This report provides our framework for interpreting the messages from last week’s Third Plenum, and the potential implications for the economy and investors.

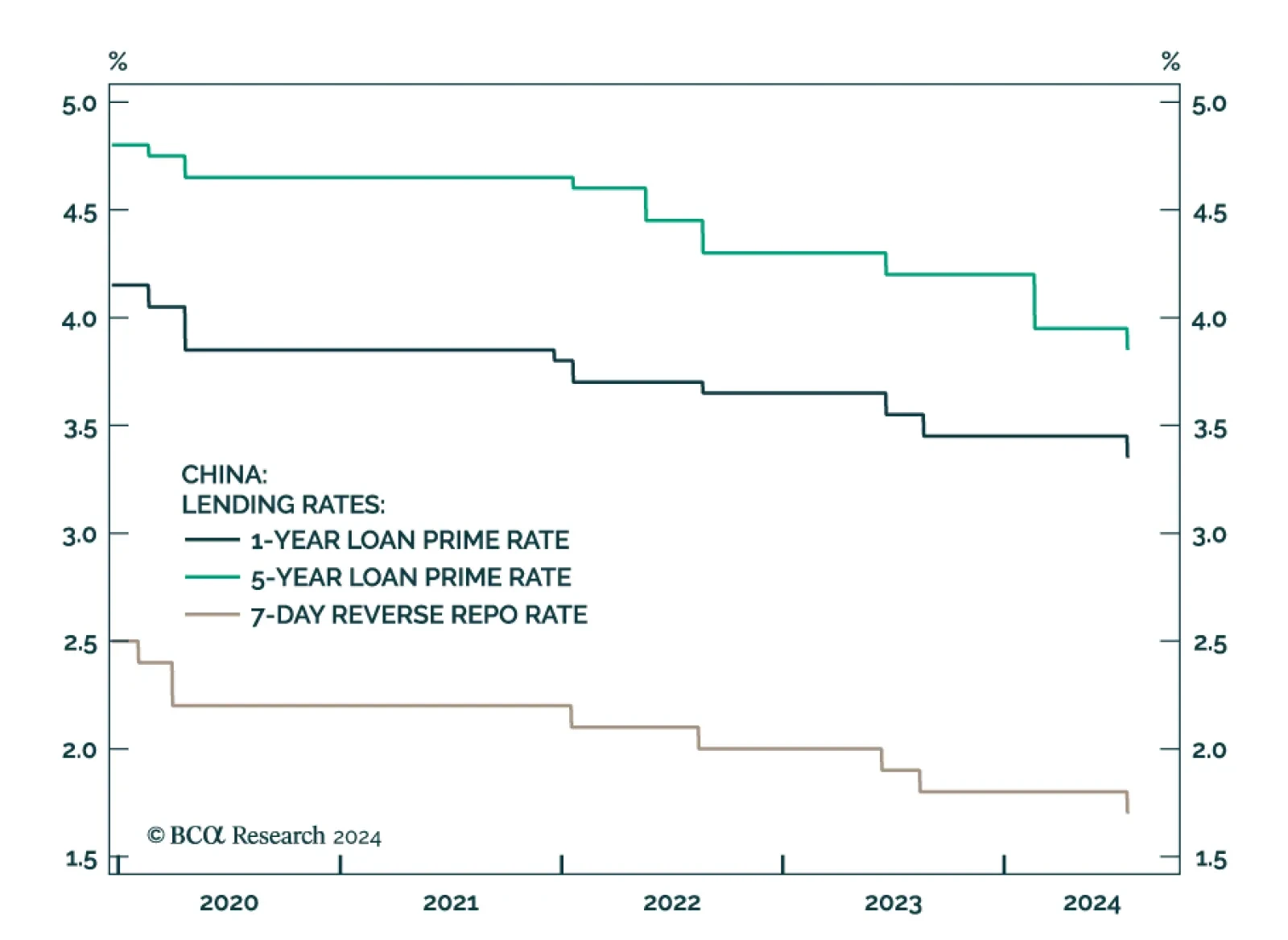

The PBoC lowered the 7-day reverse repo rate from 1.80% to 1.70% on Monday. The 5-year and 1-year loan prime rates declined by 10 basis points (bps) to 3.85% and 3.35%, respectively. However, this 10-bps cut is unlikely to…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

Though hope springs eternal among global investors for big-bang stimulus from Beijing, the closely watched Third Plenum adjourned without any specific prescriptions to reverse China’s economic slump. The communiqu…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

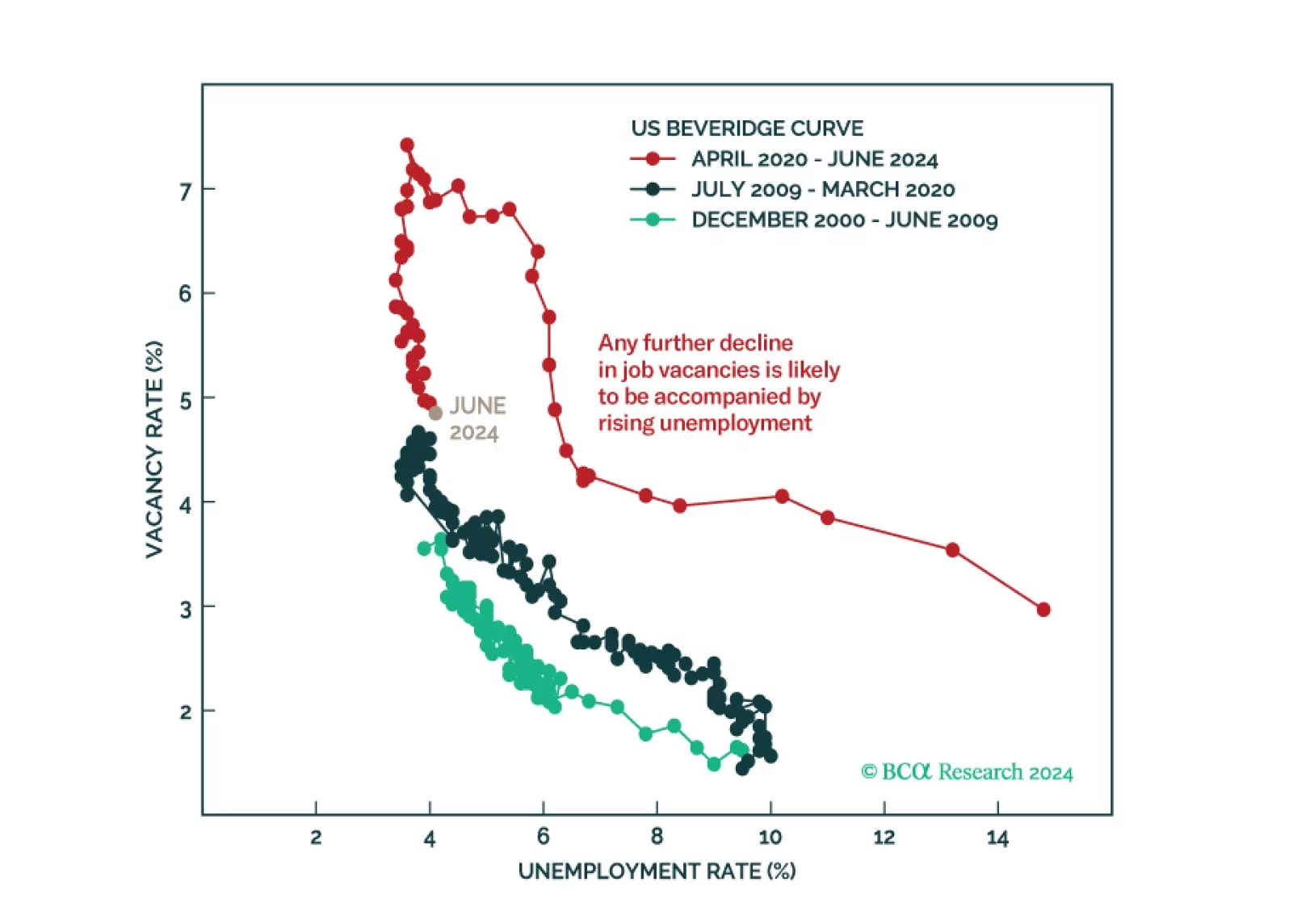

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

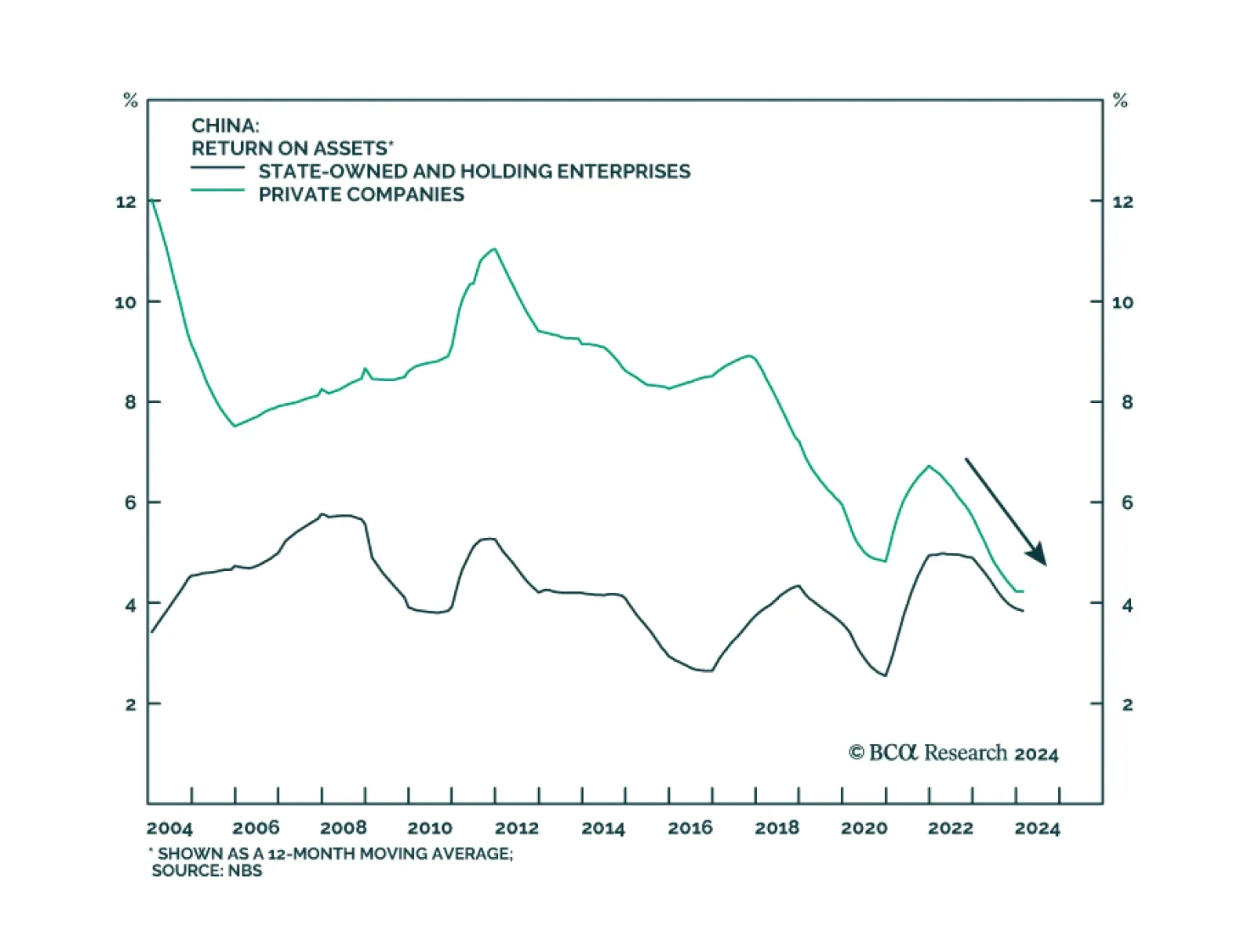

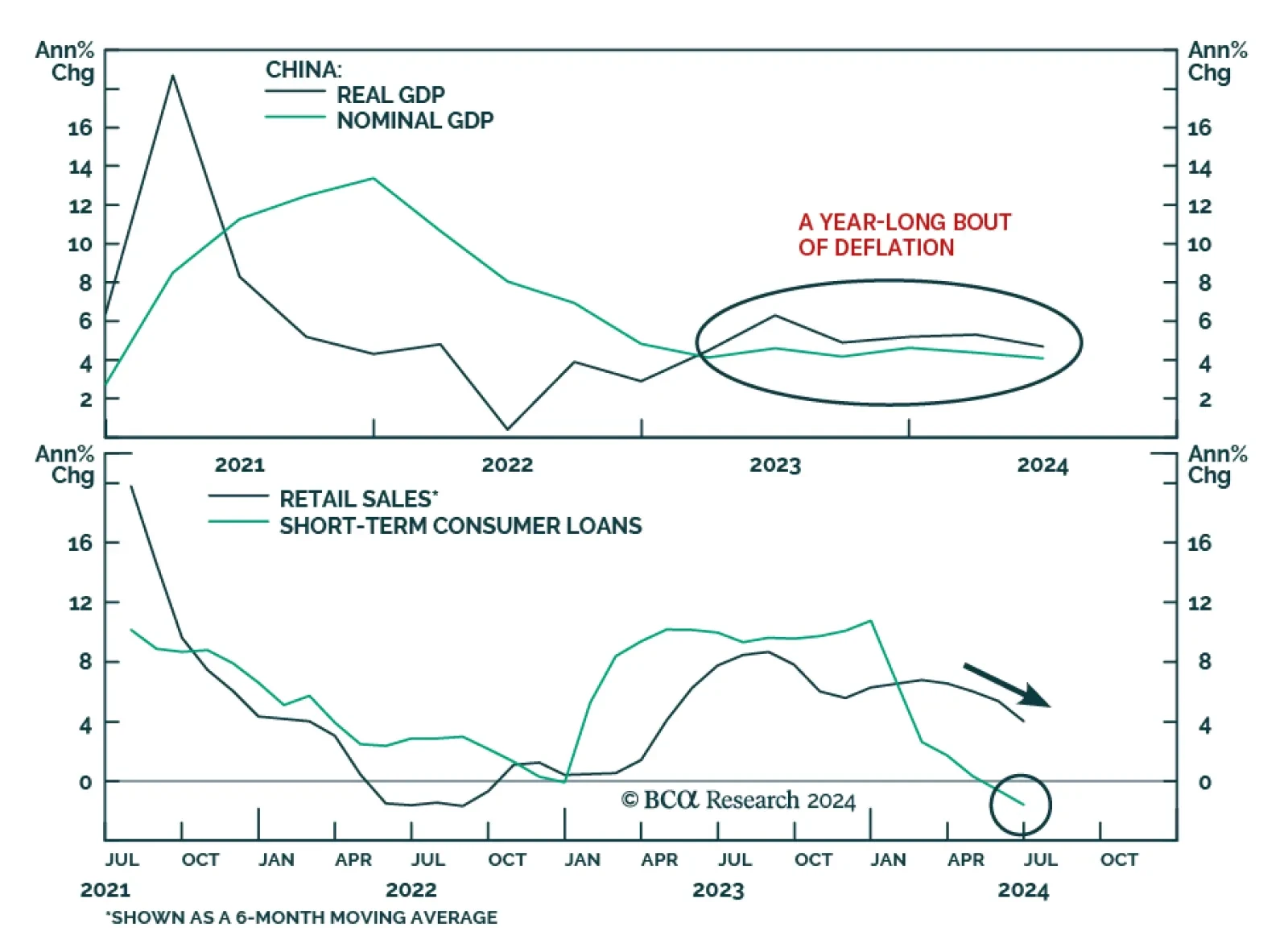

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

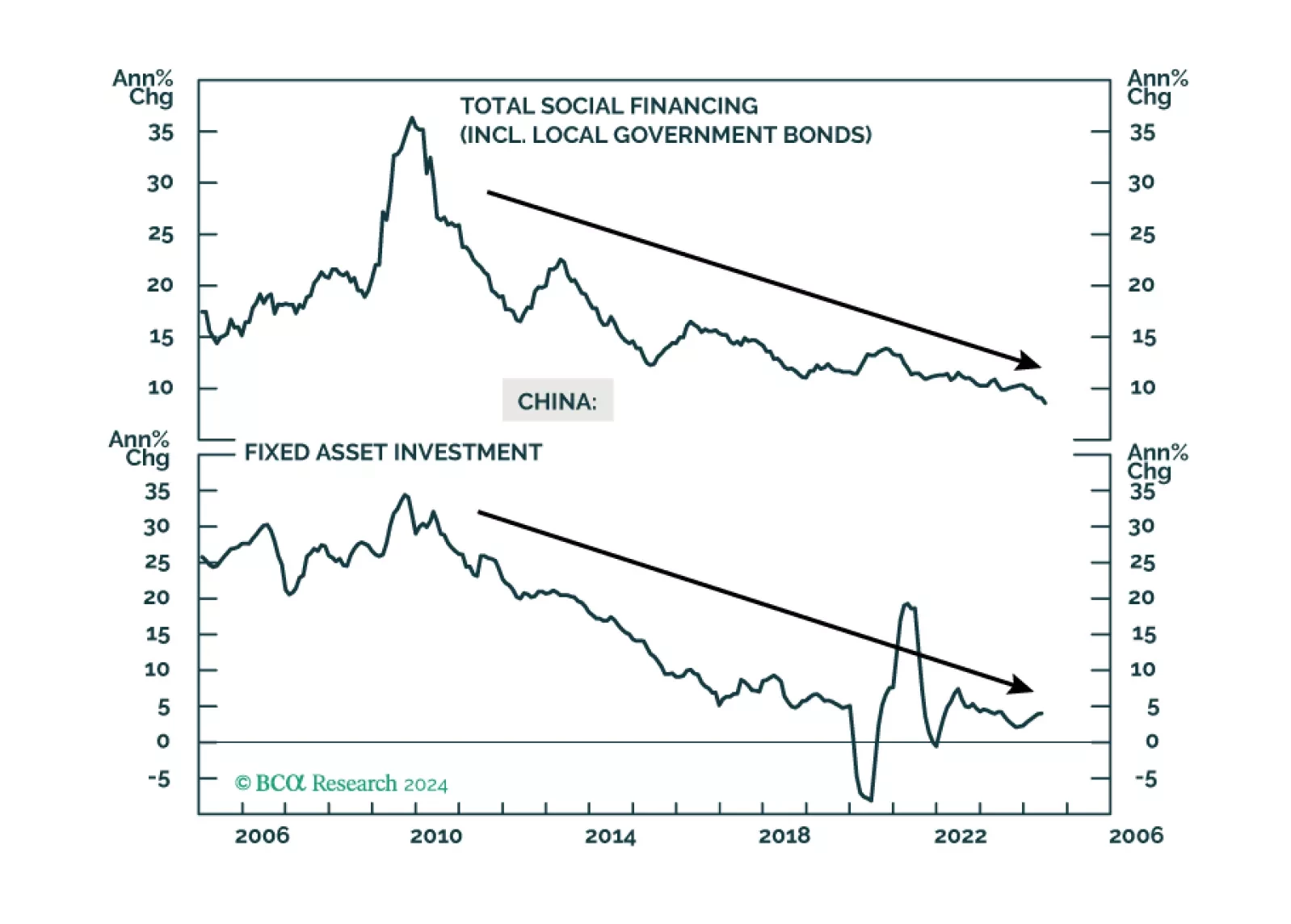

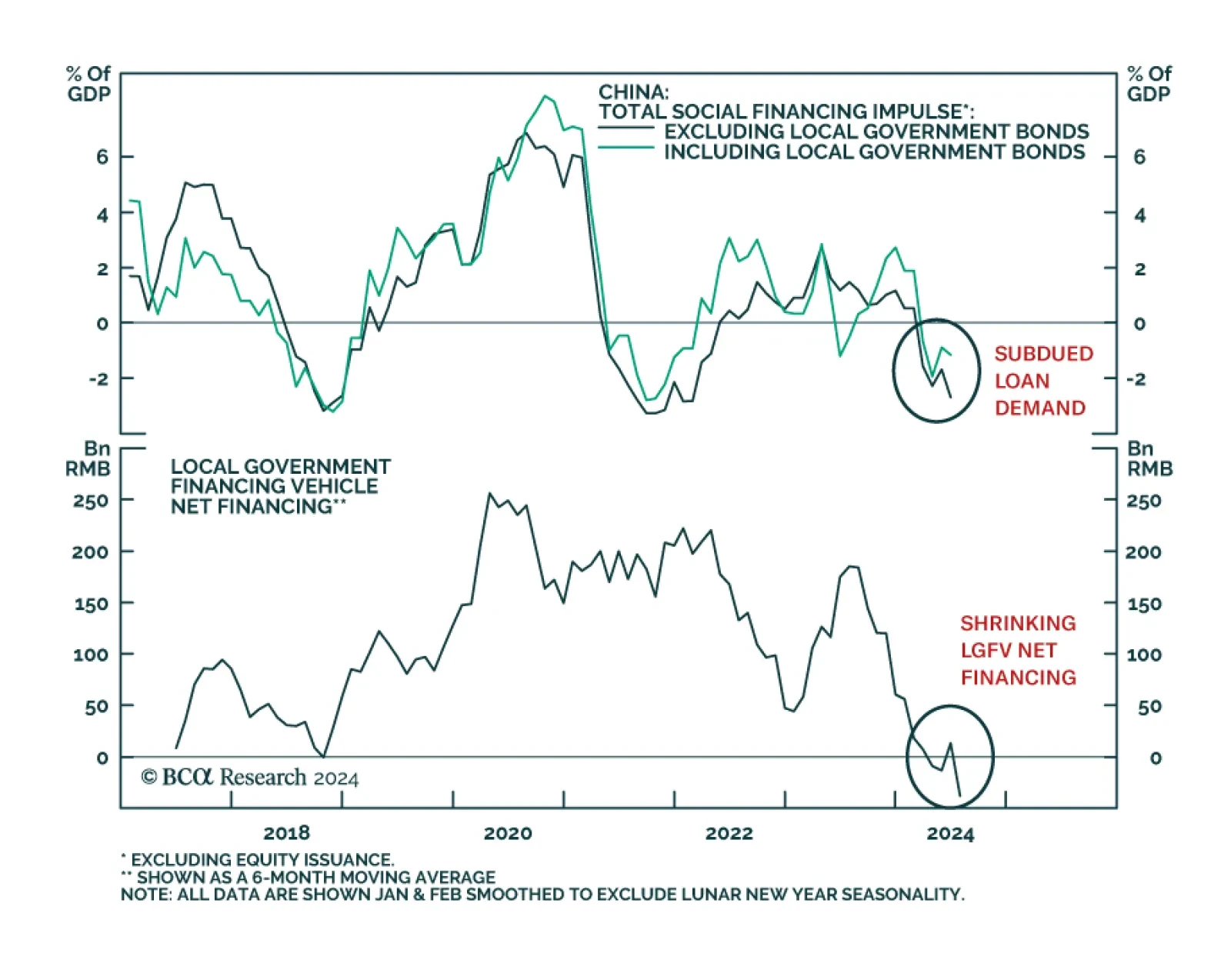

Subdued demand for credit among Chinese private-sector businesses and households persisted through June. The stock of outstanding bank loans grew by 8.3% year-on-year, marking the slowest pace since records began in 2003.…

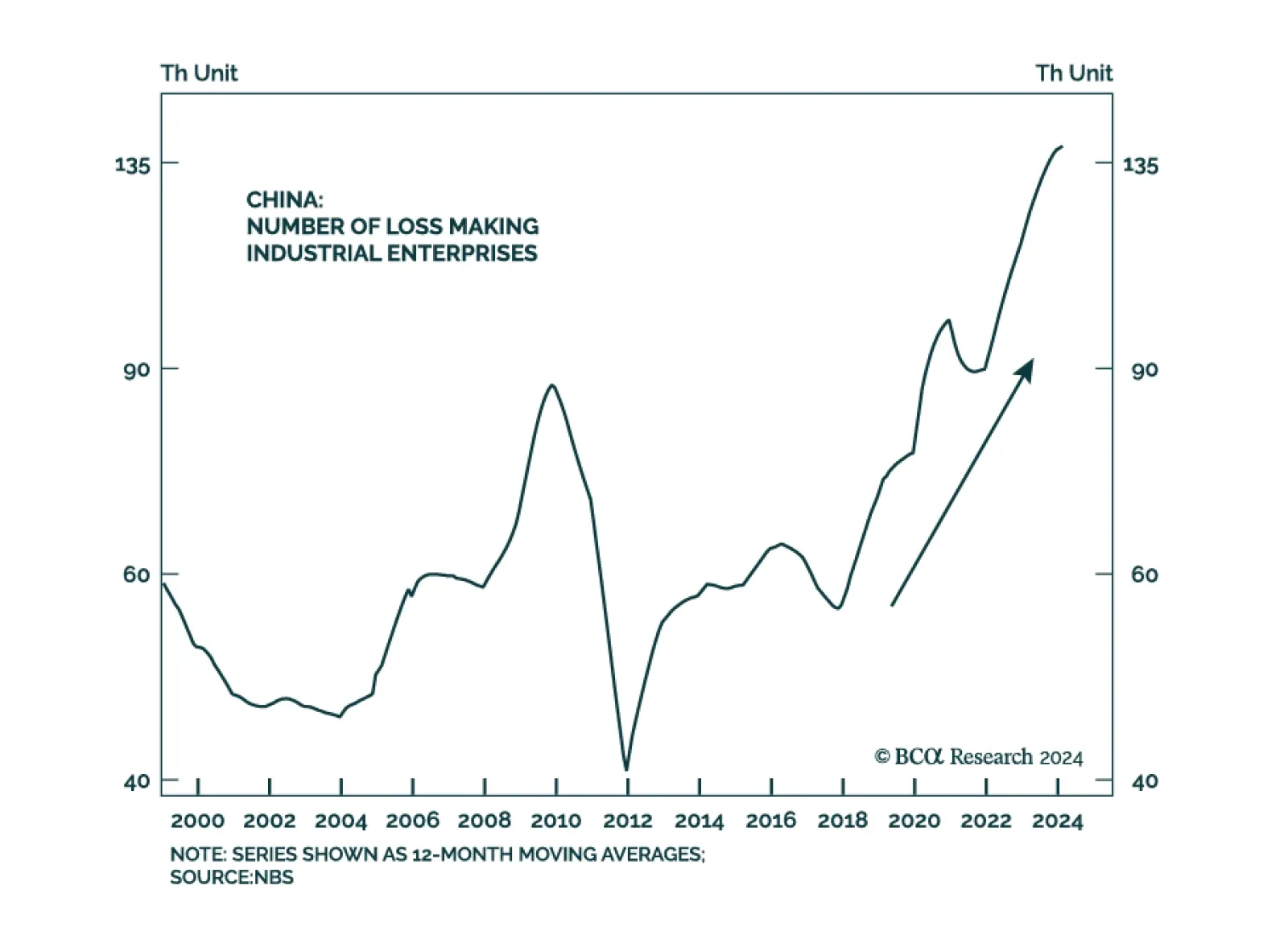

As highlighted in Wednesday’s edition of BCA Live & Unfiltered, the Chinese economy and its financial markets face several daunting challenges. Its demographic outlook is unfavorable, with a low birthrate stifling…

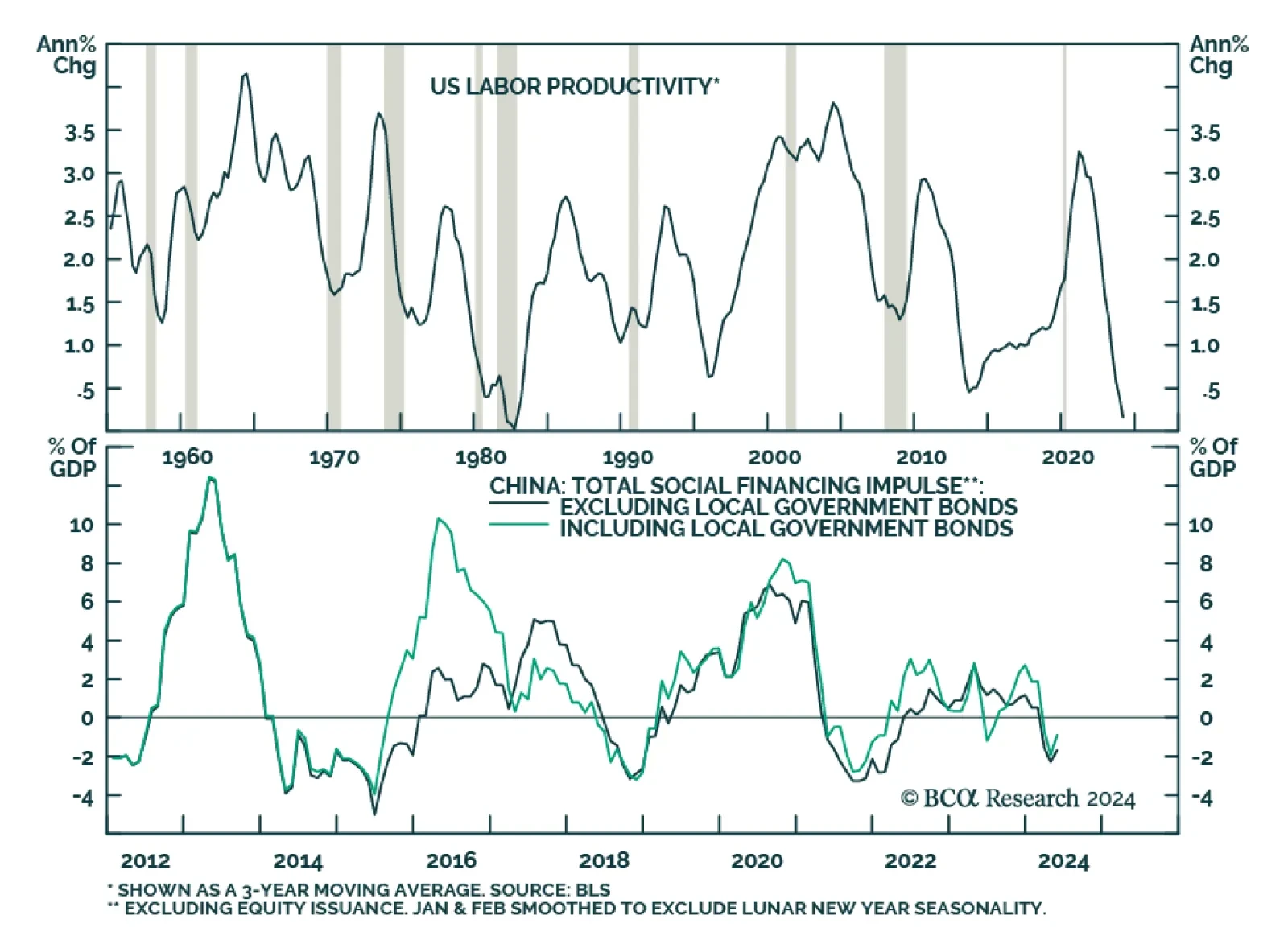

We expect continued softening in the US economy will lead to decelerating wage growth, muffling the principal consumption driver. Because the US has been the foremost catalyst for global growth in this cycle, a US recession will…