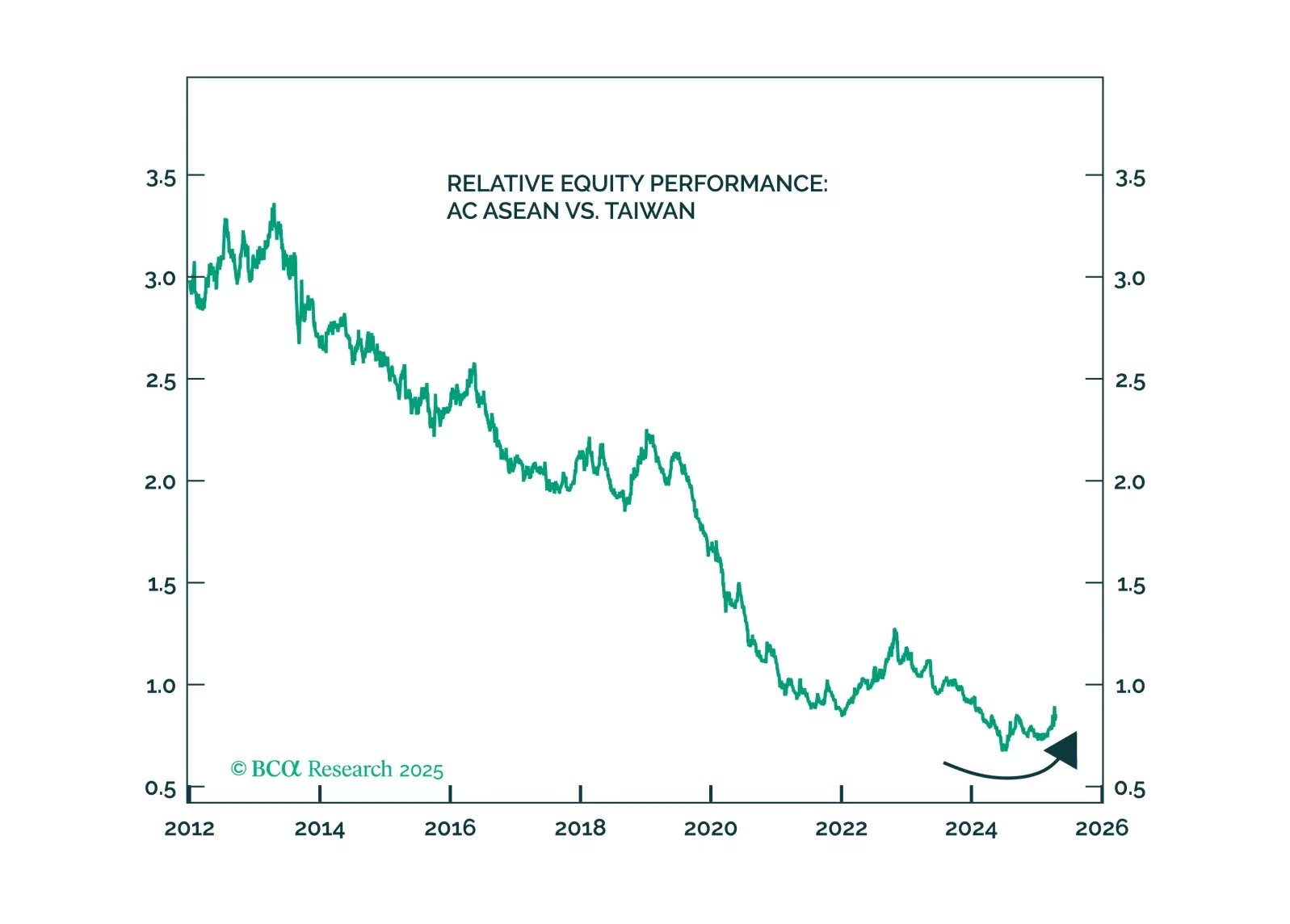

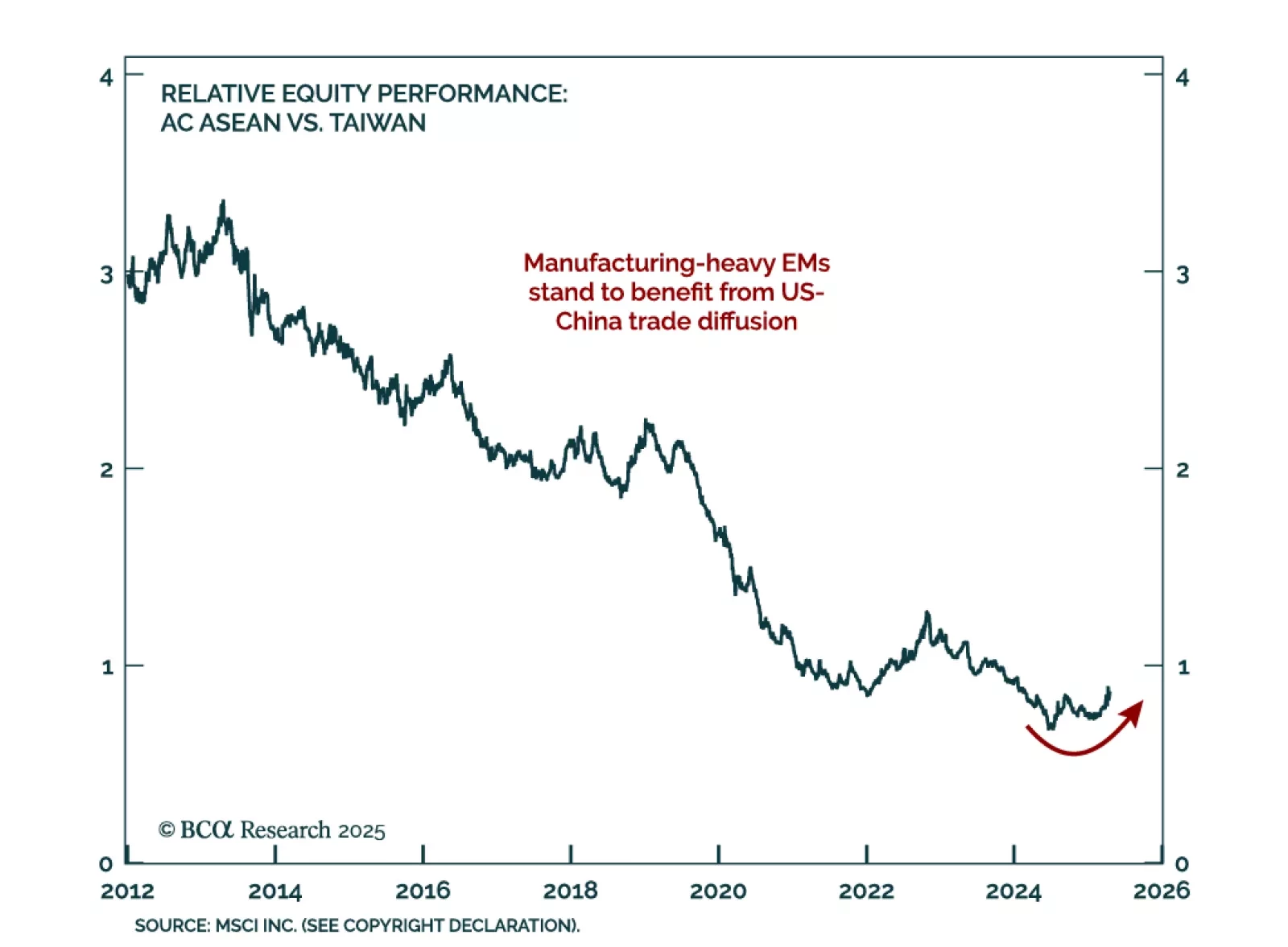

Our Geopolitical and GeoMacro strategists recommend buying tail-risk protection and adding exposure to manufacturing-oriented EMs as the risk of US-China military escalation rises. They now see a 10% chance of full-scale war over…

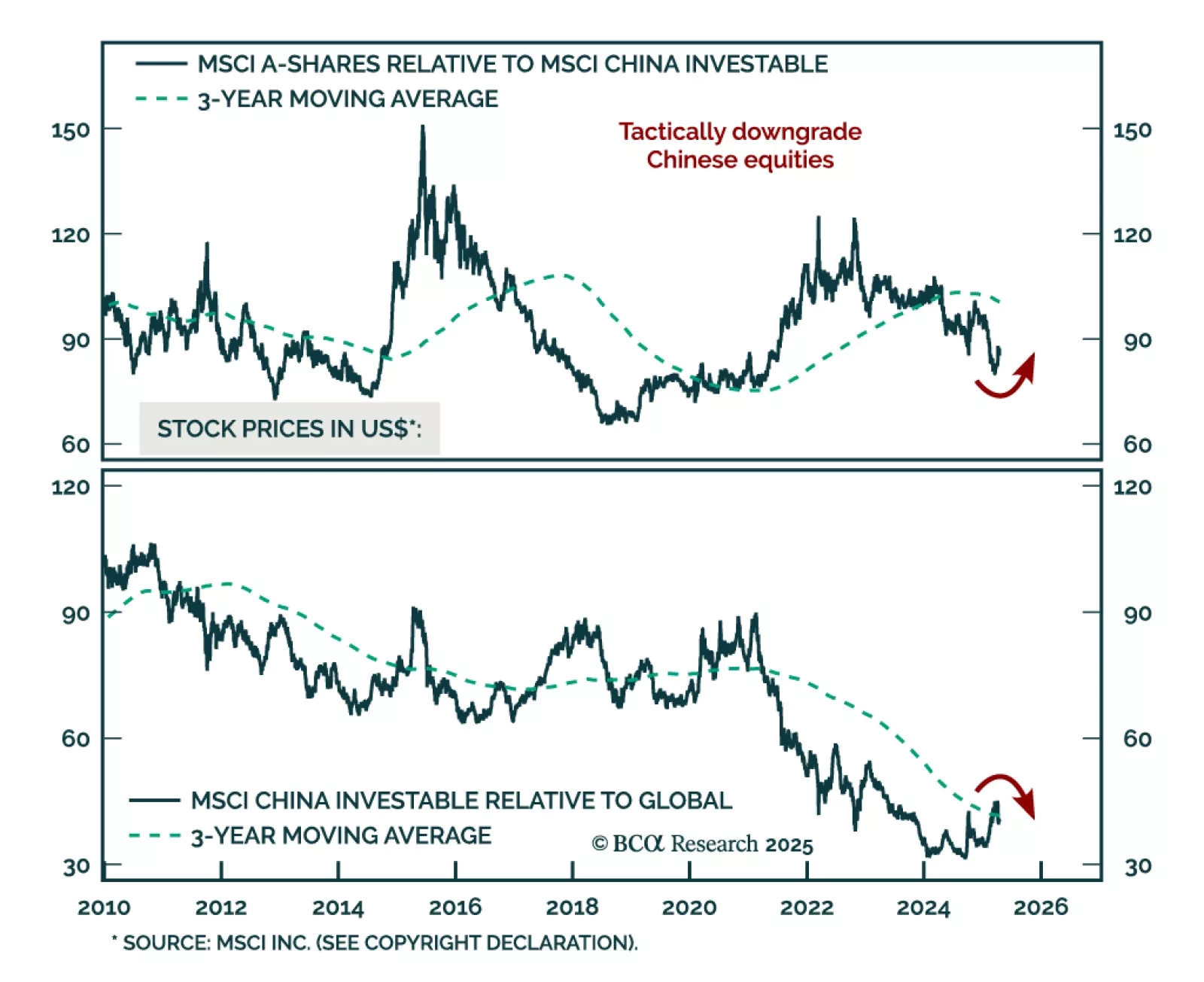

Our China strategists remain defensive and tactically downgrade MSCI China to underweight, citing escalating US China tariff tensions and subdued domestic demand. Favor government bonds over equities, defensive sectors, and A-Shares…

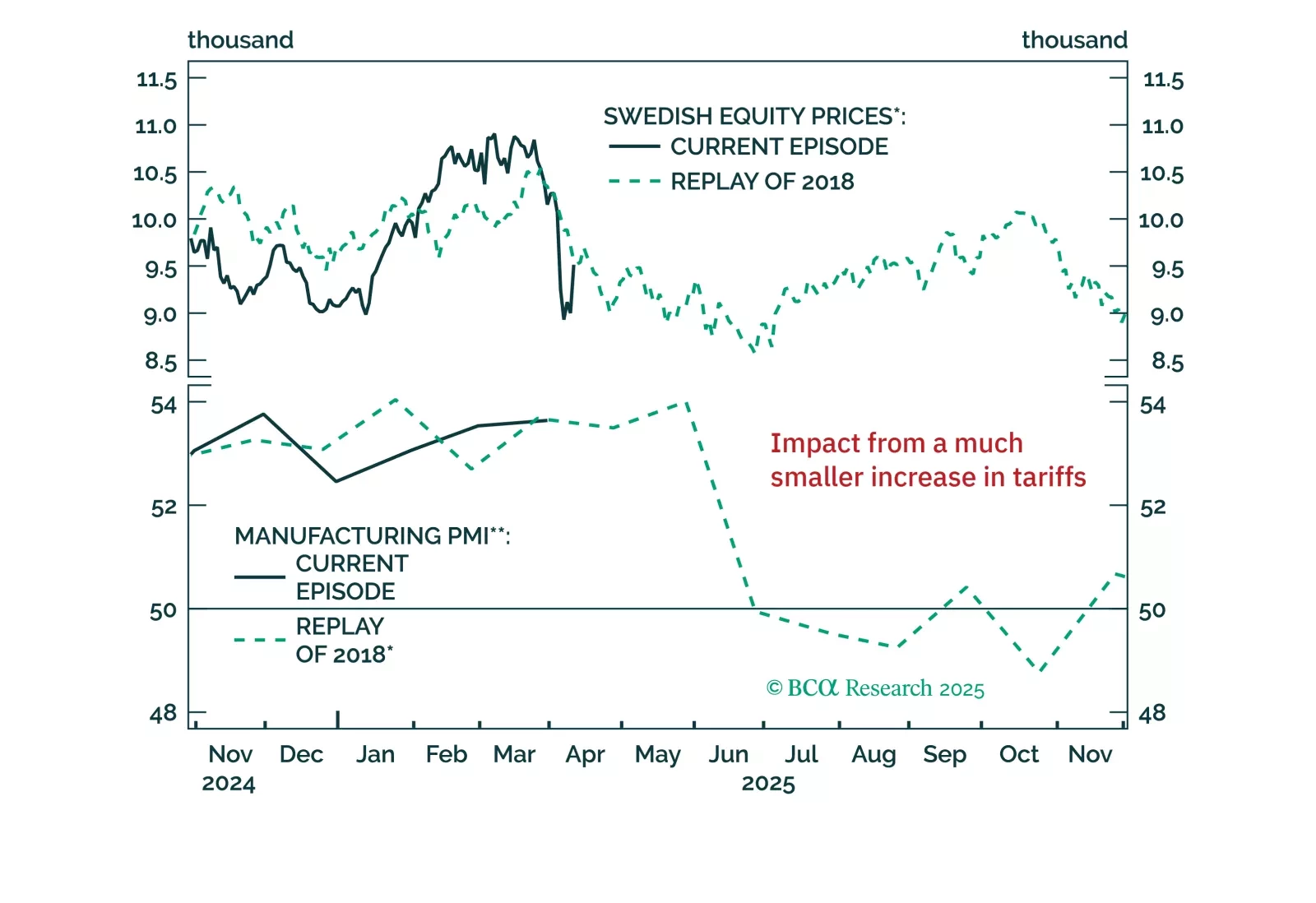

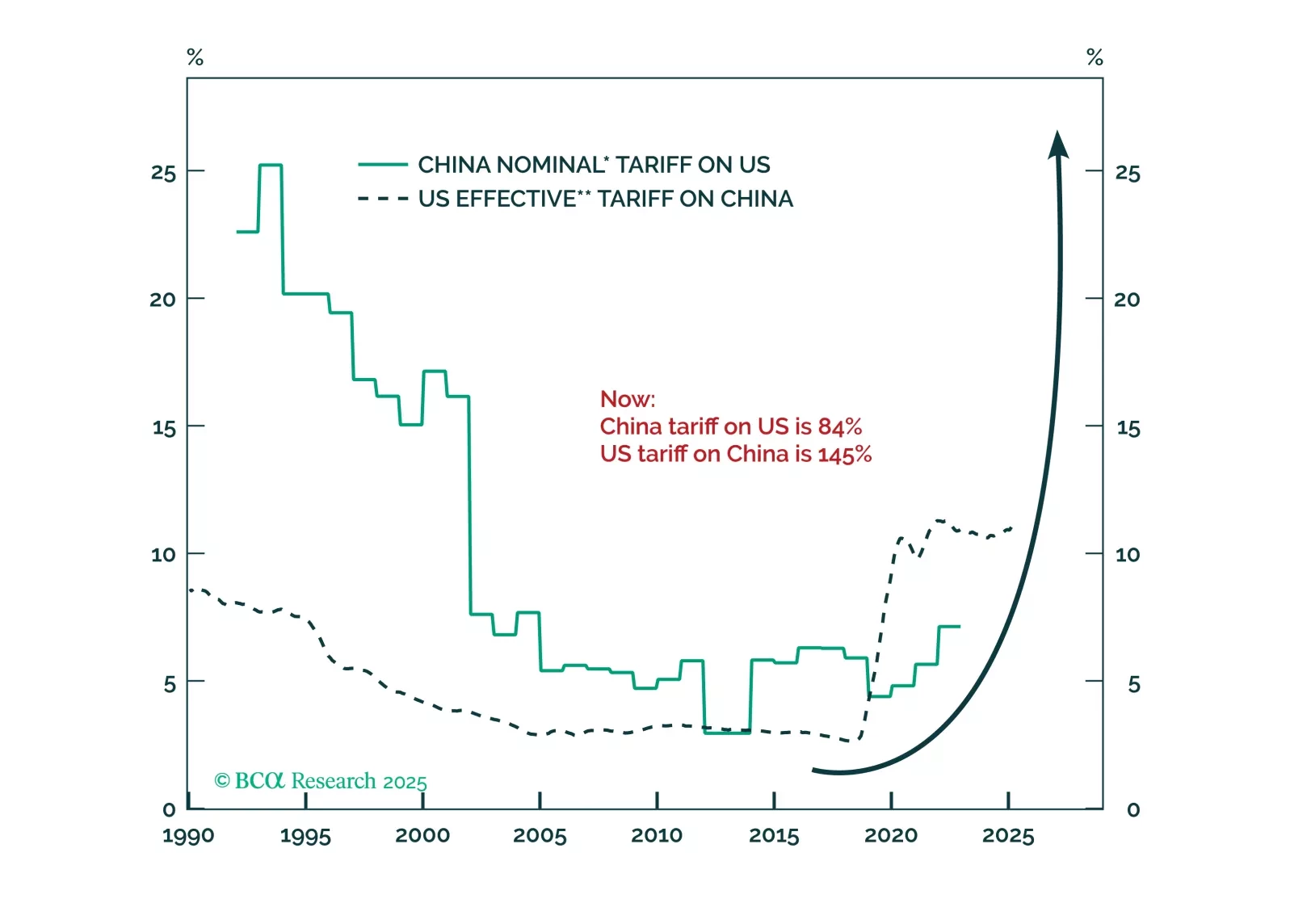

While the United States and China may aim for full decoupling, all they can afford now is some form of trade skirmishes. Increasing economic pressure will eventually force both Washington and Beijing to pursue more proactive…

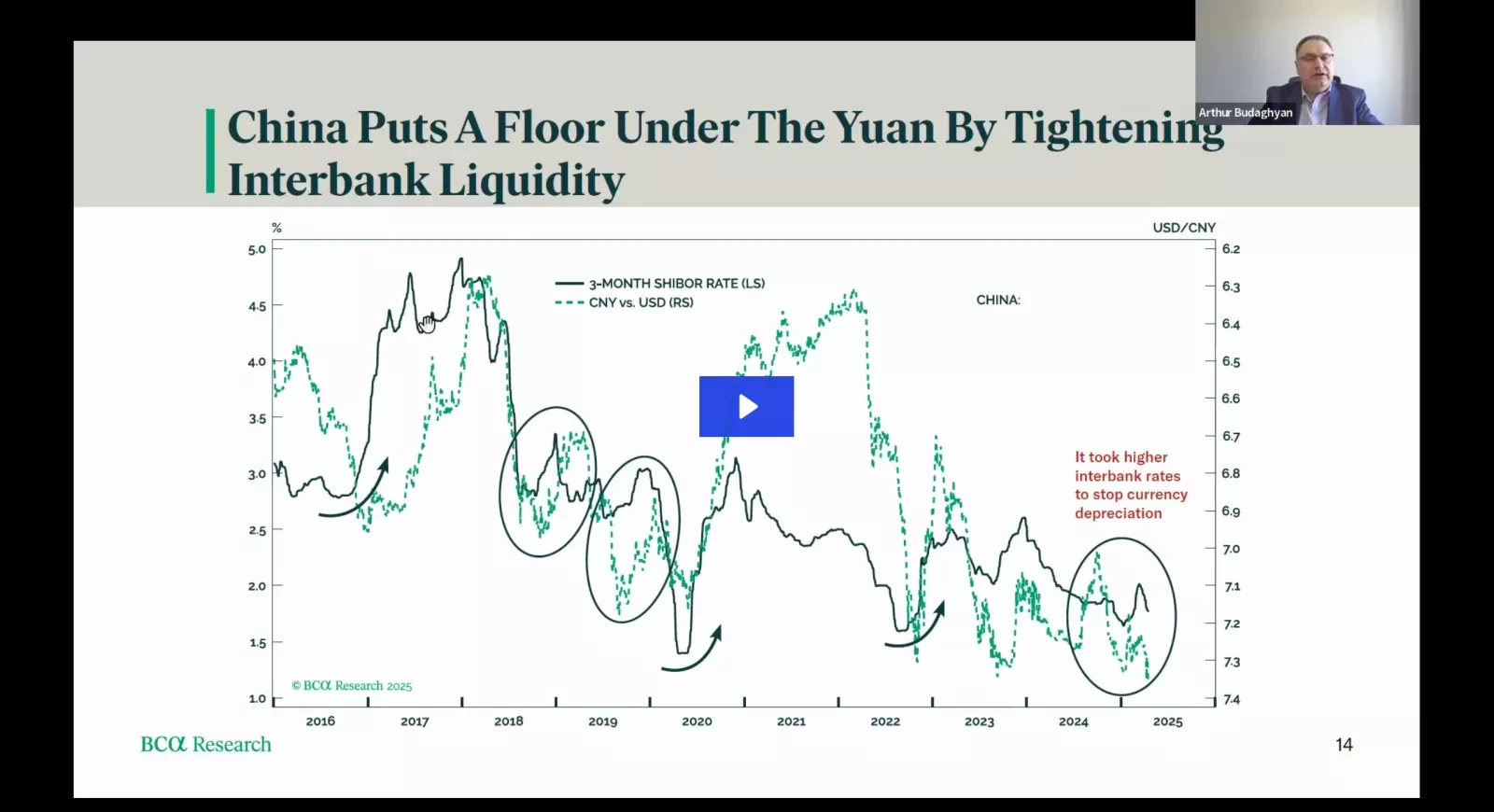

We are pleased to share the replay of Emerging Markets Webcast "Regime Shifts In Global Macro And The Implications", hosted by Chief EM & China Strategist Arthur Budaghyan.

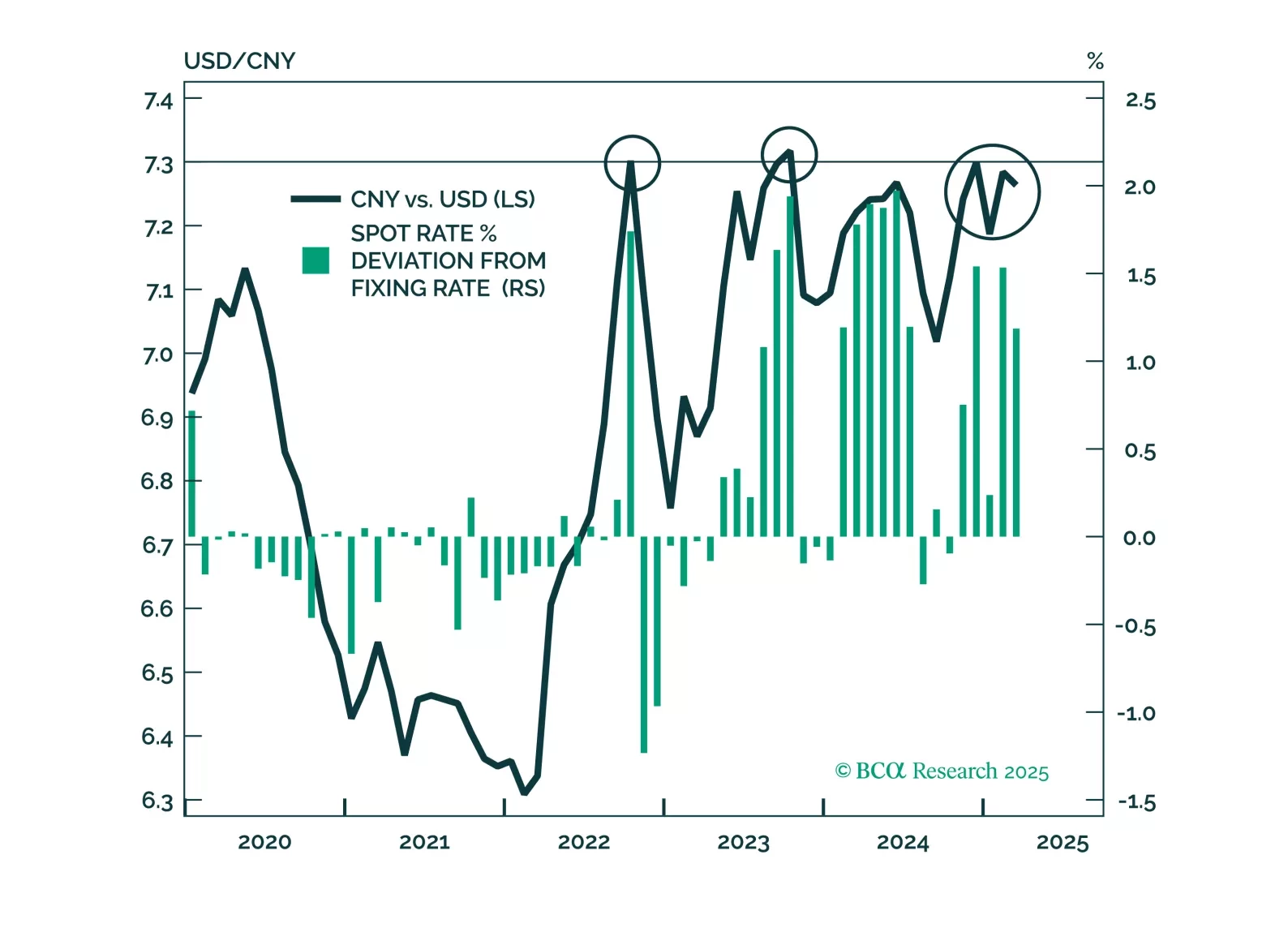

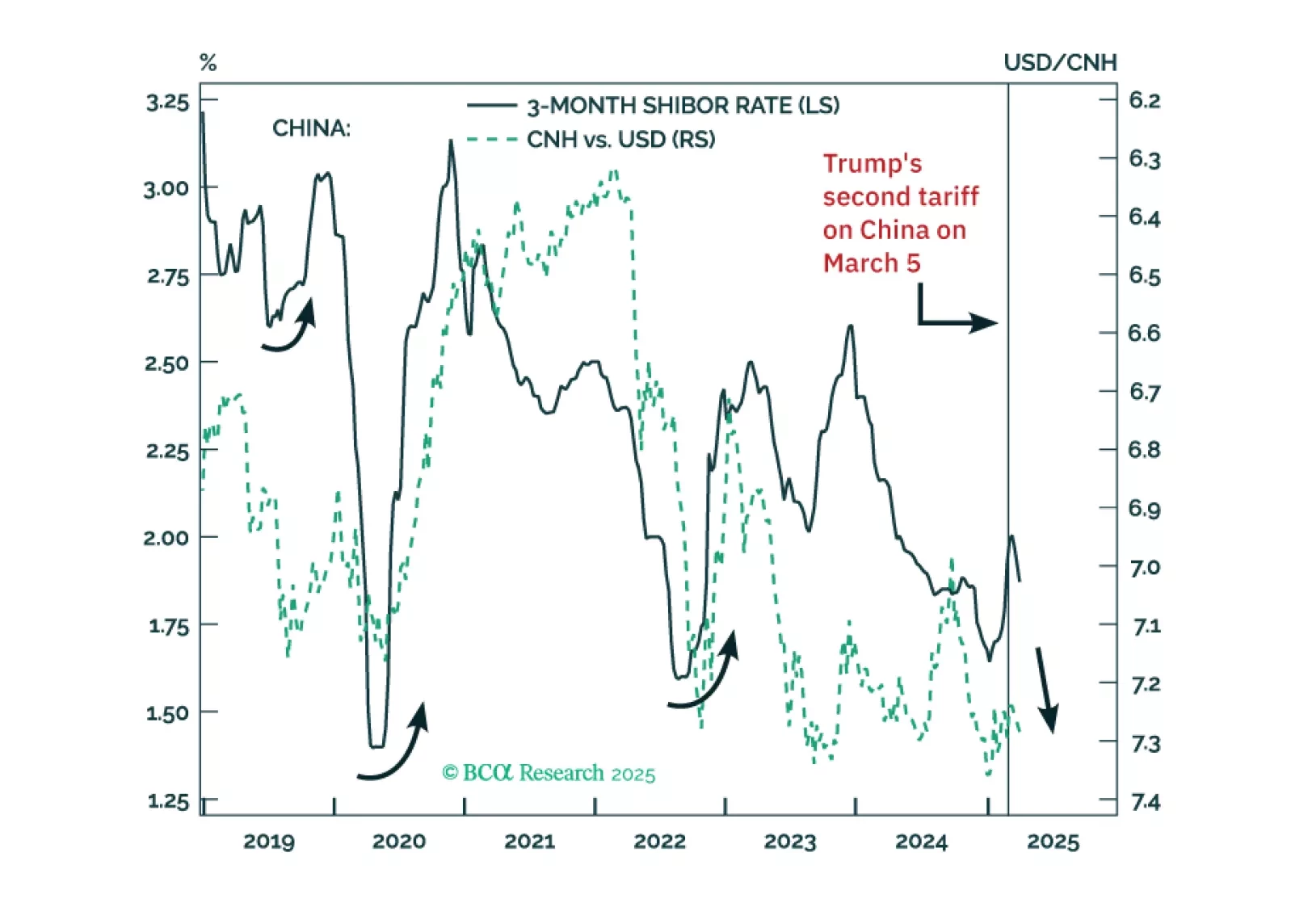

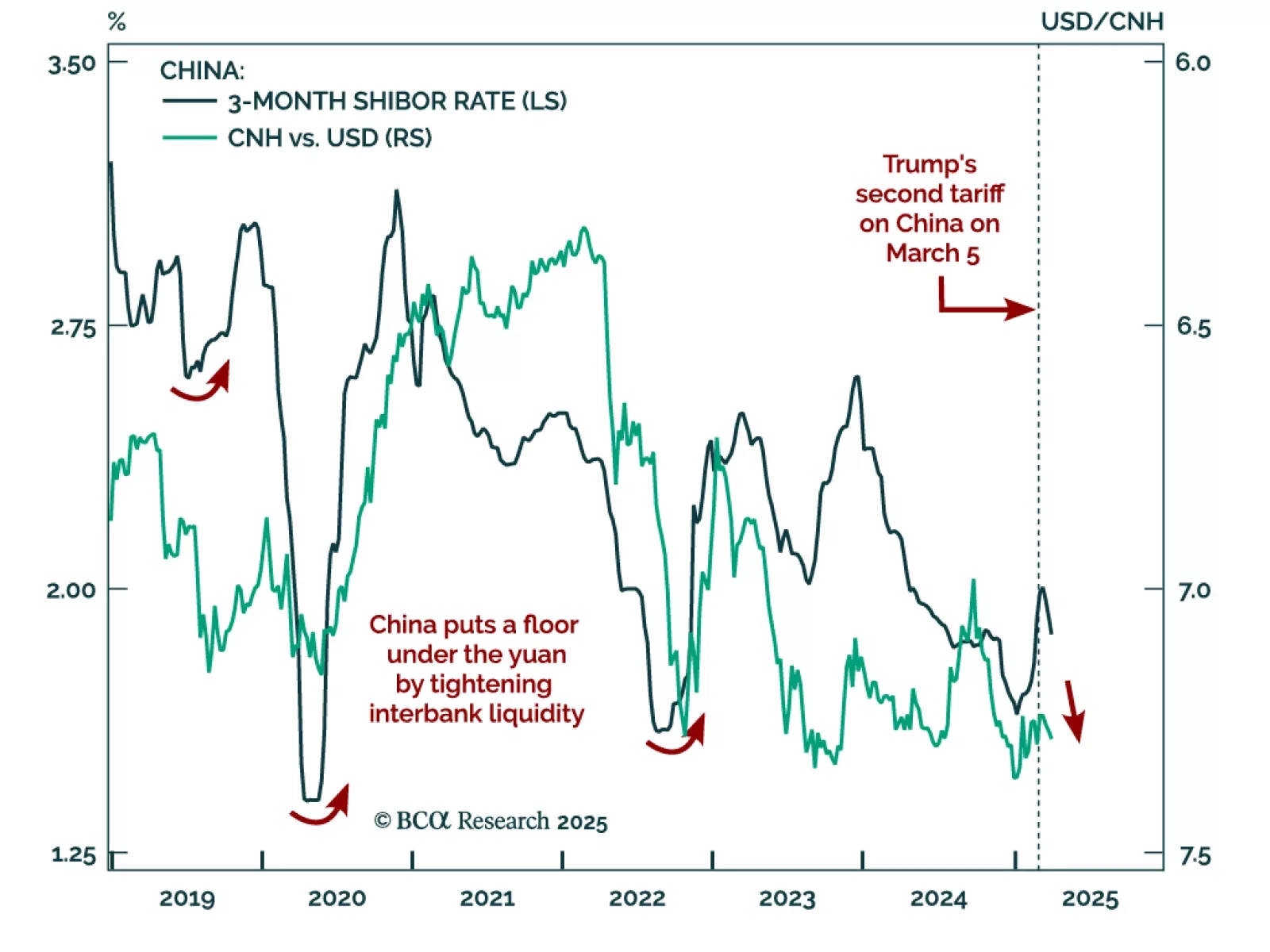

China prepares to devalue the yuan in response to US tariffs. Our Emerging Markets strategists recommend shorting CNH, downgrading offshore Chinese equities, and staying bearish on global risk assets. Beijing sees the tariffs as a…

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

We believe Beijing views these US trade actions as nothing short of a declaration of economic war, not just a trade dispute. The US-China confrontation is set to escalate from here. Chinese authorities will allow the yuan to…