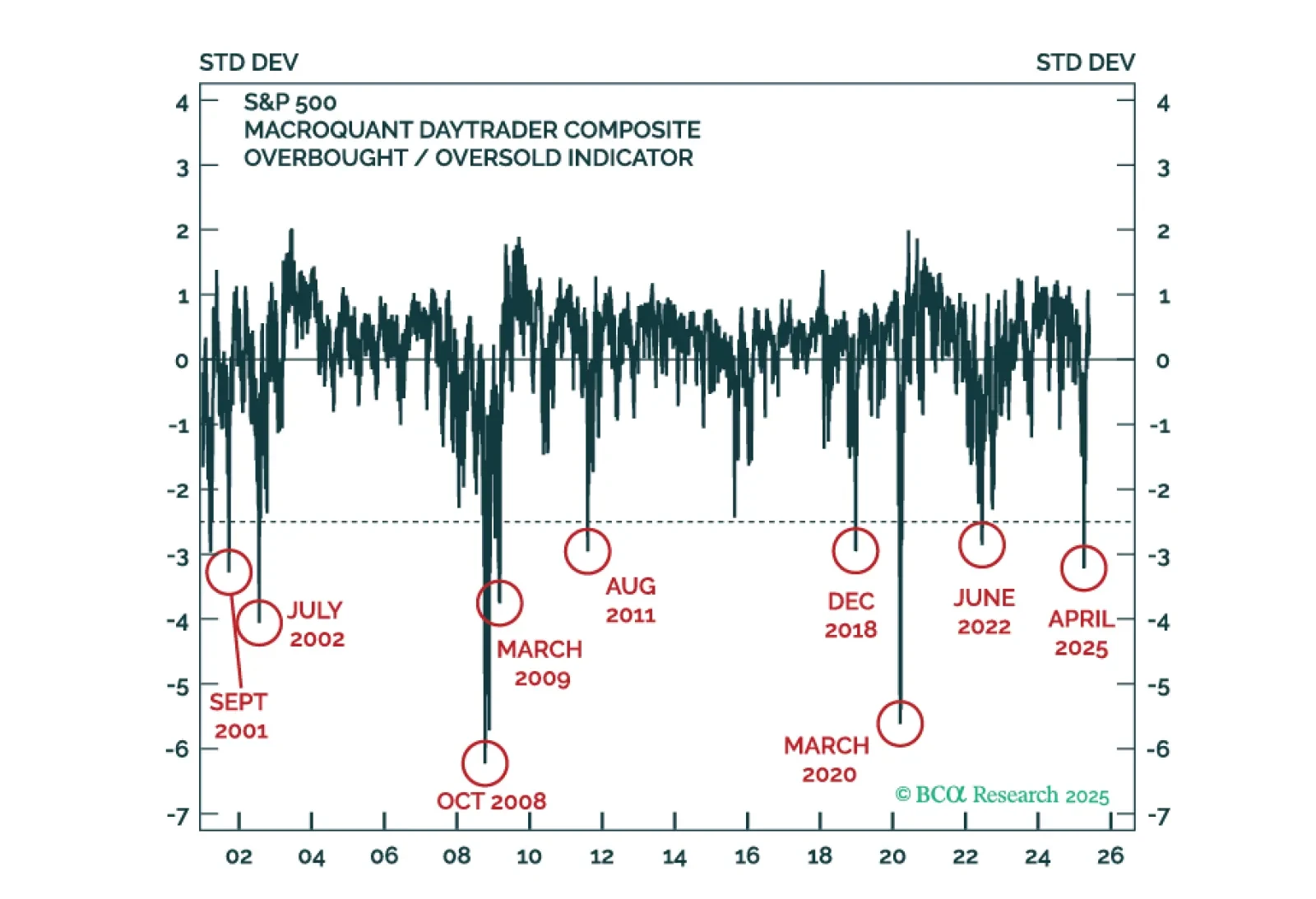

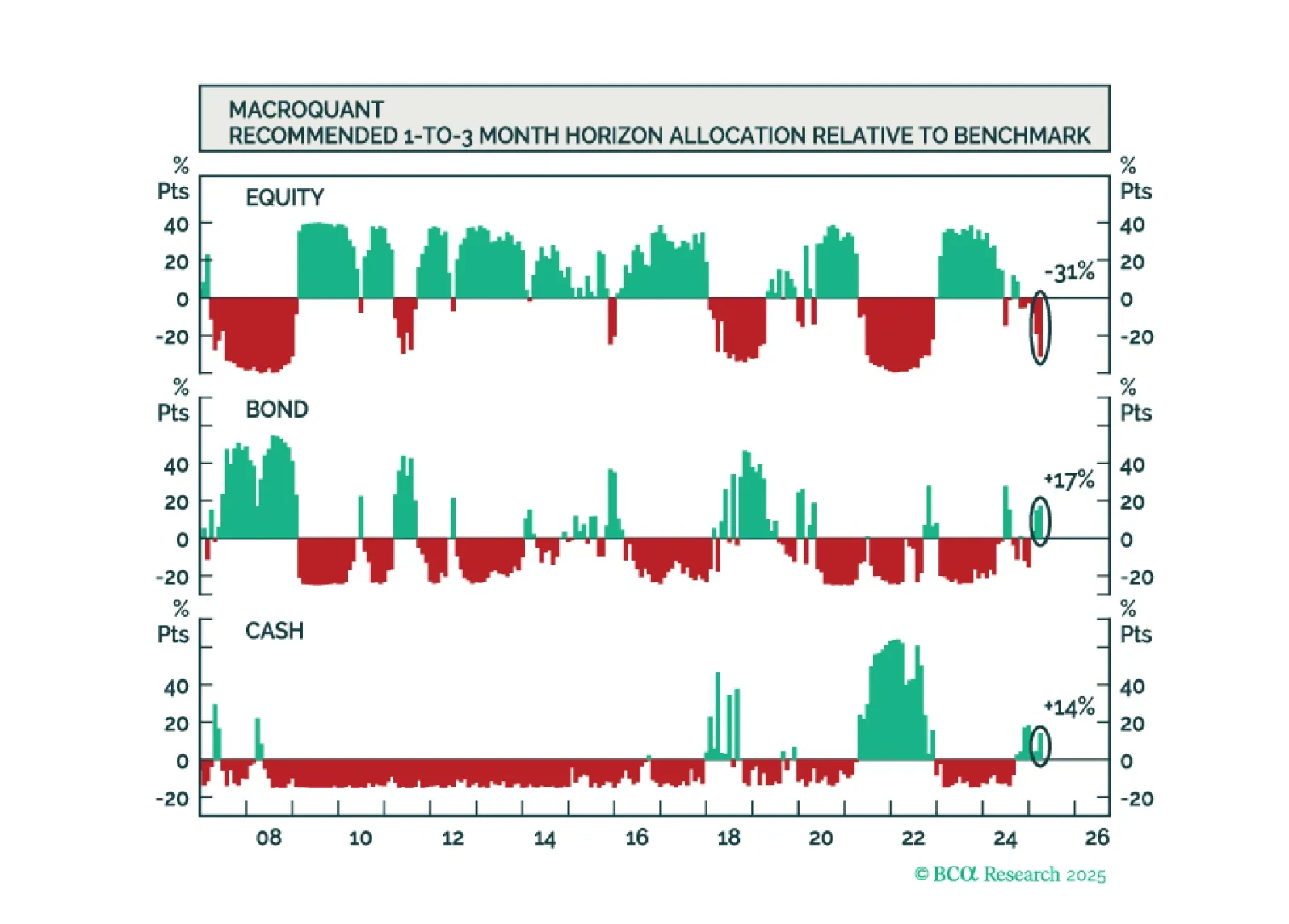

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

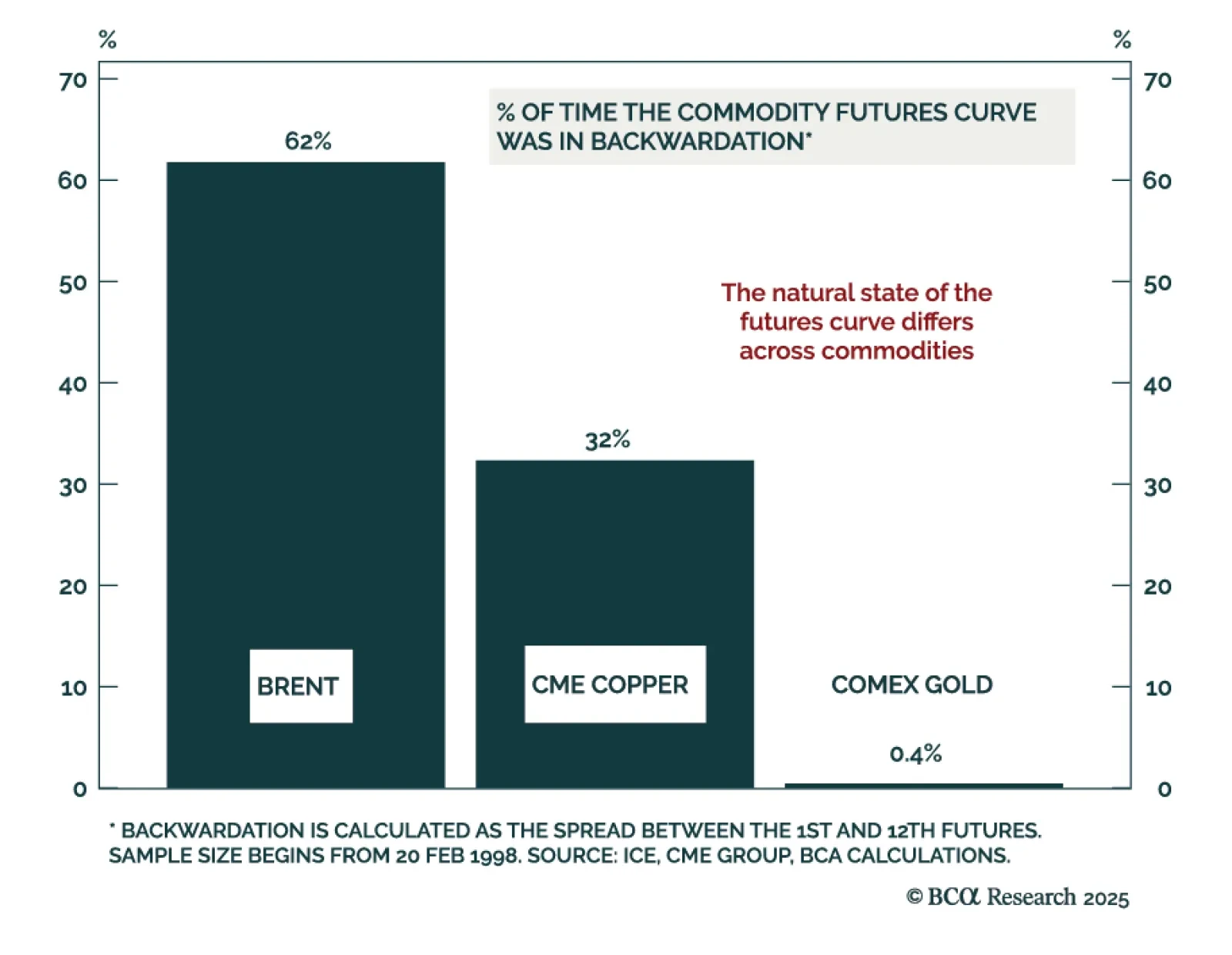

Oil, copper, and gold futures curves have experienced abnormal changes in the past few months, but a bearish global outlook will steepen contango structures across all three. Oil’s curve structure has flipped from backwardation…

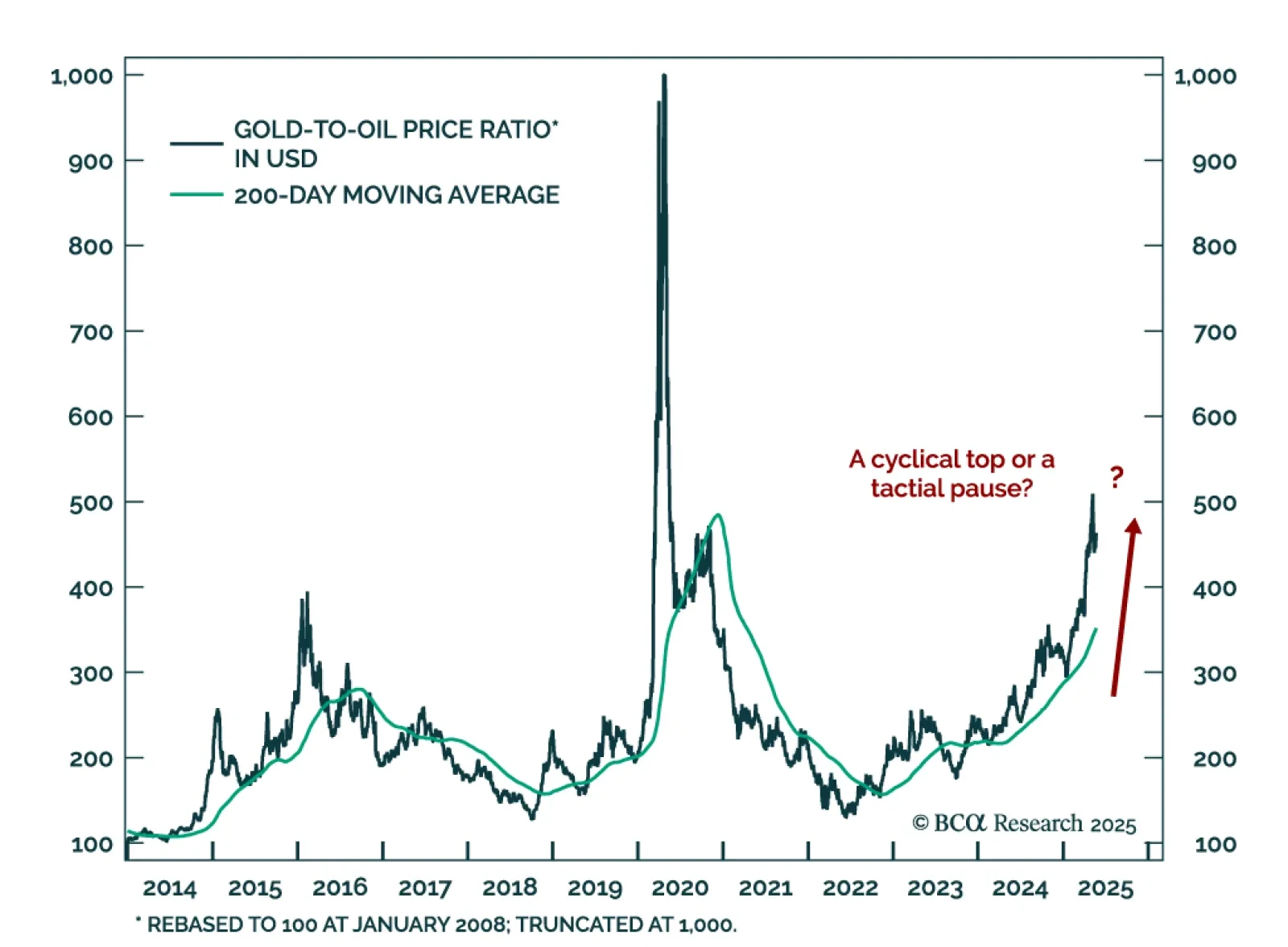

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

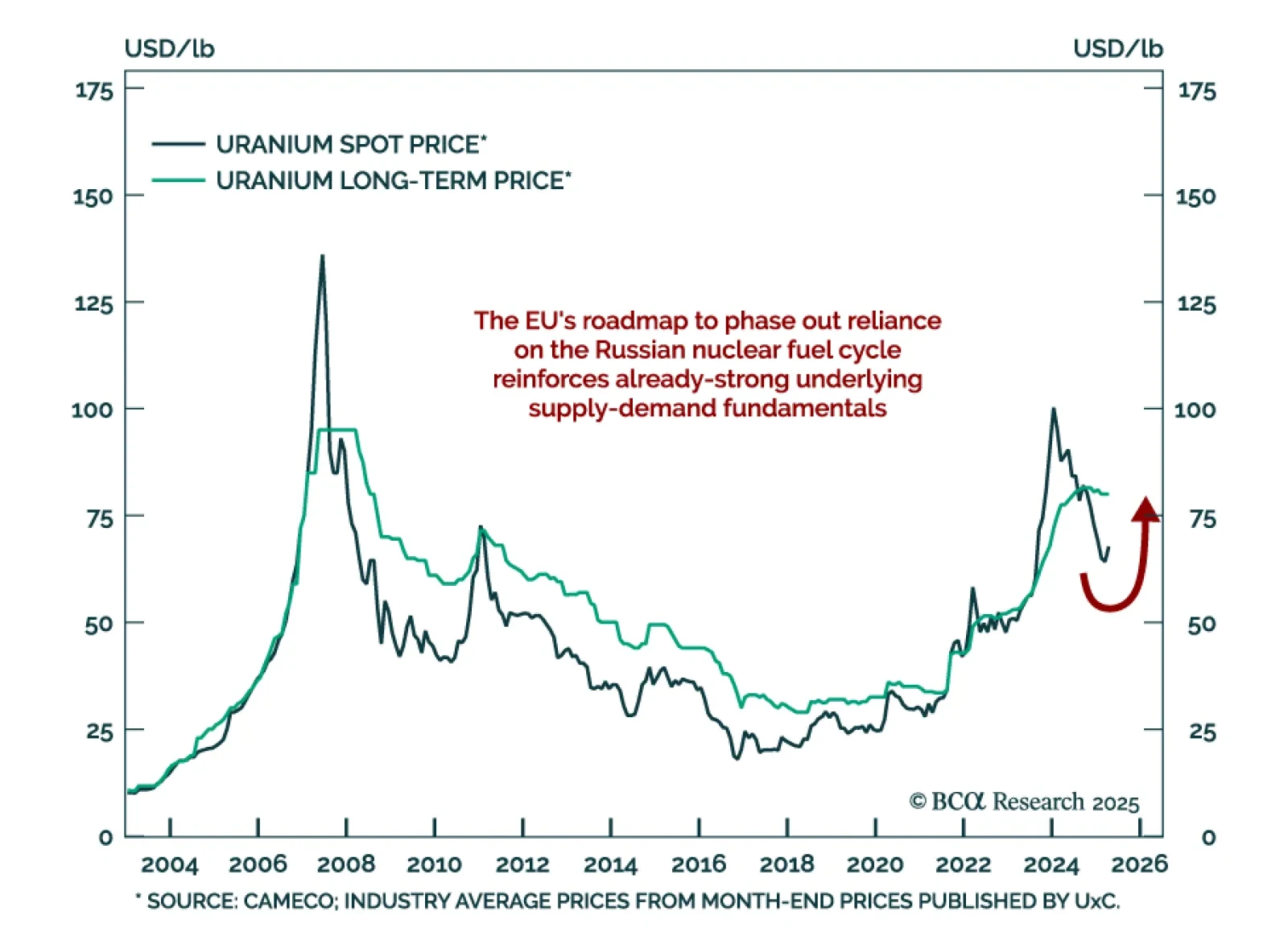

Uranium spot prices may have found a floor after falling to $64/lb from a $107/lb peak in February last year. This drawdown has been unexpected considering the strength of the underlying supply-demand fundamentals for uranium.…

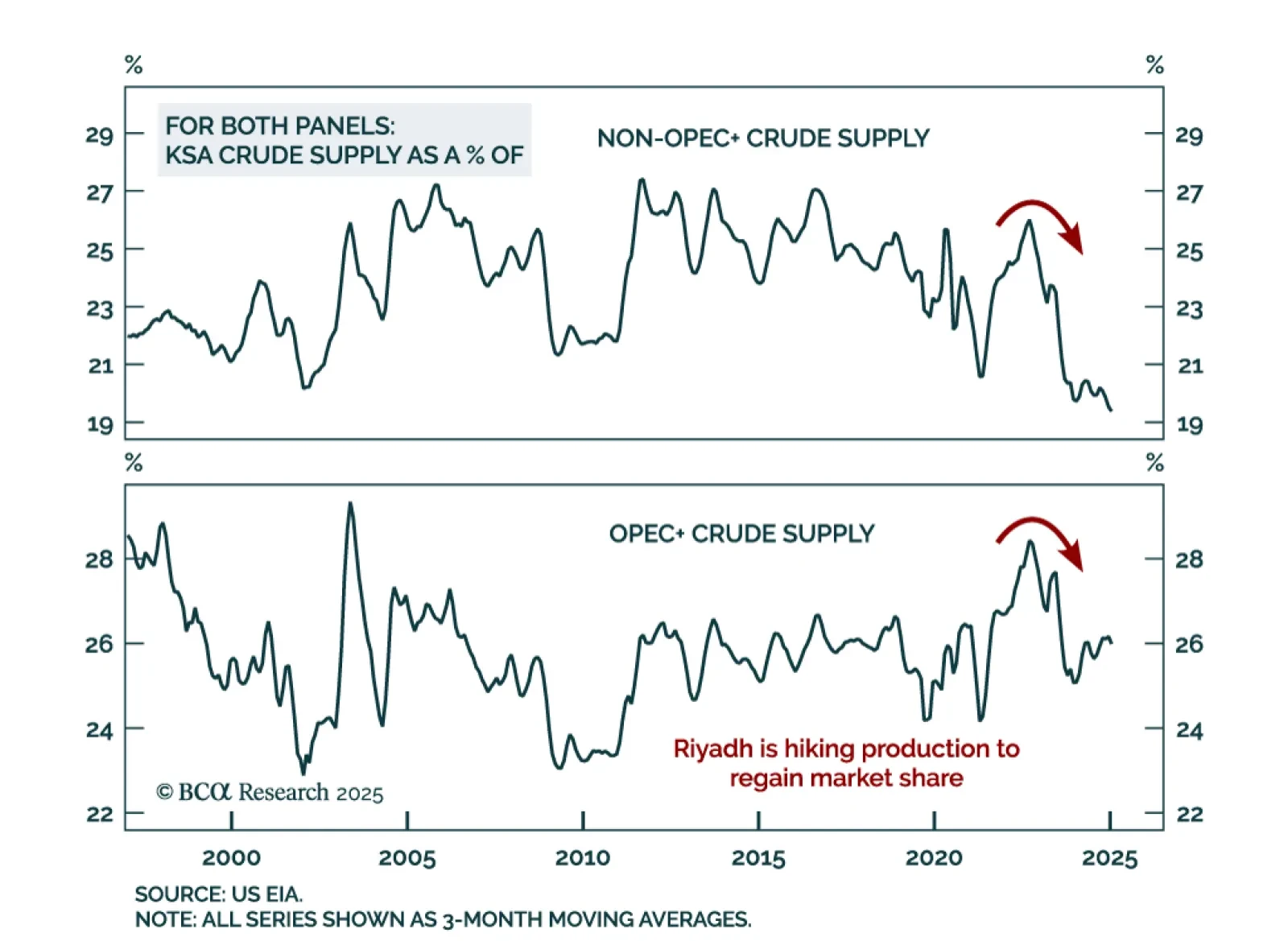

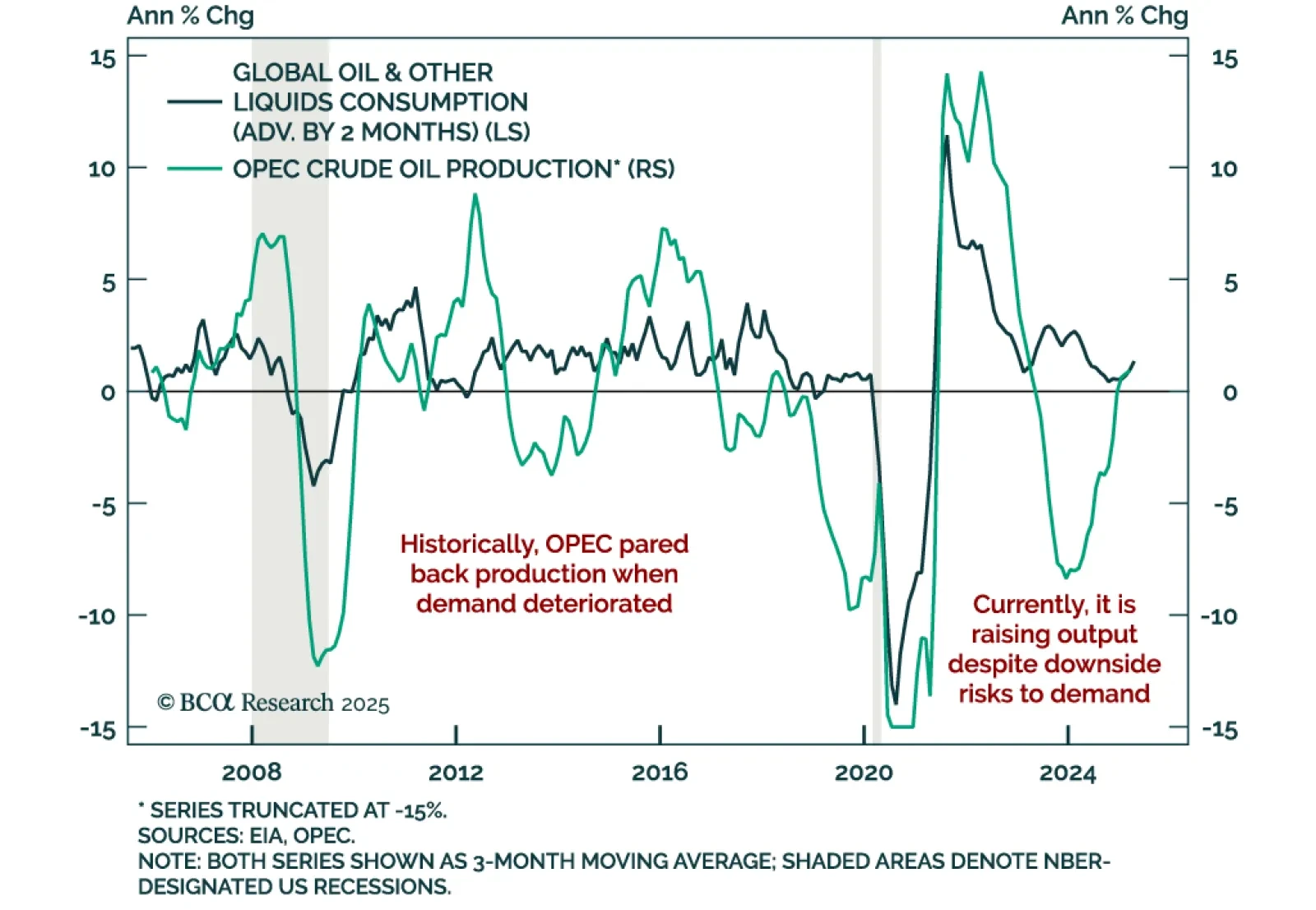

Our Commodities strategists believe Saudi Arabia is pursuing a controlled price war. Riyadh is intentionally pushing oil prices lower to regain market share and reset relations with the US. With OPEC+ production rising despite…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

Our Commodity strategists stay short oil and long gold as global demand weakens and OPEC+ offers no support. Brent’s floor has likely fallen to $50, and bearish supply and demand forces continue to dominate the price outlook. …

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.