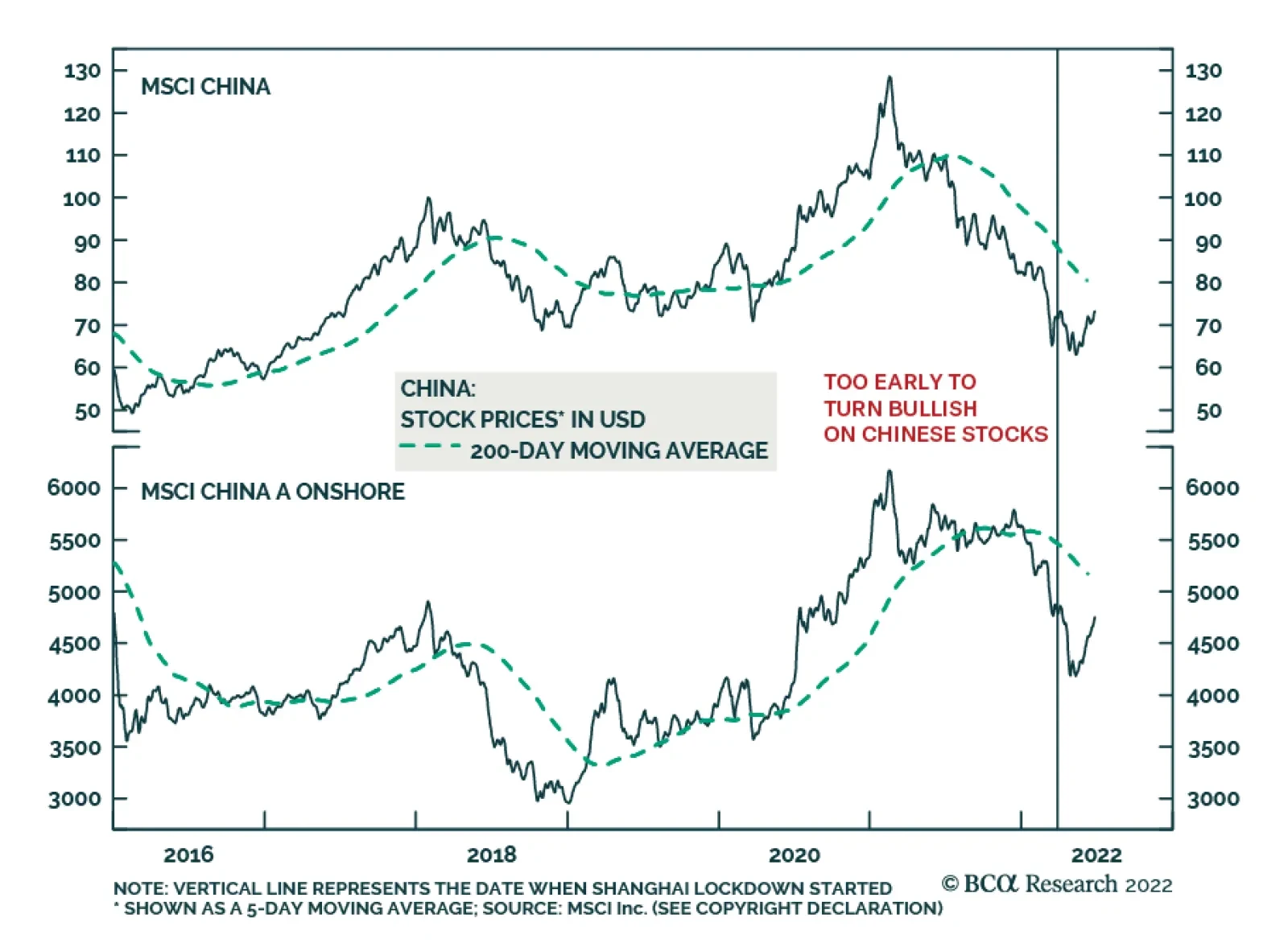

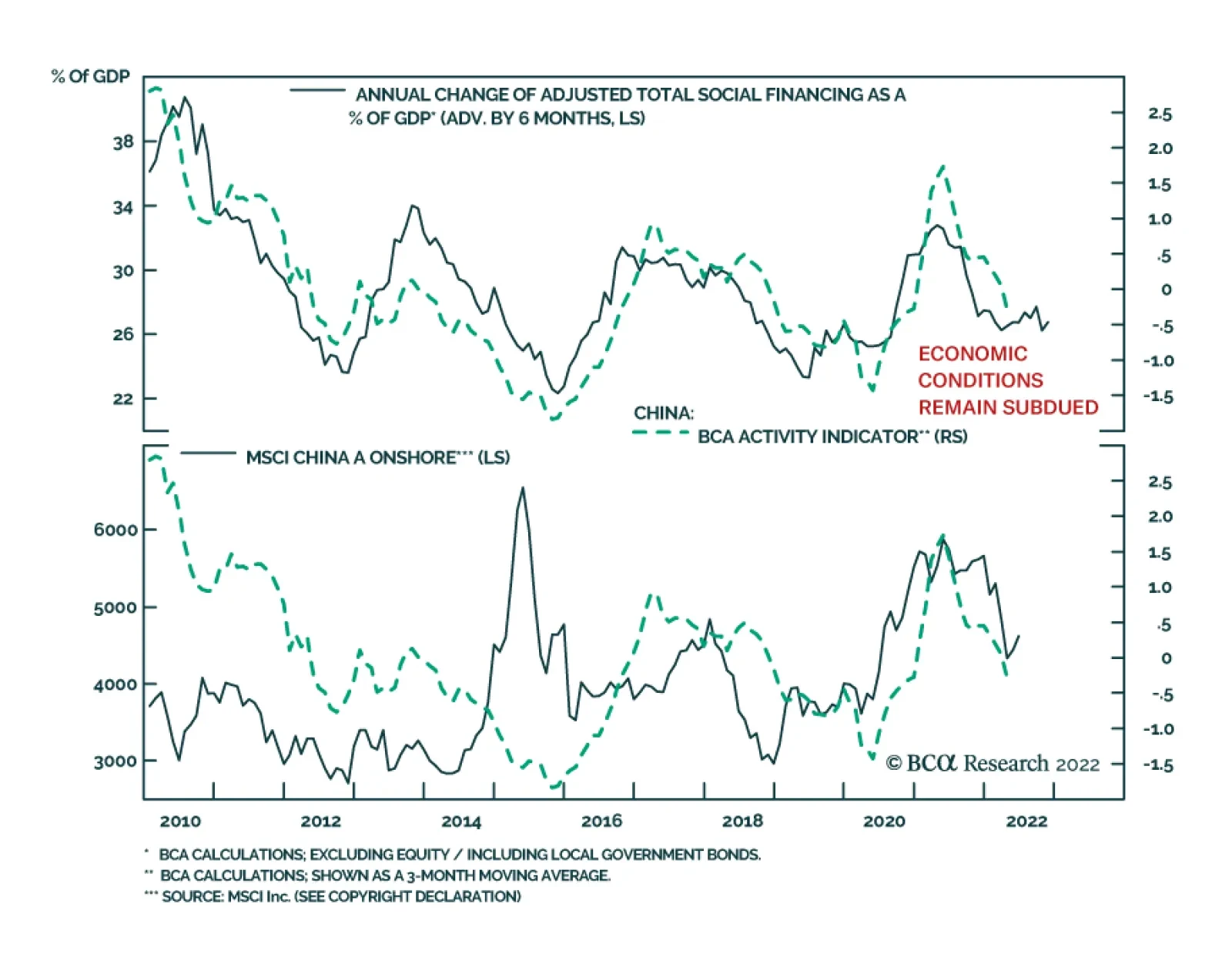

BCA Research’s China Investment Strategy service continues to recommend a neutral stance in Chinese equities within a global portfolio. China’s economic data moved up slightly in May from an extremely depressed…

Executive Summary Depressing Housing Market And Service Sector Activity May’s economic data ticked up from extremely depressed levels in April, driven by a normalization in the supply chain and a resumption in…

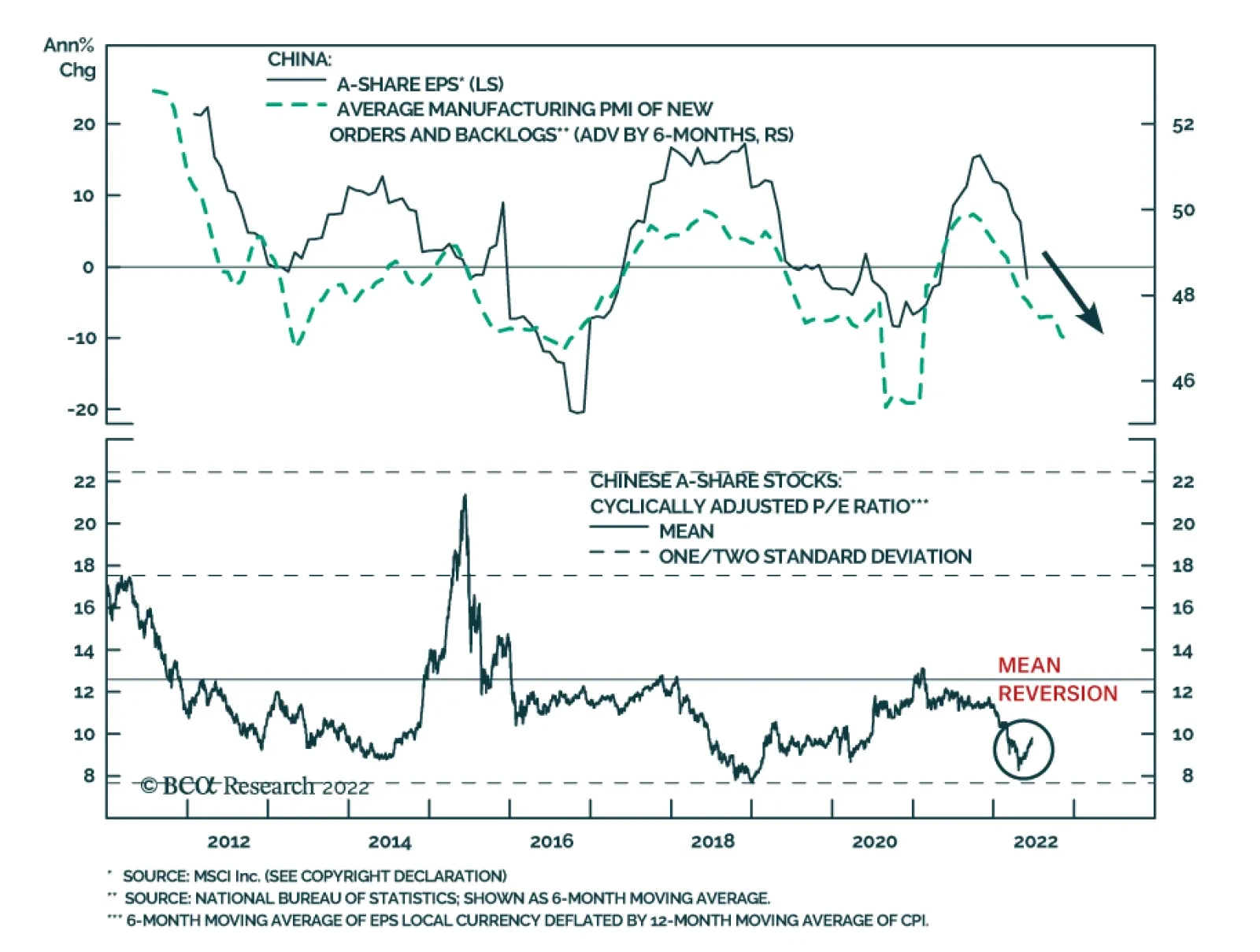

Although Chinese industrial profits continued to decline in May, the magnitude of contraction narrowed slightly to 6.5% y/y from 8.5% in April. This latest release follows a series of better-than-expected economic data Although…

Executive Summary Russia Squeezes EU Natural Gas Major geopolitical shocks tend to coincide with bear markets, so the market is getting closer to pricing this year’s bad news. But investors are not out of the woods…

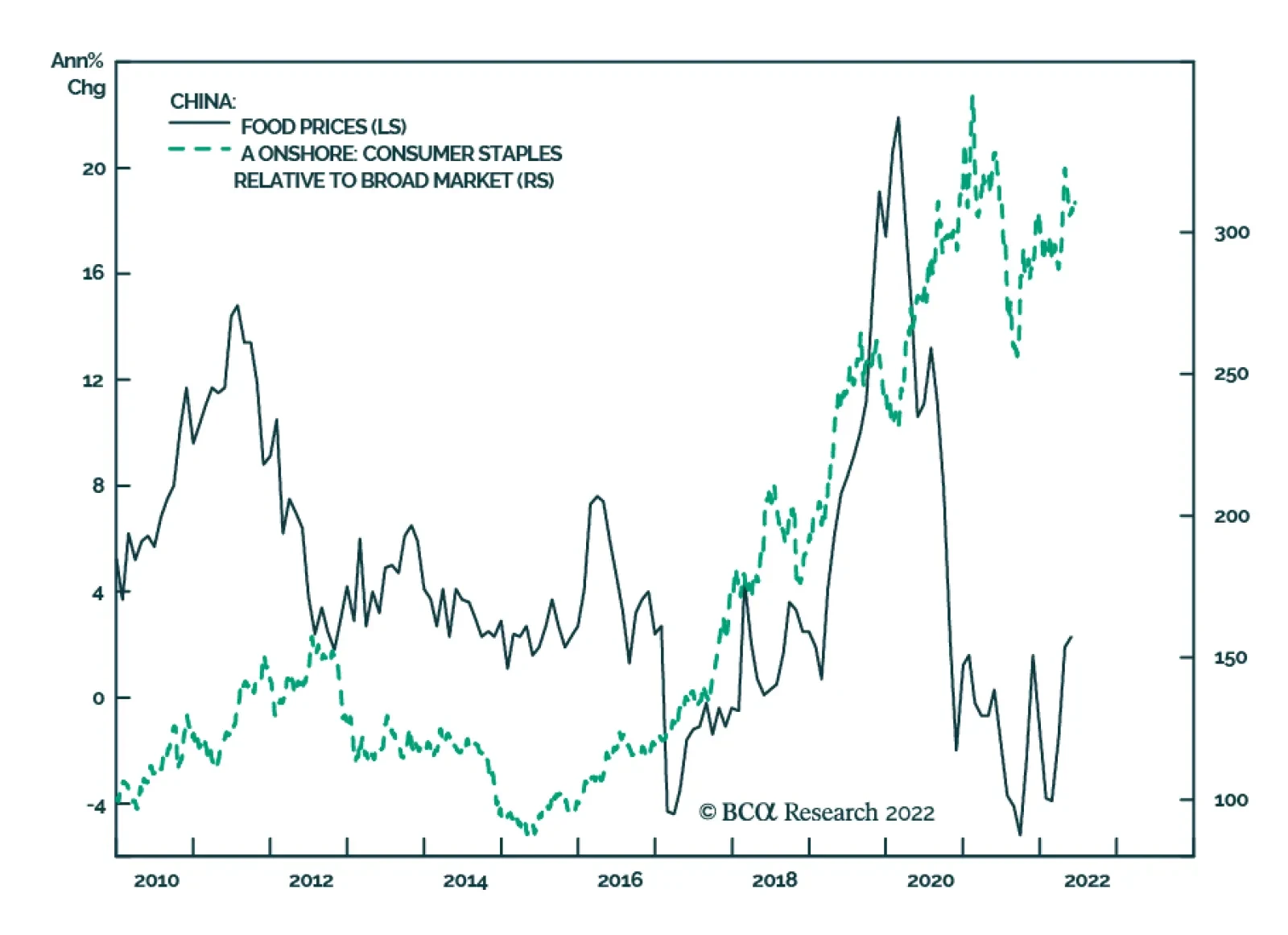

With headline inflation running at 2.1% y/y, Chinese inflationary pressures are relatively tame. However, that is not to say that the country is immune to global price dynamics. Like in most other countries, accelerating energy…

Executive Summary At our monthly view meeting on Monday, BCA strategists voted to change the House View to a neutral asset allocation stance on equities, with a slight plurality favoring an outright underweight. The…

Chinese economic data surprised to the upside in May. Industrial production grew by 0.7% y/y against an anticipated 0.9% y/y decline and following a 2.9% contraction. The decline in retail sales was less severe in May (6.7% y/y)…

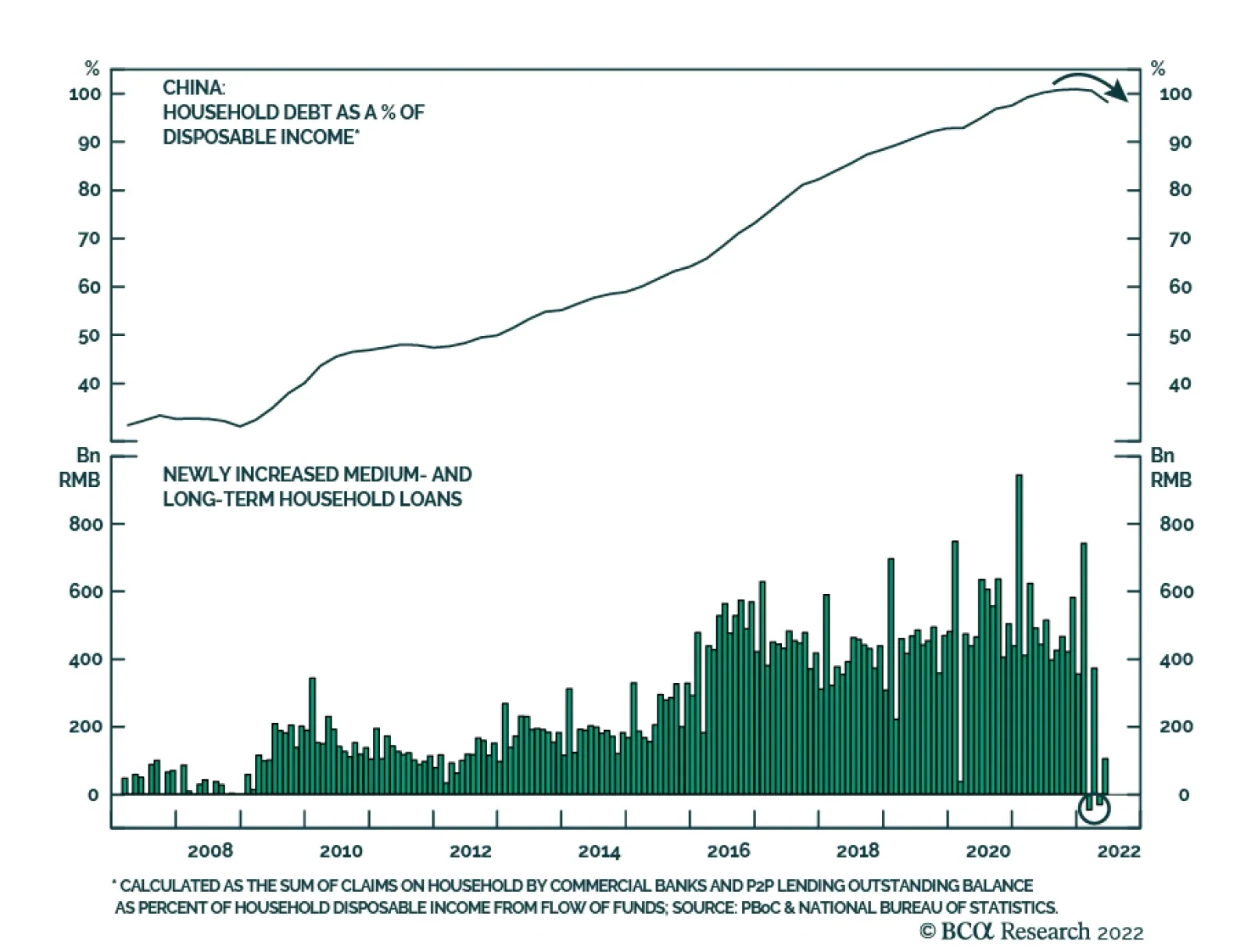

According to BCA Research’s China Investment Strategy service, a deleveraging cycle, coupled with a decline in total population, may lead to a structurally lower interest rate environment, which may be positive for Chinese…

Dear Client, In lieu of our weekly report next week, I will be hosting two webcasts with my colleague Arthur Budaghyan, Chief Emerging Market Strategist: Time To Buy EM/China? June 23, 2022 9:00 AM EDT (2:00 PM BST, 3:00 PM CEST)…