The Chinese yuan was among the best performing currencies on Thursday after authorities implemented measures to support the yuan. Specifically, the People’s Bank of China (PBoC) set its daily fixing at a stronger-than-…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…

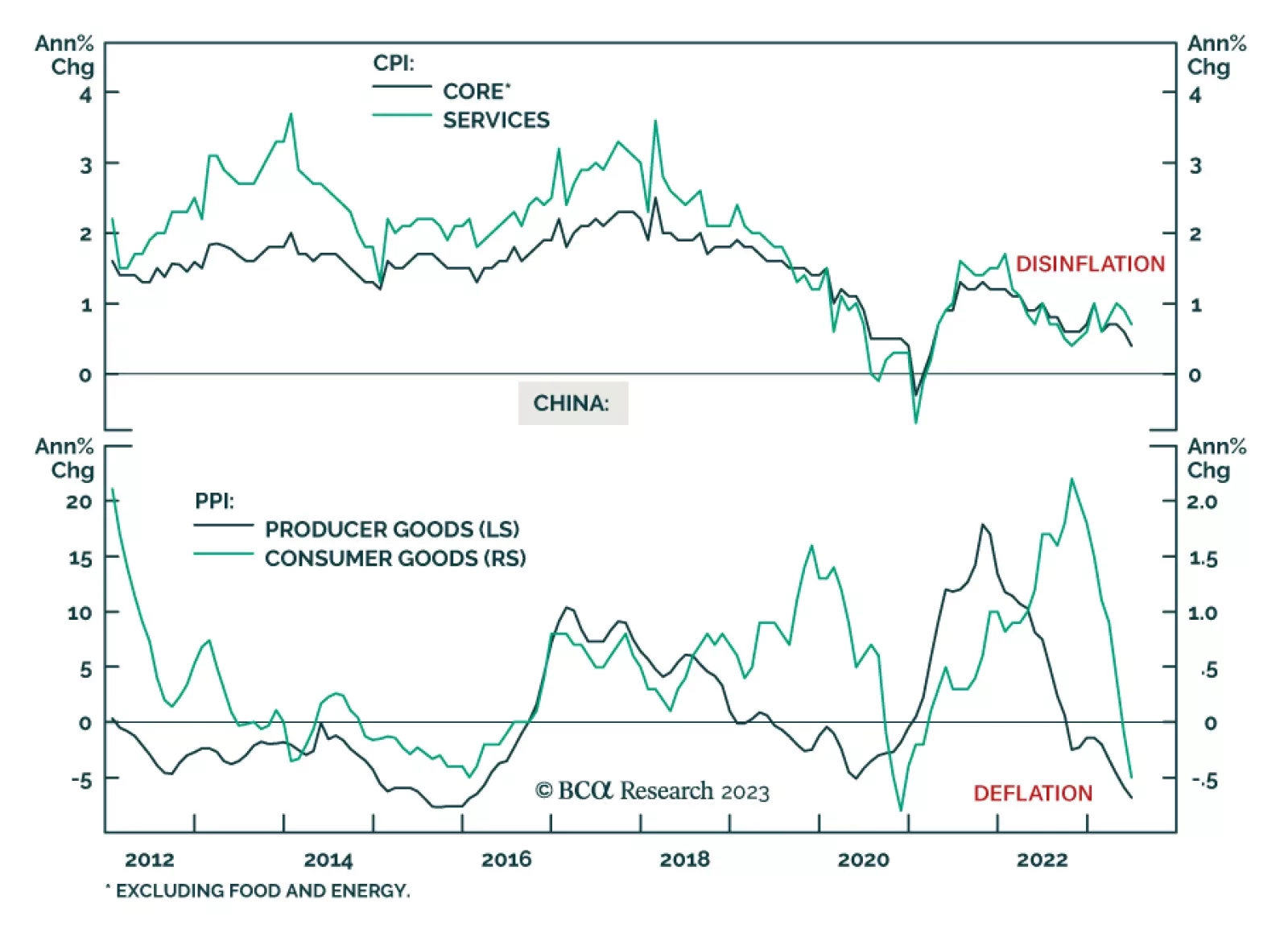

China’s CPI and PPI inflation updates indicate that deflationary pressures continue to dominate the domestic economy in June. Producer prices declined at a faster pace than in the prior month, falling by -5.4% y/y following…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

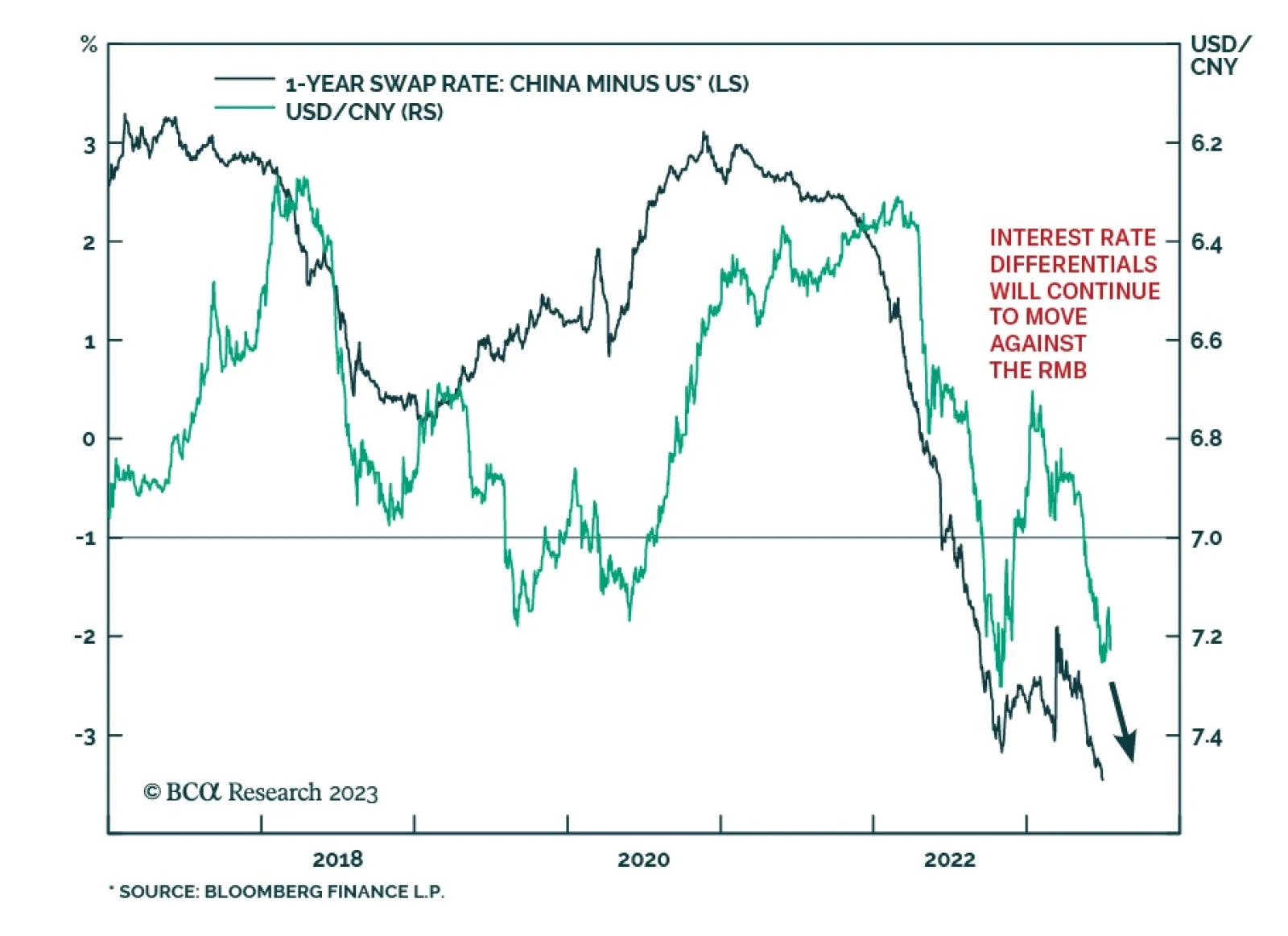

Investor sentiment on China and EM has become bullish. Meanwhile, the reflation plays have begun fraying on the edges. Cracks always appear first in the most sensitive reflation plays and then spread to the core. The narratives of…

In Section I, we explain why we do not see the deceleration in US inflation, the likely near-term pickup in European growth, and the end of China’s dynamic zero-COVID policy as signs of a sustainable rebound in global economic…