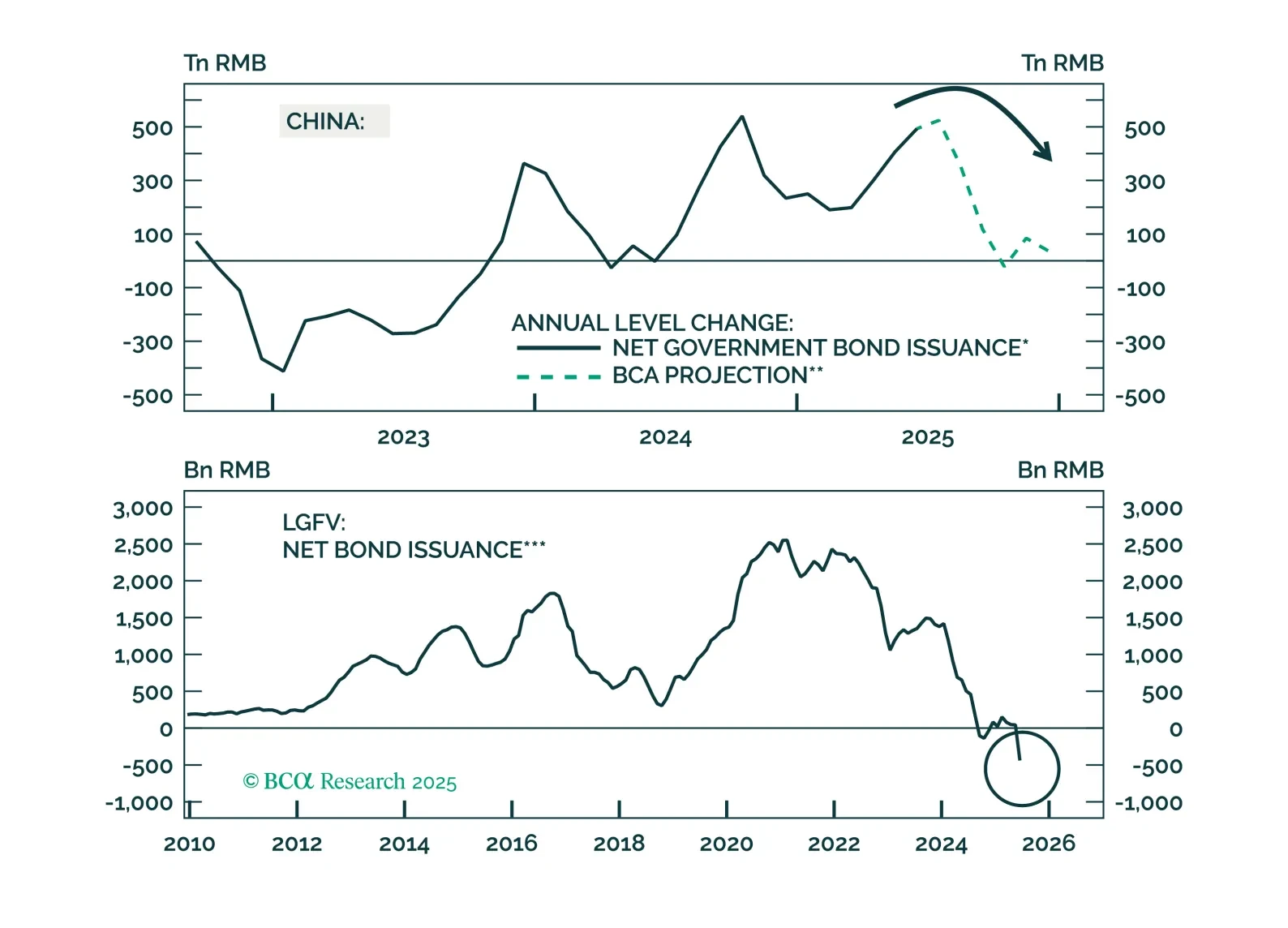

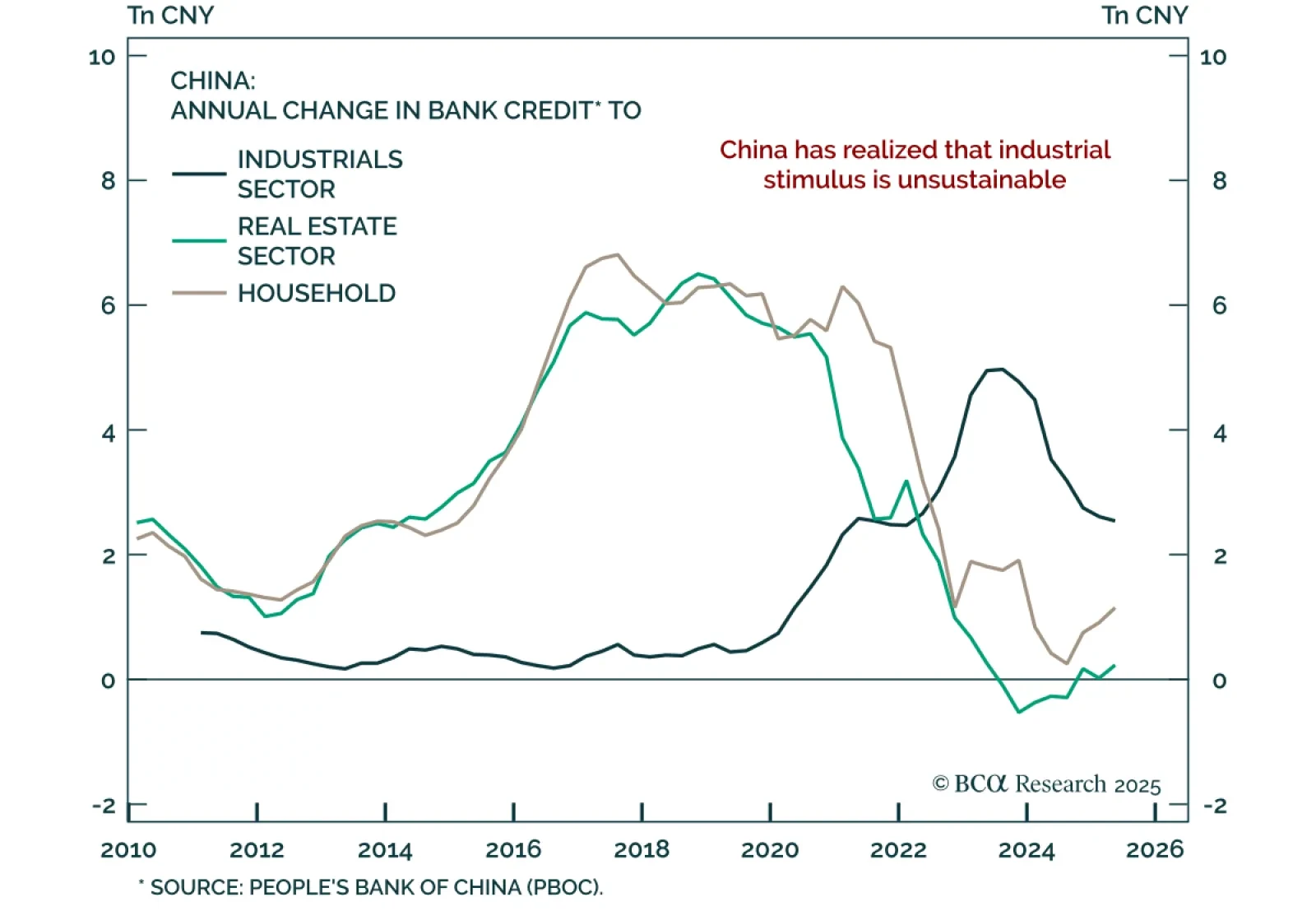

China’s Fourth Plenum outlined priorities for its 2026–2030 plan, emphasizing household consumption and technological upgrading but signaling continuity over change. The document highlights a rebalancing toward consumption as a share…

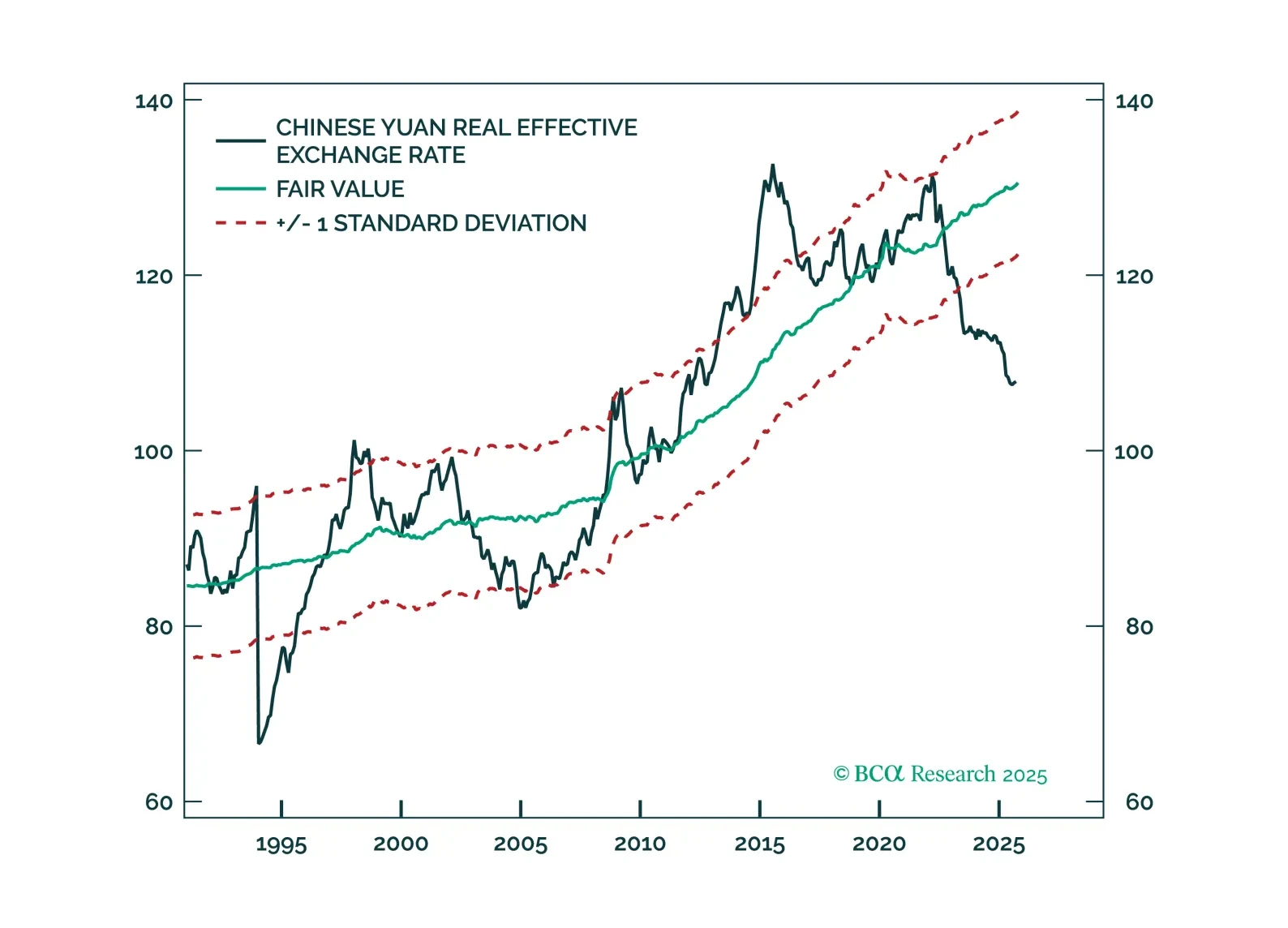

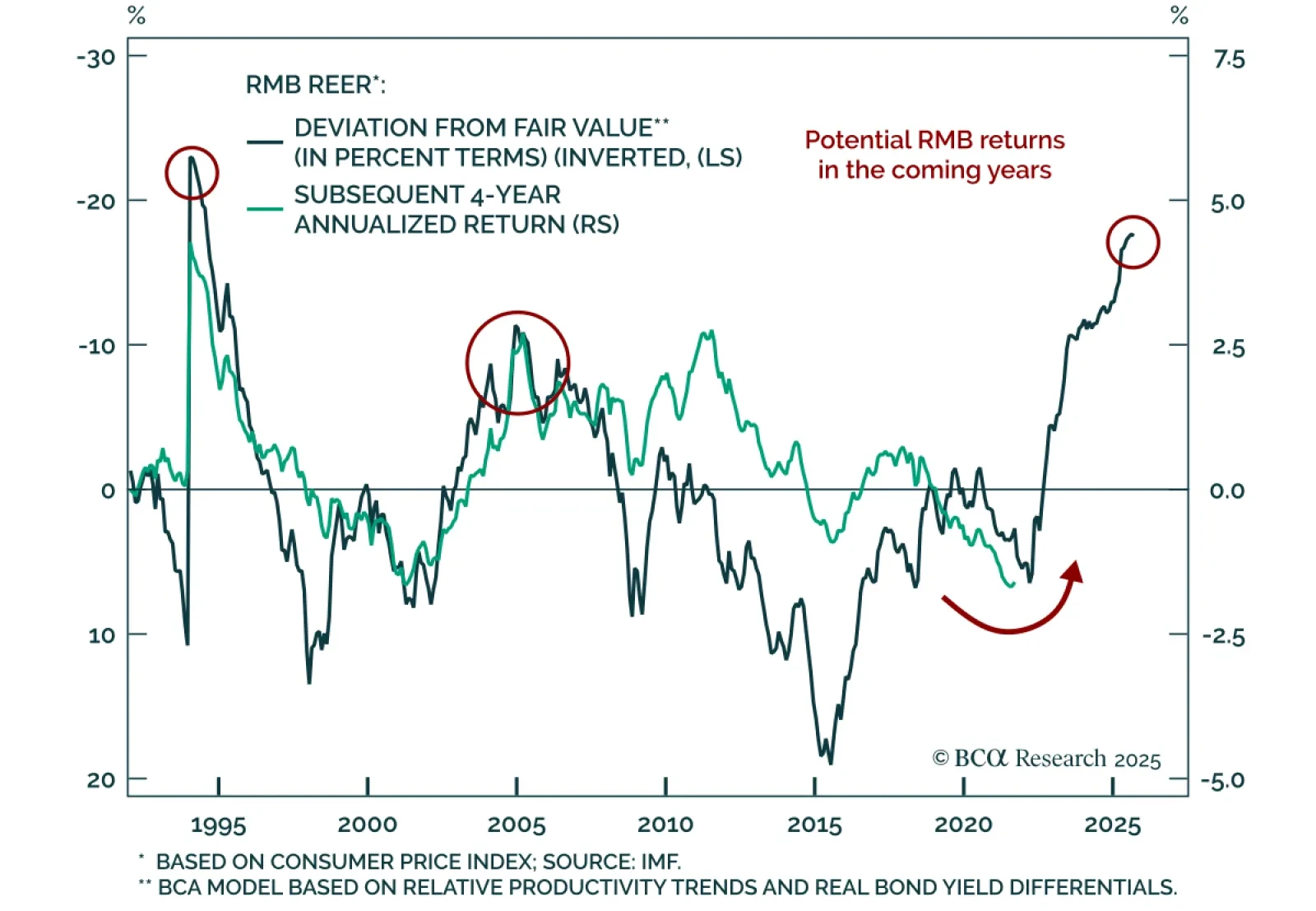

Beijing’s quiet pivot toward RMB strength and a deep valuation discount set the stage for a multi-year appreciation. Our latest FX Insight explores why we see the CNY rising to 6.5–6.8 versus the USD over the next year.

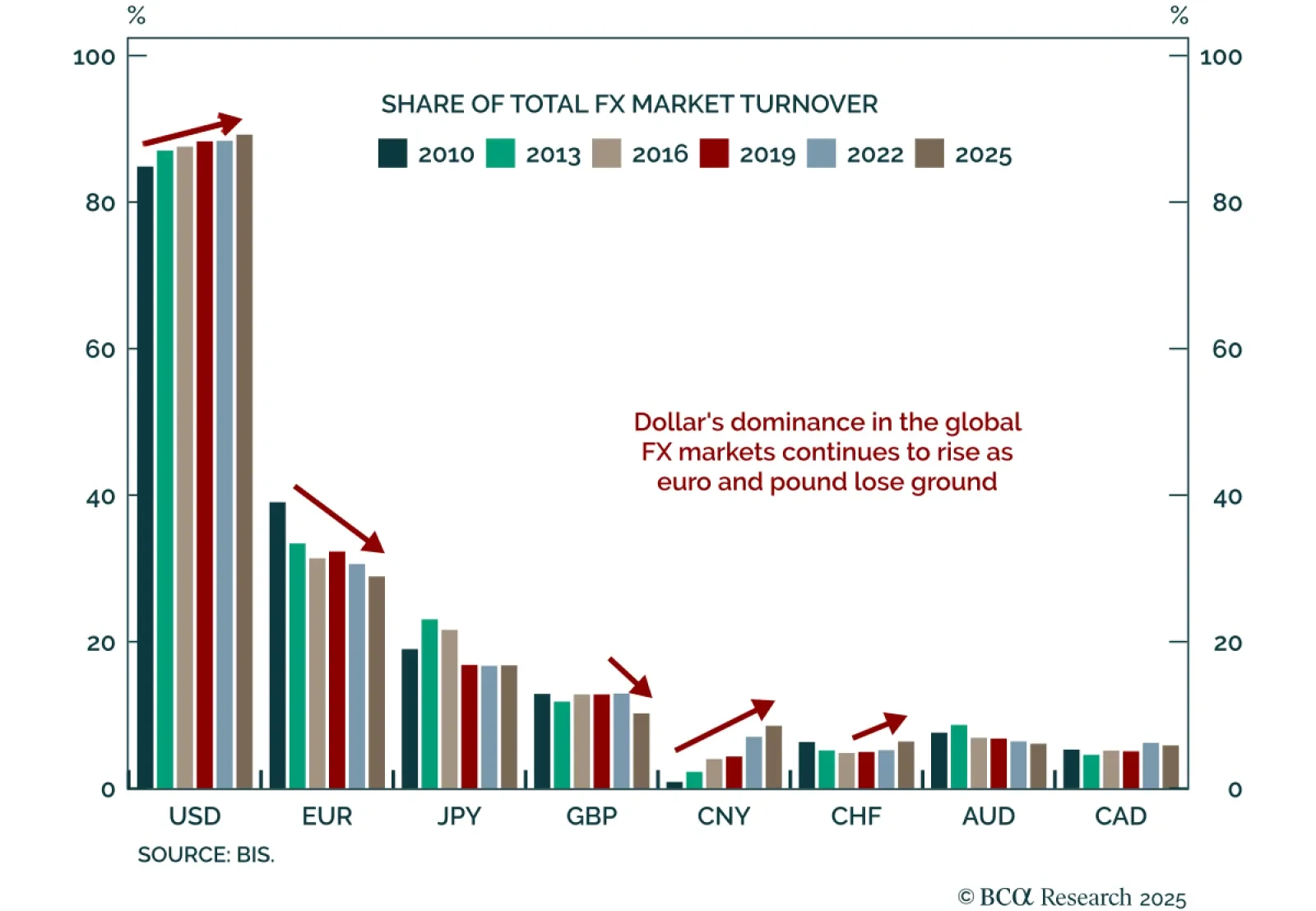

The latest BIS Triennial Central Bank Survey reaffirms the US dollar’s dominance in global FX markets, highlighting the structural challenges of truly moving away from the USD-centric financial system. The survey conducted in…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

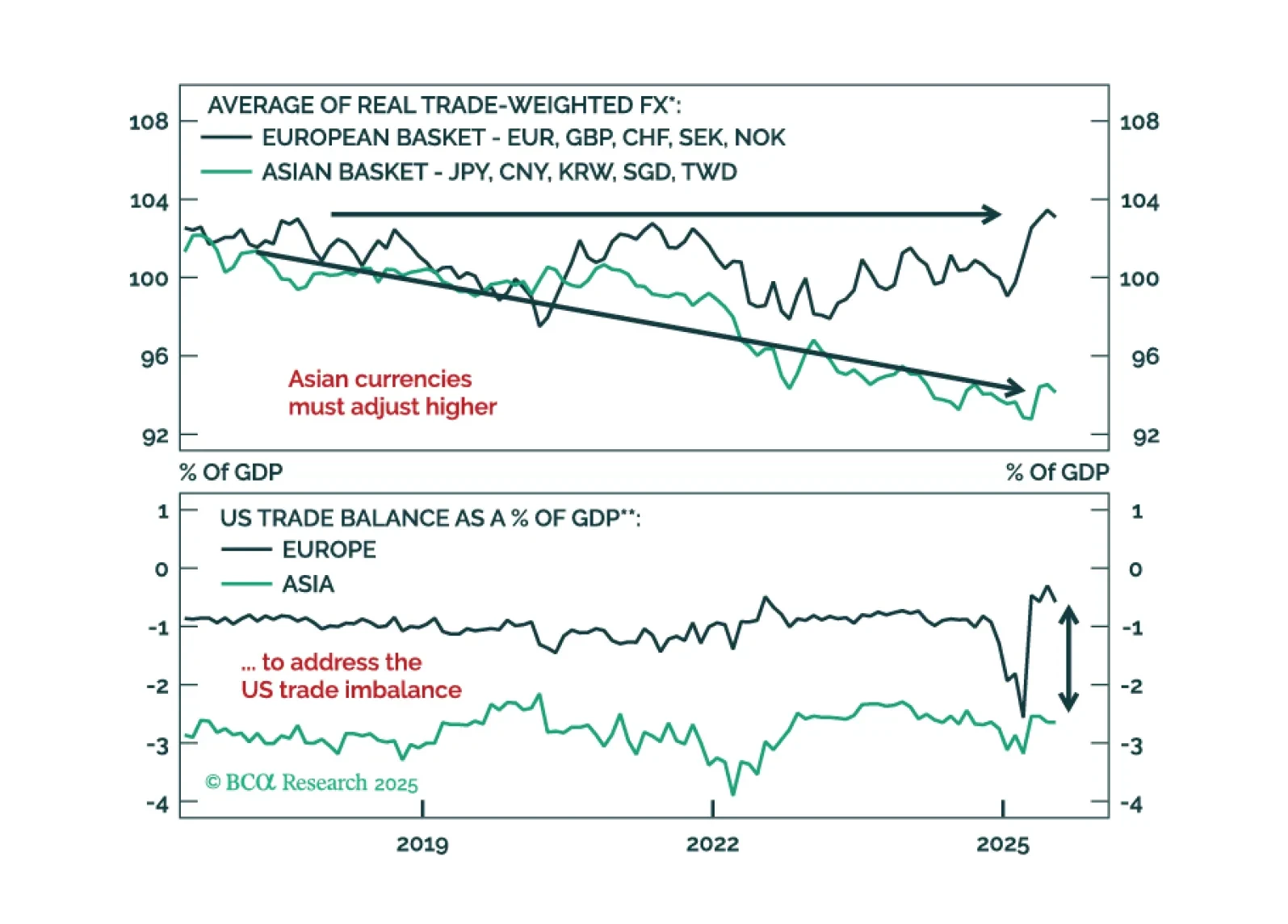

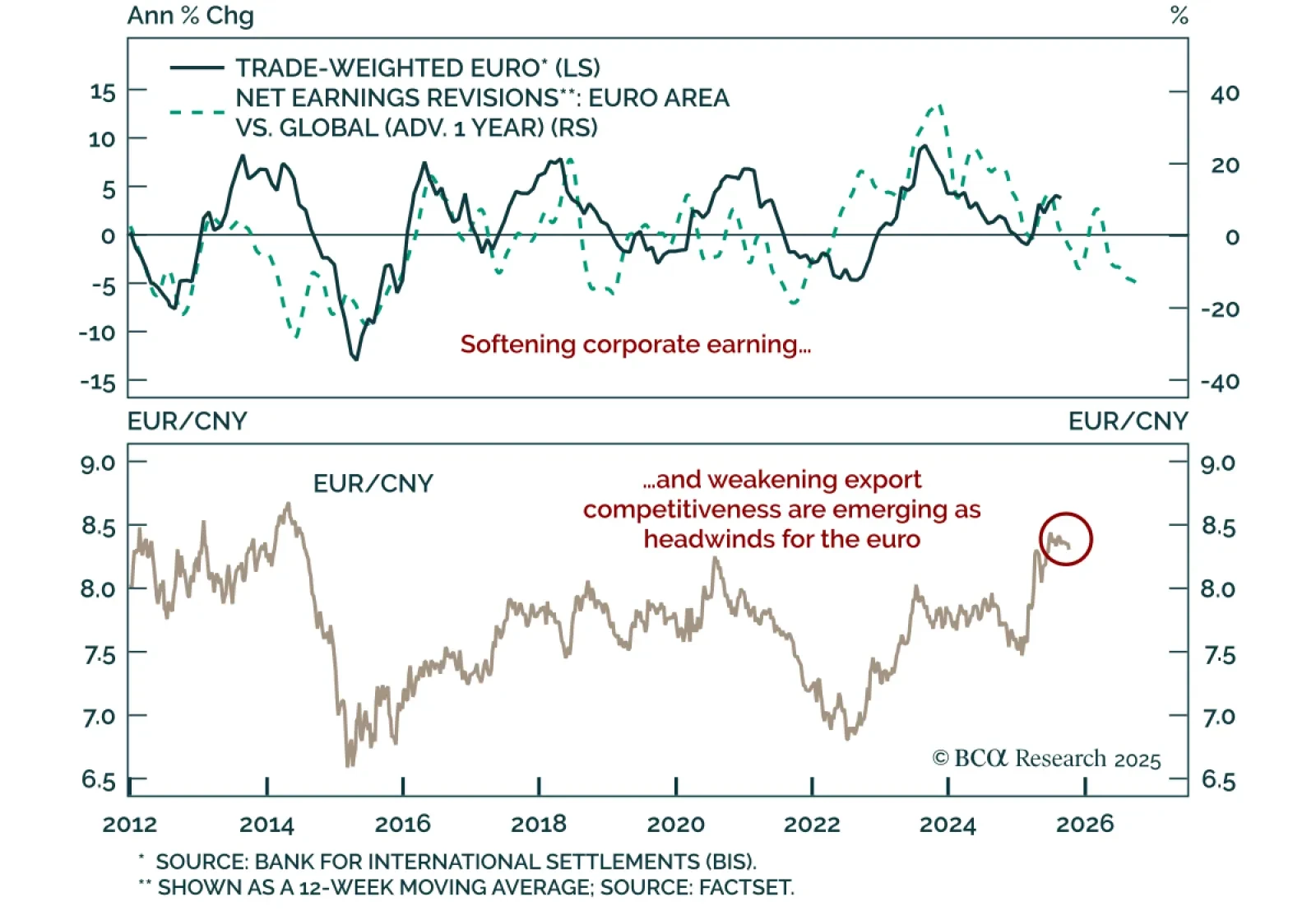

The euro’s strong performance this year remains underpinned by structural forces, but near-term headwinds are starting to emerge, arguing for patience in adding exposure.The euro’s sharp 10% appreciation against the Chinese yuan this…

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

Our Global Asset Allocation strategists upgrade the Chinese yuan to overweight as global imbalances between production and consumption begin to reverse. The US continues to overconsume and underproduce, while China overproduces and…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

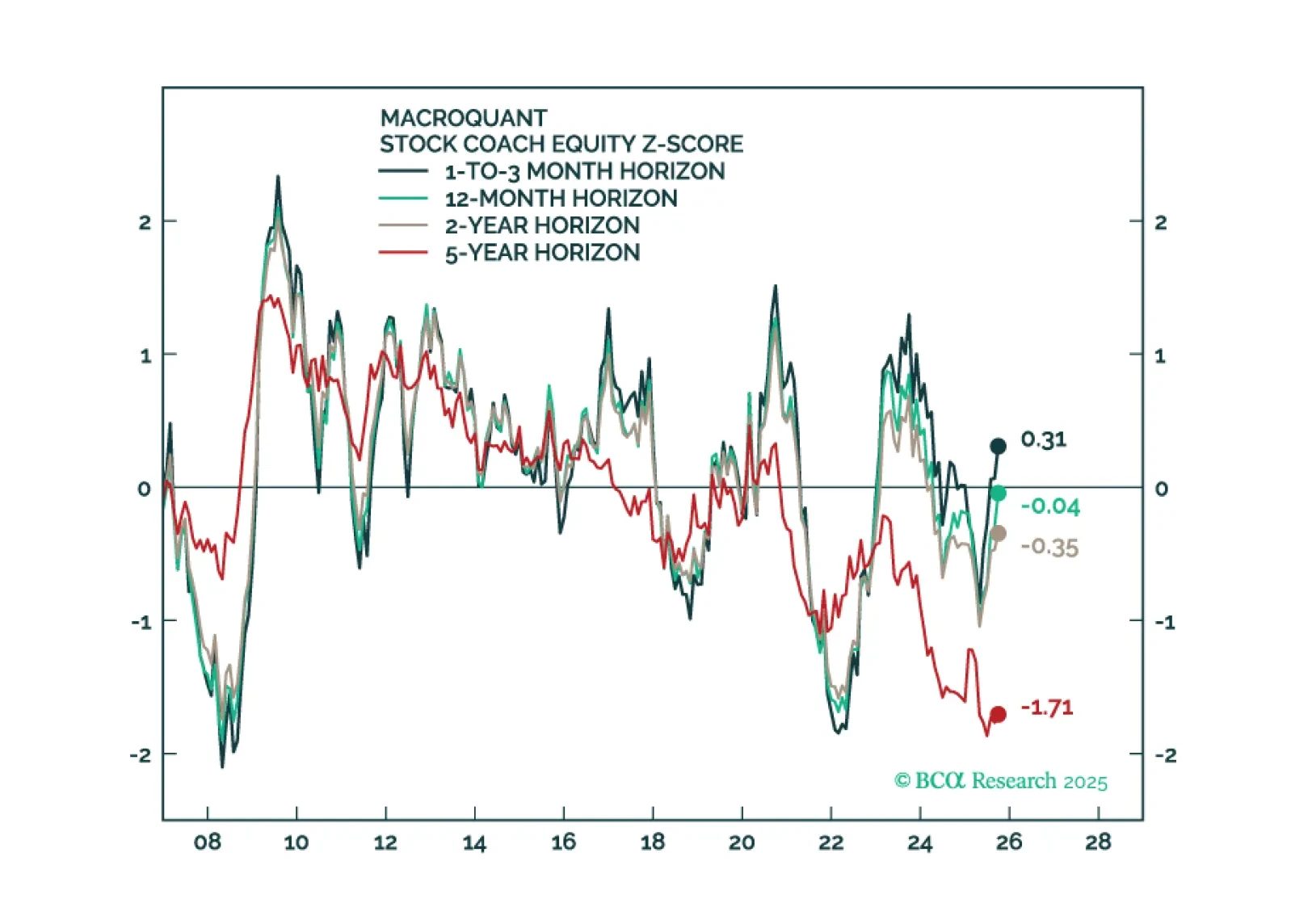

The US economy is not in recession, but is suffering from a post-pandemic stimulus hangover. The cure: lower interest rates. We expect the Fed to start lowering rates, which will benefit both equities and bonds. We upgrade stocks to…

The London Sino-US trade talks offered hope of de-escalation, but Chinese equities remain under pressure from deflationary headwinds and lack a clear macro catalyst to trend higher.