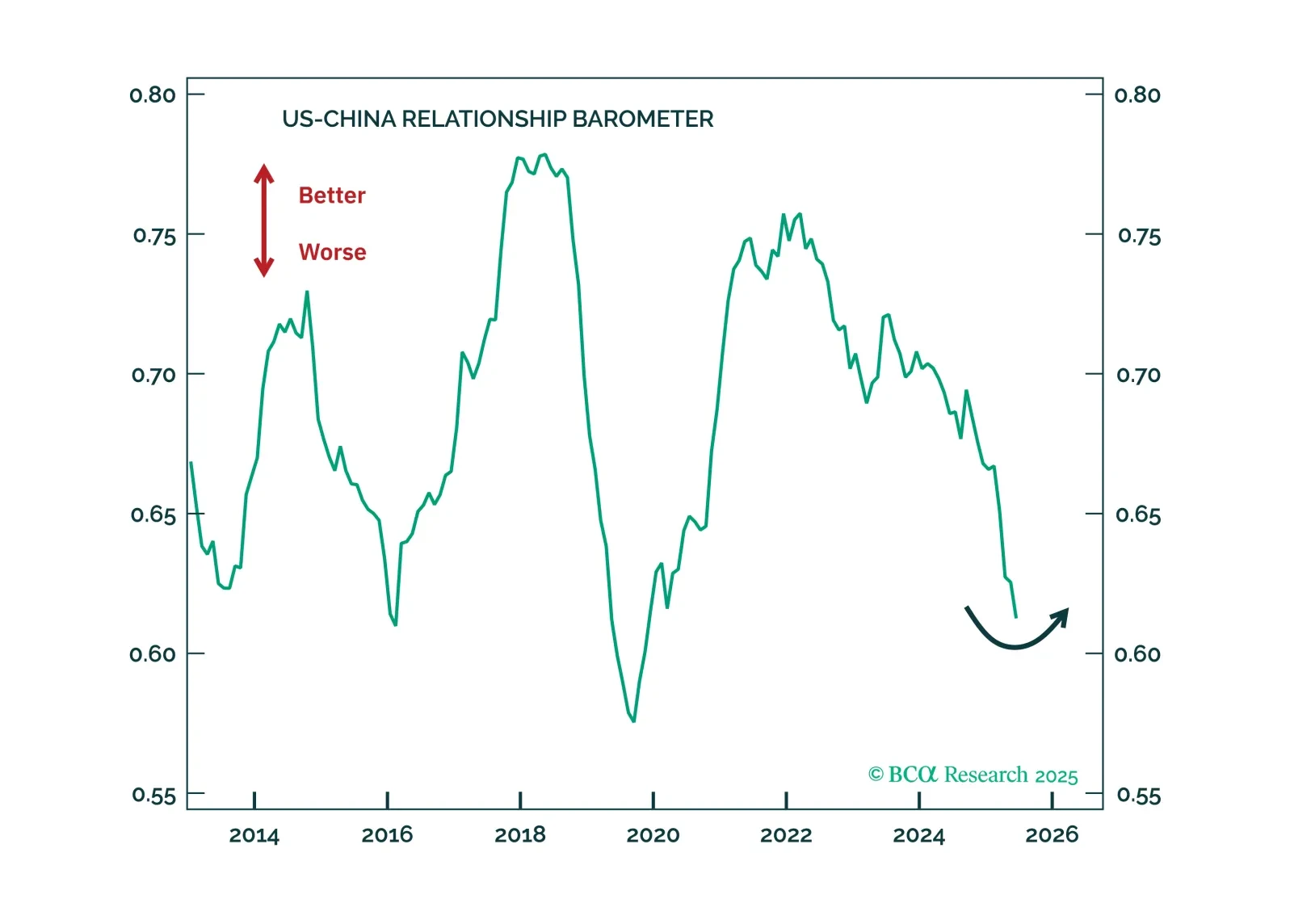

The Trump-Xi summit continued the trade truce and tentatively created a framework to contain tensions over 2026. That is not a trade deal but it is good enough for global financial markets, especially Chinese assets.

Rising Russia-NATO risks, tactical oil/gold trades, tougher sanctions on Russia (maybe China), China stimulus with ~5% growth target, and US checks on Trump’s ambitions will define Q4.

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

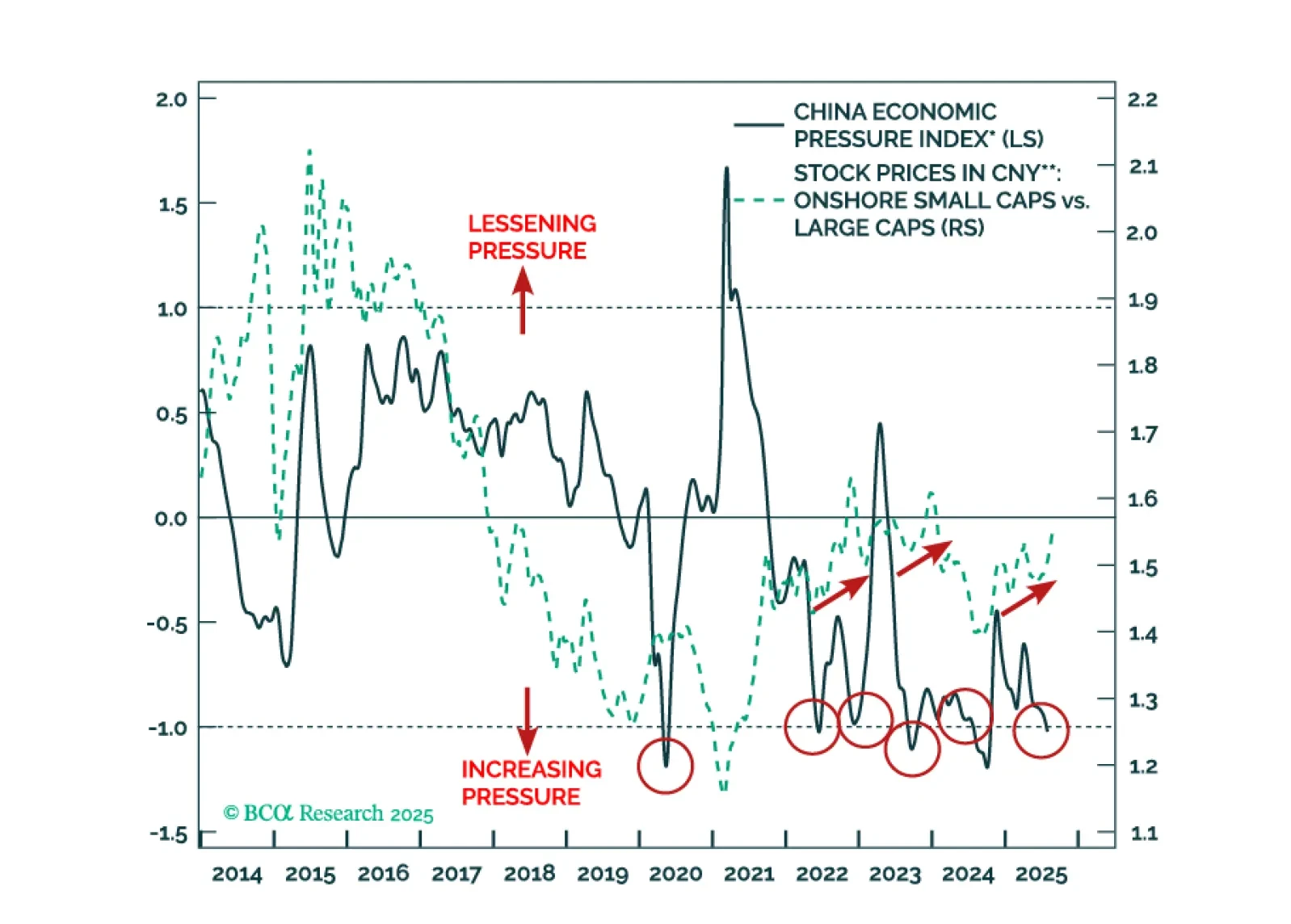

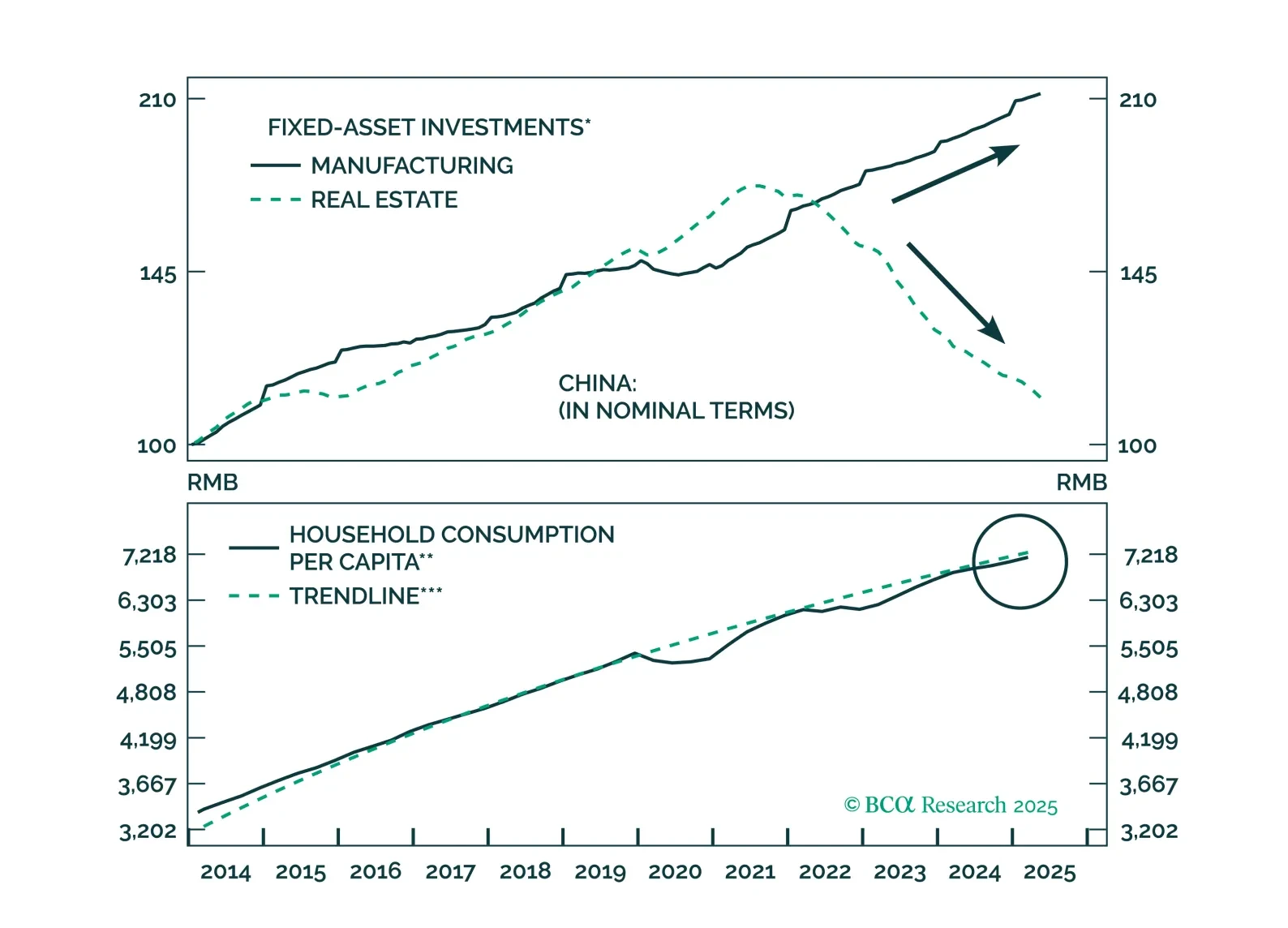

This report analyzes China’s persistent deflation, which is rooted in supply-side forces. Consumption support will be slow and incremental, keeping deflationary pressures elevated for the next 6–12 months.

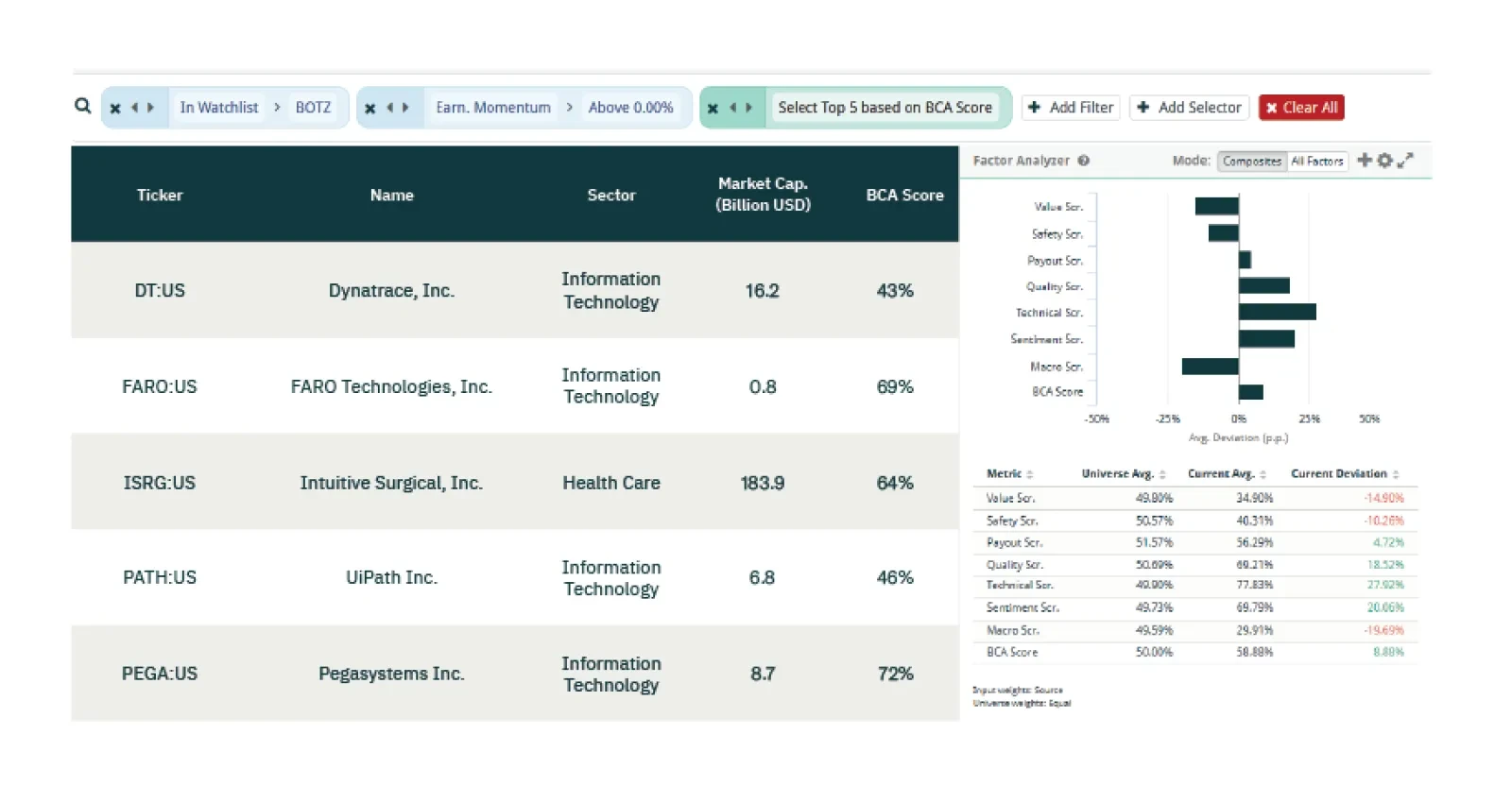

This week our three screeners explore equity trades in Robotics, European Quality and Technical, and Hong Kong.

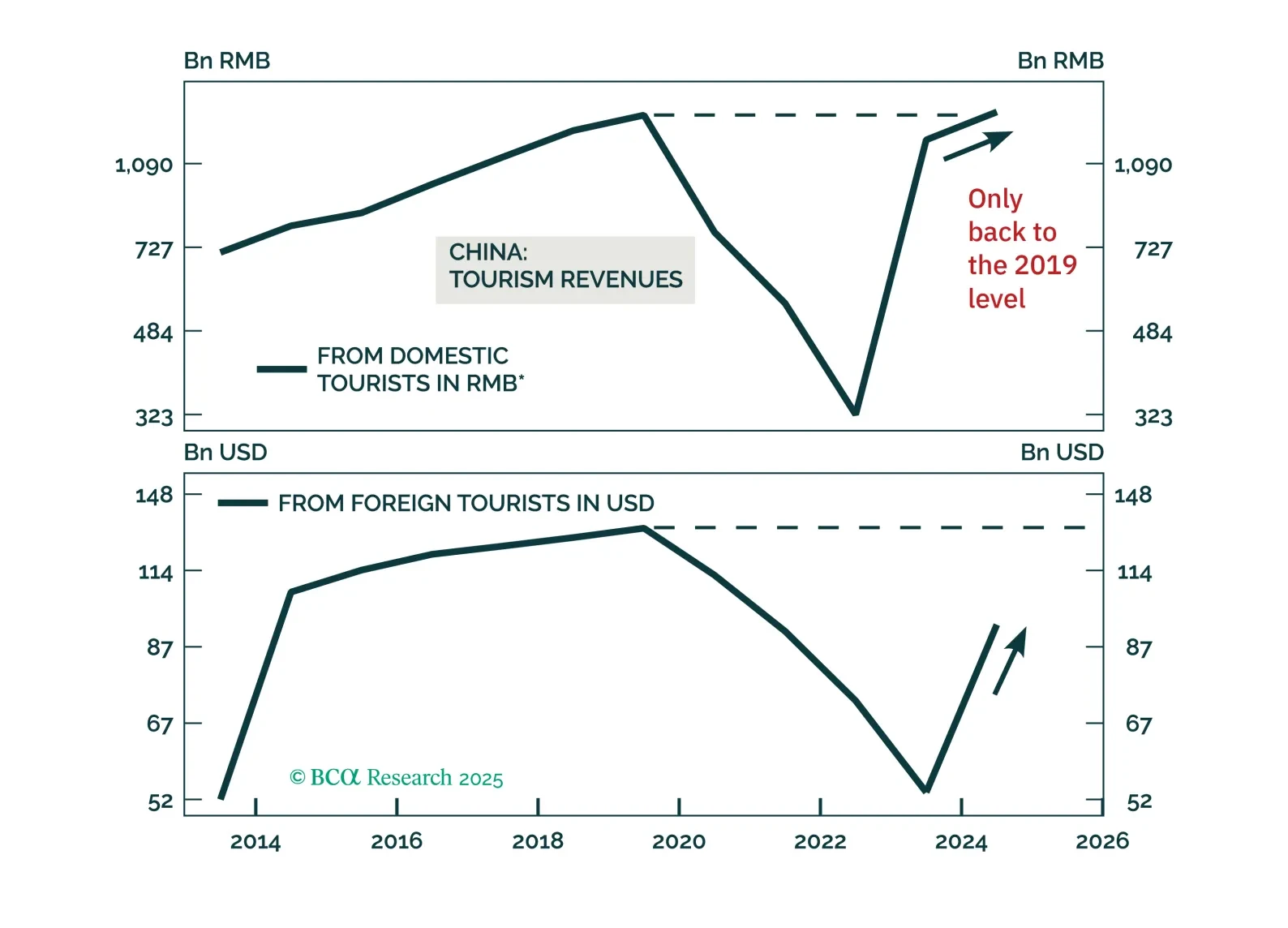

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

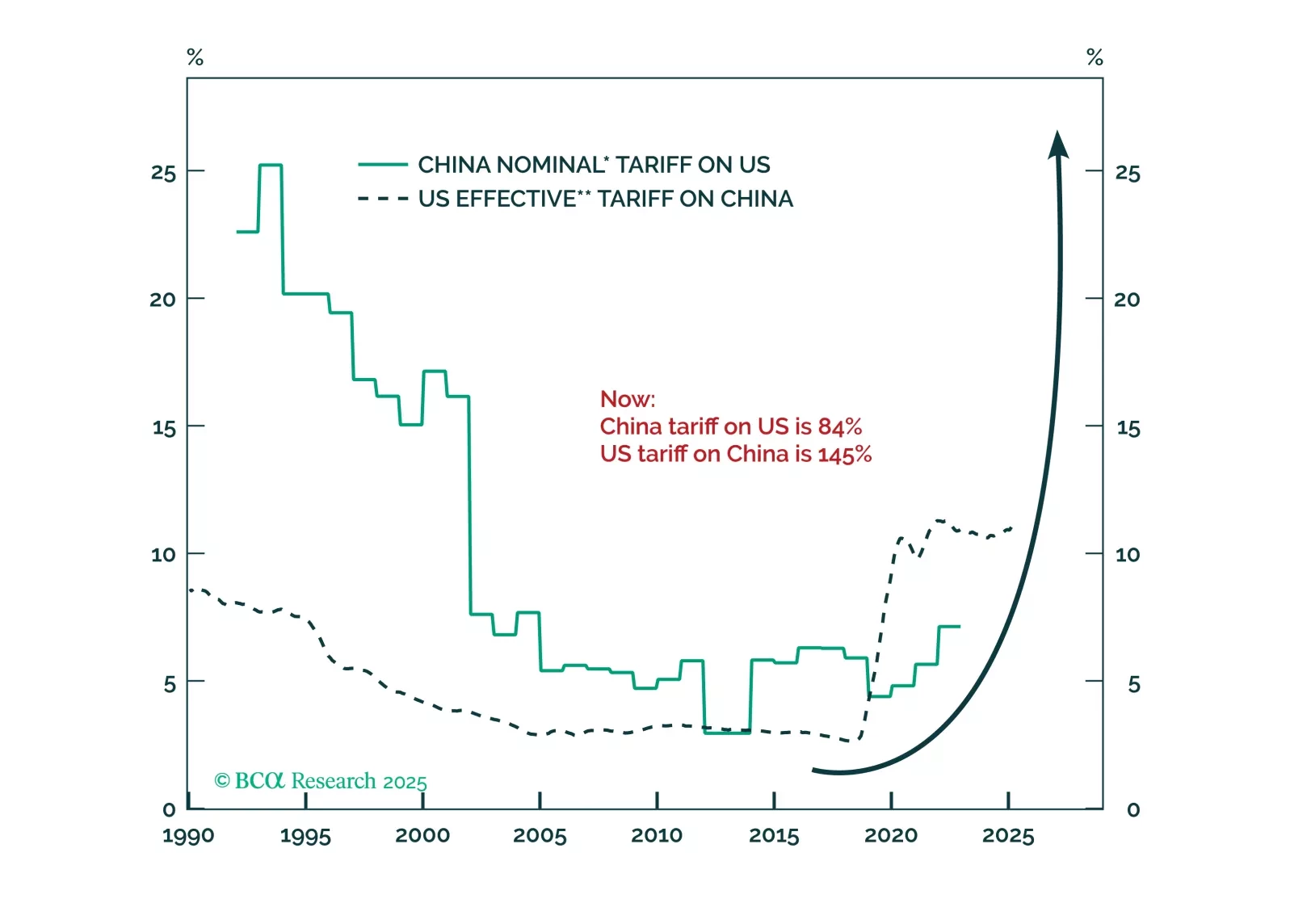

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…