This week we are sending you a transcript of my conversation with one of China’s most prominent and influential pro-market economists. Topics raised during my conversation with this Chinese expert may offer our clients important…

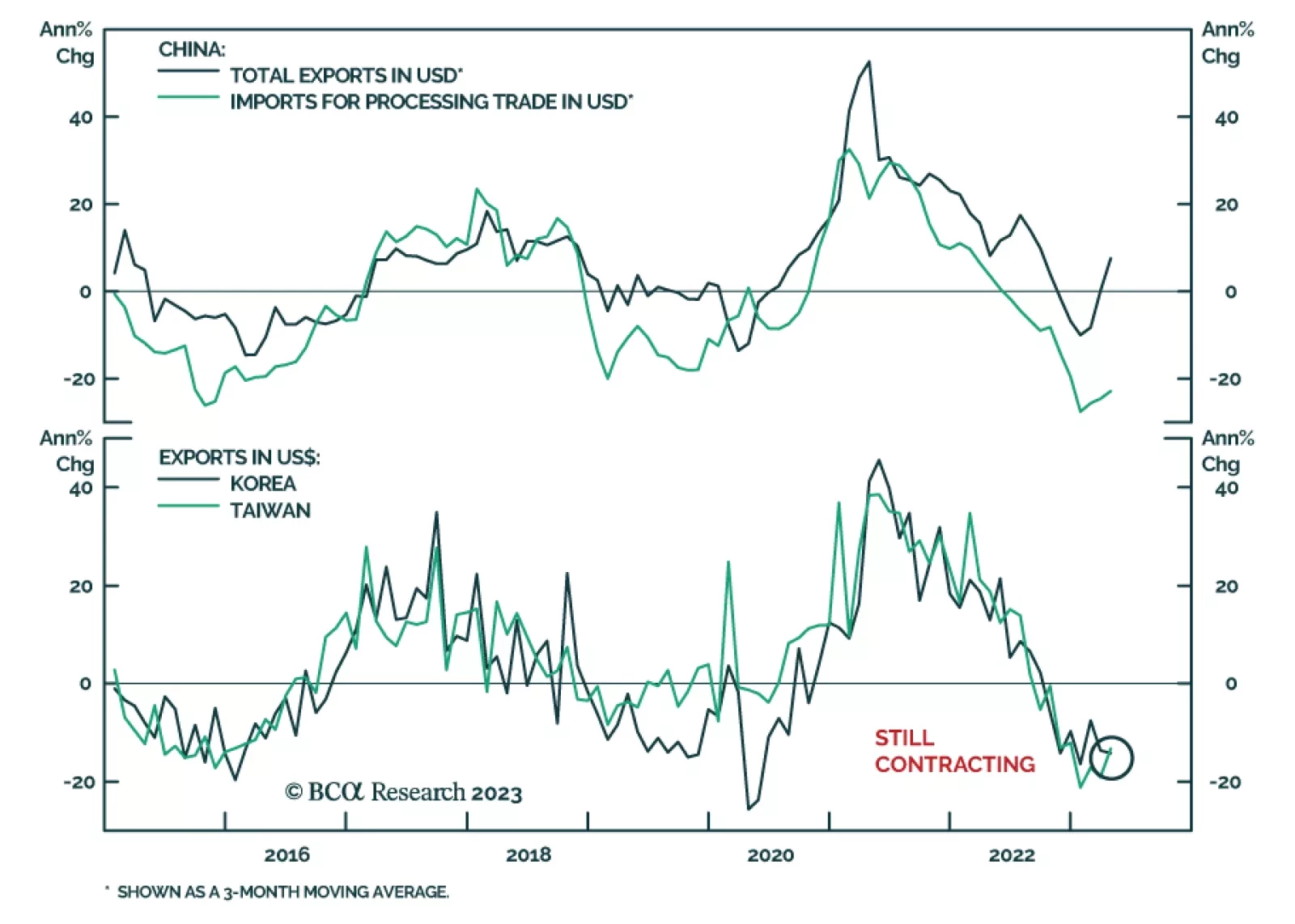

China’s trade release shows exports grew for the second consecutive month in April. However, base effects are distorting the signal. In particular, the two-month-long Shanghai lockdown that started at the end of March 2022…

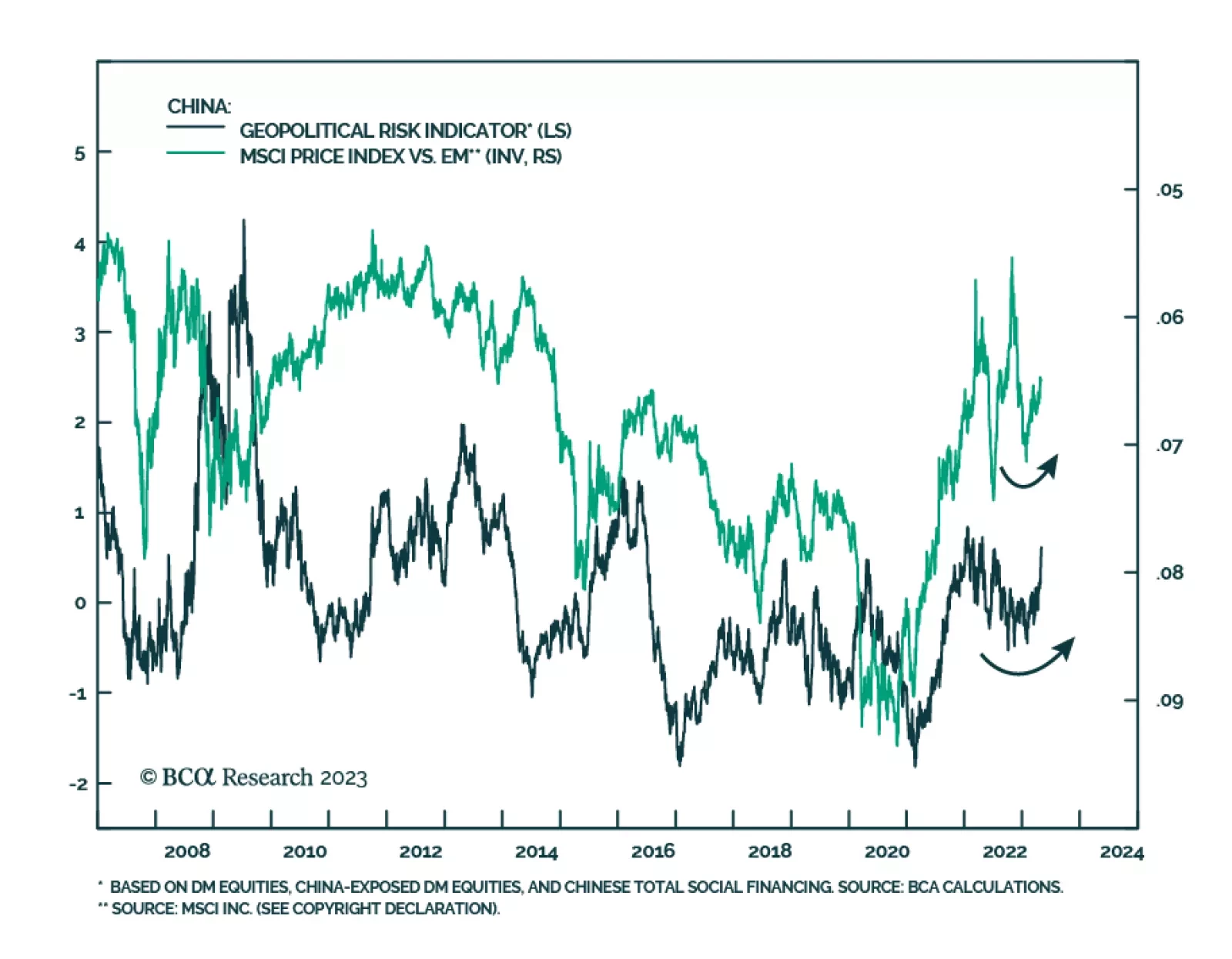

According to BCA Research’s Geopolitical Strategy service, the late April meeting of China’s Politburo suggests that the Chinese government will maintain the accommodative macroeconomic policies outlined in March.…

China’s reopening, combined with a slew of pro-consumption policy stimuli, will likely boost household consumption by 10% in nominal terms in 2023 from a year ago. Some of the hardest hit service sectors during the pandemic will…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

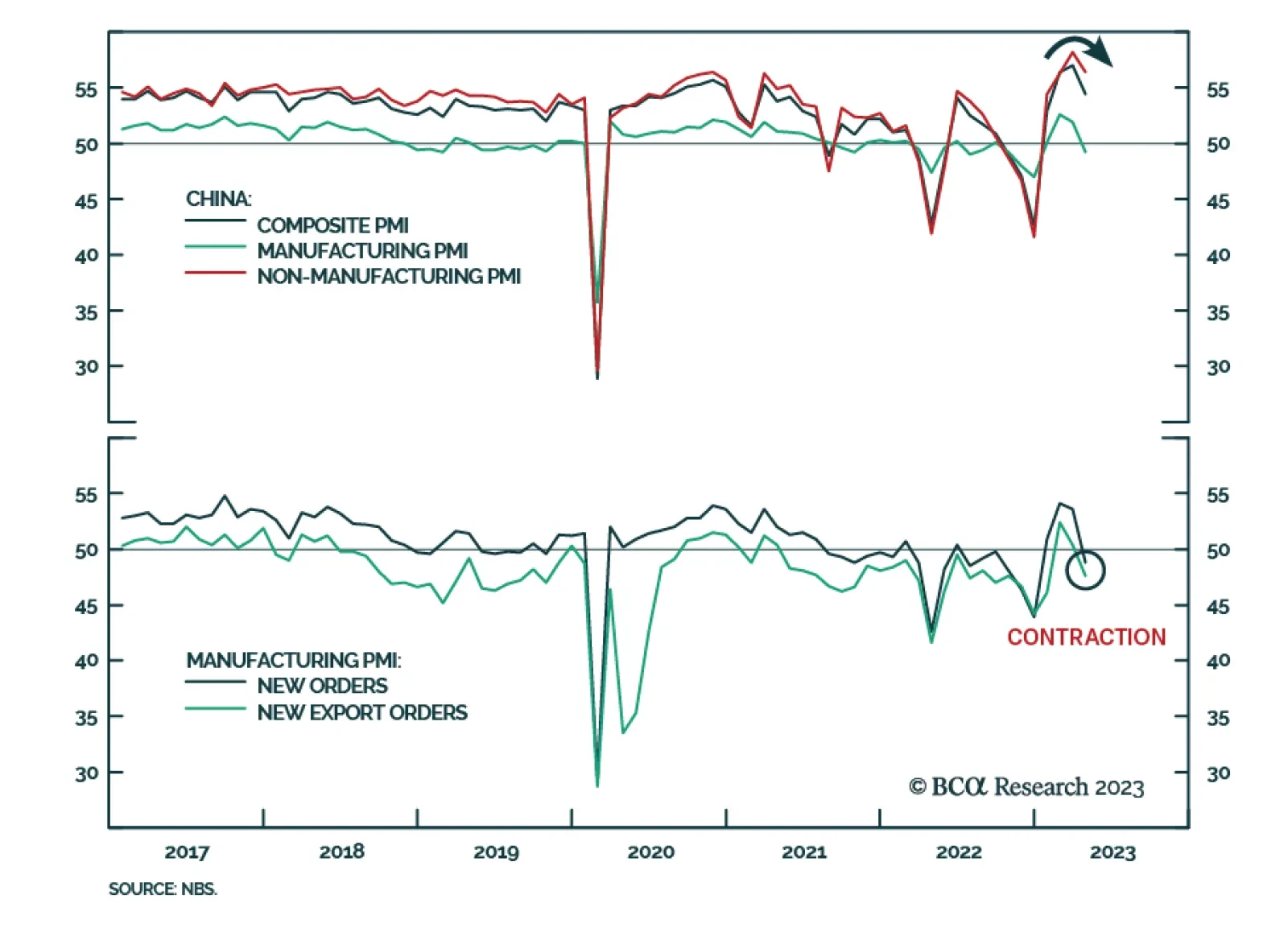

China’s NBS Composite PMI relapsed to 54.4 in April from 57 – the first monthly decline since the index bottomed at 42.6 in December. Importantly, both the manufacturing and non-manufacturing indices fell. In…

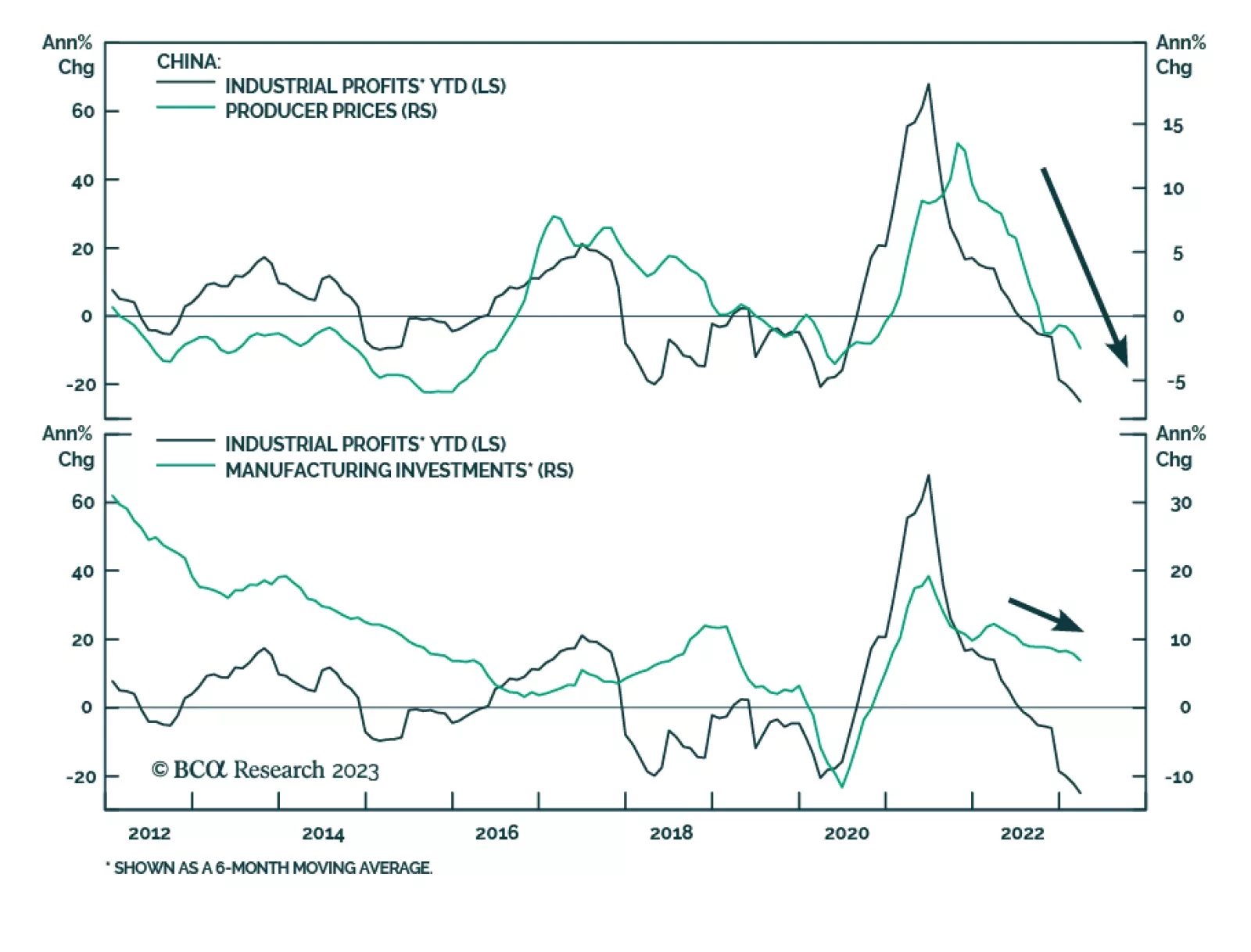

Incoming economic data confirm that China’s post-lockdown recovery remains bifurcated. On the one hand, the end of the zero-Covid policy is boosting consumer spending – particularly on services. On the other hand,…

In Section I, we discuss why the rally in stock prices over the past month reflects the soft-landing view, and why that is not a likely economic outcome. US inflation is slowing, but target inflation remains elusive. Meanwhile,…