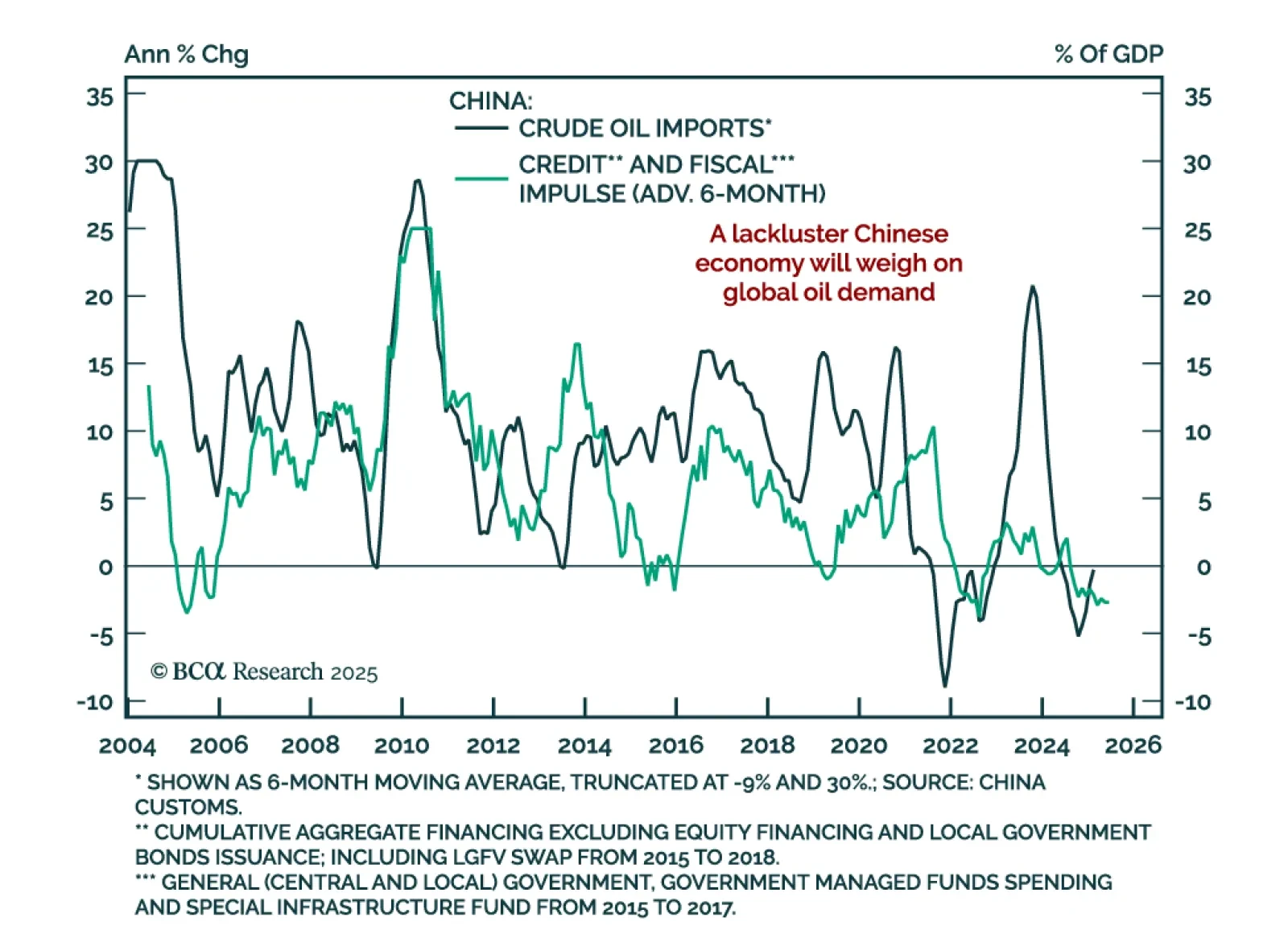

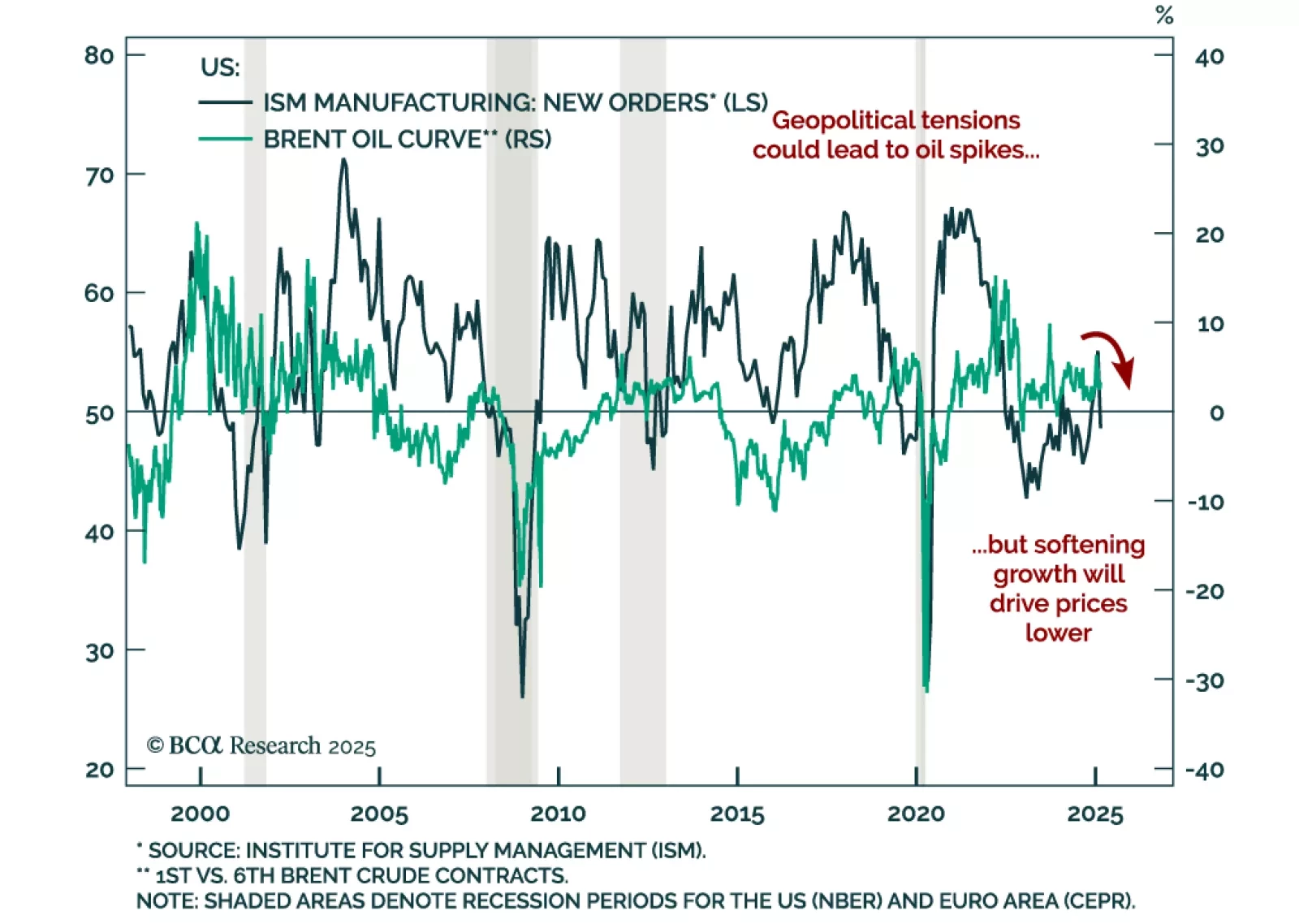

Our Commodities strategists assessed the outlook for oil as crude remains pulled between geopolitical and fundamentals forces. OPEC+’s decision to raise oil supply is driven more by geopolitics than economics. A sustained…

After range-bound trading late last year, oil prices began the year rising to resistance levels, before falling and testing support on the downside. Oil remains caught between conflicting supply and demand risks. Increased…

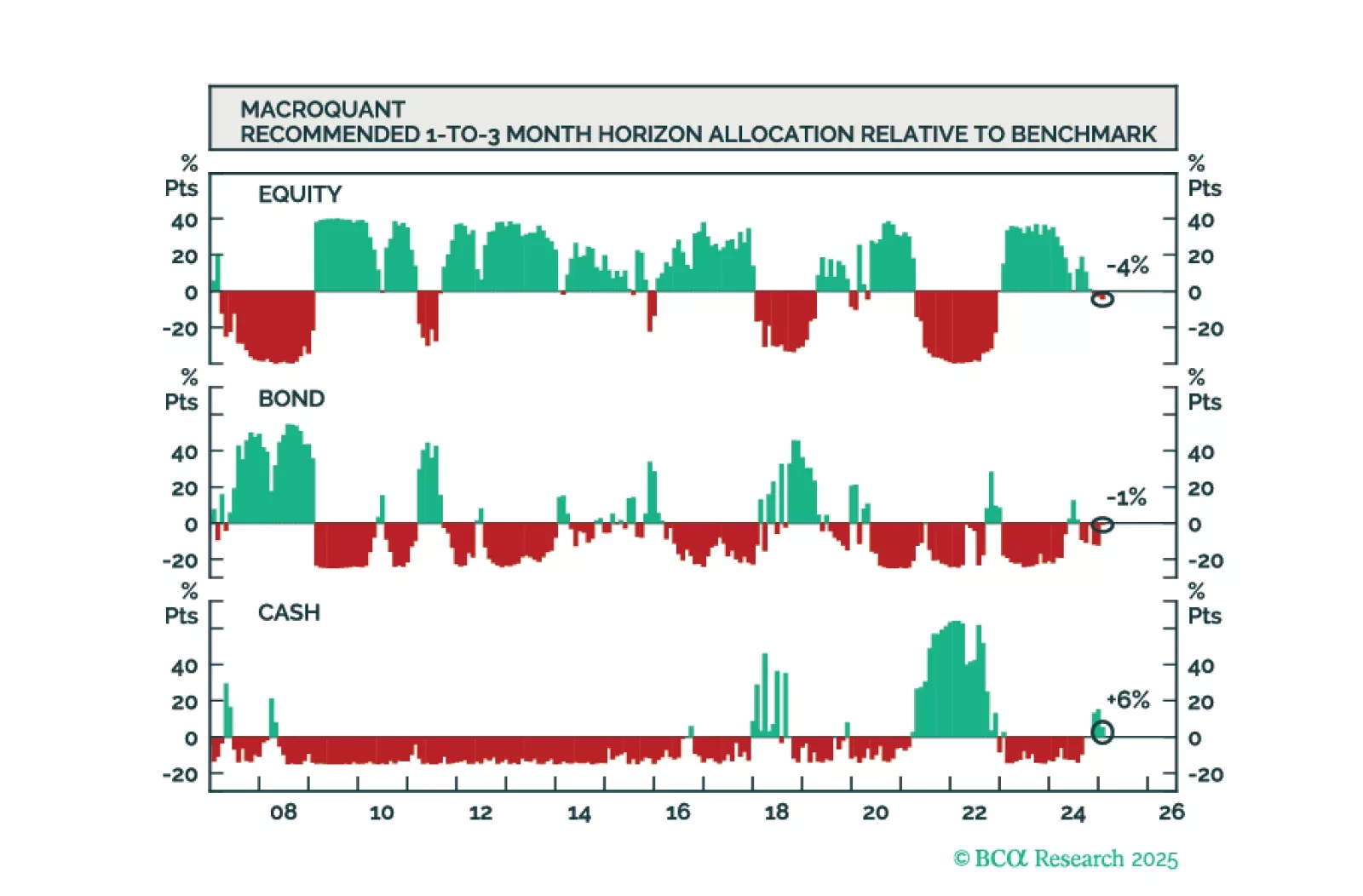

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

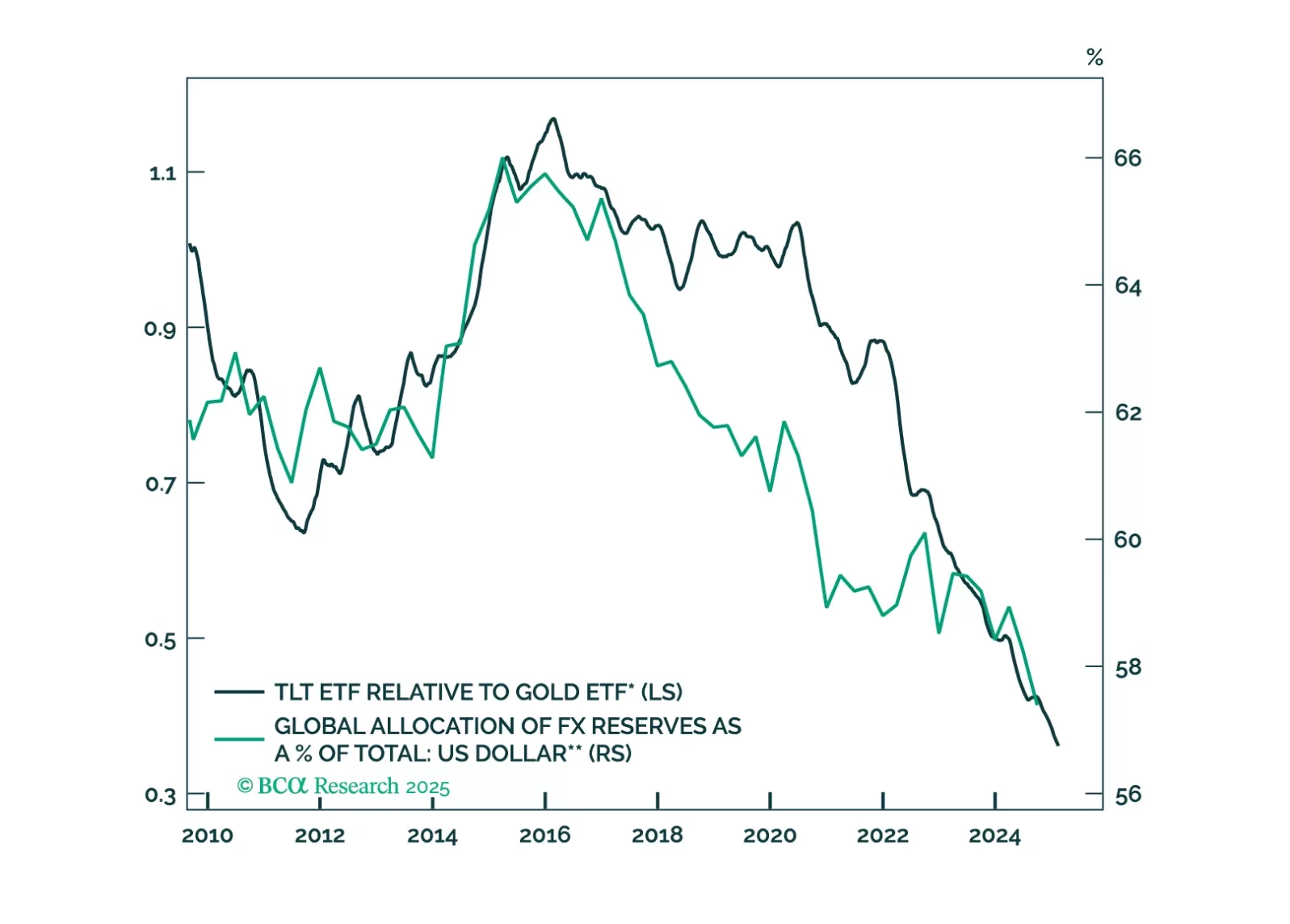

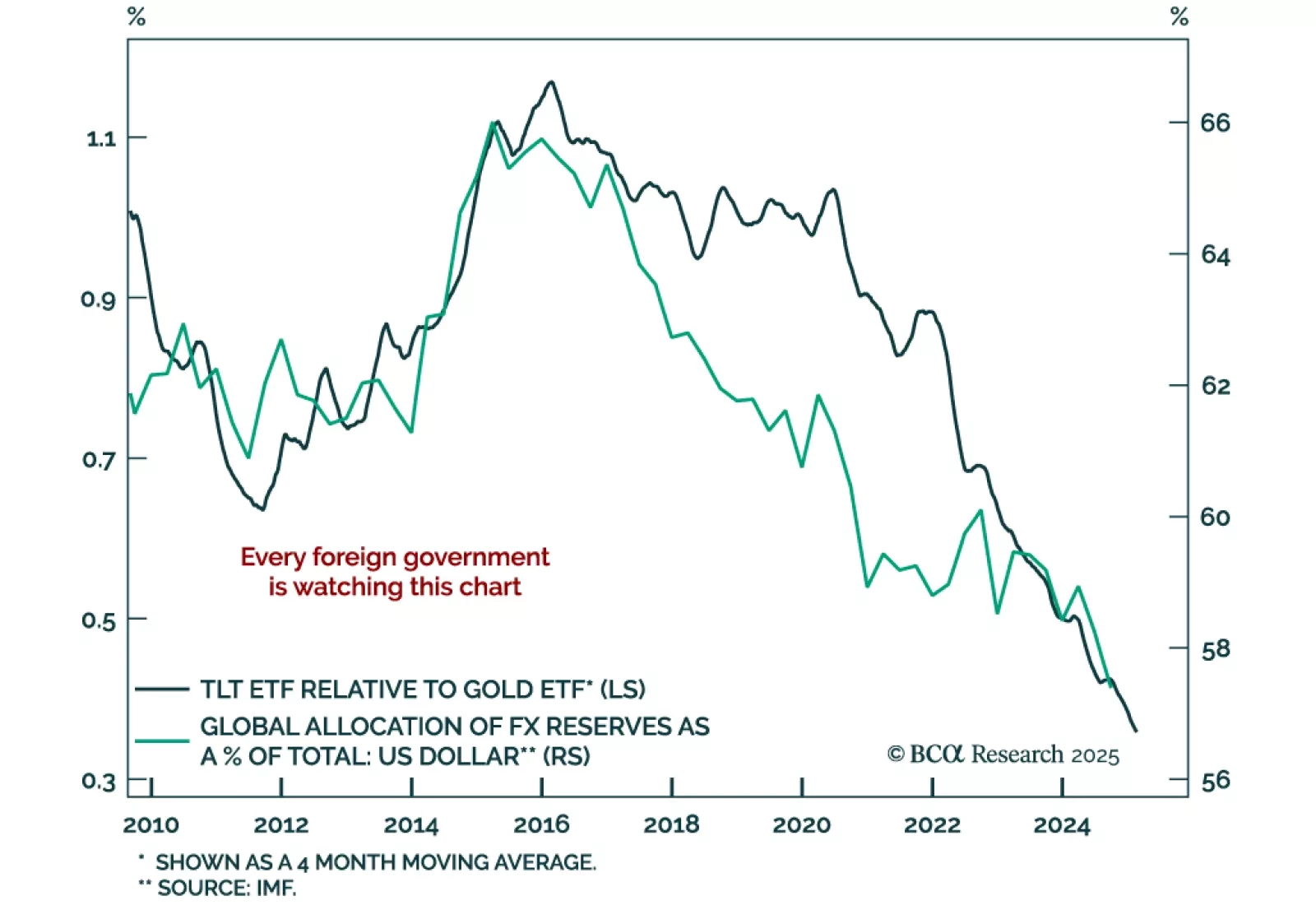

Our Chart Of The Week comes from Chester Ntonifor, Chief Strategist for our Foreign Exchange and Global Fixed Income Strategy services. A big macro trade over the last few years has been to shun US Treasuries, in favor of…

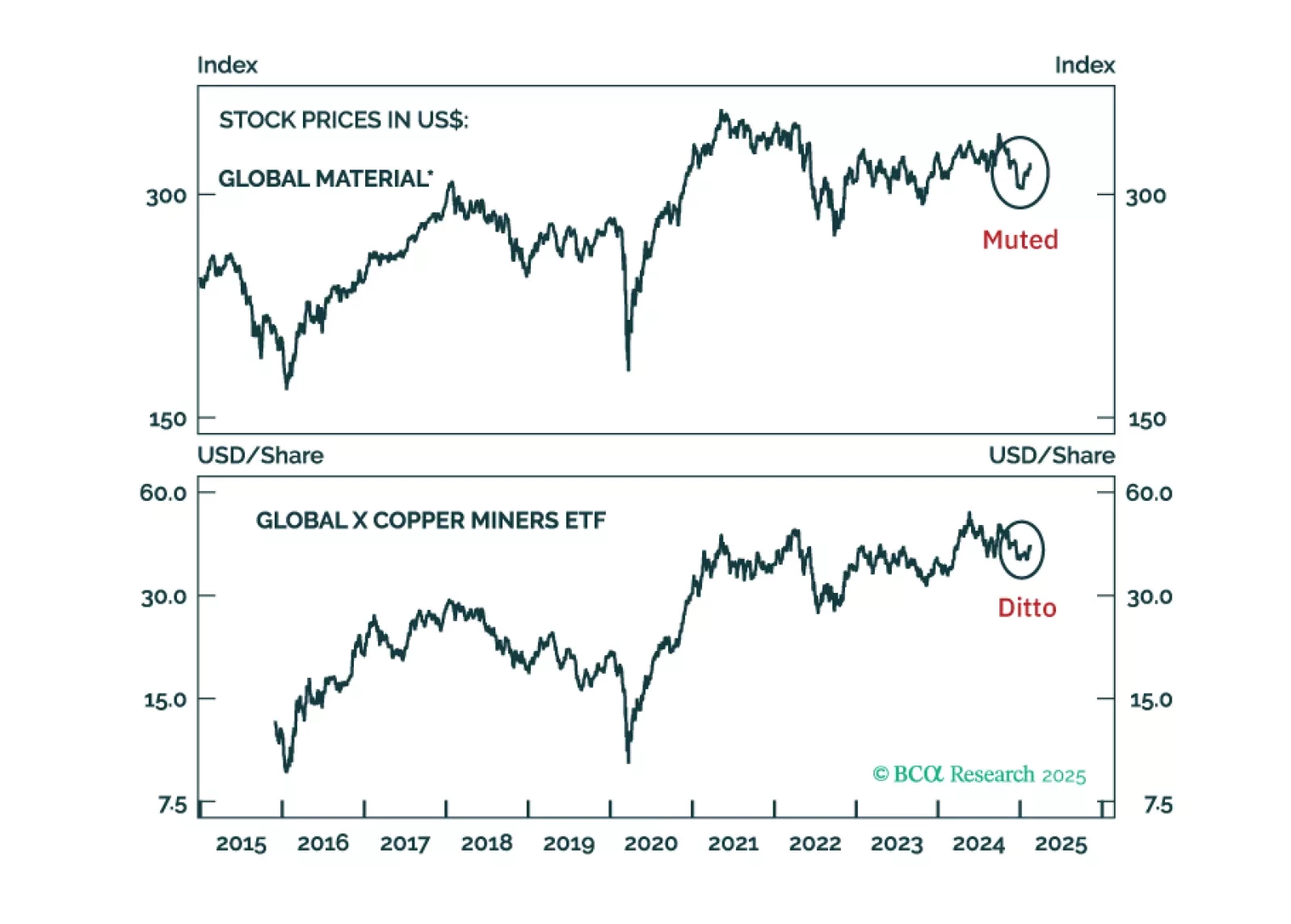

Our Emerging Markets and Commodities strategists explored the dislocations in metals markets as tariffs fears led to physical flows to the US and price spikes. US import tariffs on gold, silver, platinum, and copper are…

Expectations of US import tariffs drove the latest upleg in the prices of precious and industrial metals. However, there are no significant economic or political incentives for the US to impose import tariffs on these metals.…

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

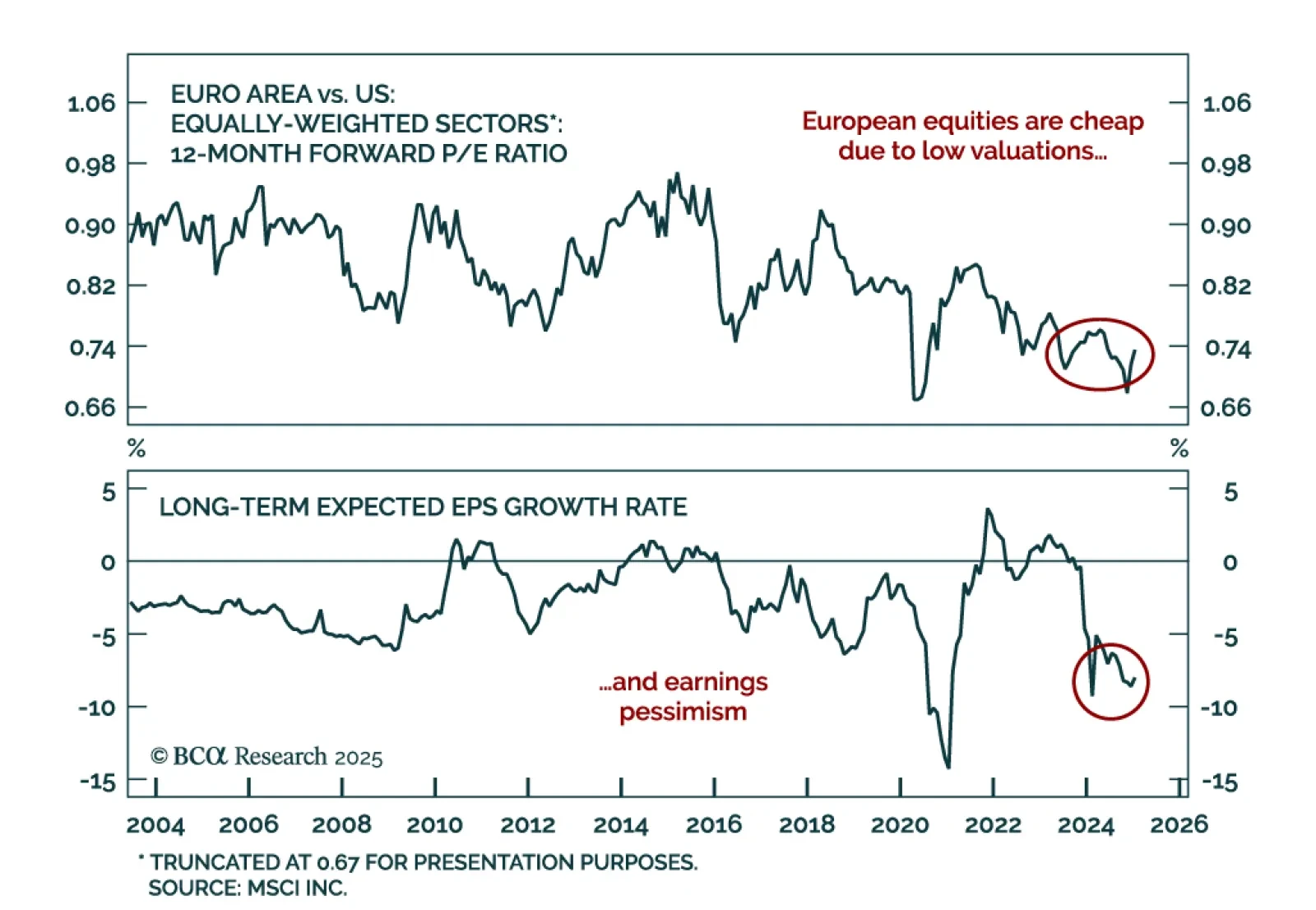

Our European strategists look at European equities after they garnered attention due to their low valuations. European equities are attracting interest primarily due to low valuations rather than strong growth expectations. Key…

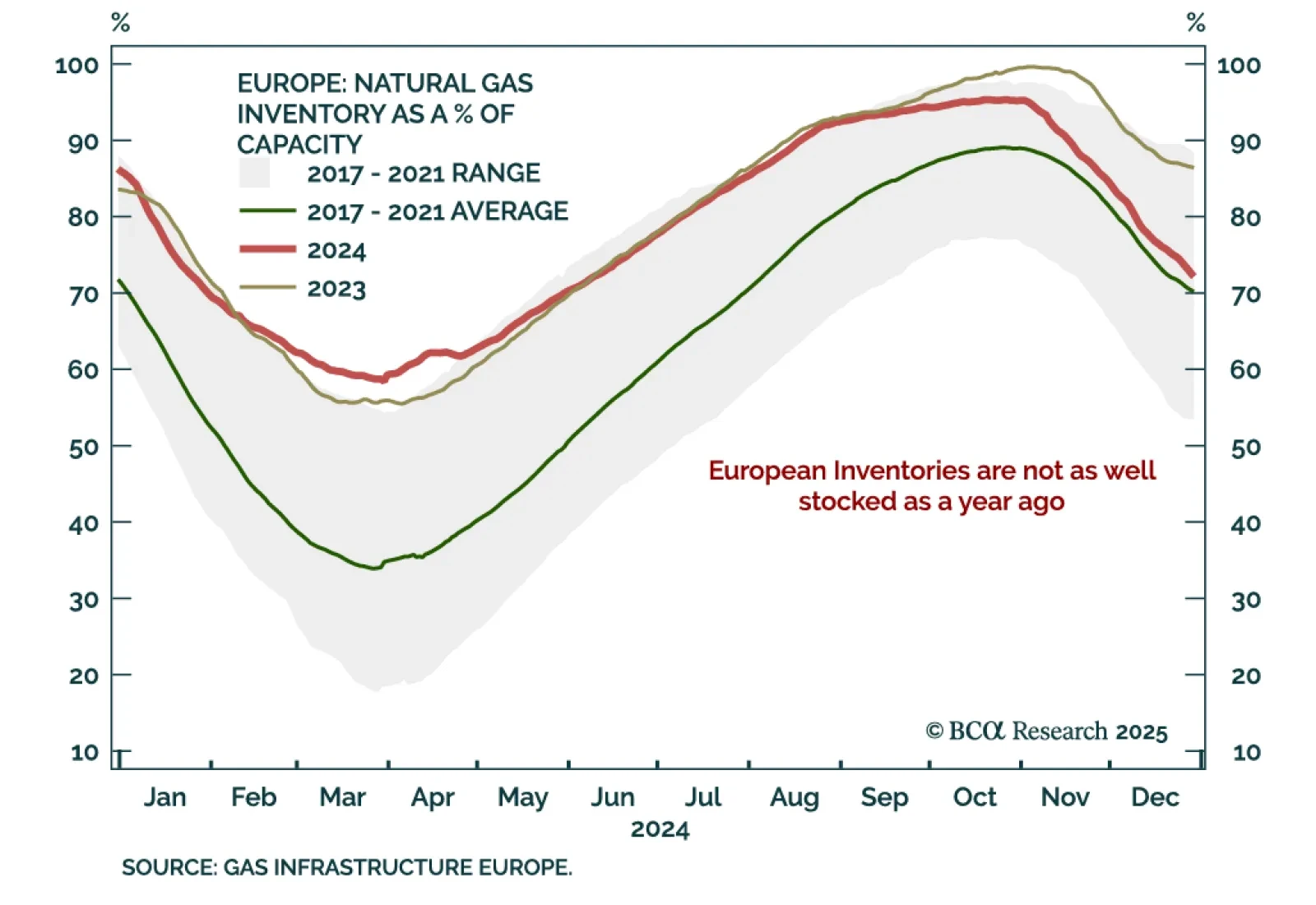

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…