Our Portfolio Allocation Summary for February 2024.

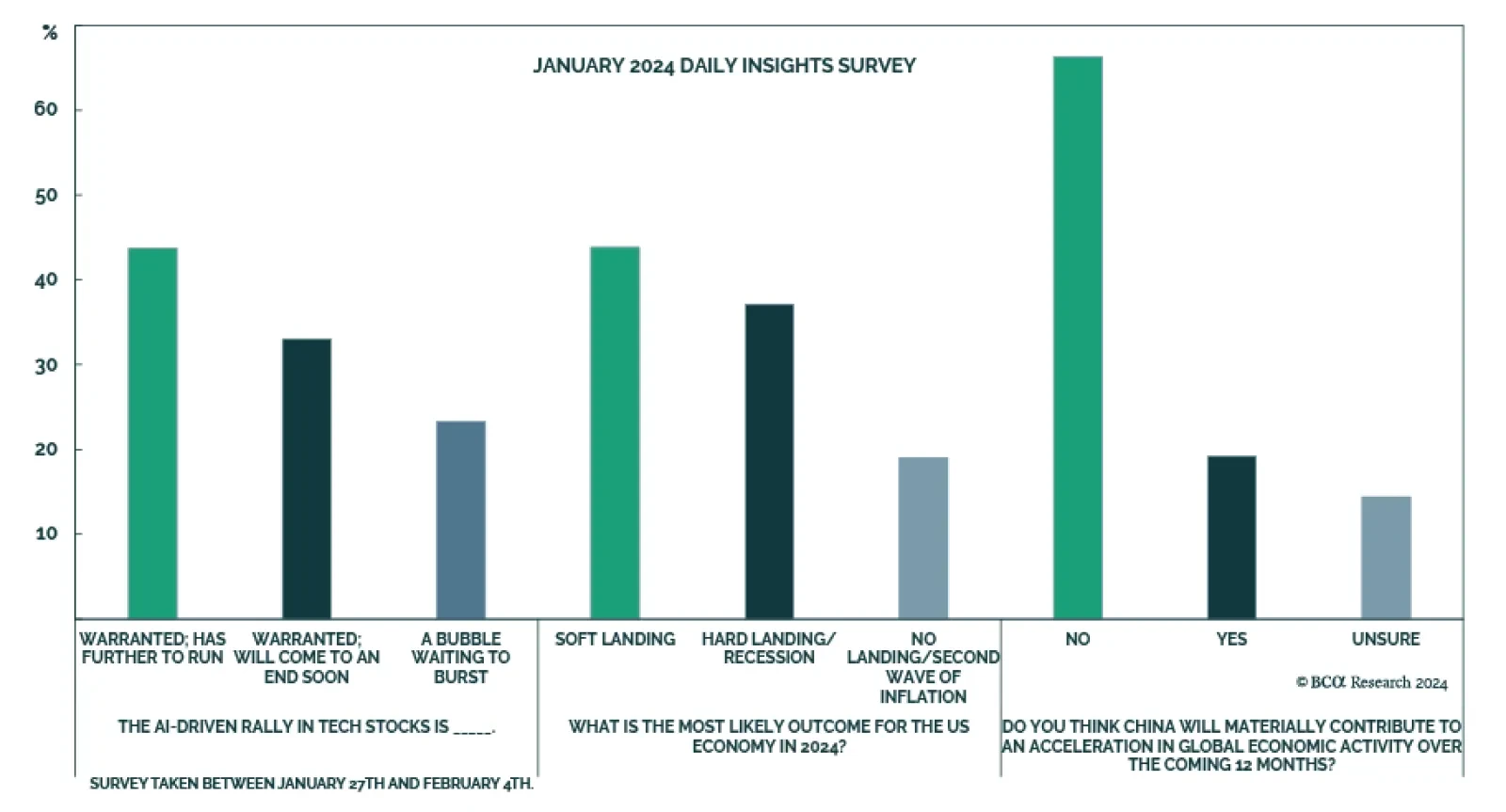

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ views on tech stocks, the US economy in 2024, and China’s contribution to global growth. Regarding tech stocks, 44%…

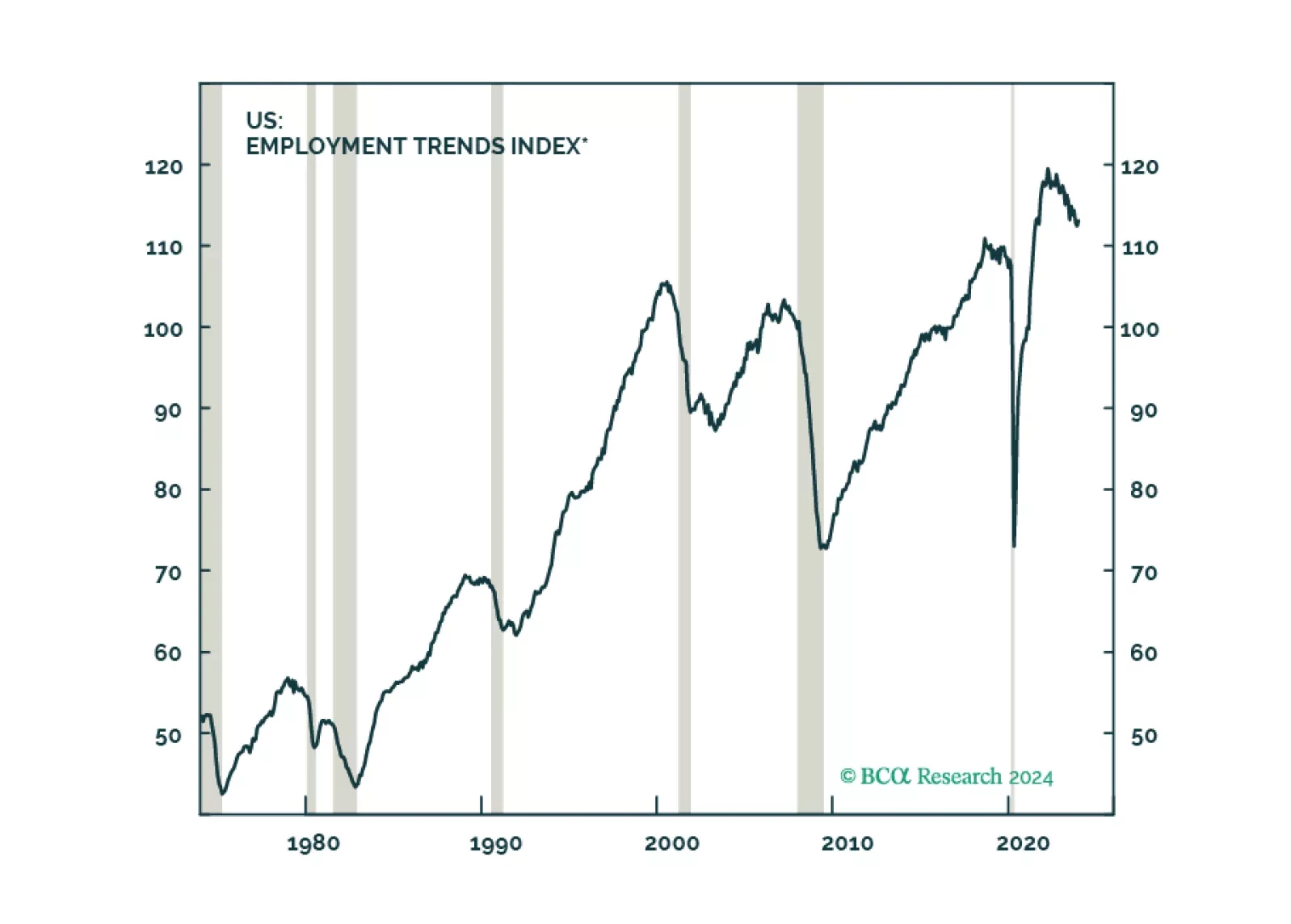

When will the US also buckle under high rates? We expect a US recession to begin around mid-year. Stay defensive.

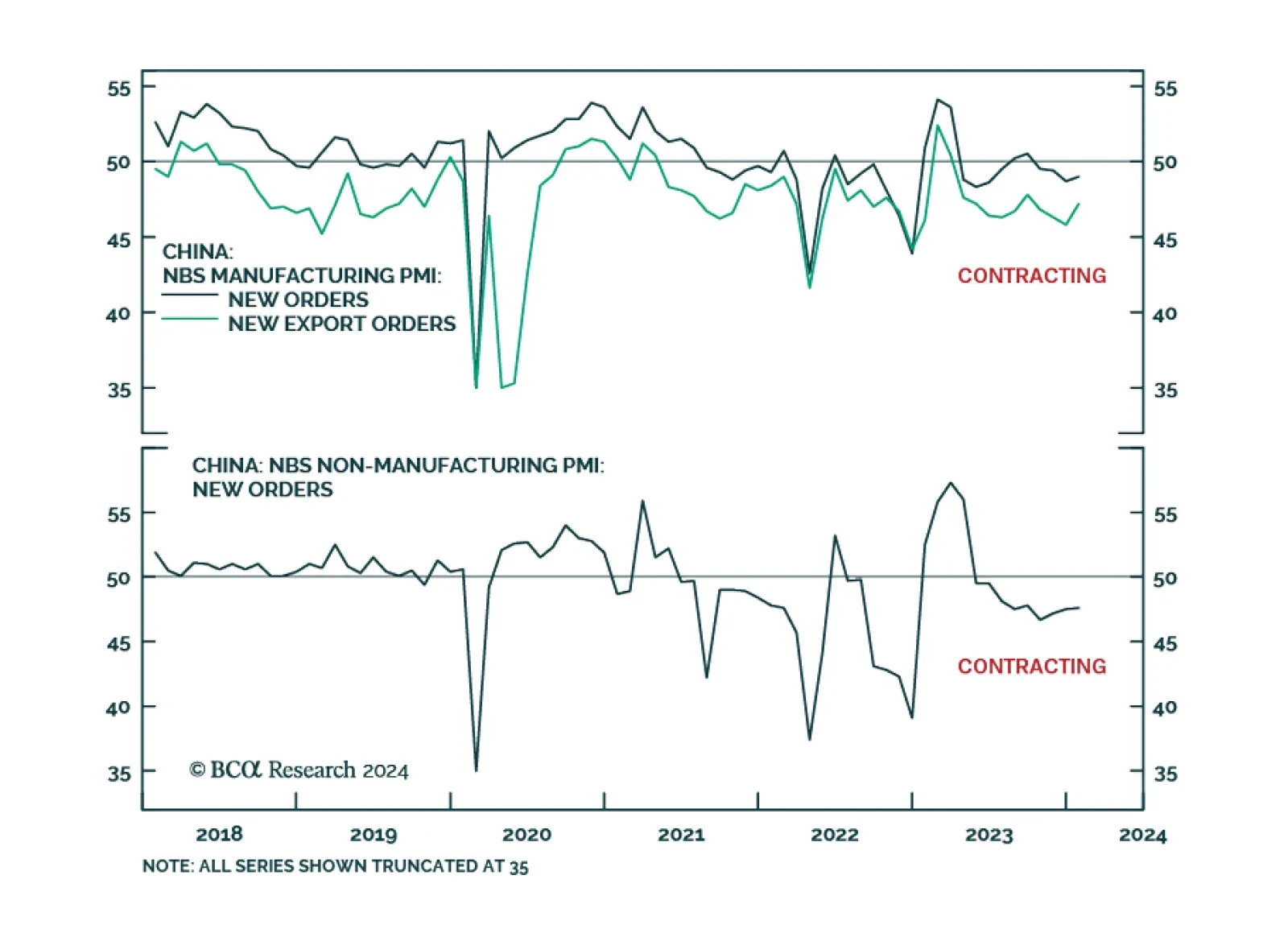

China’s official NBS PMI indicates that growth conditions remain sluggish. Although the composite index ticked up from 50.3 to 50.9, it is still barely in expansionary territory. Notably, the manufacturing PMI – which…

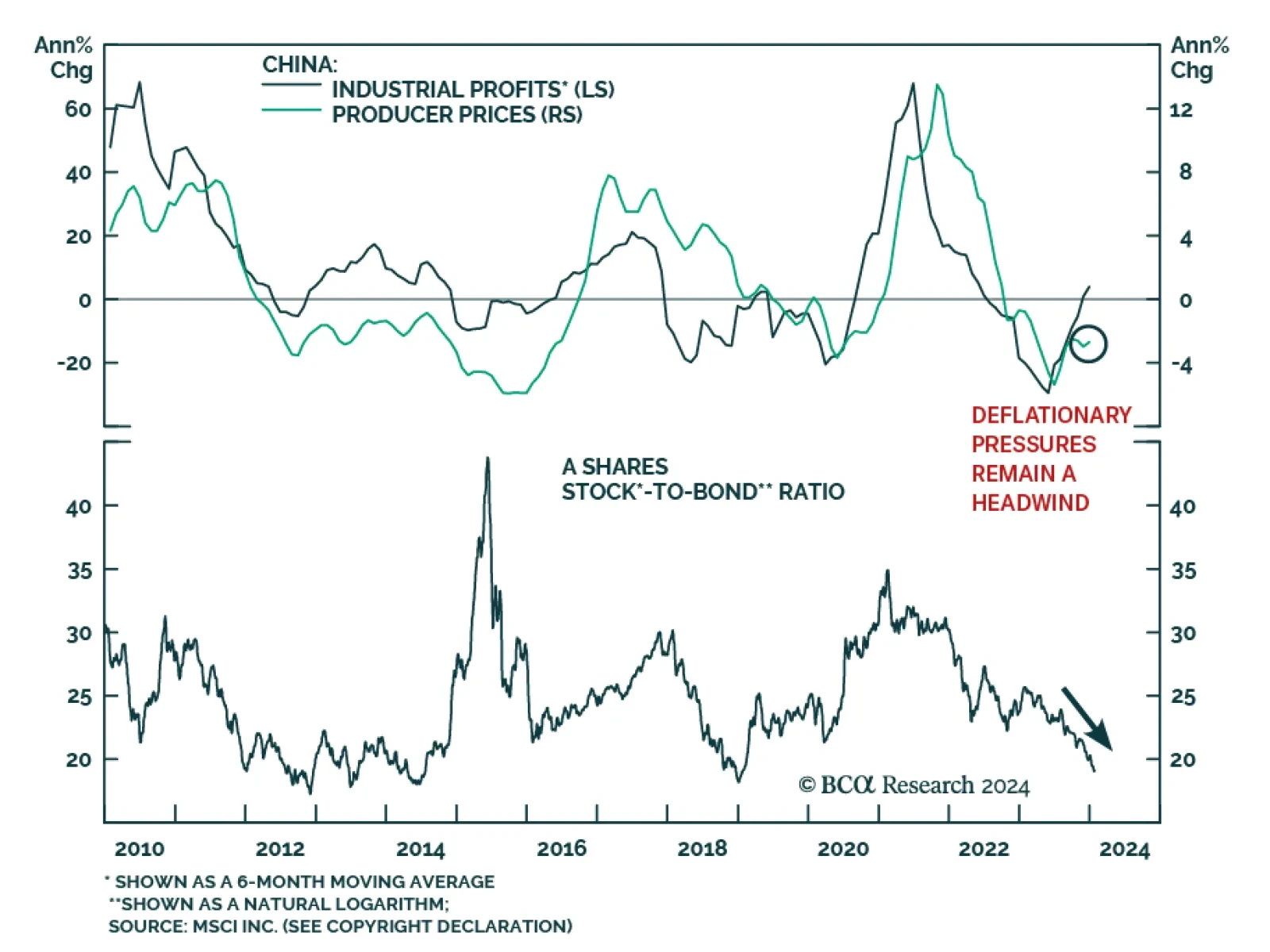

China’s industrial profits registered their second consecutive annual contraction last year, falling by 2.3% in 2023. The full year contraction comes despite a surge in industrial profits near year-end. Profit growth…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

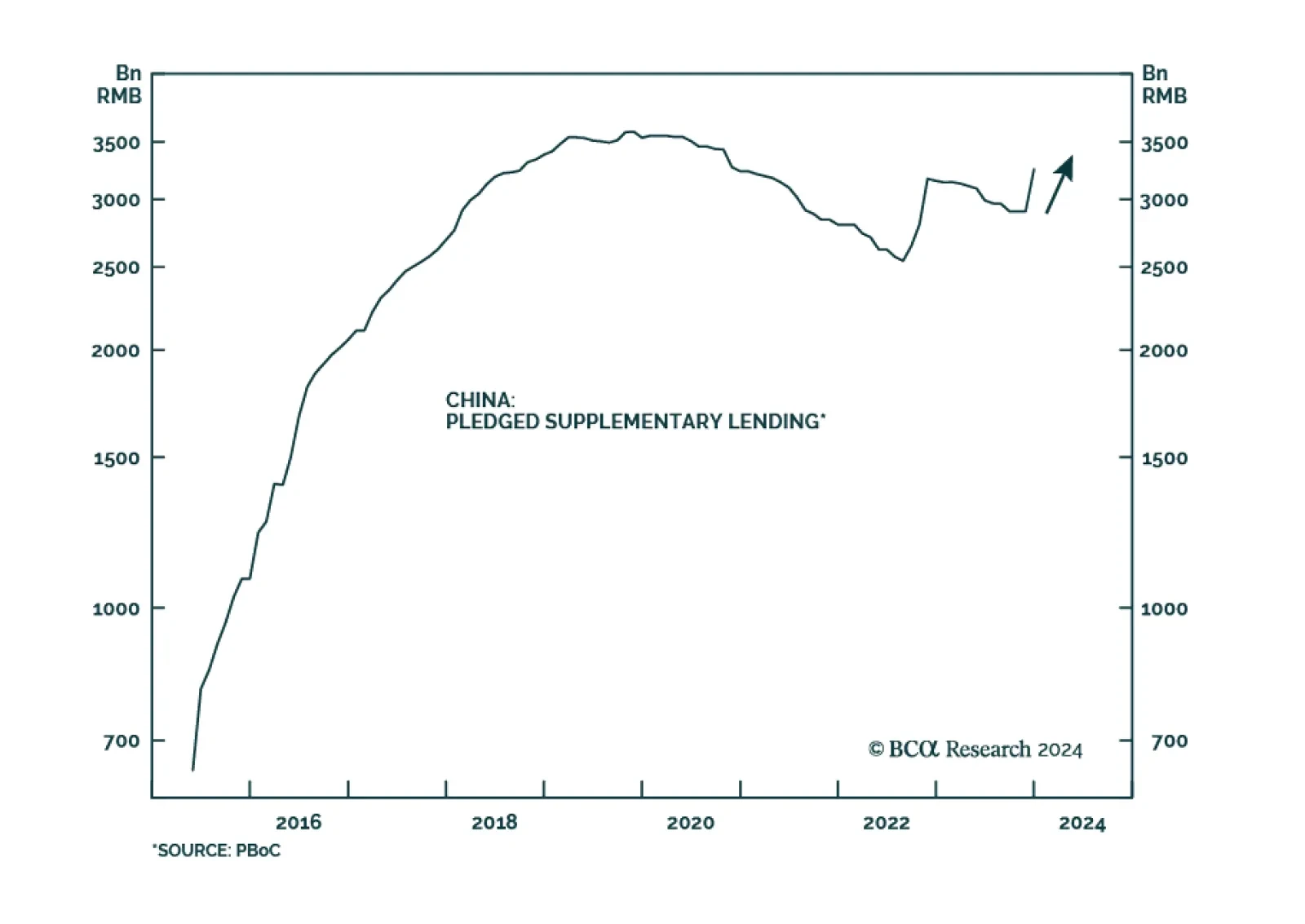

According to BCA Research’s China Investment Strategy service, the current Pledged Supplementary Lending (PSL) program will provide much less support to the housing market and construction activity than the 2015-2018…

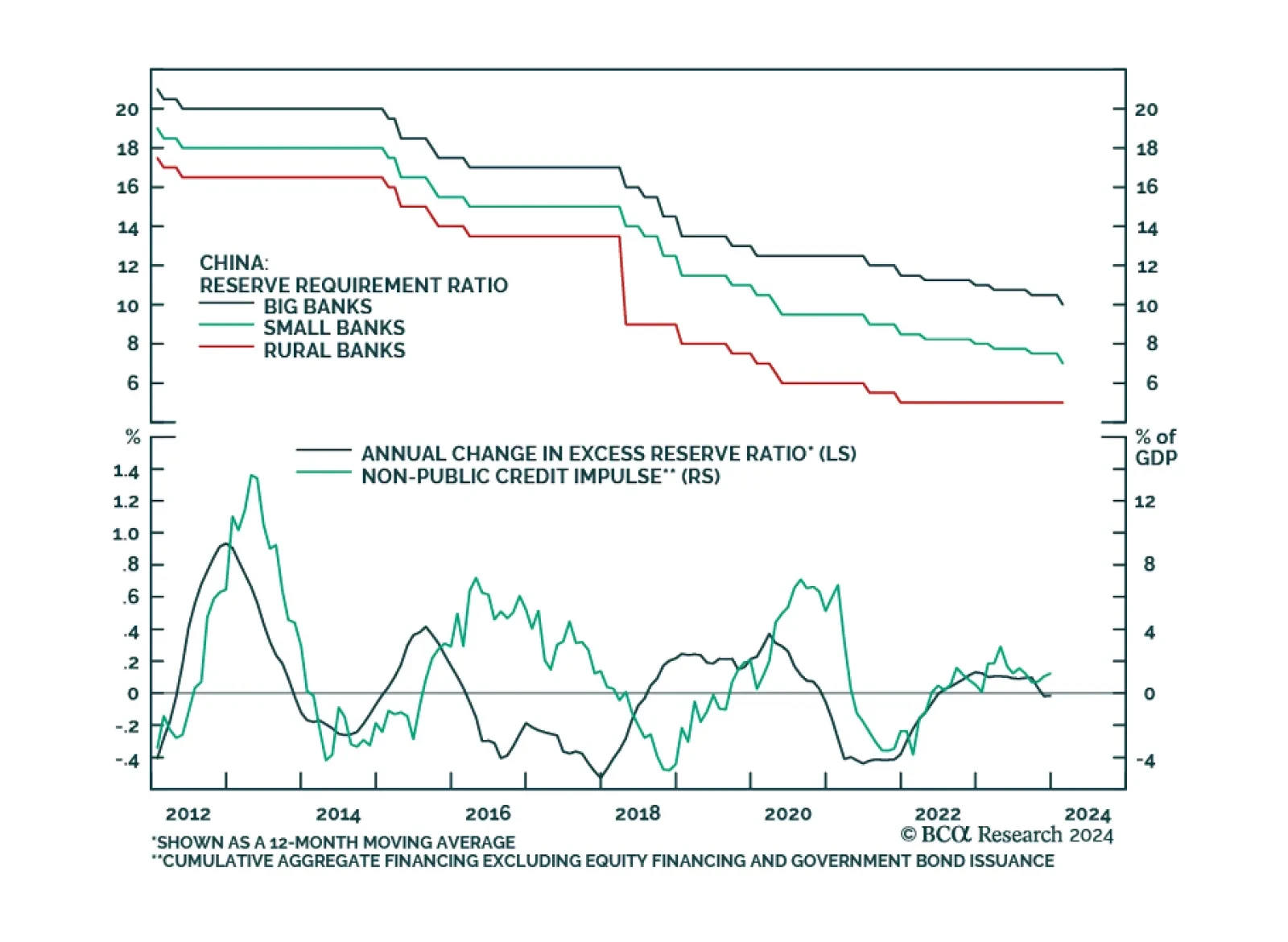

Chinese policymakers have ramped up their efforts to support the economy and financial markets over the past few days. On Wednesday, the People’s Bank of China (PBoC) announced that on February 5 it will cut the reserve…