In our Beta report, we take a break from US politics and focus on the investment implications of climate change. Our colleague Ritika Mankar, of BCA’s Global Investment Strategy, makes a case for long-term investors to actually…

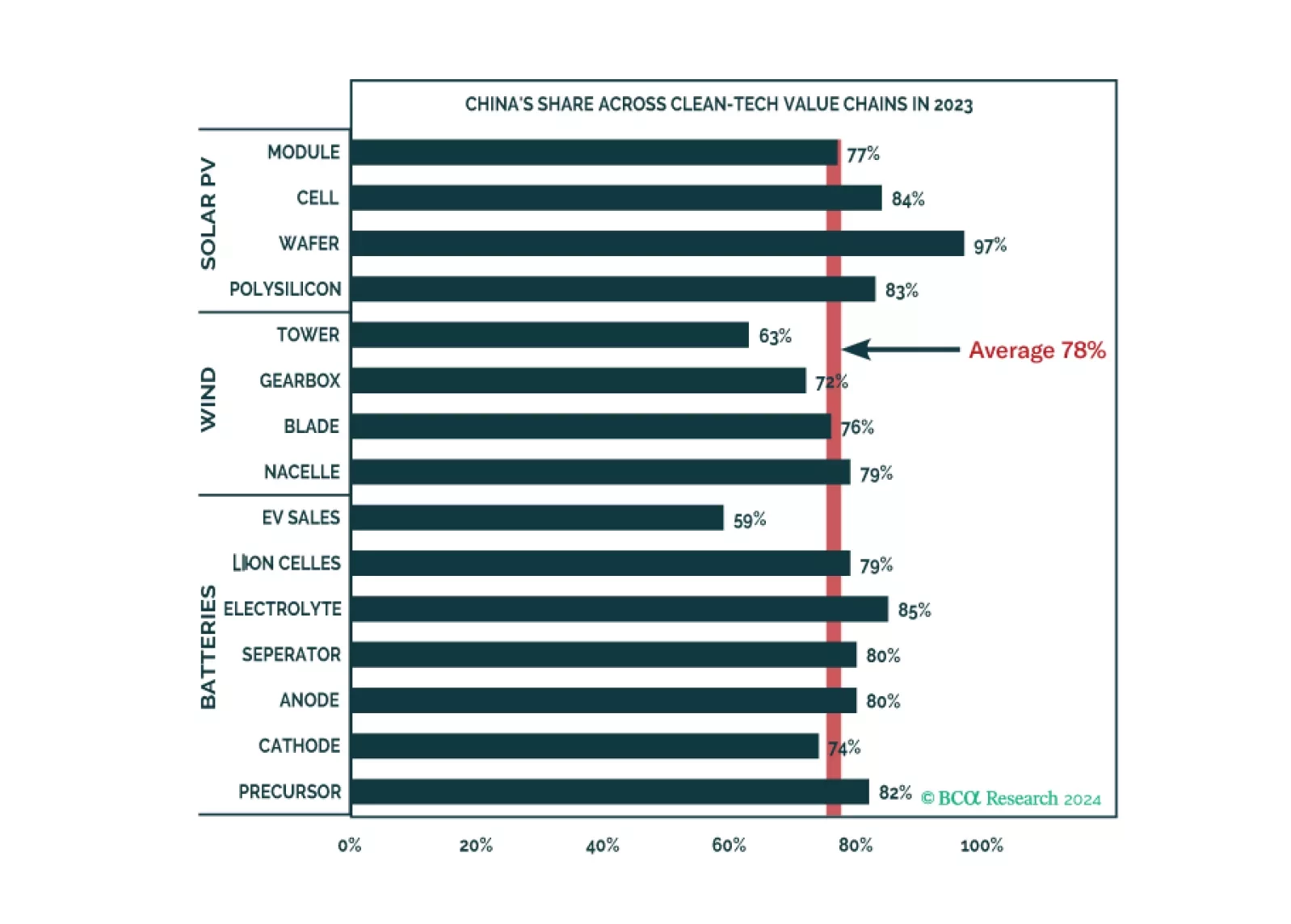

Western policymakers are pursuing three capital “T” Truths: China is evil, climate change is a major risk, and Russia is… also evil. Pursuing all three priorities at the same time presents a version of the classic “impossible trinity…

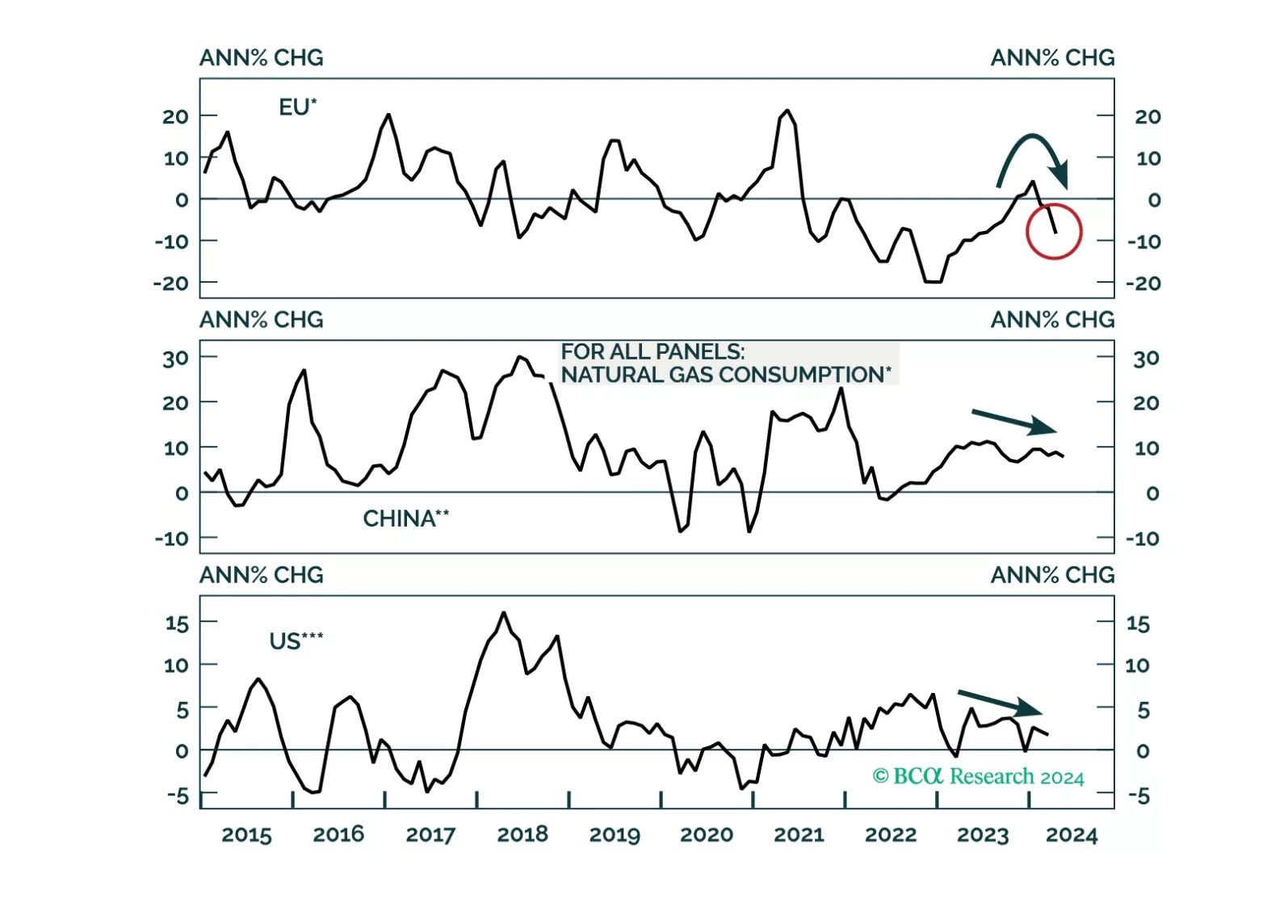

A global economic downturn will be a headwind for natgas prices over the cyclical horizon. Thereafter, LNG capacity additions will help keep the market in balance into the end of the decade. That said, Europe’s increased dependence…

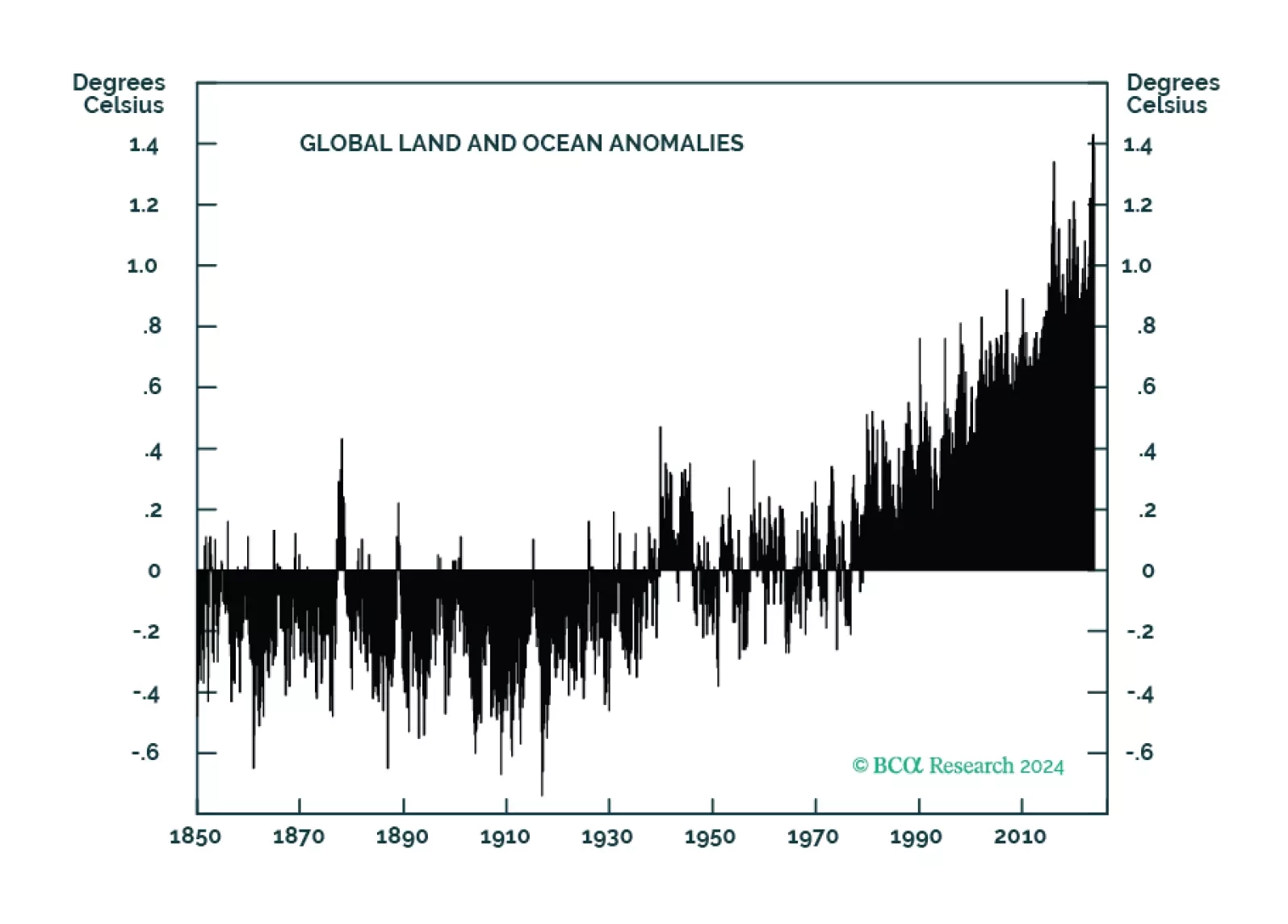

Global ag markets will become more volatile as anthropogenically induced climate change continues to degrade farmland. This will make price signals emanating from these markets less efficient in terms of processing supply-demand…

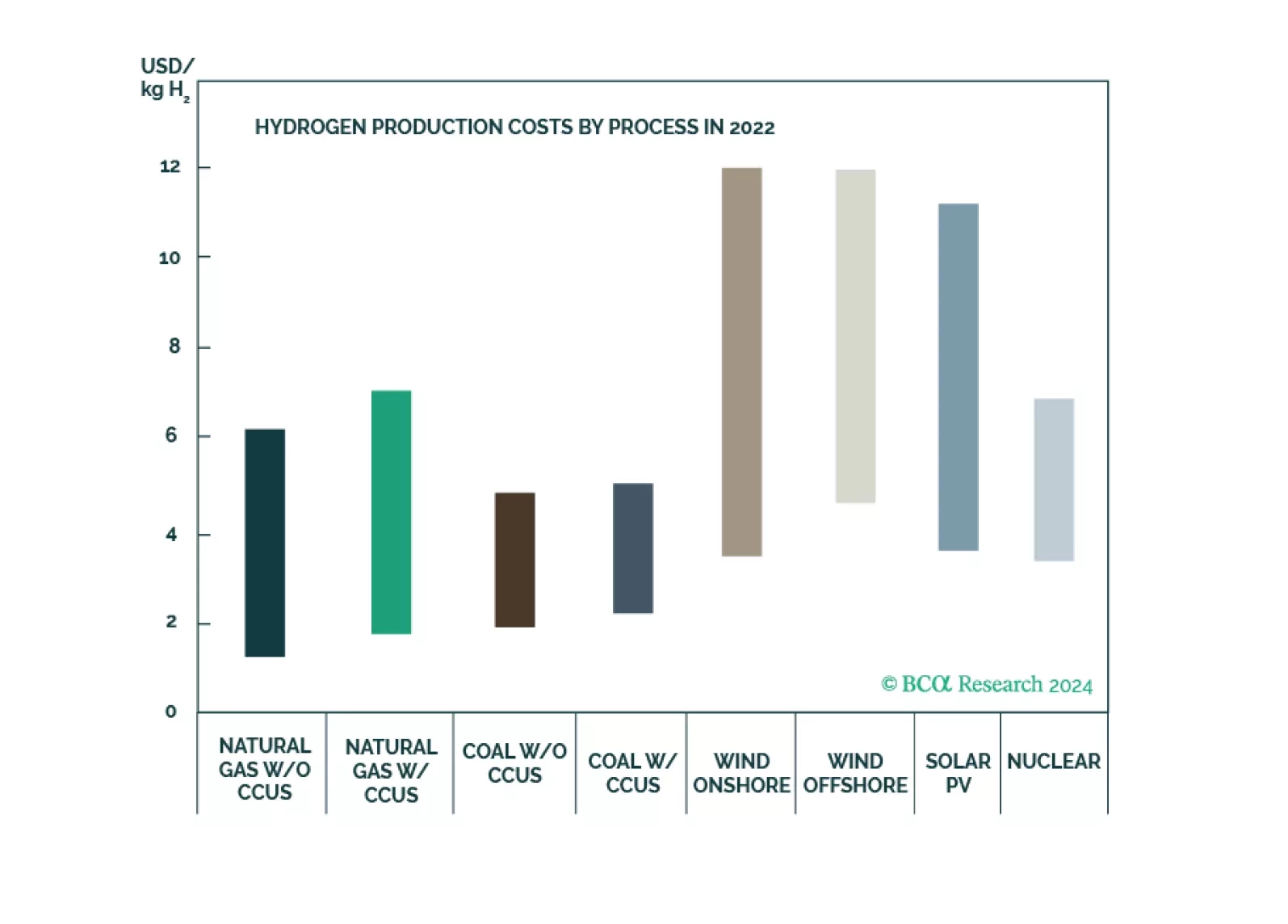

Naturally occurring hydrogen as a clean-energy source has the potential to satisfy significant energy demand growth at low cost. Oil and gas E+P companies and pipelines are ideally positioned to take a leading role in this clean-…

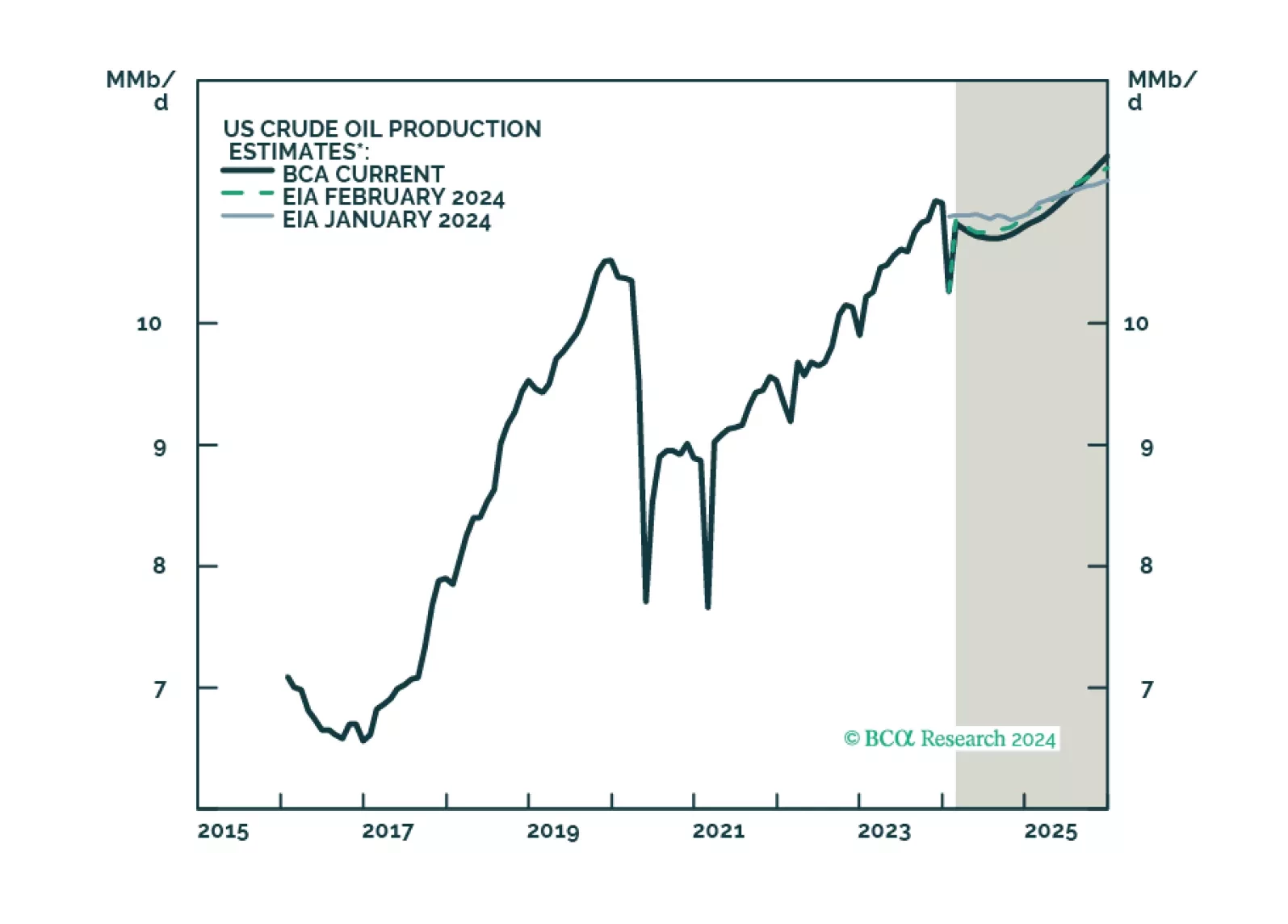

Energy markets are balanced in the short run, which keeps our Brent price forecasts at $95/bbl and $105/bbl in 2024 and 2025. Structurally, we see an upward bias to inflation, as geoeconomic fragmentation fundamentally alters supply…