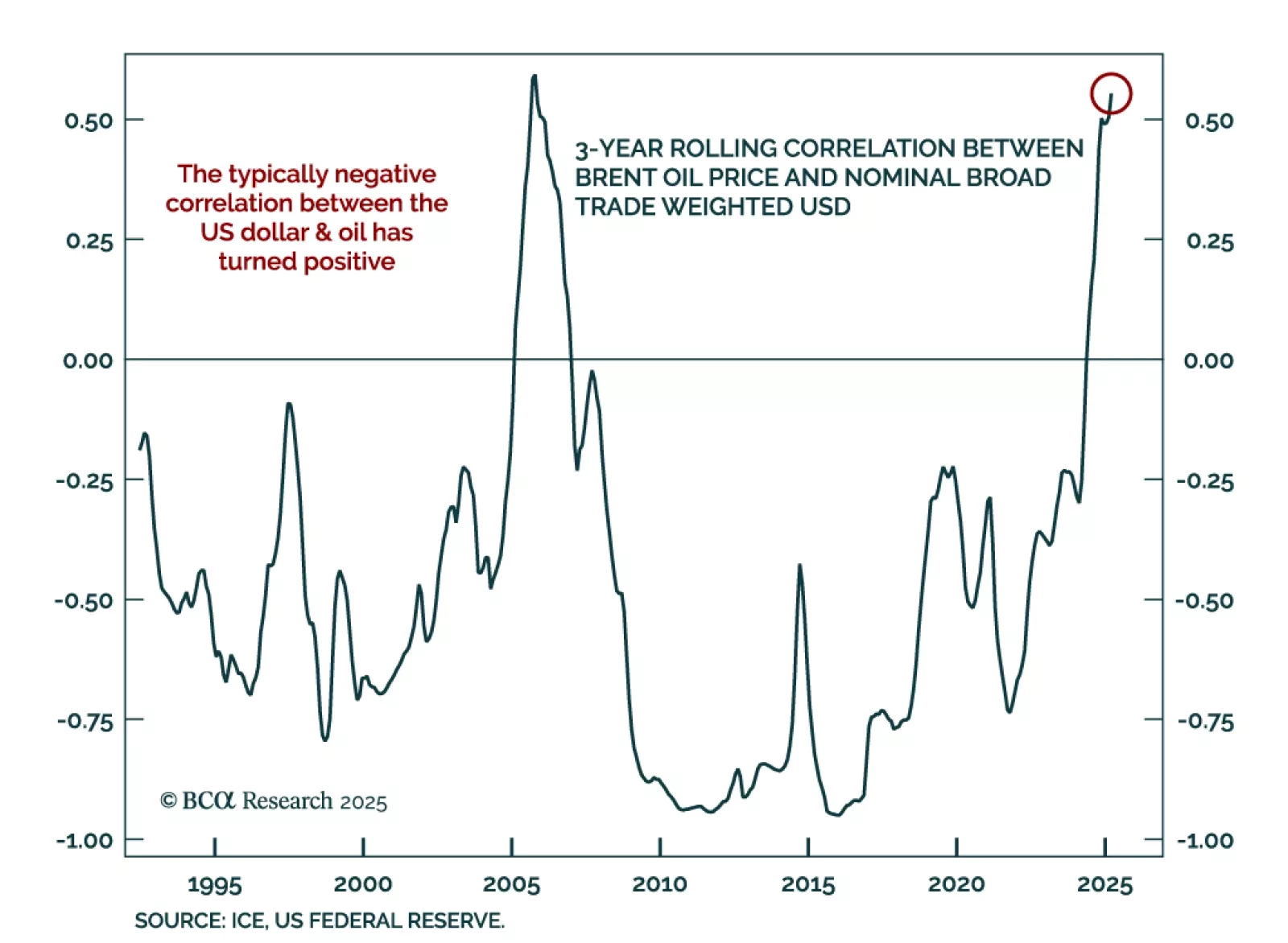

Our Commodity strategists remain defensive as both demand- and supply risks abound. Stay long gold and underweight oil and copper as increasing OPEC+ supply and tariff-driven demand risks will hurt energy and industrial metals prices…

Our Commodities strategists remain defensively positioned, recommending a long gold versus oil and copper trade over a cyclical timeframe. While gold may correct near term, it still offers safe-haven appeal in the face of rising…

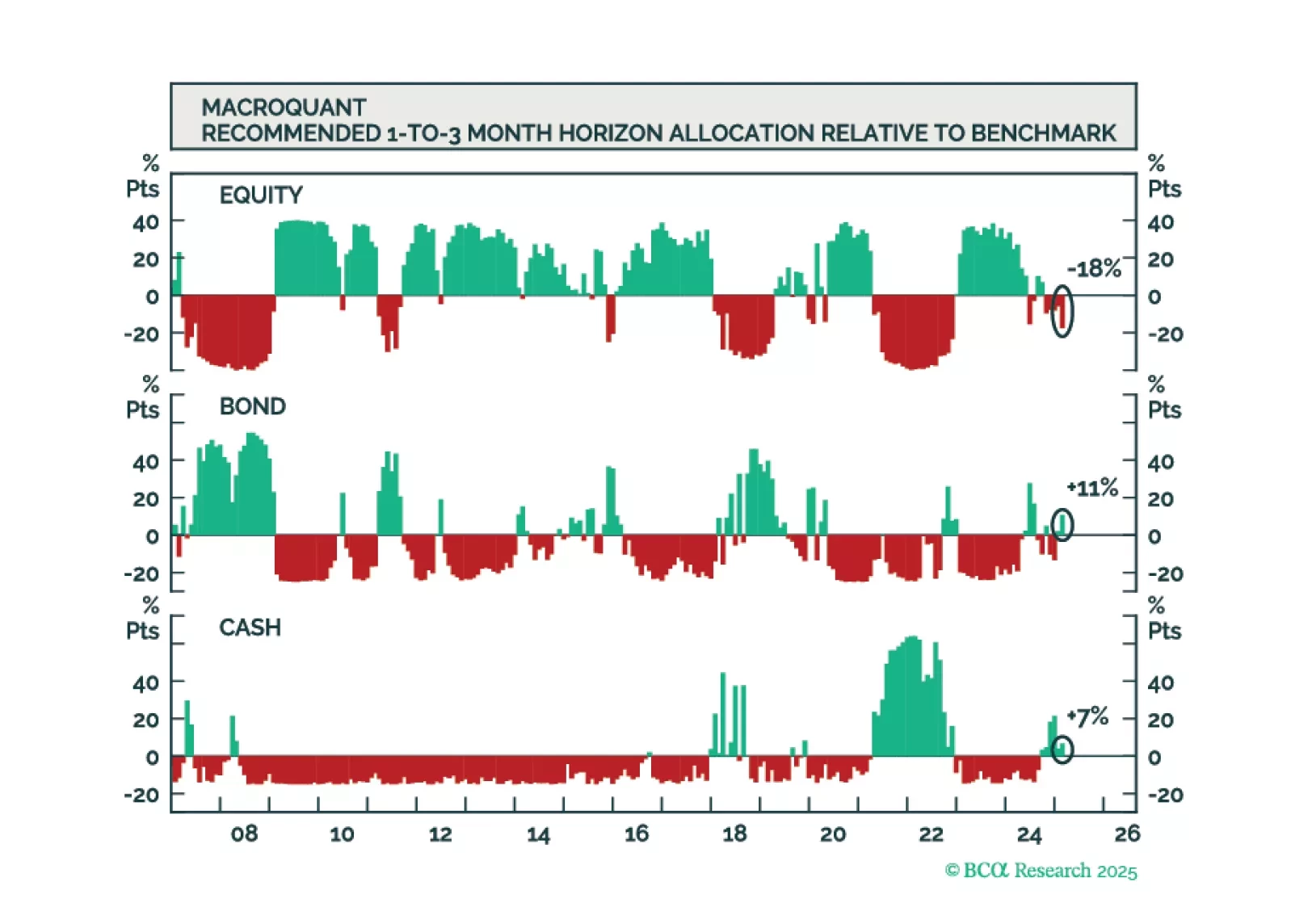

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

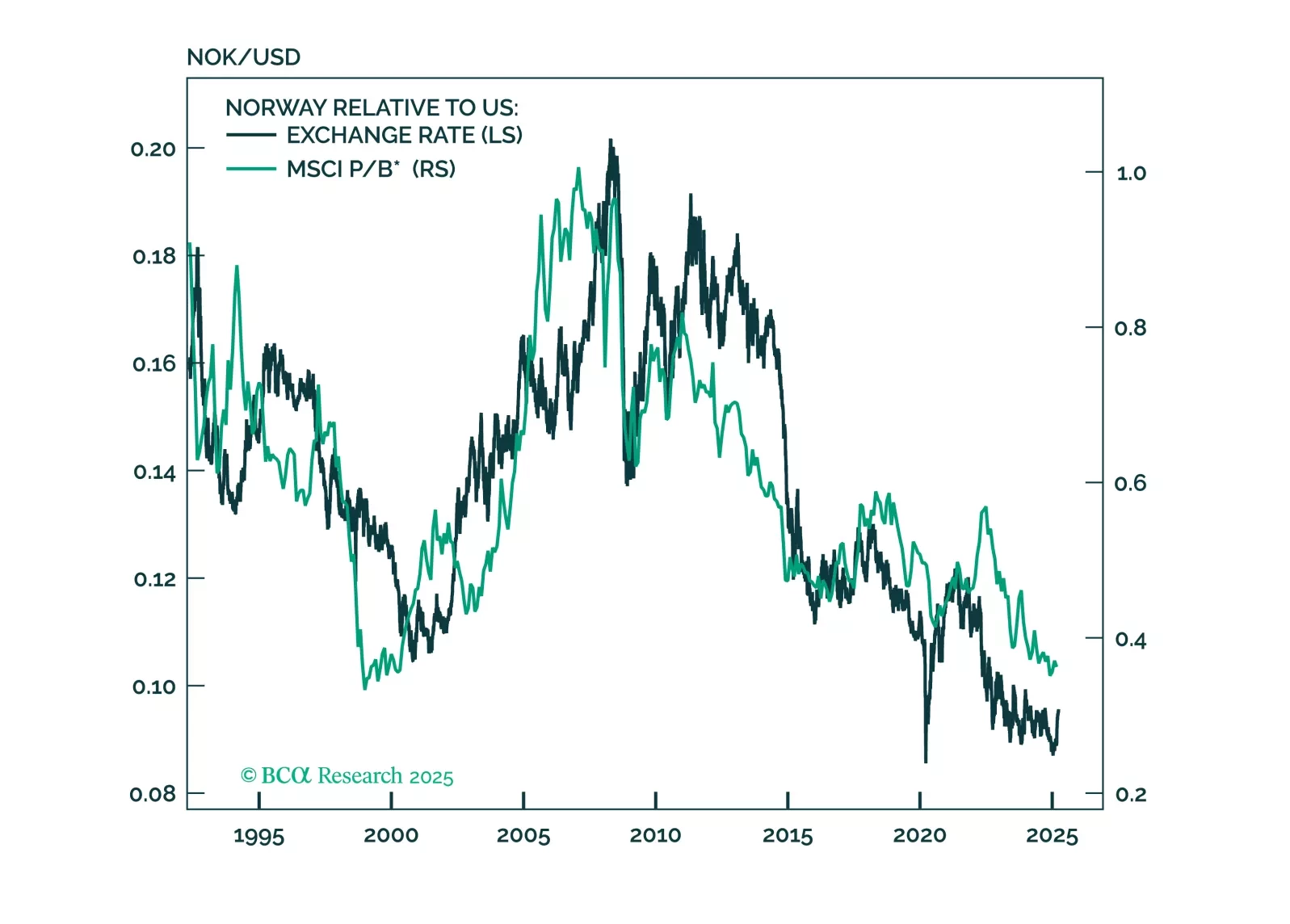

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

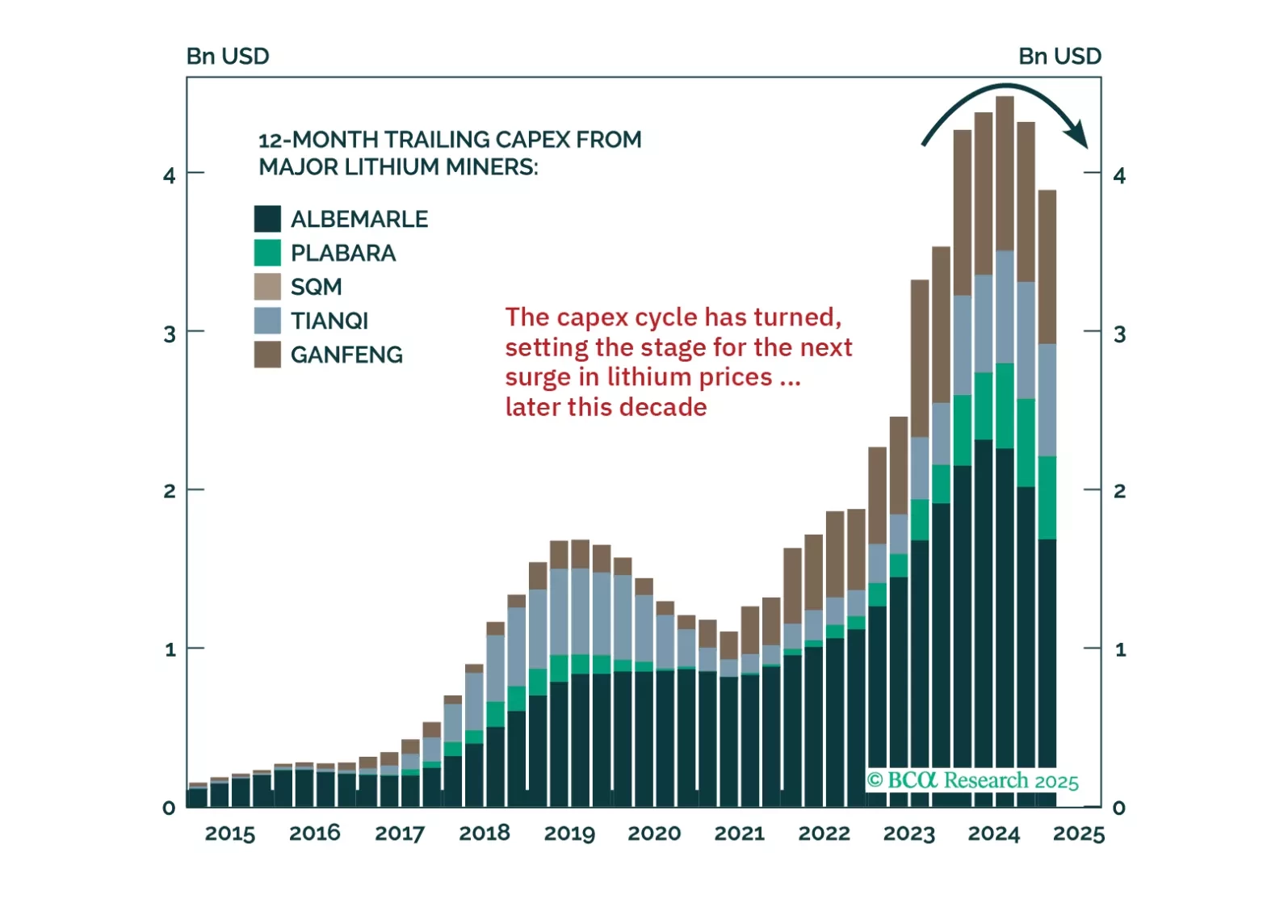

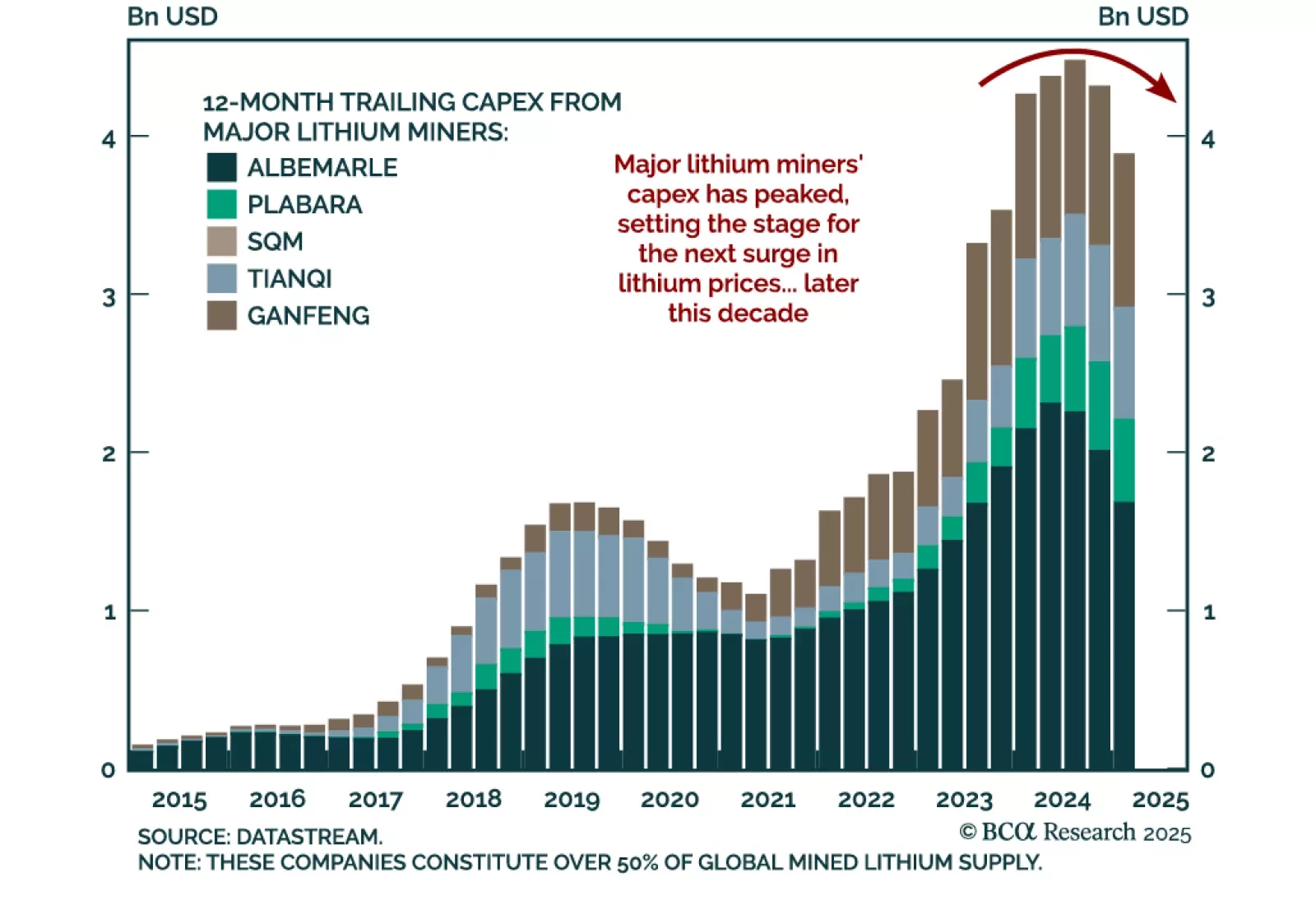

Our Commodities Strategy team advises against positioning for a near-term rebound in lithium prices, given the current headwinds from soft EV sales growth. They recommend patience, with more compelling opportunities likely to emerge…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

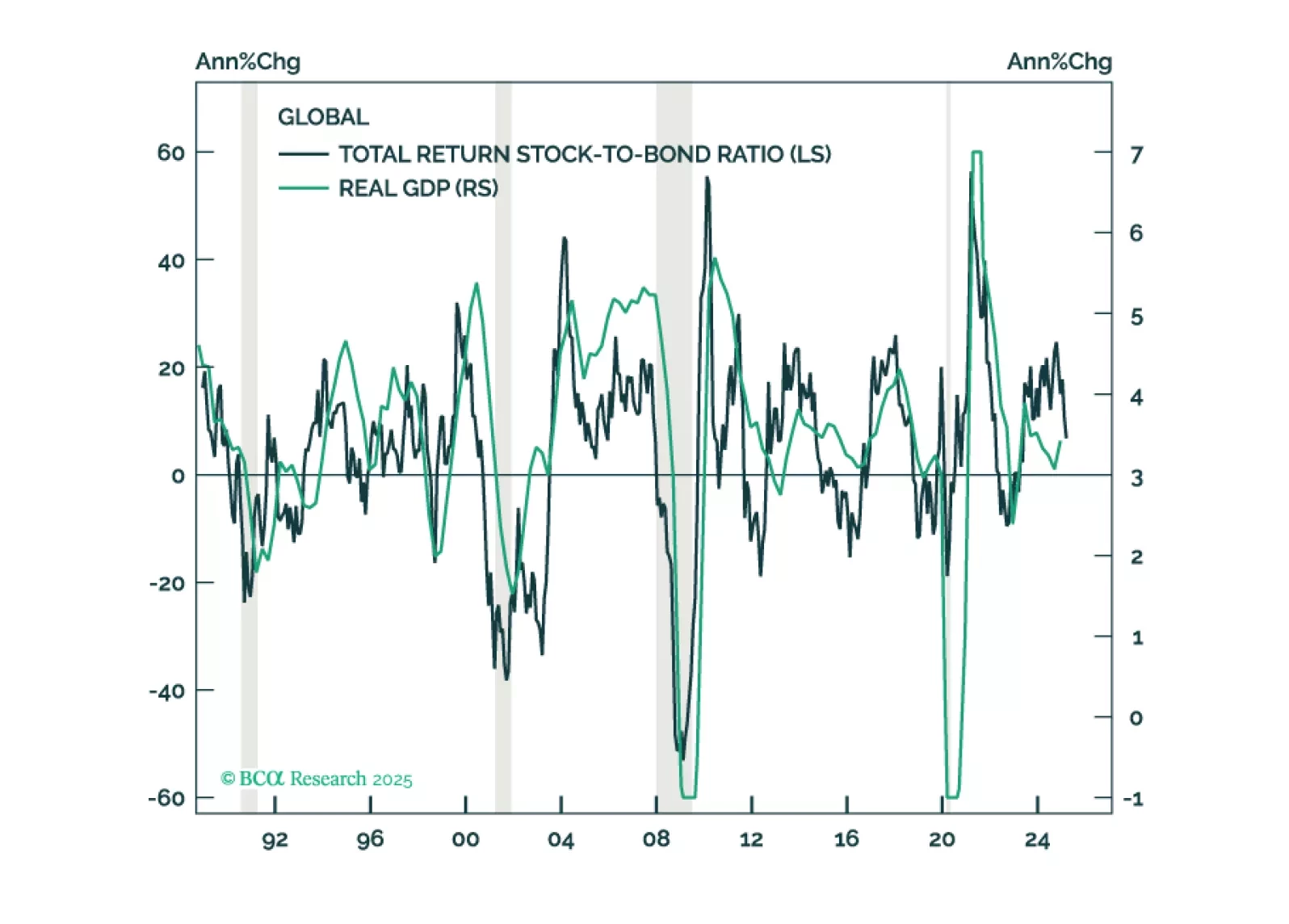

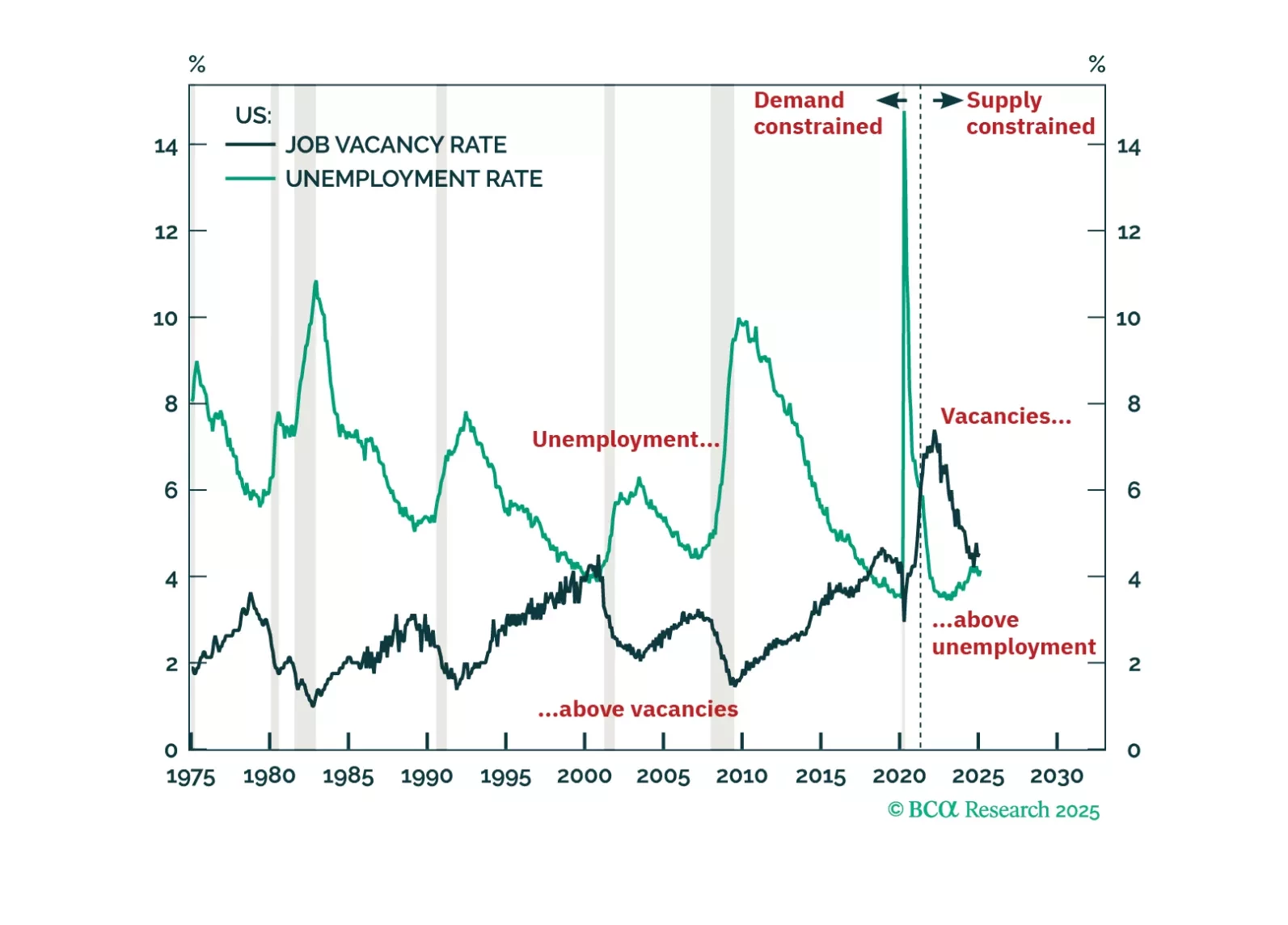

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

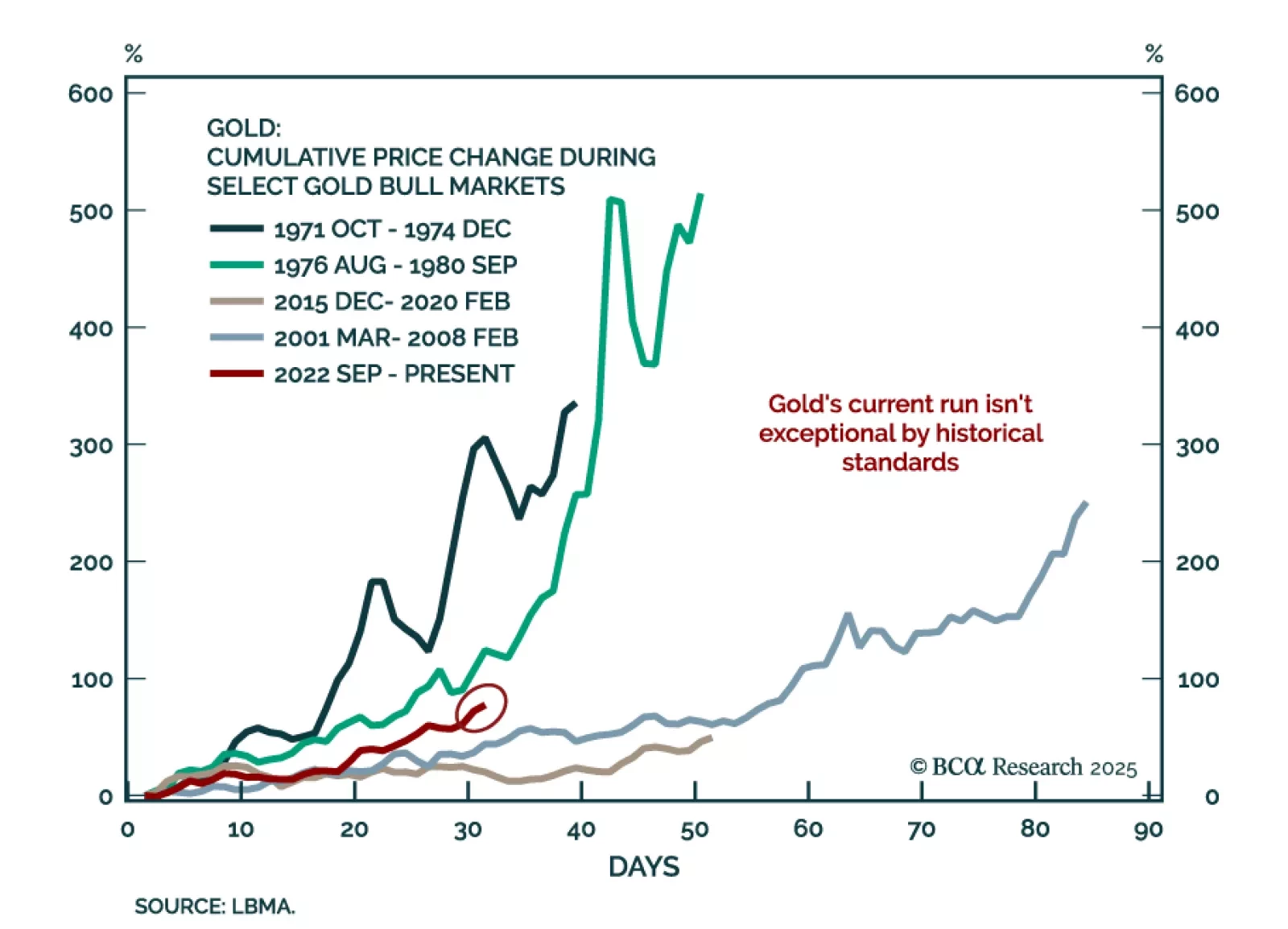

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…