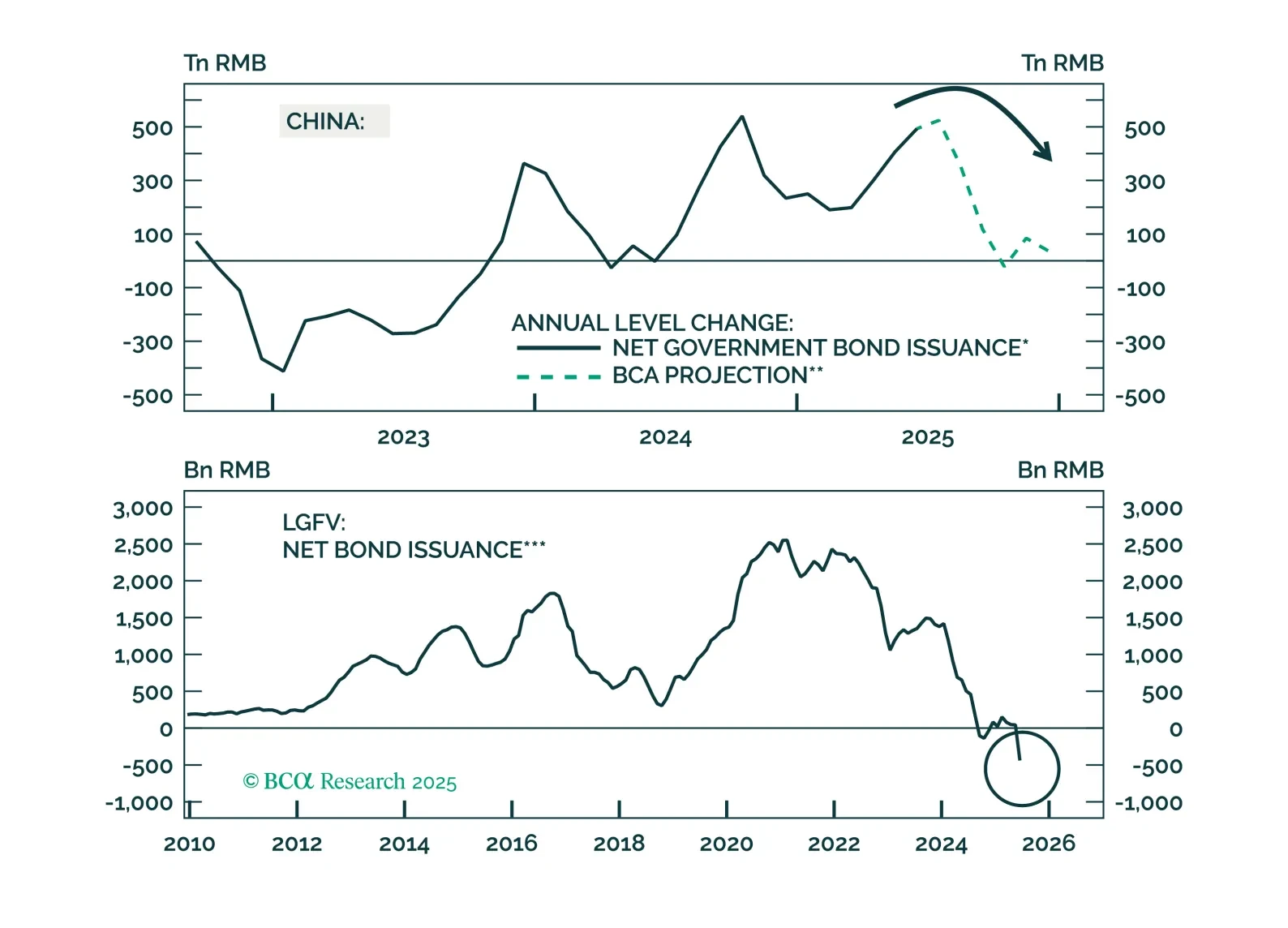

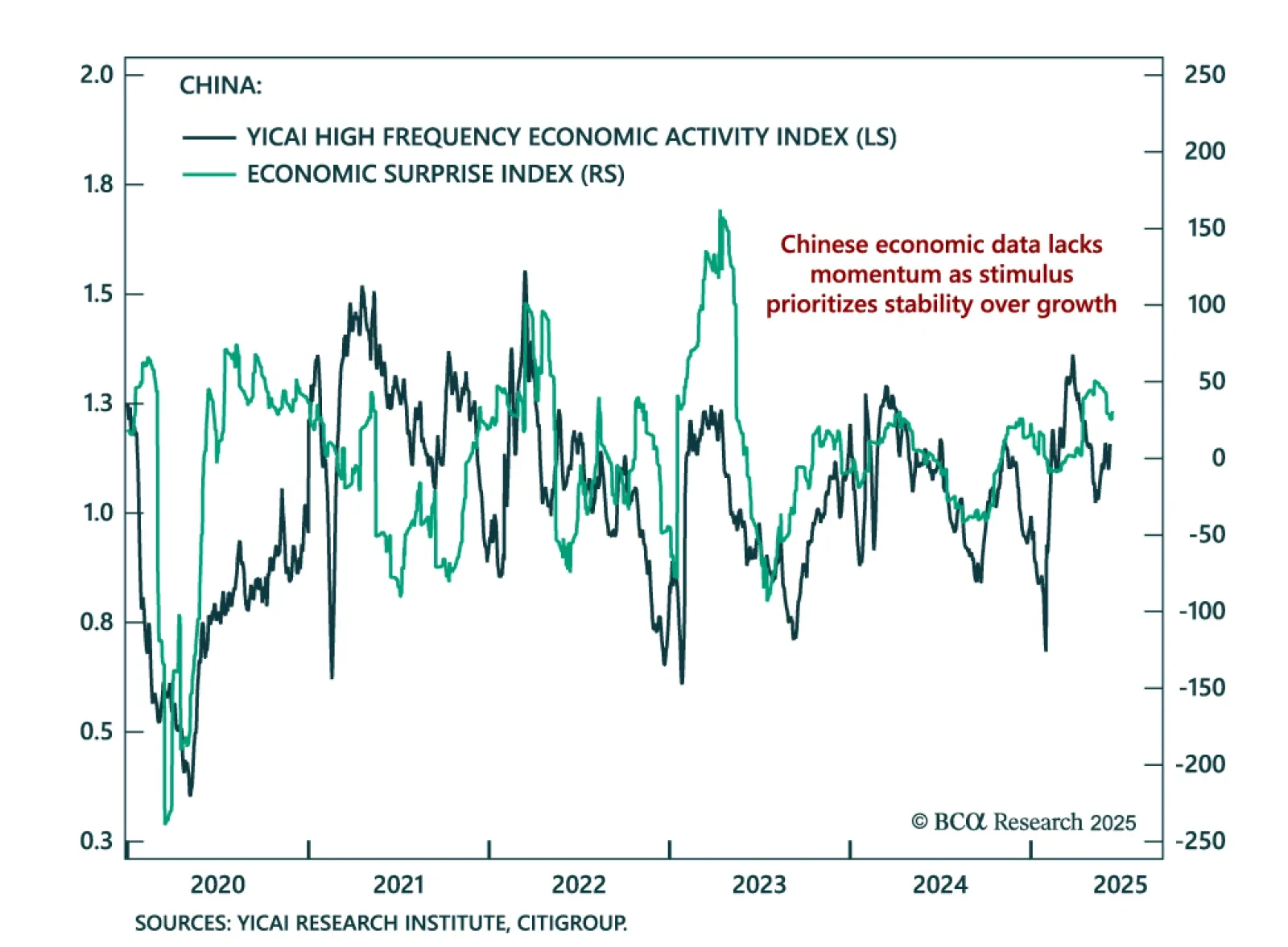

Household data beat in May, but China’s macro story remains fragile, reinforcing our overweight in local government bonds. Traditional supply-side activity decelerated, with industrial production and fixed asset investment both…

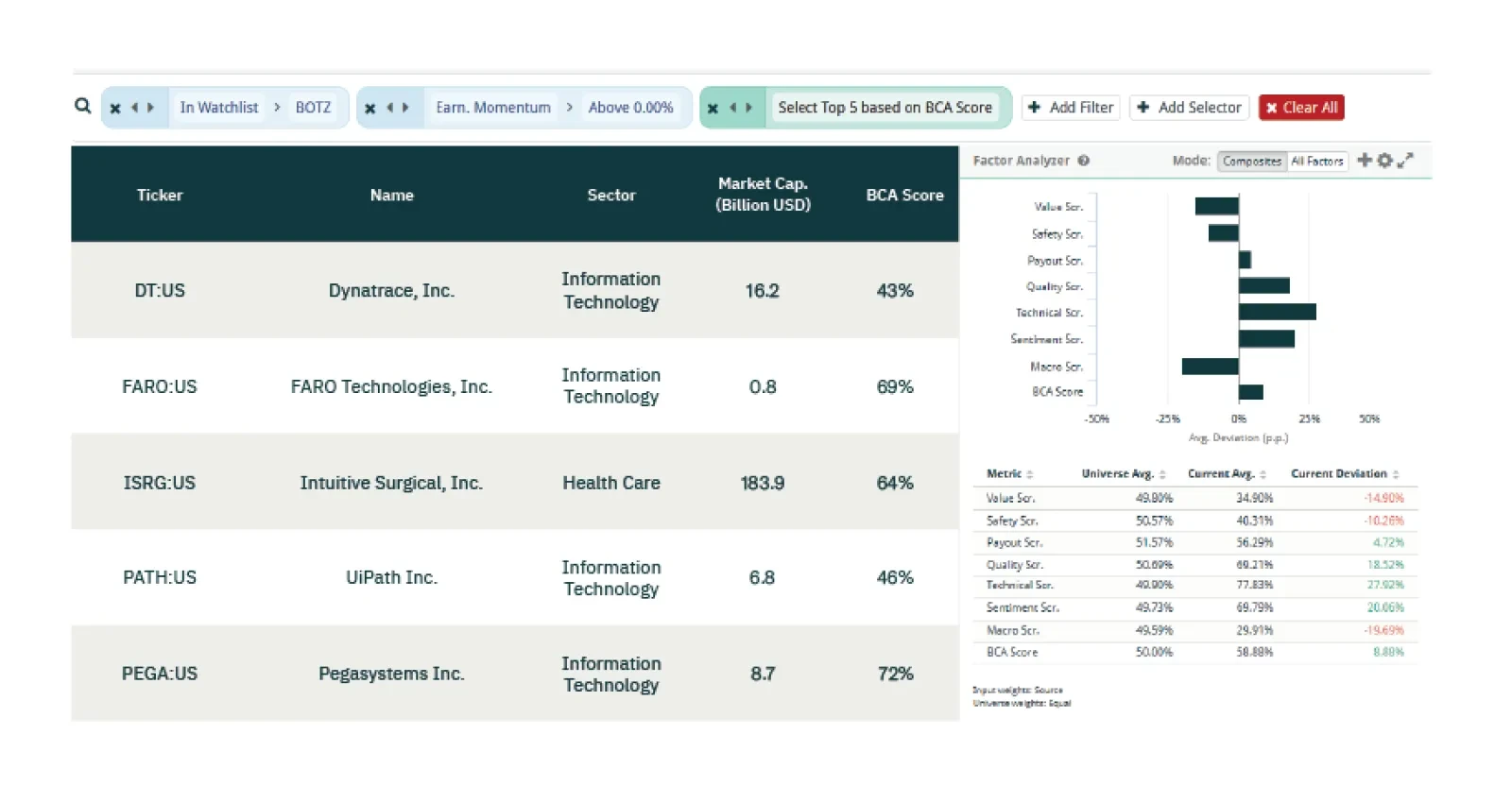

This week our three screeners explore equity trades in Robotics, European Quality and Technical, and Hong Kong.

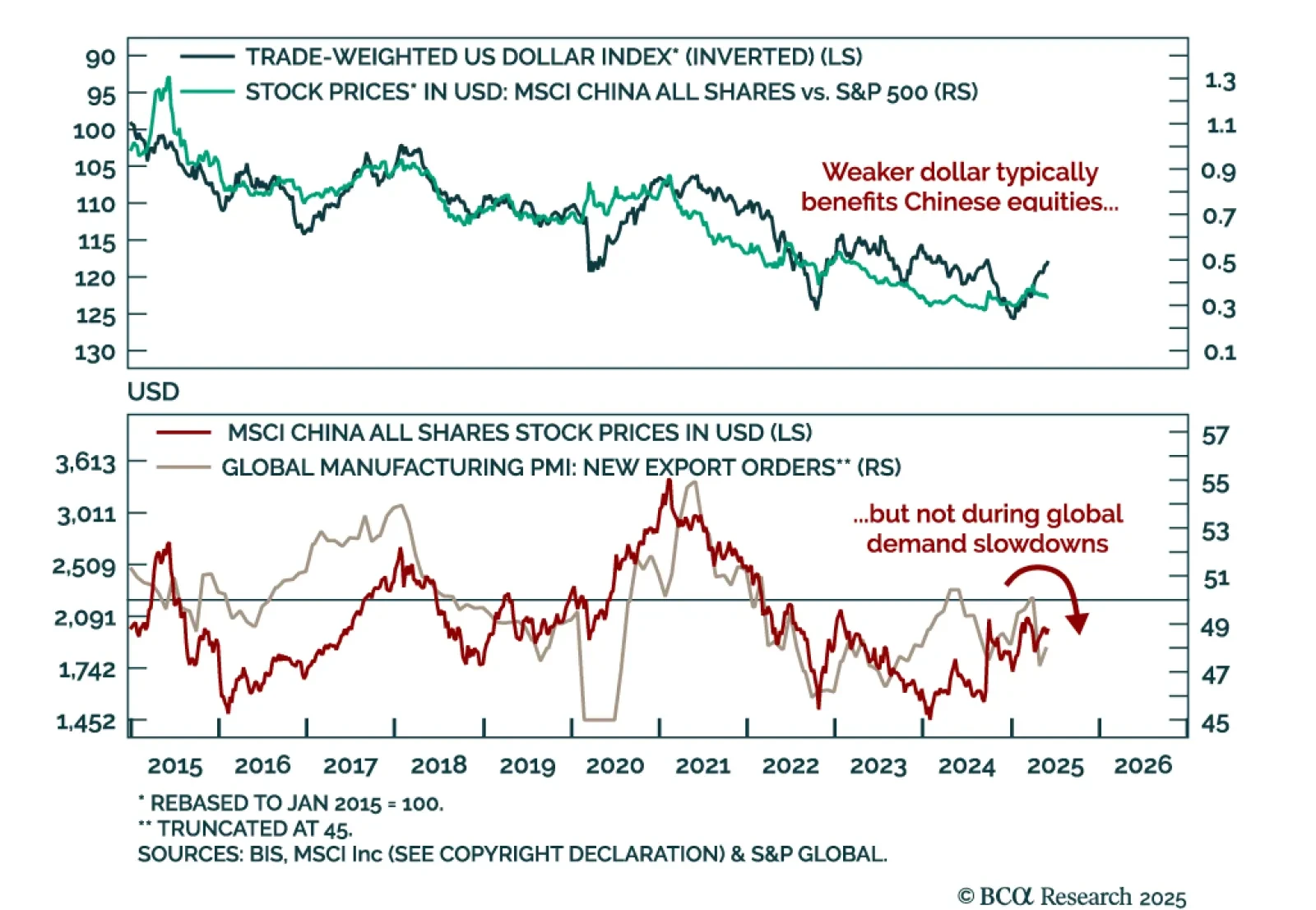

BCA’s China Investment strategists see limited upside for Chinese equities and favor bonds, as trade tensions ease but domestic headwinds persist. This week’s US-China trade talks in London lowered the risk of near-term escalation or…

The London Sino-US trade talks offered hope of de-escalation, but Chinese equities remain under pressure from deflationary headwinds and lack a clear macro catalyst to trend higher.

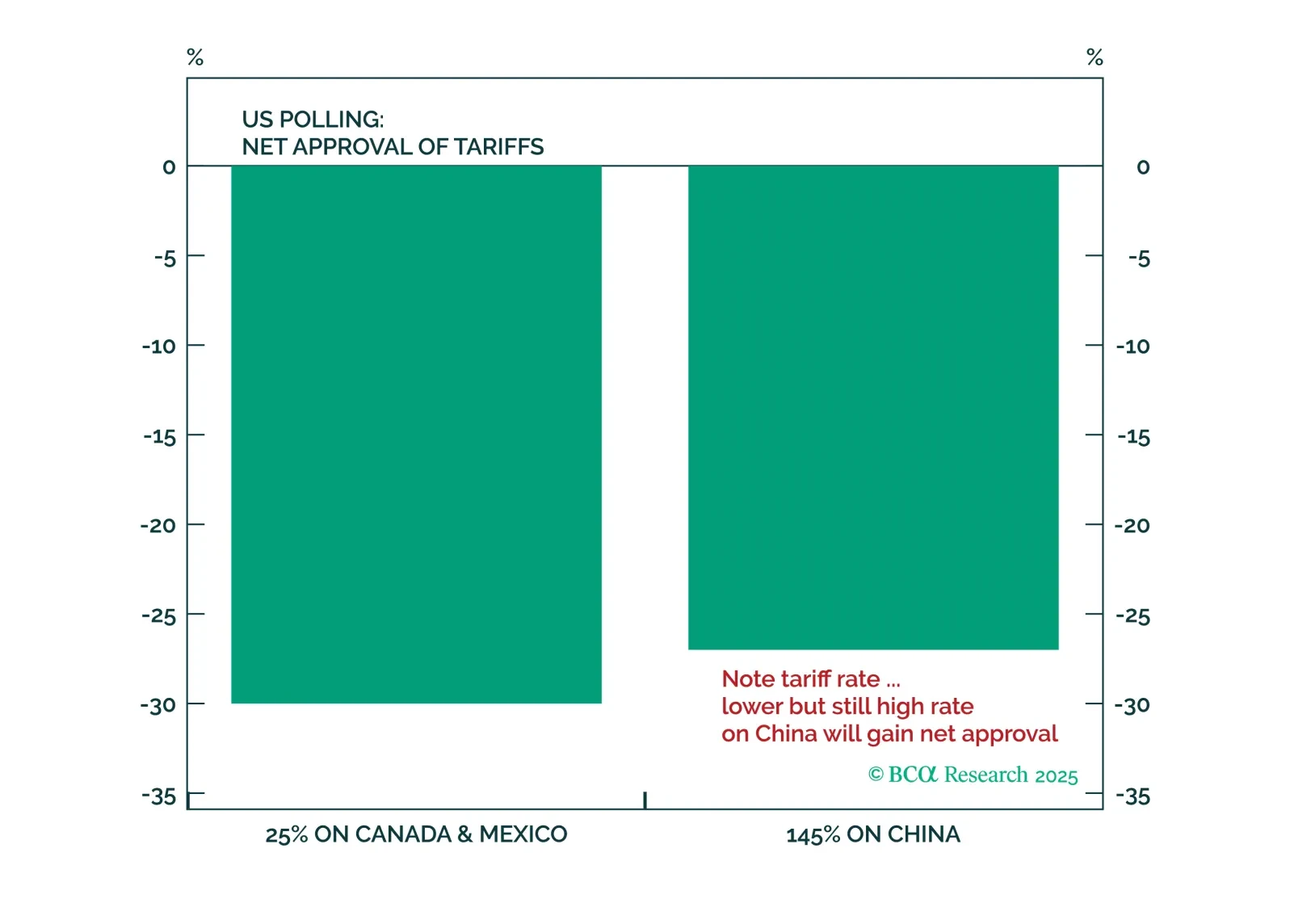

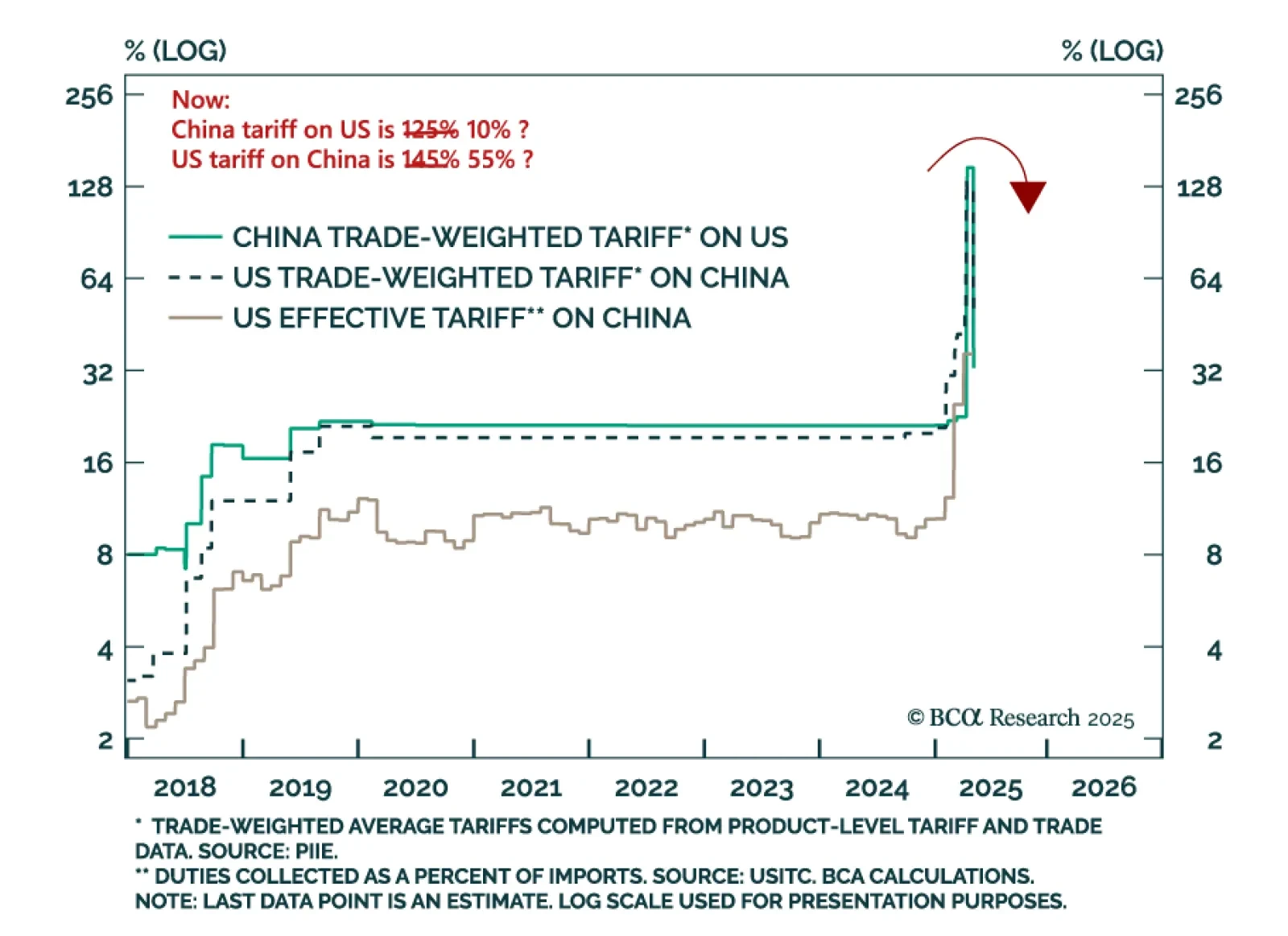

The US-China tariff deal confirms one thing: markets are still priced for perfection, with little upside even if a recession is dodged. The London negotiations yielded a partial agreement: The US will reduce tariffs, and China will…

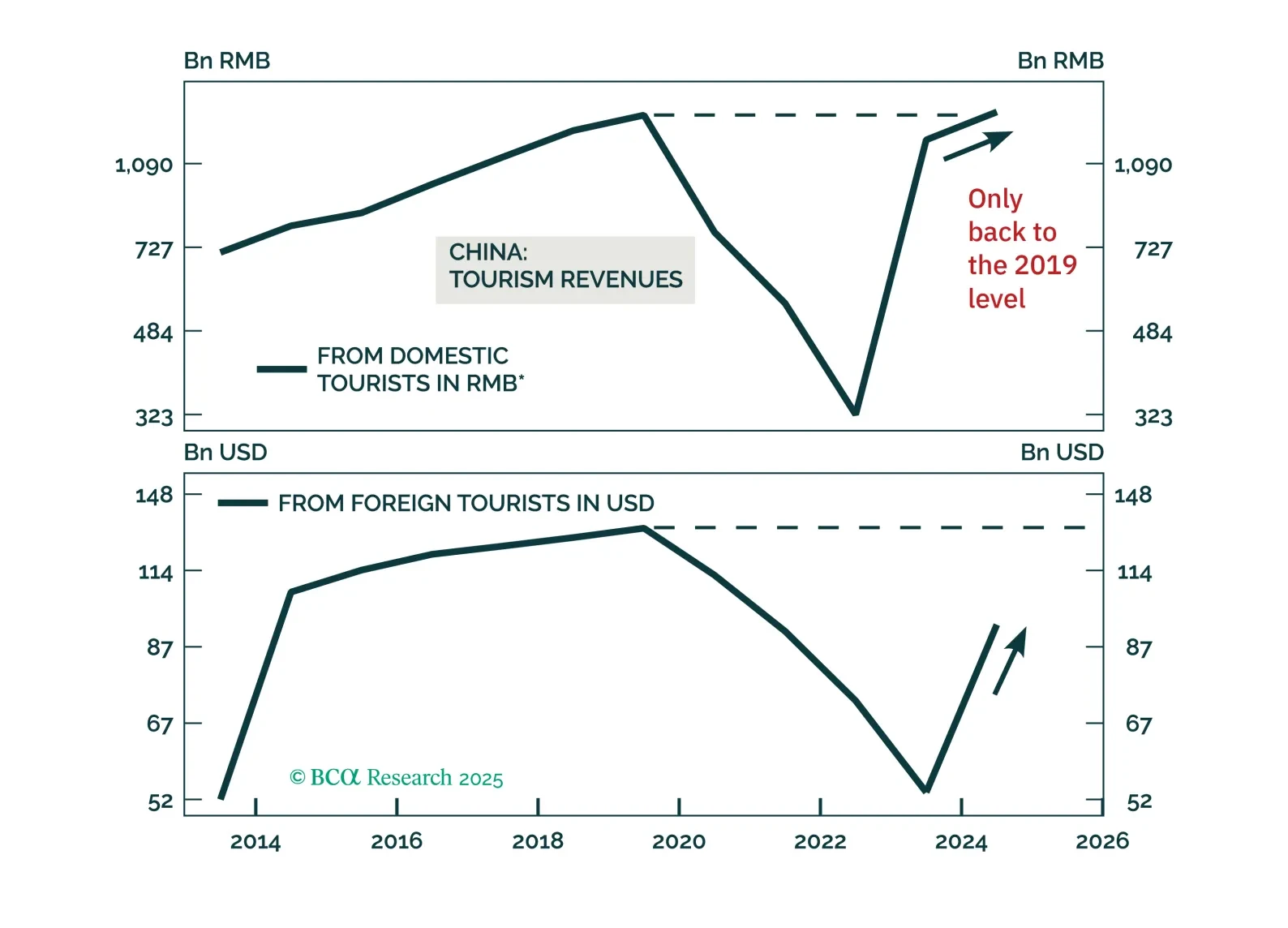

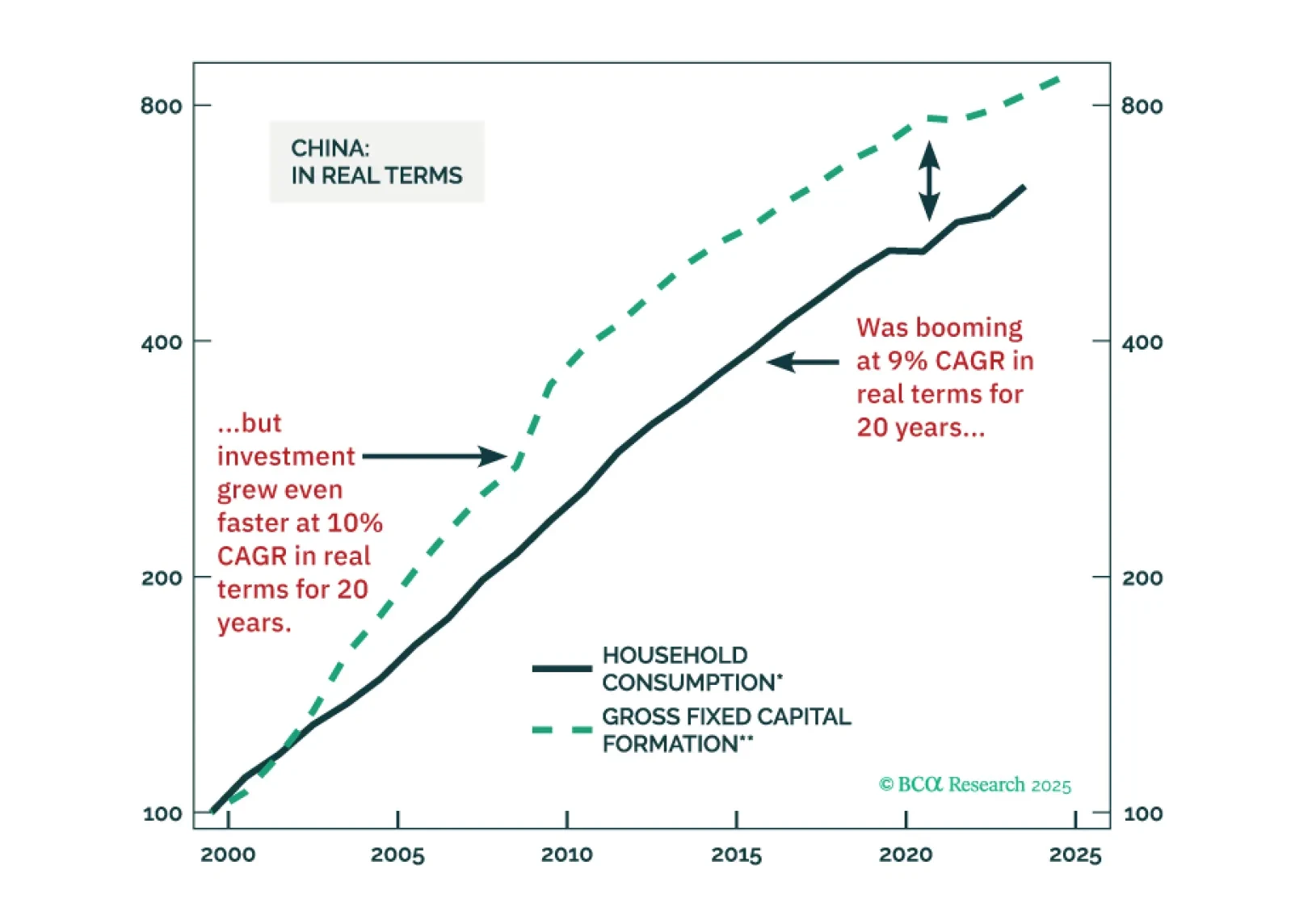

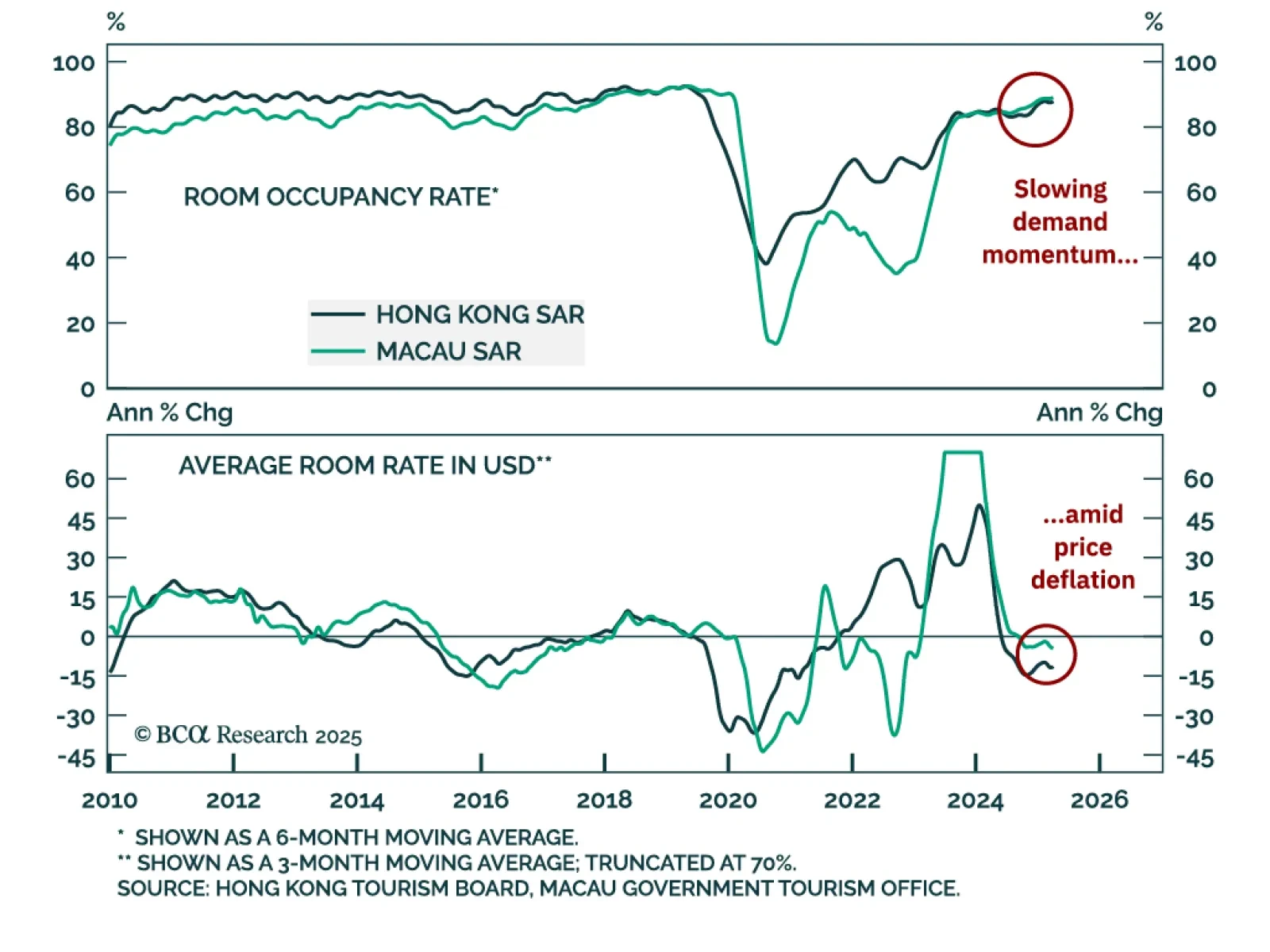

China’s tourism sector has rebounded meaningfully since the January 2023 COVID reopening; however, investors should not be complacent about the outlook for tourism stocks. The double-digit revenue growth of the Chinese tourism…

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

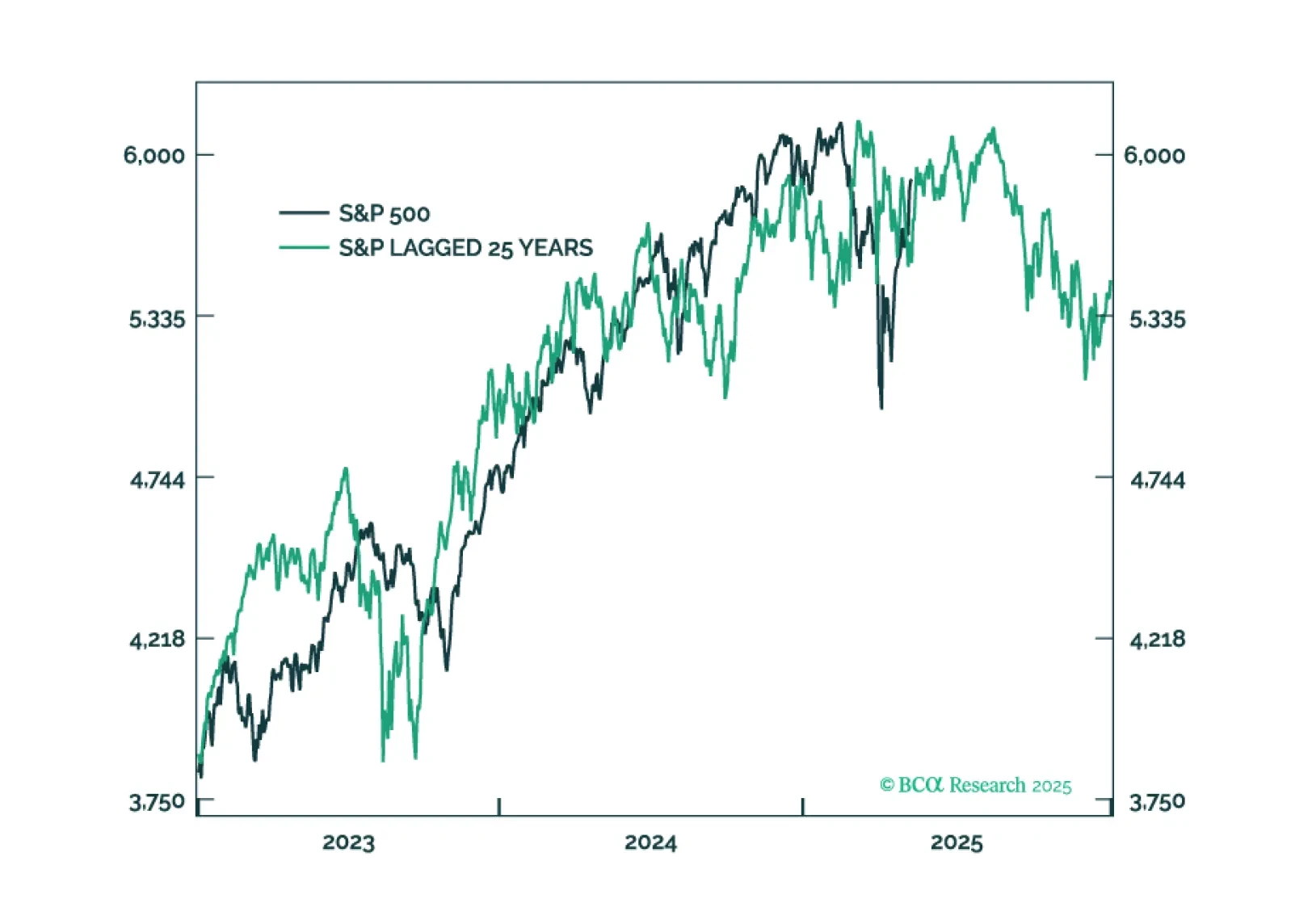

This year’s plunge in tech stocks followed by the recent strong countertrend rally is eerily reminiscent of 2000. But the market and economic parallels between 2025 and in 2000 run much deeper. This report lists 10 striking parallels…