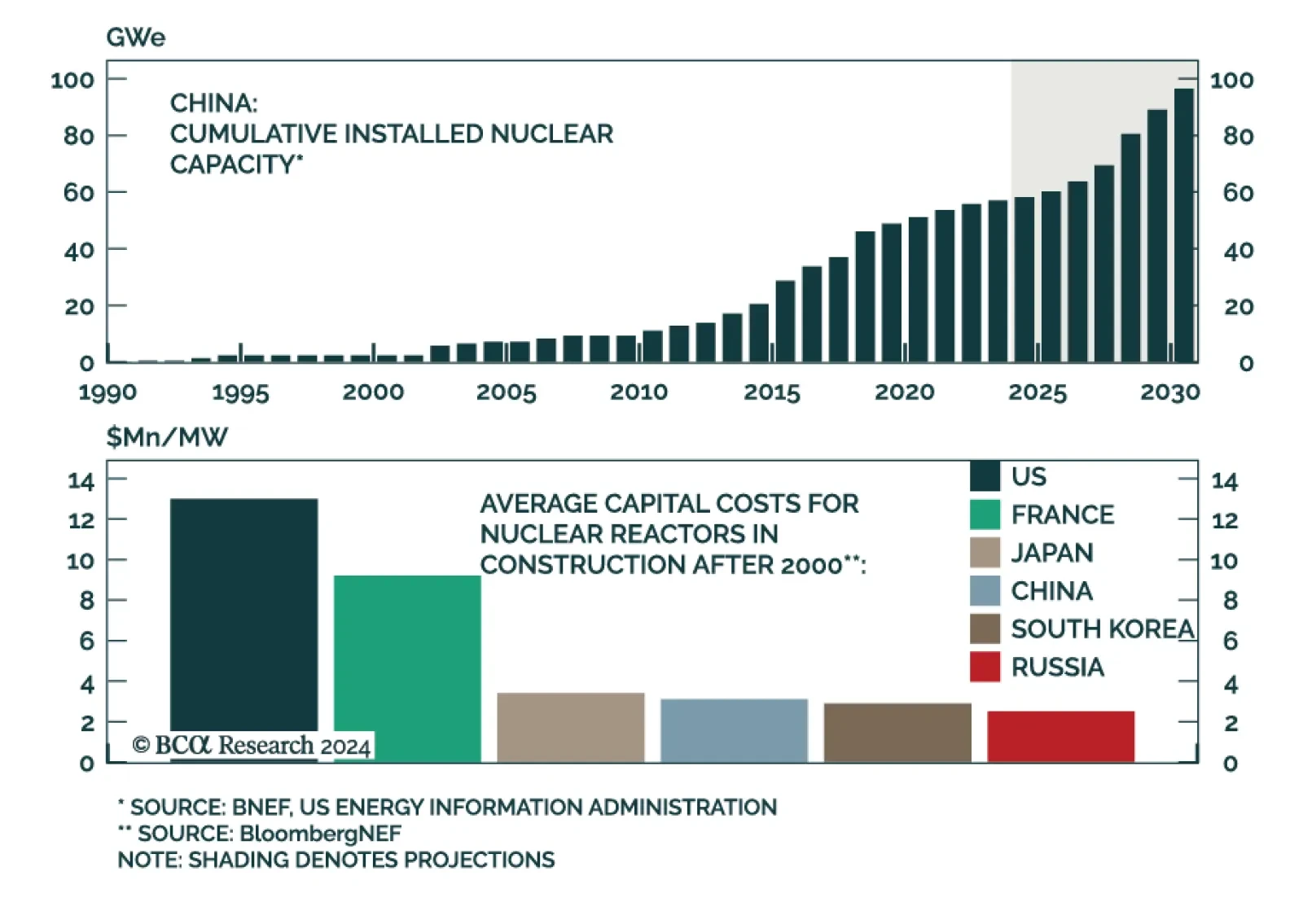

In the fifth installment of a BCA Special Report series on nuclear energy, our colleagues argue that US nuclear energy dominance is decaying. Though still the world’s leader in generation and capacity, the US will not hold…

Western policymakers are pursuing three capital “T” Truths: China is evil, climate change is a major risk, and Russia is… also evil. Pursuing all three priorities at the same time presents a version of the classic “impossible trinity…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

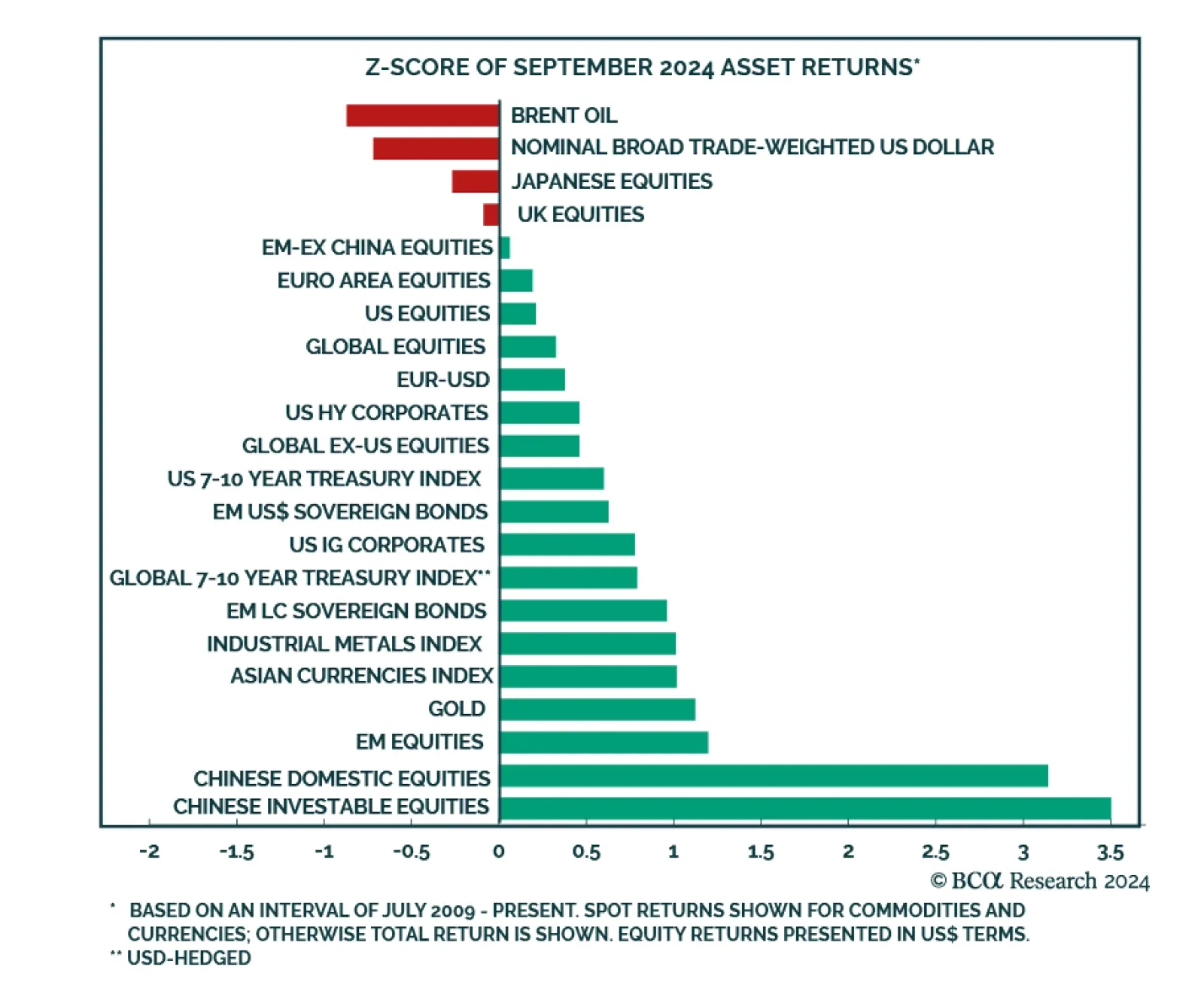

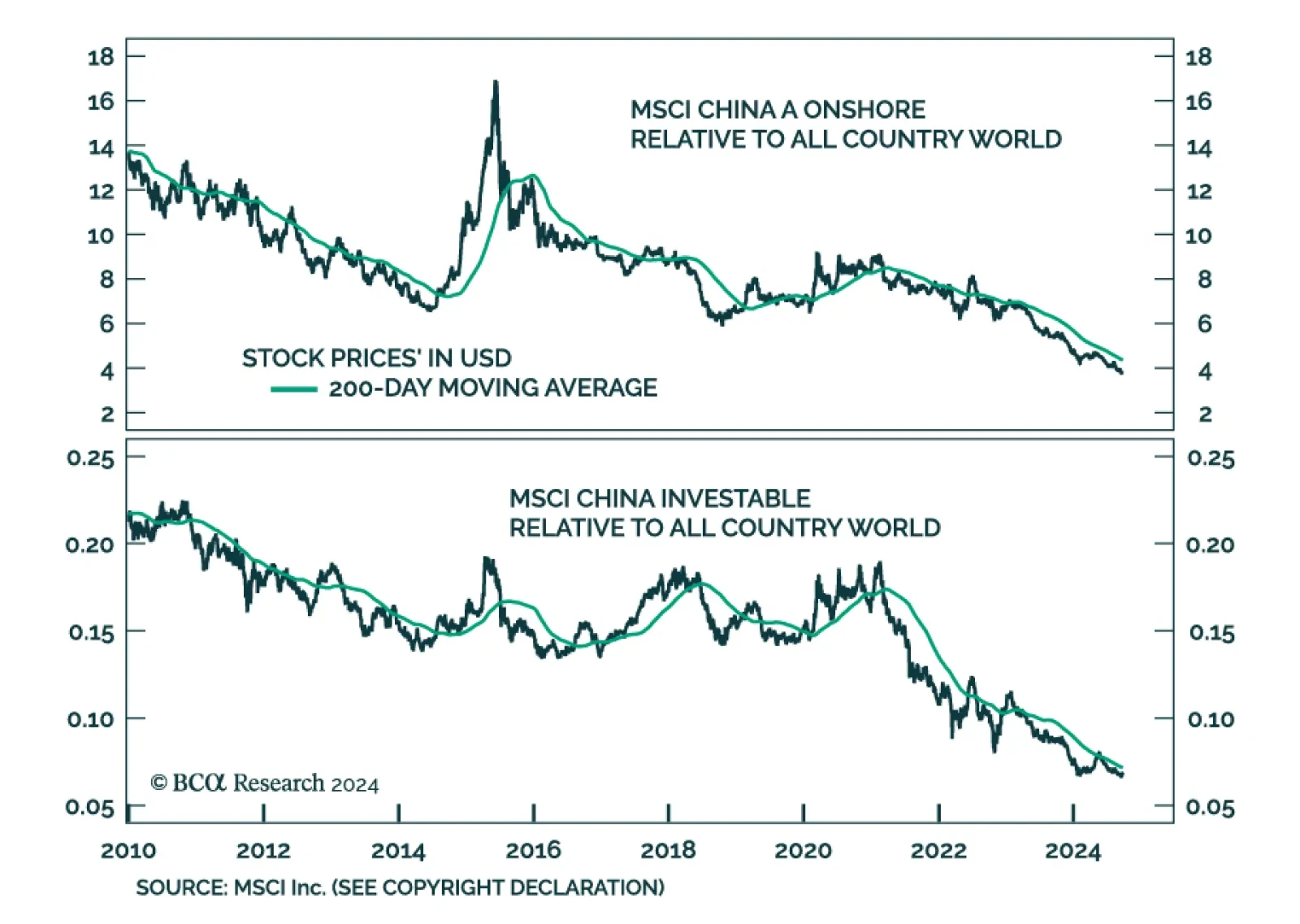

The Fed embarked on a new easing cycle with a bang and China delivered its largest stimulus since 2015, leading to a strengthening in the risk-on soft-landing narrative in September. Chinese and EM equities led the pack. We…

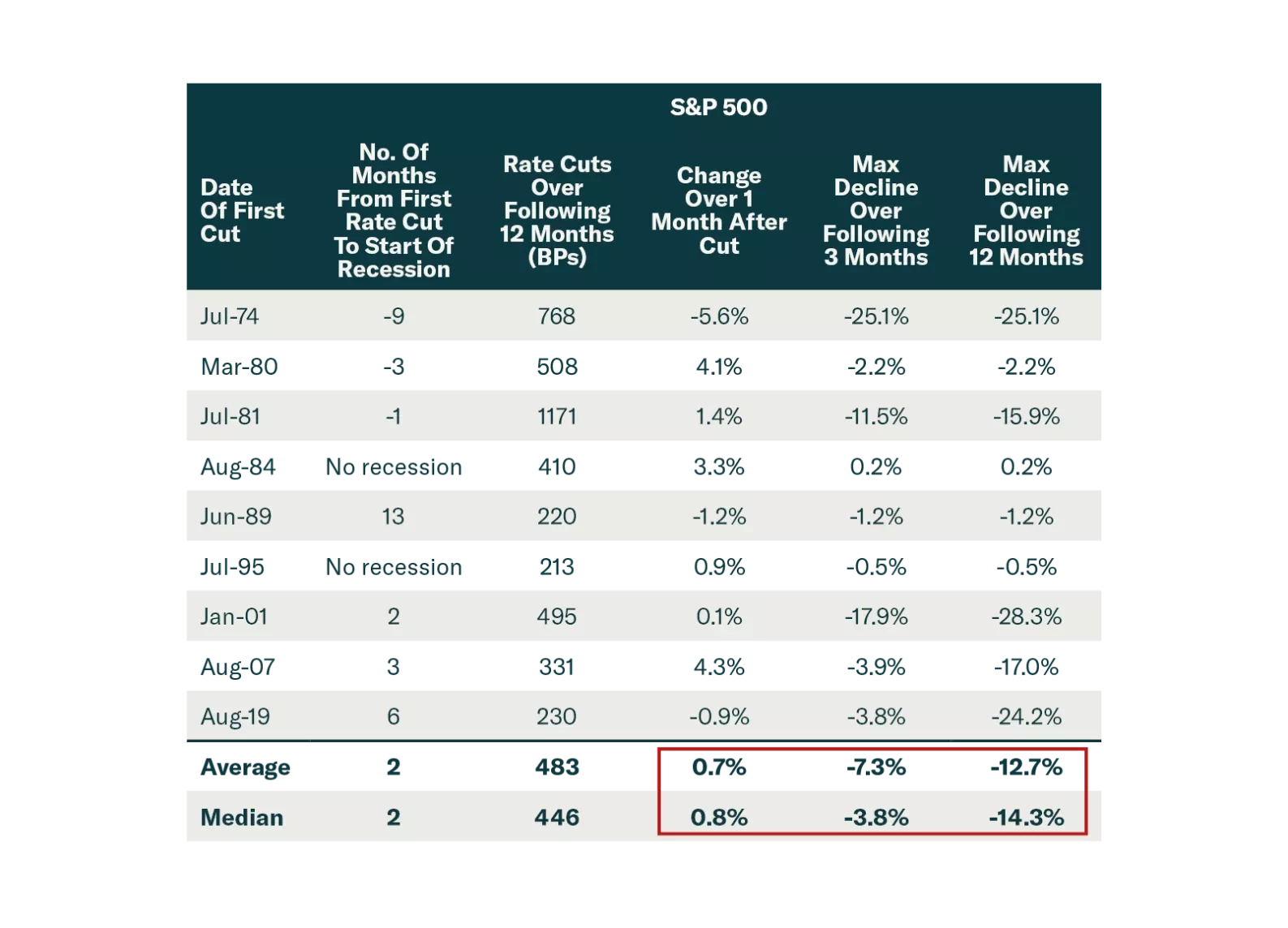

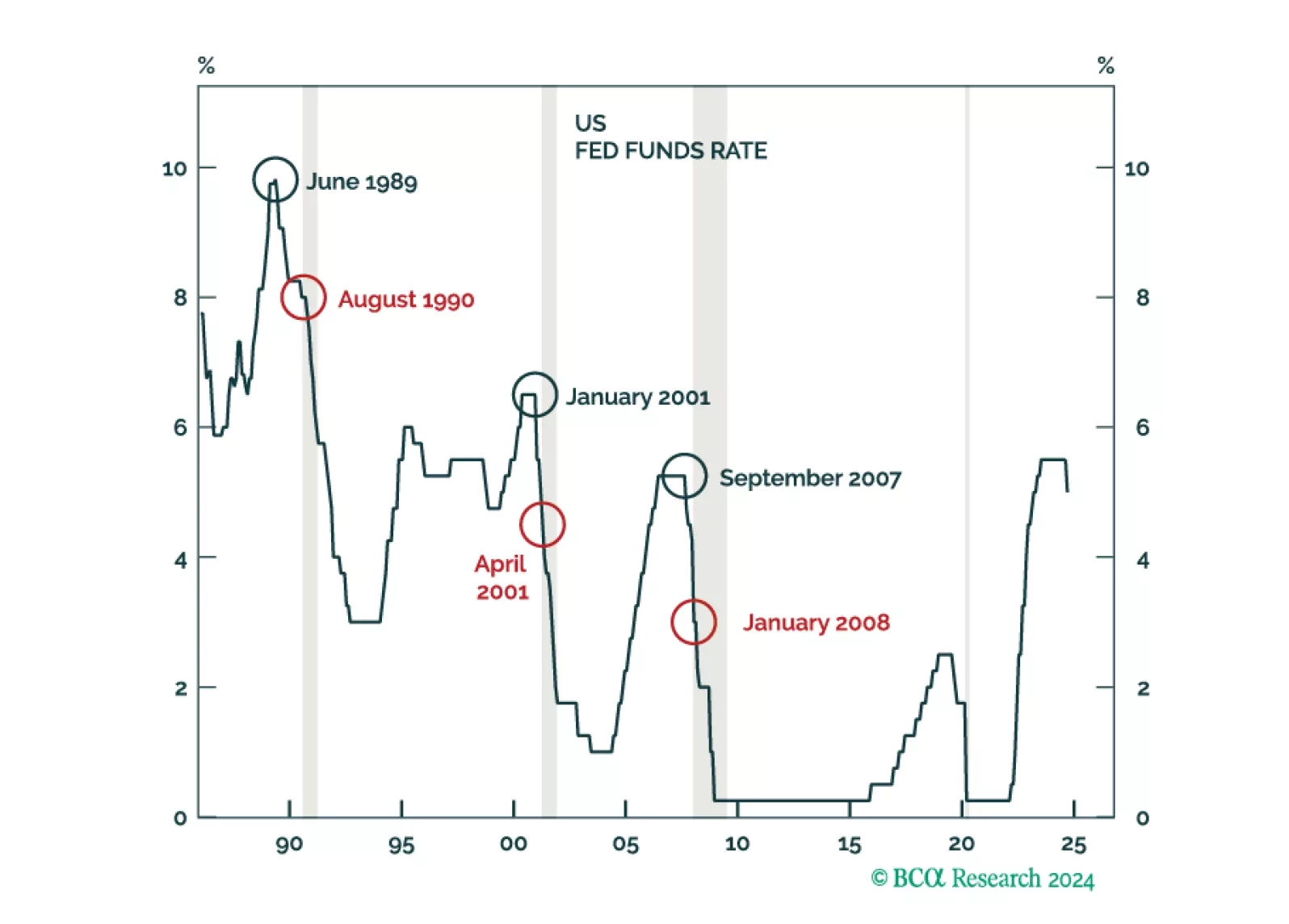

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

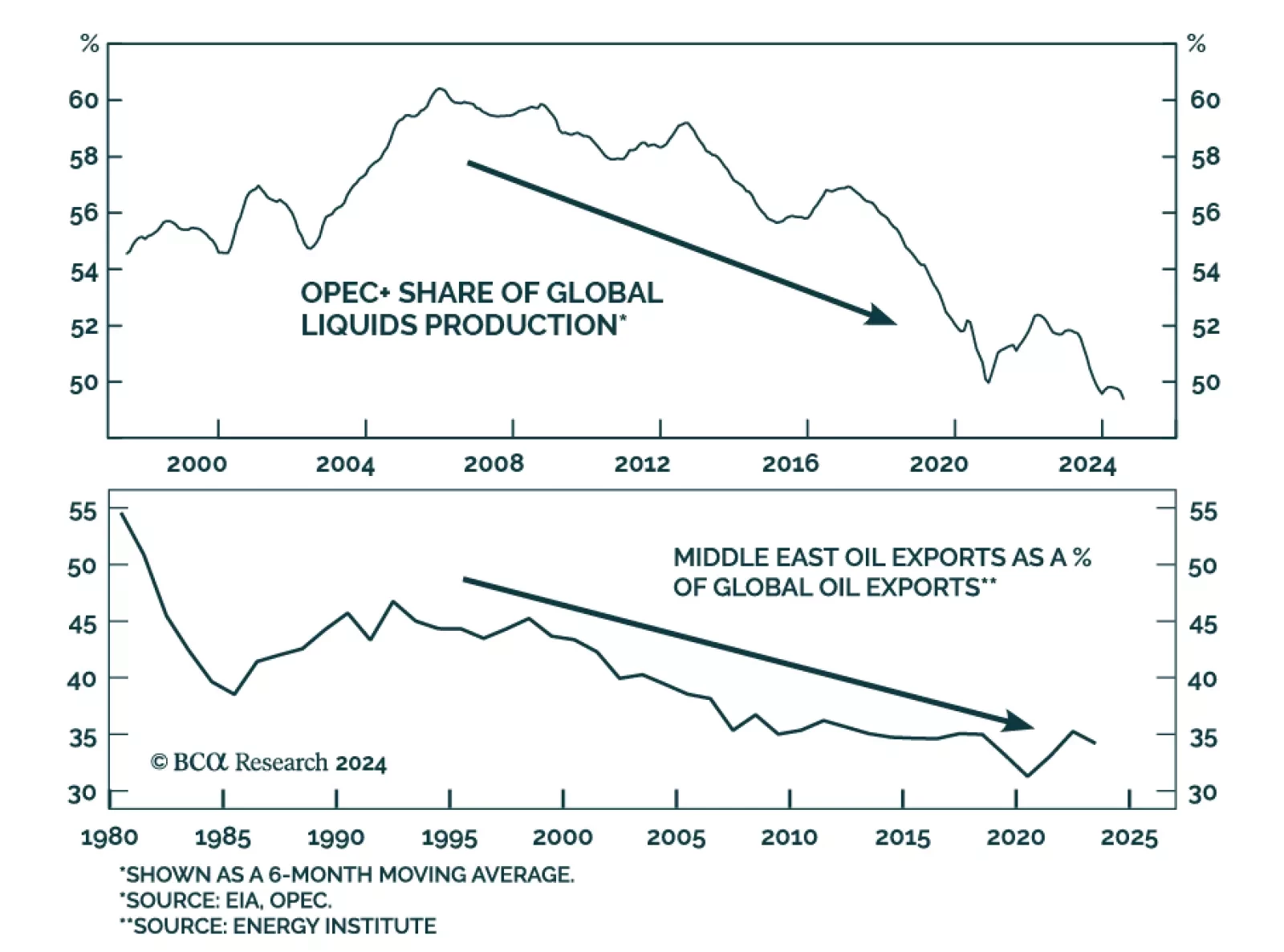

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

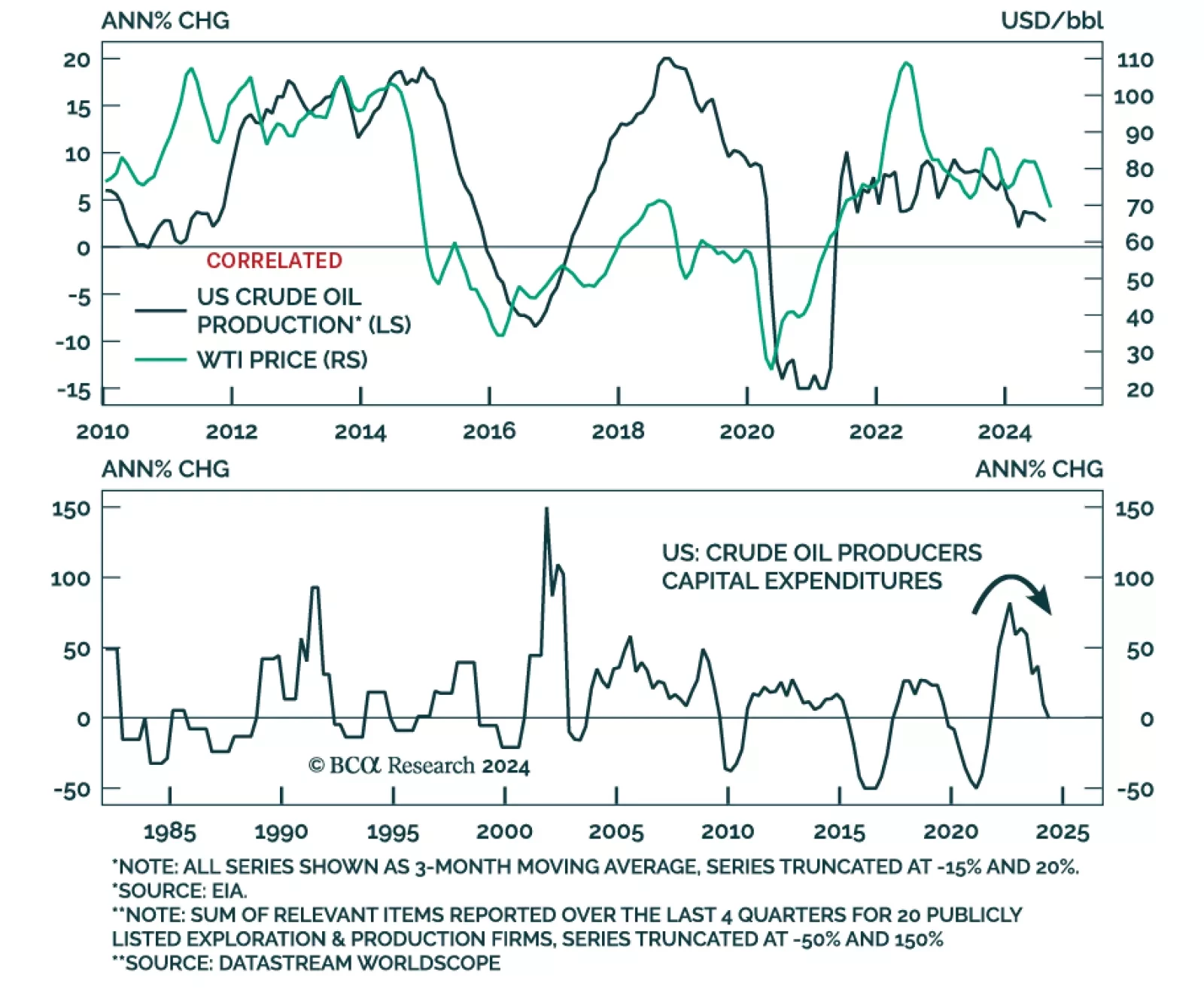

According to BCA Research’s Commodity and Energy strategy service, even though US crude output will continue rising, a meaningful growth acceleration is unlikely. US producers adjust their output in response to market…

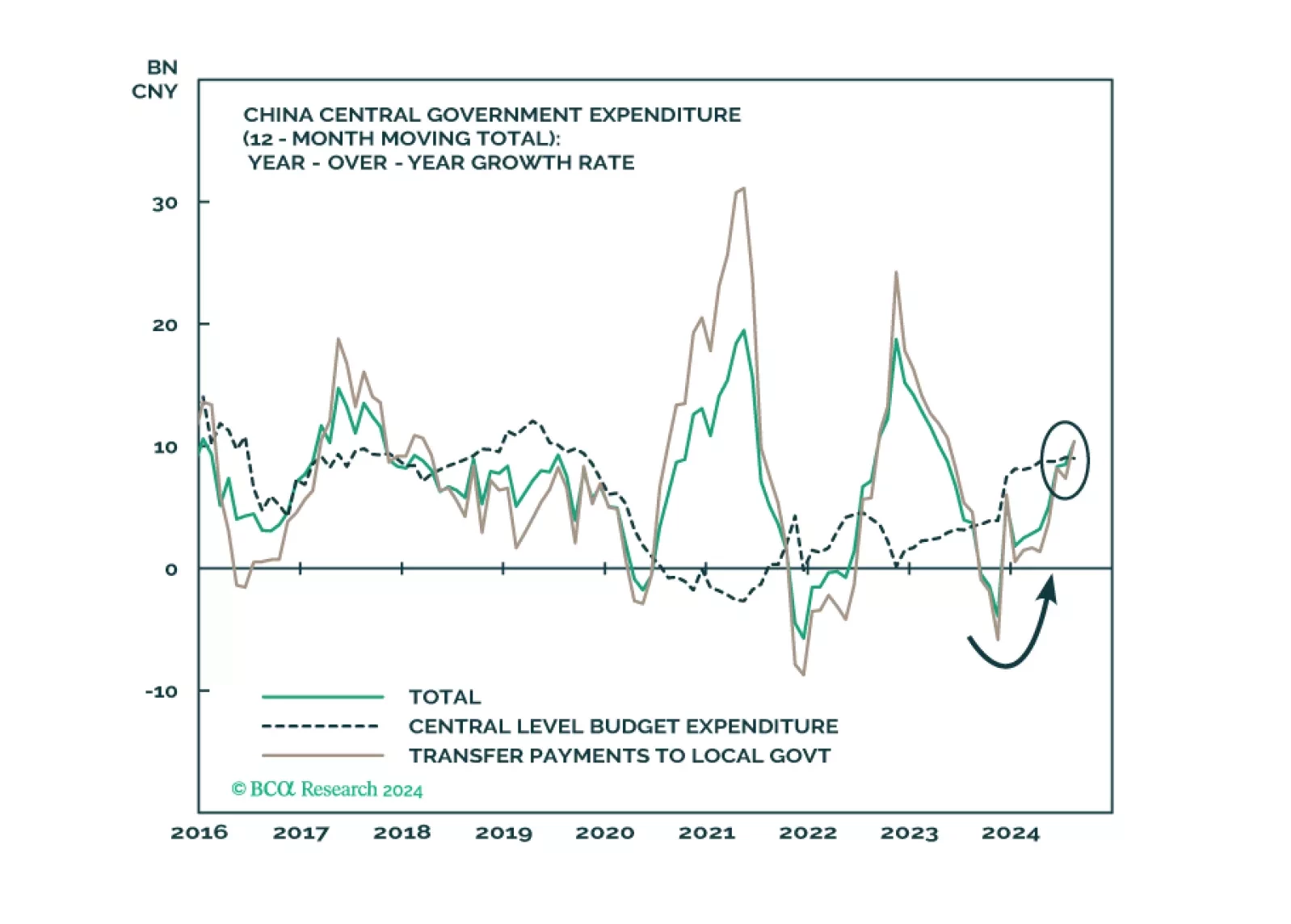

The PBoC announced further measures to stimulate the economy on Tuesday. It lowered the reserve requirement ratio from 10% to 9.5%, cut the 7-day reverse repo rate by 20 bps (following Monday’s 10 bps cut to the 14-day…