Dear Client, Next week, in lieu of our regular weekly report, I will be hosting two webcasts where I will discuss our view on China’s economy and financial markets. In particular, I will share our view on the announced economic…

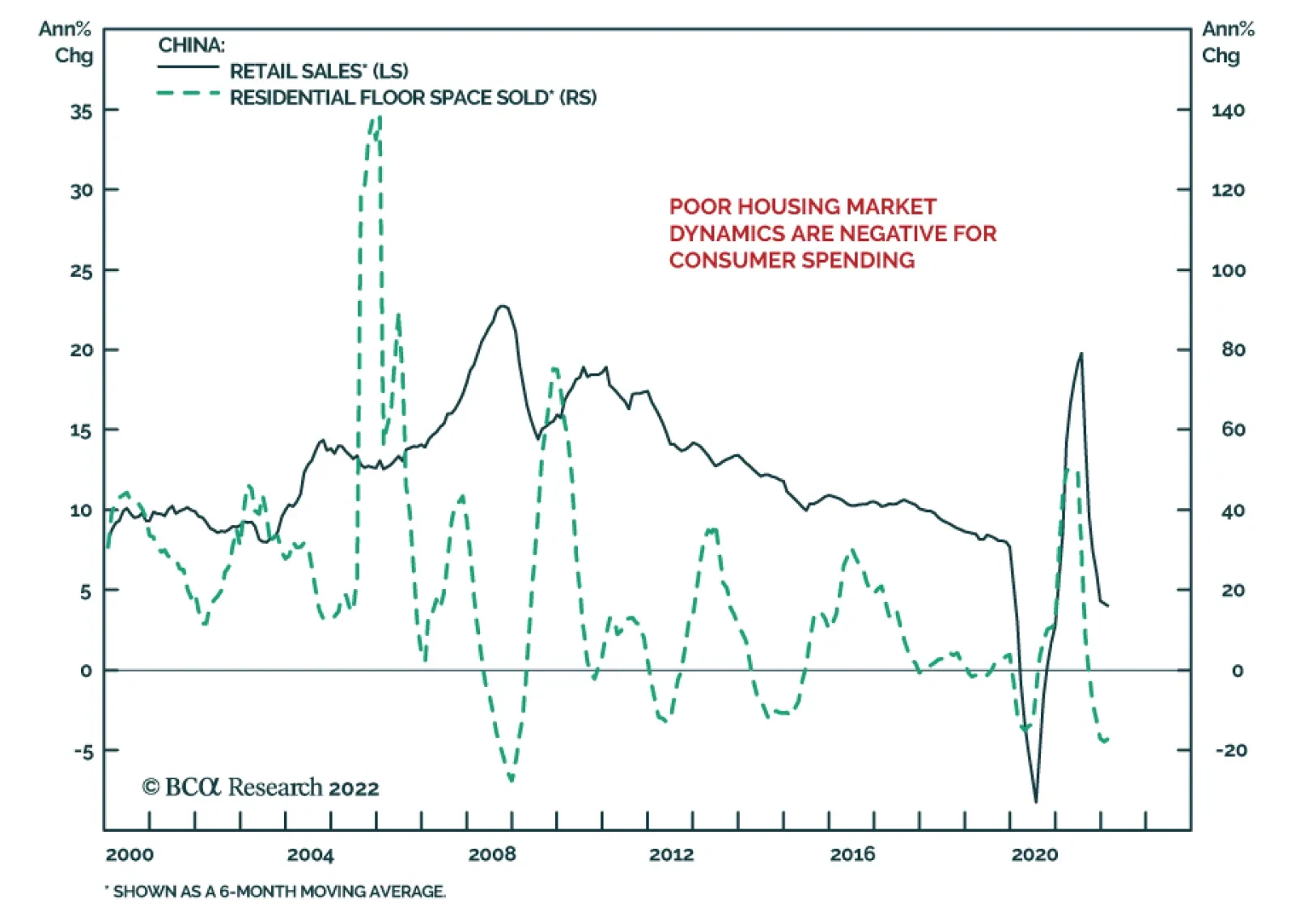

Key indicators of Chinese domestic economic activity in February such as industrial production, fixed assets investment, retail sales, and property investment all generated relatively substantial positive surprises. However, the…

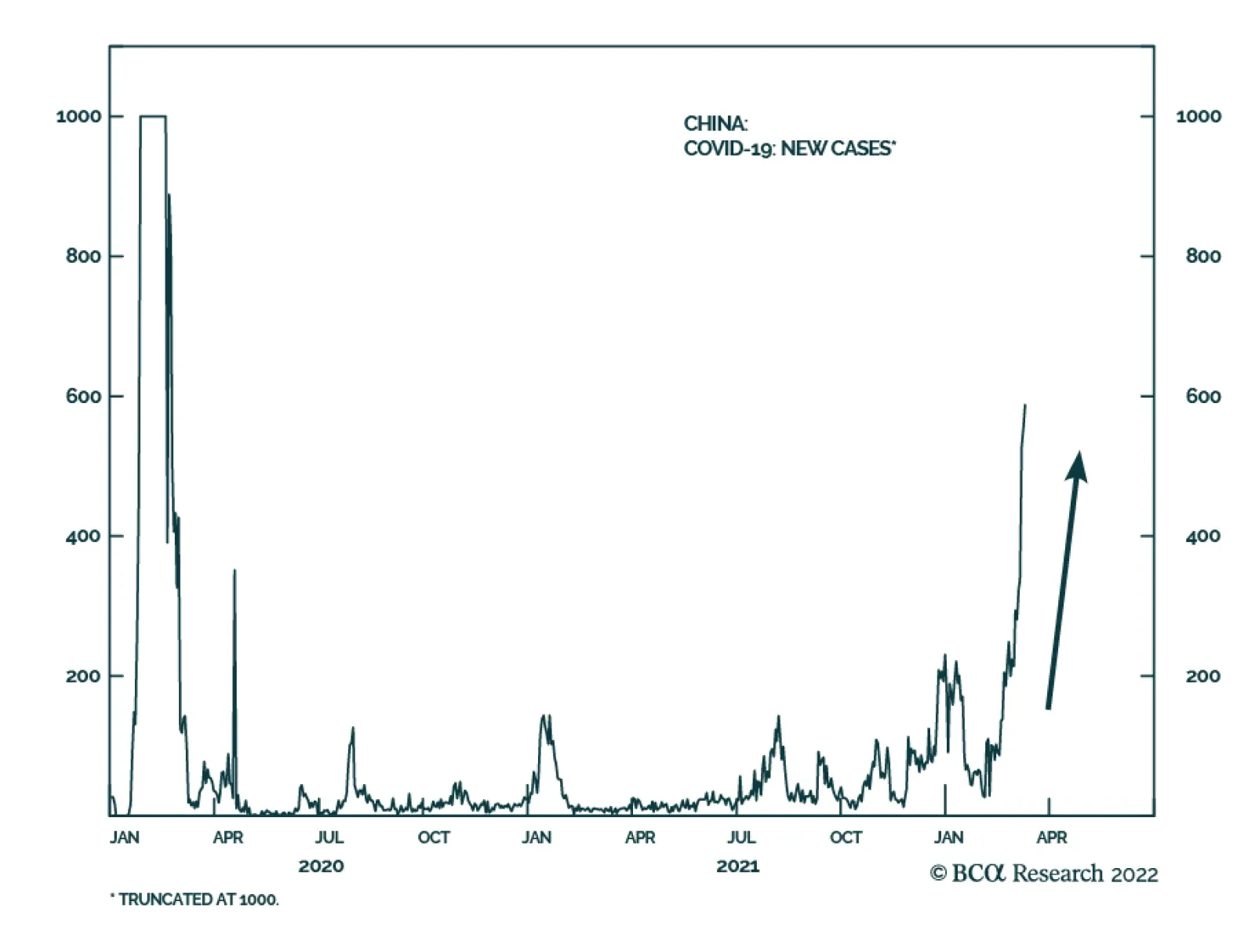

China’s zero tolerance policy towards the COVID-19 virus is a source of downside risk to the near-term economic outlook. Multiple Chinese cities have been placed under lockdown in an effort to tame surging COVID-19 cases…

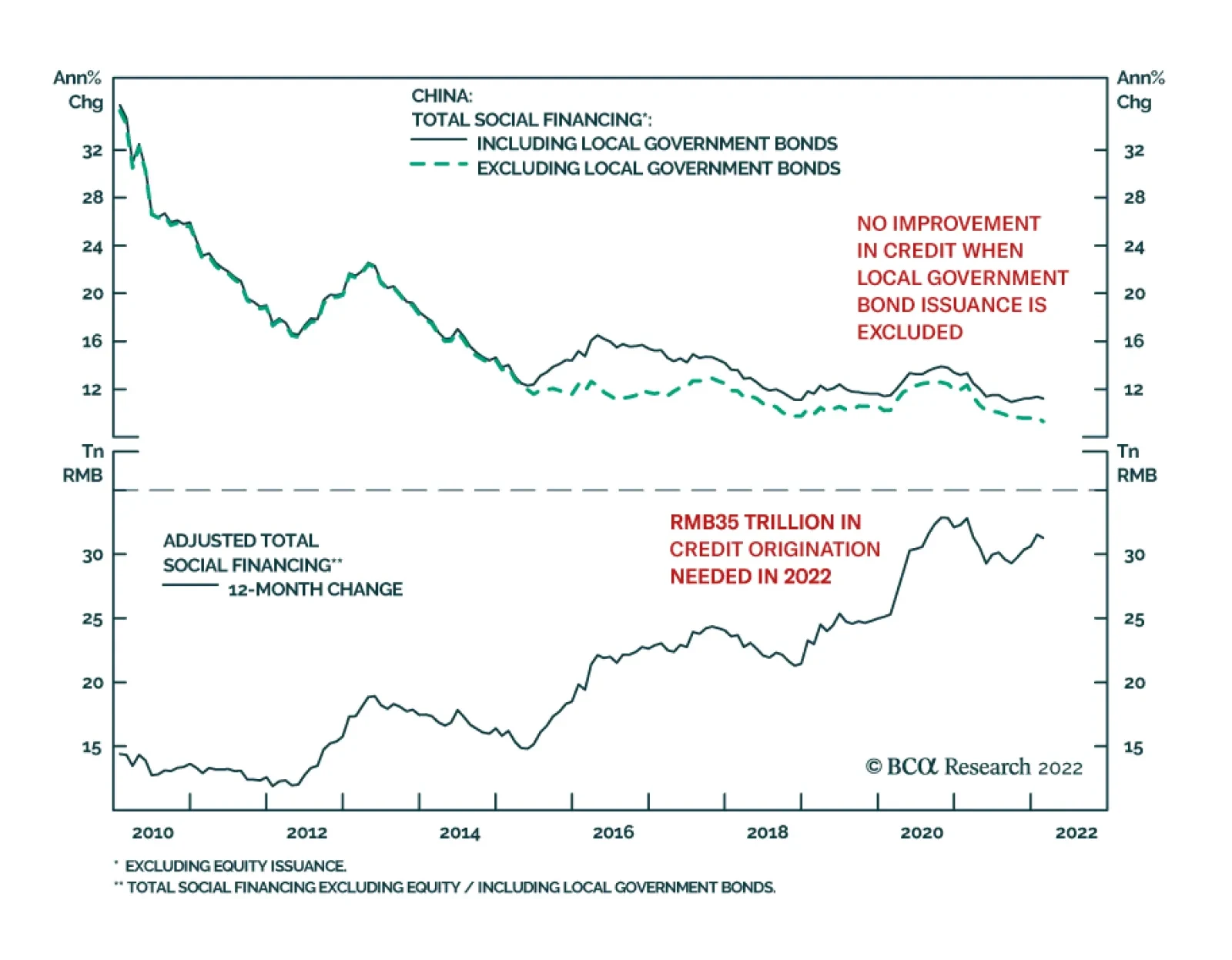

Chinese money and credit data were weaker than expected in February. New total social financing amounted to RMB1.19 trillion – below January’s RMB6.17 trillion surge and lower than expectations of a RMB2.20 trillion…

Executive Summary The RMB And Real Interest Rates The RMB has overshot and will likely consolidate gains in the coming months. The said, the yuan remains underpinned by a current account surplus, positive real rates, and a…

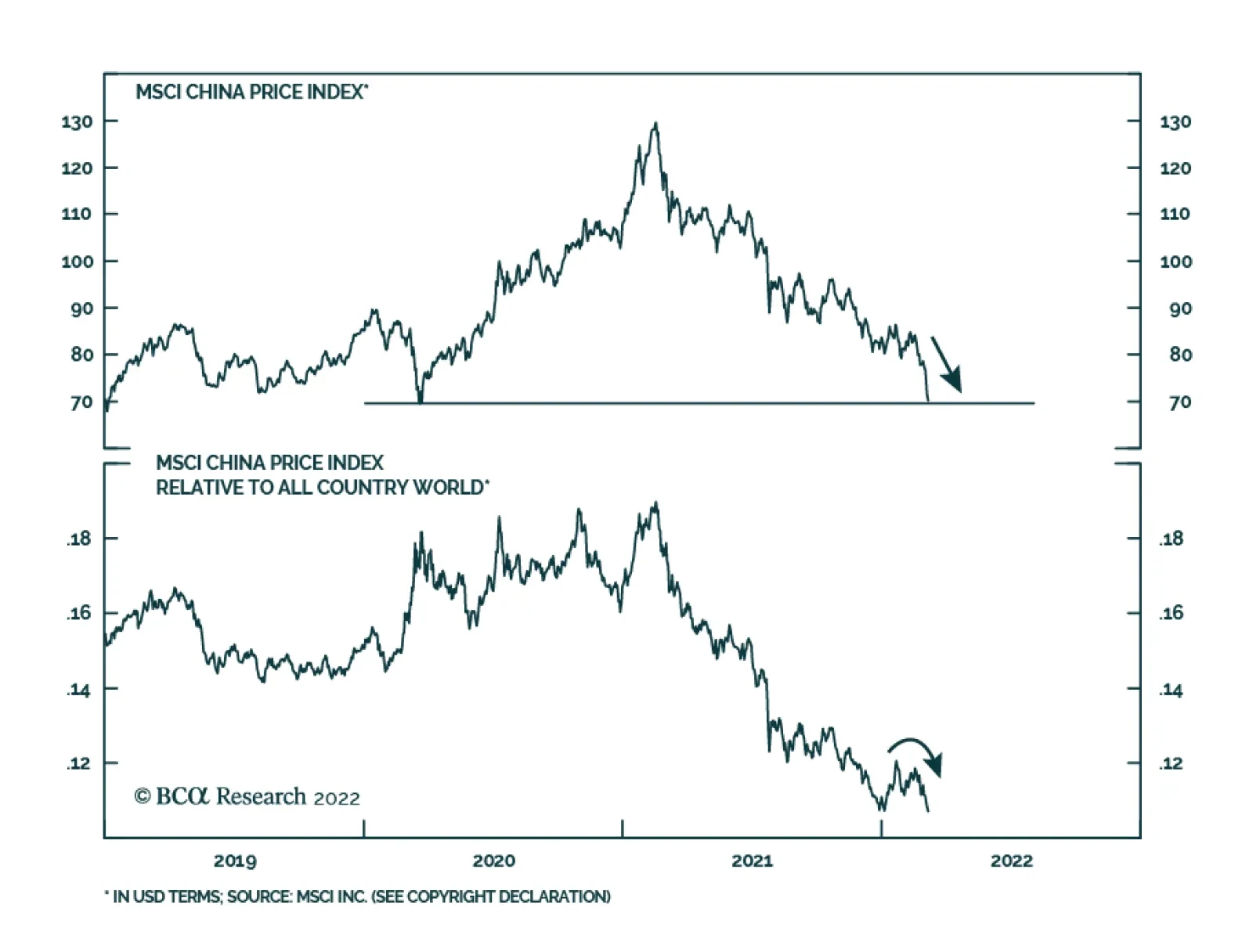

Chinese investable stocks have collapsed 12.4% since the start of the Russia-Ukraine war in late-February. The MSCI investable index is now at its mid-March 2020 pandemic low. Several factors are contributing to the selloff.…

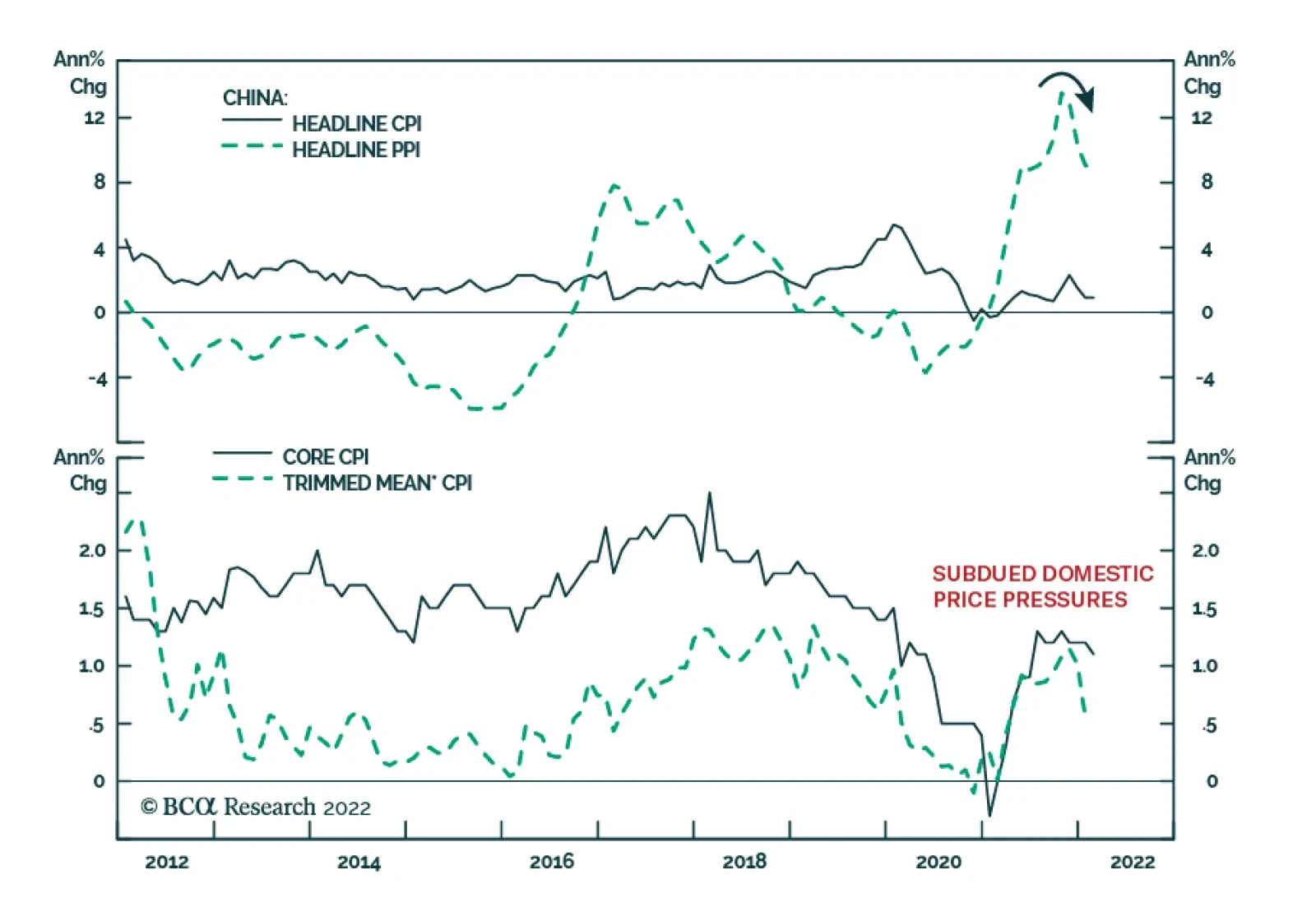

Price pressures in China eased in February. The producer price index increased by 8.8% – the slowest pace in eight months and below January’s 9.1% y/y growth rate. Meanwhile, CPI inflation was unchanged at January…