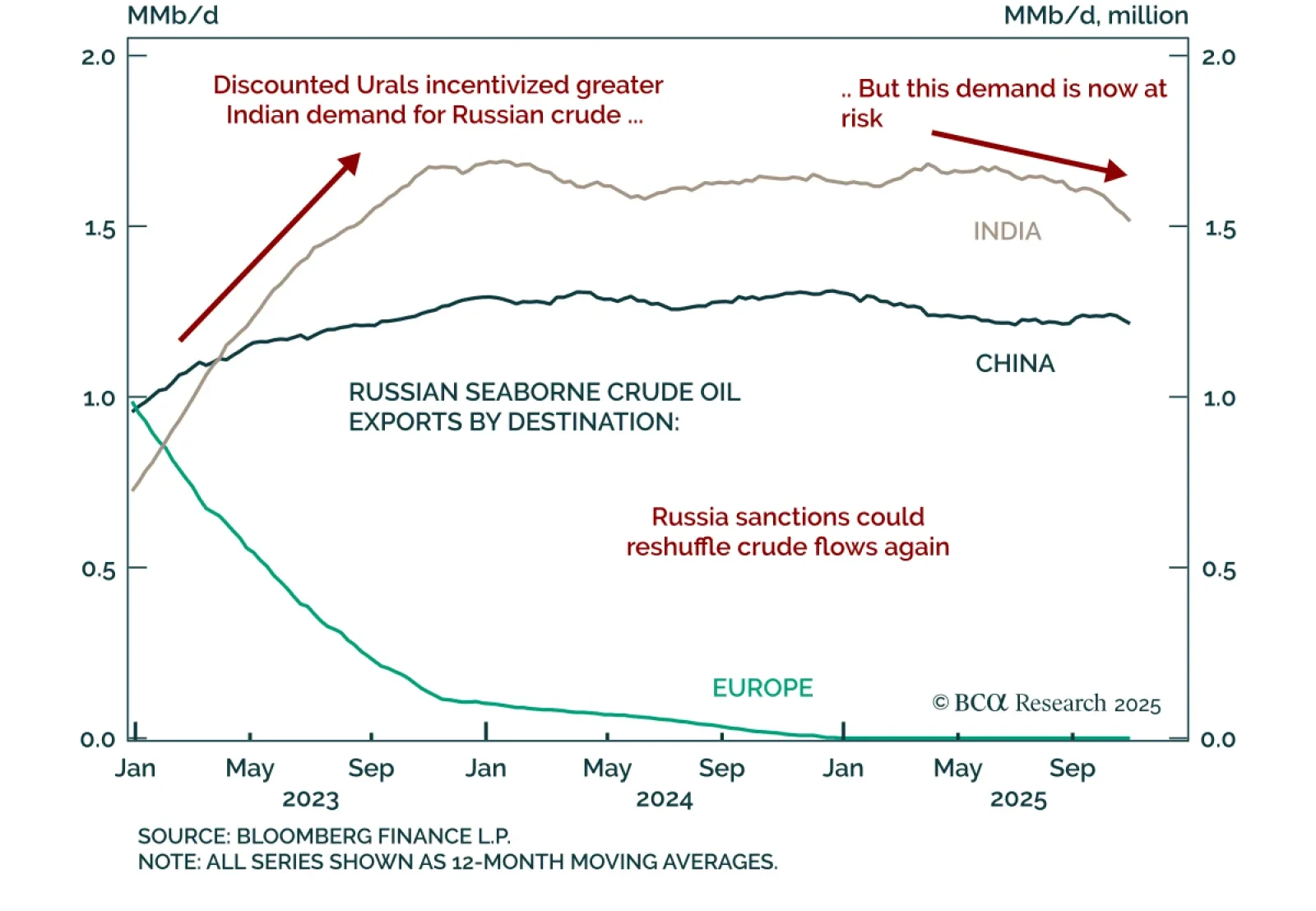

Our Commodity strategists advise staying short Brent, with a stop-loss at $73/bbl, as US sanctions on Russian crude are unlikely to meaningfully impact prices over a cyclical horizon. While new restrictions on Rosneft and Lukoil…

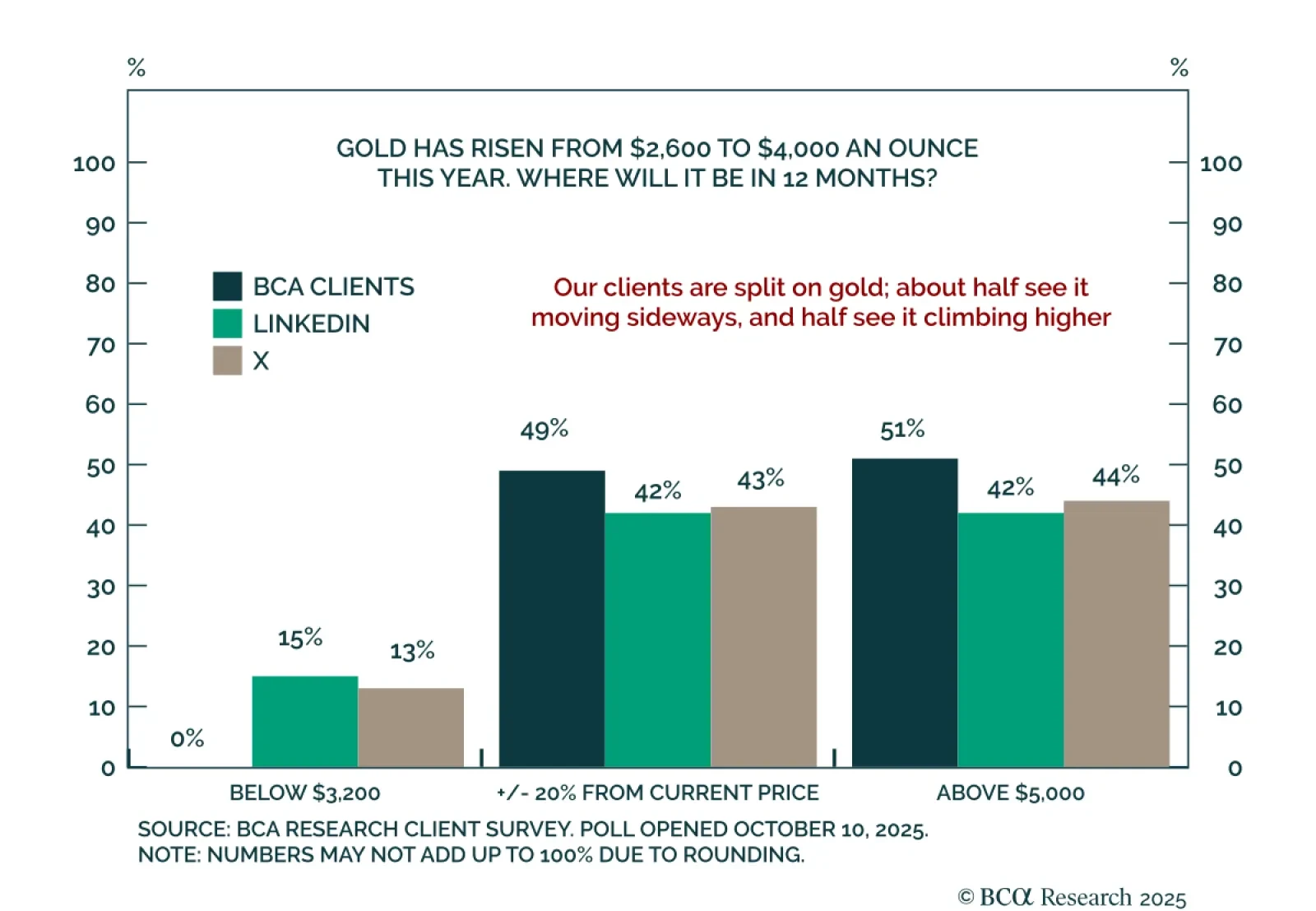

More than half BCA’s Clients expect gold to be above $5,000 in a year’s time. In the latest weekly poll on the Have Your Say section of BCA's website, we asked our clients for their October 2026 gold price forecast. The gold price…

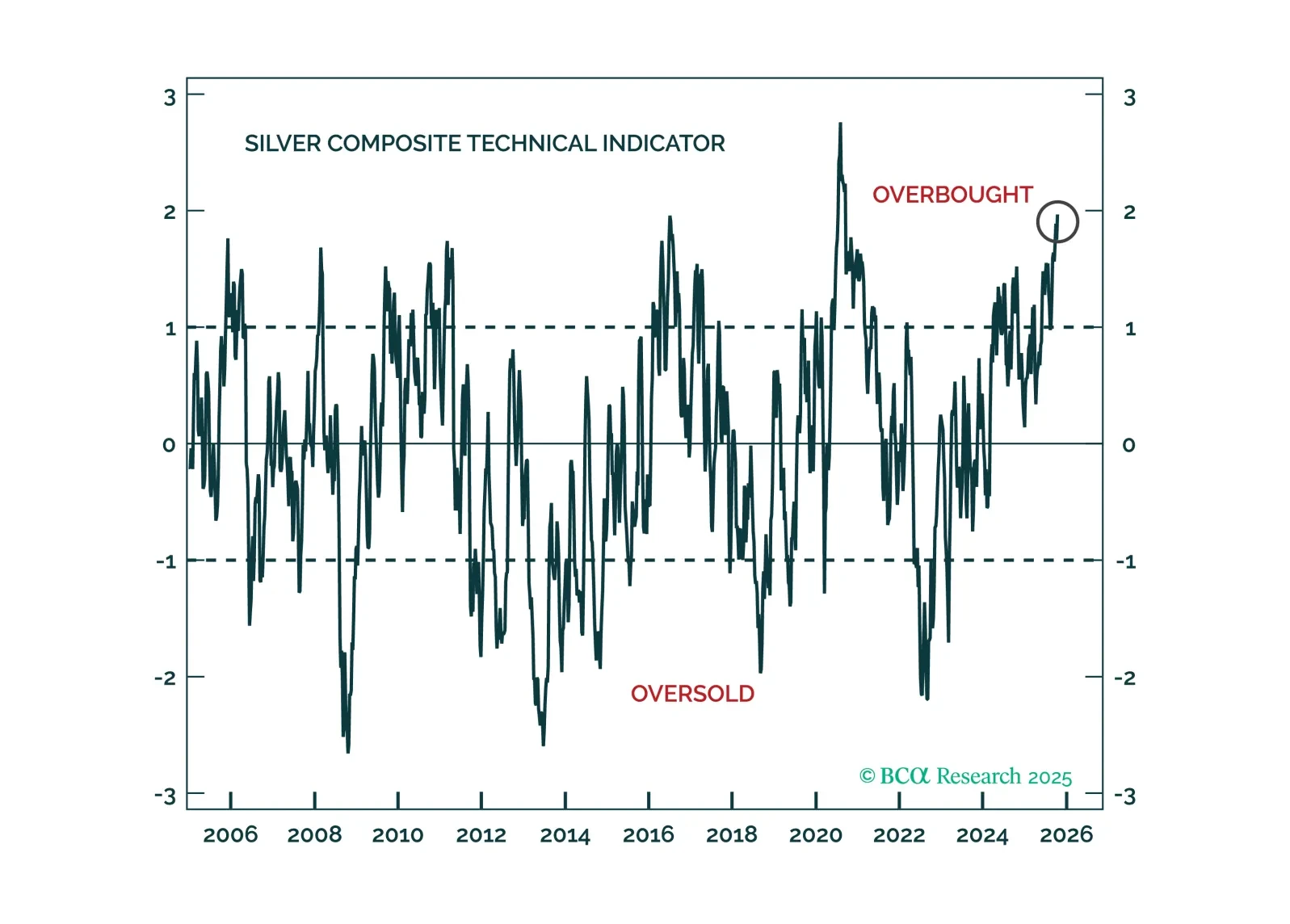

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

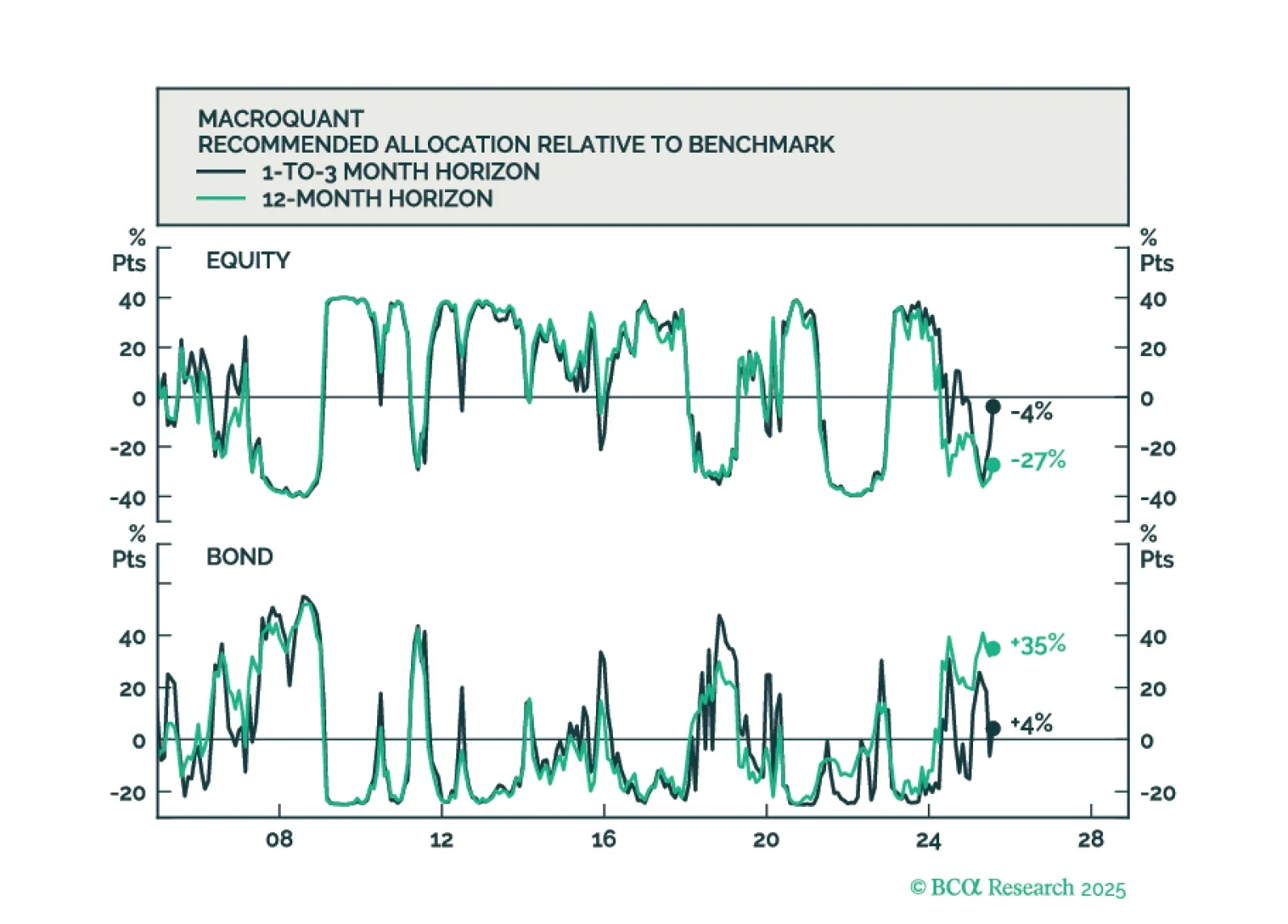

Our GeoMacro strategists remain overweight equities and bonds for now but warn that markets will soon test their “melt-up” thesis, as the cycle transitions from cash- to leverage-driven growth. The dominant theme of 2025 is not AI,…

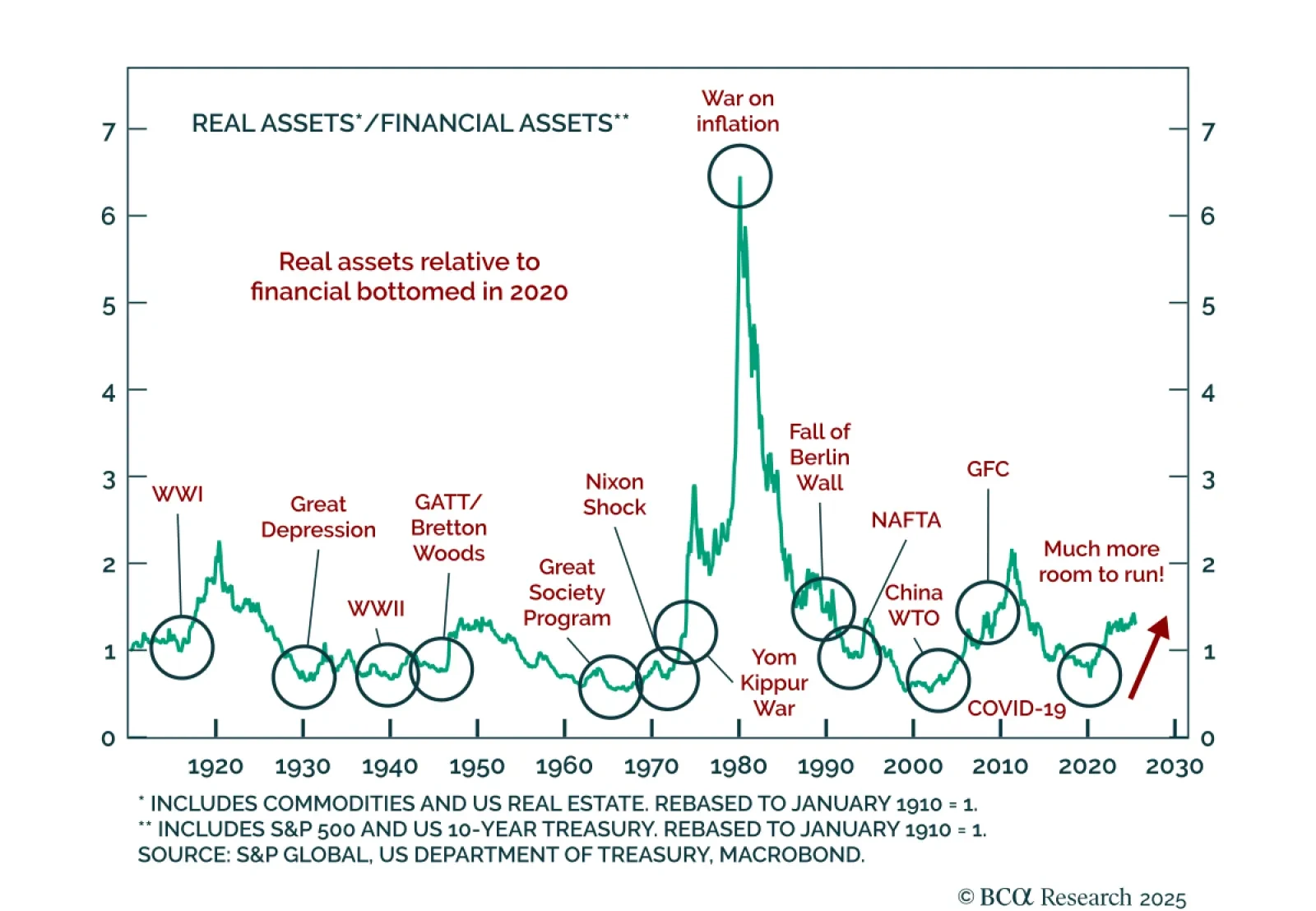

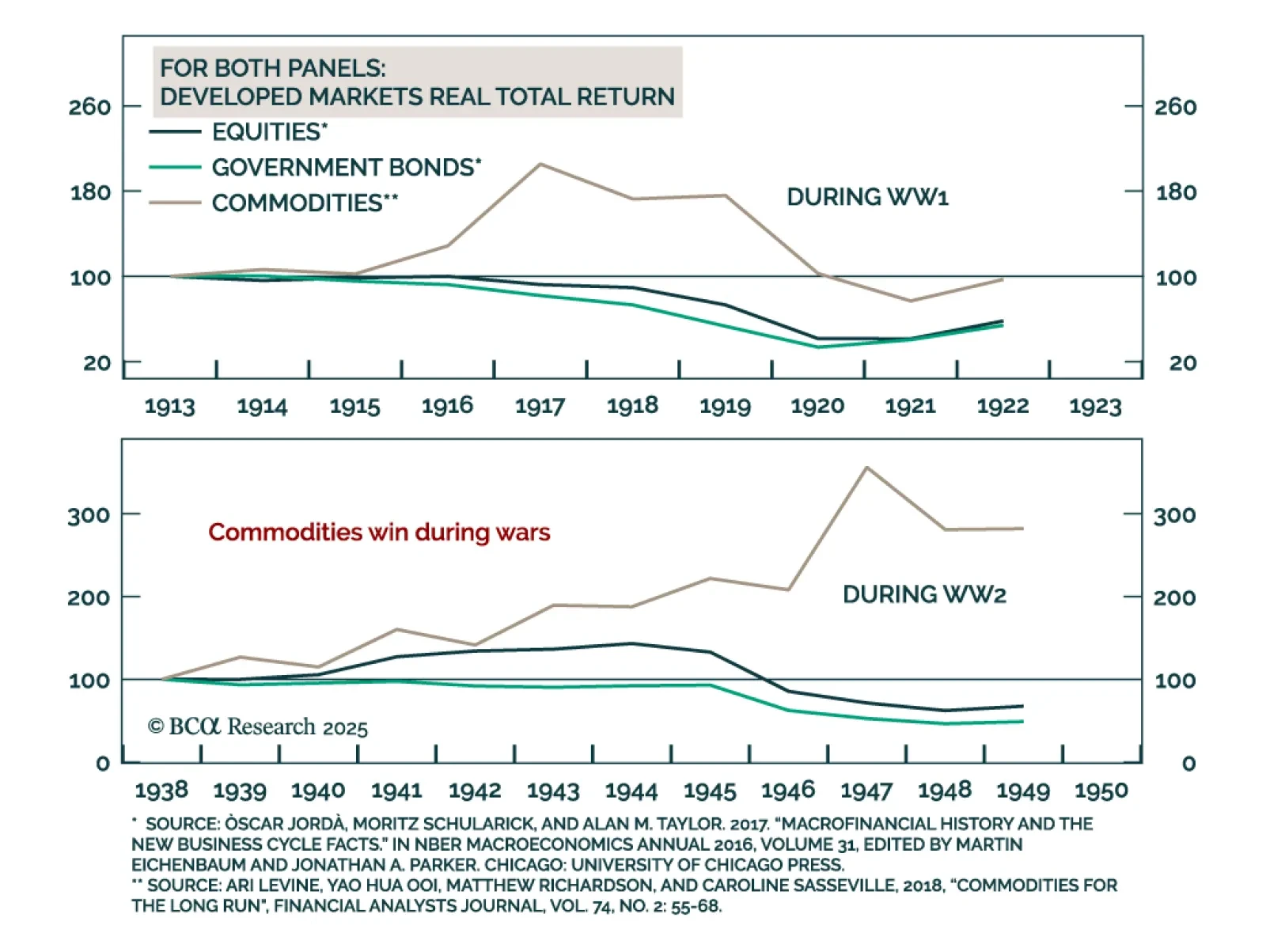

Buy commodities, neutral markets, and crypto to hedge against World War III. In their latest special report BCA’s GeoMacro and Global Asset Allocation strategists outline an asset allocation framework for a deep tail risk scenario: a…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

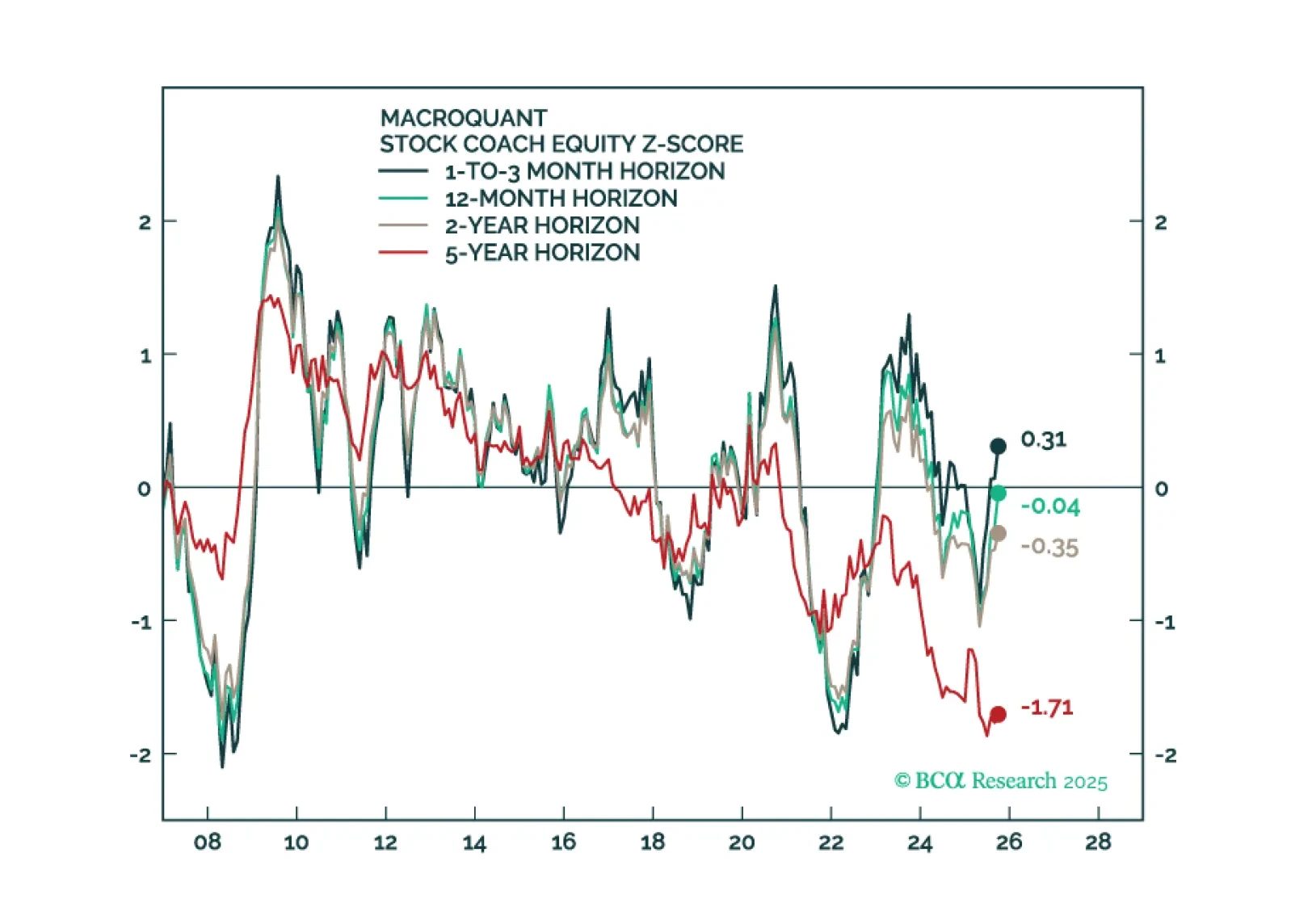

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

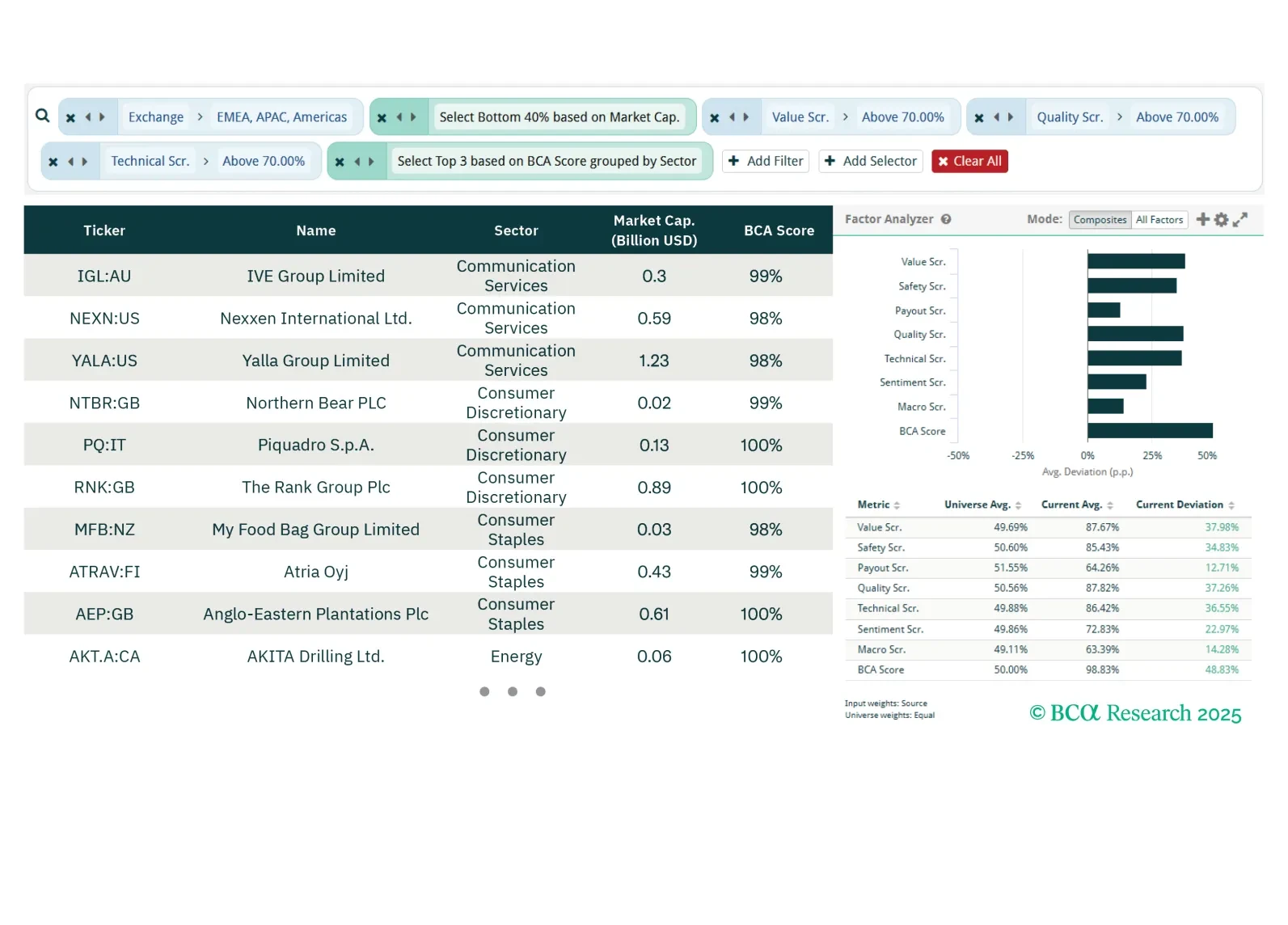

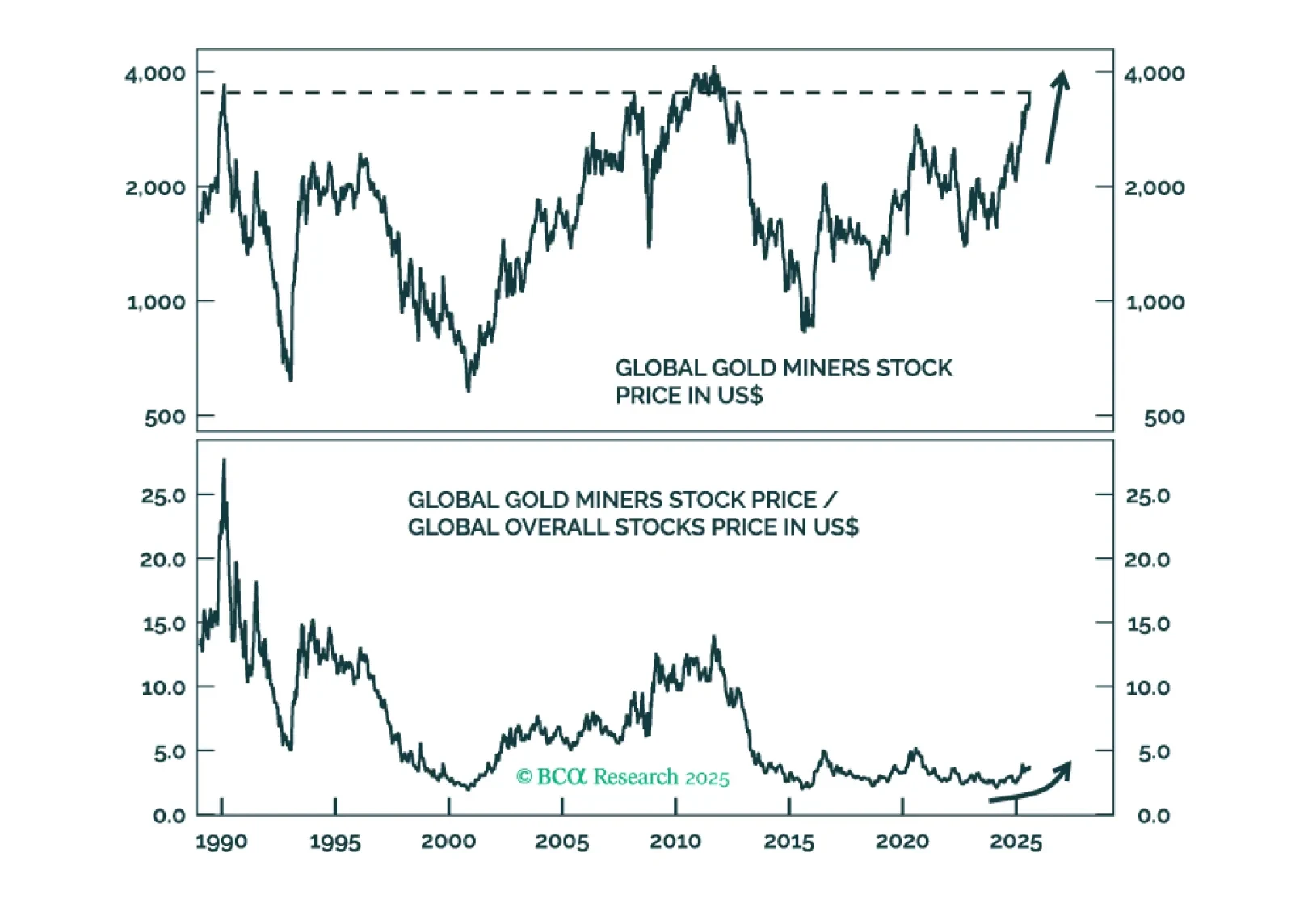

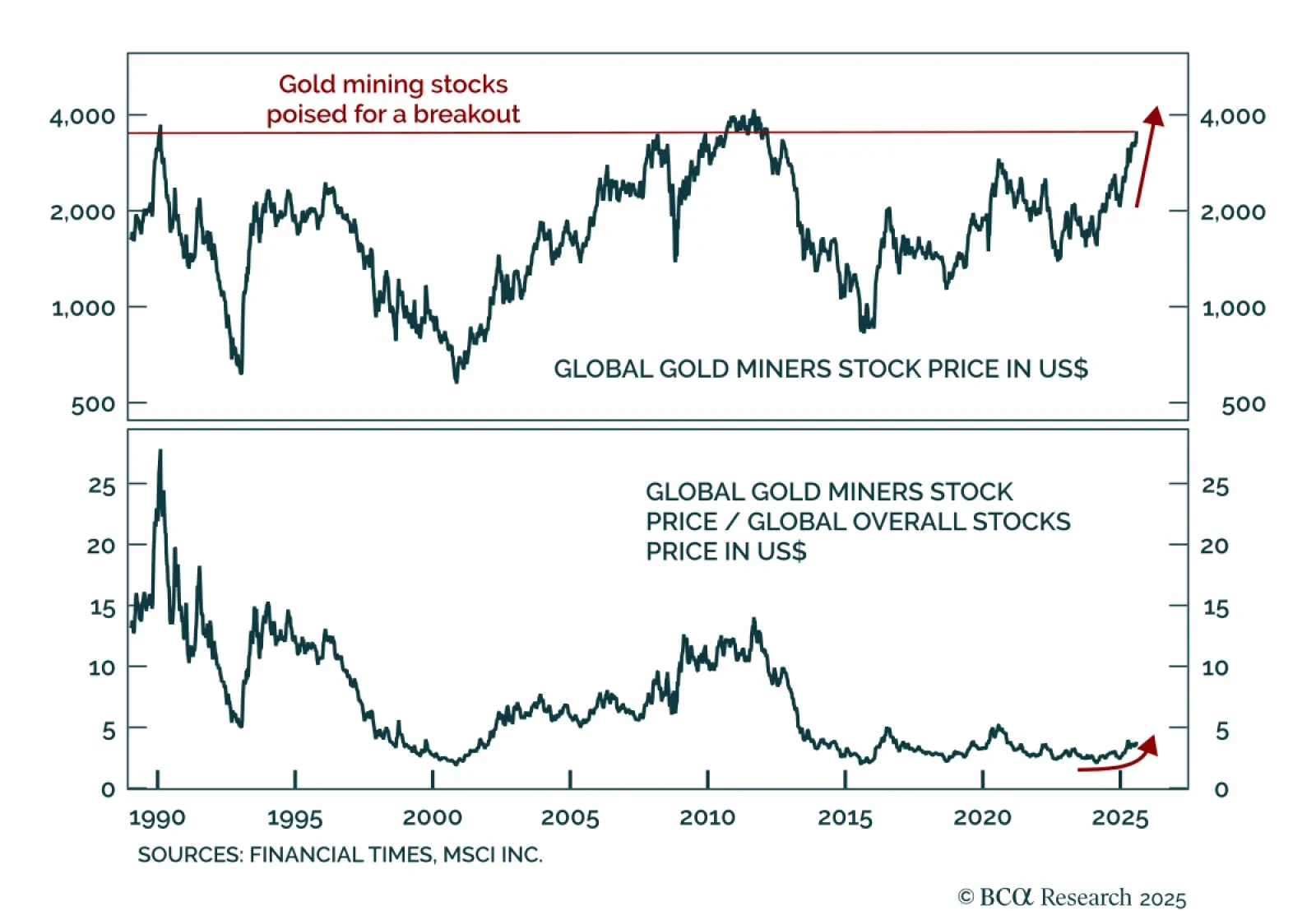

This week our three screeners highlight plays in global small-cap value stocks, gold miners, and stocks exposed to an exciting structural investment theme: Space.

Our Commodity strategists expect gold’s consolidation to resolve in a bullish breakout; buy gold and gold mining stocks in both absolute and relative terms. The metal’s resilience despite unfavorable cyclical drivers points to a…