Our China Investment strategists remain cautious on reform risks tied to the new Five-Year Plan and advise against going long any Chinese sector stocks based solely on Beijing’s blueprint. While still constructive on offshore…

We recommend a new relative tech equity trade that will likely produce positive returns over the next six to 12 months, regardless of whether the AI hype continues or reverses.

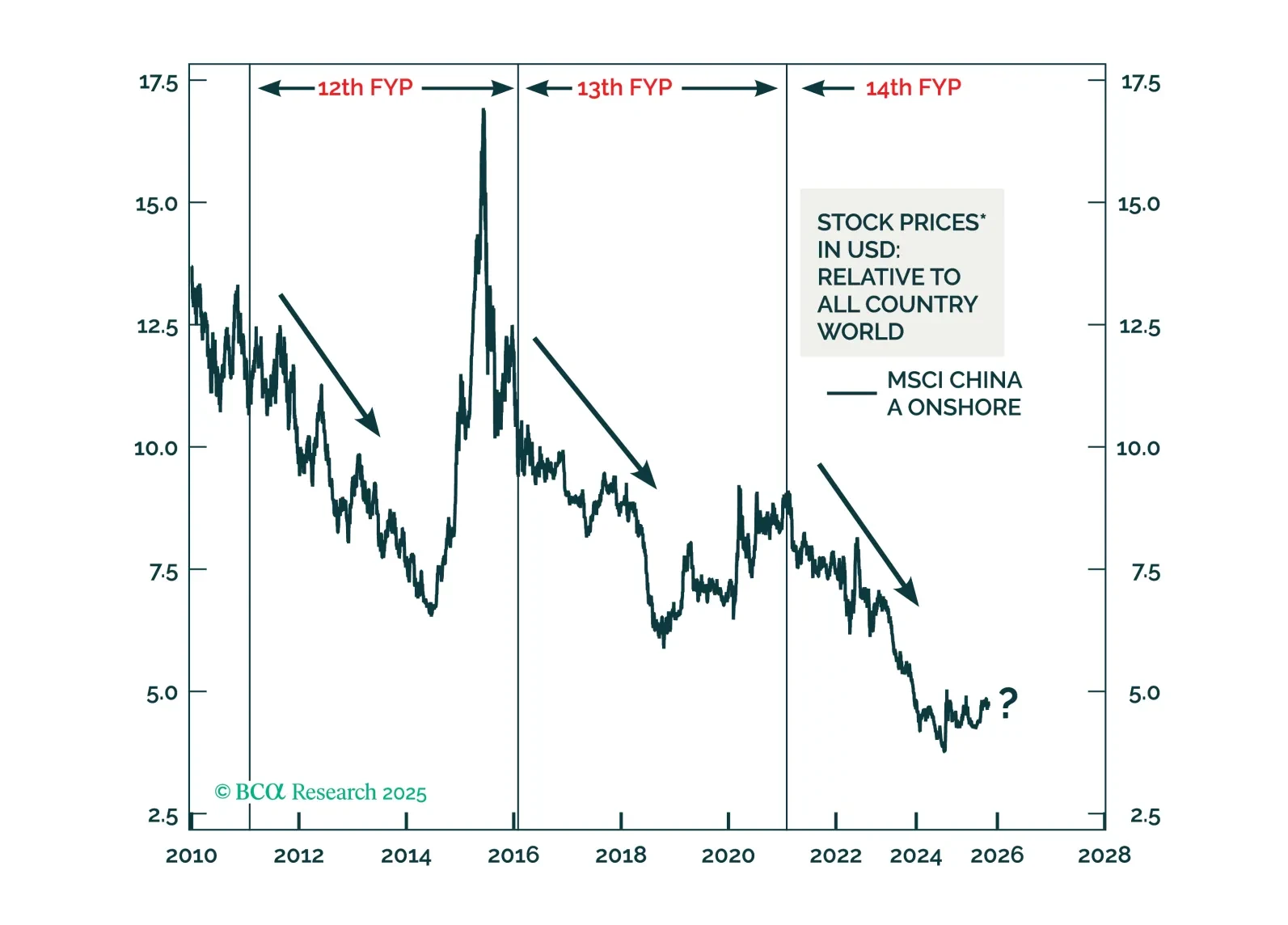

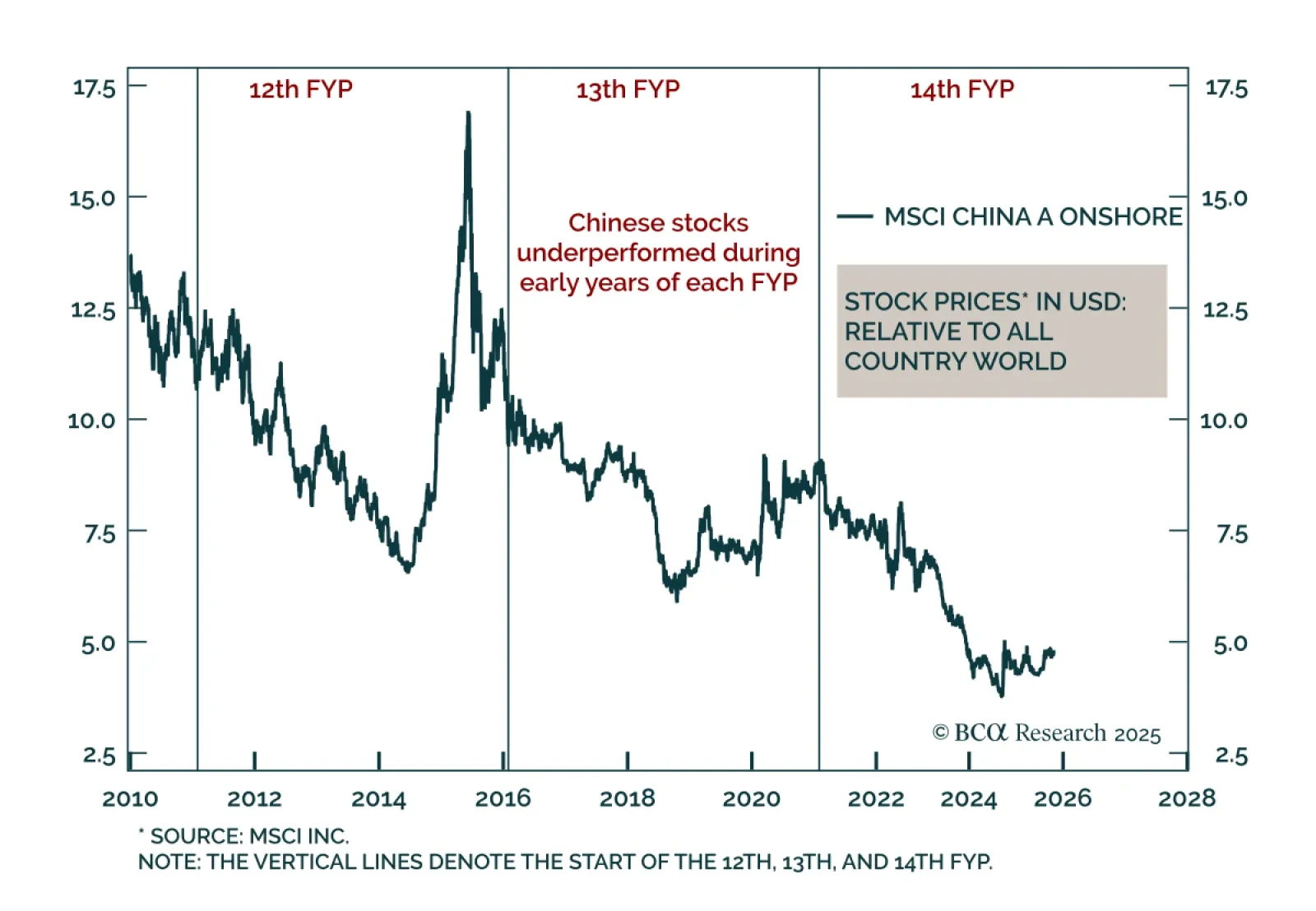

By tracing patterns across China’s past three Five-Year Plans, we reveal how policy cycles shape markets—and what investors should expect in the next five years.

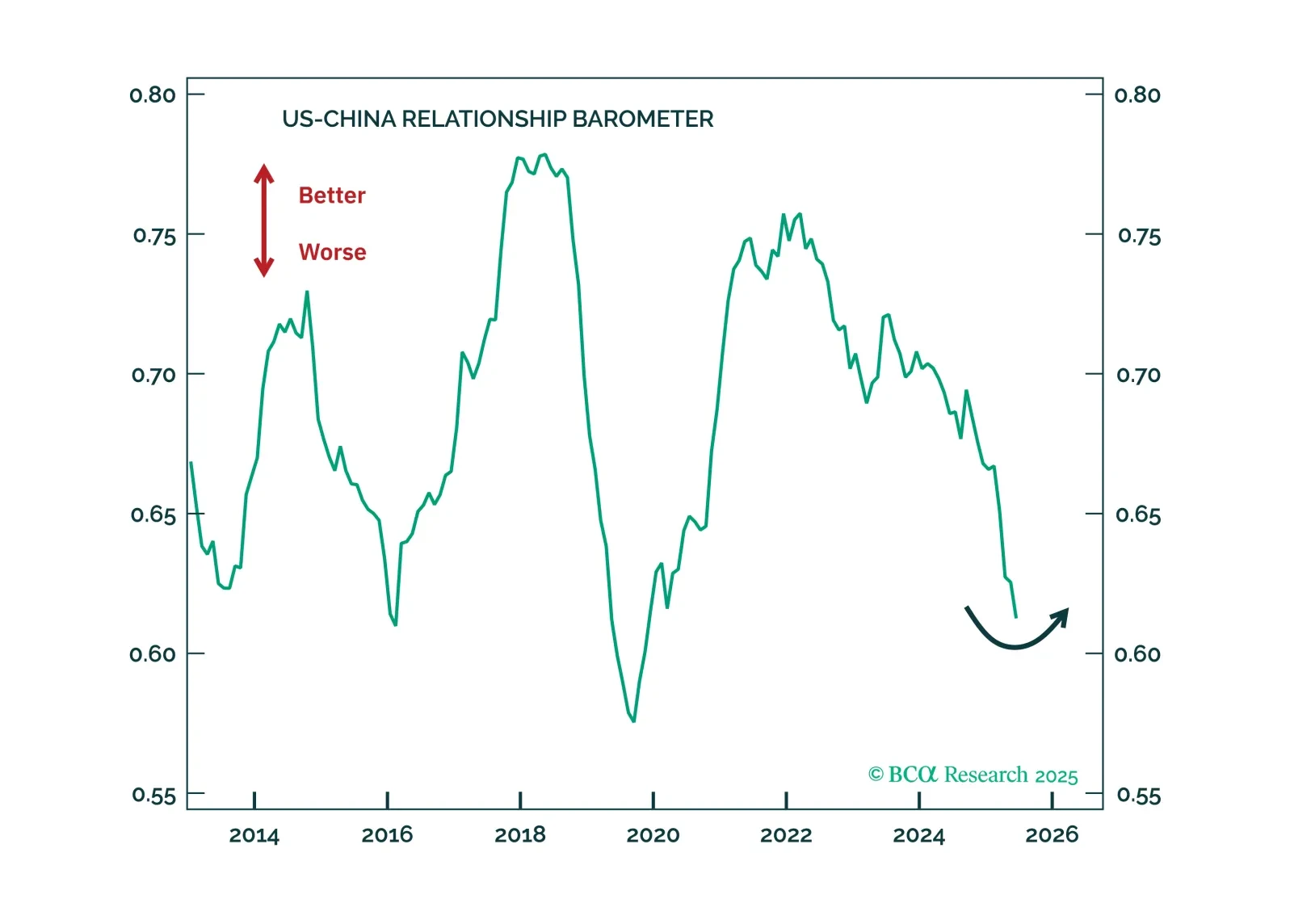

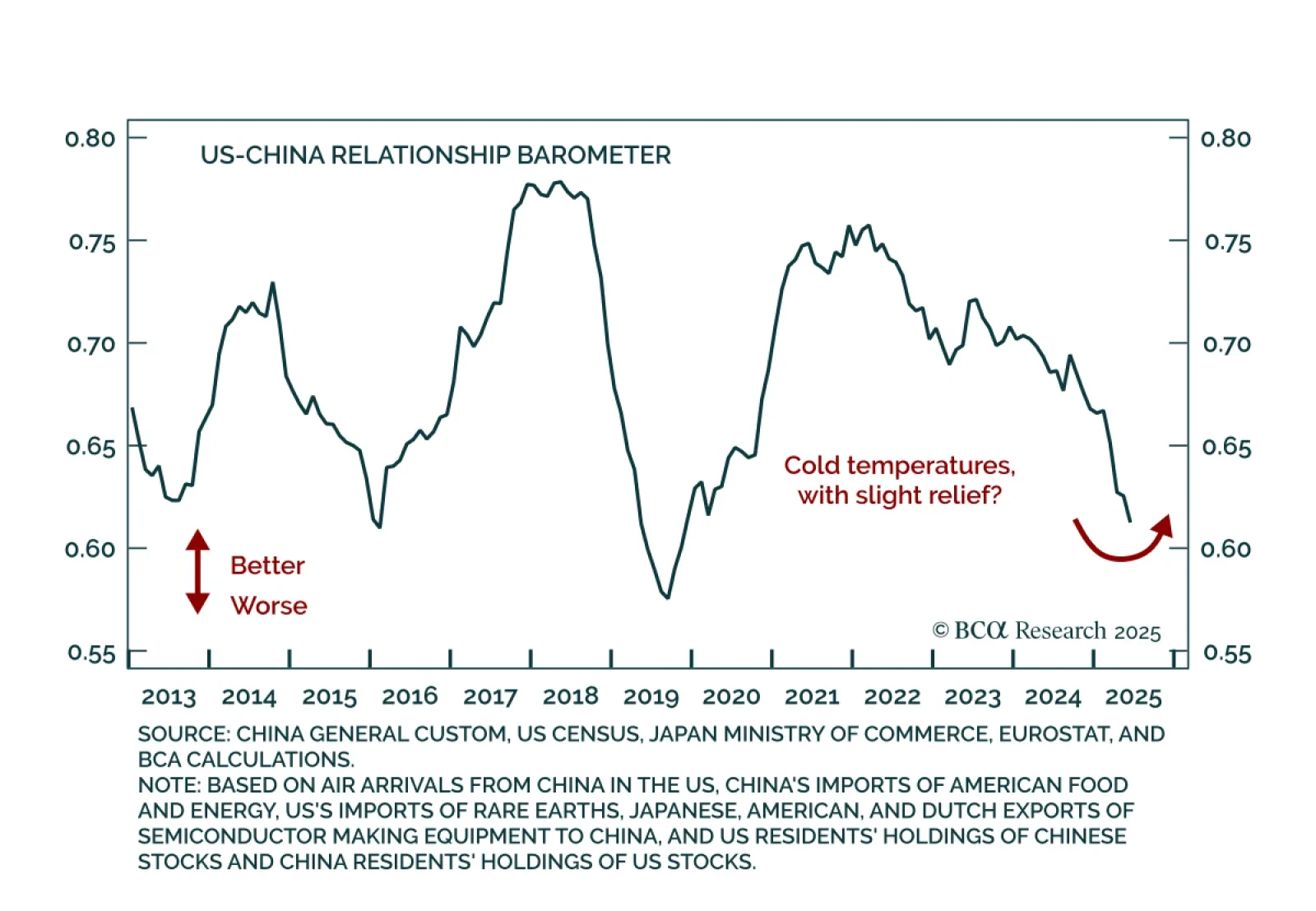

Our Geopolitical strategists view the Trump–Xi summit as a limited but market-friendly outcome, extending the tariff truce and reducing near-term geopolitical risk. While no trade deal was reached, modest concessions such as lower…

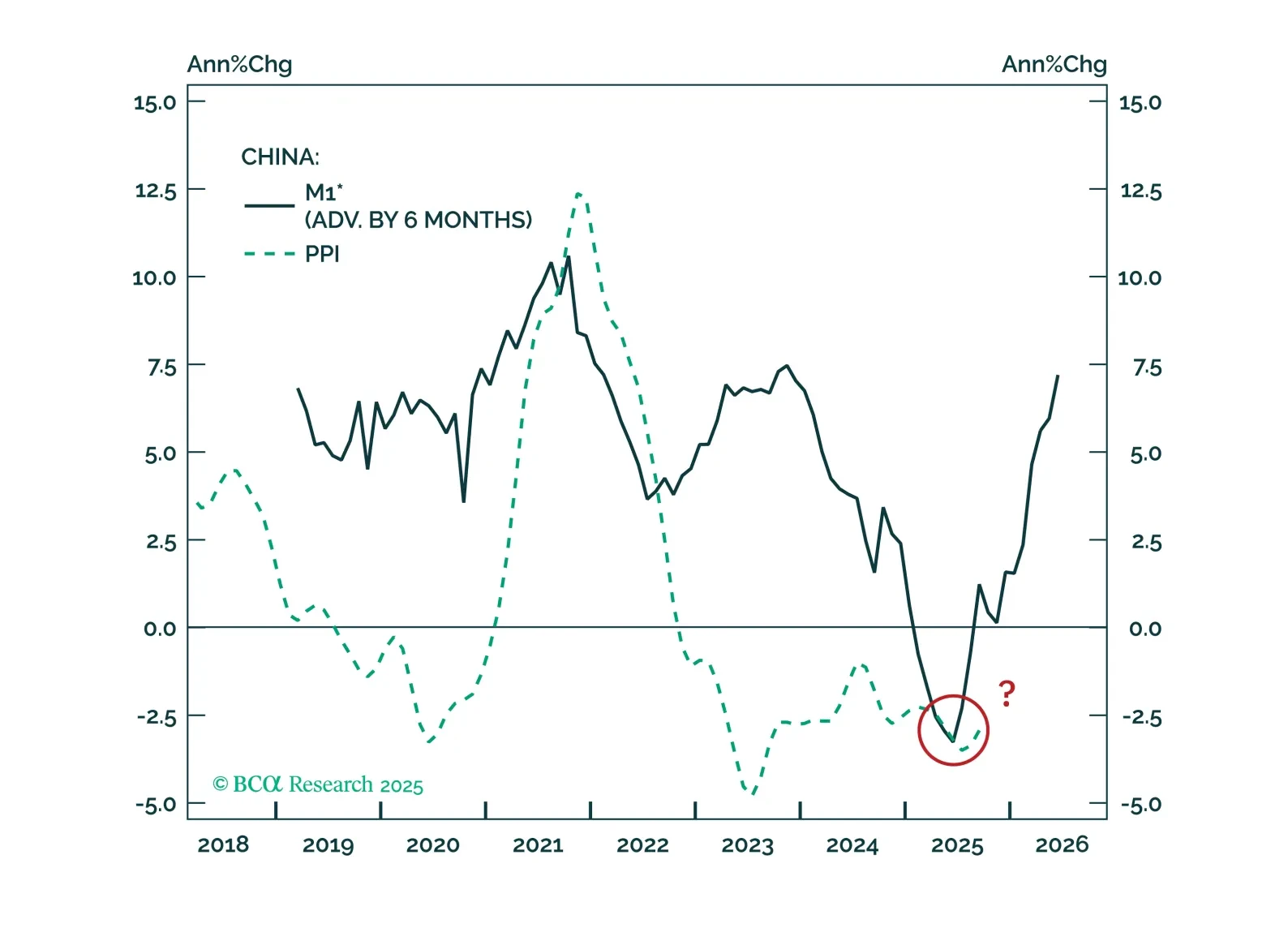

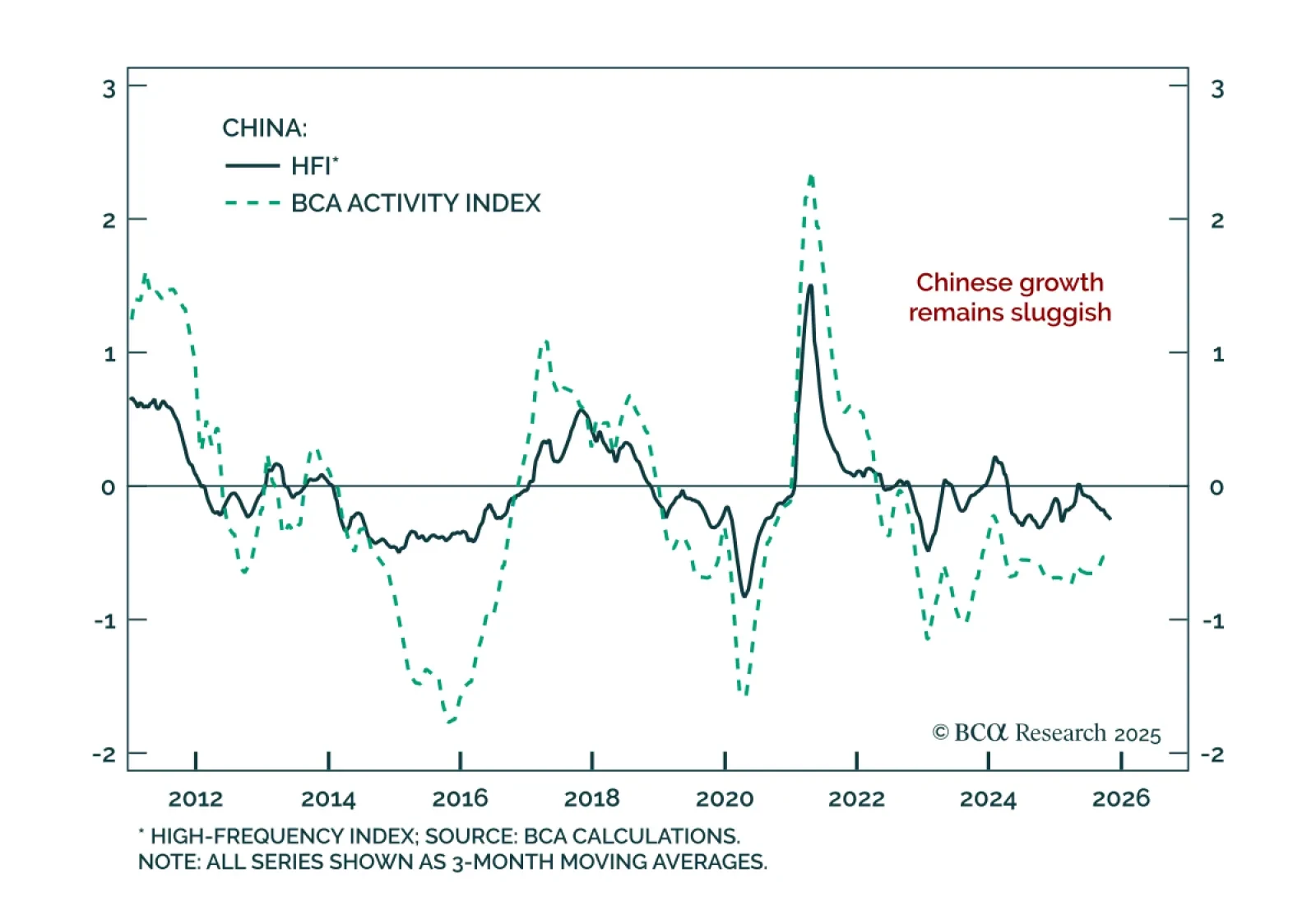

China’s October PMIs hovered around 50, underscoring a stagnant outlook and policy continuity from the Fourth Plenum. The RatingDog (formerly Caixin) Manufacturing PMI missed estimates at 50.6, down from 51.2, while the official NBS…

The Trump-Xi summit continued the trade truce and tentatively created a framework to contain tensions over 2026. That is not a trade deal but it is good enough for global financial markets, especially Chinese assets.

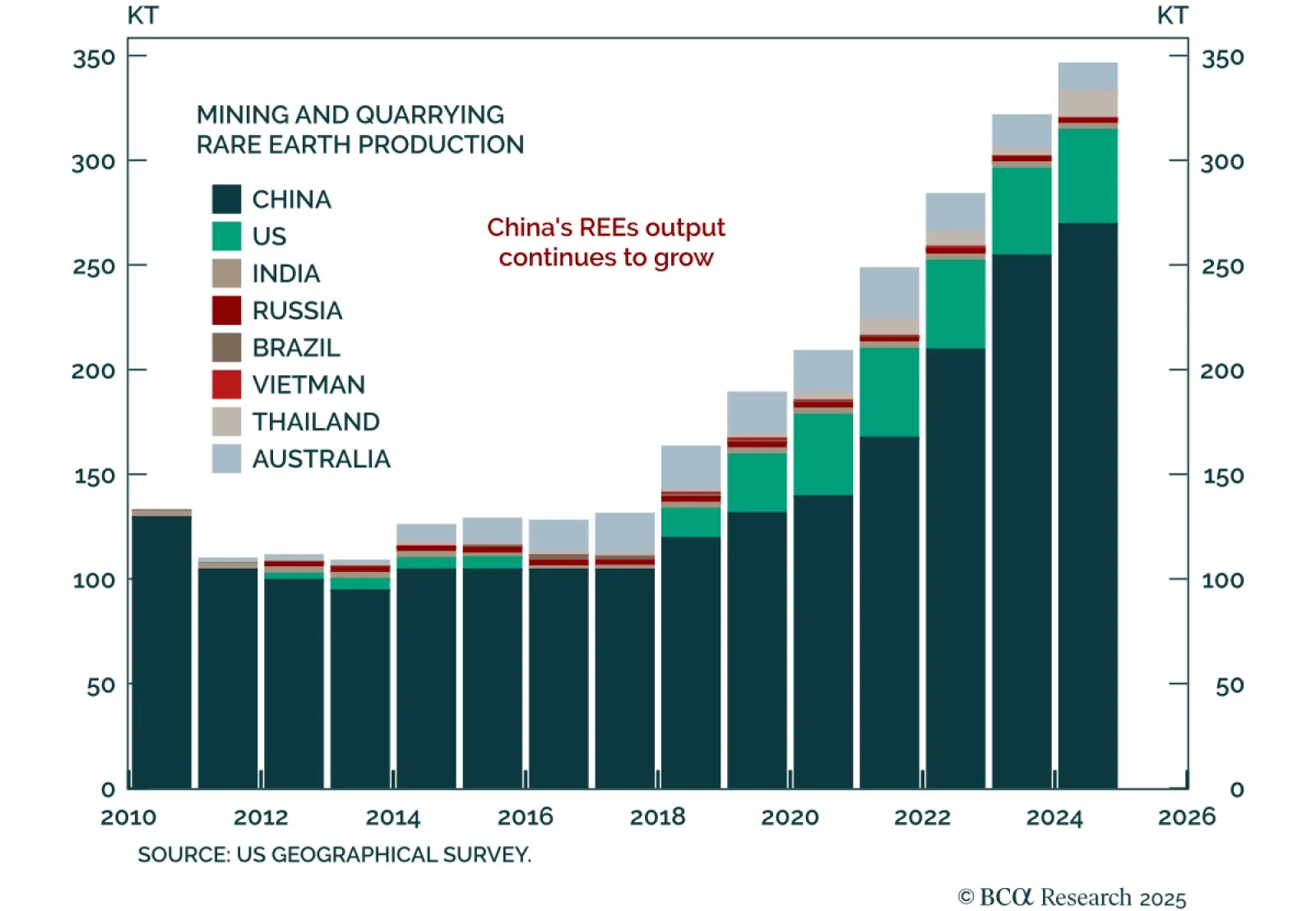

The US and China announced a one-year trade truce, but differences remain too wide for a lasting deal. The agreement includes a pause on rare-earth restrictions, allowances for blacklisted Chinese firms to import chips through…

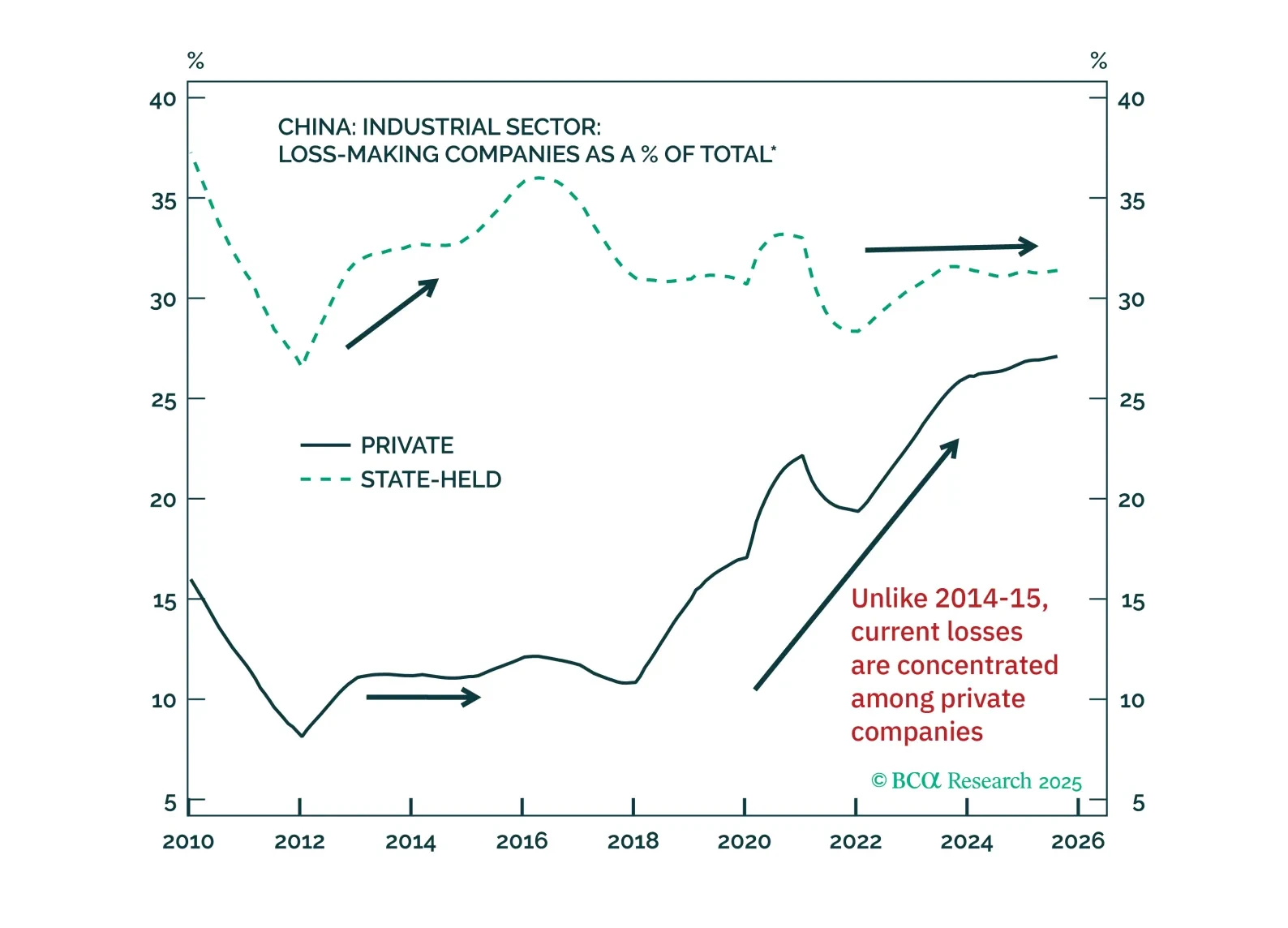

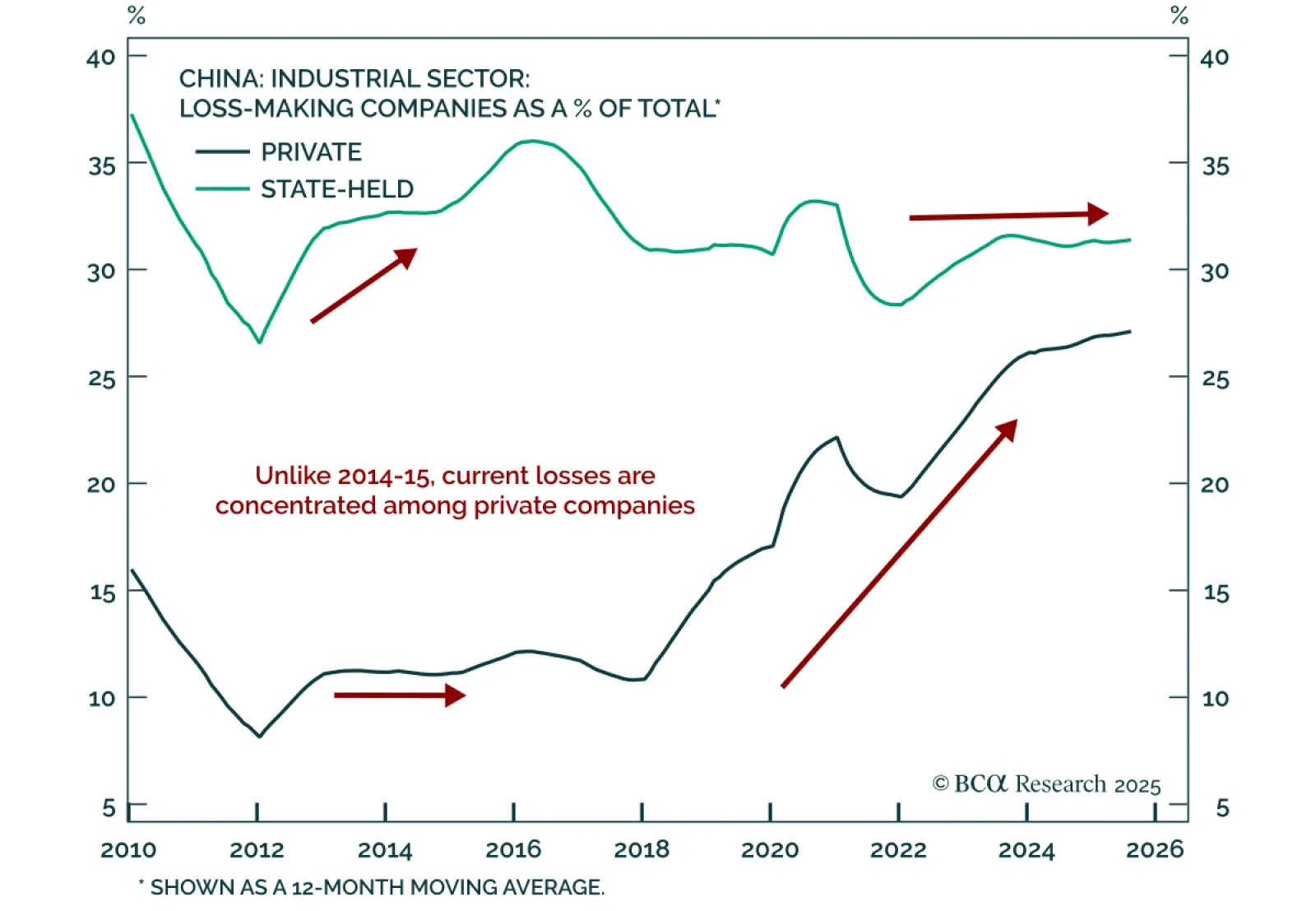

Our Emerging Markets strategists advise against chasing the rally in Chinese equities, as anti-involution policies are unlikely to end deflation or support a sustainable earnings recovery. The rally has been partially based on the…

This month’s China High-Frequency Indicator (HFI) Chartbook decodes the conflicting messages in recent economic data, highlights key signals from our HFI, and explains what they mean for China’s economy and markets.