Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

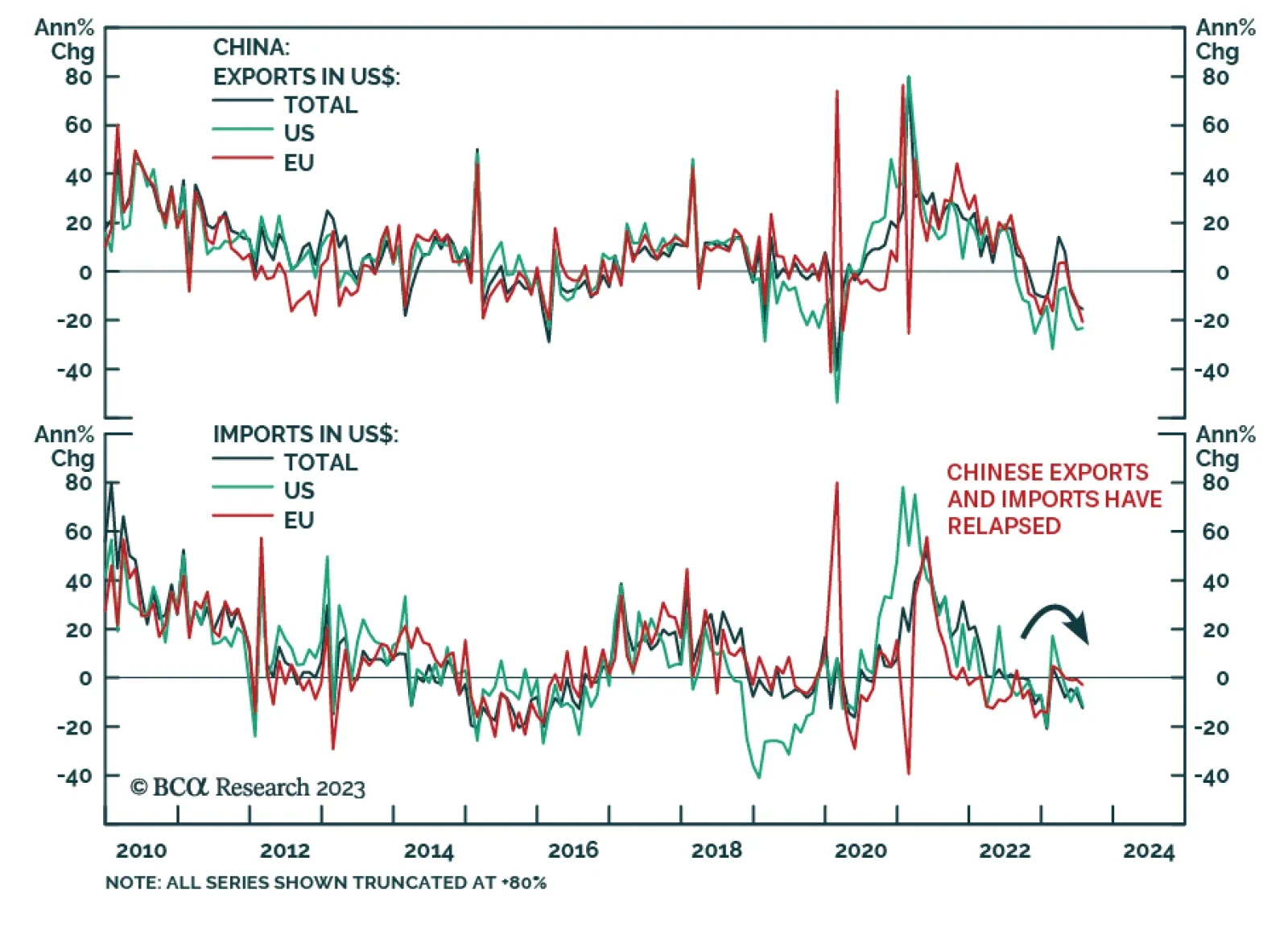

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…

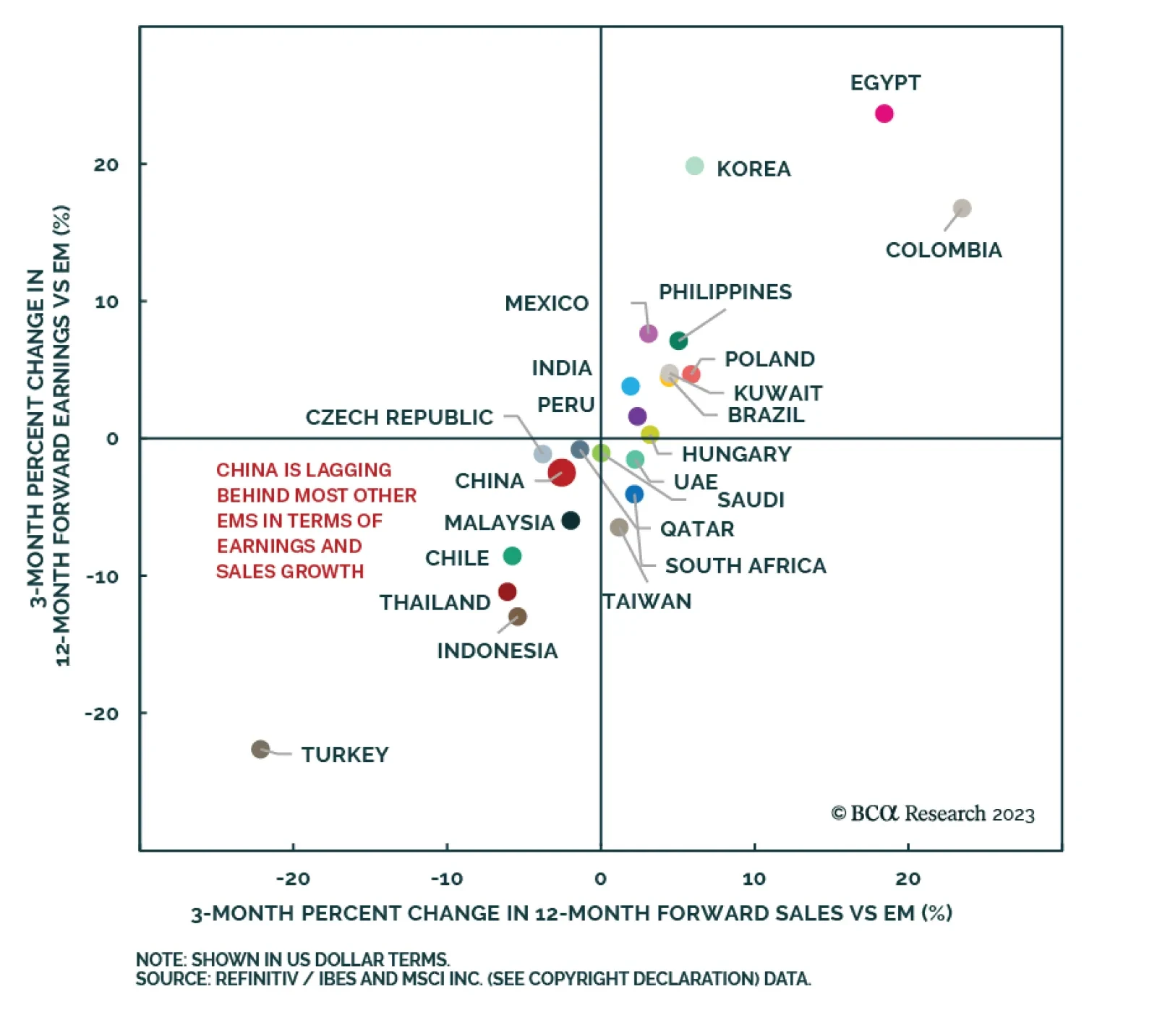

According to BCA Research’s Global Investment Strategy service, EM ex-China equities have potential to outperform China and DM in the remainder of the year. Relative to their own history and compared to other EMs,…

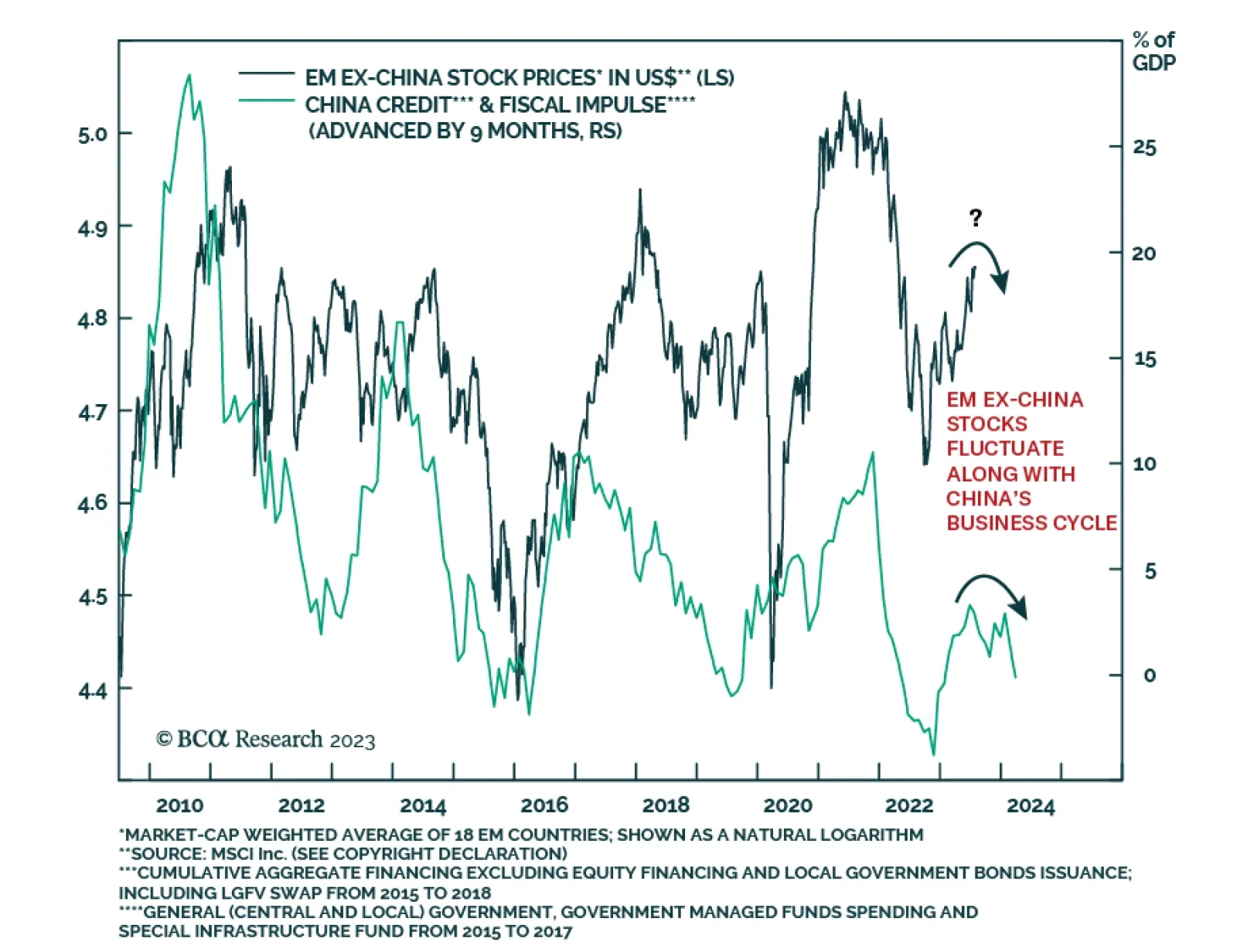

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

According to BCA Research’s Emerging Markets Strategy service, while EM ex-China markets are set to continue outperforming Chinese investable/offshore equities, they are unlikely to deliver superior absolute returns.…

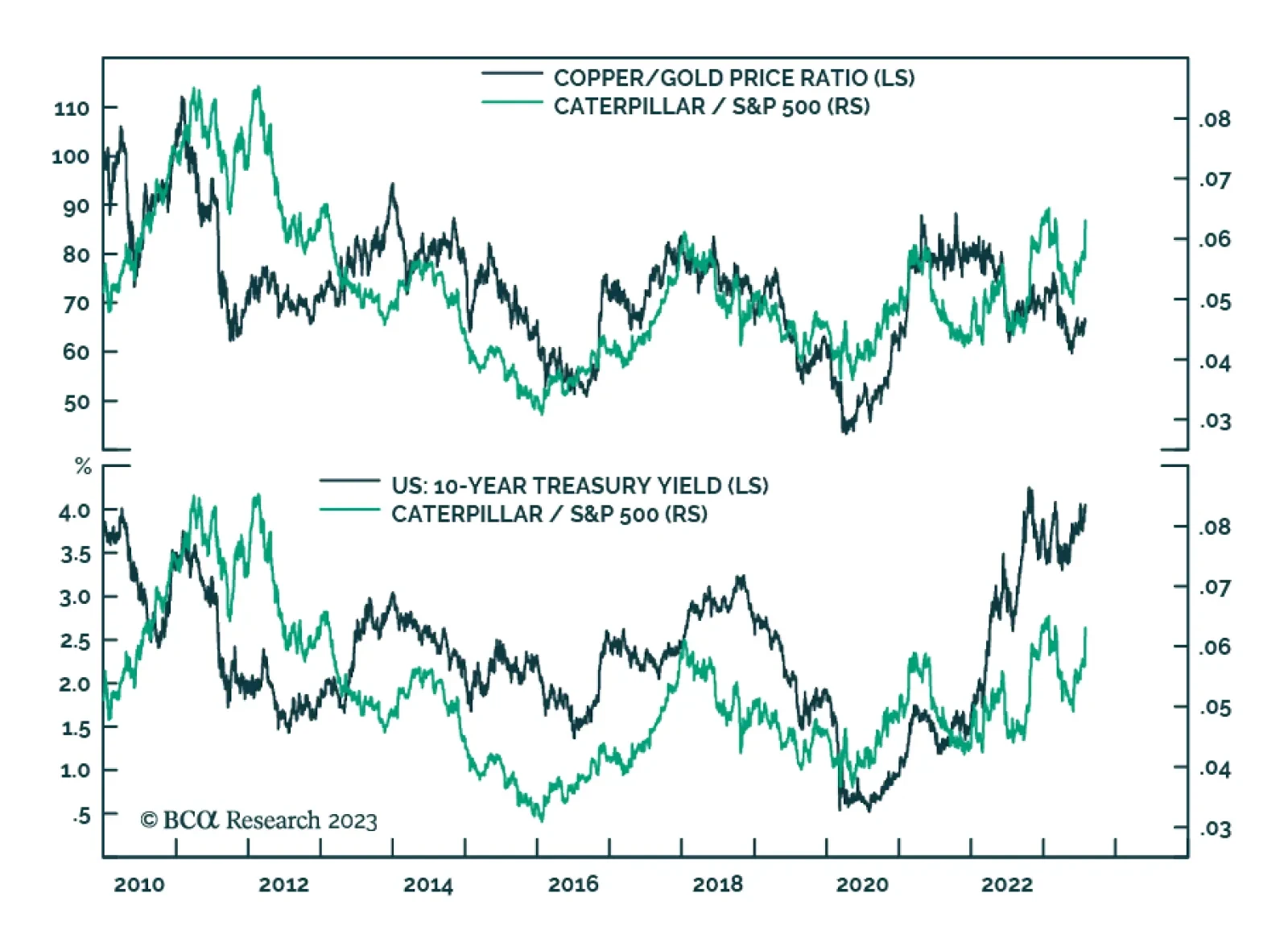

Caterpillar’s Q2 earnings results released on Tuesday beat consensus estimates by a wide margin. Second quarter profit of $2.92 billion ($5.67 per share) came in well above expectations of $2.38 billion ($4.46 per share).…

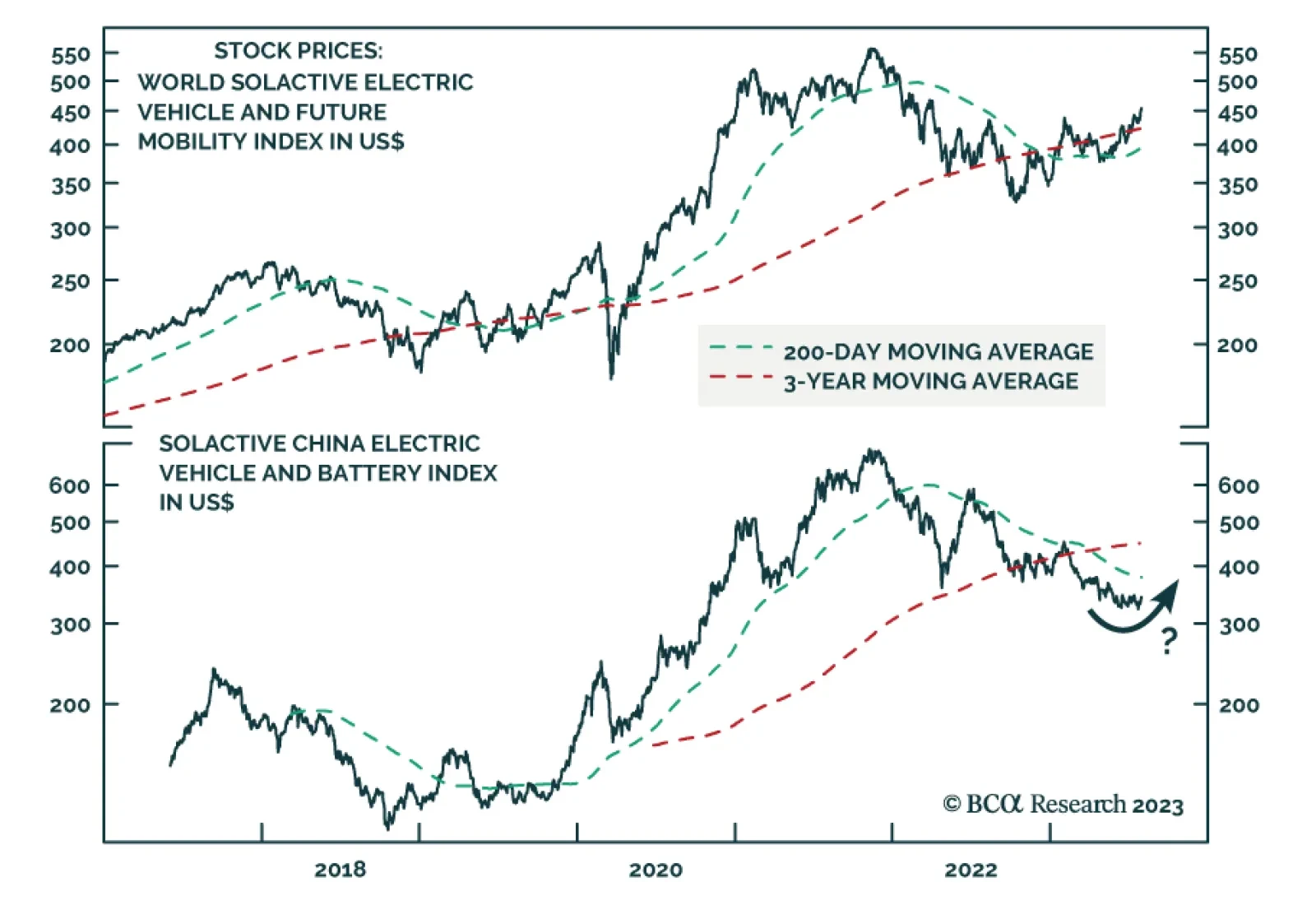

According to BCA Research’s China Investment Strategy service, Beijing’s investment focus is shifting from traditional infrastructure to new economy infrastructure, which includes clean energy and high-tech sectors…