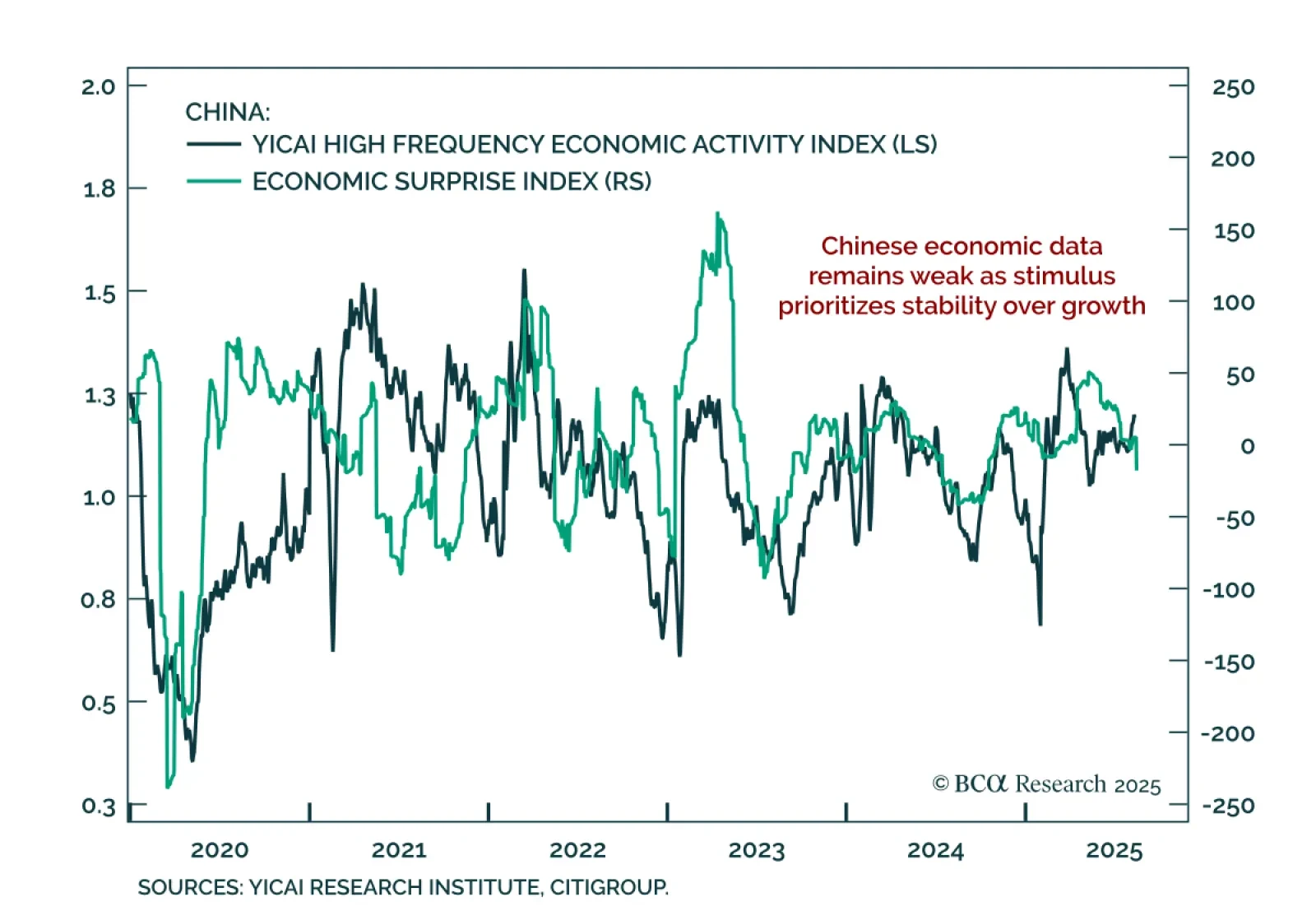

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…

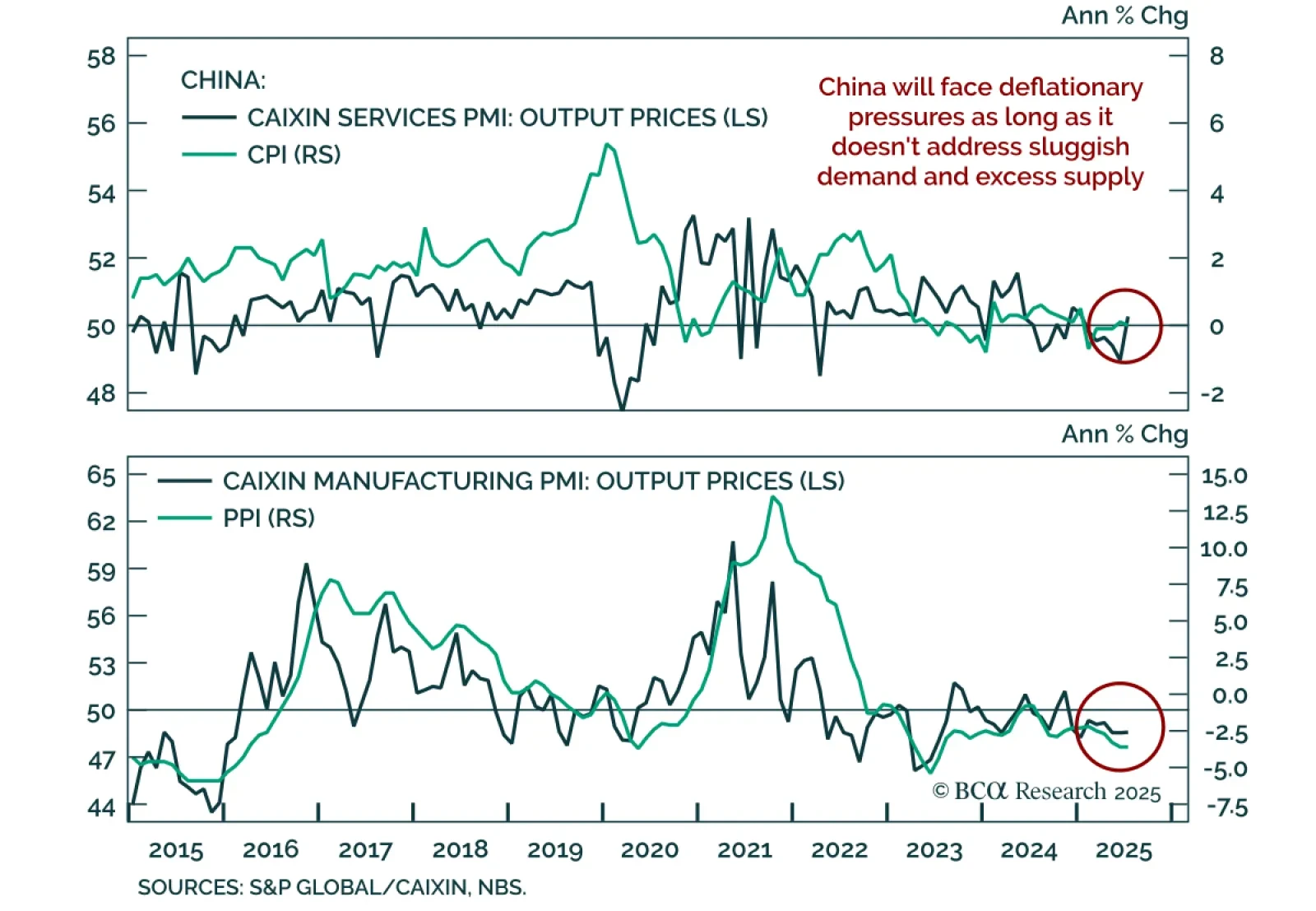

China’s July inflation data confirmed entrenched deflation, reinforcing our defensive stance on Chinese equities and overweight in onshore bonds. CPI slowed to 0% y/y from 0.1%, while factory-gate prices stayed deeply negative…

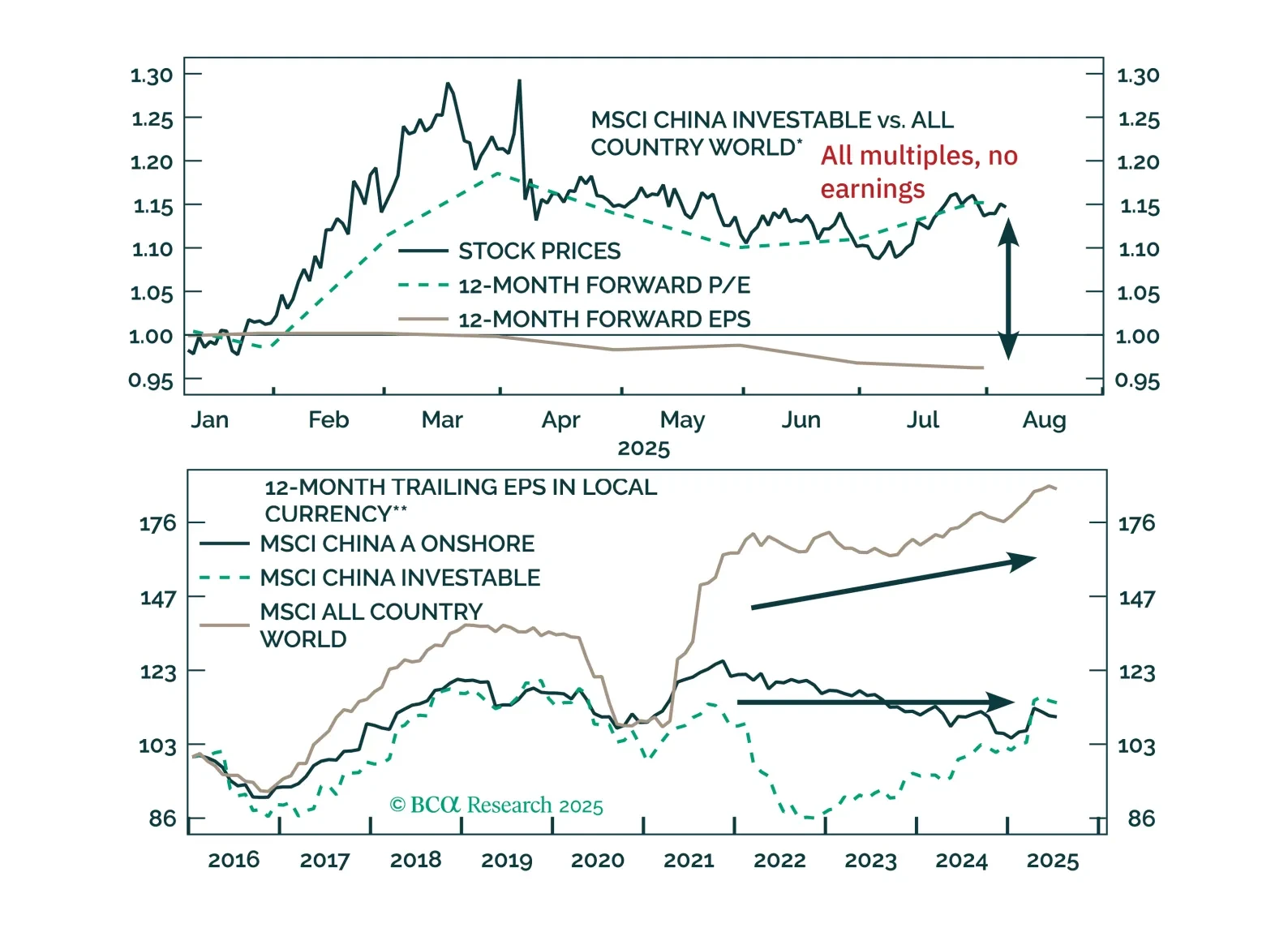

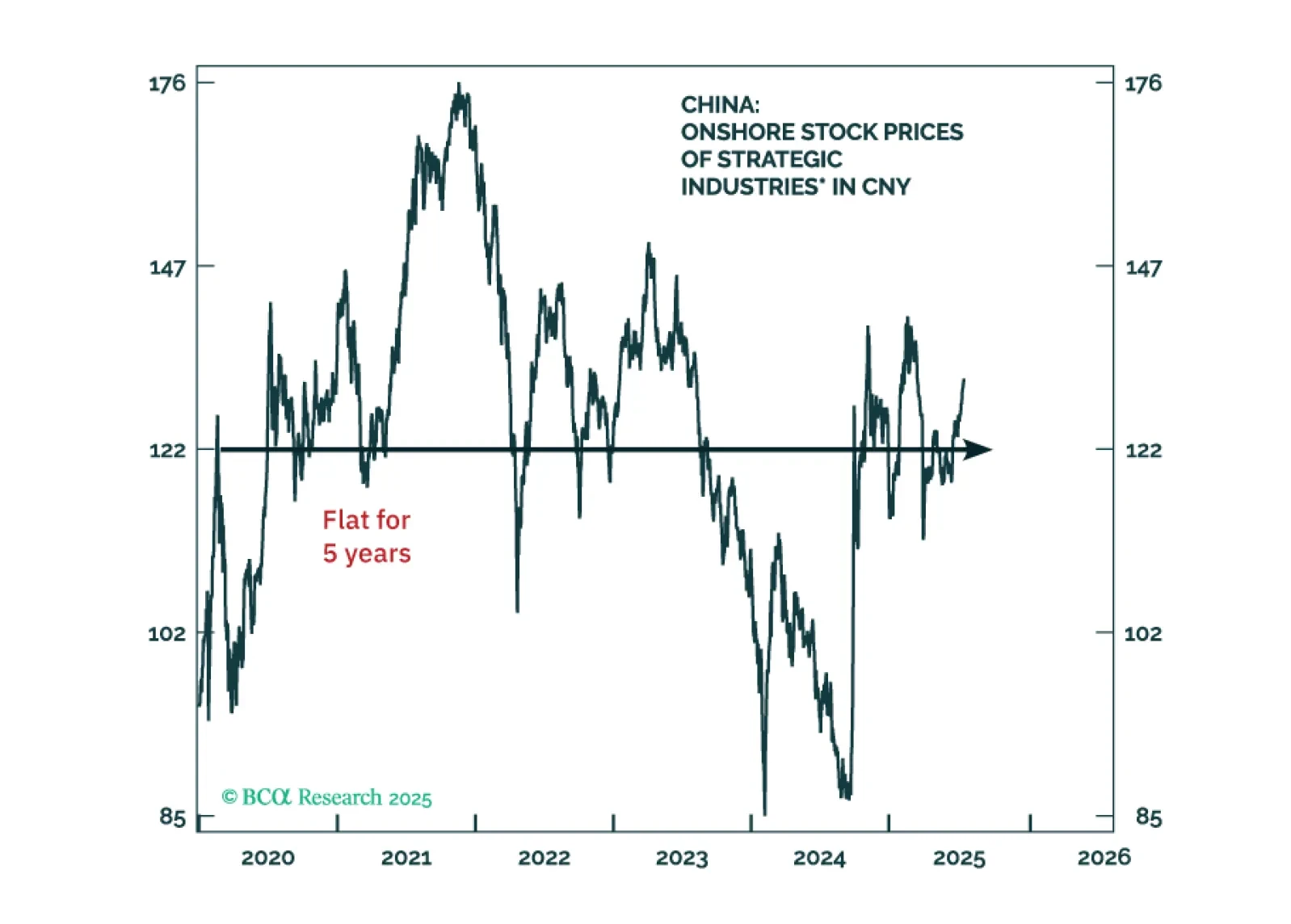

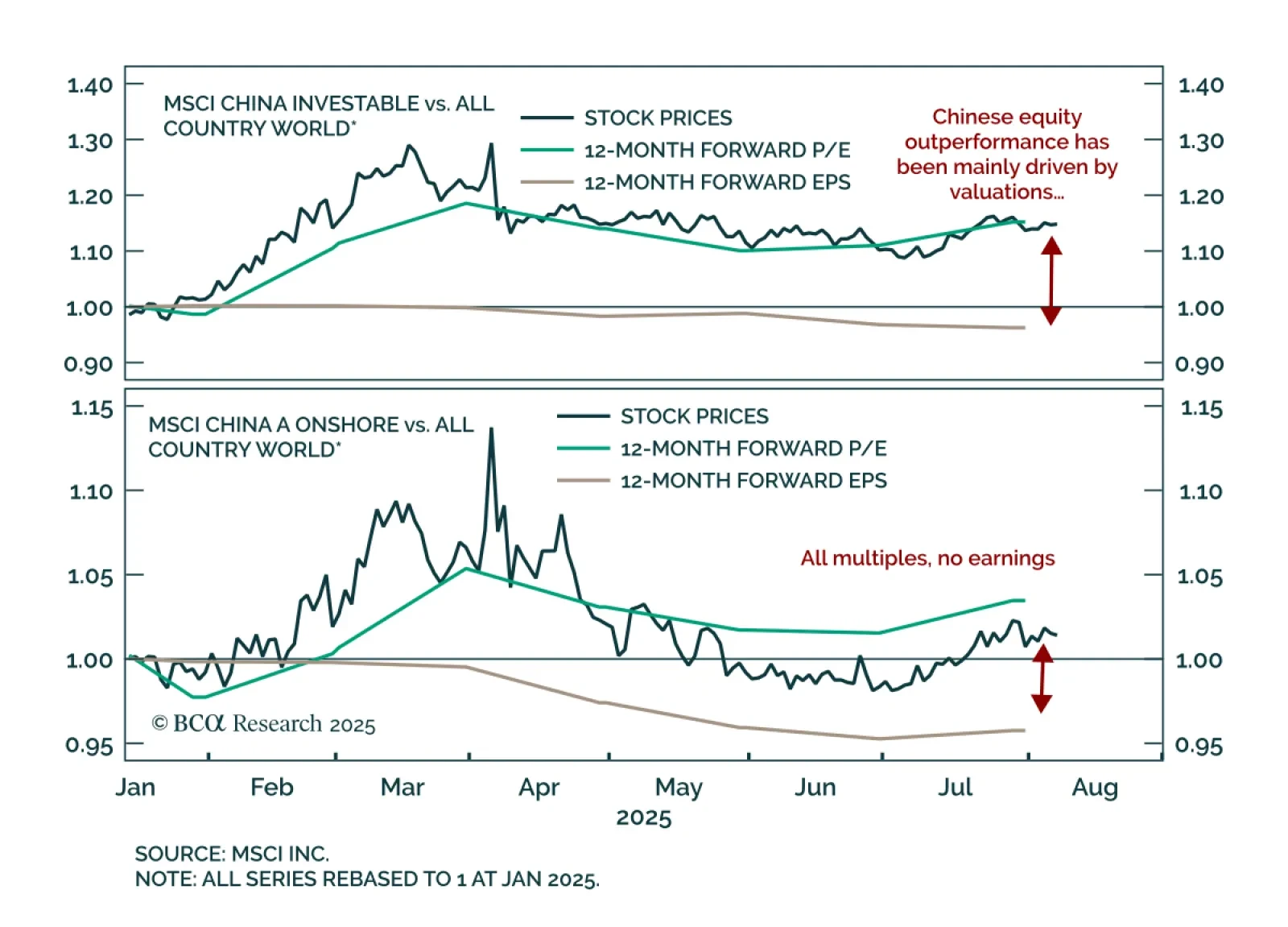

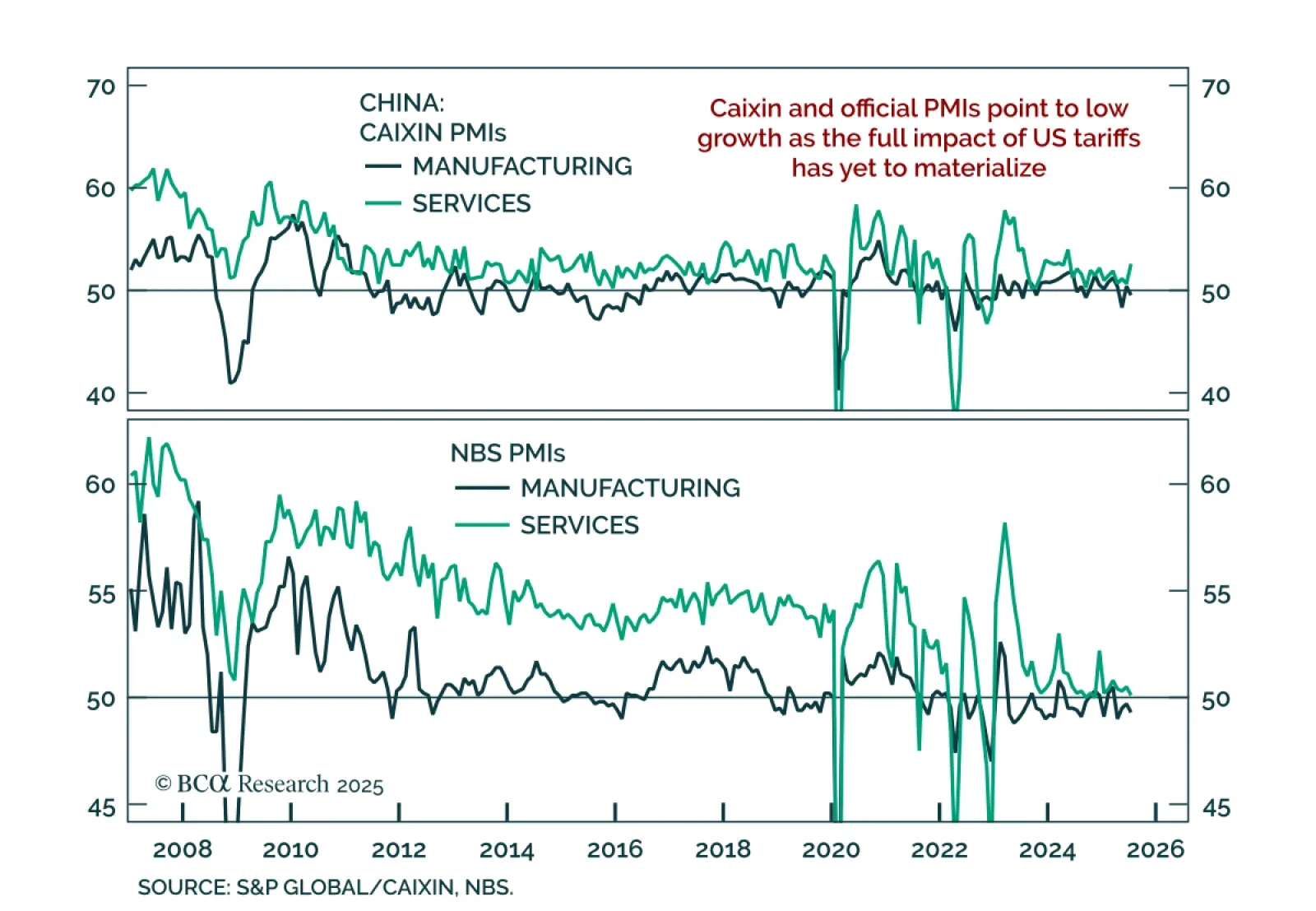

Our China Investment strategists maintain a defensive stance on Chinese equities, favoring A-shares over offshore markets. The earnings outlook remains weak, and the full impact of US tariffs has yet to be felt. Chinese equities have…

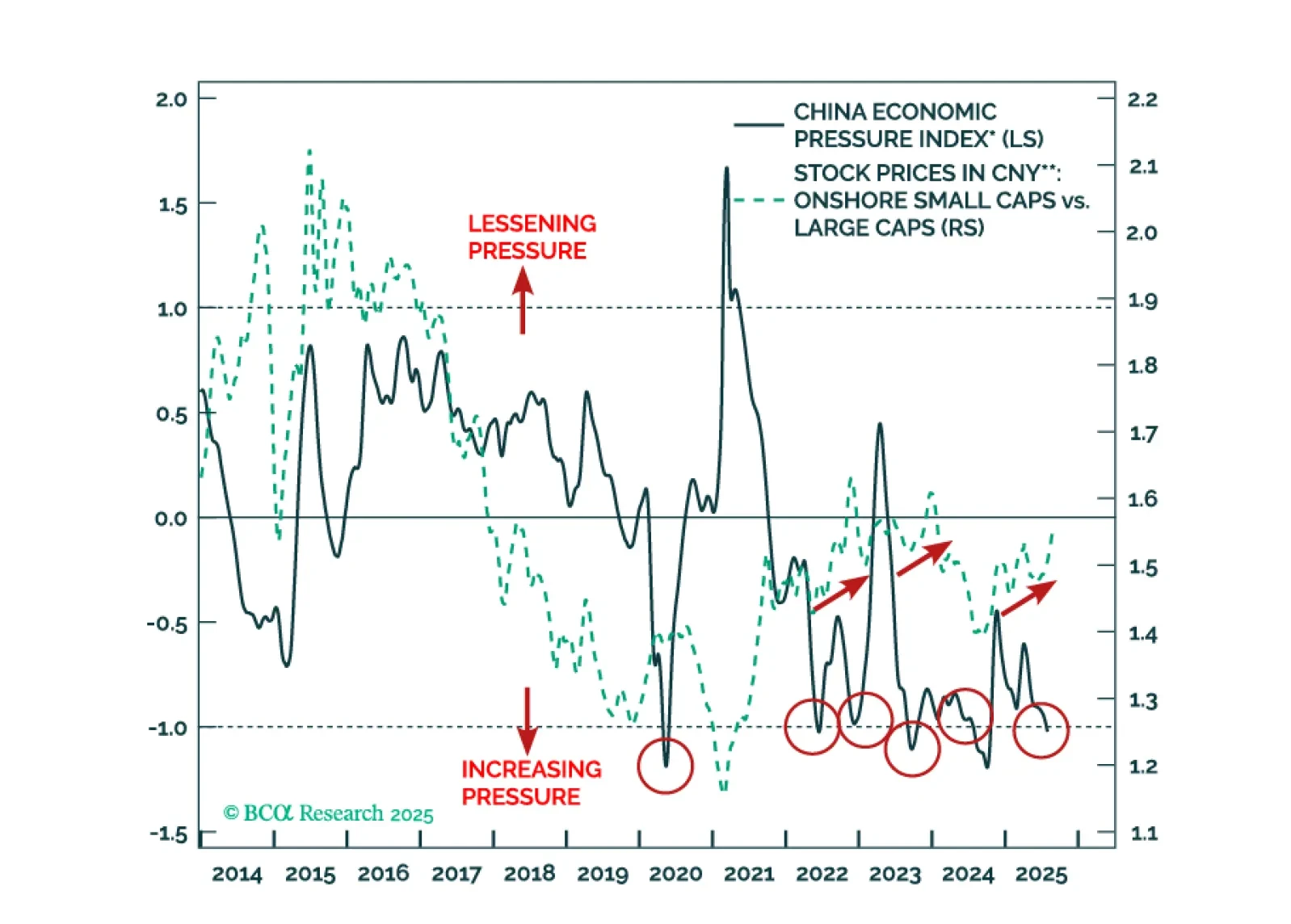

Chinese stock prices have significantly decoupled from the country’s business cycle, with the full impact of US tariffs yet to be realized. The valuation-driven equity gains without a cyclical economic recovery will be vulnerable to…

The July PMIs and inflation data confirm that China faces a persistent low-growth, deflationary backdrop, with weak demand and tariff risk warranting defensive equity positioning. The Caixin manufacturing PMI fell to 49.5, while…

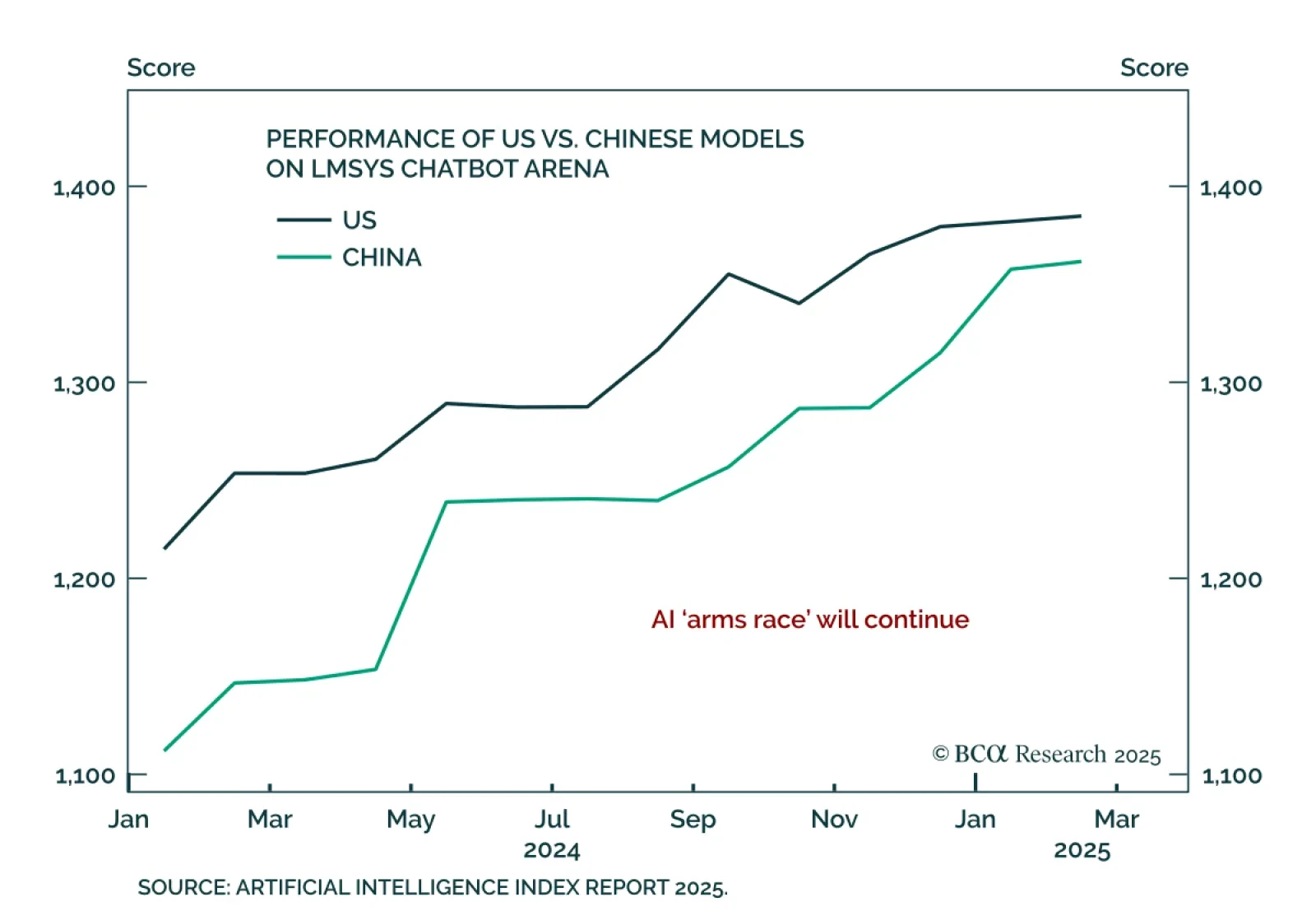

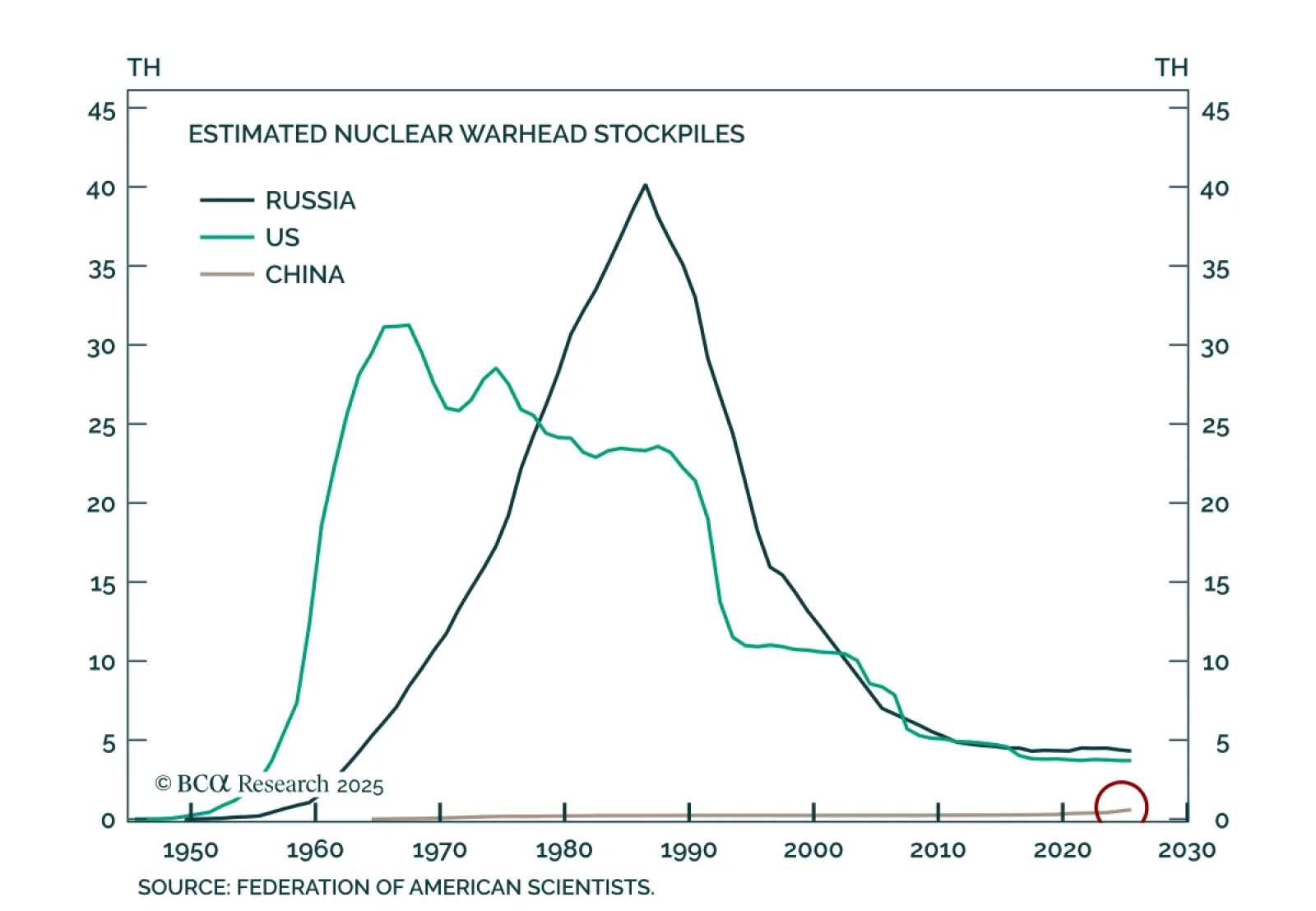

BCA’s Geopolitical strategists argue that artificial intelligence will destabilize both domestic politics and international security, prompting more aggressive fiscal responses. President Trump’s July 23 executive orders to…

BCA’s Geopolitical strategists advise investors to remain open to the possibility that a new Cold War dynamic is forming in global trade. While the US-China rivalry does not map perfectly onto the original Cold War, the analogy…

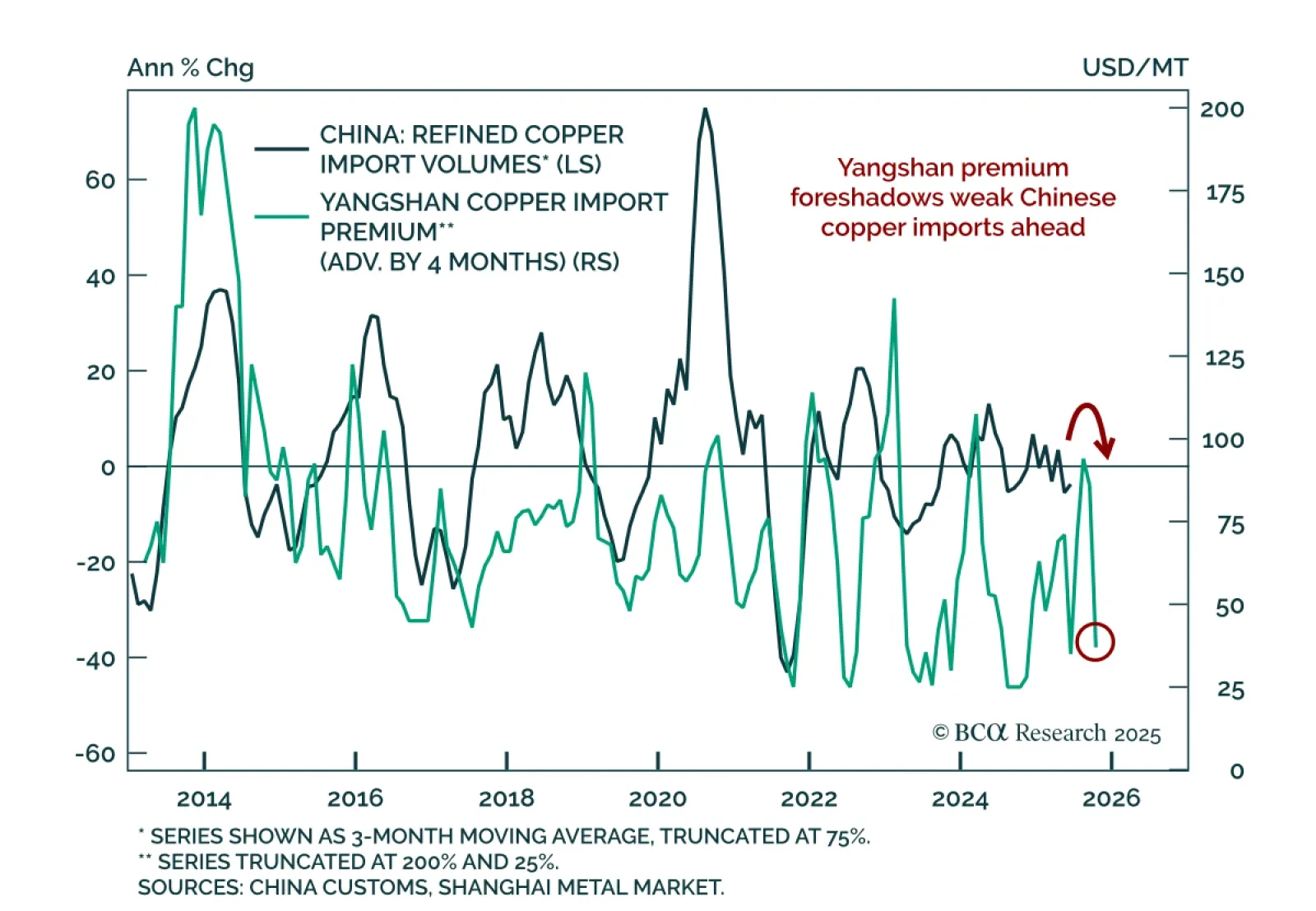

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…