We have entered a new phase of the cycle, with central banks in most developed markets turning more hawkish (the Bank of England surprisingly hiking in December, and the Fed signaling three rate hikes for 2022). How much does…

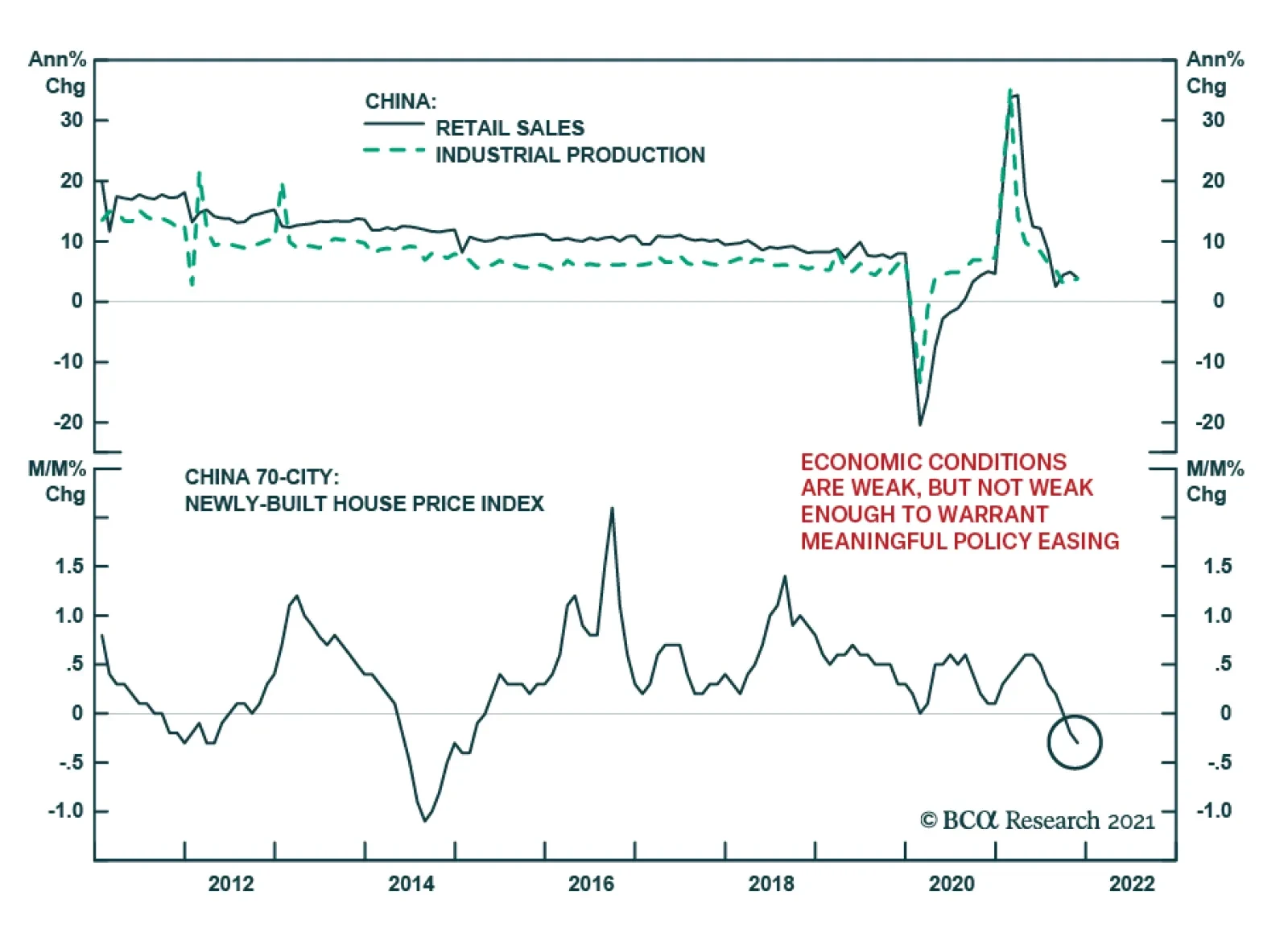

Chinese economic data for November was generally disappointing and indicate that the domestic economy is slowing. Retail sales growth decelerated sharply to 3.9% y/y versus expectations of a mild 0.2 percentage point decline from…

Highlights Our three strategic themes over the long run: (1) great power rivalry (2) hypo-globalization (3) populism and nationalism. The implications are inflationary over the long run. Nations that gear up for potential conflict and…

Dear Clients, This is the final publication for the year, in which we recap some of the key economic developments this month. Our publishing schedule will resume on January 6, 2022. The China Investment Strategy team wishes you a very…

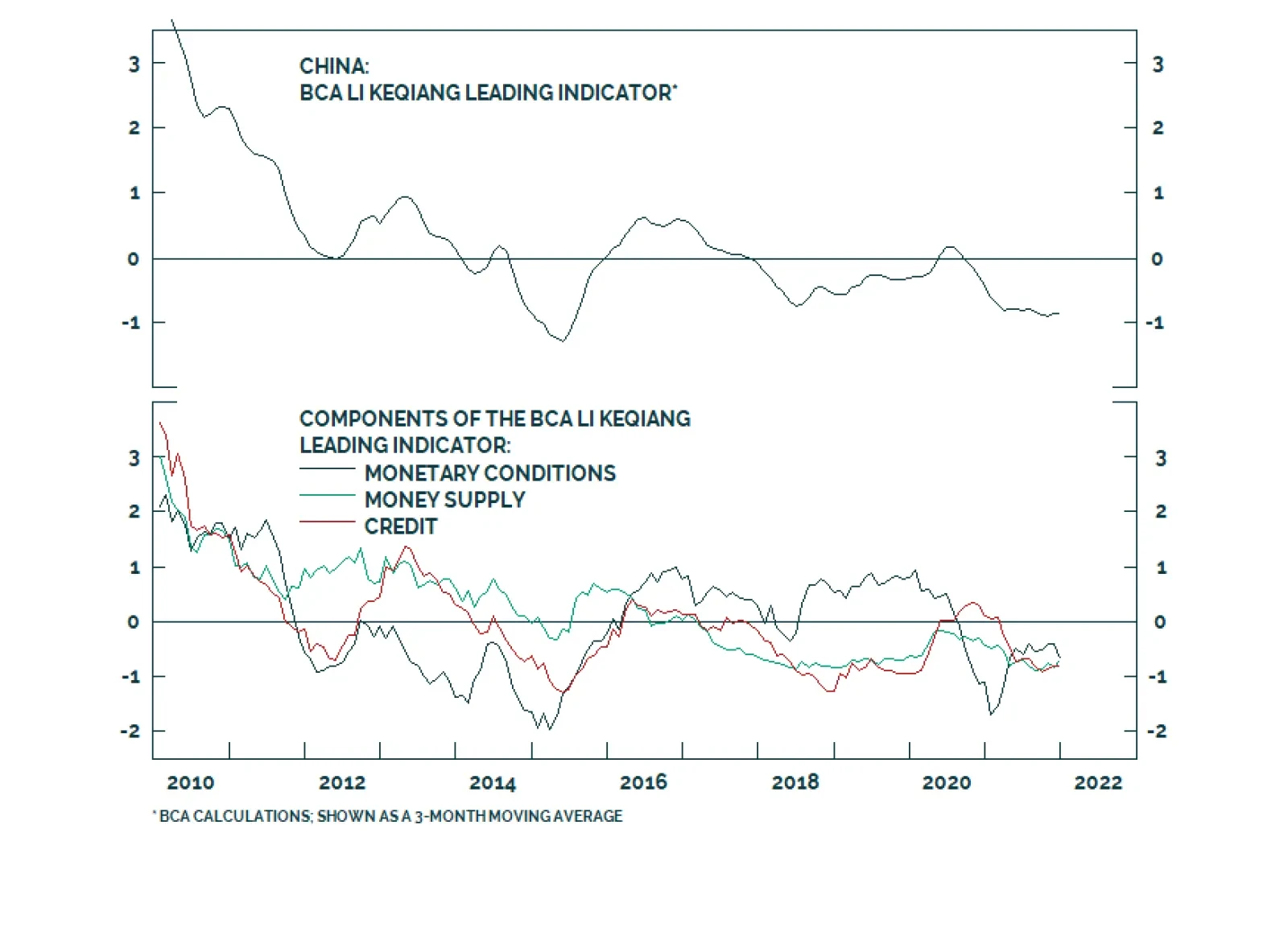

Communication out of China’s annual Central Economic Work Conference prioritizes macroeconomic stability in 2022. This is in line with the Chinese Communist Party’s desire to ensure robust economic conditions ahead of…

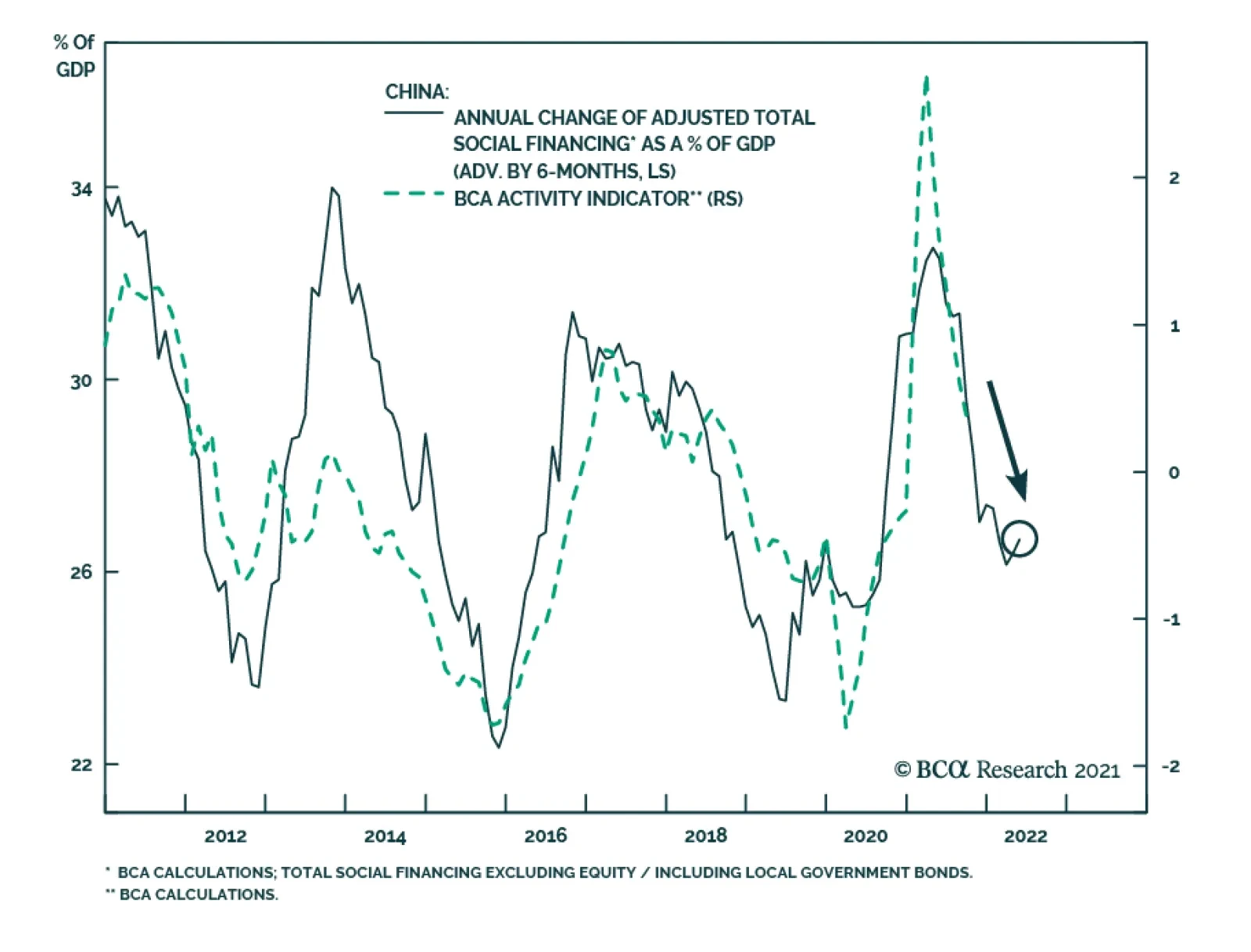

Although China’s credit data improved in November, it fell below expectations. Aggregate financing increased from CNY 1.6 trillion to CNY 2.6 trillion, slightly below the anticipated CNY 2.7 trillion. Although new yuan…

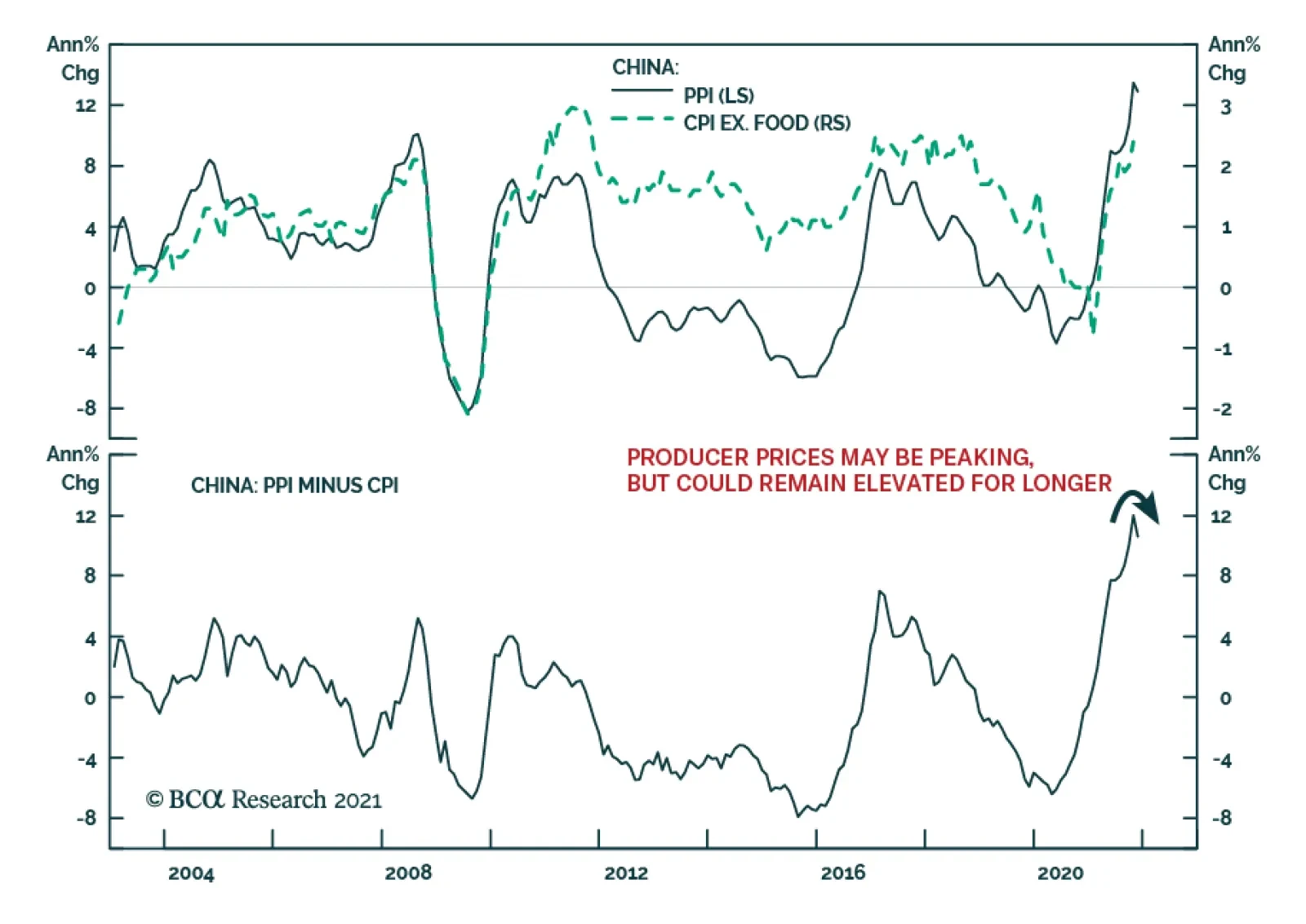

The gap between Chinese producer and consumer price inflation narrowed in November. PPI growth slowed from 13.5% to 12.9% while consumer price inflation accelerated to 2.3% from 1.5%. The moderation in producer prices reflects…

Dear Clients, Next week, in addition to sending you the China Macro And Market Review, we will be presenting our 2022 outlook on China at our last webcasts of the year “China 2021 Key Views: A Challenging Balancing Act”.…

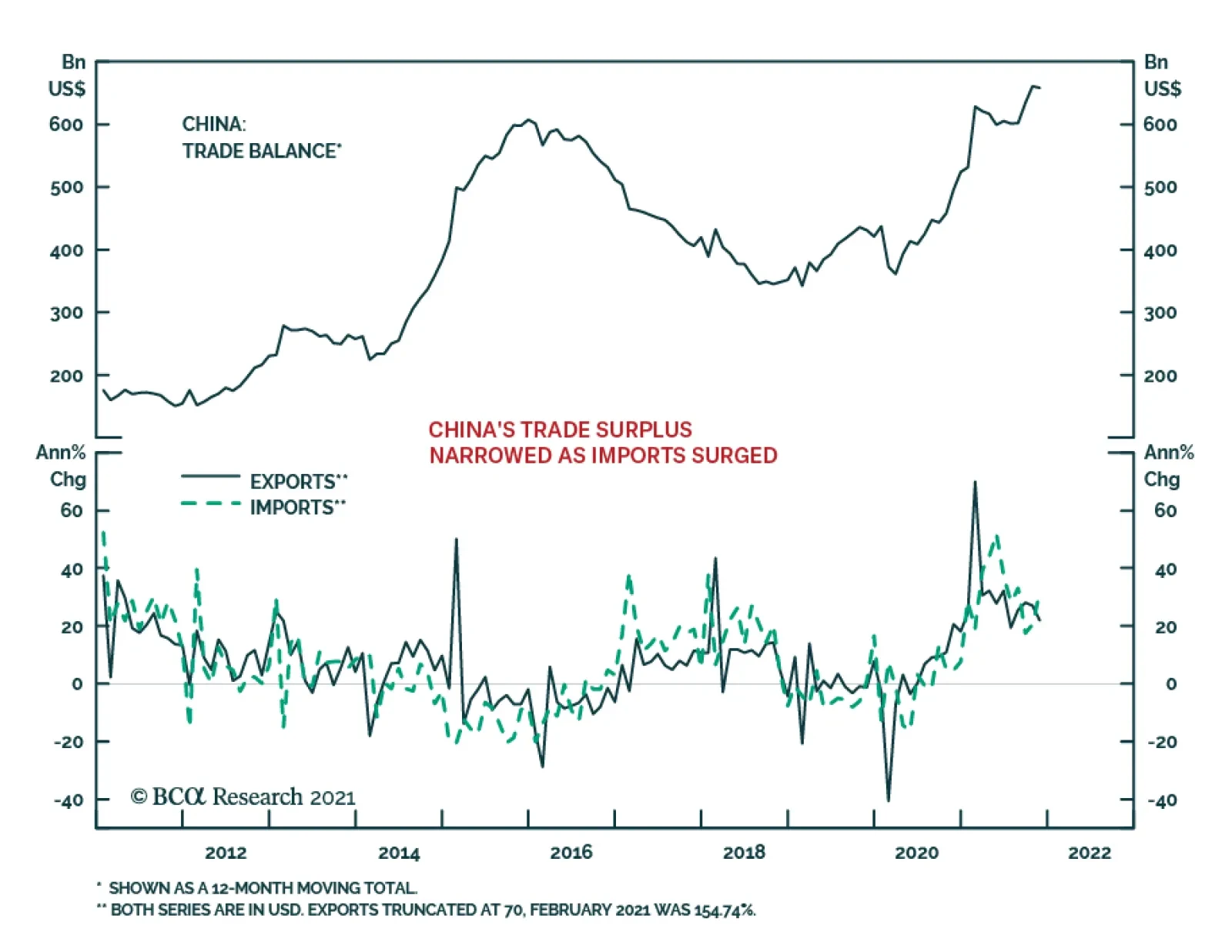

China’s trade surplus eased to $71.7 billion in November, below expectations that it would remain broadly unchanged following October’s record $84.5 billion. The narrower trade balance reflects both an acceleration in…