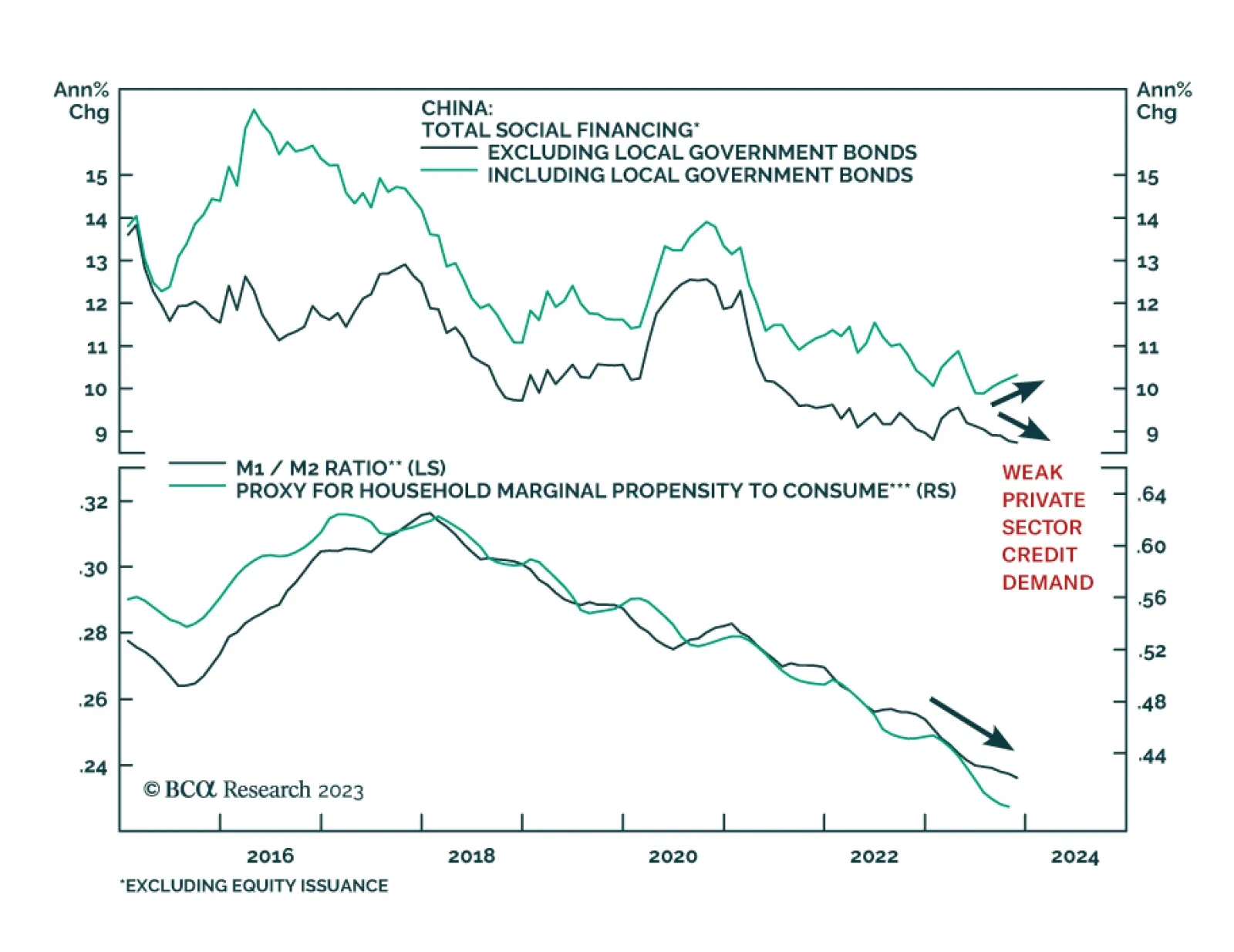

China’s credit expanded by less than expected in November. The CNY 2.45 trillion increase in aggregate financing fell short of anticipations of CNY 2.595 trillion following a CNY 1.845 trillion rise in October. Similarly,…

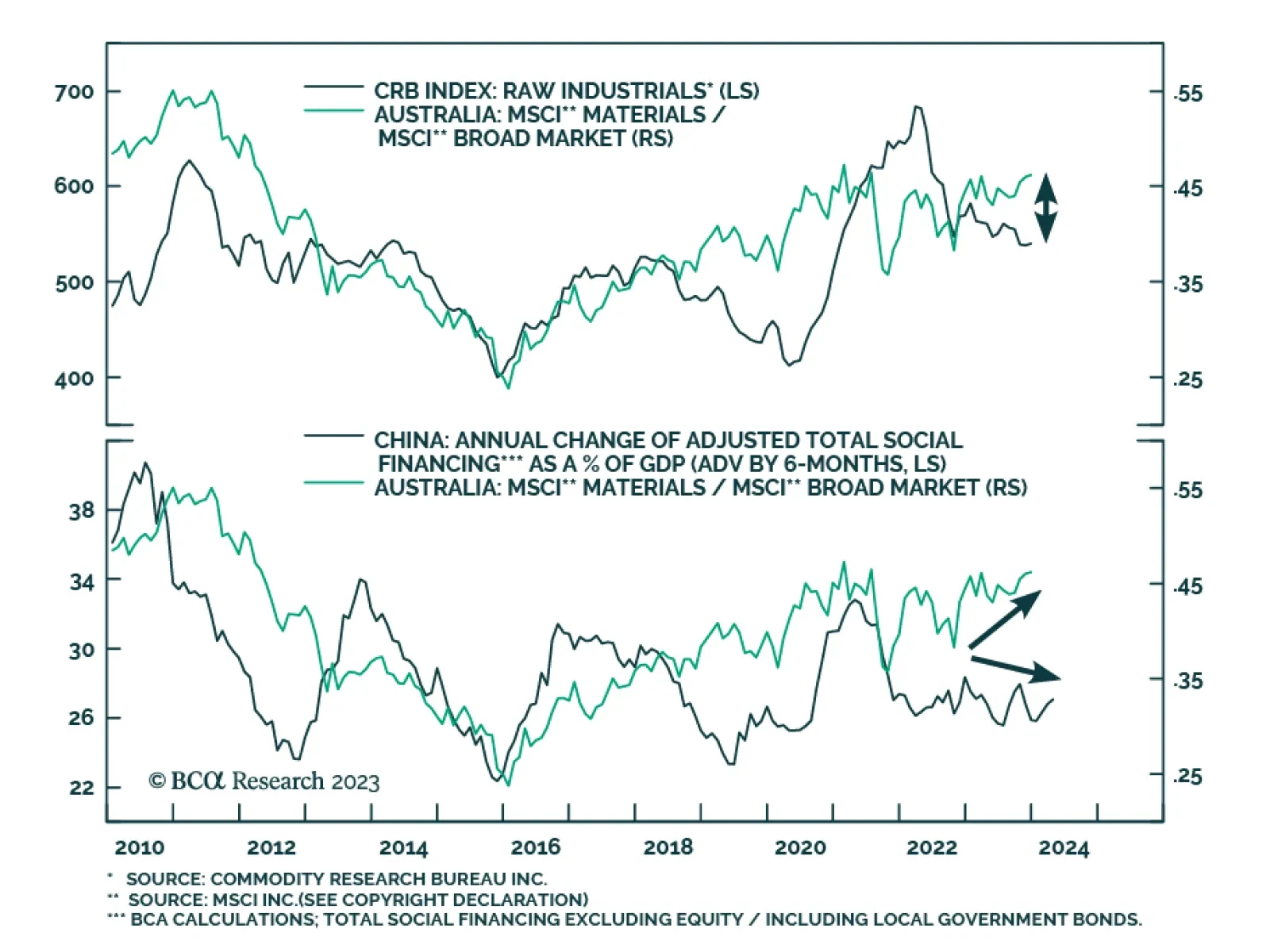

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

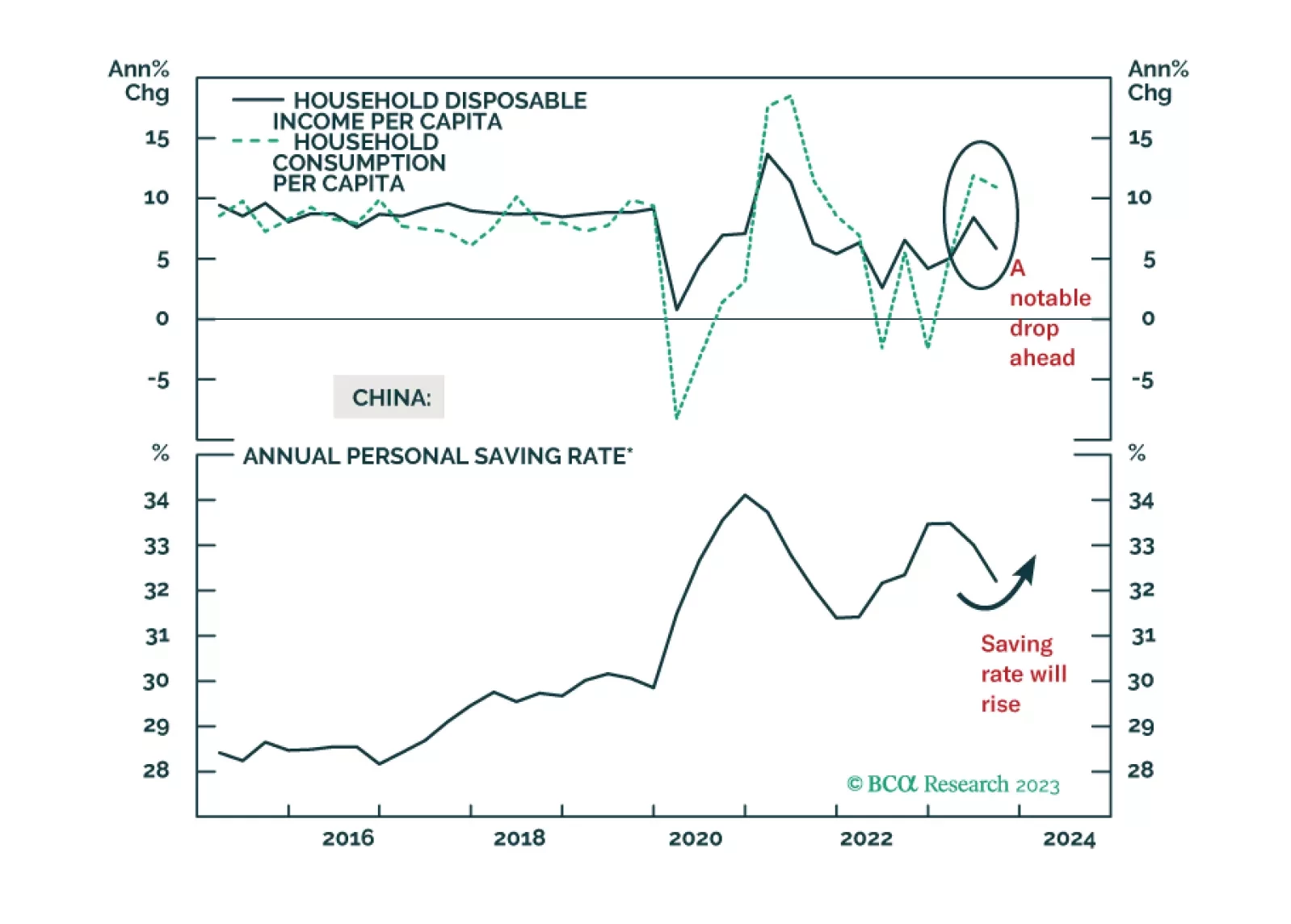

China’s CPI and PPI releases delivered a negative signal about the domestic economy. The rate of contraction in the CPI index accelerated to -0.5% y/y in November, the sharpest rate of decline in 3 years and disappointing…

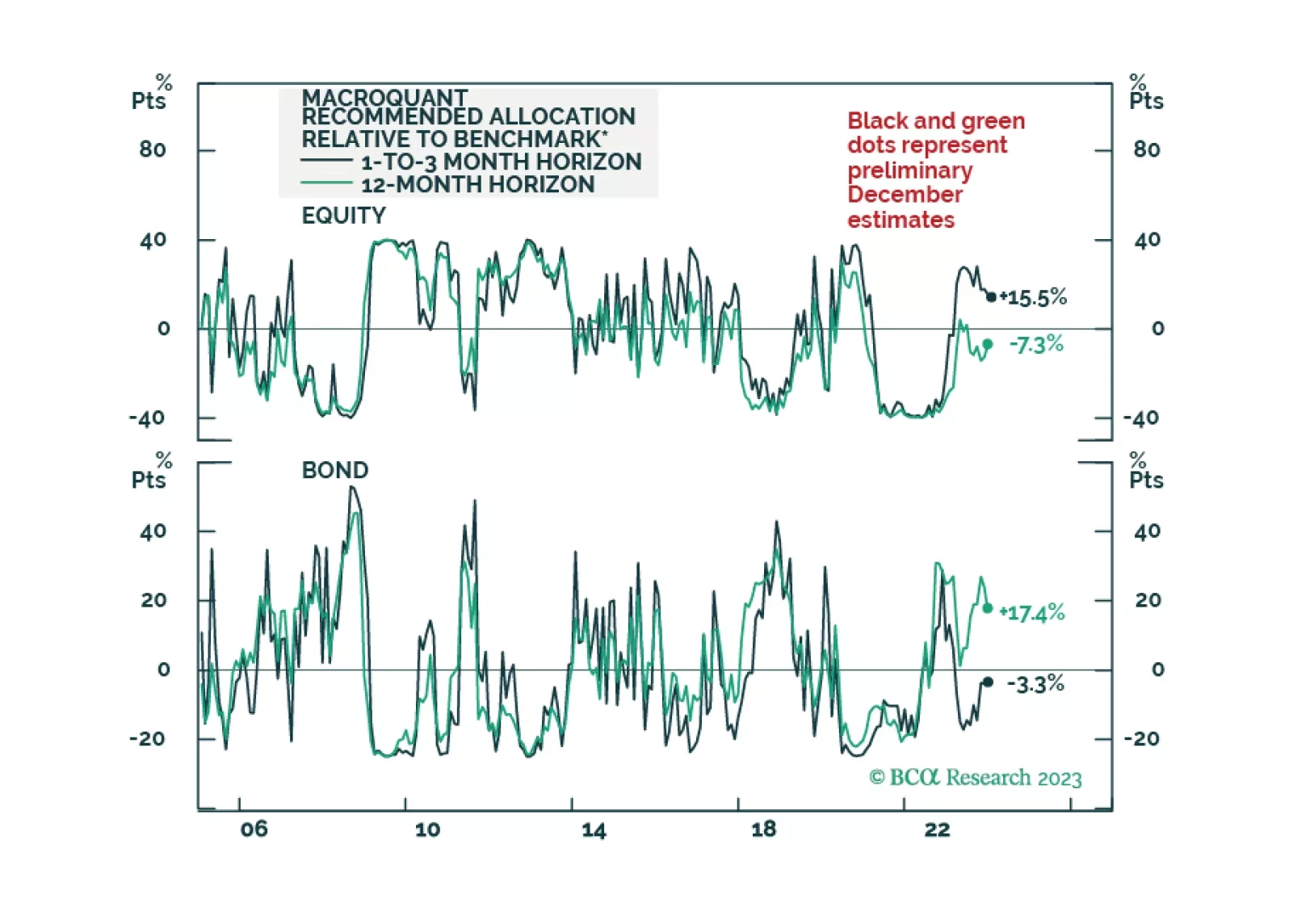

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

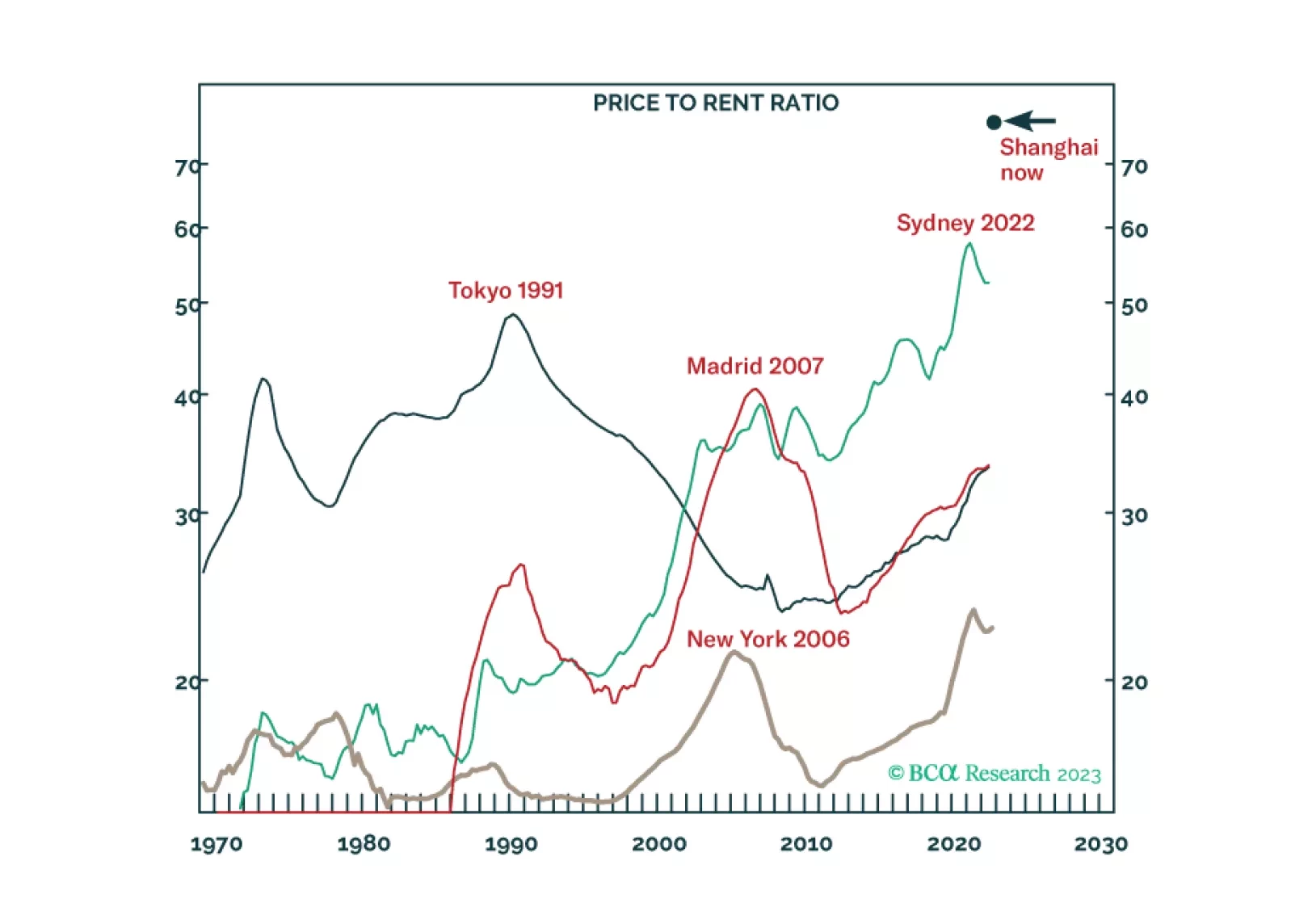

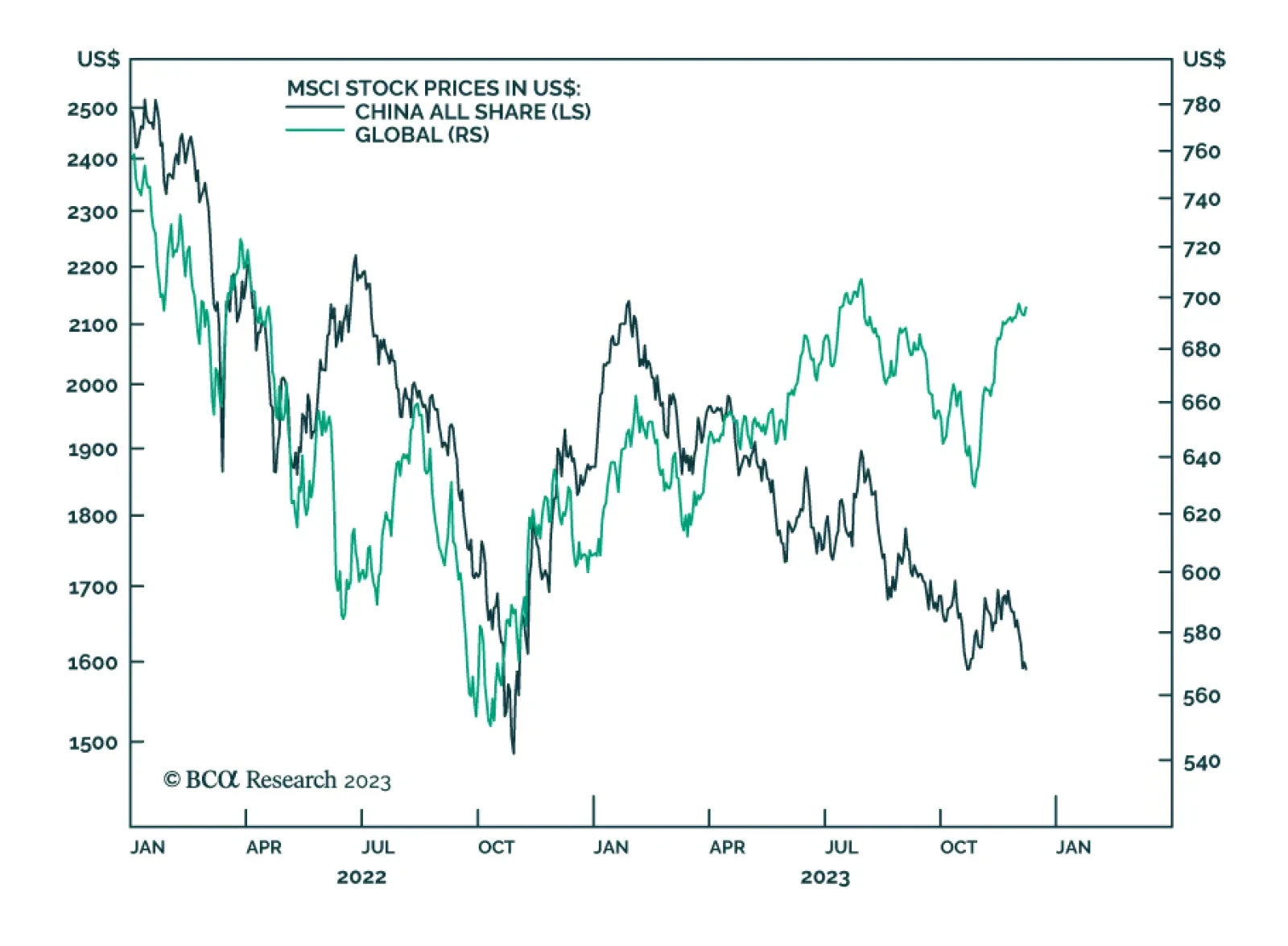

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…

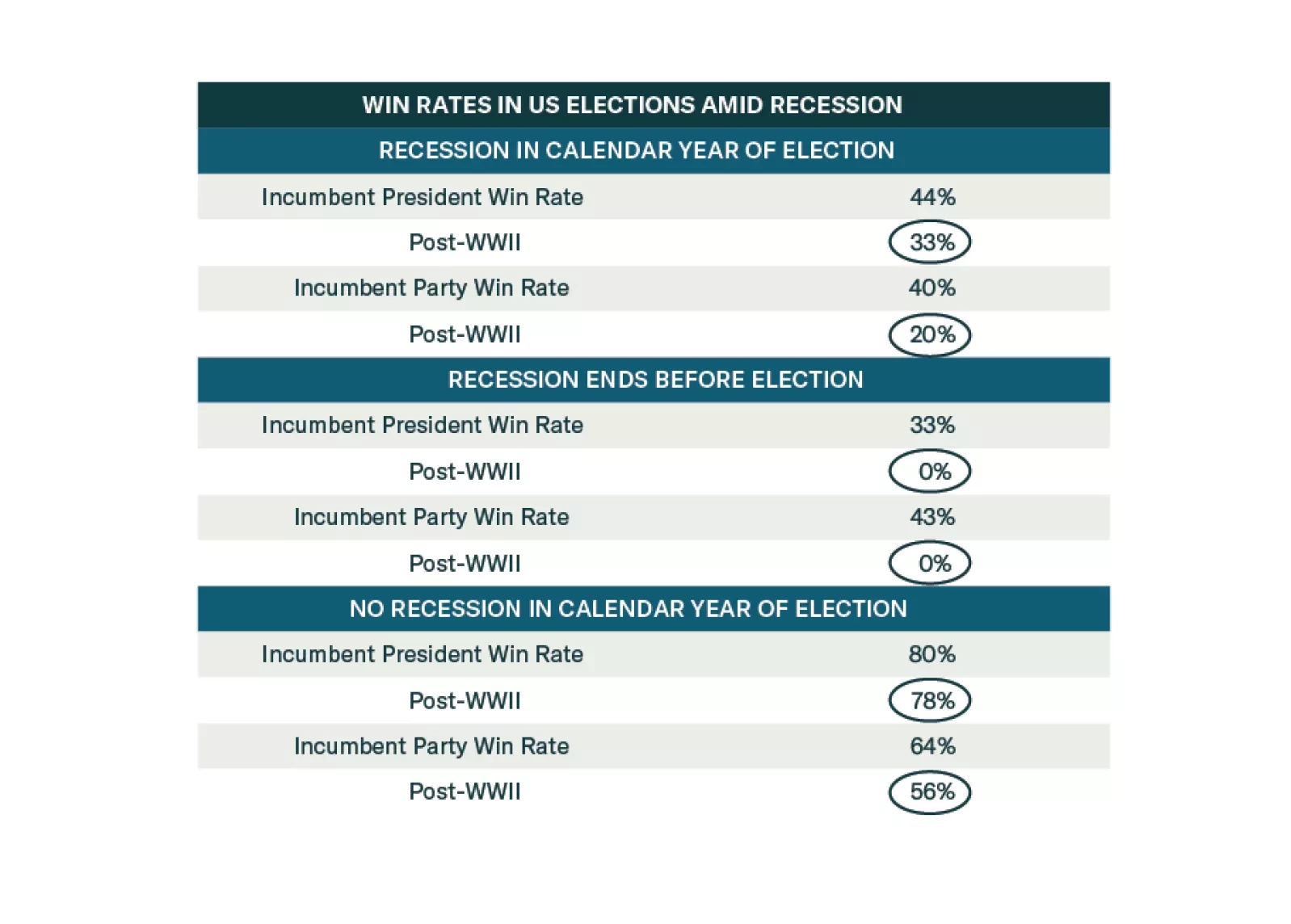

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

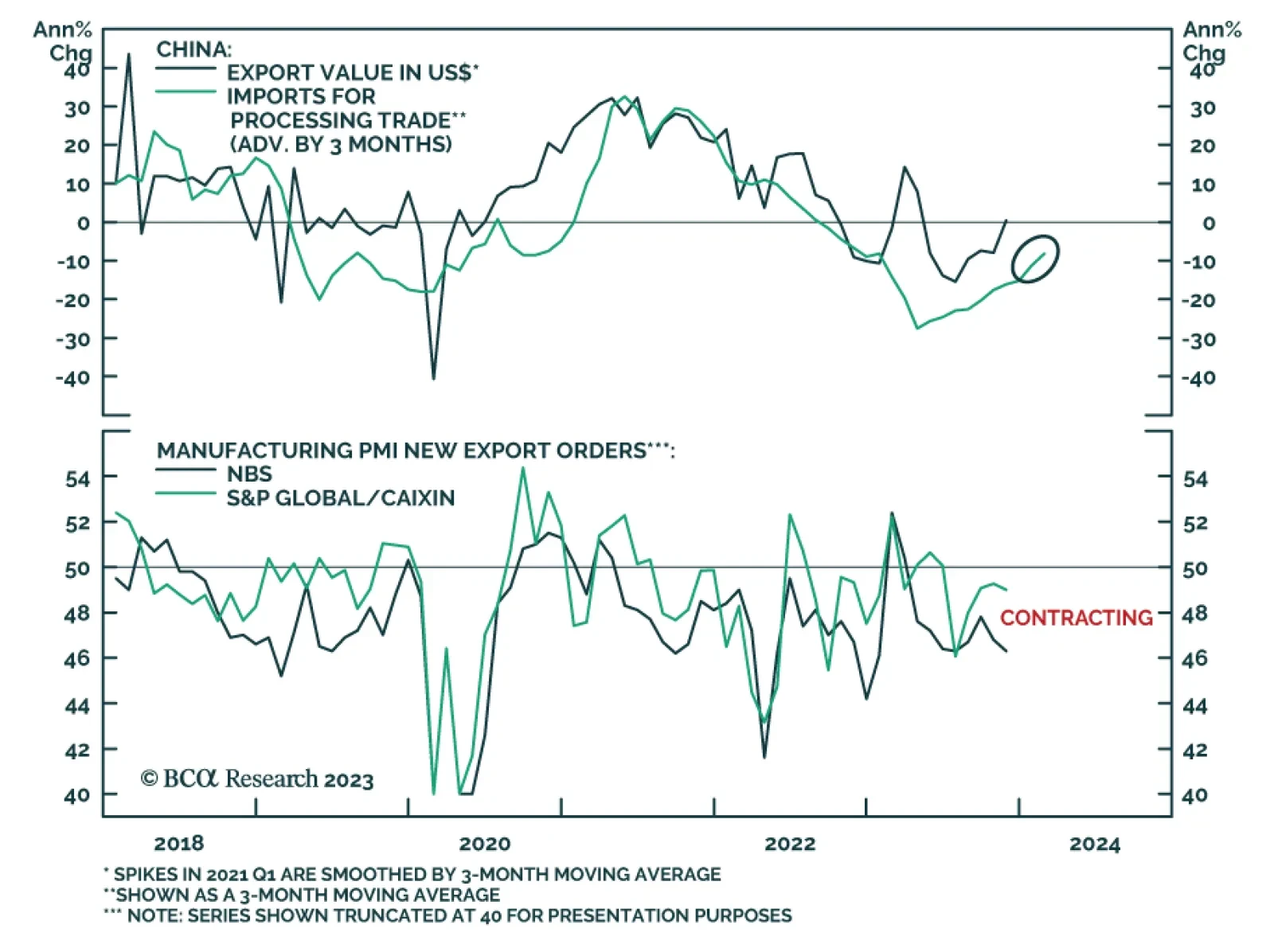

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…