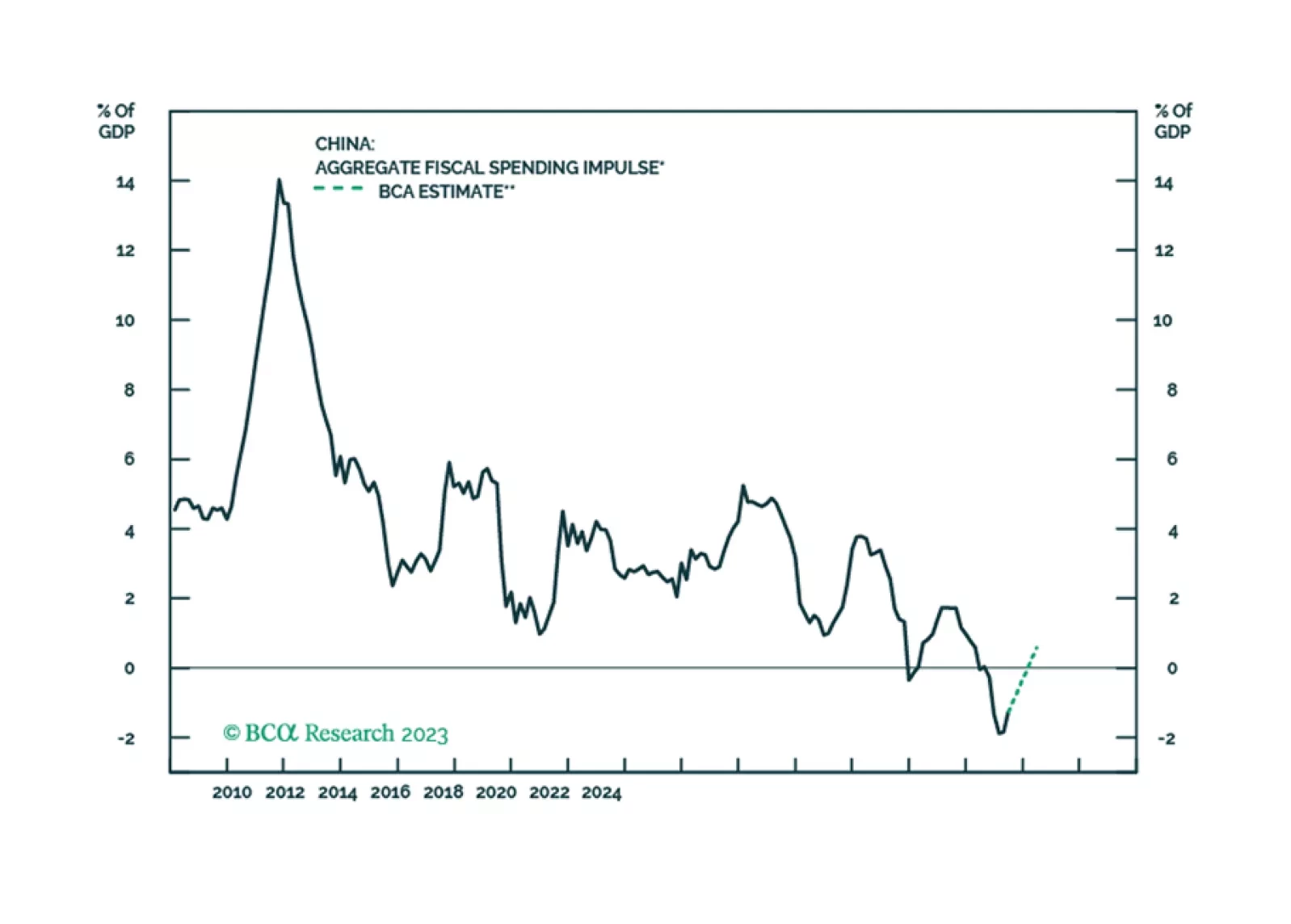

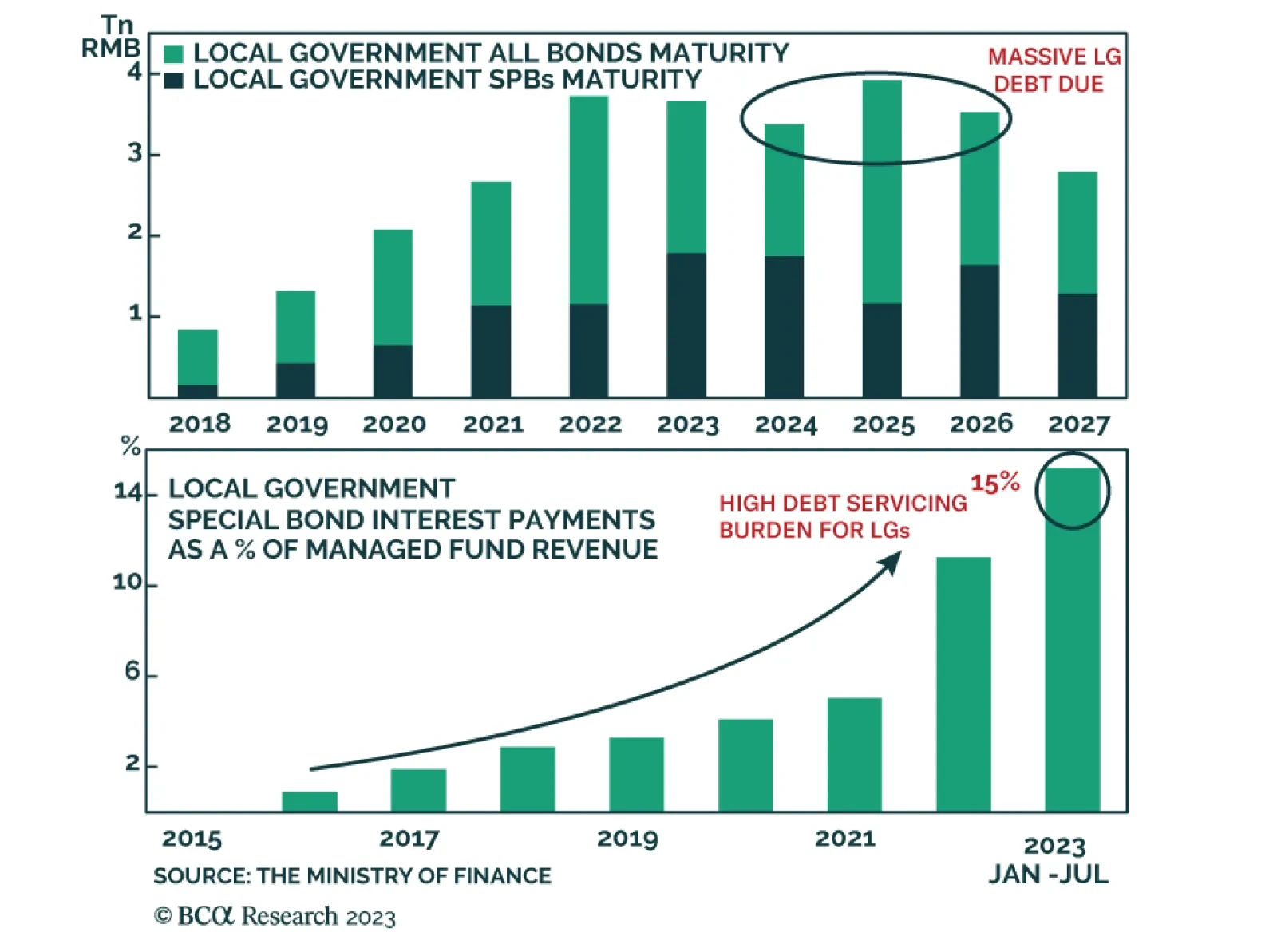

According to BCA Research’s China Investment Strategy service, China's recently introduced debt swap program will help prevent mushrooming defaults, but it will not lead to an acceleration in growth. In August, the…

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…

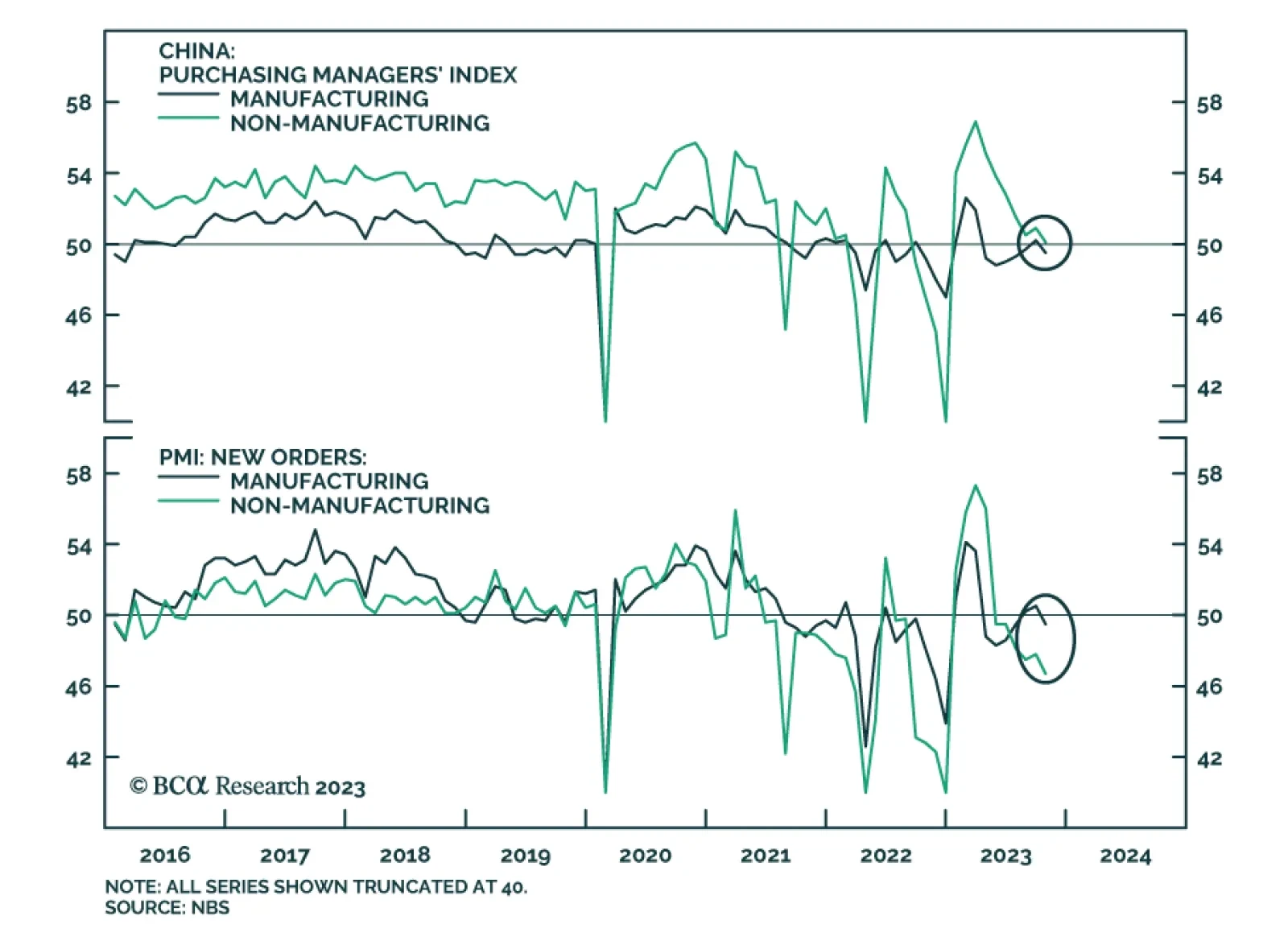

Tuesday’s China PMI release delivered a negative update on economic activity in October. The NBS’ Manufacturing PMI fell from 50.2 to 49.5 while the Non-manufacturing PMI declined from 51.7 to 50.6. Both measures fell…

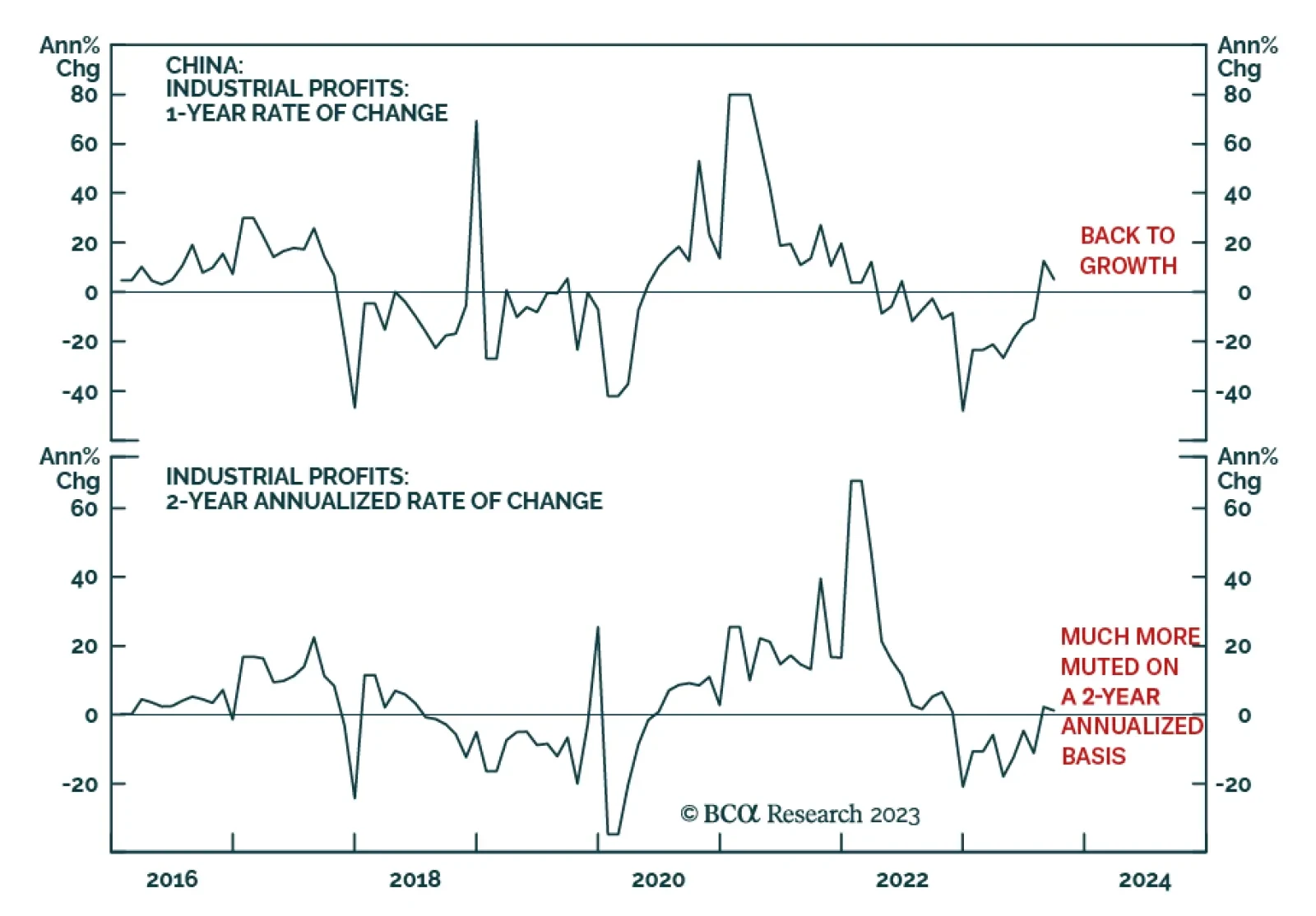

China's industrial profits delivered a positive signal over the past couple months. Total profits expanded on a year-on-year basis in both August (+17.2% y/y) and September (+11.9% y/y). Rebounding industrial profits is…

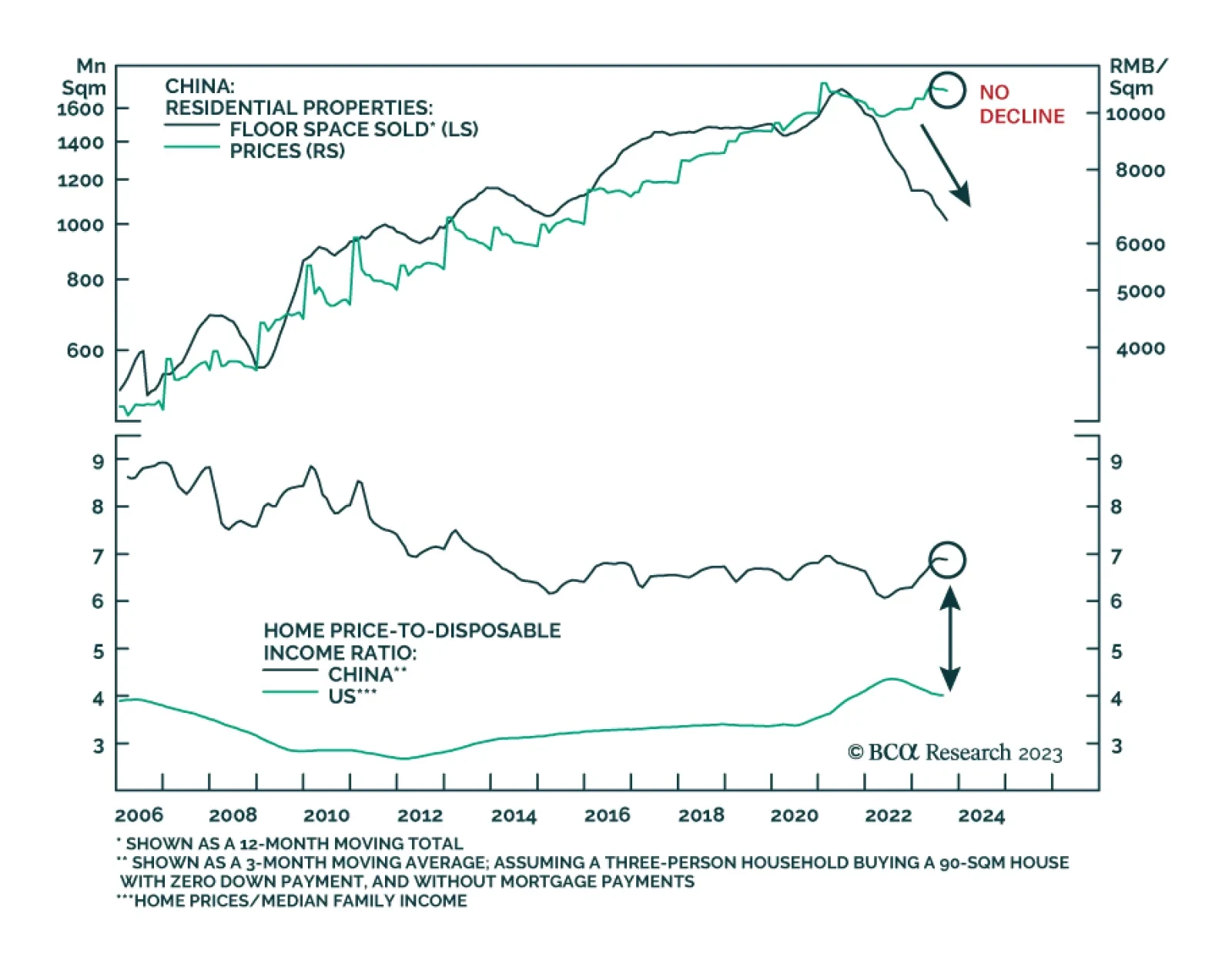

According to BCA Research's China Investment Strategy service, the property market has not cleared. Property market indicators suggest that China's real estate sector is still struggling to stabilize. Home sales and…

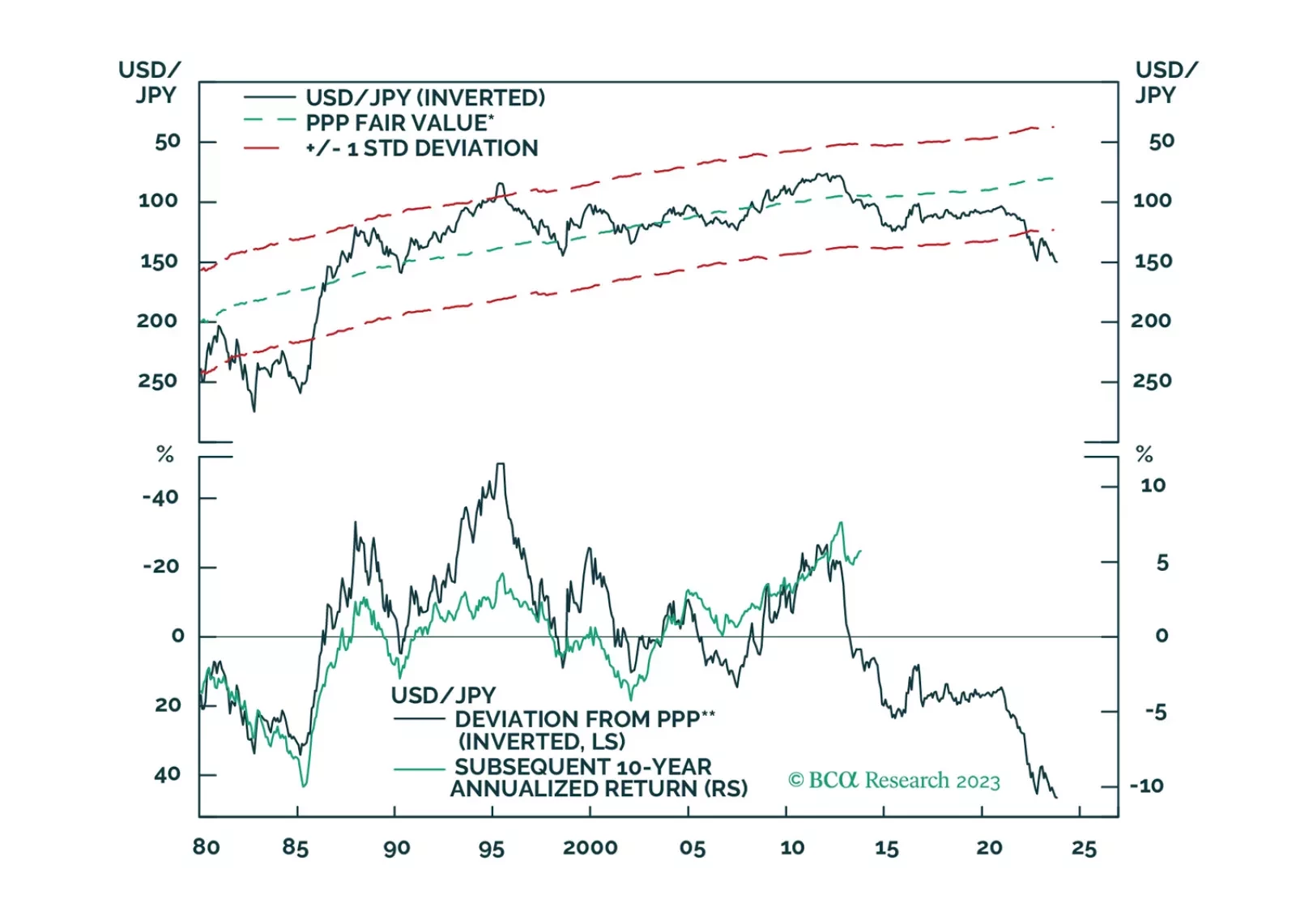

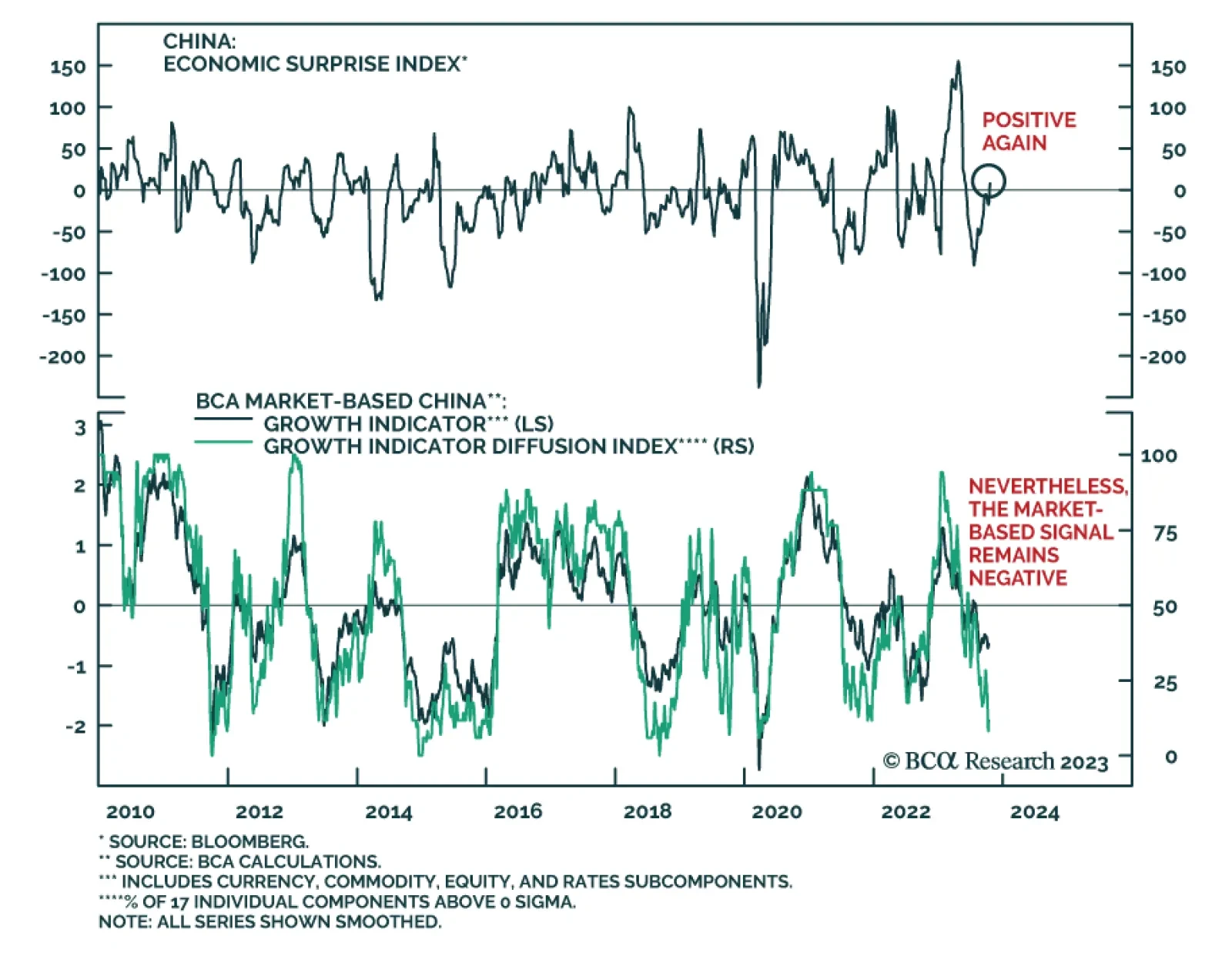

China’s economic growth will stagnate, at best, rather than revive. Lower valuations of Chinese equities are justified, and share prices have more downside. The RMB will continue to depreciate versus the US dollar.

China's CSI 300 equity index fell below its March 2020 pandemic low on Monday, bringing its loss since the February 2021 peak to -40%. Similarly, BCA Research's market-based China growth indicator – a broader…

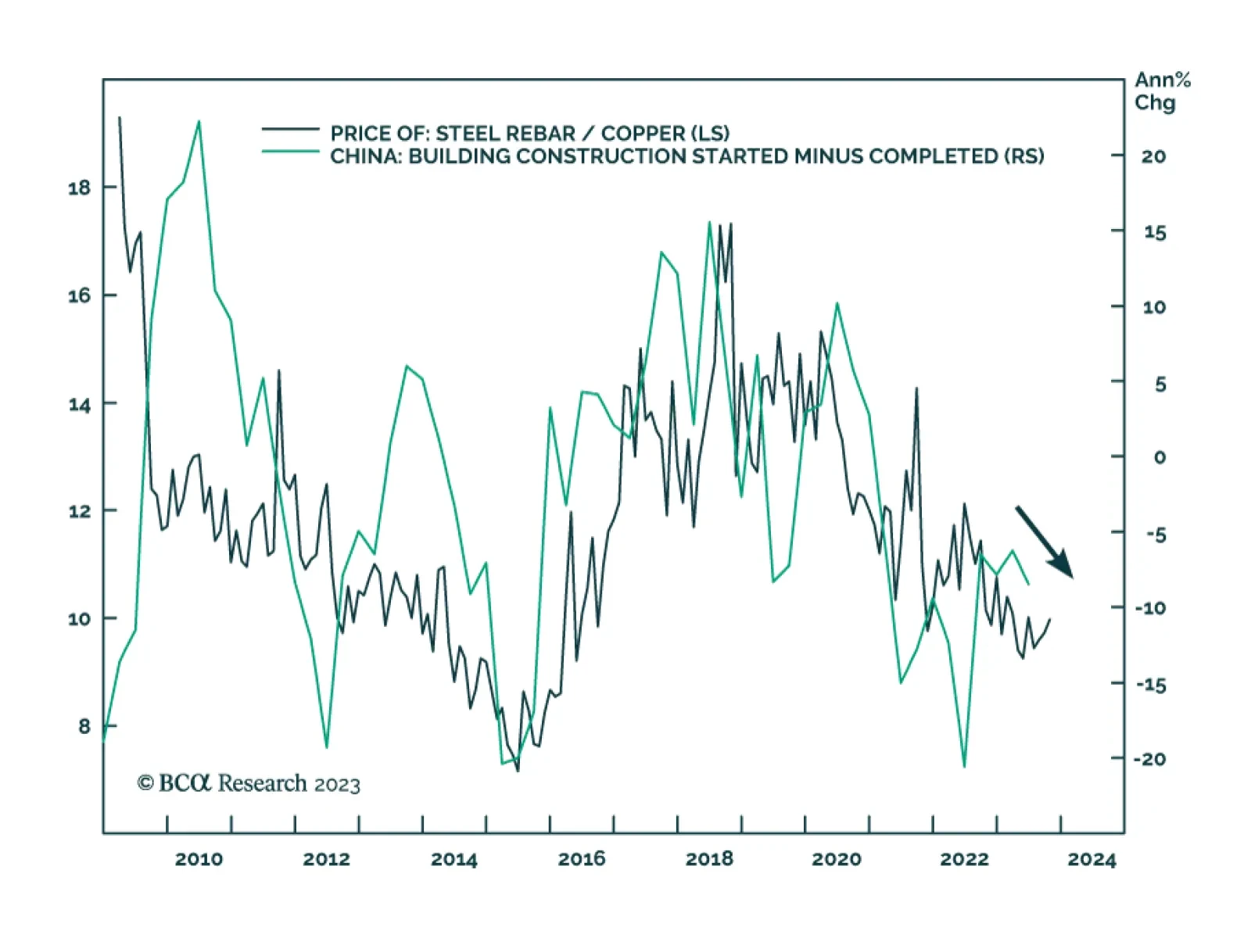

Earlier this year we highlighted that China's property market dynamics pose a greater risk to the price of steel vis-à-vis copper. This view was based on the expectation that Chinese policymakers will direct financing…

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

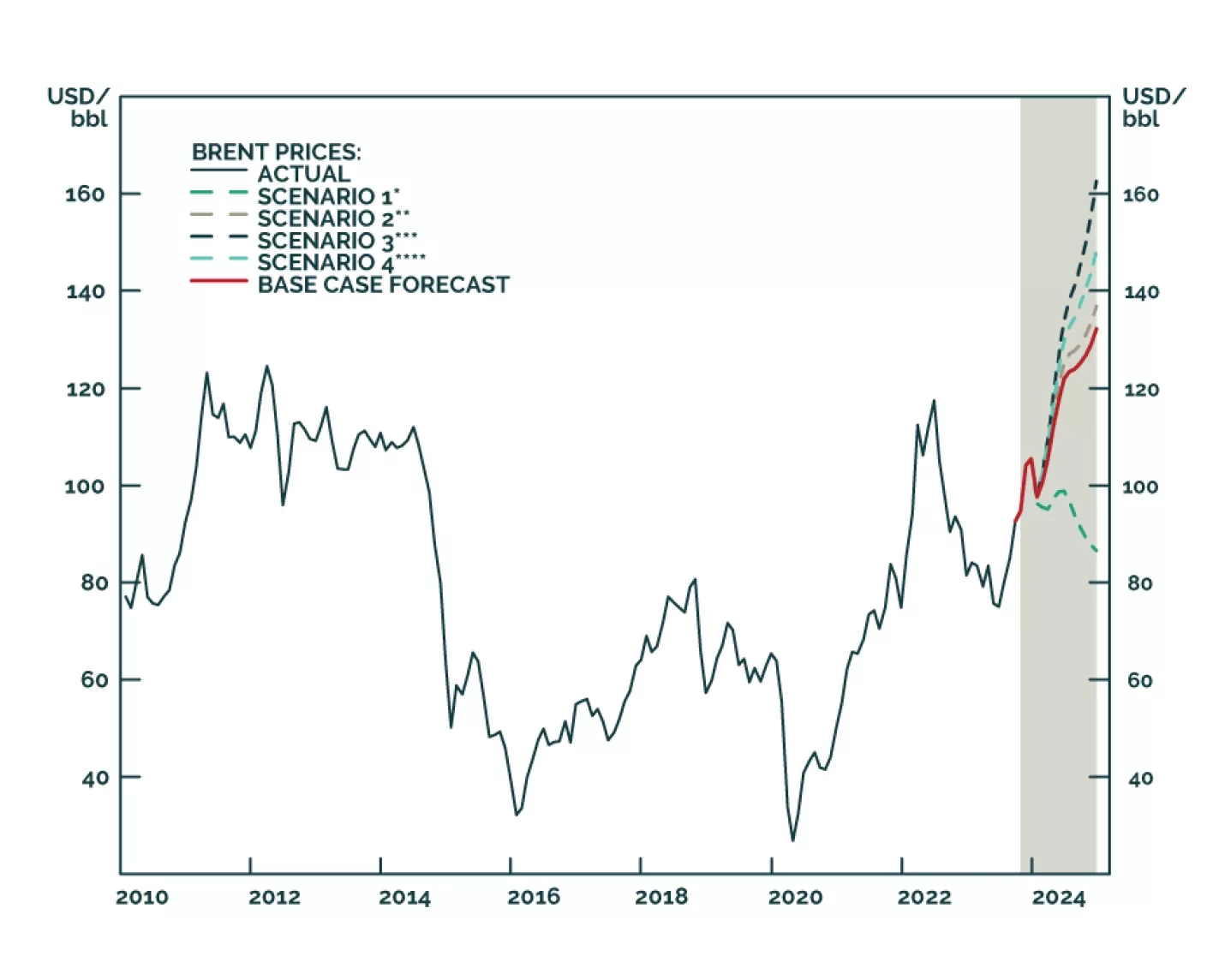

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…