China's economy is about to experience demand-driven deflation. The lack of an economic recovery and falling producer prices will depress corporate profits and, hence, share prices. Beijing will allow the yuan to depreciate more to…

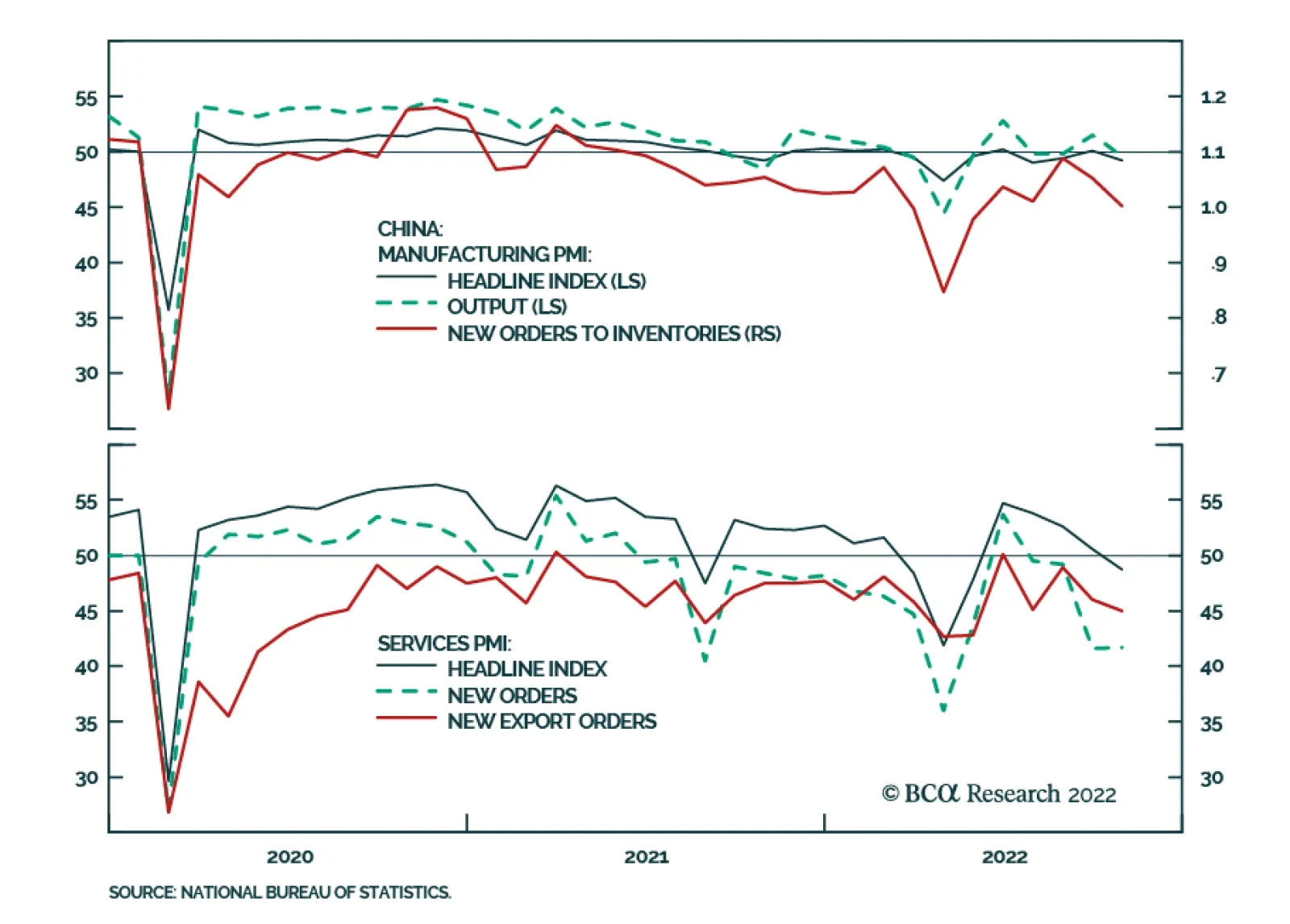

The Chinese manufacturing PMI from the National Bureau of Statistics contracted anew in October, after briefly improving above the 50 boom-bust line in September. The headline index decreased from 50.1 to 49.2, missing…

Stay short Greater China assets. Stay long Japanese yen. Hold back on Brazil for now but look forward to opportunities in future.

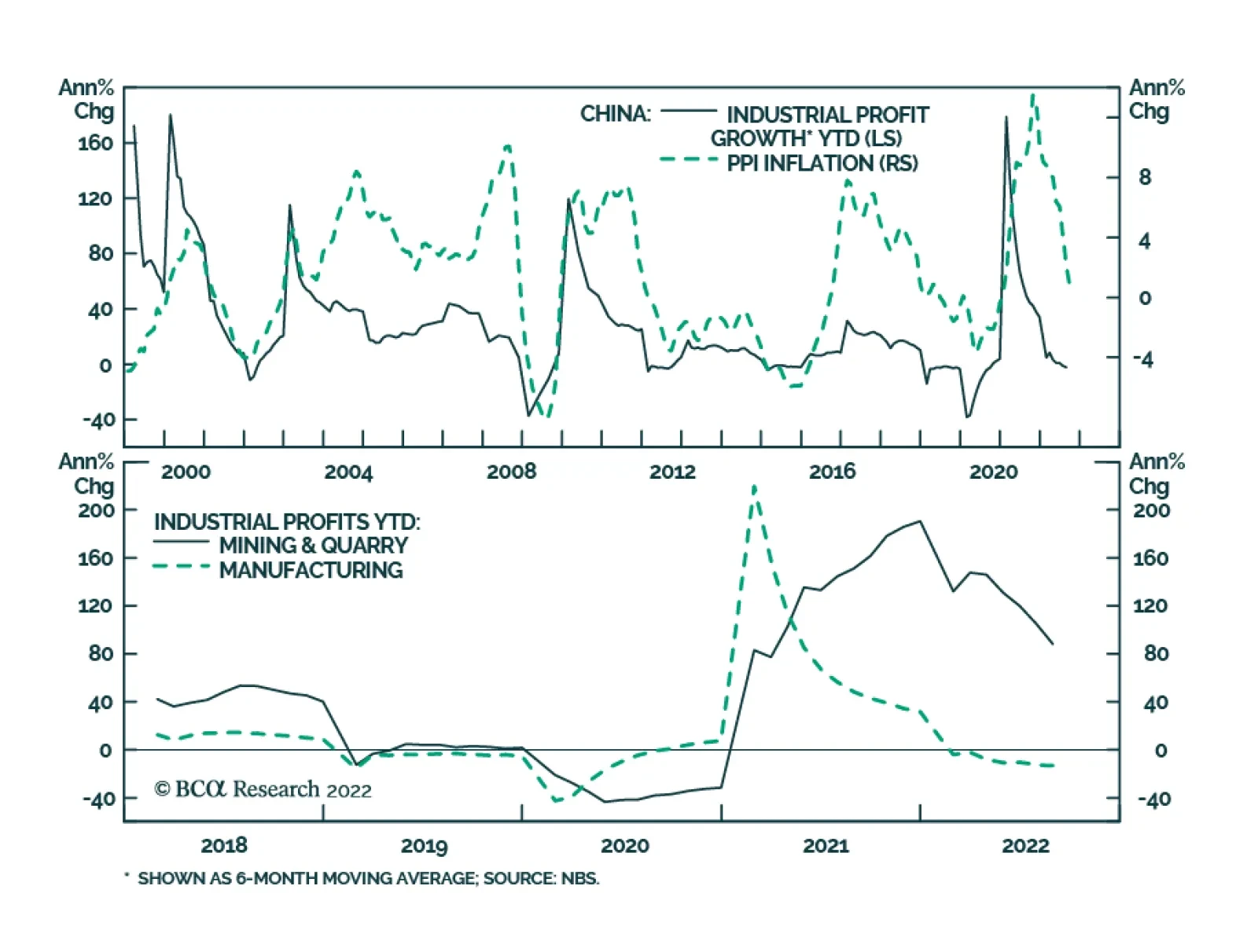

Chinese industrial profit growth continues to shrink, down 2.3% ytd y/y in the first three quarters of 2022. The weakness is particularly pronounced among downstream sectors. Profits of manufacturers contracted by 13.2% ytd y/…

Falling inflation will allow bond yields to decline in the major economies over the next few quarters. As such, we recommend that investors shift their duration stance from underweight to neutral over a 12 month-and-longer horizon…

In Section I, we note that while recent inflation developments point to some supply-side and pandemic-related disinflation, they also point to potentially stickier inflation over the coming several months. The inflation, monetary…

According to BCA Research’s China Investment Strategy service, messages from the Party Congress suggest that China’s policymakers will continue to balance the trade-offs between short-term economic growth, socio-…

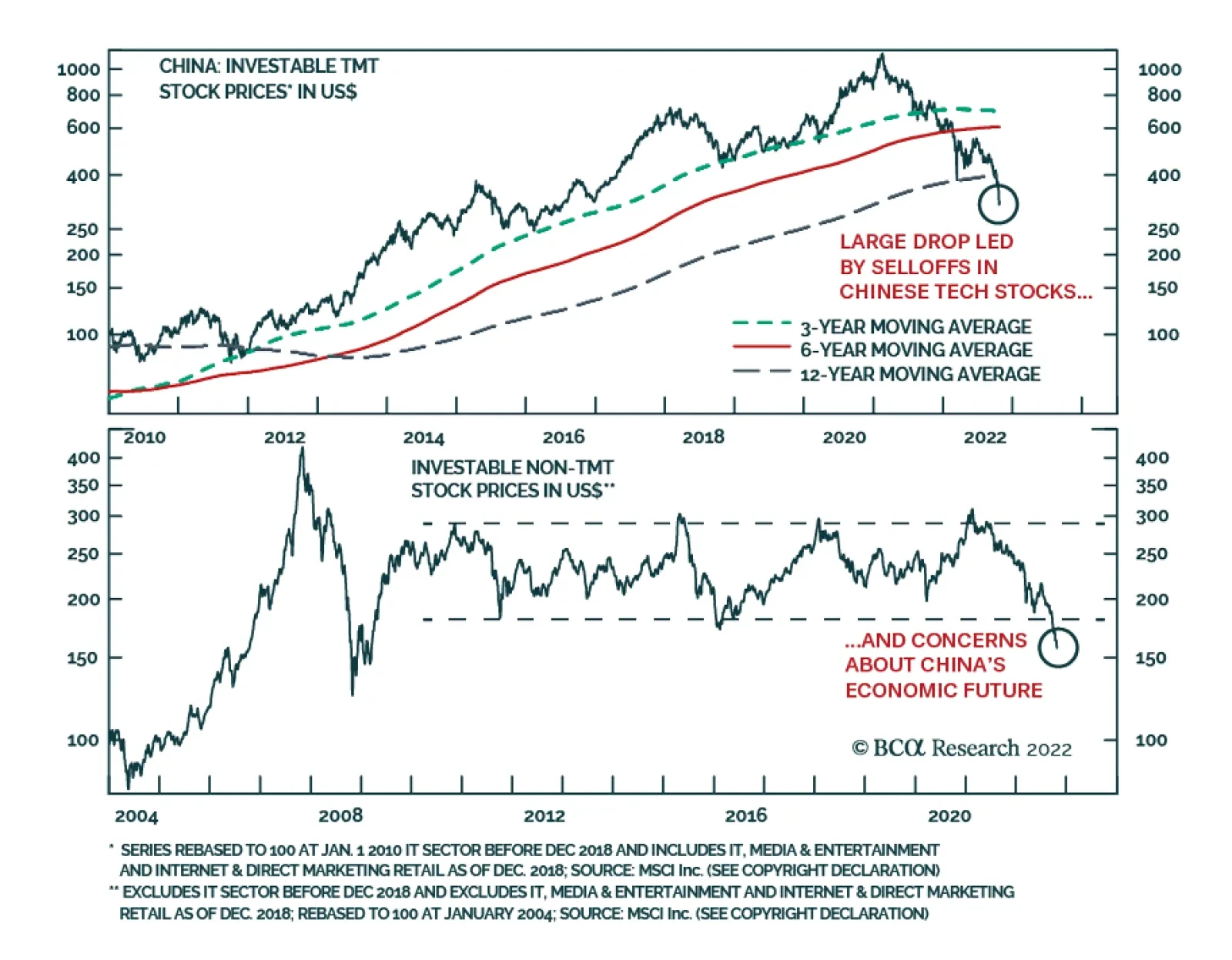

The 20th Communist Party Congress concluded on Sunday with President Xi Jinping cementing his third term in office. We are maintaining our cautious stance on Chinese stocks and the exchange rate. The lack of a significant shift away…

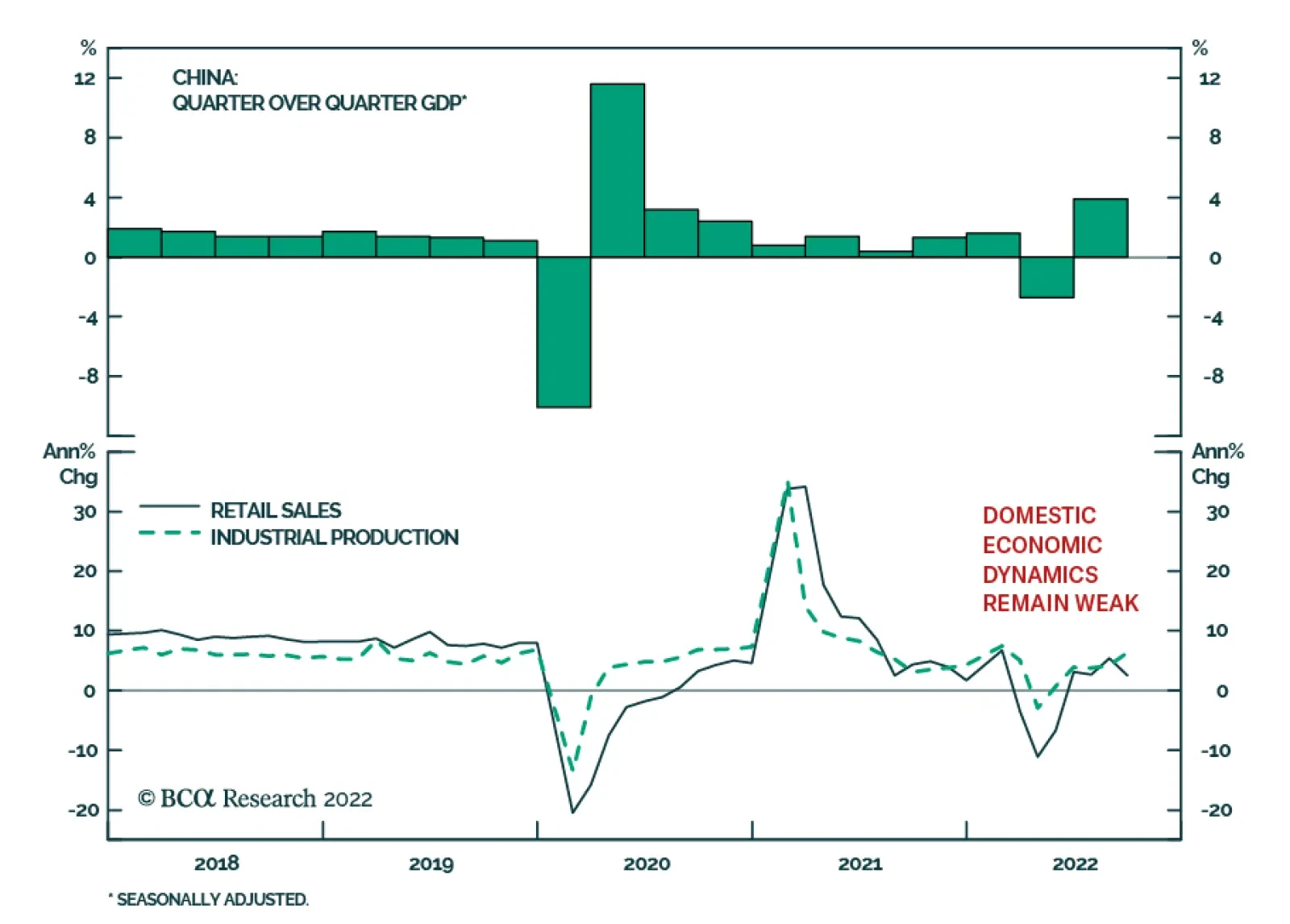

China’s Q3 GDP growth data surprised to the upside. It accelerated to 3.9% y/y from 0.4% y/y in Q2, beating expectations of 3.3% y/y, and returned to growth on a quarter-on-quarter basis following a contraction in Q2.…