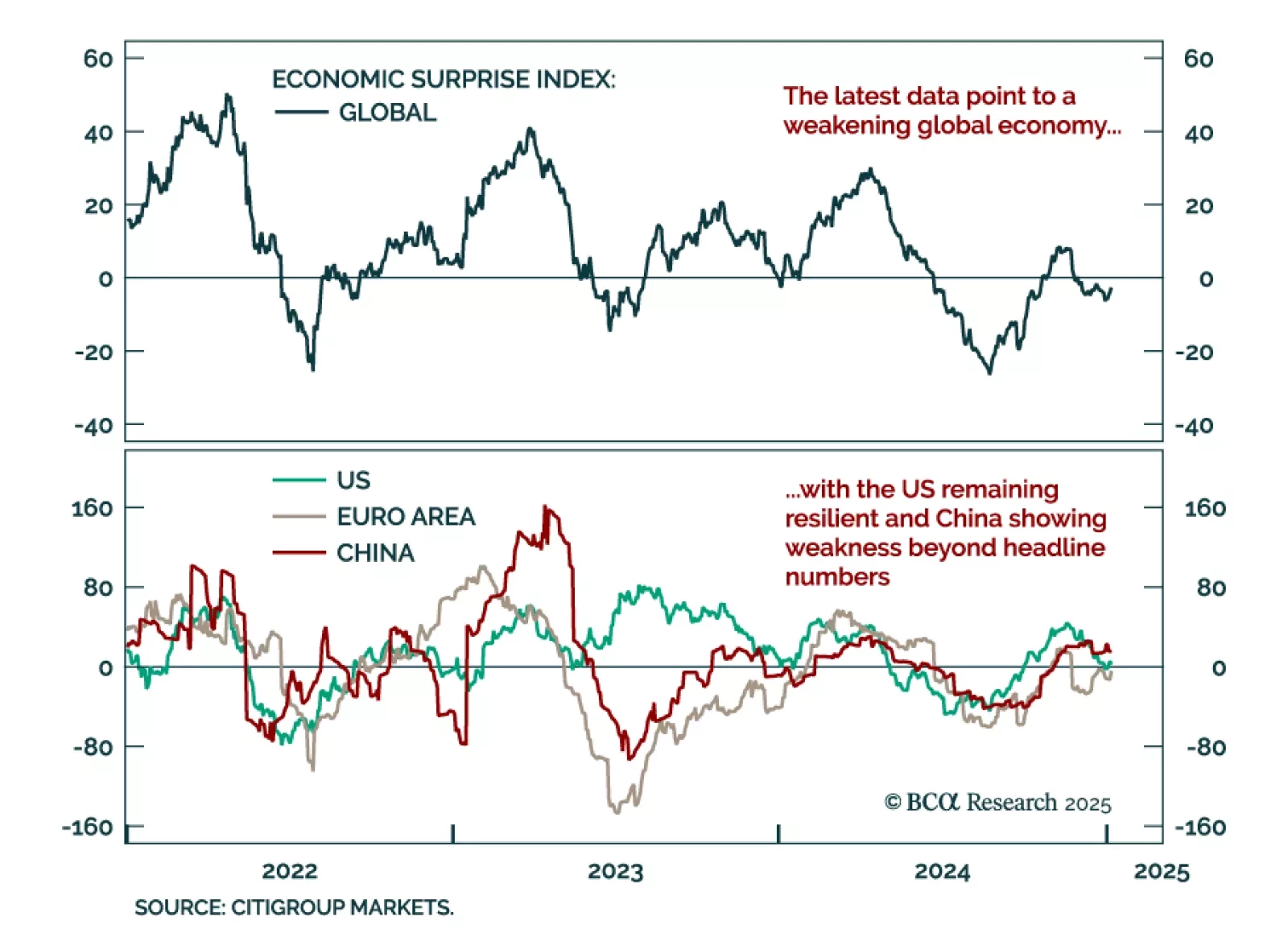

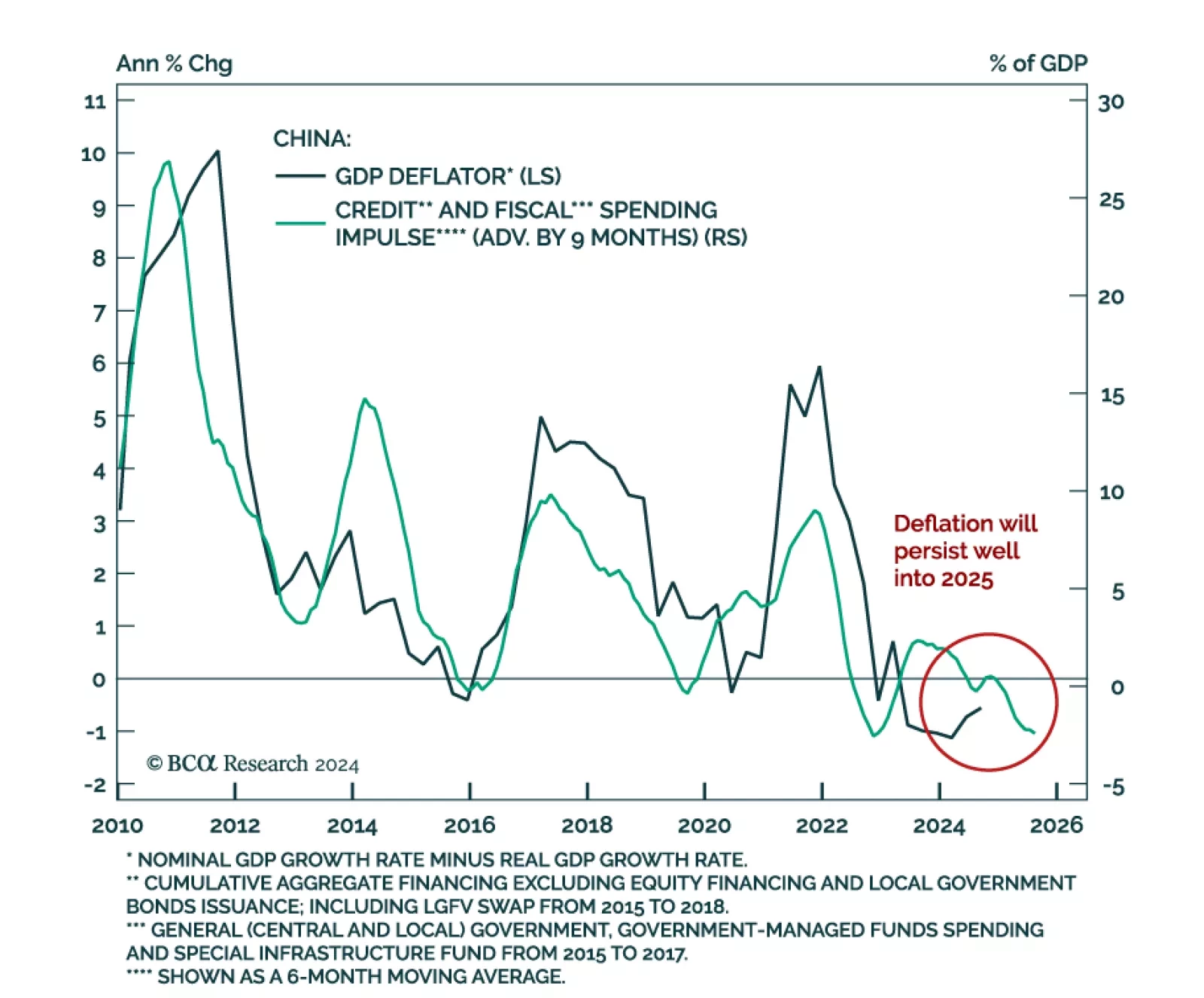

Economic data released over the holiday period extended recent trends, reflecting a softening global economy with resilient US growth, and an ailing manufacturing sector. The December global manufacturing PMI declined to 49.6…

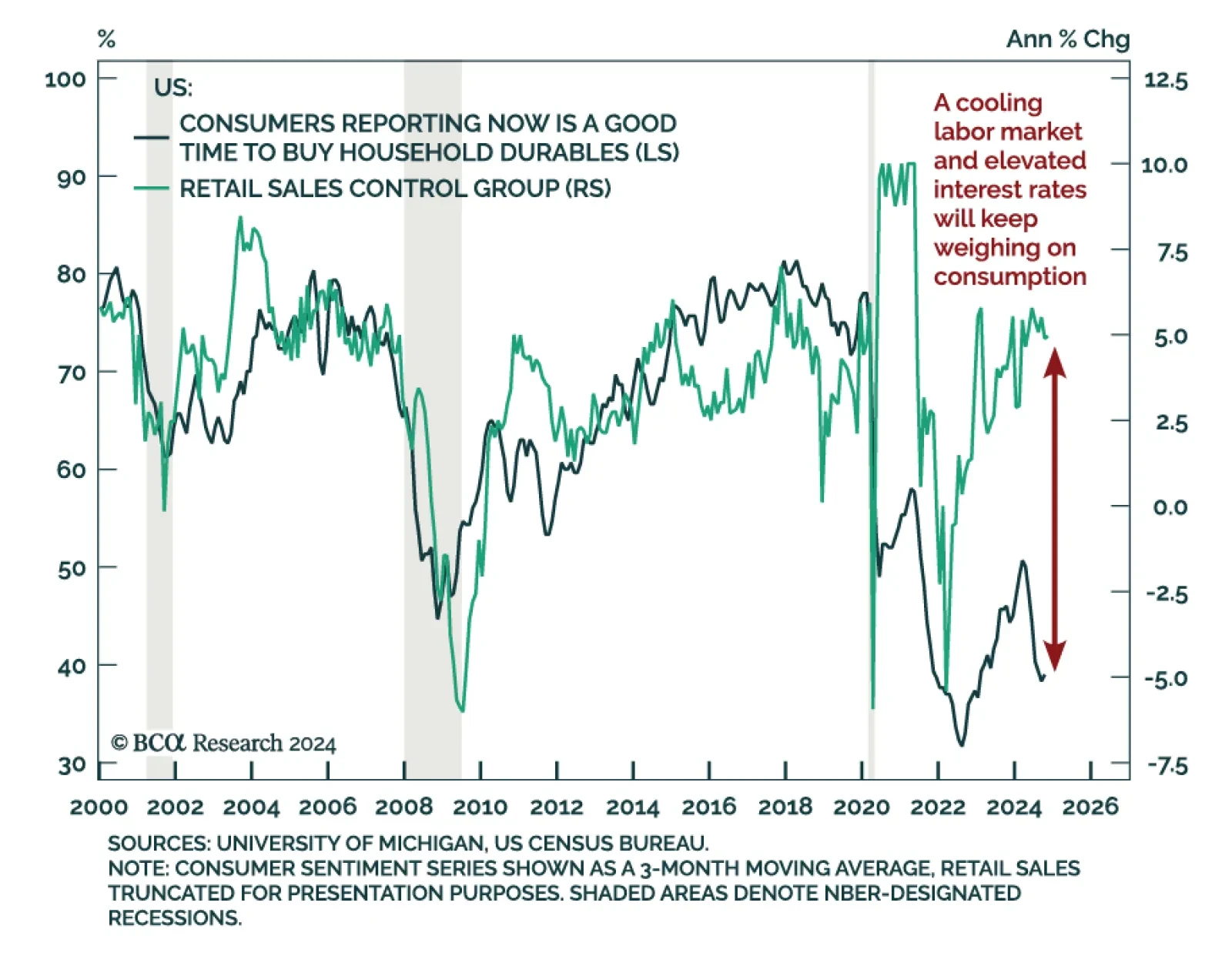

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

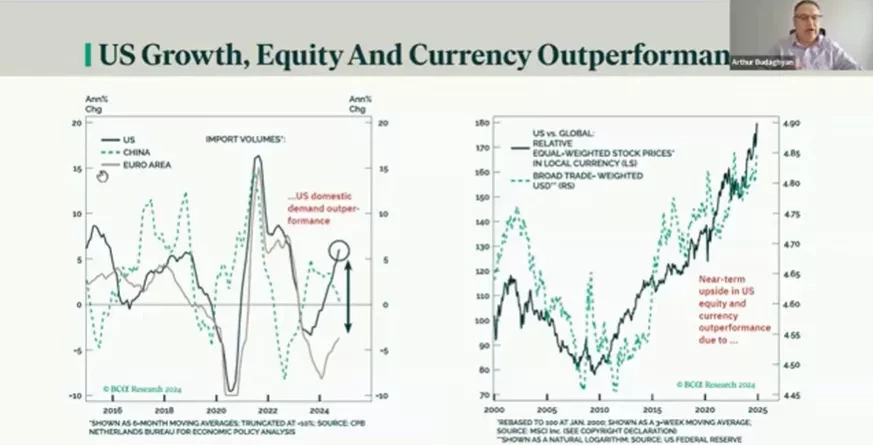

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

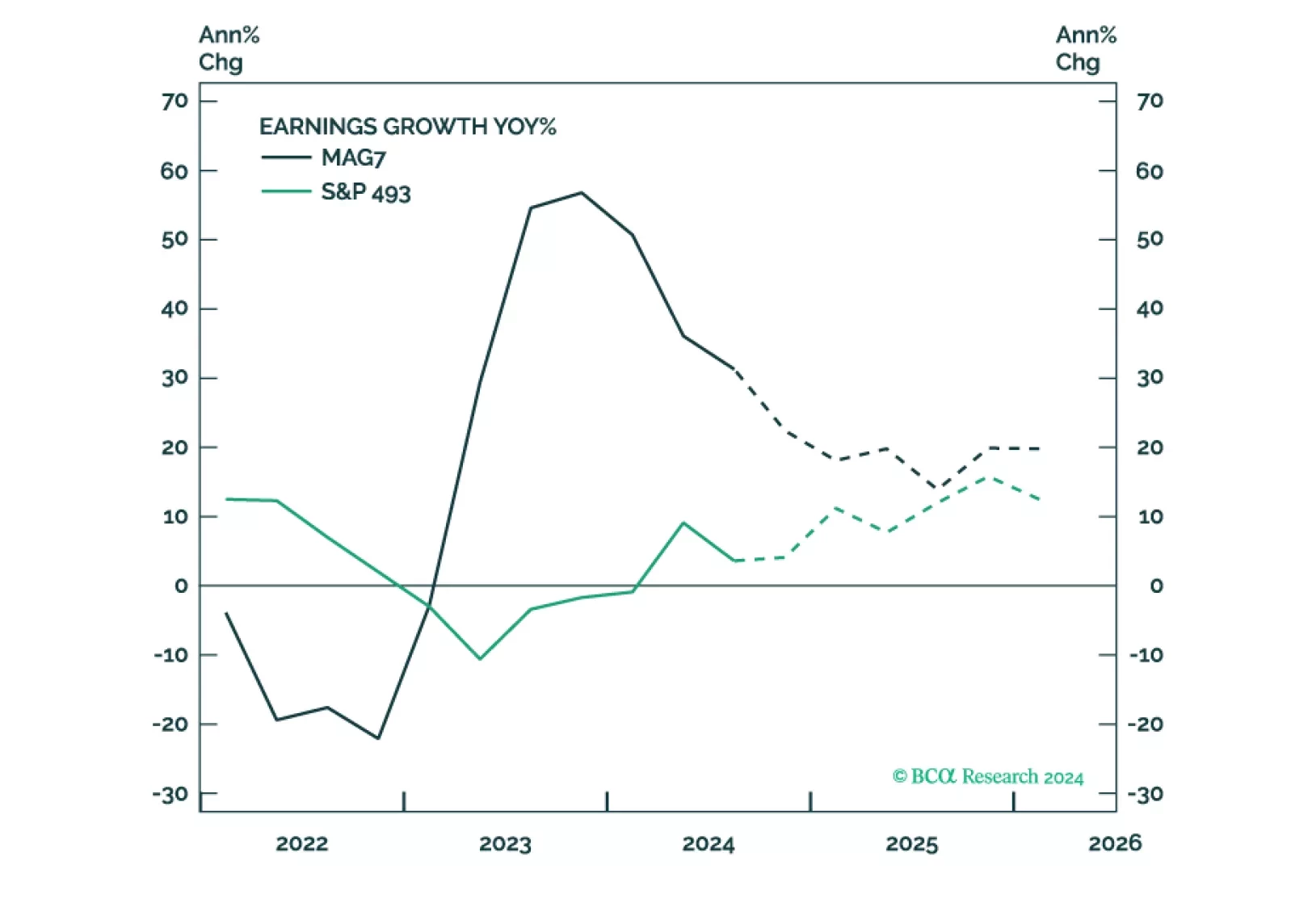

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

What is new? EMS is preparing the ground for a potential change in its USD view sometime in H1 2025. This will be a major milestone as EMS has been structurally bullish on the USD since the spring of 2011.